Women’s tenuous relationship with credit & the factors that affect their borrowing decisions

The second blog of the insights from the “Banking on Women” series covers our respondents’ views on credit, their borrowing patterns and preferences for credit instruments.

Our previous blog will help you get more context on the socio-economic status of our respondents. Read the Banking on Women series for a deeper understanding of all the 20 personas.

The concept of credit

Many of us in the formal employment sectors access credit by proving our creditworthiness to banks and other lending platforms through our monthly account statements. But what about women in informal sectors with little or no digital footprint of cashflows, credit history or collaterals to pledge? Among most of our respondents, savings and credit were the means to achieve a business or household goal. While goal-based savings take time and commitment, loans are relatively instant and help counter possible future inflation of high-value asset prices.

Our respondents include women with a range of opinions on credit. We have women who strongly dislike credit, who would choose it as the last resort and ones who embrace it as a way to extend their budget or meet business goals. While their opinions might differ there are some very common challenges they face when approaching credit platforms. In this article, we assess the borrowing patterns of our respondents in terms of formal/informal sources, preferred instruments and apprehensions when it comes to credit as an idea.

Credit Cards

As per the Reserve Bank of India, there are around 940 million debit cards in India as of December 2022 while the credit cards stagger at 81 million1. This goes to show that there’s only 1 credit card for every 12 debit cards in India. Though globally the average credit scores of men and women are now identical, evidence states that in India, male members of a household are more likely to own credit cards than their female counterparts2. This could be because women, employed or not are dependent on their husbands or fathers in order to make financial decisions.

Another common insight from our conversations with women was that they are generally risk-averse. Indian families idolise a debt-free life, as there have been anecdotes of friends and families getting pulled into the quicksand of bad debts. The availability of credit discourages self-control and women might be afraid of overspending and getting into a debt cycle.

I did not apply for a credit card mainly because I prefer the concept of only using money that I have rather than using money that I don’t have beforehand. Credit cards work on the basis of the latter which is why I don’t use them. Basically, I am not comfortable with starting a debt cycle.

- Pragati, 27 year old recruitment professional from Pune

While the convenience and rewards offered by a credit card make them a coveted financial tool, women who seek fiscal discipline try to steer clear of the instrument and are vocal about their beliefs.

I do not believe in spending money that I do not have. So, a credit card is not a necessary product for me.

- Rachana, 39 year old home maker from Nashik

Even in our research, only 7 out of the 20 respondents have a credit card of their own or a supplementary card from their husband. While another 7 said they don’t even believe in the very concept of a credit card. Further research in this area could shed more light on the reasons for the same.

But though I have a credit card, I have made a conscious decision not to use it. I feel we should only use money which is ours. My husband uses one but we generally try to limit usage and never let it go beyond a certain amount.

- Preksha, 47 year old Counsellor from Kolkata

Even among the respondents who either own a credit card, only 3 use the card regularly. The others said that the card is used rarely for travel booking or to redeem points.

I don’t use my credit cards much. I rely on my debit cards. Sometimes when there are points, etc I might use a credit card. I am more of a debit card person. I will spend what I have.

- Tara, 40 year old Human Resources Professional

While these are the views on credit cards, the numbers speak differently when it comes to loans.

Loans

Almost three-fourths of the respondents have availed formal loans in the past, either for financing their businesses, or homes or to get out of an unexpected predicament.

If the loan is for something to do with me, I’ll take it in my name. If it is something involving my child’s education or something related to the house, that will be a joint loan. - Rachana, 39 year old homemaker from Nashik

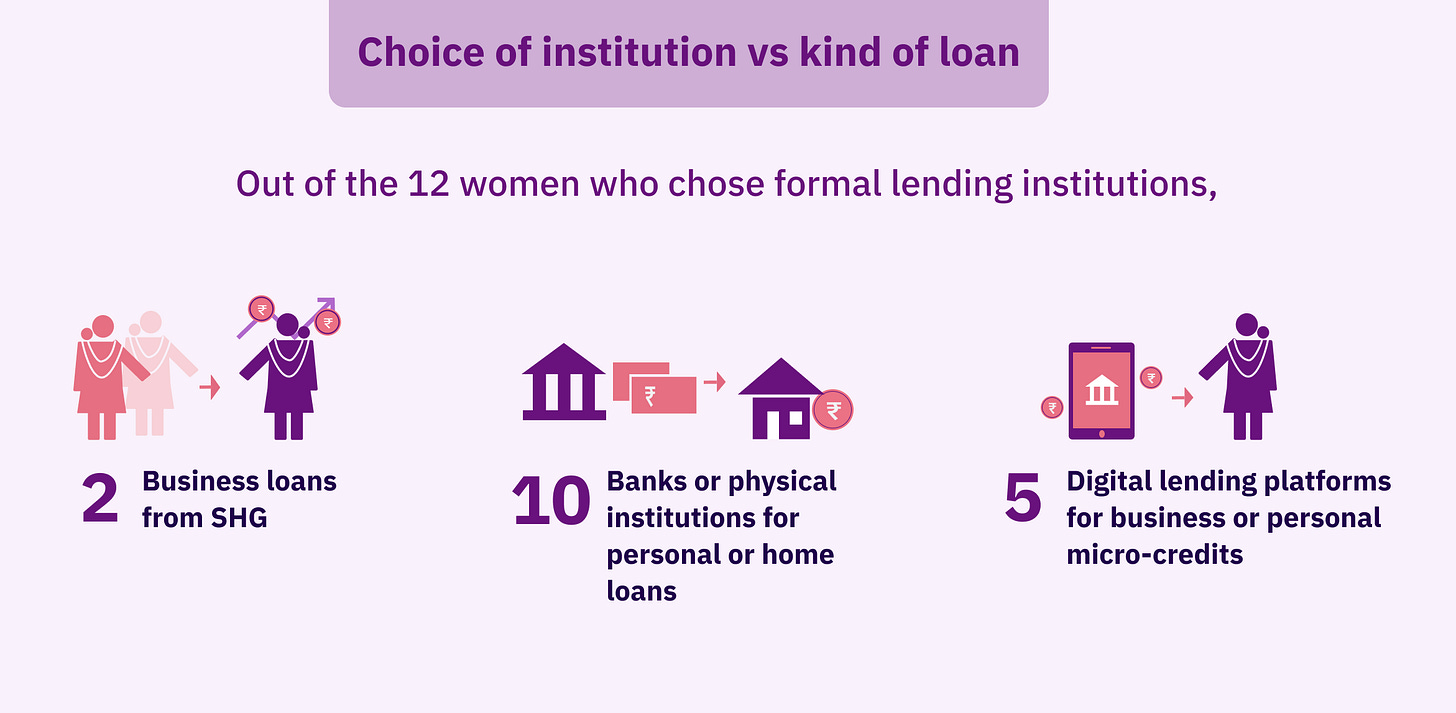

On analysing their responses, we notice that women’s preferences for lending institutions differ with the kind or the size of the loan.

Even if it is for an emergency, I would not be comfortable borrowing more than INR 25,000. I would consider digital platforms only for such small amounts. For larger amounts of money, I feel it is better to approach a physically present financial institution and talk to someone and receive help from them. - Zainab, 27 year old aspiring writer living in Coimbatore

But I don’t even use a credit card for that matter so I’m really not sure if I would be comfortable borrowing. In general, I am not very comfortable with debt as an instrument.

- Pragati, 27 year old recruitment professional from Pune

7 of the women said they are not comfortable with the idea of borrowing though their male counterparts have availed loans in the past. Saving up the money needed instead of borrowing is a common ideology among these women. In fact, in the order of preferences to fund a need, borrowing from formal institutions comes in as the last resort.

I am not really comfortable with the idea of borrowing money, but if required, and that's the only option, then I would not mind.

- Susan, 37 year old from Kolar working on short-term contracts

Informal Borrowing

Almost all of the women we spoke to were involved partially or collectively in the financial decision-making of the household, and only 2 of the 20 women have expressed their preference for informal borrowing from friends and family. This indicates that the households where women participate in financial decisions3 are more likely to opt for formal means of borrowing.

At least in the case of borrowing from other people, even if you decide to repay with interest, at least there won’t be ridiculously high late fees as they are human and will be understanding.

- Deeksha, 32 year old teacher from Rajasthan

Some secondary research into the topic also shows that women also prefer informal borrowing methods to hide the inflow of cash that they might want to use for personal expenses4.

Apprehensions with technology

I am a little hesitant about platforms which are completely digital. Since I have been using traditional banking throughout, unless there is a visible brick-and-mortar institution which I can approach for help and assistance, I feel a little hesitant.

- Preksha, 47 year old Counsellor from Kolkata

Women’s apprehension to new age technology is evident when it comes to borrowing as well. In the last blog, we covered reasons why women are hesitant to use digital payment apps.

Among the 18 women who either already have loans or might consider borrowing in the future, 7 said they don’t trust fintech lending platforms and prefer to either borrow from an established physical lending establishment.

Why do some women dislike credit cards but not loans?

One possible reason for the contradicting views when it comes to credit cards vs loans is the idea behind each of these instruments itself. While credit cards help offset the household budget in a month-on-month setting, loans are goal based and are often used up all at once. This demands the individuals to apply for new loans for each new goal thus adding a layer of friction between wants and purchases.

From the previous blog, we learn that women strive to run their households within a budget and plan their expenses. When credit cards are used to offset the household budget each month, the availability of credit might throw out the otherwise meticulously planned expense limits. Unmonitored usage of credit cards and unavailability of funds to pay the debts incurred could cause households to go into an unwarranted debt cycle.

I would prefer a product that allows us to borrow money when we need it urgently and repay it on a monthly basis as and when we have money in our hands. It need not be much, it can be even for sums below INR 10,000. I would have used such an app instead of a credit card.

- Zainab, 27 year old aspiring writer living in Coimbatore

On the other hand, a similar product like a credit card that offers a line of credit, which can be converted into EMIs or embedded financing at a product level, paired with basic training in fiscal management and discipline could help households get access to credit without falling into the debt trap.

Credit Scores

Currently, it is a near impossible feat for women from informal segments to build a credit score with little digitised data or proof of creditworthiness.

I have heard about it and I’ve even wanted to check it sometimes but I have found it confusing. If there are any fintech apps that can simplify how to check credit scores it’ll be helpful.

- Mary, 37 year old paper cutting artist from Meghalaya

Regulators as well as service providers play a vital role in educating as well as designing the interfaces for credit scores, starting with awareness and knowing the factors that affect it, to making it accessible for the users to check as and when they need requires design and technological intervention.

Designing better credit interfaces

In this section, we will discuss the guidelines that help in designing the interfaces of credit instruments like loans and micro-credits. Though credit cards also give the user a revolving line of credit, it is seen as either an emergency fund for times of risk or to make aspirational purchases. Also, a credit card by nature is a physical instrument and falls outside the purview of this section that covers the interface design of borrowing platforms.

In order to achieve financial inclusion in the credit segment, the focus must be on helping every woman build a healthy relationship with credit, providing access to funds for adverse events and assisting them in meeting their long-term goals. We will cover these sections with guidelines to follow at each stage of the user journey funnel: Awareness, Consideration, Commitment, Recovery and Retention

Awareness

When it comes to the awareness phase in the credit industry, we need to focus on both business as well as personal and household borrowing.

Business loans:

Increasing the awareness of the availability of different credit instruments. Encouraging women business owners to borrow from new-age lending platforms that offer tailored credit solutions, can lead to higher financial inclusion and closing the gender gap.

Regulators as well as neo-banks and lenders should invest in spreading awareness and educating women on the advantages of formal loans and the fringe benefits it gives them like saving tax.

Personal loans:

It is important to debunk the taboos around credit as a concept. When women dismiss credit as an instrument due to preconceived notions or past experiences, they miss out on building a healthy credit score. While it is a woman’s prerogative to opt for a loan or choose to save for their goals, it is preferable for every individual, regardless of their gender to understand the workings of a credit score and the factors that affect it.

Consideration

In most cases, investment and credit are two sides of the same coin. While women invest to grow the money required for future goals, the need to fulfil an immediate goal veers them towards borrowing. Once women have decided on a goal, they start looking out for lending platforms that best suit them.

The above diagram covers the apparent issues women have when it comes to formal borrowing from a bank or app-based loan providers.

Reading between the lines helps us arrive at solutions for each of the issues and design a better solution for women’s credit.

Reputation is a two-way street:

Trust in app-based lending platforms will take a little time meanwhile the onus is on the regulators as well as the lending institutions to communicate clearly to the users about their authenticity.

I wouldn’t be comfortable borrowing from a digital platform. I am scared because it might be a scam with fake claims. Also, I fear that they might misuse our data once they have access to our ID. On the other hand, in terms of the organizations that I have borrowed from, there are people right in front of me who I can approach and they teach us everything properly.

- Farah, 31 year old cloud kitchen owner from Bangalore

Regulators can do their part by constantly updating and publishing a list of regulated, RBI-registered institutions and help users trace and verify the authenticity of the information provided.

The lending institutions can use simple and vernacular language to let the user know about the purpose of data collection and the steps for the user to delete their data from the platform. We have covered more on the importance of contextual and progressive data collection while onboarding on blog 1.

Design to overcome the limitations of mobility:

One of the concerns from our respondents is that bank loans involve running back and forth to the banks which is an arduous task for women who are not always socially mobile.

Well for bank loans you have to run around a lot and it’s a very tedious process. I don’t have the time as I have to be on work calls constantly.

- Raksha, 39 year old freelancer who lives in Ahmedabad

Hence, it is prudent to bring the lender to her doorstep by means of community agents, doorstep services, and assisted app-based lending, all while using their vernacular language. In the case of underserved users, assisted models with either an agent or video-based assistance can be offered.

Use technology for the greater good:

While many women have apprehension about trusting technology, it is undeniable that introducing tech in mundane data collection modules like onboarding or KYC can save time and eliminate frustration among women users.

Initially, I considered taking a bank loan. But usually, for bank loans they need so many kinds of documents and they ask for a guarantor from our side.

- Mary, 37 year old Paper cutting artist from Meghalaya

Loan providers can take advantage of Account Aggregator access and Digi locker to verify the borrower, eliminating the need for lengthy and manual KYC documentation.

When salaried professionals’ creditworthiness is assessed by means of their future earning potential but when it comes to a woman nano-business owner or women-led MSMEs, the banks require a few references or a male guarantor who can co-sign the loans. This warrants relooking at the underwriting process of small business loans.

Commitment

After women have chosen their providers and applied for the loans, a newer set of issues in terms of their creditworthiness and communication prop up and pose hindrances.

Paving the way for inclusive underwriting practices:

By adopting newer techniques that use a gender-intelligent lens and leveraging surrogate data points such as bank account usage, UPI transactions, e-commerce spending patterns and other such parameters, the earning potential of the individual can be gauged.

But if it is an unregistered business like mine, nobody would give me a loan unless they know me personally. Funding becomes a little easier when a business is registered. Once my revenue reaches a particular amount, I will go ahead and register my business.

- Bhavana, 33 year old Mandala Artist from Bangalore

In the past couple of years, newer technologies have emerged, that employ AI and Machine Learning to create unbiased predictive models to assess the risks associated with prospective borrowers5. These models can help create rich personas for cohorts that have a thin credit history.

Make the process more humane:

Some women said they feel more comfortable borrowing from a brick-and-mortar institution rather than the new age apps.

I am a little hesitant about platforms which are completely digital. Since I have been using traditional banking throughout, unless there is a visible brick-and-mortar institution which I can approach for help and assistance, I feel a little hesitant.

- Preksha, 47 year old Counsellor from Kolkata

Reading between the lines, we understand that women miss the security and the humanness of a customer relationship manager that a physical establishment provides is missing in an app environment. Community managers or agent-assisted models could help in such situations.

Steering clear of deceptive patterns:

In the interest of increasing their user base, some apps resort to advertising the lowest interest rates for borrowing hiding floating interest rates or hidden charges in the fine print.

…apps might have a very high-interest rate and I don't know what their lending process will be like. So I am not comfortable even for a very small amount.

- Mary, 37 year old paper cutting artist from Meghalaya

To encourage more women to trust the platform it is important for the apps to be upfront with their communication. Displaying a clear calculation of interest rates, breaking up the EMI and explaining the terms clearly in simple language without confusing the user will help retain them as well as attract newer borrowers through word-of-mouth marketing.

Recovery

Unlawful acts of certain recovery agents precede the reputation of the loan institutions and tarnish the image. One of the biggest apprehensions to borrowing is the fear of recovery agents who resort to using social stigma as a means of coercion.

It is the institution’s prerogative to see to it that the recovery team is well-behaved and refrains from reference callings and other such practices that might jeopardize the woman’s social image.

Rethink rewards and punishments:

It is ironic to punish the defaulters with more charges. Instead, lenders can personalise loan products as per their cash flow such as customised repayment terms and flexible timelines.

When women run MSMEs or nano-businesses face volatility with cashflows and miss loan repayments, instead of imposing them with more charges, allow them to course correct. Women who are focussed on future goals and see merit in engaging with a business for the long term and try their best to clear their name of any tarnishes.To reward timely payments, positive reinforcements such as increasing their credit limit or credibility score would encourage them to continue doing so.

Learn from successful models like group loans to leverage social proof and social capital:

Set up a robust relationship system and grievance management for open communication. SHG models that use social proof, where women feel like a social pariahs when missing payments, work on a similar principle of positive reinforcements and punishments. Meanwhile, adding more charges on a defaulter might push them to the brink of leaving the organisation rather than wanting them to mend and repair the relationship.

Retention

First time I took INR 10,000 and later I took a loan of INR 25,000. I am considering taking a third loan as well. It feels so nice that they believe in you and trust that you will repay them. I’d say it’s one of the best things that has happened to me. This simplicity in the process of availing of the loan has opened the doors for me to explore so many opportunities in my life.

- Mary, 37 year old paper cutting artist from Meghalaya

Many platforms prefer lending to women-led businesses as historically women have been serious about paying back on time and performing better than their men counterparts6. Women are the gatekeepers of the household’s goals. When it comes to long-term goals they are more motivated and disciplined7. They are adept at transforming personal, professional and household aspirations into goals-based saving plans like education or wedding of their children, expansion of business and home improvement or purchase of a property.

As discussed earlier, the need for both credits and savings stems from goals. While repayment of loans is dependent on the available liquidity and their financial status, cross-selling investments as an avenue to fulfil future goals and aspirations can help retain women customers. These goal-based savings can also be bucketed as a contingency fund for future mishaps, and business volatility or can feed into an insurance plan for themselves or their family.

Over the next couple of blogs, we will delve into the investment habits, risk resilience and access to insurance of these respondents. We will dive deep into what are the factors that veer women towards certain instruments over others and when do they see the merit in choosing a financial service and of course guidelines on how to design them better.

https://www.rbi.org.in/scripts/ATMView.aspx

DLAI Fintech Conclave 2023 Podcast - Serving the Next 100 Million in conversation with Sucharita Mukherjee, Kaleidofin and Manish Lunia, Flexiloans

https://www.entrepreneur.com/en-in/news-and-trends/the-role-of-ai-in-creating-an-inclusive-credit-underwriting/440374

https://financialallianceforwomen.org/download/fintechs-serving-the-female-economy/

Podcast IBID. 4

All artworks are designed by Himanshi Parmar and Rahi Deroy from NOCT.

If you enjoyed reading this blog and would like to receive more such articles from D91 Labs, please subscribe to our blogs here.

To read more about our work, visit our website

You can follow us on Twitter | LinkedIn | Instagram | WhatsApp