# 2 Tara

As solo entrepreneurs, we should always fix the cost of our effort because if we were to hire somebody else, they would have also taken their share.

“Honestly, I was happy, was earning a good salary, and everything was sorted. I knew if I go ahead with consulting or do something on my own, I would not get that kind of income or certainty. However, at the end of the day, I wanted to touch people’s lives and bring about a little change.”

Short Story

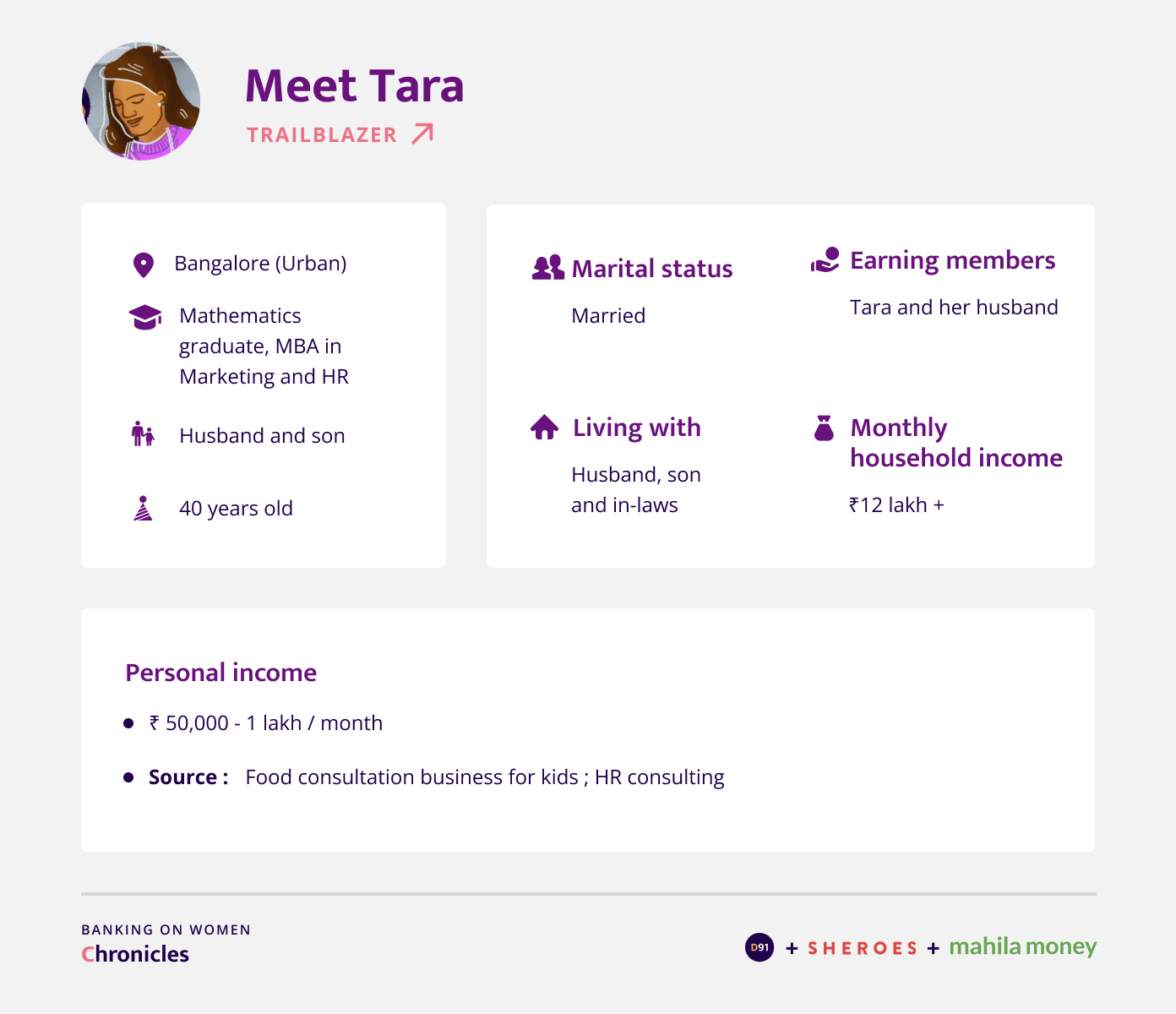

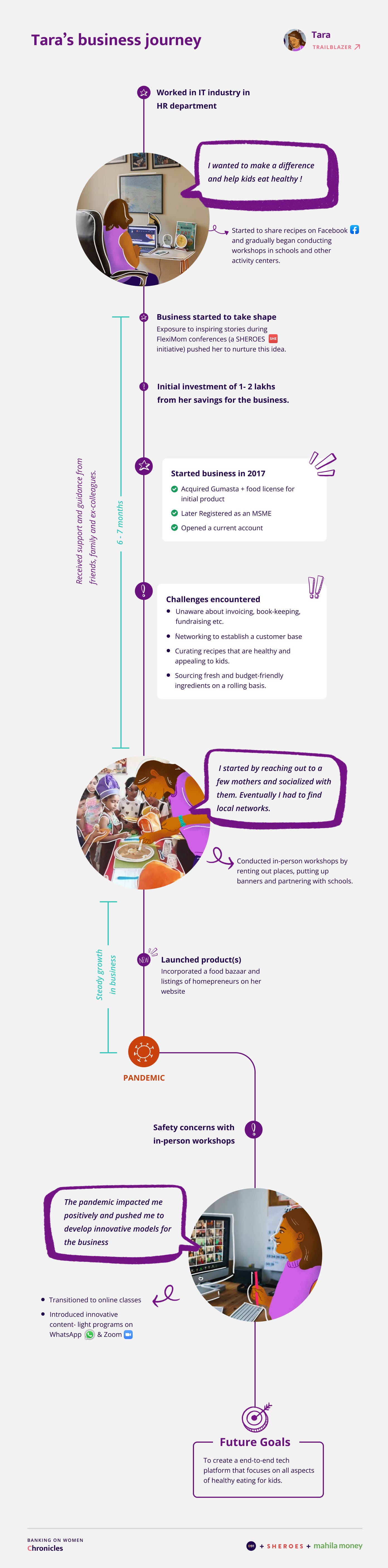

Tara is a 40-year-old Human Resources professional based out of Bangalore. She worked in the IT industry for several years before she decided to nurture her passion to help kids make healthier food choices. Tara’s journey offers financial and entrepreneurial lessons for first-generation women in business. She has built her business and brand from scratch, as well as adapted her business model for a virtual audience during the pandemic.

Read to learn more about her business, investment strategies, and growth journey from zero to one!

Personal and financial background

Where do you live? What does your daily routine look like?

I am currently based out of Bangalore. I lived in Bombay till about 6 months ago. Since the pandemic started, my daily routine has become quite chaotic, and I am waiting to get back to my old routine. My day starts with early morning yoga followed by some exercise. After about 2 hours, we all have breakfast. I start my work around 9 am. I work on weekends conducting workshops and on Monday and Tuesday, I do consulting assignments. Most other days go into content and recipe creation, writing blogs, website updates, promotions, marketing etc. Since I am a solo-preneur, I do most of the work but I have a team of three part-timers working with me. Pre-pandemic, I would have school meetings, do appointments, and catch up with people. By around 5 pm, I try to finish my work and give time to my son and help with his studies or take him to his classes. I try to wrap up my work in the 9-to-5 zone to keep my day structured and ensure it doesn't start hitting my balance.

Can you tell me about your educational background and work?

I am a mathematics graduate with an MBA in marketing and HR. I worked in the IT industry in the Human Resources Department till 2017 across various enterprises, startups and SMEs. About four years ago, I started a business to help kids make healthier food choices alongside my full-time job. I am involved in providing consultation, conducting workshops and curating recipes for kids through which they learn how to make and eat healthy food. I still do HR consulting, but that's only because I have subject expertise in that domain.

Business details

Why did you choose this particular business?

I get asked this question a lot. People wonder why I chose to pursue this when I could have done so much in HR. Honestly, I was earning a good salary and everything was sorted - I was happy! Especially since I knew that if I pursued anything of my own, I would not get that kind of income or certainty. But, I wanted to touch people’s lives and bring about a small change. Hiring people was not cutting it so I started to wonder what else I could do - something new and challenging! At that time, in my personal life, I was realising the importance of cooking healthy meals for my son and family as a working mother. Even though cooking was never my forte, I started focusing on healthy meals for my child. I realised that if this was a challenge for me, it could be a problem for many working mothers. Here was something new and challenging! That’s how it started. Since I was neither a chef nor a nutritionist, studying and understanding everything about nutrition was the challenge. The entire experience was really interesting. Almost one and a half years I spent on figuring out whether my target audience should be kids, mothers or corporates.

Eventually I realised that my initiative did not start as a business - it was more a cause - I just wanted to help kids change their eating habits. It started as a blog on a Facebook page where I would share recipes and tips. Gradually, I started doing paid workshops with kids and their parents and the business started taking shape from there. Soon after, I decided to focus on building the business and quit my full-time job. I dedicated time towards creating content, reaching out to kids and their mothers, understanding their psychology, problems they face and figuring out all aspects of healthy eating. Before the pandemic, I worked offline and partnered with schools, daycares and activity centers. But now everything has moved online and things are very different.

Even today, every time I meet a child, it's a new case study for me!

What was the process for setting up the business? Did you need any licenses?

When I started, my business was not registered but I did want to keep things as organized as possible. The first year was chaotic as I figured things out but I learned the importance of keeping track of expenses and business-related transactions and maintaining a file for it. Now it is MSME registered, but before, I had a Gumasta license and got a food license valid for 5-10 years. A food license is not required for services, but I did have a product initially - a substitute for the sugar-loaded chocolate milk powders available in the market. A home made, sugar-free malt made out of millet and seeds which became quite popular with customers. But after the pandemic hit, I had to put the product on hold since I moved to a new city and still have to figure out where to source the raw material from.

How have you financed your business till now?

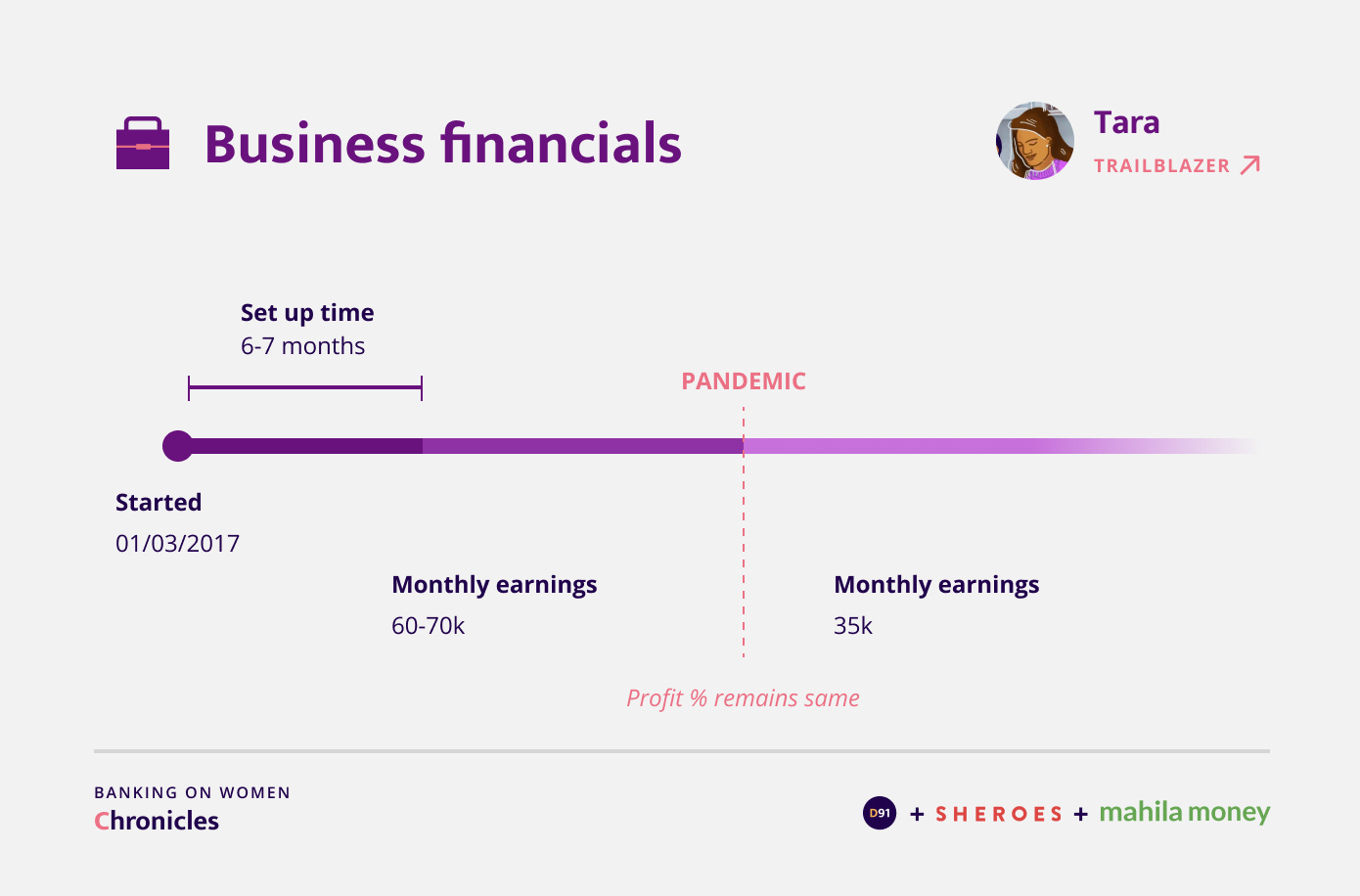

Initially, I invested INR 1-2 lakhs from my savings. It was experimental at first but over 6-7 months it took shape into a business. Most of the initial investments were used for kits for children, the website and having a relevant technology platform. I want the business to be self sufficient instead of utilising my savings constantly.

How much do you invest in the business every month? What is this typically used for?

Generally, I attempt to be precise in my investments.

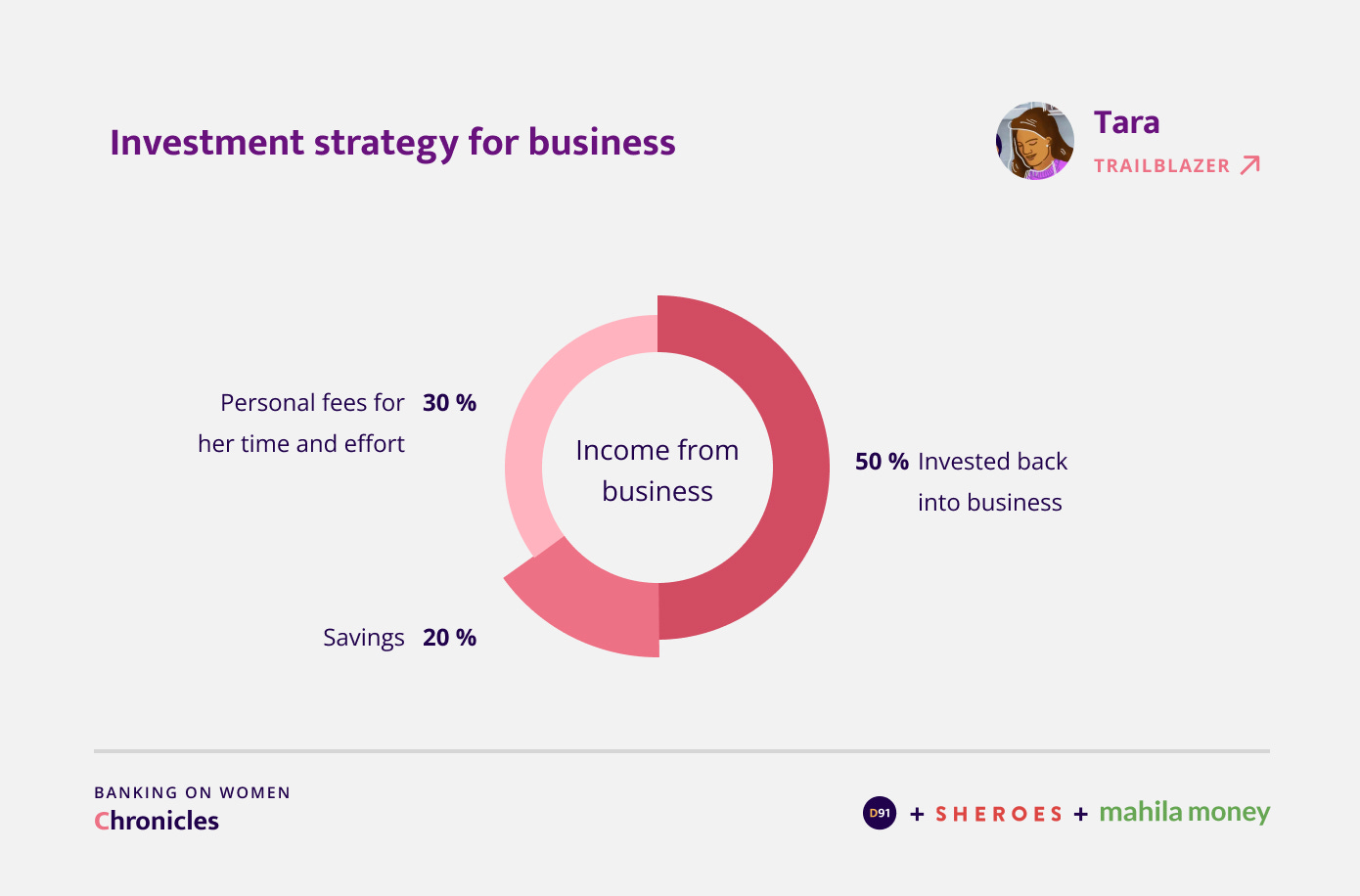

The investments into the business are utilised towards marketing costs and Facebook ads. I take a fee for my personal effort and time invested and the remaining sits in the business account as savings. Typically, the savings usually untouched and all costs in the following month are paid through the 50% investment. If I am certain that there are massive upcoming expenditures, I take care of those by planning ahead. I have been following this from the beginning. Pre-pandemic investments were primarily for renting out venues and marketing through posters, banners, etc. that were in general more pricey. Now we save on these things since many tools are freely available online, but instead spend on social media marketing and technology platforms like Zoom and Airtable, which we use to onboard people. We are also looking to get an agency on board, which will be an additional expense. As our business model has changed, so have the overheads.

Was there a reason you chose to make business investments this way?

I have always believed in balance, be it in financial decision making or life. While many will choose to fix a minimum investment into their business, I have chosen a maximum because without a roof on such investments, we can get tempted to use whatever we have towards the business instead of trying to rationally apply what resources have been allocated for it. This strategy helps me keep my expenses in check at the same time gives me the comfort of making decisions with my other income to my discretion.

In addition to this, I have a slightly different perspective on costing. When I had just started out, a friend gave me a great nugget of advice - “we should always include our own effort whenever we are doing costing for our business”. As a solopreneur, this was some of the best advice I have received in running my own shop. If we make a cake, we tend to count the cost of ingredients but not the cost for the effort we put in! But, I think that should always form a part of the final price! Same goes for any business endeavour!

How was your business impacted due to covid-19?

Due to the pandemic, types of expenses have changed. Earlier, off-line venues such as schools and activity halls would take care of sign-ups as they were frequented by my target audience. However, post-pandemic, the marketing and getting customers has become my responsibility. Engaging with students and their parents has therefore become more challenging. Schools are having trouble communicating the curriculum online and are hesitant to add more screen time for kids in the form of workshops. Further, pricing for such workshops has also changed after the pandemic. We have seen that people are not willing to pay as much for online workshops. I will admit though that the profit percentages have not gone down because the cost to run online workshops is significantly lesser. As such, the revenues have been impacted and I can't talk about big numbers yet.

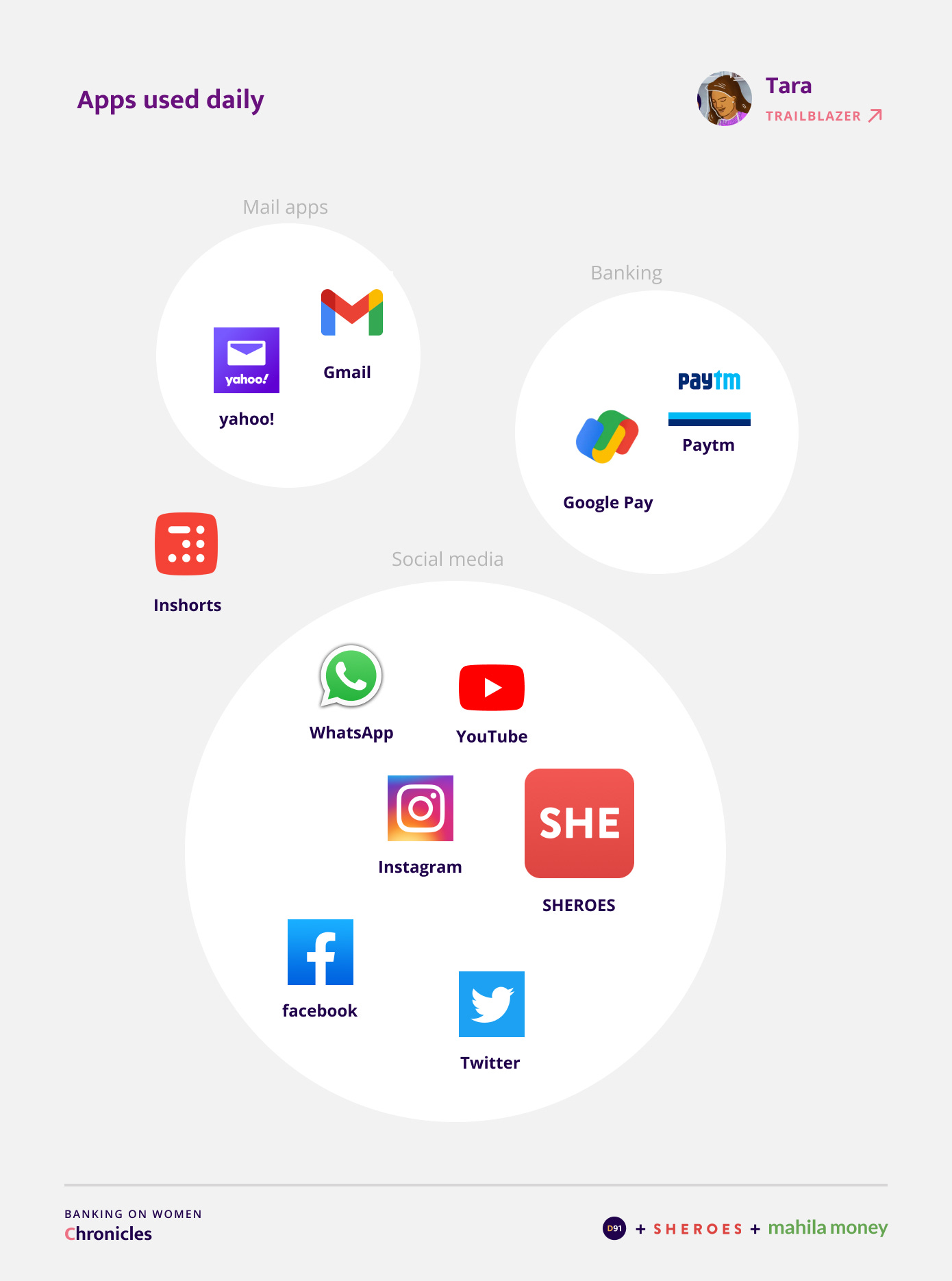

However, from a creativity perspective, the pandemic had a positive impact and pushed me to develop innovative business models. As I experimented with online classes, I tried Facebook Live, Zoom and such other platforms, when I learned about them. The situation made me rethink programs to make them content light and more engaging like 7 or 21 Days Kitchen Challenges, 21 days No Junk Food challenge - entirely on WhatsApp! I am also working on food clubs. None of this would have started if not for the pandemic.

Business Journey

Did you get support from your family to run this business?

My husband has been a great source of support. He helps me with the technology side of the business and always promotes my work in his channels. When I have to travel, he look after our son since we don’t have help for that. My in-laws have been supportive too. They respect my personal space especially when I am working. When you are a solopreneur, there are a lot of ups and downs you go through. The business does not always do very well and you need a lot of emotional support. I think that kind of support comes from my family members, especially my spouse and it has helped me sail through.

What were your pain points while setting up this business?

There were several pain points because I came from a very different background. At the outset, I did not know how to network and reach out to mothers because they were my ultimate target audience if I wanted to make a difference in the lives of children. I started by reaching out to a few mothers; I had to socialize there and eventually find local networks. Once I found one network, it was just a domino effect and helped me reach other networks.

The next challenge was figuring out the right places to run the sessions and the right people to team up with. Since children were involved, I had to look for safe places and develop trust among the parents. Most parents and schools wanted to work with brands they had heard of and were hesitant to work with a beginner like me. Eventually, my son's activity center agreed to let me run a session with them, which was a big hit. We put it on social media, and many other centers started approaching me to collaborate. However, the most difficult part was to create recipes that were healthy but were tasty and appealed to kids as well. They needed to made from freshly sourced ingredients, quick to make, budget-friendly and fire-safe.

Did you have any mentors or friends to help you plan and execute this business?

Most things I did on my own. However, SHEROES was an immensely helpful community. When I was working with an HR company, SHEROES had launched an initiative called FlexiMoms, to help identify flexible work options for women on a career break. During those SHEROES conferences, I met so many inspiring people and heard stories that pushed me to go ahead and take the plunge. These stories gave me the courage to accept failure!

Additionally, my ex-colleagues were always kind enough to guide me. A very good friend of mine helped me understand the fundamentals and guided me in registering my business and gauging essential requirements for that, etc. I had a diverse set of people help me in my quest and I still reach out to them when required.

If you think of scaling this business, what do you think is the direction it would head?

Ultimately the goal is to create a tech platform that focuses on all aspects of healthy eating for kids. Apart from the product offerings, the workshops, and videos that are always available, I envision a marketplace of sorts. Currently, there is a small food bazaar on my website with homepreneurs based in Bombay who make products for kids. The aim is, any mother who reaches our platform can enable her child to learn healthy eating, gain access to healthy recipes that she can try out herself, and in cases when neither the mother nor child can cook, they gain access to a list of places to order healthy meals from. Basically, an end-to-end platform that ensures the child eats healthy.

Household finances

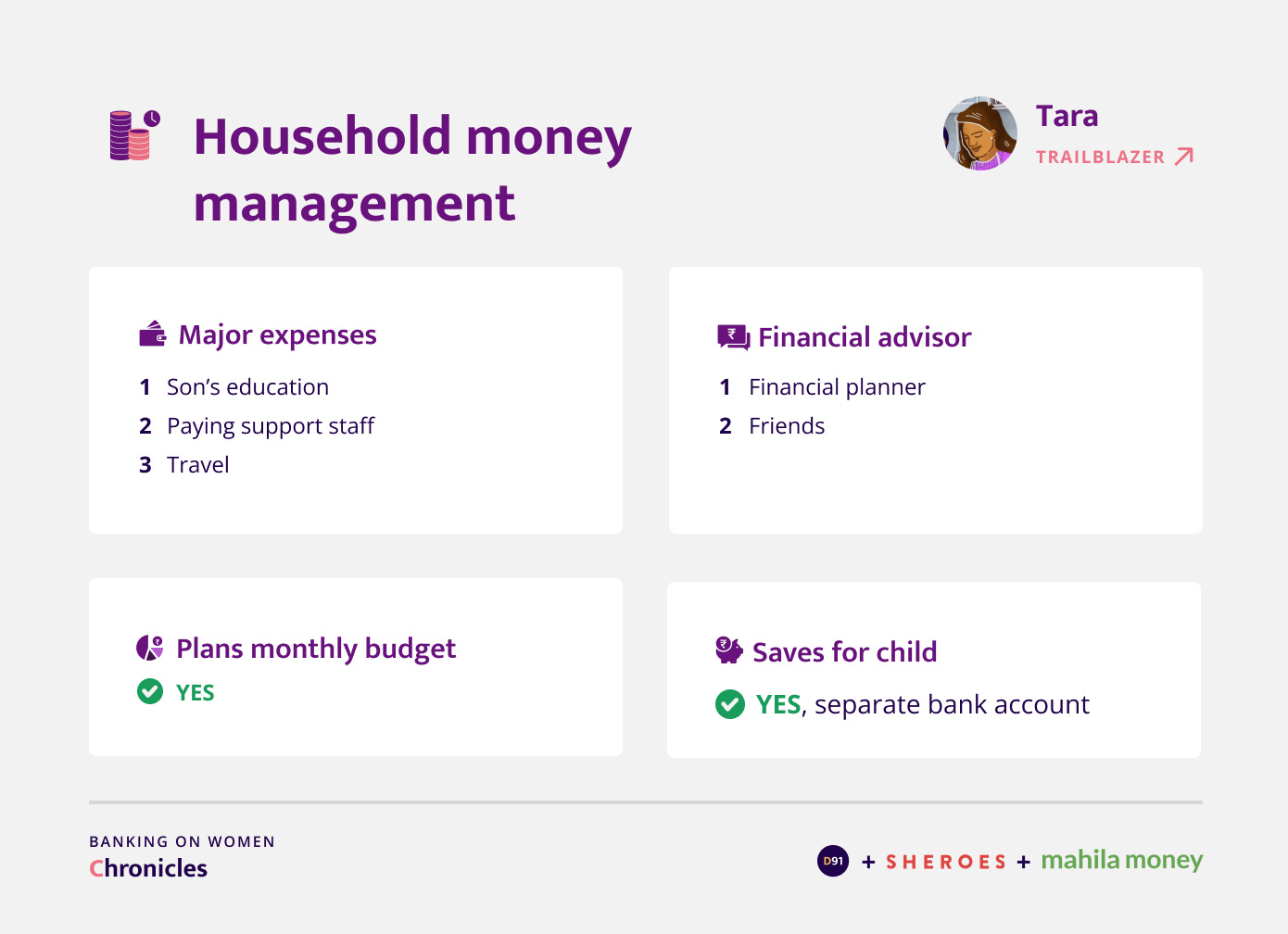

Do you have a monthly household budget?

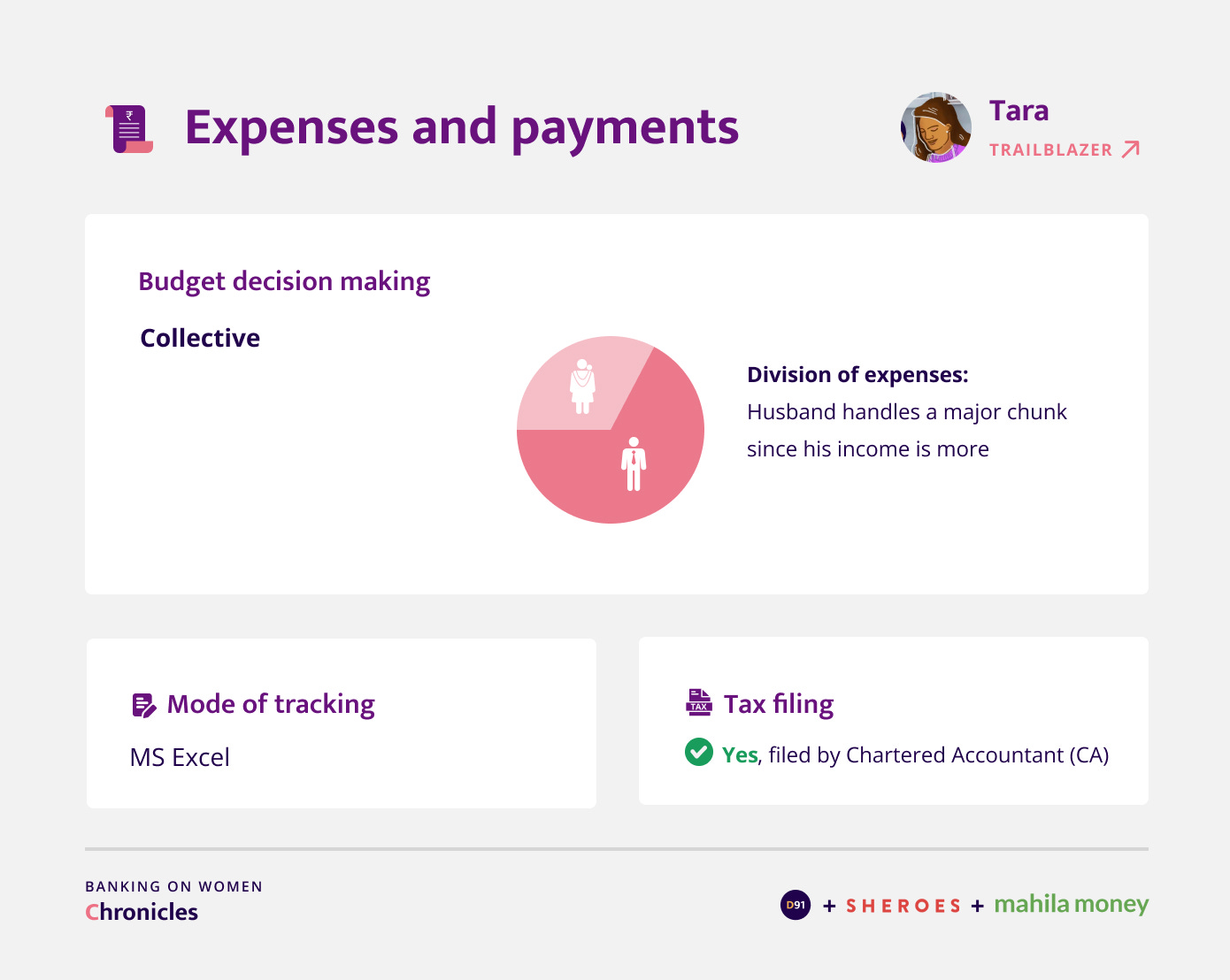

Yes, we do have an estimate based on expenses. Though we are not very strict in following the budget, we ensure that we do not exceed a limit. Irrespective of whether the money is going from my account or my husband’s, we discuss it without fail.

Who is responsible for making investment decisions in your house? Do you save money separately for yourself?

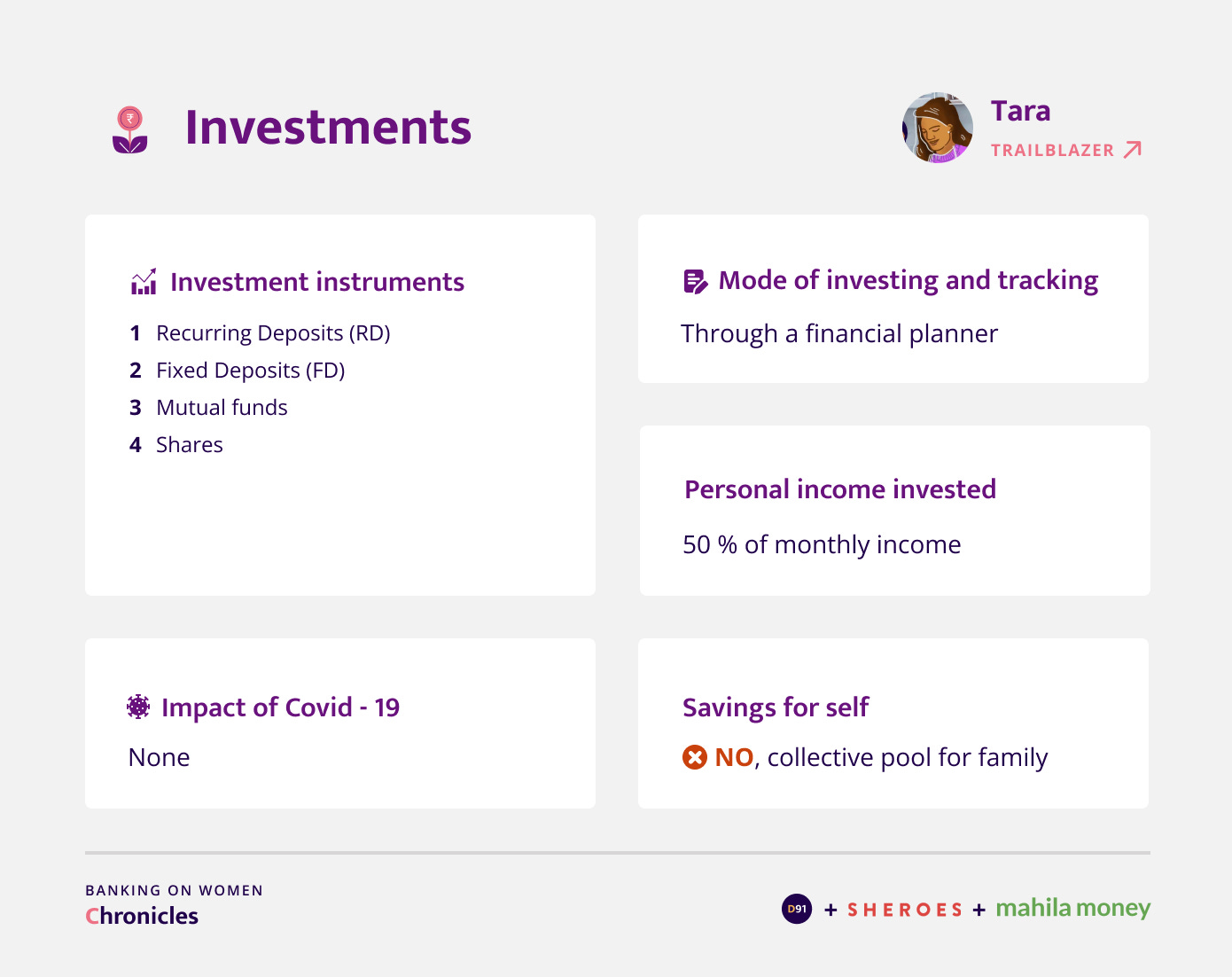

Majority of the investment decisions we take together including decisions on investments made from my savings. My husband makes the investments through a financial planner. We felt we should get somebody who can help us rather than handling it on our own as we felt we were not very savvy with it. Though we have learned a lot about financial planning since then, we still have the comfort of somebody managing our portfolio and guiding us.

Expenses and Payments

Do you remember the first time you used any payment app? Can you tell us more about that experience?

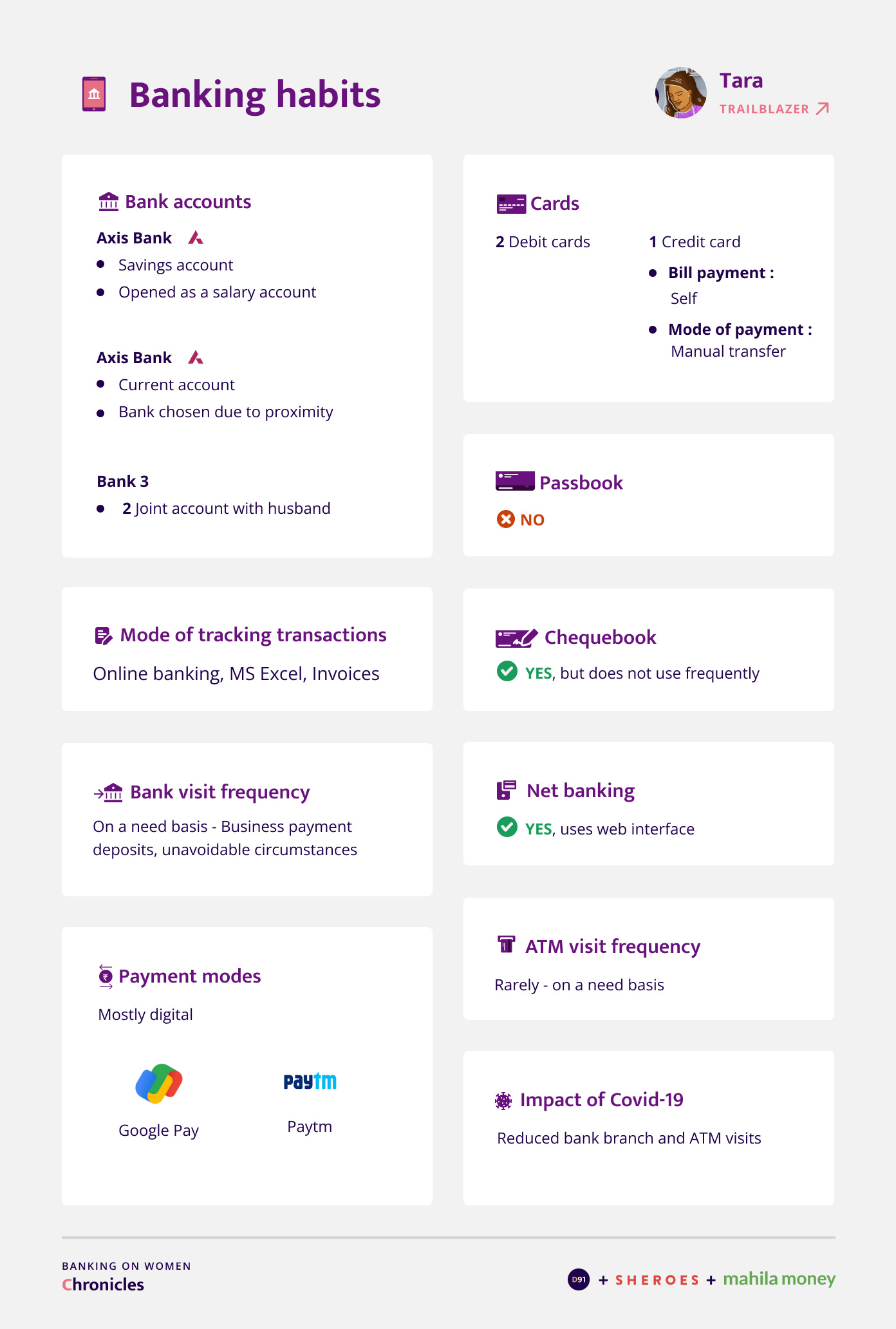

Paytm was the first payment app I used. I was pretty impressed that money could be transferred in this manner. It was easy, and I thought it was great because it meant I do not have to carry cash anymore. Soon I noticed that even vegetable vendors had a QR code for customers to scan and make payments and that transition was very interesting to see.

Banking Habits

Do you use a credit card?

I do not use my credit card much. I rely on my debit cards because I believe in spending only when I have the money. Sometimes when there are points, I might use a credit card.

When did you start using digital modes of payment?

No, I moved to digital modes of payment when I started my business in 2017. Before that my husband handled a lot of expenses, investments and most banking requirements. But because this business was my own initiative, I wanted to handle everything by myself including the banking aspects. Since going digital, I check my account balance regularly after every transaction online.

Financial products and services

Since when have you been investing? How did you start your investment journey?

My first investment was a Recurring Deposit (RD) when I was in college and it is still ongoing. I introduced this concept of RD to my husband as well. I also invested in some mutual funds. However, I did not understand these new instruments well and relied on my husband to keep track sometimes. But eventually, we decided to get a financial planner and he helped us align ourselves with respect to investments.

Do you have goals attached to your investments?

We have goals and financial planning really helps with that. We have both short and long-term goals and make investments accordingly. Long-term goals would be things like a house or car, and short-term goals include travel.

What challenges do you face in investing?

Sometimes, it becomes very overwhelming when I do not understand how a particular instrument works. I rely on friends and others in my circle who are aware of these things to educate me because I do not want to lose my hard-earned money by making wrong investment decisions. For example, there was a time when many people around me were trying out Sharekhan to trade online. I was very young and decided to follow the crowd and opened a trading account back then. However, I could not get the hang of it.

I believe it is essential to be patient while understanding how various instruments work, and it helps to experiment with small amounts to get the hang of things. Since I did not spend enough time on understanding the specifics, I stuck to simple and safe options such as RD and FD, though the interest rates are not very good. I have also considered investing in SIPs, but it still feels confusing with half-baked knowledge. On the other hand, some people are very good at grasping the inner workings of various instruments and seem to have a knack for these things.

Our understanding of Tara’s business journey

In our conversation with Tara, we thought of her as a game-changer in her field. She took the risk of starting a novel business to make a small change in society even when there was no ready-made market. She leads by passion and will go the extra mile to reach her goal of improving food choices for children. Tara manages most of her business-related expenses and is mindful of her investments into the venture. Tara sets the bar high for first-generation women in business and solopreneurs.

About the Research

This blog is a result of an online interview conducted with the participants’ consent. The interview was conducted in English. This is a part of the Banking on Women chronicles.

Disclaimer: The name and other sensitive personal details in this documentation are masked to honour the privacy of the participant.

Project Partners

SHEROES

The SHEROES Network is a content and community ecosystem enabling access to employment, entrepreneurship, and capital for women. It includes the SHEROES app, SHOPonSHEROES marketplace, Babygogo, Naaree, MARSbySHEROES and has a user base of over 24 million women. The SHEROES Network is committed to increasing women’s contributions to GDP.

Sheroes.com | SHEROES App | Twitter | LinkedIn | Instagram | Facebook

Mahila Money

Mahila Money is a full-stack financial products and services platform for women in India. Mahila Money specializes in offering loans to women who want to set up or grow their own business along with resources and community to achieve their financial goals. Mahila Money can be accessed via the Mahila Money app on Android.

Twitter | LinkedIn | Instagram | Facebook | Website | Play Store App

All artworks are designed by Poorvi Mittal.

If you enjoyed reading this blog and would like to receive more such articles from D91 Labs, please subscribe to our newsletter here.

To read more about our work, visit our website.