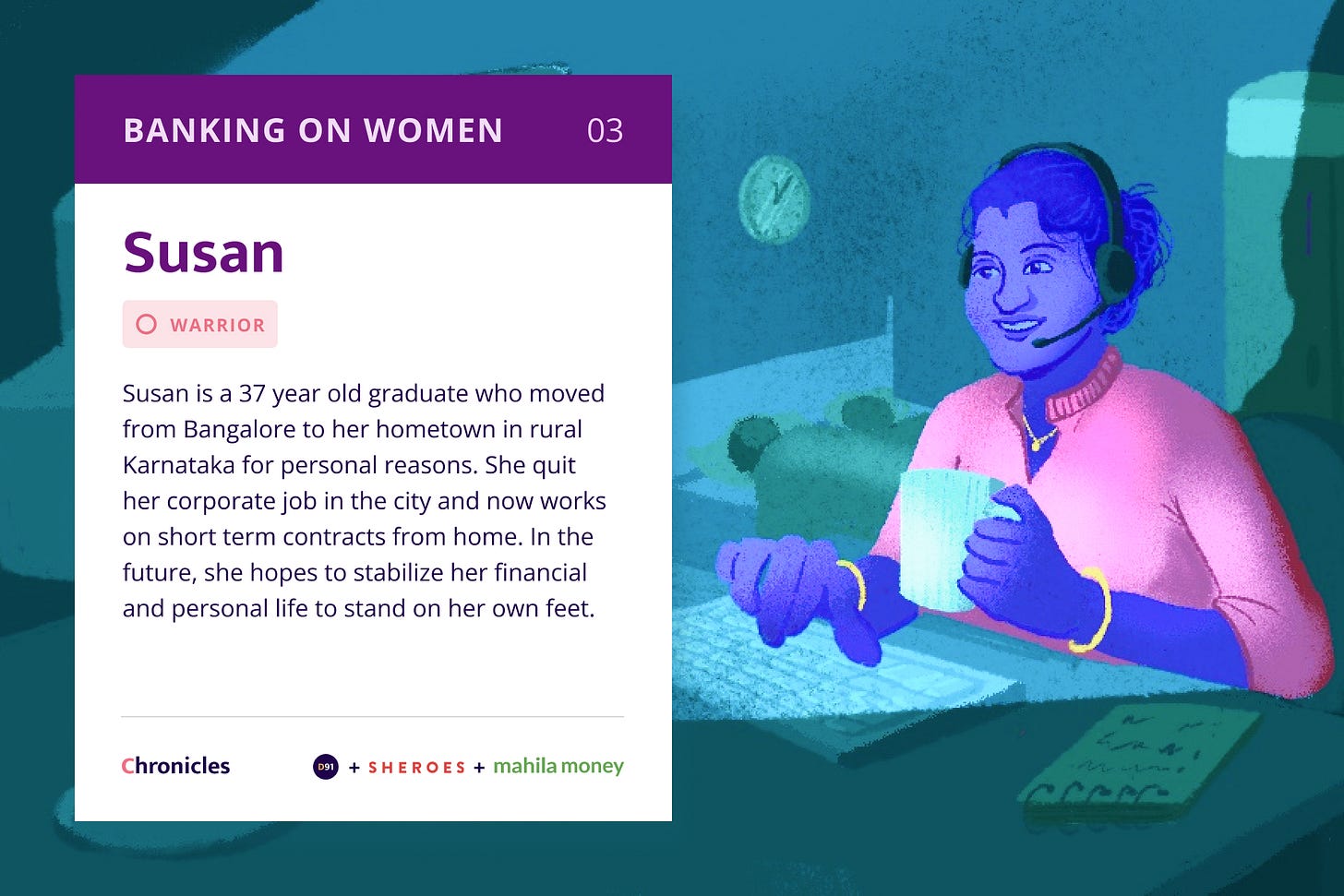

# 3 Susan

For me, trust and confidence in the institution is of utmost importance when taking financial decisions such as loans because there are a lot of swindlers who try to extract money from a debtor.

"I think there isn't much feasible help available in the market for a woman in my circumstances or women in worse circumstances, who have to face society alone. When it comes to women who run their families on their own, having surplus money is all they need. The rest of it, they can and will take care of."

Short story

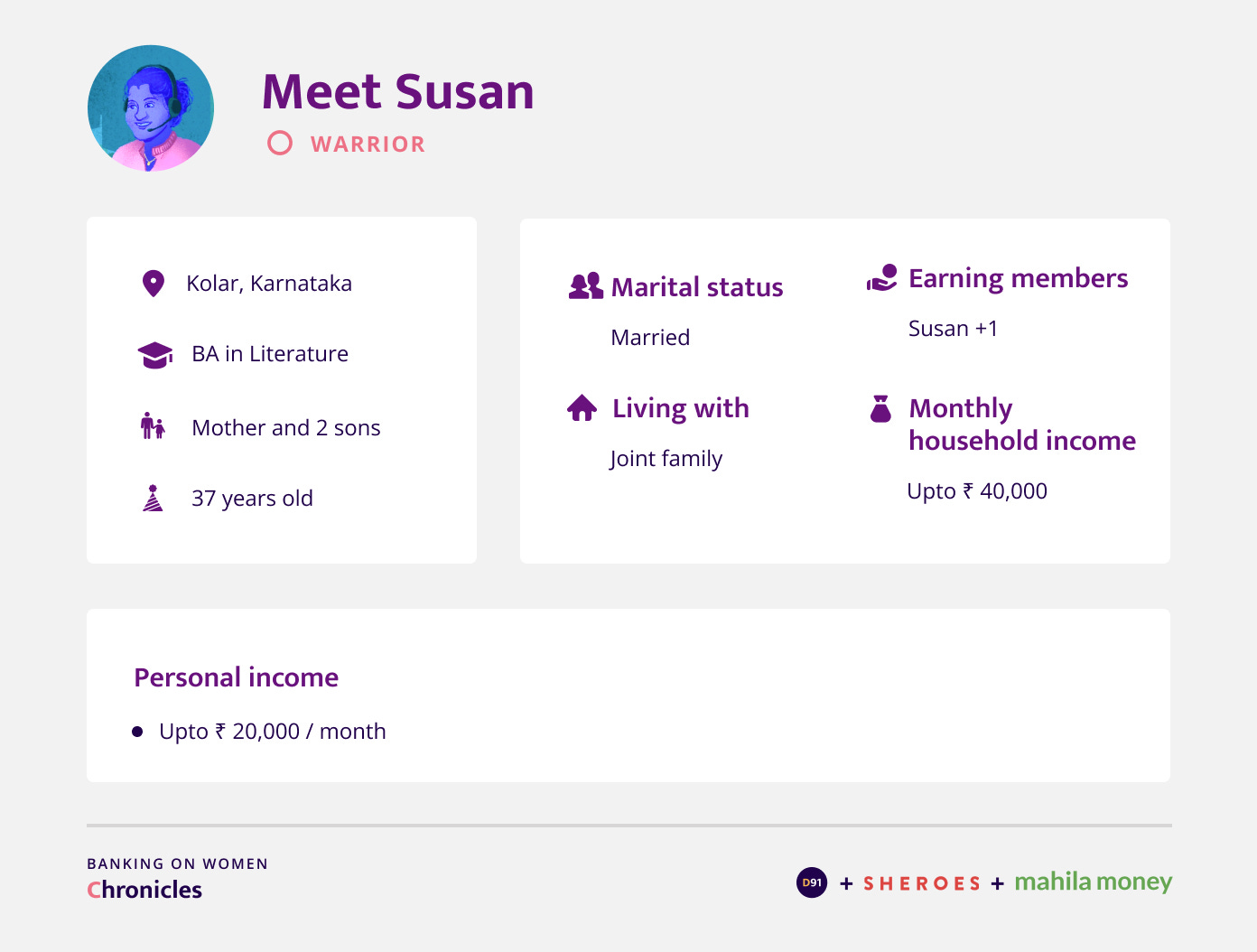

Susan is a 37-year-old Literature graduate who has worked multiple corporate jobs in Bangalore. In 2016, she moved back to her hometown in rural Karnataka to attend to personal matters. She currently works as a MARS by SHEROES partner. While her life today looks very different from the one she had originally set out on after graduating, she has taken these circumstances in her stride and managed to create a meaningful and sustainable career working at home. Her hope is to stand on her own feet and stabilise her financial and personal life to build a better future for herself and her family.

Read on to learn more about how Susan bravely adapted to a starkly different environment and continued her life and financial journey!

Personal and financial background

What is your daily routine like?

I currently work night shifts and have been for the past couple of years. Everyday, my shift ends at 8 am. Just before I log off, I take a short break to make breakfast for my family as the kids head to school after 8.30 am. Once I finally log off, I finish my chores at home and run any errands that I need to. Then, I wrap up and get some sleep before the kids come back from school. After that is pretty much the same - lunch, homework, church and dinner. I put everyone to bed after dinner and my shift starts again at 12 am. That’s my day!

Can you tell us a little bit about your professional background?

After graduating, I started my professional journey as a tele-calling agent and worked with that organisation for about two years. I moved on to start as a Training Manager in Sales and Collections at another organisation. As I continued to work in that space, I moved up the grade and started working as a Training and HR manager. However, around that time, I had to resign and move back to my hometown because of personal reasons. Since I moved here, I have been involved in various work-from-home initiatives through the SHEROES network and MARS by SHEROES programs. Despite operating in a remote rural area, it has been a great journey. SHEROES has helped me find the right type of work, campaigns and processes even before the pandemic started. Through this platform, I have stabilized my family life despite all the cuts on budgets and change in circumstances.

Since when have you been associated with the MARS by SHEROES program? Can you tell me briefly about all of the jobs or processes that you have worked under the program?

I have been with this program since 2016 and this is the 5th or 6th job or process that I am working on with them. I have done a diverse range of processes so far. I first started in the pharmaceutical space, dealing with medical discounts and then transitioned to working for a retail brand.

My third job was handling social media for a large fintech and the one after that involved coordinating deliveries for a delivery services company. This was a tough one for me, I had never made so many phone calls. My last stint with them was profile verification for a HR processes management platform. I also did a short one for a pet supplies store where I coordinated advertisements.Some of these jobs became fairly hectic for me since I had to manage my responsibilities at home as well. But I learned a lot from these experiences.

Did you get support from your family when you started, considering you moved from a corporate setup to this one?

If my family hadn't supported me, I don't think this would have been possible. There is always a fine line that we have to draw between work life and home life. I have to log into work at a specific time everyday and that cannot happen if I have to do all the household work by myself. There needs to be a lot of communication and cooperation to keep things running smoothly within a house. Also, my mother and I have a long standing ritual of having chai together, and it’s something I am very particular about including in my day-to-day life.

Has Covid-19 impacted the kind of work that you have been doing, and the opportunities that you have seen in this context?

Thankfully, nothing has changed from my point of view. Even though operational parts of some of the businesses we work with have been affected, our work which is mostly in the corporate and BPO sector has not been impacted. It is steady and still very much ongoing.

Household finances

Do you have a monthly household budget?

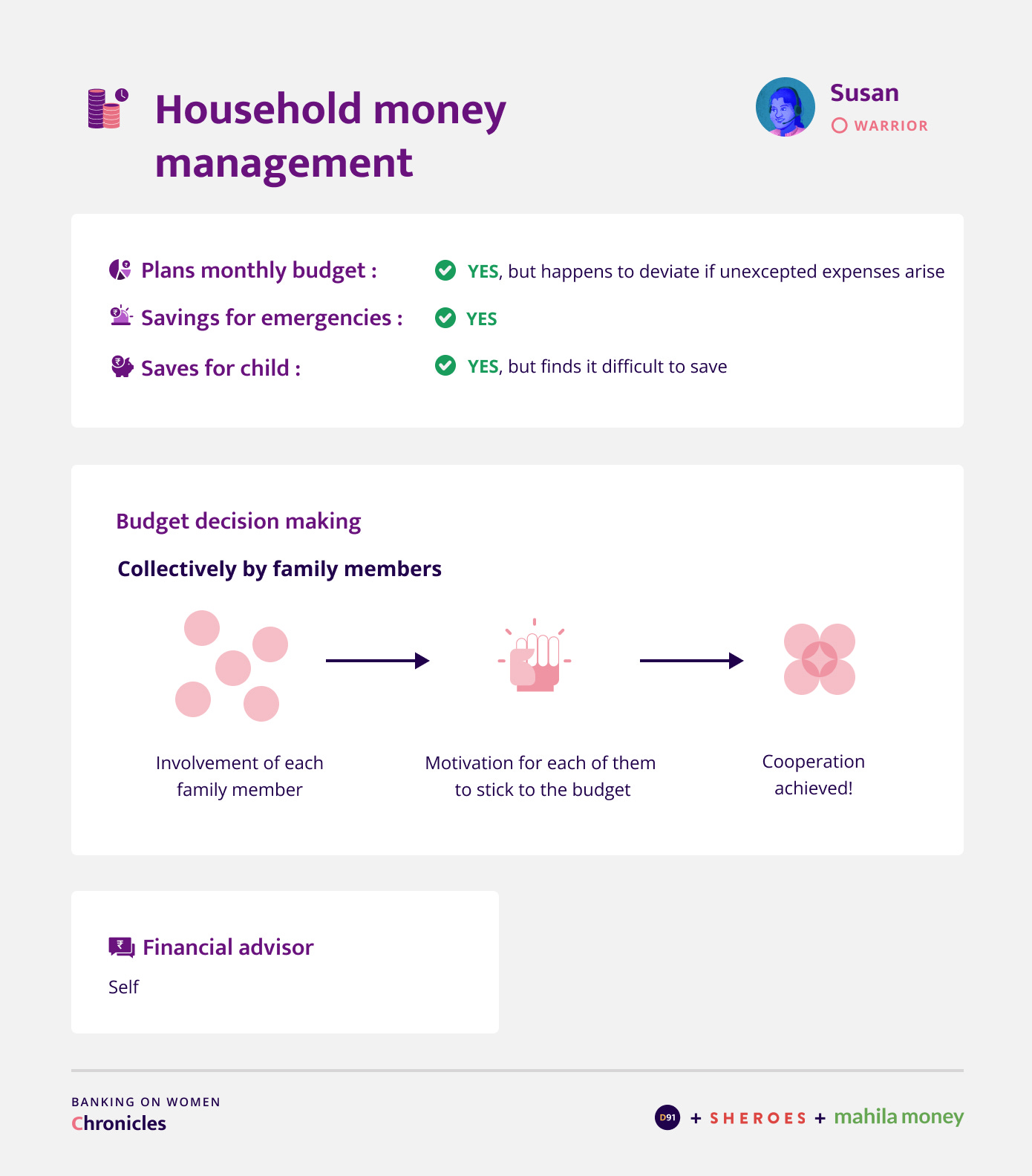

We definitely have a planned budget, but we deviate from it almost every month. As and when requirements arise, depending on the priority, I make the decisions to reallocate funds as necessary.

How is the family budget decided? Independently or collectively?

Well, making any plans alone - including a budget, is not going to help because we need the whole team to pitch in to stick to the budget. So we need to pull in everybody's interest and then there must be some perk for each one of them as well. We have seen this work best for my family!

Do you save money separately from the monthly reserves that you have for a rainy day? Does your family know about it?

Most definitely, yes. I believe in saving for a rainy day and I do. Although it's a secret because the moment someone knows that it exists, they will have needs. I often tell the one person in my family who will appreciate this the most and possibly add value to it.

How are the expenses divided between you and other family members? Or are all the expenses are handled by you?

What we do is, we pool in all the money for the family expenses and accordingly take a call on how to manage expenses with that amount. This way, everyone contributes and we get things done equitably.

Has COVID-19 impacted your household budget?

It has quite a bit. Our costs of food and electricity have risen substantially. I think this is primarily because the kids are at home all the time. Even their clothing has increased because they are increasing in size now with the two years of home stay. But on the flip side, the travel expenses have reduced, so somehow it evens out.

Expenses and Payments

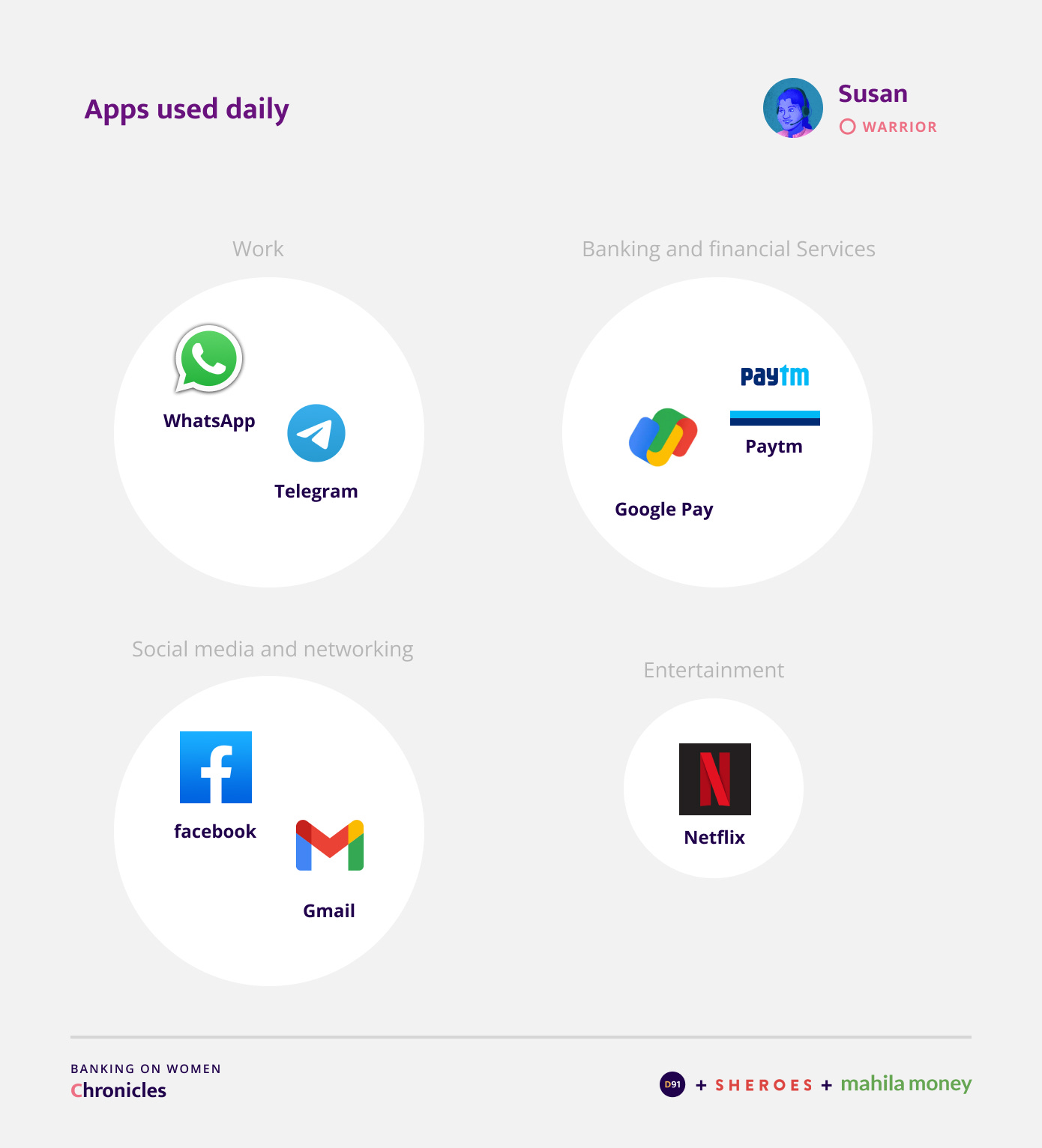

Do you use payment apps for your monthly utility bills, rent, fees?

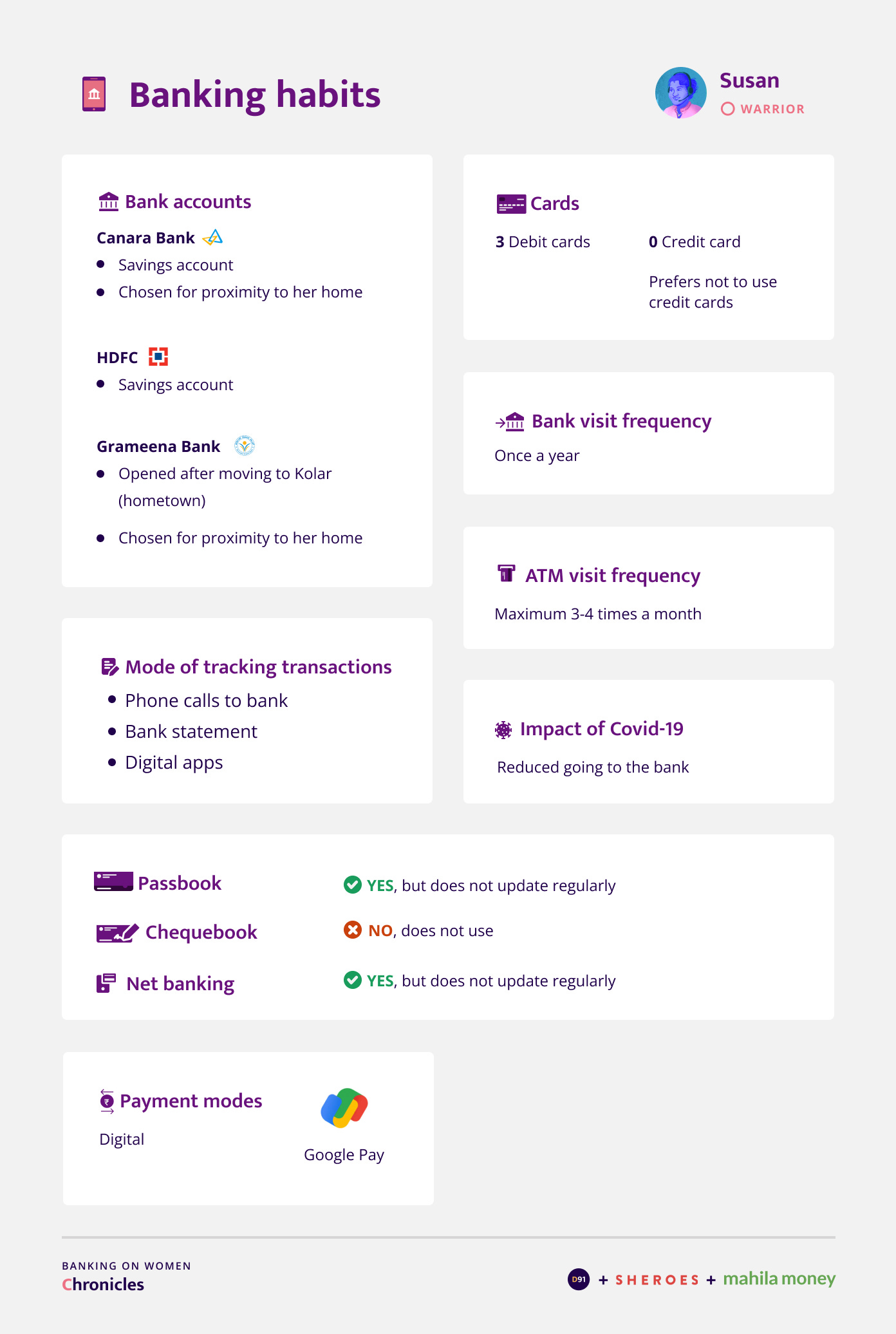

School fees are paid annually here and are recommended to be in cash. We pay electricity bills through Google Pay and gas bills i.e. for gas cylinders we pay by cash at the time of delivery, they are small merchants who prefer cash payments.

Do you remember the first time you used any payment app? Can you tell me a little bit about the experience?

The only app that I prefer to use is Google Pay. I started using Google Pay since in one of my jobs, I heard a lot of complaints about the other popular payment apps. When I first started I was worried that I would face a lot of trouble but thankfully that has not yet happened. I think my first payment was to the fruit stall guy - it was actually quite easy to install and use.

Do you file your taxes yourself? Or do you get someone else to file your taxes for you?

Ever since I joined SHEROES, I have a person I met through that platform who helps me with my taxes. I find the whole process very smooth and secure with her. I guess, it’s a woman thing, we connect well and I trust her.

Banking Habits

At which banks do you have accounts and why did you choose them?

Initially, when I was working in Bangalore, I used the international corporate banks. But once I moved back home, I had to choose a bank which had local branches. So I dealt mostly with Canara Bank, which is close to my house. My experience with them so far has been really good. I have accounts at a couple of other banks for my children's school purposes as well.

Do you prefer to make payments in cash or do you prefer to make them through digital modes?

I use both depending on what the requirement is on the other end. If I were to pay a merchant, I would prefer the digital way. But if I have to make payment in cash at the bank, or at the tailor, then I wouldn’t mind doing so. However, my personal preference is digital payments.

Do you prefer to withdraw money in bulk at the beginning of the month?

I do not withdraw money in bulk. I take whatever amount is required and the remaining I prefer to make online payments. Where I live, very few merchants do have digital options, so I need to pay them in cash and I withdraw cash only for such purposes.

Financial products and services

Investments

Do you save money for yourself? (Not children or other family members)

No, I am not so self-centered, my savings are for my family! I do have savings in the form of a few LIC policies that I pay quarterly or half yearly. Also, where I currently live, people prefer post office savings, so I have invested there as well. Apart from that, it is just money in the bank.

Do you save any money in the form of cash at home?

I don't believe in saving it in cash form as it is very risky to do that.

You mentioned that of the total household income, about 80% is expenses. Is it accurate to assume that the other 20% is used for investment purposes?

Not necessarily. Sometimes there could be miscellaneous expenses or expenses not accounted for, such as a wedding that came up. It could be any unplanned event for that matter. The good thing is the post office is quite flexible and there is no requirement to deposit a fixed amount regularly. So, my investments vary from month to month. Whatever remains after the expenses, becomes the investment for that month!

Since when have you been investing?

Whatever investment I had when I was in Bangalore, I have withdrawn all of that. My investments were restarted after coming here.

Did you have any specific goals attached to your investments?

Not all of them are planned. A few of them are for my children's education and future. The rest are unplanned and just money that is parked for future use upon its maturity. It’s been my experience that money in hand does not stay idle for long - I'm sure there will be something that comes up once the amount is available for use.

Who do you turn to for financial and investment advice? Do you consult a bank representative or portfolio manager?

I do not rely on friends, family or any other external sources for advice. I believe finances are a very personal thing because we go through many ups and downs in life, and only we know what works best for us based on our circumstances. Since I run a lot of errands in the family, I believe I am more aware of my financial profile than any other person, however well-meaning. People can give me advice but at the end of the day, I prefer to take the final decision on how to go about my finances as I believe I can build my financial health better than anyone else can.

Even in terms of investment instruments, I do my own research. People who write information on the internet or give advice about their experiences, have nothing to gain or lose out of it. I wouldn't want to adventure too much because I don’t have a lot of surplus in the first place so I have to be very careful about where I put my money. My most preferred investment is gold and I recommend it to many people because the other instruments have the potential to lose value very quickly. Things like mutual funds, stocks etc. have the potential to turn upside down when a pandemic or such other calamity hits again and are dependent on the state of businesses, markets all of which which we have little control over.

What are your thoughts on digital gold? Have you considered that?

No, not really. For me the pleasure is to put on the gold. It is an investment and it looks great!

What challenges do you face in investing?

The problem is that I can't invest regularly because things are very unpredictable lately on the finances front. It's been my experience that if I want to invest in something, I may need to stack up some money because if I only invest small amounts, then it’s not going to give a lot of return. Therefore, investments are not a regular thing for me right now, even though I try to do my best. What I would prefer is a scheme where I can keep paying a small amount every month and once that adds up to a significant amount then, I can go ahead and invest in an instrument of choice such as an LIC policy or Mutual Funds. Right now, I do it in the bank and it is not very profitable.

How has the pandemic impacted your investments?

Investments have reduced quite a bit because the expenses have increased and stacking money up has slowed down. I have two growing sons, they are both adolescents now and it's not easy. I am hoping it will pick up some speed soon though.

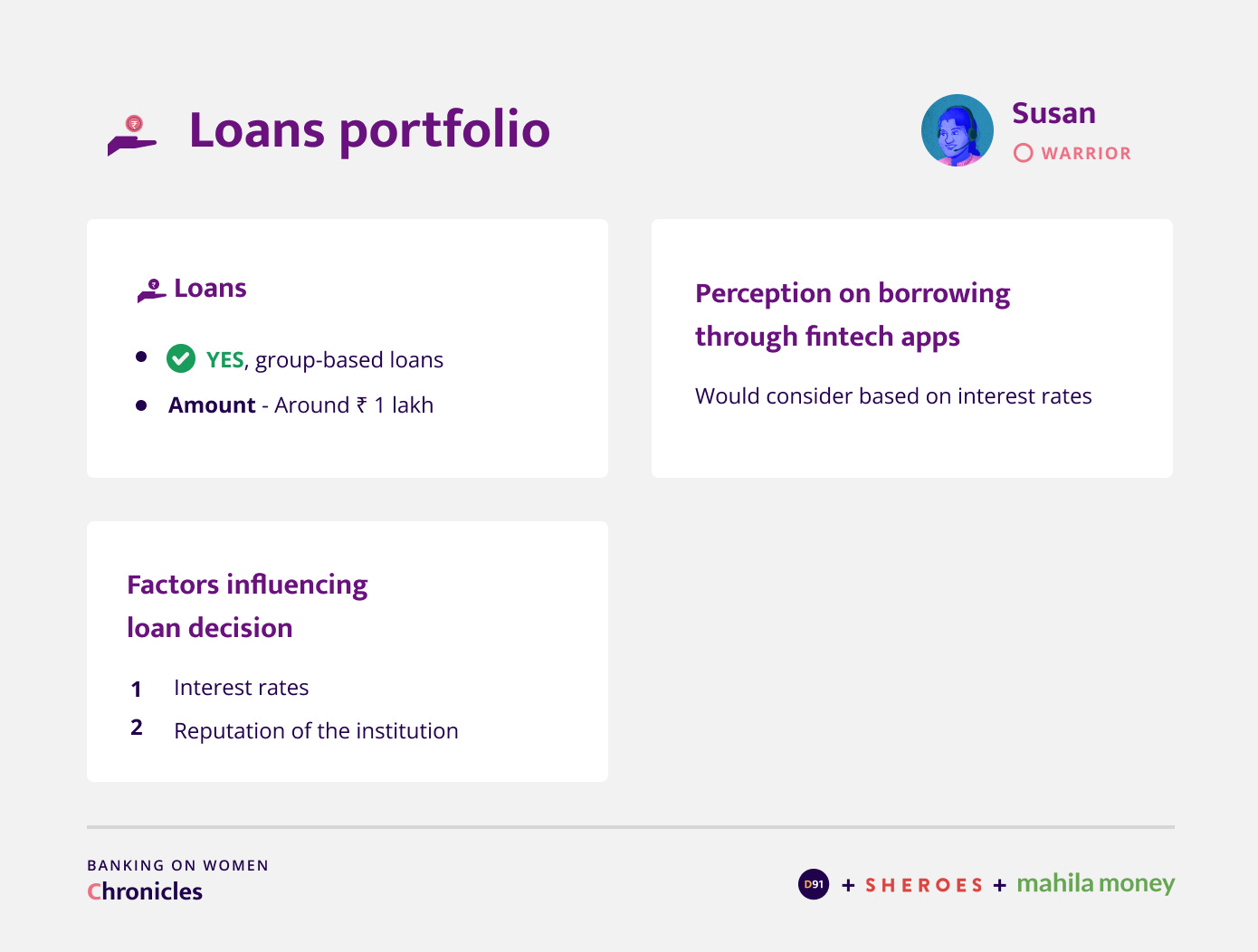

Loans

Have you taken any loans in the past two years?

I prefer not to take bank loans because of the interest rates. However, there are a few Mahila groups that run in rural areas. They are groups which run on investing money on a monthly basis. The group involves 20 women who invest small amounts in the group every month and keeping in mind the investment that we have made, there's a rotation of money among the members of the group. If I want a loan, there's a leader in the group and she would help me with my needs. Whatever amount it may be, they will rotate the money within the group and I have to pay it back monthly. It's a very minimal amount with minimal interest. It is basically our own money, but we just rotate it. Such informal but structured lending instruments are quite common here in rural areas. I prefer these over bank loans any day.

Would you be comfortable sharing the amounts or if any of these loans are outstanding right now?

I have no loans outstanding right now but when I had first moved here, I took a loan of about INR 1,00,000, it was to set up my work requirements here as well as pay the school fees for my kids. I was able to repay that back in time and I am comfortable now by God's grace.

Have you considered using digital apps for borrowing loans? If yes, what are the factors you would consider before borrowing from them?

I am not really comfortable with the idea of borrowing money, but if required, and that's the only option, then I would not mind.

Apart from interest rates, there are a few factors that come into play while borrowing money from any institution. Firstly, a lot of confidence and faith in the institution because these days there are a lot of swindlers who try to extract money from a debtor. Even after the loan has been repaid, there are few banks that come back and say a certain amount is still outstanding. There is a need for money in the market and I wouldn’t blame them because that’s how the world works. But to put things into perspective, considering the population, even if they were to extract only one rupee from each person, imagine how much that will amount to. For these reasons, I would take a lot of time to decide as for me trust is very important and the reputation of the institution matters.

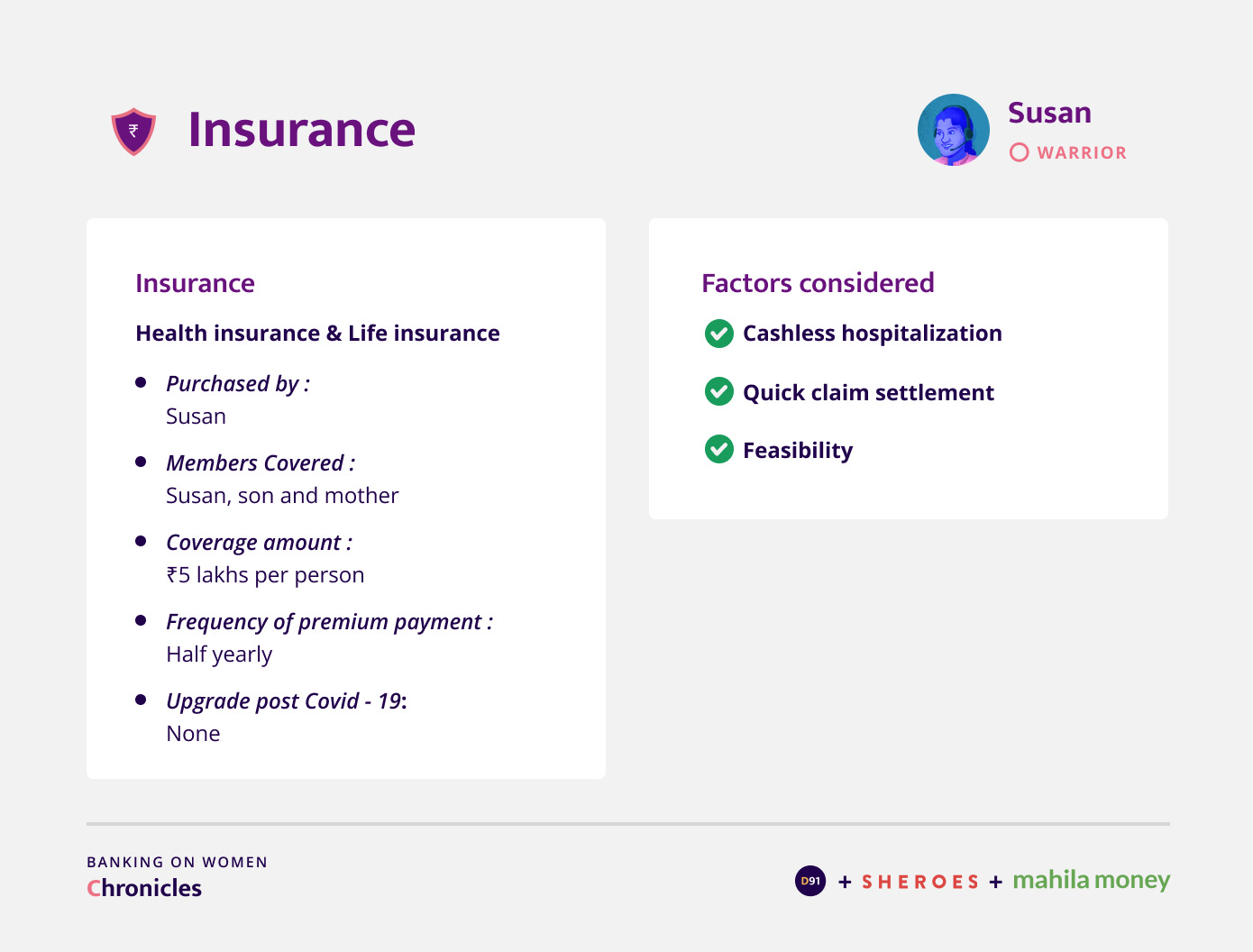

Insurance

When did you buy your 1st insurance product and why?

When we work with corporate companies we have insurance as employees. Since I quit my corporate job, I did not have one. But I see value in insurance as a product and that was the reason I decided to choose my own insurance. I know I will need something to rely on in case of emergencies.

Did you look into other factors like claim rates and premium?

Well when it comes to claim rates, not everybody is giving good ones. There is always a cut there. But there needs to be some time to at least make the money. So up until then, if they are able to cover then I will be able to pay the rest. Eventually nobody's going to pay for the smaller things, you know, the bandages or cotton so we already know that. The idea is to safeguard till you can build a reasonable net in parallel.

Outlook towards the future

In your opinion what is the one financial product or service that will have the most impact in supporting your financial journey?

I have not thought of anything like that because I think there isn't much available in the market as feasible help for a woman like me or even women in worse circumstances who actually have to deal with the society alone. When it comes to women who run their families on their own, having money, surplus money makes all the difference. Because the rest of it, they will take care of.

Nobody is going to give money for free, there’s always a catch and that's how the world works. Once we understand that, I don't think we will have high expectations from anyone.

Our understanding of Susan’s journey

Susan’s journey has several curveballs that have thrown her off a steady linear path. She has chosen however to march forward resiliently in the face of adversity. Her struggle is personal but the consequences of that often spill over and impact her relationship with society at large. It also shapes her outlook towards her capability and her dependence on others. Her indomitable spirit to forge her own path and take matters into her own hands makes her story an inspiring and brave one!

About the Research

This blog is a result of an online interview conducted with the participants’ consent. The interview was conducted in English. This is a part of the Banking on Women chronicles.

Disclaimer: The name and other sensitive personal details in this documentation are masked to honour the privacy of the participant.

Project Partners

SHEROES

The SHEROES Network is a content and community ecosystem enabling access to employment, entrepreneurship, and capital for women. It includes the SHEROES app, SHOPonSHEROES marketplace, Babygogo, Naaree, MARSbySHEROES and has a user base of over 24 million women. The SHEROES Network is committed to increasing women’s contributions to GDP.

Sheroes.com | SHEROES App | Twitter | LinkedIn | Instagram | Facebook

Mahila Money

Mahila Money is a full-stack financial products and services platform for women in India. Mahila Money specializes in offering loans to women who want to set up or grow their own business along with resources and community to achieve their financial goals. Mahila Money can be accessed via the Mahila Money app on Android.

Twitter | LinkedIn | Instagram | Facebook | Website | Play Store App

All artworks are designed by Poorvi Mittal.

If you enjoyed reading this blog and would like to receive more such articles from D91 Labs, please subscribe to our newsletter here.

To read more about our work, visit our website