#14 Deeksha | Credit in the time of Covid-19

In order to be able to move forward with finances, it is important to be able to trust the system or the person who is willing to guide you.

“Though there have been some very hectic times in my life, I believe that unless and until we go through a tough time we will not find ourselves succeeding and this mindset has kept me going.”

Short Story

Deeksha is a 32-year-old woman from Rajasthan who works as an abacus trainer online. She quit her job as a school teacher during the pandemic as she was struggling with balancing her personal and professional life. She takes financial responsibility for herself and her family and hopes to open her own abacus training academy in addition to restarting her coaching center with her husband, who is also a teacher.

Read on to know more about her financial journey and the life circumstances that shaped her financial choices for herself and her family.

Personal and financial background

In your own words, can you describe your current work? Have you worked elsewhere in the past, if so can you tell us what it was?

I am originally from Kolkata and I moved to Rajasthan after marriage. I was a teacher at a renowned CBSE school for the past 5 years. However, it has been about 3 months since I left my job at the school. Once the pandemic hit, I transitioned to abacus classes in partnership with a friend of mine. I have tied up with two abacus training academies, one is run by my friend and another with an institute that I came across.

What is your daily routine like?

I start my day with prayers and after that I commence my early morning classes. Earlier I used to teach at a school but recently I made a career transition to becoming an abacus trainer. I conduct class for two batches early in the morning at 6 am and 7 am, so I am completely packed with that for two hours in the morning. After that I prepare breakfast as my husband and son have to leave for work and school respectively by 8:30 am. Around 9 am is when I become a little free and spend some time with my daughter. This is followed by household chores and from 4 pm to 9 pm I get busy again with my abacus classes. Post class hours I get back to doing household work. One benefit of working from home is that there is no need to worry about making it back home on time due to potential delays while commuting from one place to another. So this has helped me keep up with my schedule.

Business Details

Apart from these Abacus classes, is there any other business you run parallelly?

No, I don't run any other business, but since my husband and I are both teachers, we had our own coaching institute. However, due to the pandemic, the movement of people is restricted. We are hoping to resume these classes soon.

How much are your earnings on an average in a month? And how much do you typically spend on it?

There is no fixed amount. It varies based on the number of students. But around INR 20,000 to 25,000 is what I earn on an average. In terms of expenditure, I only require an internet connection to run these classes online. Apart from that, for things like study material it’s a one time investment because once I buy the tool to teach and get a copy of the study material in a PDF format, I can use that for every batch.

What made you choose this business?

The pandemic was a tough time for everyone and I was in need of financial help because as school teachers we were getting paid only half the salary. Since our current home was purchased on a loan, running the household, paying the EMI and taking care of everyday expenses had started to become tough for both my husband and me. The irregularities in receiving our salaries and closure of coaching centers made it extremely challenging to manage. I then reached out to my friend for help. That’s when she proposed the idea that rather than helping me with money, she would prefer to help me become self-sufficient by enabling me to earn an income through abacus training. I started to receive training from my friend who runs the abacus academy. As surprising as it may sound, within a month after completing my training with her and starting abacus classes, I decided to quit my job as a school teacher. Online classes had become a big headache for us teachers and it felt like we had no free time. Despite all the struggle, the end result was that neither the parents of students nor the school administration understood the pain we were going through. That’s the reason I decided to quit and I am happy with this career transition as I am able to dedicate time to my children now and that’s a wonderful thing for me. It was difficult to maintain a positive mindset at that point, but with God’s grace, I was moved to a project known as the Internet Saathi programme with SHEROES and that helped me change my mindset and keep going. So that’s how I got started.

At present, the academy I work for is run by my friend. In the future I hope to start my own academy.

Were there any pain points that you faced when you were getting started?

A major pain point was that my schedule had become too tight. I was undergoing abacus training while still being a full-time teacher at the school. It was challenging to manage the workload from the school which included taking care of class work, homework, creating question papers and also running the house with two kids. Additionally, I was also at the tail end of the Internet Saathi programme and I didn’t want to discontinue halfway as I had already dedicated 5 months of my time on that and had benefited immensely from it. Though that was a hectic time for me, I believe that unless and until we go through a tough time we will not find ourselves succeeding and this mindset kept me going.

Household finances

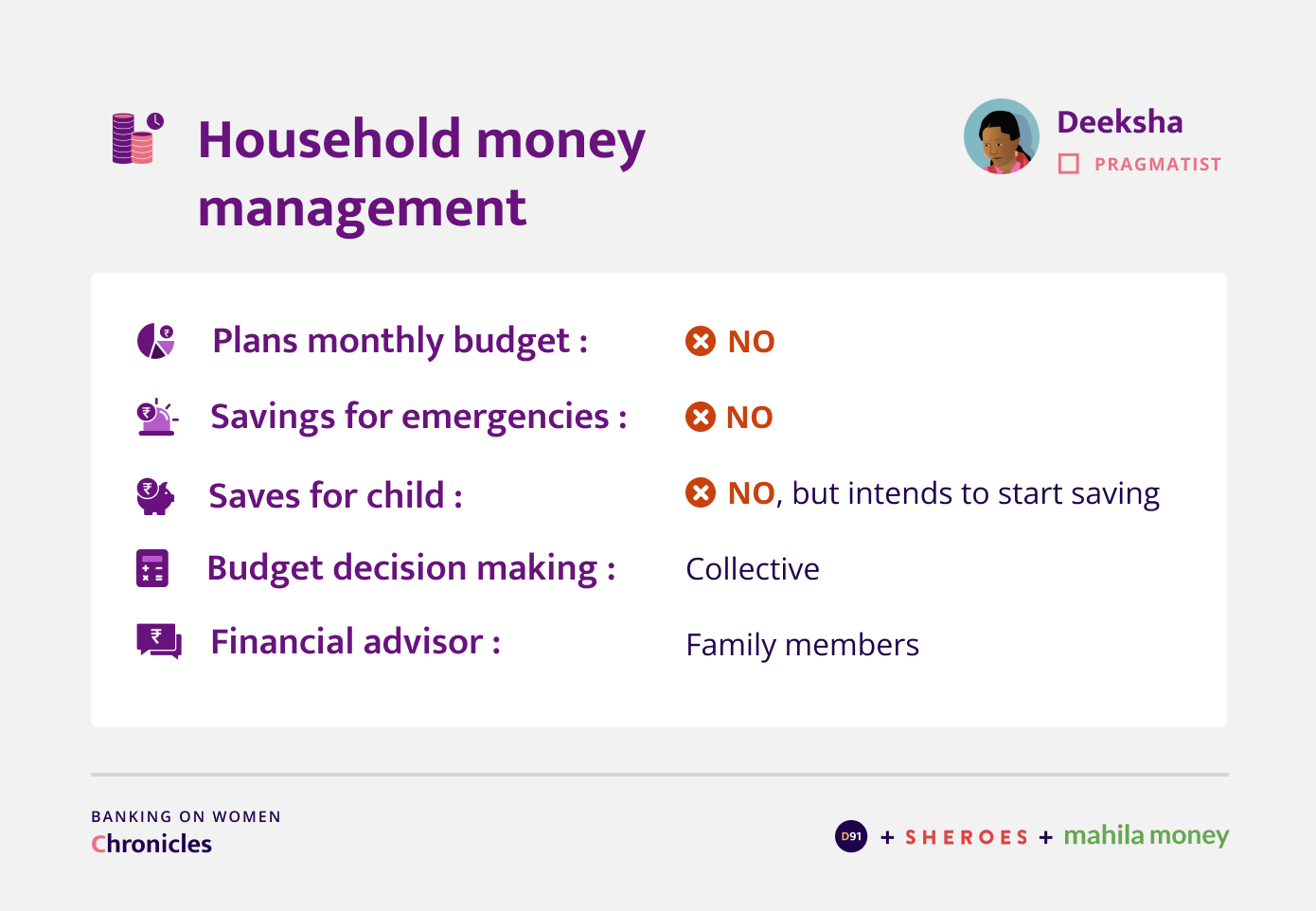

Do you have a household budget?

Actually till now we haven't maintained a budget because in the current abacus teaching model that I follow, I don't get a fixed amount as income as the strength of the class varies from time to time. Though the income from the school used to be fixed, a large part of that used to go into the EMI so we haven’t been able to stick to a budget.

Do you save money for any emergency use?

We haven’t been able to save for emergencies till now because once we purchased the house 4 years ago, our income has been going towards paying the EMI. It has been tough to save money, but with God’s grace now the situation has changed and we are now planning to start saving.

Expenses and Payments

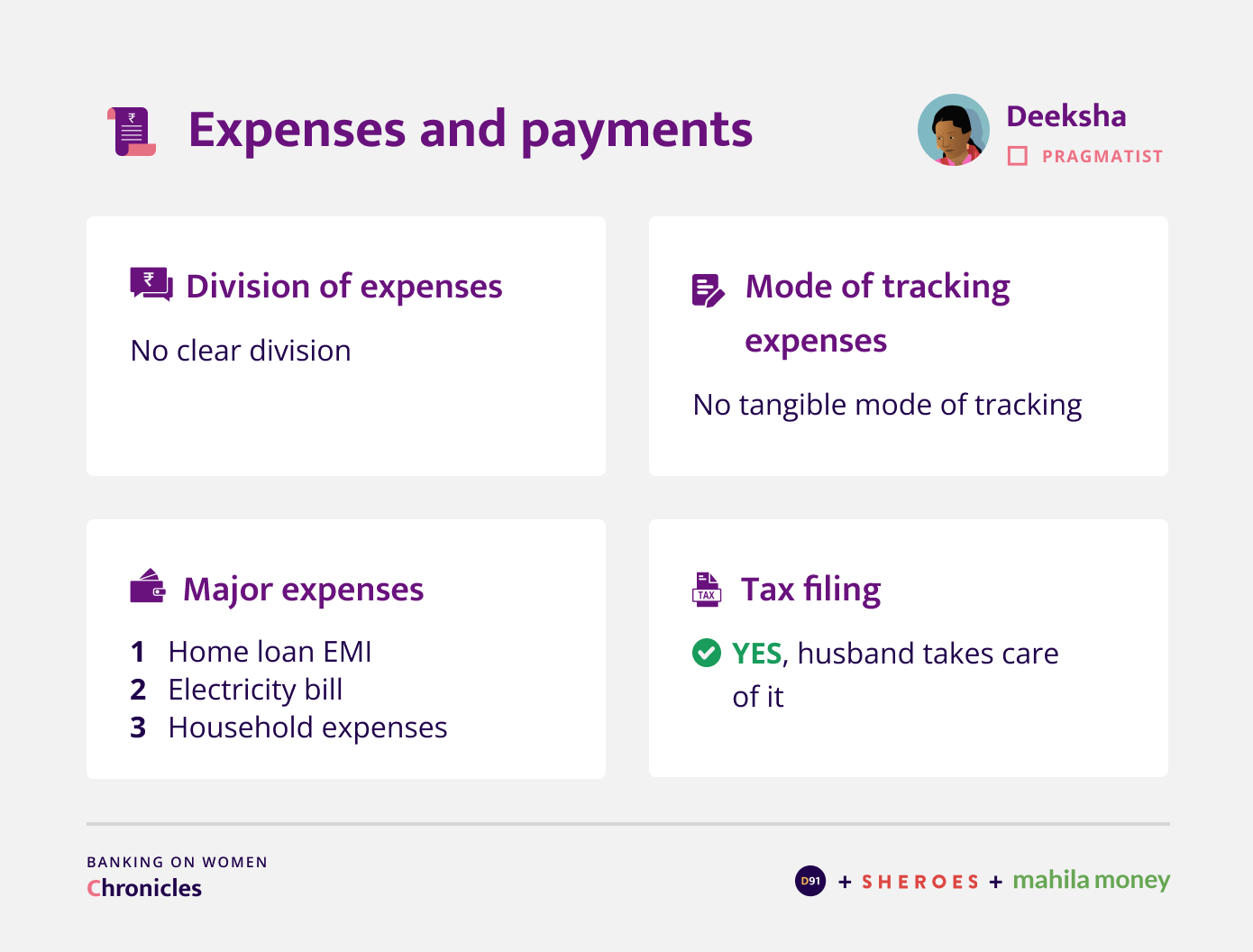

Do you handle all expenses related to the household or is it divided between you and your husband?

My husband and I both manage it and it is always a collective decision. We consider the money that we earn as a common pool of money and there is no distinction. Based on the monthly household income, we decide on what to spend it and prioritize purchases.

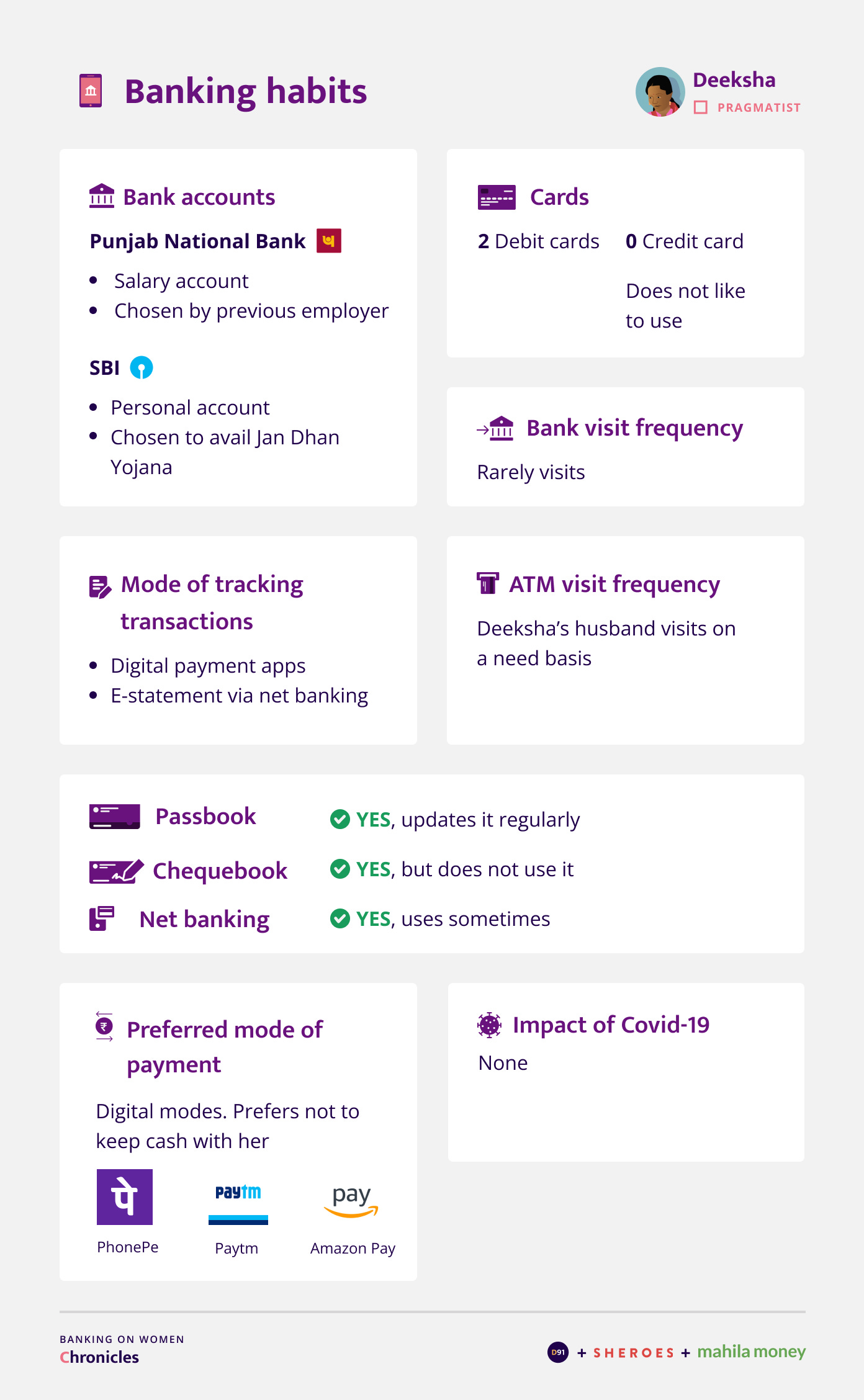

Do you remember the first time you used any of these payment apps? What was your experience like?

I decided to explore it on my own and I started to use it. I was a bit nervous as I did not know if the outcome would be successful, but at the same time I was excited to explore this new way of making payments. Honestly, I was scared of what my husband would say as well because if it didn’t end up working properly and something went wrong, he wouldn’t be too happy about it. However, he was very supportive in letting me explore and in fact, when he decided to try out digital payments, I helped him understand the steps he needed to follow in order to proceed. At that moment I felt proud that I learnt something on my own and also passed this knowledge on to my husband. It made me feel good about the independence I had showcased.

Banking Habits

Financial products and services

Investments

How did you start out your investment journey? Did you start because you had certain goals attached to your investments?

It began with the urge to get started somewhere in terms of investing. I read the book Rich Dad Poor Dad and that influenced and inspired me to start investing. I learnt the importance of keeping some money aside as savings for myself and I made up my mind to start investing at least INR 1000-2000 and I began to pretend like that money is not a part of my income at all. My husband also supported me when I told him that I want to start investing. He's the kind of person who is always very encouraging and is with me in whatever I plan to do, so that is a major plus point for me I’d say.

When you started your investment journey, did you rely on anybody for advice? How did you go about investing in mutual funds?

I started with doing my own research through Google. That’s when I came across PolicyBazaar and one of their advisors got in touch with me. In order to be able to move forward with things, especially finances, it is important to be able to trust the system or the person who is willing to guide you. Despite it being a largely digital world lately, I decided to put in some amount of trust in the person I am speaking to rather than being skeptical without even trying it out. I was very honest with the advisor that I am new to this field and have no idea about how to go about investing. Luckily the person I got in touch with was very genuine and he has also shared his contact details with me so that I can reach out whenever I face difficulties in investing or need any information about a particular instrument. This helped me get started with my journey.

Did you face any challenges when you were trying to start out this investment journey?

Not really, my main problem was to make up my mind and to take the leap and start investing. Now that I have initiated things, there’s no going back. I had told my husband about this as well and he was fully onboard with the plan and is aware of all the details.

Do you use any app to keep track of your investments?

I think I have received a link to an app but since I am new to this field of investments I am taking things slowly. Even the emails that I receive about how much my investments have increased or decreased, I am not able to make much sense of it as I don’t understand the specifics of how exactly these things work.

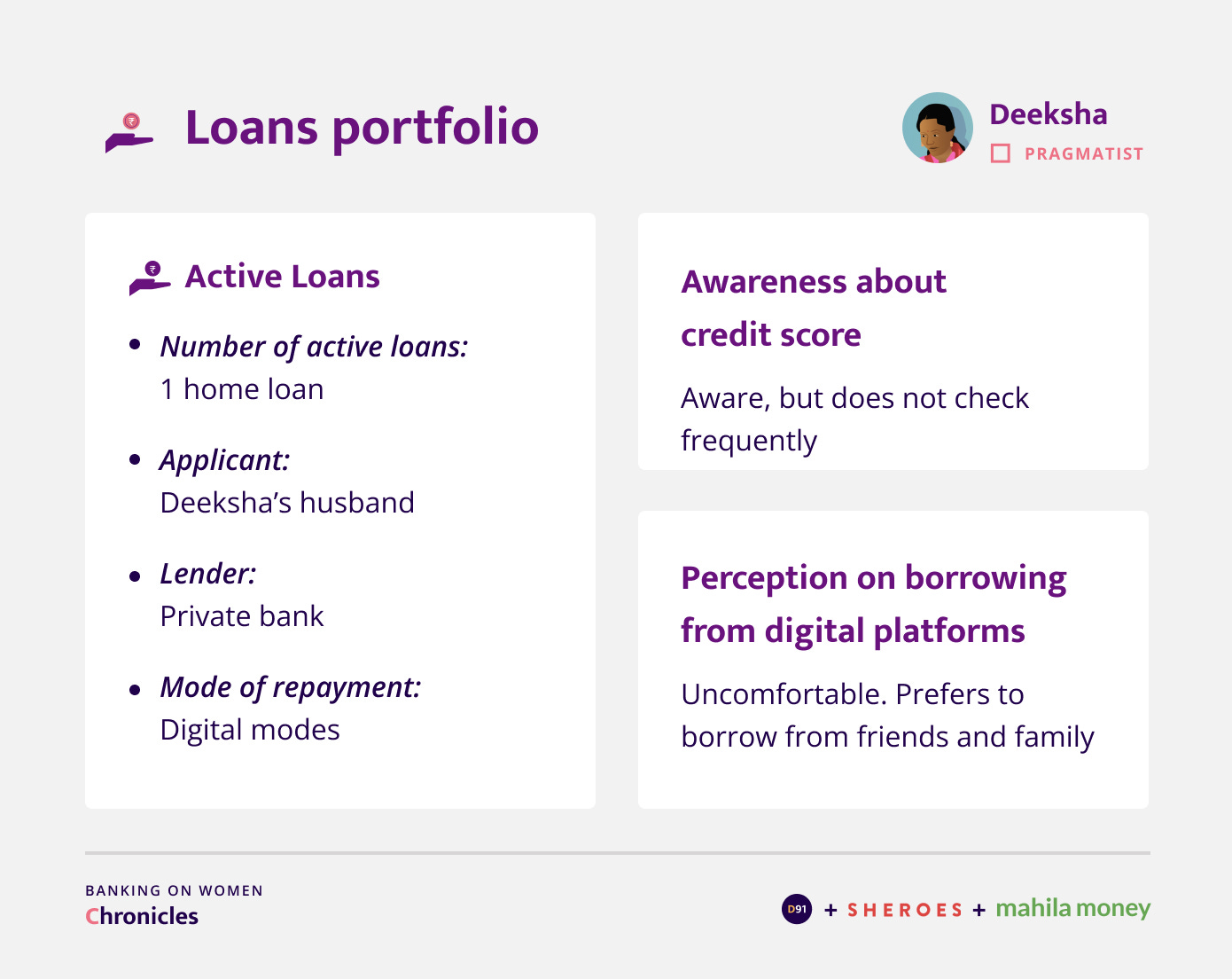

Loans

Where have you taken the loan from? Would you be comfortable sharing that?

We have taken the loan from a private bank because we were not able to get the amount we were asking for from the nationalized bank that we were considering. For this reason the rate of interest is quite high.

When you were thinking of taking a loan, what were some of the factors that you considered before going ahead with this particular bank?

Actually I never wanted to take out a loan but one thing I knew was that I do not have the amount required to purchase a home. I was very hesitant to take a loan but my parents helped me change my mind that since I am a salaried person it is okay to take a loan. Moreover, in today's time purchasing a house is no joke as it is nothing less than INR 30 lakhs and no person would let us borrow such a huge amount. Also, we hadn’t invested our money anywhere to be able to pay through our own savings. So after rejecting the idea several times when my husband suggested it as I was not ready to take on EMIs, I finally agreed. He helped me understand that 5 years from now things would have only gotten more expensive and prolonging the purchase would not be of much use. For these reasons I decided to take a loan and see what the future holds for us. However, the pandemic was a difficult time for me to pay the EMI and even the bank was not very understanding. They only cared about the money even when the RBI had announced a moratorium of three months for home loan borrowers during the pandemic. Only we know the struggle that we went through. That was no time to rejoice because though we didn’t have to pay for 3 months, behind the scenes they had increased the Private Mortgage Insurance by 5% and we struggled a lot to pay that. Those few months were a nightmare and it was difficult to handle things by myself.

Have you ever considered taking loans through a digital platform? Would you be comfortable borrowing money from a digital platform?

Yes, I am okay with borrowing money from digital platforms. There are several apps such as TrueBalance and MobiKwik that are offering loans but their charges are very high. If they say they're giving you a loan of INR 5000, then in reality you have to pay at least INR 750 more to them as additional charges. Even the EMI is quite high. That’s why personally I feel it is better to borrow money from an individual that you know personally and can afford to be a lender because in such a case there will be no unnecessary charges.

Is there a maximum amount that you would be comfortable borrowing since it’s a digital app?

Firstly, I am not comfortable taking loans from a bank or any financial institution for that matter. I feel it is better to borrow from a person because bank charges are too high if you’re not able to pay the EMI on time. They make frequent phone calls without understanding our situation and what we are going through. Moreover, each time it is a different person calling from a different number and we have to undergo the same torture time and again. Despite explaining things to them, there is no solution offered and we have to pay additional charges that include the bouncing charges for late payment along with the EMI. At least in the case of borrowing from other people, even if you decide to repay with interest, there won’t be ridiculously high late fees as they are human and will be understanding. On the other hand financial institutions have no emotions and after the terrifying experience that I’ve had, I view them as inhumane machines who have no regard for a customer's problem. So this is my personal opinion and I hope I can repay my home EMI as quickly as I can so that I can live in peace. I have urged my husband as well to never take a loan from a bank in the future.

Insurance

Do you have health or life insurance?

I don't have much knowledge about insurance, but I am researching and trying to learn more about it as I have realized it is an important investment. I have spoken to a few agents and insurance advisors about health, life and term insurance. But I haven’t purchased one yet.

Does your husband have health or life insurance?

My husband had life insurance before marriage but after the move from Kolkata to Rajasthan he hasn’t paid his premium at all.

Outlook towards the future

In your opinion what is the one financial product or service that will have the most impact in supporting your financial journey?

One thing I would like to see is some humane aspect being brought into financial institutions. As I have shared my loan experience with you and the problems we have faced, it felt like though the Government had announced a few rules to benefit the common man, in reality there was absolutely no advantage for us. Our lives were filled with suffering and our hard earned money was negatively impacted. There is no service in place that does this at the moment. So one service that I would like to see is the availability of a person who understands the customer's problems, feelings and the general situation. Because right now based on how things are, if we were to meet with an accident or encounter an emergency and are not able to pay the EMI, then there is no one to understand our grievances. I feel this kind of support in the form of customer support is an essential requirement and there should be somebody who overlooks this.

Also, I want more resources to increase my financial knowledge because we have not learnt these things in our schools. Since I have been in the teaching sector, my financial knowledge is limited and I don’t have any advisors. So I want to increase my financial knowledge so that I can secure my family’s future.

Our understanding of Deeksha’s journey

Deeksha’s journey is one of personal development and growth. She has re-aligned her priorities to suit her lifestyle and her circumstances and she hopes to improve the financial well-being of her family through realistic and achievable steps. She dutifully submits to her household responsibilities while also acknowledging the difficulties of wanting a professional life in parallel. She is hoping to gain more financial independence through her endeavours and given her pragmatic approach, we have no doubt she will achieve it!

Hope you enjoyed reading this blog. We at D91 would love to receive your feedback on the work we have been doing so far. Here's a brief survey for us to understand your experience while engaging with our content. This survey should take less than 5 minutes of your time and all responses are anonymous.

You can provide your feedback by clicking on the following link - https://forms.gle/4WUzRUBCht2prHs28

About the Research

This blog is a result of an online interview conducted with the participants’ consent. The interview was conducted in English. This is a part of the Banking on Women chronicles.

Disclaimer: The name and other sensitive personal details in this documentation is masked to honour the privacy of the participant.

Project Partners

SHEROES

The SHEROES Network is a content and community ecosystem enabling access to employment, entrepreneurship, and capital for women. It includes the SHEROES app, SHOPonSHEROES marketplace, Babygogo, Naaree, MARSbySHEROES and has a user base of over 24 million women. The SHEROES Network is committed to increasing women’s contributions to GDP.

Sheroes.com | SHEROES App | Twitter | LinkedIn | Instagram | Facebook

Mahila Money

Mahila Money is a full-stack financial products and services platform for women in India. Mahila Money specializes in offering loans to women who want to set up or grow their own business along with resources and community to achieve their financial goals. Mahila Money can be accessed via the Mahila Money app on Android.

Twitter | LinkedIn | Instagram | Facebook | Website | Play Store App

All artworks are designed by Poorvi Mittal.

If you enjoyed reading this blog and would like to receive more such articles from D91 Labs, please subscribe to our newsletter here.

To read more about our work, visit our website