#4 Bhavana | One Mandala at a time

Initially, it hurts to pay for investments every month because that money cannot be used for other things, but eventually when you see your money grow, it feels great.

“I always wanted to pursue a creative field, but due to conventions around what is considered a respectable career within my household, I decided to pursue law. Now that I have stabilized my finances and can afford to invest my own money to experiment with a business, I decided to go ahead with selling Mandala art.”

Short Story

Bhavana is a 33-year-old lawyer currently on a career break. Originally from Calcutta, she has been living in Bangalore with her father for over a decade. With a flair for creativity, she decided to mold her hobby as a Mandala artist into a full-fledged business during the pandemic. Bhavana has self-learned various aspects of running a business by building a community on social media. As someone who thoughtfully handles various aspects of her business and finances, her journey offers valuable lessons for aspiring entrepreneurs.

Personal and financial background

What is your daily routine like?

Currently my routine has changed because I am on a career break. Broadly, it involves a morning walk, followed by daily chores and catching up on reading. Since I am trying to pursue painting as a business, I spend some time every day discussing with friends, family and other artists on how I can kick start my business. Earlier it mostly involved my morning routine and going ahead with my work schedule for the rest of the day.

Business details

Do you already run a business or are you in the process of setting it up?

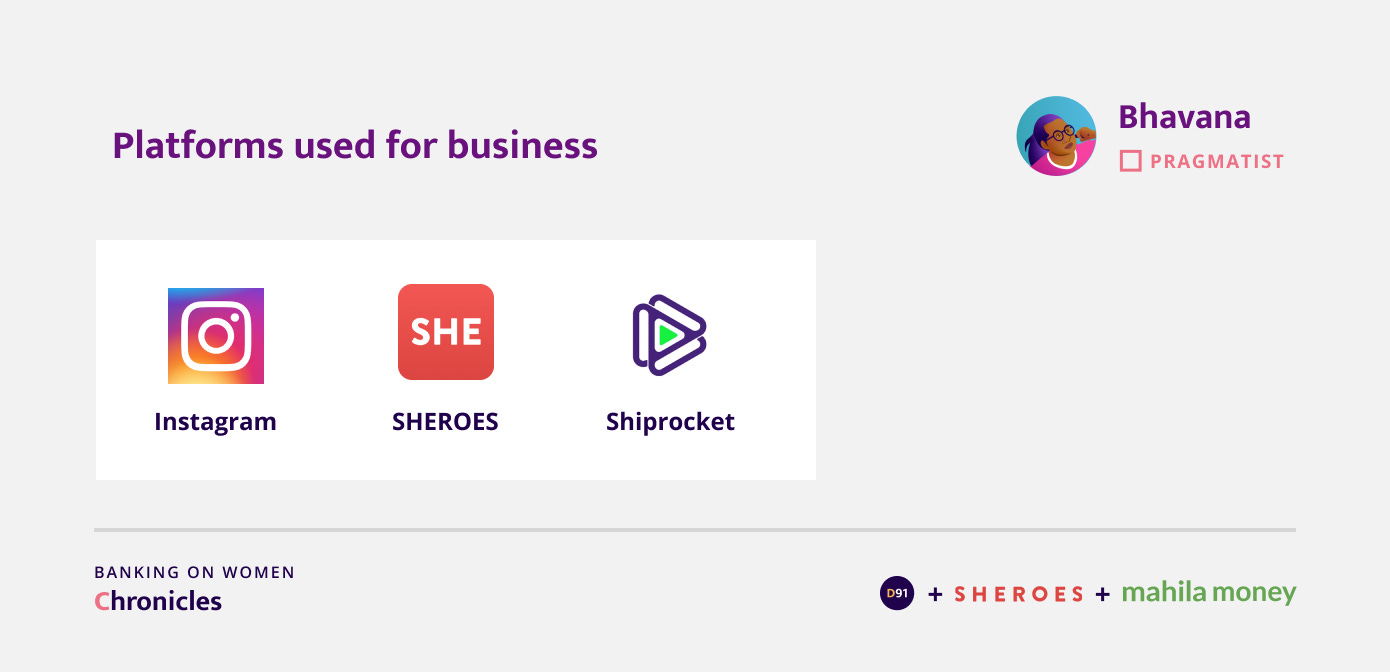

I have been selling and publishing my paintings on the SHEROES platform for about 2-3 months now. I intend to explore other platforms to grow my business.

Can you tell me a little bit about the various products you sell?

I sell framed hard copies of hand drawn Mandala paintings. Additionally, digital art is something that I am learning, but I find that slightly more challenging than handmade ones.

How much does your business earn every month on average?

On average I earn between INR 5,000 - 10,000 a month from my paintings. However, I have a lot of things in mind to scale my business and I anticipate higher earnings once I work that out.

How much do you spend on your business every month for things like materials, supplies, etc?

It all depends on what exactly I am looking to buy or spend on, whether it’s papers or logistics. For shipping I have got a few agencies around so that my shipping charges are less, because when I send it through professional courier services, it costs a lot. I have also contacted Shiprocket, they are really helpful and they take care of the packaging completely. Whereas, professional courier services do not take care of packaging. I have been able to cut on my cost in this manner. So, I spend around INR 2,000 - 3,000 monthly on material, shipping and to make sure the product goes out well. I also save some of the money that I make.

How did you finance your business till now?

It was completely self-funded. I took care of materials, shipping and various other aspects on my own. Of course once I started selling my paintings, the money that I got from my customers was also available for business.

Is it completely run and owned by you or do you have people who help you with various aspects of the business from ideation to delivery?

It's completely my idea. A one woman army.

Did the pandemic play a role in pushing you to kickstart your business from home?

Yes, the pandemic played a part, around 40% I’d say, because during the lockdown, I was stuck at home, had a lot of time and did not want to sit in front of the computer. That’s when I decided to invest my time somewhere else and started painting. I used to paint in school and college, but it stopped once I got busy with work. It started as a one-time thing, but apart from COVID, I attribute the remaining 60% to the appreciation I got from people. They were the ones who told me I should do something about this interest and encouraged me to sell my art. In fact, they urged me to share it with them so that they can promote it. So, it was through word of mouth that others became aware of my work and that’s how my business started.

Business journey

Why did you choose to do this business?

I always wanted to pursue a creative field, but due to conventions around what is considered a respectable career within my household, I decided to pursue law. Now that I have stabilized my finances and can afford to invest my own money to experiment with a business, I decided to go ahead. It was my own self-motivation to try something really creative that pushed me to start this business.

How long did it take you to set up this business?

Well, it took a lot of time. I used to paint even before the pandemic and post it on Instagram and follow people. However, it took around three years to reach a place where people started recognising my work and for me to start selling my art.

Did you get support from your family to run this business?

Absolutely, I have received amazing support. My friends were the ones who publicized my art. My family was also supportive. Initially when I started shipping through professional courier services, my father would sit down and help me in packing all the paintings and take them to the store to ship.

What were your pain points while setting up this business?

My challenges were mostly around how to make my paintings a little more perfect for people to appreciate them. Of course art is very subjective and need not be perfect, but when we sell it to others, it has to look attractive and nice. Apart from that, I was not aware of the right materials and colours to use since I never went to an art school or wasn’t trained professionally. So it was mainly these technical problems that I faced.

The second problem was to figure out how to publicize my art and let people know that I am willing to sell it. When I used to share it on my personal account, because of the dynamic that I have with my friends, they were hesitant to discuss pricing and ask if I was willing to sell it to them. However, funding was a little easier for me since I was working. I will be back to work again later, but for now I have the availability of funds to experiment. So mainly technical aspects and social media promotion was a problem.

Did you have any mentors or friends to help you plan and execute this business? How did you navigate through these issues that you mentioned?

I started to explore Instagram. It is the best place to get to know artists with similar interests. I started following a lot of them and they were extremely approachable and helped me by sharing their journey with me, sharing links to their own YouTube channels so that I can familiarize myself with the essentials. They were encouraging and told me how these resources would help me understand the technicalities better. Apart from that, a lot of self-learning went into it. I relied on Google and self-taught artists who put up videos and reels on Instagram about what kind of materials they use, where to buy them from and other such information. This helped me immensely and I also learned how to publicize and advertise my work by just following them and understanding.

Do you market your products anywhere? If yes, where?

Currently I don’t market my products anywhere apart from SHEROES. Since SHEROES is a place where I can connect with people and sell my art, it became easy for me. If similar platforms come up in future, I might try them out, because I am happy with the kind of profits that I'm making.

Have you also considered registering or formalizing your business and is there a reason why you would like to formalize it?

Yes, I intend to. However, I am waiting for a few things to work out in the meantime. Registering a business is a good idea any day because it becomes easier to get a loan from a preferred institution when required. But if it is an unregistered business like mine, nobody would give me a loan unless they know me personally. Funding becomes a little easier when a business is registered. Once my revenue reaches a particular amount, I will go ahead and register my business.

Household finances

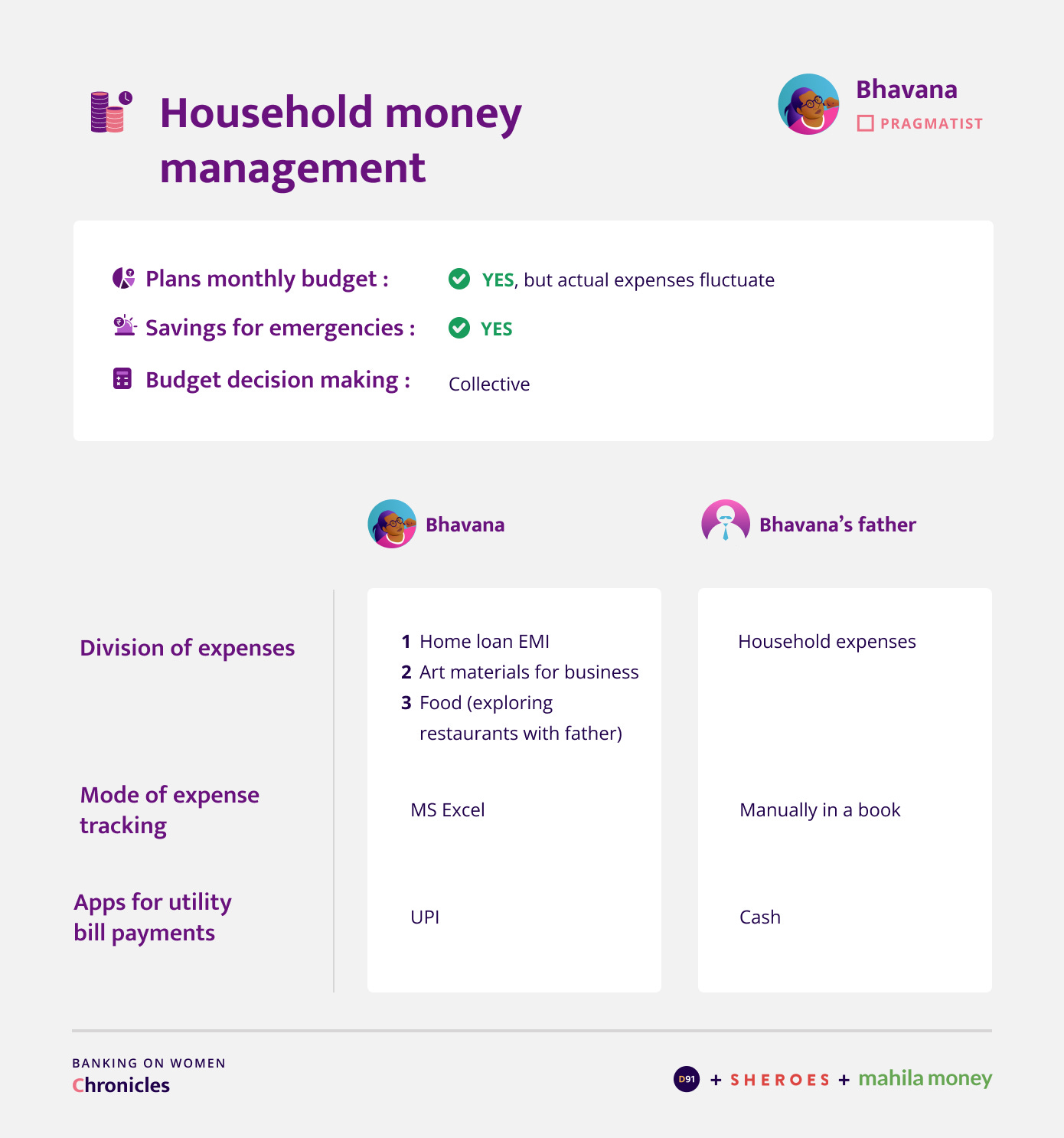

Do you have a monthly household budget and if yes who is responsible for maintaining it?

Yes, we do have a budget. Though not a very strict one, we try to keep the monthly expenses within a certain amount and it is actually maintained by my father. I just give him the money and I ask him to do the needful because I have other things to manage. He completely takes care of the budgeting part at home. This does not include the money that I earn from my business.

Do you save money separately from the monthly reserves for rainy days or later use?

Yes, I do. Every month once I get a salary from my company, I keep aside a portion of it as a salary to myself. This is the amount that I spend on on 3 items :

My art supplies

Clothing

Any other items that I come across while shopping and wish to buy. For example, say a watch that I really like.

However, the day I run out of this fixed amount, I pretend to be broke and I don’t spend on anything else.

What are your top 3 expenses?

My top three would be

EMI for my house, it’s the first thing that comes to my mind the day I get my salary.

Things related to my business, such as materials that I buy every month.

My father and I have a ritual where we try out a new food place twice a month. We keep a budget on that and decide how much to spend on those meals.

Whom do you rely on for financial advice?

My go to person is my best friend who is a CA. He helps me understand things related to finance and he advises me on how much I should save and invest based on my salary.

Expenses and Payments

Is there any technique through which you or your dad keep a track of these expenses?

My dad still maintains an old book. Every month I see him drawing lines in a book and noting down how much was spent on specific things and he maintains the ledger. I tried teaching him Splitwise, but I kept putting all the money under his name since I spend so much on EMI and due to this unfair division, he decided to maintain the book.

Do you or your father use payment apps for your monthly utility bills, rent?

When I make a payment for electricity, gas or anything else, I use UPI only. When it comes to my father, and he has to pay for his Scooty’s petrol or diesel, he uses cash. He is more comfortable with cash and cards rather than UPI.

Do you remember the first time you used any payment app? Can you tell us more about that experience?

Sometime in 2016 when UPI came around, my friends and I were ordering food and someone happened to fall short of cash. That’s when a technologically inclined friend of mine suggested that it is not a problem and he will pay and he can be paid back via UPI. This incident made me curious to understand what UPI is. I realized how easy it is and even if I am falling short of cash and someone else has it, I can use UPI and pay them later. Moreover, I was immediately drawn to the fact that it is completely safe and I can never lose it like cash or cards. Also, when using the scanner on the app, I can never go wrong with the amount and do not have to worry about change. For these reasons I was one of the early adopters. I also remember that Google Pay was offering cashbacks to each person who signed up. I got a cash back of INR 800 once, but that was much later.

Banking Habits

Did you start using UPI during the pandemic or were you using it before that?

I have always been a fan of UPI because it is easy and safe. In case of debit cards or cash in hand, there is potential to lose or misplace it. I have lost debit cards a number of times when I was in college, either because I left it in the machine or in somebody's room. So for me, UPI is really convenient and ever since apps such as Google Pay and Paytm came into the picture, I have been using it extensively. I do not use cash or cards anymore.

Do you use net banking through the web or mobile or both?

I use the app since every bank has one where I can do a lot of things such as adding, editing and managing beneficiaries. When it comes to downloading the statements, I use the web interface, but for most other activities, I use the phone app.

How often do you visit the ATM in a month?

I think two to three years back was the last time I went to an ATM. Also, when I traveled to Goa a couple of months back, I went to the ATM because in Goa you have to pay cash, they still don't take UPI and cards. So only when I'm traveling to Goa, do I go to the ATM. Otherwise, I don't.

Financial products and services

Investments

Do you have active investments in bank instruments, mutual funds or the stock market?

I have investments in SIP. Apart from that, we tend to buy gold during Diwali so that's one part of the investment. I am not a very big fan of gold though. Also, my father invests in Fixed Deposits(FD) and Recurring deposits(RD) since he believes in them more than mutual funds. He takes care of those investments and I just ask my CA friend how much I can invest in each of those instruments and I transfer the money as per the details provided by my father.

Since when have you been investing?

I started actively investing six years ago when I joined a corporate law firm. Before that I was a practicing lawyer and had a very small income. But when I joined corporate law it became easier to set aside money to invest. It was then that I realized the importance of investments. Back then SIP was very new to me and I did not know how it works. Gradually I learnt about it and started investing.

Do you have goals attached to your investments?

Yes, I do have goals and have been investing to fulfill them. SIPs have different options and the one I have opted for remains active unless and until I stop paying. The day I stop paying is when I will take out all the money and use it to travel.

Was it your friend who taught you about investments and SIPs or was it through trial and error? How does this entire decision-making process go?

Initially it started with my friend telling me about it. He is up to date with these things and has more knowledge about it. Gradually, I developed an interest in it. I decided to experiment with small amounts because in the case of a big amount, It really hurts when things do not go the right way. I used to invest for short periods of time and it was mainly trial and error. I invested in SIP for one year and at the end of that period when my money had grown with interest, that motivated me to continue investing. Initially it hurts when you have to pay every month because you cannot use that money for other things, but at the end of the year when you see your money coming back a little bigger than what it was, it feels great. So that is how my journey started and I have been enjoying it.

How do you track your investments? Do you use any app to invest or track your investments?

Well I have set reminders for SIPs and FDs, otherwise I'm very bad at keeping track of these things. So either it’s an auto debit or there is a reminder. In terms of gold it's only once a year during Diwali. I avoid tracking things manually.

Do you have an emergency fund for any sudden or ad hoc expenses?

I did not understand the importance of an emergency fund until a few years ago when I learned that life is very uncertain. Now for emergencies, I have kept an amount in a separate bank account which is jointly maintained by my father and me. Also because I love to travel, my SIPs are for travel purposes.

Loans

Can you briefly tell me how many years of servicing are left for your home loan?

Another 10 years, because when I started it and booked the house, I wasn't earning too much, that’s why I opted for a very long period of time.

What is the mode of repayment? Is it in cash/ cheque or through any digital mode? If digital, then which mode?

Initially the mode of EMI repayment was Electronic Clearing Service (ECS). The payment was completely from the bank that I have taken the loan from to the builders account. I was just responsible for signing and the rest was taken care of digitally. However, I decided to close that bank account because it wasn't serving any other purpose for me apart from the EMI payment. Now I pay through UPI.

Where have you taken the loan from? Why did you choose that lender?

I took a loan from India Infoline Limited(IIFL) housing finances. I took it because that particular day, they were giving me a good interest rate when compared to the other banks that were present. Moreover, IIFL had something specifically for working women professionals where they were giving it at an interest rate of 6.5%. The other banks were providing a floating interest rate and I find that very risky because we don’t know what will happen and it might become difficult later on. That's why I decided to go ahead with IIFL at that point of time.

Did you need a male family member as your co-guarantor/ signatory?

Not at all. They needed a co-guarantor, but it could be anyone and not specifically a male member of the family. In fact, my mother was the co-guarantor for the loan. Other than that the loan is completely in my name.

Did you face any challenges to borrow because of your gender?

No, it was a normal experience and I was treated like any other person. They collected the documents and it was a very regular process.

Have you heard of the term credit score? How frequently do you check your credit score?

I check it once every six months or a year. I make sure I don't default anywhere and ensure that things have not gone south anywhere else. Earlier when I had just taken the home loan, I used to check more frequently as I was really scared because people had given me varied opinions and had instilled fear about banks in general. I never understood why people did that when there is law in society to keep things in check. But now I check it once in a while.

Would you be open to exploring digital apps for borrowing?

I have two perspectives regarding digital apps. One is, if the digital app is verified, and we know our data is not going to be misused, then people can go for it. Because there are a number of digital apps that I know of and I know they harass people. To elaborate, during the pandemic, a lot of my friends had lost their jobs and they had to take loans. These apps sugar coat things initially and say they are flexible with repayments, but when you don't pay, they actually access your phone book and they start calling people in your contact list. I got random calls from people threatening me that if my friends don't pay, then I have to pay. I was shocked as to how they got my number. I went to the nearest police station and complained that I have been receiving threatening calls from certain numbers. That’s unacceptable. Maybe my friends were not able to pay for their own reasons, that doesn't mean they can call me or my friend and threaten us. Even if they call to enquire about the reason for delay in repayment, I know there is a collection policy in every financial company and threatening is not a part of that. So we have to be really careful and only go for it if it's a trustworthy platform. We need to do thorough research. There is no harm in being late while borrowing money, but it’s important not to get harassed by these people.

What is the maximum amount you would be comfortable borrowing from a fintech company?

If it's a verified place, and I am sure these people will not come back to threaten me later, then I might consider. Because known banks do not behave this way. I think I would go for a lakh or two as that’s an amount I think I can repay. But, if I'm not aware of the digital platform at all, I would go for INR 50,000 to 70,000 max, not more than that.

When you say verified, do you mean an RBI registered entity?

Yes, a registered entity and I would consider what the market review is. Because every financial institution, not the digital ones, but every bank has a collection department and if we do not pay, they have a professional way of conducting the inquiry. For instance, due to the pandemic, a lot of people were not able to pay their home loan and the banks did call and ask people if they were okay and asked what happened. That’s why it is important to check the market review to understand how a particular institution goes about things, what their code of conduct is and how their collection department works and only then go ahead.

Insurance

If you have personal insurance, when did you buy your first insurance product and why?

I only sought out. I use this app called ET Money where I invest on my SIPs. That is where I came across term insurance. I started researching and looking at the market, reading about the different types of insurance available, how much I need to pay and picked one which would be the best fit for me.

What other digital apps do you use apart from what you mentioned before?

Apart from the ones I mentioned, I used PhonePe for a year when they had introduced digital gold. I thought that was really nice and I got a good amount of gold and transferred it into cash very recently when the gold price had increased. That was a fun thing to do and it’s more like gambling. Other than that nothing else.

Outlook towards the future

In your opinion what is the one financial product or service that will have the most impact in supporting your financial journey?

I have not thought about that. Probably a little more guidance in the form of a service would be great or a go to book that serves as a resource where I can learn the fundamentals of establishing a business. This would avoid me having to follow 10,000 people on Instagram to learn these things.

Our understanding of Bhavana’s journey

Our conversation with Bhavana gave us an insight into how she leveraged the power of networking to transform her hobby into a business. She is realistic in her approach to tackling challenges and takes responsibility for her own actions while navigating various aspects of her financial and business journey. Her unflinching perseverance and initiative is inspiring and sets an example for anyone fostering a nascent venture.

About the Research

This blog is a result of an online interview conducted with the participants’ consent. The interview was conducted in English. This is a part of the Banking on Women chronicles.

Disclaimer: The name and other sensitive personal details in this documentation is masked to honour the privacy of the participant.

Project Partners

SHEROES

The SHEROES Network is a content and community ecosystem enabling access to employment, entrepreneurship, and capital for women. It includes the SHEROES app, SHOPonSHEROES marketplace, Babygogo, Naaree, MARSbySHEROES and has a user base of over 24 million women. The SHEROES Network is committed to increasing women’s contributions to GDP.

Sheroes.com | SHEROES App | Twitter | LinkedIn | Instagram | Facebook

Mahila Money

Mahila Money is a full-stack financial products and services platform for women in India. Mahila Money specializes in offering loans to women who want to set up or grow their own business along with resources and community to achieve their financial goals. Mahila Money can be accessed via the Mahila Money app on Android.

Twitter | LinkedIn | Instagram | Facebook | Website | Play Store App

All artworks are designed by Poorvi Mittal.

If you enjoyed reading this blog and would like to receive more such articles from D91 Labs, please subscribe to our newsletter here.

To read more about our work, visit our website