#6 Preksha | Investing in kids, at home and at work

Not everybody is from the banking sector, so a platform to help bridge the financial knowledge gap will make it much easier for the masses to grasp things without feeling like we are lacking.

“Children are the most precious resource anybody can handle. I wanted to contribute in molding them to reach their best potential. I have always believed that I should take up every opportunity I get . My contribution towards this field, the quality of work and experience I have gained from it has mattered more to me than the salary that I make from it.”

Short Story

Preksha is a 47-year-old Kolkata based counselor working on student and family welfare. Despite graduating with a pure sciences degree, she gravitated towards social work as she wanted to help children achieve their true potential. She is married to a naval officer and is often on the move depending on her husband’s postings. Preksha strategically handles the household finances and co-participates in financial planning with her husband. She aspires to start her own counseling practice after gaining experience through the school and other such organisational settings.

Before you go on to read the blog, here's some exciting news from D91 Labs! We are hosting a webinar on "Moving from access to usage: Making formal finance work for women" with panelists from fintech companies and research think tanks like SHEORES, Mahila Money, Global Alliance for Mass Entrepreneurship and Salt.one (@mysaltapp). Register here.

Personal and financial background

What is your daily routine like?

I start my day around 7 am. After my morning tea and reading the newspaper, I prepare breakfast for my family before my classes begin. As a counselor, my classes follow the schedule of the school and take place between 8 am and 2 pm. Post work, I have lunch and get an hour to rest once my younger daughter finishes her classes. After which I dedicate time to writing for a few platforms such as SHEROES. I am also a part of Blogging Elementary and have just finished an internship with them. In the evening before I go for a walk, I spend some time planning for the next day's classes, overlooking my daughter's study routines and sending messages and reminders to different groups since everything is online now. 9 pm is our dinner time and I try to wind up my day by 11 pm.

Can you tell me a little about your professional history?

I currently oversee the life-skills classes for middle and high school children. I conduct classes to equip children with a combination of study skills and life skills to make them more productive and confident. I also attend single referral based counseling cases.

Before my current job I was on a sabbatical. In the past, I have worked as a branch head in a pre-school chain. Most of the time in my career, I have been affiliated with single organizations such as NGOs, schools and other institutions that align with my focus group which is children and their families.

How did you start your journey as a counselor?

My career choice might seem a little unexpected and surprising since I graduated with a pure sciences degree in Botany. I knew I wanted to do a postgraduate degree and I applied to both some pure sciences courses and also for a Master’s in Social Work. I knew somewhere that my interest lay there and I wanted to give it a real shot. As luck would have it, I got my first round acceptance from the Masters in Social Work program before the others came through. As I went through the various rounds of the application, I realised that this is what I wanted to pursue. It felt like it was my purpose so I made a conscious decision to transition. I decided to give it my all and also pursued a second degree and family and life welfare counseling in parallel.

After the degree, while there was an option to work with corporations, I did not think that worked for me. I am married to a naval officer and we move very often. Also, I knew I wanted to work with children who I believe are the most precious resource a person can handle. I wanted to contribute towards molding them to reach their best potential. On that basis I decided to work with schools. Schools are everywhere and schools have children! Talk about two birds with one stone. That's how I started work in the education sector.

What does the future hold for you professionally?

I plan to freelance maybe five years down the line. I have always felt that I should take up every opportunity I get and not worry too much about the money. I pursued this profession to help kids and my contribution, work and experience has always mattered more to me. When you work in a school setting, you have a designated role with expectations and requirements. Having worked with varied groups ranging from very young children to physically challenged adults, and a significant part of my time in school settings, I now know what the general expectation is from me.

Going forward, I would like to pursue freelancing and individual counseling. Basically I only want to take up work based on the time I can dedicate to it. I finally want to pursue my passion for writing more seriously now that my children are going to be old enough soon. My vast experience will make it possible for parents and families to trust me when they come to me for counseling for their children or loved ones.

Household finances

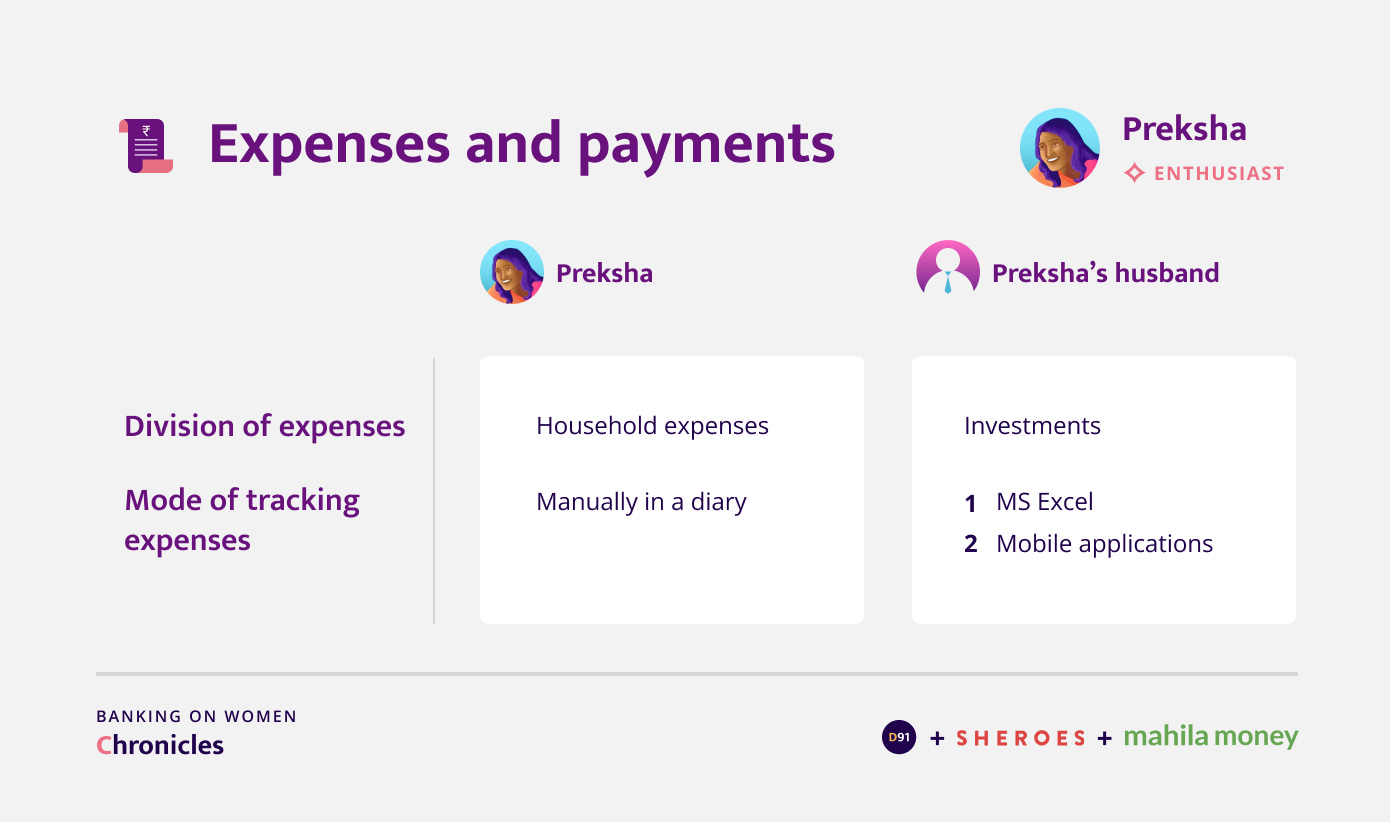

How are the expenses divided between you and your husband?

Household expenses such as groceries, utility bill payments, paying support staff or domestic help is independently taken care of by me. Investments are taken care of by my husband. Even though I am aware of the kind of instruments he is putting money in for the kids, for example, the execution and payment is handled by him. The house rent gets deducted from my husband’s salary and we don't have to actually pay because it comes as a benefit with his job.

Expenses and Payments

Do you use payment apps for the household expenses that you handle?

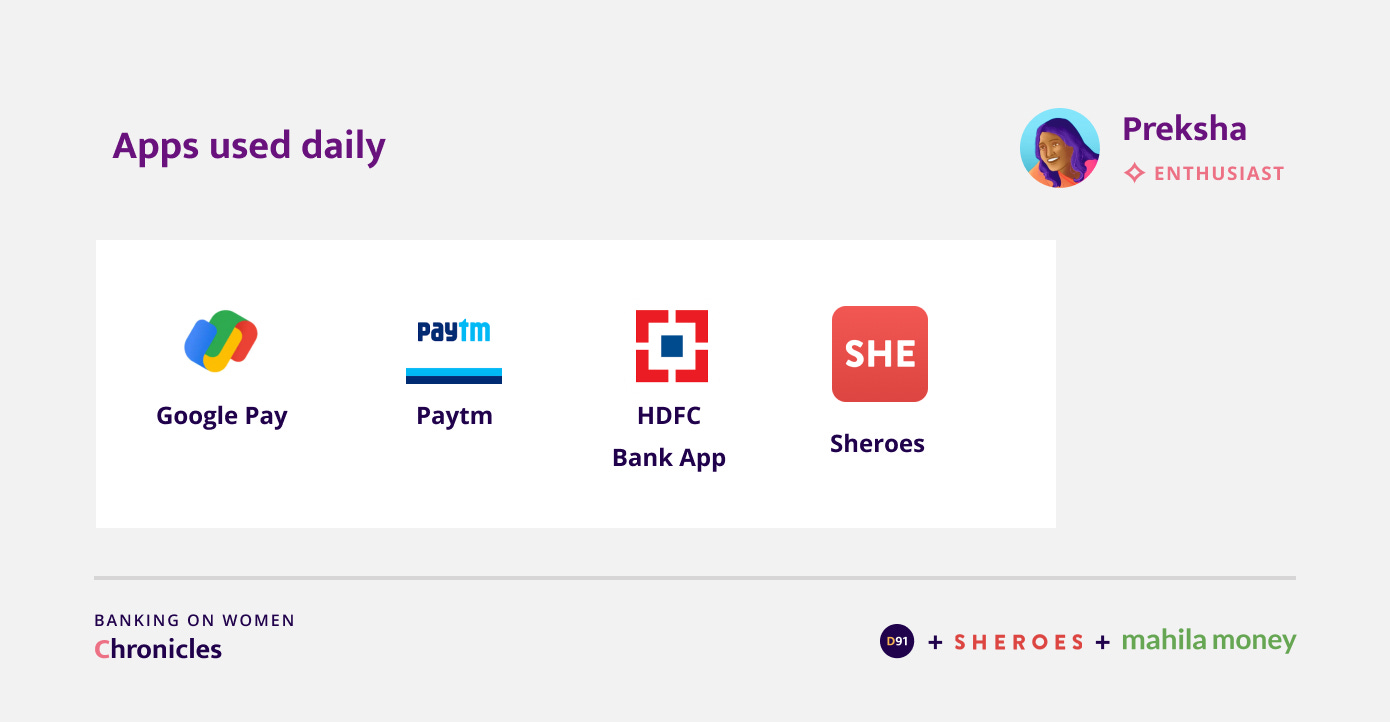

I have been using cash for most expenses but lately I use Google Pay or Paytm as well. For eg. my house help also has Paytm now, so making payments through that is better for them.

How do you decide to make payments in digital mode or in cash? Is there a specific logic that you use?

For smaller amounts, if cash is at hand it is much better as it gets done immediately. Also there are times when people prefer a cash payment. But if it is a large amount, like anything above INR 10,000, I would not want to pay it in cash and would prefer to do a bank transfer.

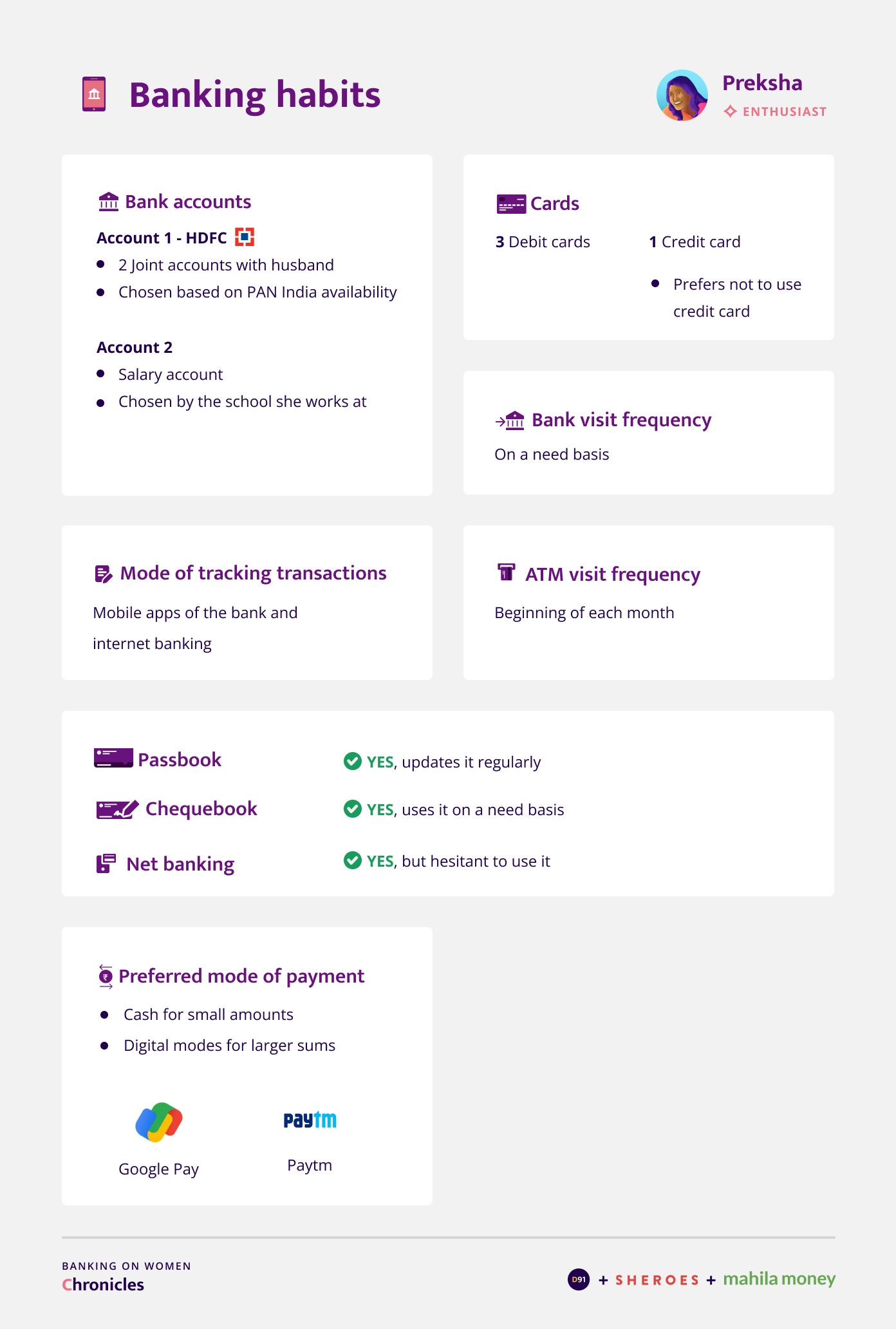

Banking Habits

You have had a bank account for a long time with a single bank? What factors made you choose this bank?

While we all have our own opinion about banks, since we are constantly on the move, we had to ensure that the bank we picked had enough branches in the places we were moving to and a support system to back us up when needed. That's how we decided to go ahead with HDFC bank and we have been with them for almost 30 years now.

How often do you visit a bank branch?

Initially I used to go often to deposit cheques, but now it has become so easy to do these things online that besides an ATM, we don't need anything else. Unless there is something specific like discussing a loan or other such things, there is no reason to visit a bank. For example, the last time I visited was when my daughter's account had to be converted when she turned 18. We have a relationship manager for our accounts and he checks in and reminds us of most things related to the bank’s compliance and requirements, and is also available when we have a concern. This ensures we do not really need to go to the branch often.

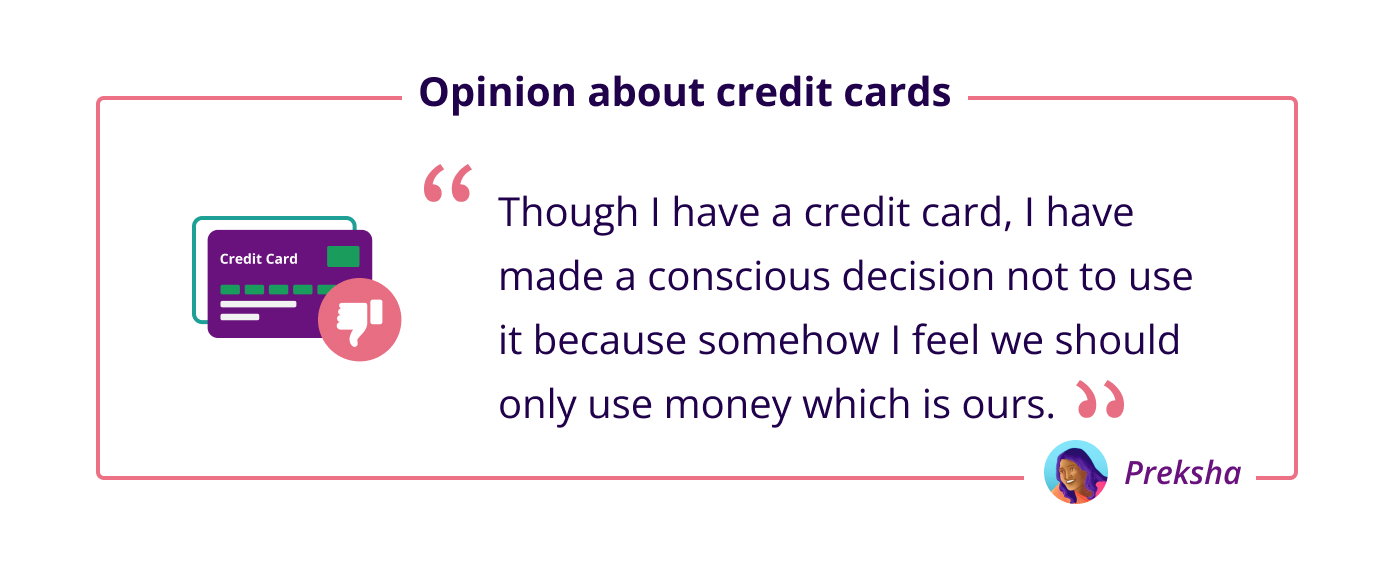

Do you use debit or credit cards?

I am very fond of debit cards and I use them extensively. But though I have a credit card, I have made a conscious decision not to use it. There was a period of about seven to eight years during which I did not use a credit card at all because somehow I feel we should only use money which is ours. My husband uses one but we generally try to limit usage and never let it go beyond a certain amount.

Do you have a passbook?

I have a passbook for my salary account. I feel very nice looking at it because it reminds me of the times I used to go to the bank and update my dad's passbook when I was in college.

Do you use net banking? And do you use it through the web or mobile or both?

I actually do very limited net banking because I am a little scared. I need to get more comfortable with it because there is actually very little existence without digital modes in today's times. Whenever I use it, it is through my laptop.

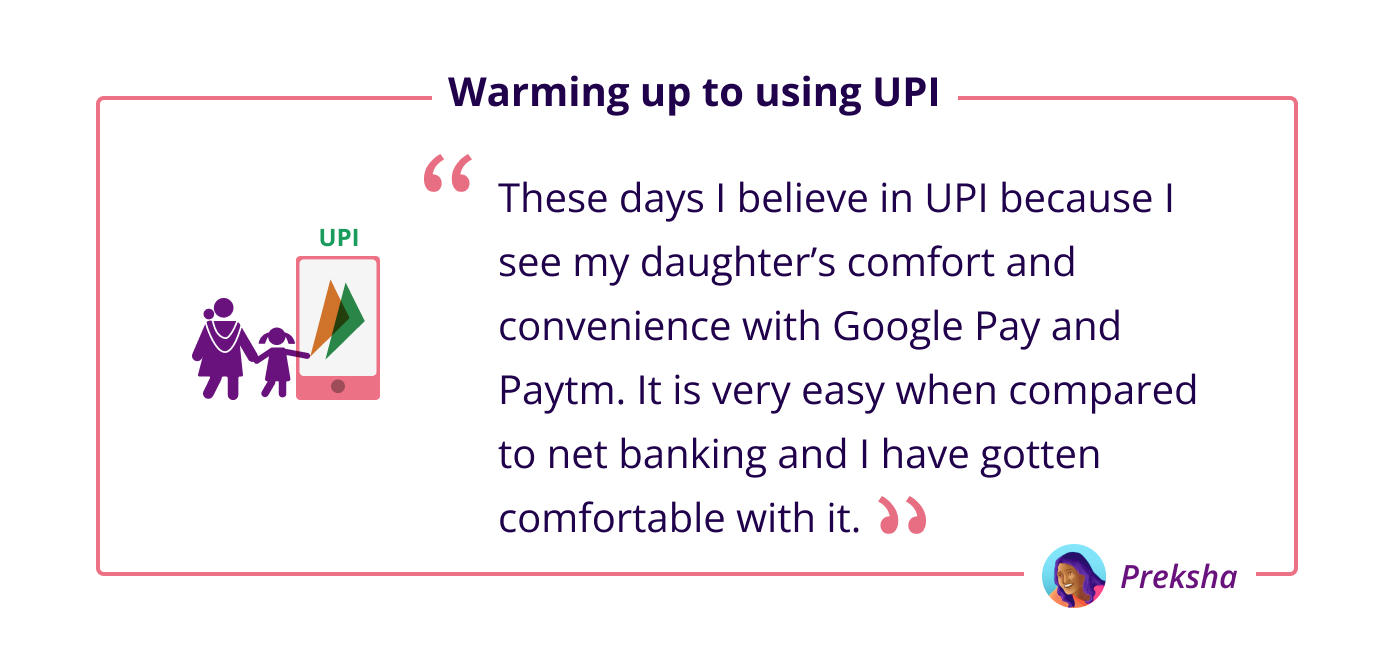

Do you have the same kind of experience with UPI payments or are you more comfortable using them when compared to net banking?

These days I believe in UPI because I see my daughter’s comfort and convenience with Google Pay and Paytm. It is very easy when compared to net banking and I have gotten comfortable with it. Moreover, it is safe as well.

Financial products and services

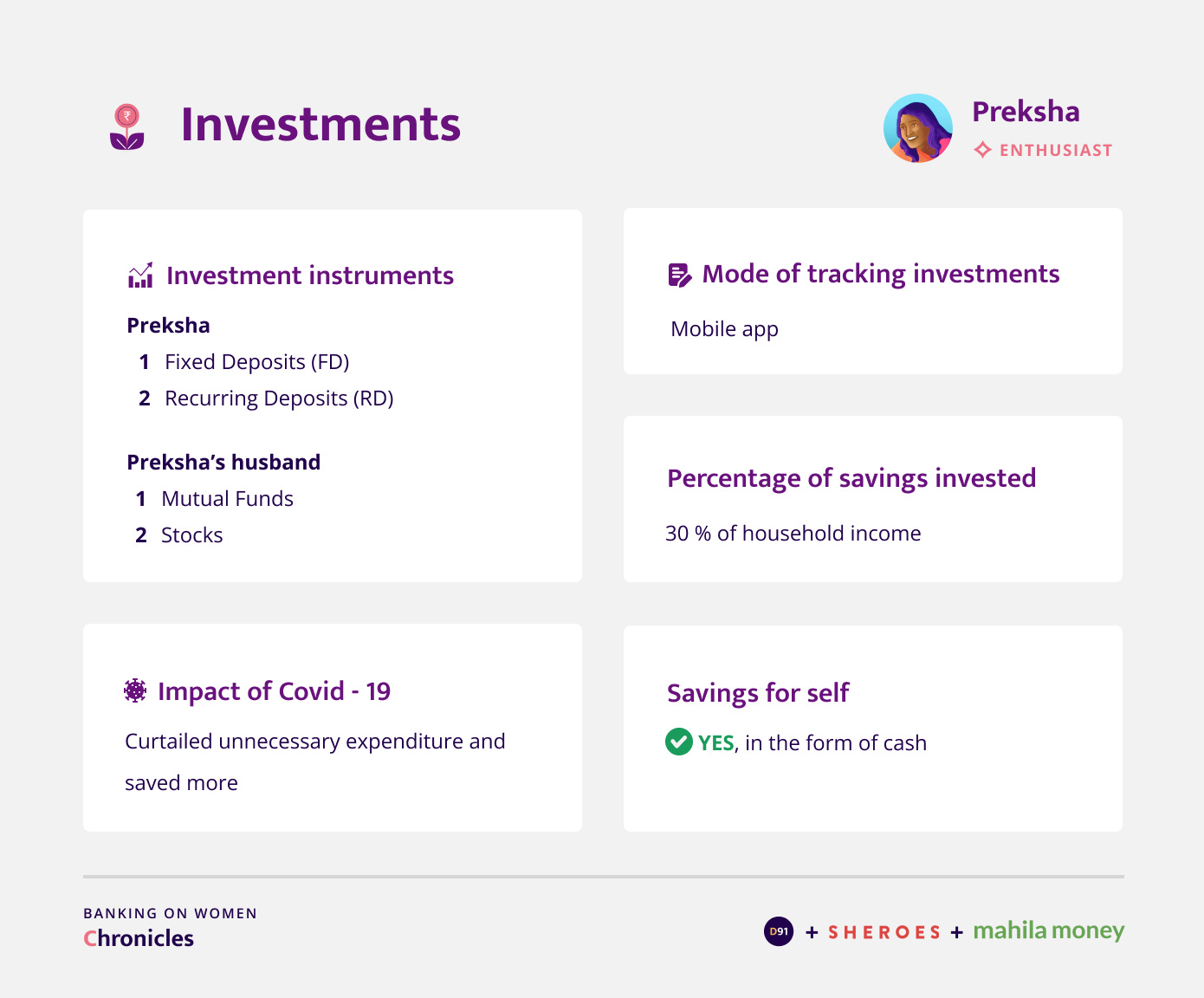

Investments

Do you actively invest in any instrument? Do you invest/ save or is it in cash at home?

I wouldn't say very actively, but FD and RD are instruments which I feel are very safe to put my money in and have invested in them. But other than that, I have not ventured into mutual funds and stocks at all. My husband is very inclined towards stocks and has a profile which he maintains to understand his investments and to monitor where we stand at the end of the month.

Since when have you been investing? What pushed you to start investing?

I started investing about 10-12 years ago primarily for my children. The first one was an RD for my elder daughter in her minor account. I opted for the auto debit option so that every month there is a part of my salary being invested without any conscious effort from my end to remember and pay.

Do you share your investment details with your family?

My husband and I discuss all investments and our personal finances but we generally do not share it with anybody else. Between us, we have joint accounts and as such we are both aware of what is happening in these accounts.

Do you save money separately for your children’s expenses?

Yes, we do. We had initiated an investment for our elder daughter when she was in 10th grade so that when she turned 18, that money could be used for her college education. Next year, depending on where she decides to pursue her post graduation, we will plan the finances accordingly and might take an educational loan if required. But till now we haven't had to take a loan, we have planned it and ensured we have finances to back up their education. We plan to do so for our younger daughter as well once she’s a little older.

Did Covid-19 impact you in terms of expenses & investments?

I would say yes. Last year, we realised that our spending was much less and we decided to save more. Even after the lockdown was lifted, we curtailed a lot of unnecessary expenditures such as outside food and going out and this led to quite a bit of savings. We became aware that there are a lot of things which are just not needed and shouldn't be indulged in. Secondly, for us as a family, our spending habits evolved and conscious buying became integral to our expenses. Even the children started to ask if they really needed a particular thing and only bought it if they felt it was absolutely essential.

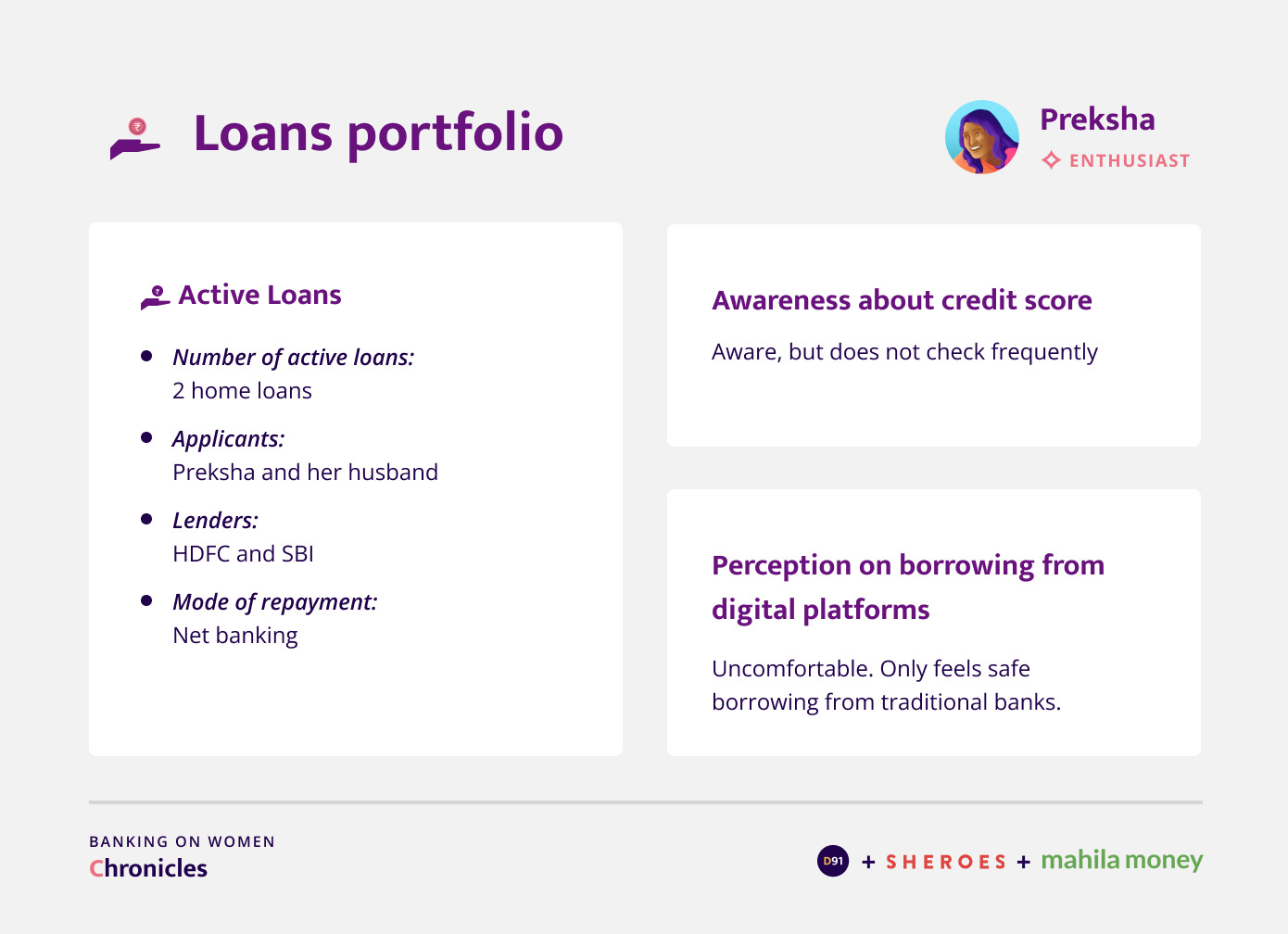

Loans

Where have you taken the loan from? Is there a reason why you chose a specific institution?

The bank where we have had an account for several years was the first one we approached. Considering how our profile has been with them, it wasn't an issue to get a loan. We have taken the home loans from two different banks, one from HDFC and the other from SBI as we thought it would be easier to maintain two different accounts to handle our payments. But there was no specific reason why we chose them for loans. Since we were familiar with these banks after availing their services for years, they were the first ones we happened to approach.

Have you heard of the term credit score? How frequently do you check your credit score?

Yes, I am aware of what a credit score is and how a good credit score can help us build a financially stable profile. However, I am not aware of the specifics of how to build that score. I do not check it frequently. The last time was two years ago.

Have you considered using digital apps for borrowing loans?

Like I have mentioned, I am a little hesitant about platforms which are completely digital. Since I have been using traditional banking throughout, unless there is a visible brick and mortar institution which I can approach for help and assistance, I feel a little hesitant. I don't know how far this opinion that I hold is right, but I feel more safe with conventional banking.

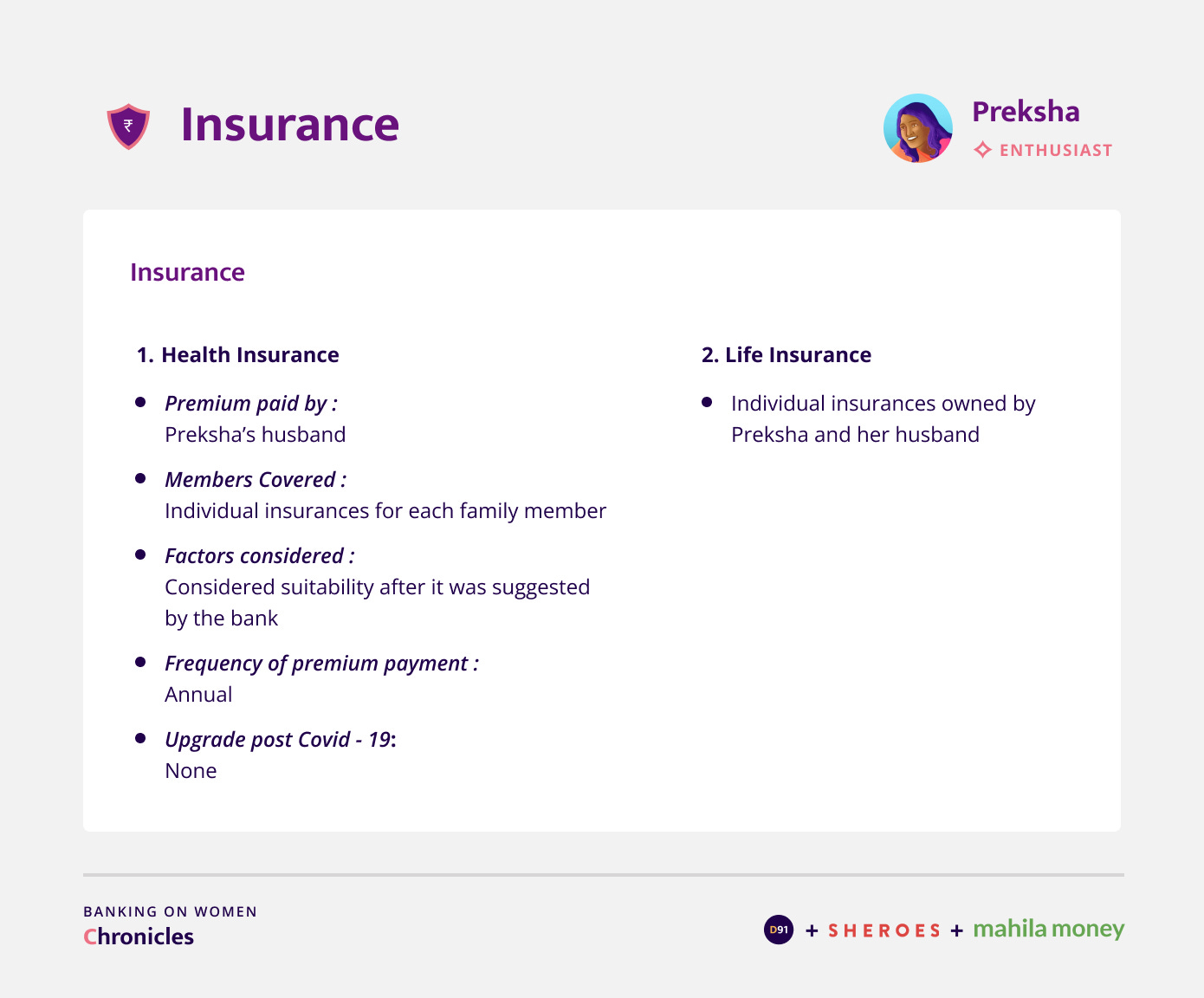

Insurance

If you have health insurance is it specific to each person or is it one that covers the entire family?

It is a separate one for each individual. My husband is covered by his organization. But my children, mother-in-law and I had to get individual insurance.

When did you buy your first insurance and what triggered that decision?

It was recommended by the bank and that triggered the thought that it is an essential investment that we will need sooner or later. Though the conversation was initiated by the bank that it is advisable to have children and everyone in the family covered, we did our own research to find out what it covers and based on our requirements, we decided to go ahead only after we found a policy that met our demands and chose one accordingly.

Outlook towards the future

In your opinion what is that one financial product or service that will have the most impact in supporting your financial journey?

I am a little hesitant to use internet banking and digital platforms and I have to think this is a common problem. I feel that for somebody with my mindset, it would be great to have an app which enables me to understand the different ways I can invest to reach my targets. It would also help to receive suggestions that I can rely on and learn where to invest my money without having to think too much. Basically clearly defined plans that help me overcome my fear of investments and gives me the confidence and comfort that my money is in a good place. At present, investments are something I am very allergic to and scared of. It would be extremely beneficial if the modes of investment are presented in a simple manner and made accessible so that I can break out of this mindset and become open to trying out newer instruments. Even in case of complex concepts, I should be able to find a solution within the app itself or have somebody who can give me a background about the fundamentals. Also they need to use less jargon and stick to simpler terms to convey the various things I can do and what the end result would be if I invest in something. Not everybody is from the banking sector or has a background in economics, so such a platform will make it much easier for the masses to grasp things without feeling like we are lacking.

Somewhere, this is a generational thing as well. What I mean is, my journey as a daughter and a wife today will be different from what my daughter is going to have, so the first step as a working person is to enable her to have that kind of knowledge to be independent, right from the beginning. Coming from my generation, I have inherited a cautious mindset which does not allow me to indulge in certain kinds of traditionally risky instruments. I wish that for the future, for my daughter that would change. I wish that this should be something she is comfortable with from the get-go and that can happen only with knowledge and understanding. It is not something that only men should be handling, every single person despite their gender should be in control of and aware of their finances. One way that I have found works is platforms like SHEROES that build a safe space to learn and understand these concepts from each other. I have seen many women on the platform who despite working for many years are struggling to independently work their financial lives. This in my view has to change for my daughter and the generations after her. Though there is a change already, I wish that change keeps happening, so that it makes it much much easier for others.

Our understanding of Preksha’s journey

Preksha’s journey is a shining example of passion meets hard work and strategic thinking. Aware of her circumstances and a clear idea of what she wants to do, Preksha has built for herself a wealth of knowledge which she aims to apply to her life and work in a step by step manner. Keeping up resiliently with the moving world, she looks at her future to be a combination of the best of what she has learned and what she will enthusiastically learn in the years to come! We were blown away by her limitless spirit and passion for her chosen path!

Hope you enjoyed reading this blog. In case you missed registering for our upcoming webinar on "Moving from access to usage: Making formal finance work for women", here's your chance. Register here.

About the Research

This blog is a result of an online interview conducted with the participants’ consent. The interview was conducted in English. This is a part of the Banking on Women chronicles.

Disclaimer: The name and other sensitive personal details in this documentation is masked to honour the privacy of the participant.

Project Partners

SHEROES

The SHEROES Network is a content and community ecosystem enabling access to employment, entrepreneurship, and capital for women. It includes the SHEROES app, SHOPonSHEROES marketplace, Babygogo, Naaree, MARSbySHEROES and has a user base of over 24 million women. The SHEROES Network is committed to increasing women’s contributions to GDP.

Sheroes.com | SHEROES App | Twitter | LinkedIn | Instagram | Facebook

Mahila Money

Mahila Money is a full-stack financial products and services platform for women in India. Mahila Money specializes in offering loans to women who want to set up or grow their own business along with resources and community to achieve their financial goals. Mahila Money can be accessed via the Mahila Money app on Android.

Twitter | LinkedIn | Instagram | Facebook | Website | Play Store App

All artworks are designed by Poorvi Mittal.

If you enjoyed reading this blog and would like to receive more such articles from D91 Labs, please subscribe to our newsletter here.

To read more about our work, visit our website