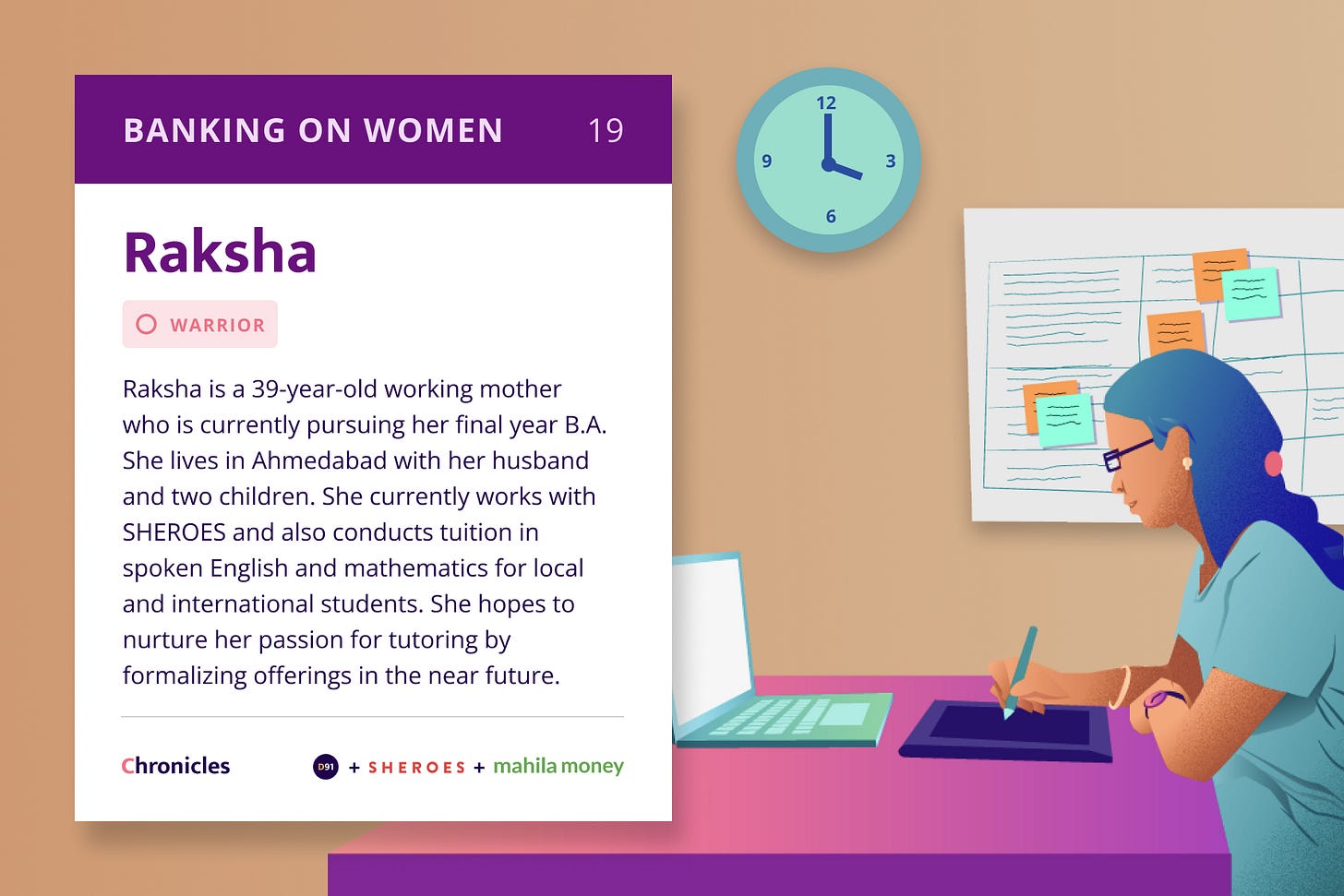

#19 Raksha | Mastering the hustle culture despite setbacks

Several times, irrespective of my skill sets, organizations have decided not to move forward with me because I don’t have the right qualifications on paper.

“I couldn’t complete my education earlier because I had to start assisting my father in his business after 10th grade due to personal reasons. Then after getting married, I gave birth and had no time to study. Finally, I decided to pursue my undergraduate studies once they grew up a little, but I also needed to do a job because of my financial situation. That’s why I continue to do all of this parallelly.”

Short Story

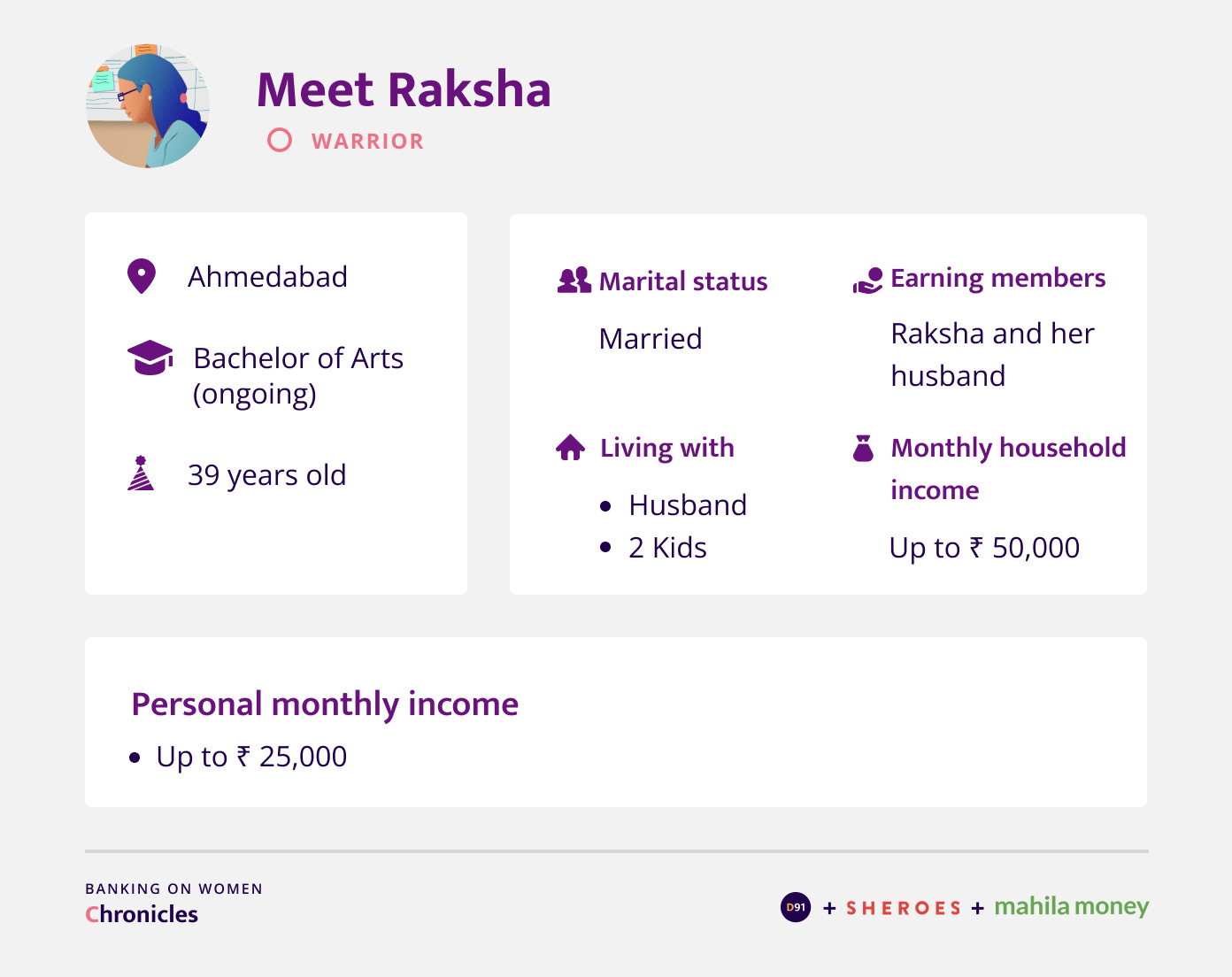

Raksha is a 39-year-old working mother who is currently pursuing her final year B.A. She lives in Ahmedabad with her husband and two children. Due to unfavourable circumstances within the family, she could not pursue an undergraduate degree. After she got married, she had to her prioritize financial stability and took on several part-time roles to fulfill the same. Raksha actively contributes to household finances along with her husband. She currently works with SHEROES and also conducts tuition in spoken English and mathematics for local and international students. She hopes to nurture this passion for educating young minds by formalizing her tutoring offerings in the near future.

Personal and financial background

If you are comfortable, can you give us an indication of your monthly personal income?

To be honest, I am involved in multiple things. I have a full-time job from which I get around INR 18,000 in hand. Apart from that I conduct tuition for students and I earn up to INR 5,000 from that. I also work as a freelancer in business development for a recruitment consultancy. I earn anywhere between INR 2,000 to 5,000 from that. So on an average I earn around INR 25,000 a month. But my earnings are mostly from tuition and the full-time job.

What is your daily routine like?

I start my day around 6 am. I start by washing the dishes, cooking, feeding my dog and the birds that visit my balcony. I then drink tea or coffee and I water the plants. That’s my morning routine for about an hour everyday. After that I bathe, do puja and start my office work. We have a conference call at 9:45 am every morning, so once I put my system on for the day, work goes on and on. In between work, I take a quick break to make lunch. I try to wind up early but work goes on up to 9 pm sometimes. But considering how challenging the job hunt situation is after the pandemic, I count this job as a blessing. In the evenings I take tuitions. The schedule for that varies, depending on the student’s availability. I teach students spoken English and mathematics, I also help international students with SAT test preparation. Since some of these students are in a different timezone, I sometimes have online sessions at 2: 30 am and have to wake up in between for that. Post work I cook dinner around 8 pm and once we have dinner I get done with pending chores and go to bed by 12 am.

In your own words, can you describe your current work? Have you worked elsewhere in the past, if so can you tell us what it was?

So the reason why I couldn’t complete my education earlier is because I had to start assisting my father in his business after 12th grade due to personal reasons. We had retail shops and I used to work with my father as I really needed the income. Then after getting married, I gave birth and had no time to study. Finally, I decided to pursue my undergraduate studies, but I needed a job because of my financial situation. That’s when I started working with various Ed-tech companies and took on part-time, work from home teaching jobs. Apart from that I have also worked part-time with leading knowledge management companies and briefly helped Japanese students with English by evaluating their essays and providing feedback. After a slight break in between I started conducting tuitions at home on my own and I started getting queries. I also ran a clothes reselling business from home. I briefly worked in HR with a recruitment company as well. I currently work with SHEROES and I handle delivery processes for various companies.

Business Details

Is the tutoring job freelance work or have you set up your own brand under a registered business?

I intend to get my tutoring business registered and I want to develop my own app and invest in a good website, but that’ll take time. Right now I am very occupied with the job and also I need to have a substantial amount of income to be able to invest a lot of money in scaling the business. So that is my long term plan. I plan to do a job for another 5 years but once I am close to fifties, I won’t have the energy to do a full-time job. By then my kids will also be older and will be able to sustain themselves, so I feel that will be a good time to spend my days running a business that I am passionate about.

How much do you have to invest into this business on a monthly basis?

I don’t really have to invest too much. I just needed the pen tablet, that's all. Apart from that I am also looking to get certified by the British Council, but that’s a bit expensive so I have put it on hold for the time being.

For how long have you been running these tutoring classes?

I have been conducting offline classes for more than 9 years now. Apart from the 3 international students that I used to conduct online classes for, the rest of my students transitioned to this mostly after the pandemic. Earlier people were not interested in taking online classes but now of course after the pandemic they were forced to make the switch.

For the offline classes I had to invest in small tables, but even that I got economical ones because there were only 4 kids coming home and we managed by using the sofa as well if required. Sometimes I used to give them scorecards and goodies to encourage them to do better. Appreciation in this form always helps to keep young kids motivated. But apart from these things I didn’t really have to invest in anything else.

How was your business impacted by Covid-19?

Actually my business had no impact. My husband's business took a hit because it was in the travel industry, but my classes continued online.

Business Journey

Was there any other reason why you chose to do this business over anything else?

I chose to do this for the satisfaction that I get from it. Teaching kids and taking tuition is like a hobby for me and I feel good. When you educate somebody you feel good right? And it’s also personal growth in some sense for me as the syllabus keeps getting upgraded and I get to learn new things.

Did you get support from your family when you were getting started?

They have always been supportive. Because I have a session at 2:30 am, my husband sleeps in the other room on those days.

What were some of your pain points while getting started?

Technical glitches mainly. My laptop was giving me some issues and I need to invest in a new one. I have gotten it fixed temporarily for now, but it keeps going off.

Do you promote your tutoring offerings on any online platforms?

Initially I used to market when I was associated with EdTech companies, but I didn’t really get results. Now I don’t have to market, word of mouth is enough. In fact, I have had to say no to a few interested students due to a lack of time.

Would you consider formalising and expanding your business? What in your view are the basic requirements for such formalisation?

Maybe in another 2 years I’ll look into formalizing it. There are some necessary qualifications that are required. I don’t have a B.Ed and that’s not something I want to pursue either. However, I do want to get the Cambridge English or the British Council certification. Since I am not even a graduate yet, I feel something is lacking in me because many times when I have tried to apply as a tutor on online platforms, they said they have a minimum requirement of an undergraduate degree. I was approached by a few organizations and I did clear a few rounds of interviews, but they said that irrespective of my skill sets, I don’t have the right qualifications on paper and they didn’t go ahead with me. Eventually I got the opportunity to work with a few organizations and have understood how to go about things, that’s why I want to start off on my own. So once I have the time and money, I will invest in scaling this into a full-fledged business.

Household finances

Do you save money for emergencies?

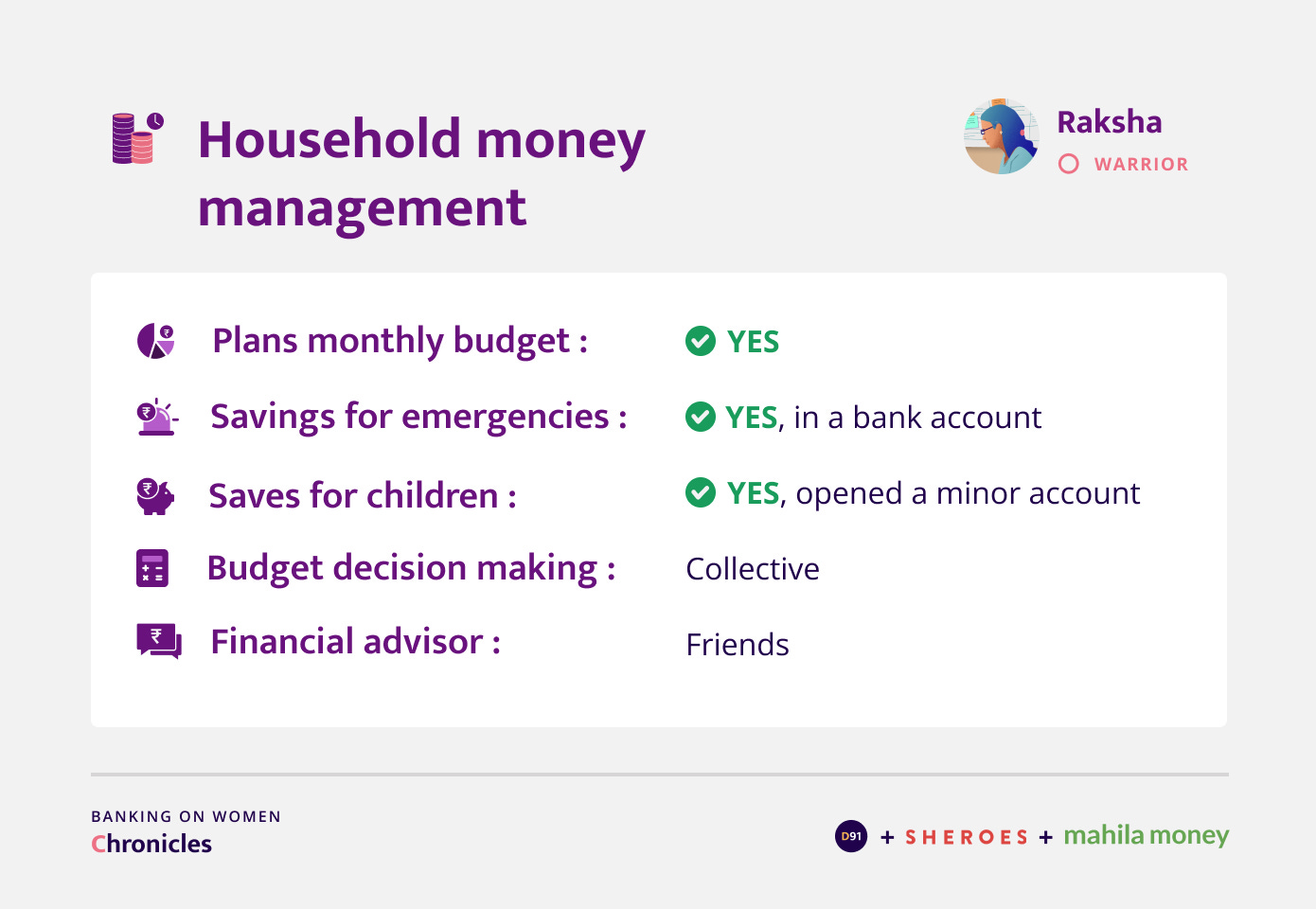

Yes, I have a savings account for my kids and I put money in that because if I keep the money with me then I will end up spending it. Minor accounts cannot be touched so my money is safe there. I got it done as a birthday gift for my kids.

Whom do you rely on for financial advice?

I have a friend who works in Delhi and she is working in the Ministry of Defence. Since she’s a Government employee, she is well aware of how to go about finances. She suggested that I open a private pension account and a few other things as well, but I haven’t done it yet. I will look into these things soon though. I blindly trust her.

Expenses & Payments

Can you tell me what percentage of income is used towards your household's monthly expenses?

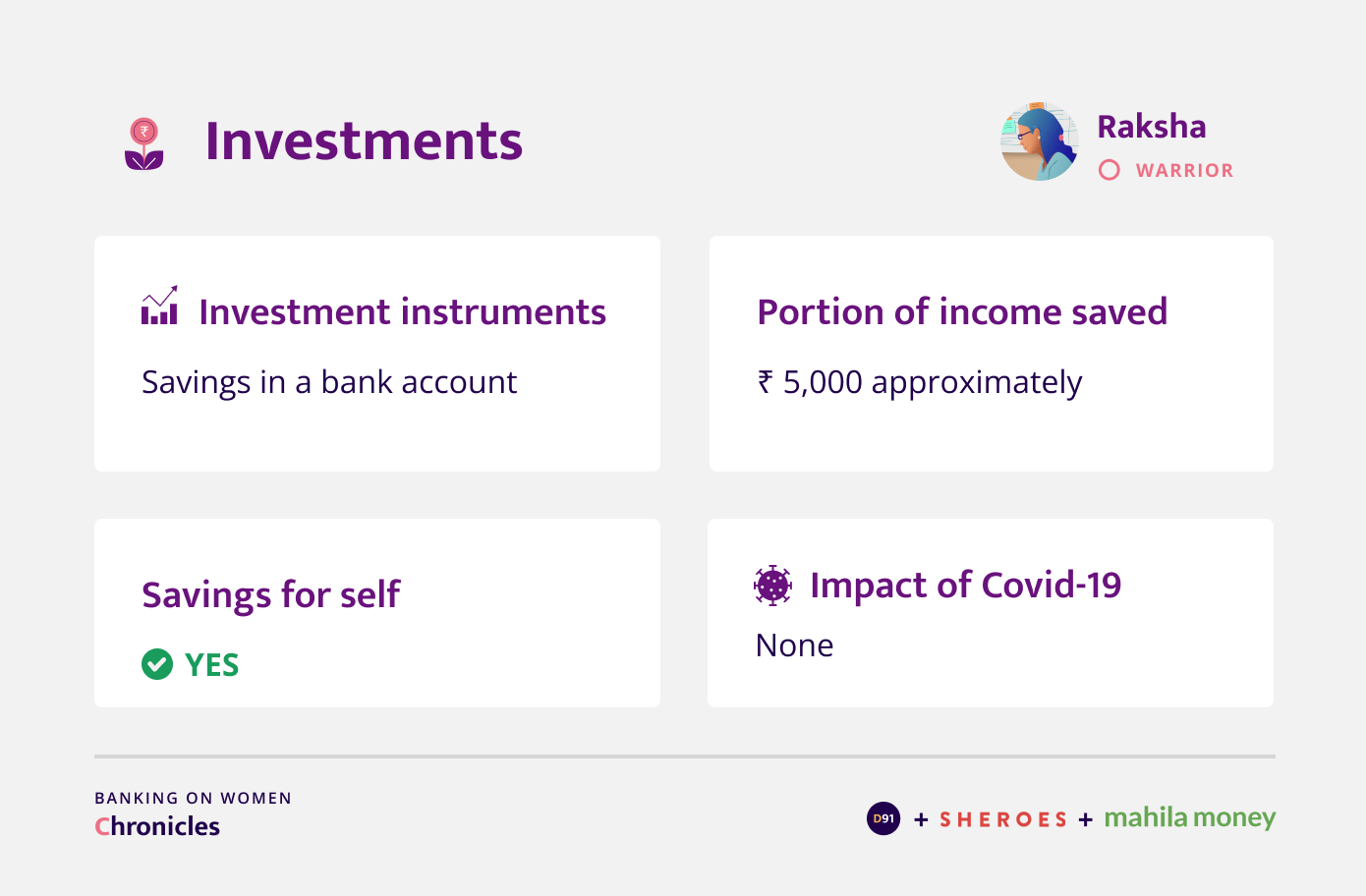

I spend around INR 14,000-15,000 out of my salary. INR 4,000-5,000 are kept aside as medical expenses for my mother since she had a laparoscopy recently. But my brother and I are pooling in for those expenses. So my salary is over with it. However, what I earn from tuition remains as my savings.

How do you keep track of your expenses?

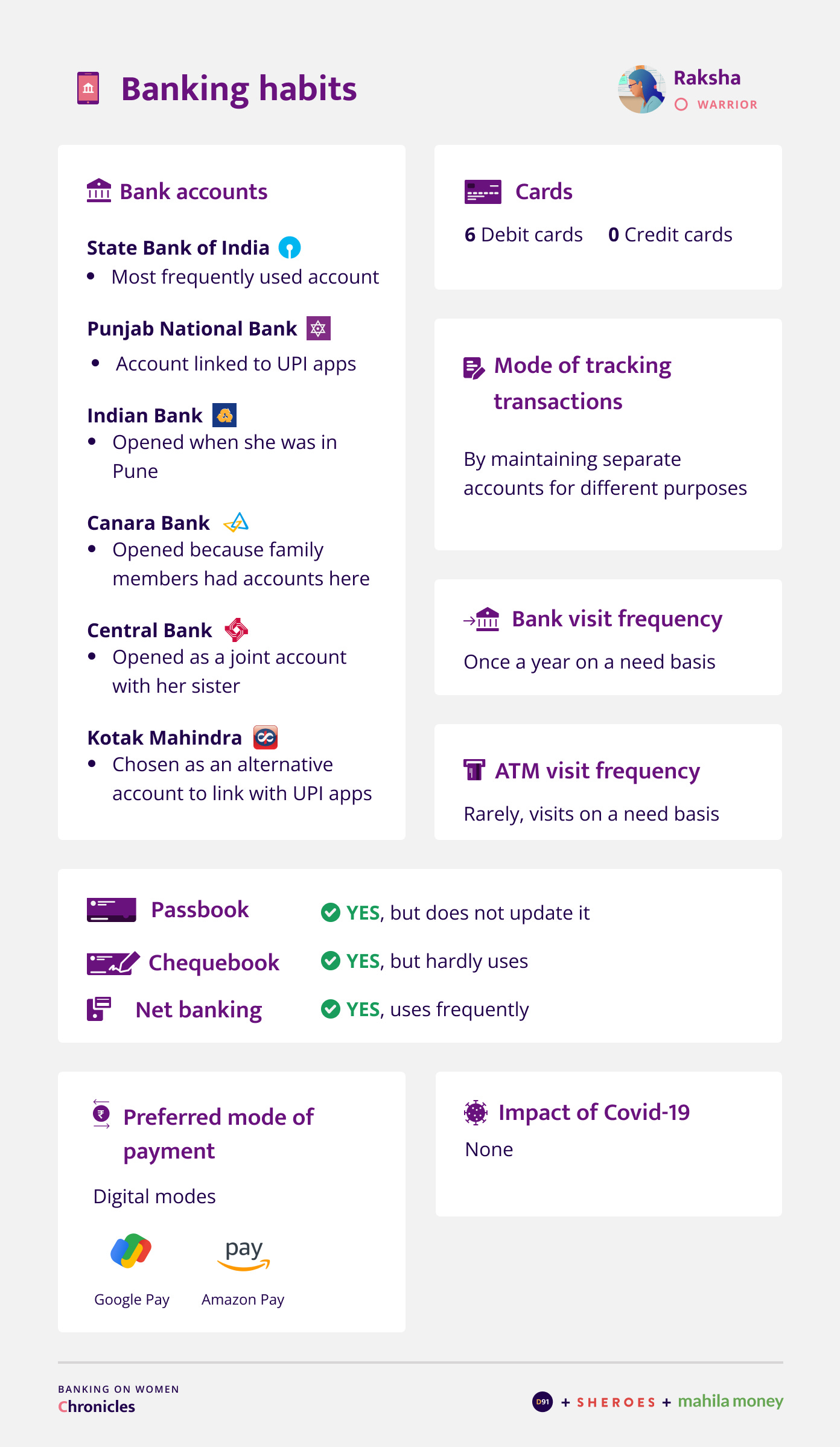

I usually don’t have to write down anything because I mostly spend on groceries and for that I have the same list of products that I order every month on BigBasket. I just go to the app, select the order and add all items to the cart again. This has made things easy and I don’t have to keep a separate file to track what I spend on. Gas bill is a fixed amount and I receive a reminder on Google Pay for that. So these are fixed expenses that are not a problem for me to keep track.

Do you remember the first time you used any payment app? Can you tell us more about that experience?

I just downloaded it from the Google Play Store and tried it. It was easy to go about using it.

Banking Habits

Did you shift to using digital modes of payment because of Covid-19?

No, since I have always been working, I have never had the time to go to the ATM. Even before platforms like Big Basket were in the picture, I used to order groceries online itself. There was one startup in Ahmedabad wherein a shopkeeper had started a website from which I could order.

Financial products and services

Investments

Where do you invest or save your money?

Right now it’s in the form of money in the bank account. But I am planning to invest in a Fixed Deposit and the pension plan that my friend suggested. LIC policy is also something I am planning to invest in because I feel it is a very important thing as I’m aging. It has many benefits and I am aware of this because earlier I had taken a license to work as an LIC agent, when there were no online jobs before I got married. It’s great because it serves as an insurance and it has its own financial benefits as the term is done. A friend of mine also suggested that I invest in mutual funds, but I am not aware of the specifics of it. I also have friends who are investing in gold, so I might do that as and when I get a salary hike.

The reason why I haven’t started actively investing yet is because when we’re newly married, we need to invest in buying a lot of things. We had to invest in a two wheeler, Aquaguard, and other such things for home improvement that we constantly required. Since it is difficult to buy everything at once, it takes time for things to settle down. For the past few years we have been buying things and a lot of money has been going out of our pockets. Due to this there was no opportunity to save.

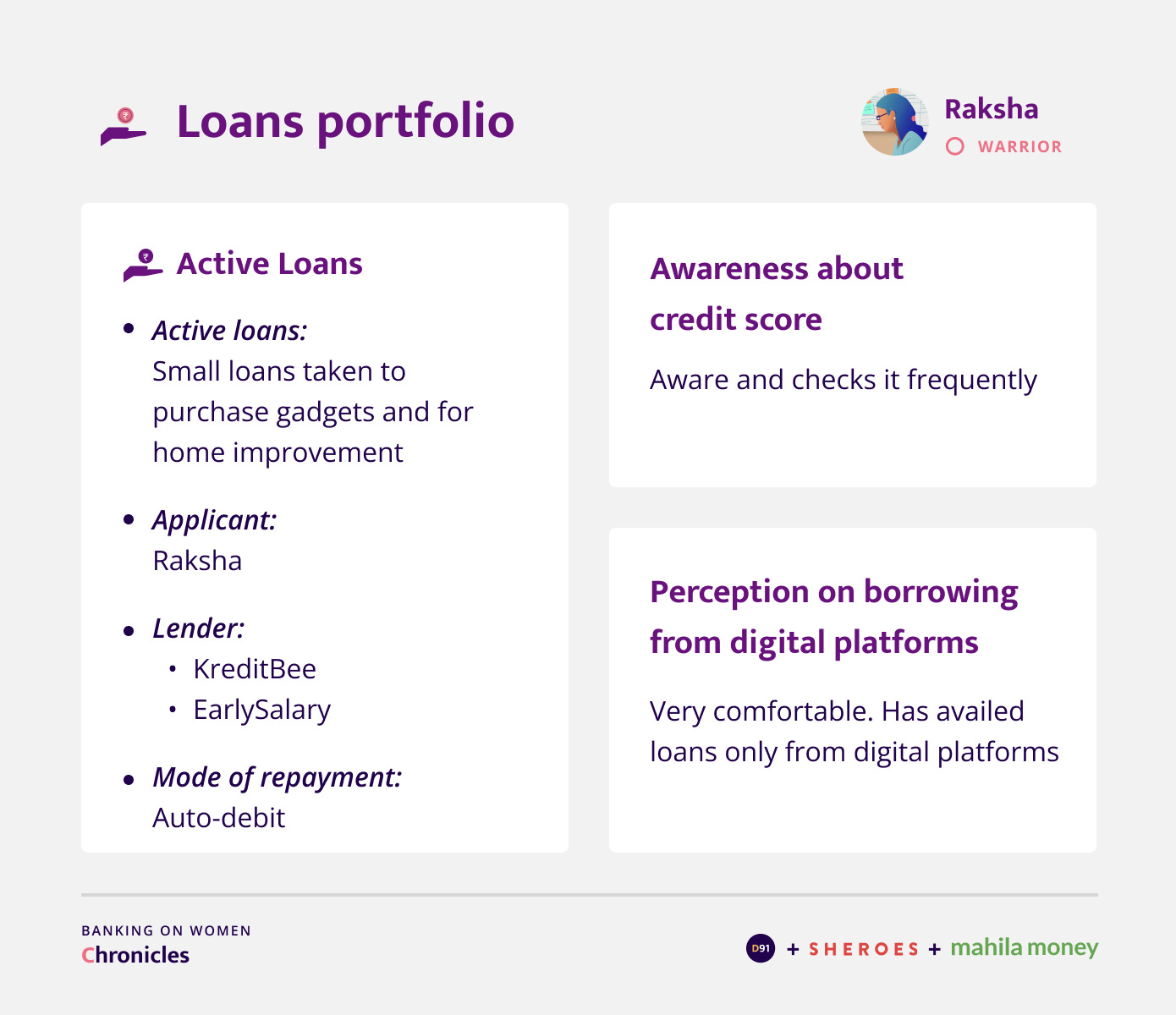

Loans

Have you taken any loans in the past 2 years?

Yes, I have borrowed from apps that offer loans because sometimes we get delayed salaries. Payments that are due won’t wait, so I decided to take small loans. I took one for my phone and my son’s phone. Even the Aquaguard was purchased on a very short EMI.

Can you give me more details about what apps these are?

One app is called KreditBee and the other is called Early Salary. Whenever I need money, I borrow from them and as and when I get my salary or TDS amount, I close off loans with that. I sometimes receive payments in bulk when parents pay for the entire year in advance so that also helps me repay loans quickly. There have also been times when I take some extra money from my husband and close loans before the EMI payment is due itself.

What are the basic requirements you need to avail loans from these apps?

They only require my PAN Card, Aadhar card, salary slips and bank statements and they do video KYC.

Any specific reason you chose to take a loan from these platforms rather than a traditional bank loan?

Well for bank loans you have to run around a lot and it’s a very tedious process. I don’t have the time as I have to be on work calls constantly.

Did you need the signature of any male member or a co-guarantor while taking a loan from these apps?

No, they didn’t ask for anything. One of them asked for a reference number and I gave my sister’s contact number.

What is the maximum amount you would be comfortable borrowing from digital platforms?

If required I might borrow a large amount. But I don’t want to have liabilities unnecessarily. That’s why I borrow small amounts for only how much I require. Otherwise if I have money on hand, I will spend it as there are always some expenses coming up. But even if they offer me a home loan and I am in need of one, then I will go for it. I once applied for a car loan from the IDFC app, it was approved, but then I didn’t go ahead because I felt like it’s an investment I could forgo at that point.

Insurance

Do you or any other family member have health or life insurance?

My husband had, but we didn’t continue with it because I felt the reviews were not good. We are looking into investing in Star health insurance.

So currently we don’t have any insurance apart from vehicle insurance.

Have you done any comparisons for which ones to invest in the future? What were some pain points that you faced that you decided to switch to a different insurance?

The problem was that every year they hike up the amount. Initially it was INR 1 lakh and then they made it mandatory that you have to take a Mediclaim for INR 2 lakhs. Apart from that, customer reviews are not good. Apparently they delay payments while claiming, that’s what a lot of people have told us. I have heard that Star health insurance service is good, which is why we are considering that.

What are some of the factors you consider before investing in insurance?

Customer service. We need somebody to respond when we have queries, nothing more than that.

Did you buy or renew your insurance due to Covid-19?

No, we have all isolated ourselves at home. Our kids attend school online and I conduct online classes because I don’t want to risk my family with students coming and going. My husband also works from home, he was working from home even before the pandemic. Since we have been cautious, we felt that there was no need for any insurance for Covid-19.

Outlook towards the future

In your opinion what is that one financial product or service that will have the most impact in supporting your financial journey?

I think a platform that can offer loans with low interest rates, low processing fees and have a longer tenure. I was not happy with some of the apps that I have borrowed from. We borrow money when there’s an emergency or when salaries are delayed and payments are due. But if they expect repayment with 2 or 3 EMI’s, then how can we repay so immediately? We need some time to repay the money when we borrow. For this reason, I am unhappy using them and I have decided to stay away from apps that have unrealistic repayment expectations. The apps that I continue to borrow from do not disturb my routine expenses unlike the others that charge very high interest rates and I don’t feel like borrowing again even if I need to.

I also feel I have a lack of knowledge in terms of financial instruments. I haven’t found the right person to talk to or resources to refer to. Even for insurance, I haven’t been able to get in touch with the right person. The offerings in terms of financial products are vast, but which one do we choose? How do we proceed? Taking these decisions is a challenge. Of course everyone promotes their own products, so we’re always confused about which to actually go ahead with.

Our understanding of Raksha’s journey

Raksha’s journey is one that has been filled with several hurdles from a very young age. However, she continues to bravely battle the challenges and accepts accountability for her life circumstances. Through her diversity of interests and engagements, she has been able to sustain herself and contribute towards family finances. Despite her abilities being questioned due to the lack of a formal degree, she continues to excel through sheer skill and has never stopped believing in herself. We are immensely inspired by her bias for action!

Hope you enjoyed reading this blog. We at D91 would love to receive your feedback on the work we have been doing so far. Here's a brief survey for us to understand your experience while engaging with our content. This survey should take less than 5 minutes of your time and all responses are anonymous.

You can provide your feedback by clicking on the following link - https://forms.gle/4WUzRUBCht2prHs28

About the Research

This blog is a result of an online interview conducted with the participants’ consent. The interview was conducted in English. This is a part of the Banking on Women chronicles.

Disclaimer: The name and other sensitive personal details in this documentation is masked to honour the privacy of the participant.

Project Partners

SHEROES

The SHEROES Network is a content and community ecosystem enabling access to employment, entrepreneurship, and capital for women. It includes the SHEROES app, SHOPonSHEROES marketplace, Babygogo, Naaree, MARSbySHEROES and has a user base of over 24 million women. The SHEROES Network is committed to increasing women’s contributions to GDP.

Sheroes.com | SHEROES App | Twitter | LinkedIn | Instagram | Facebook

Mahila Money

Mahila Money is a full-stack financial products and services platform for women in India. Mahila Money specializes in offering loans to women who want to set up or grow their own business along with resources and community to achieve their financial goals. Mahila Money can be accessed via the Mahila Money app on Android.

Twitter | LinkedIn | Instagram | Facebook | Website | Play Store App

All artworks are designed by Poorvi Mittal.

If you enjoyed reading this blog and would like to receive more such articles from D91 Labs, please subscribe to our newsletter here.

To read more about our work, visit our website