# 1 Rachana

In my life, I have learned the hard way about the value of financial knowledge and so I am educating my daughter about finances at a young age itself.

“Unless and until you do it on your own, nothing gets done. This was the biggest learning in my life.”

Short story

Rachana is a 39-year-old mechanical engineer who lives in Nashik with her daughter. She resigned from her full-time job after her marriage, over a decade ago. Since then, she picks up part-time engagements such as teaching or resume writing, but does not have a consistent source of personal income. Her husband has a transferable job and he currently lives in a different city than Rachana and her daughter. Rachana has been handling her family’s finances single-handedly and has a keen interest in finance. She aspires to become a certified financial planner.

We asked her some questions about her financial life and journey as well as her hopes and aspirations for the future. See what she had to say about it all below!

Personal and financial background

Can you tell me a little bit about your professional background?

I am a mechanical engineer by qualification but I stopped working full time over a decade ago. I have done jobs on and off but I have not worked since the pandemic started. I handle my family's finances myself.

Can you walk me through your day?

I usually juggle between household chores and the share market. When the household work becomes too much, I keep the market-related work aside. However, I definitely do both on days that I can. Apart from that, I typically research investment opportunities. Whenever I get some money, I try to invest in the share market.

Can you tell me about your sources of income currently? Also, how much of your income do you use for family-related matters?

Whatever money I have in hand is mostly from my initial savings, earnings through various jobs, or what my husband gives me. I do my own research as I am also very interested in the share market and try to make a diversified portfolio with this income. Typically, there is no such fixed amount I use for family matters. Investments, loan repayment and insurance are fixed amounts that get deducted periodically. If I invest in some shares or mutual funds, the amount invested varies. For instance, if my expenses are high in a month, I have to skip investing in that month. Finally, my daughter’s school-related expenses are a top priority for me, and about INR 20,000 per month goes into that. The Covid-19 pandemic has added a lot of uncertainty in my expenses.

Household finances

How do you decide the household budget?

My income is not fixed, and the amount my husband gives me on a monthly basis varies. So my budgeting depends on the amount I have in hand. In general, I know how much I need for groceries, outings, school fees and possible medical emergencies so I keep that aside. But a sudden expense can really throw the monthly budget off the mark. For example, last month, we shifted to a new house and got kitchen furniture made, so we had to dip into the monthly budget. But the good thing is, in times when my husband gives me a sum larger than what I need that month, I tend to adjust it for months when I do not have enough and we get by on that basis. In such months, I also put the extra money into an emergency fund. Sometimes he doesn’t give me any money for two consecutive months, in that case, I take care of expenses with this additional money from past months. I therefore need to keep a continuous tab on my cashflows.

Is there a fixed amount that you calculate and set aside for emergencies every month?

Yes, I do keep aside a fixed amount for emergencies. At the beginning of the month, I ensure I pay amounts towards my household expenses and other particular payments such as loan and insurance without fail. Apart from that, if there are specific needs such as purchases for myself, for the house, or for my daughter, I need to adjust these expenses as well. So first, I take care of all the above monthly needs and whatever is left, I keep aside for savings as an emergency fund. I prefer to keep it in the bank.

Do you save money separately for your child’s expenses? Any goal associated with your child’s savings?

Of course. I have had an experience before where I realized it’s better not to depend on anyone - whether it’s my husband, father or anyone else for that matter. So, I have made a separate account for my child and set aside savings there. I have retained this account as an emergency fund which no one else has access to.

Expenses and Payments

How do you and your husband make expense-related decisions in the household?

We don’t usually make joint decisions about household related expenses. He just transfers the money to me and asks me to spend it the way I need to. So whatever money he gives me, I don’t have to give him an account of how I spend it. We also try to take decisions of collective matters such as those related to our daughter or the home loan which is in both our names together. Otherwise, he is certain I can take care of the finances myself.

Does your husband have complete knowledge of whatever emergency and normal savings that you have?

No, he doesn't. He has some knowledge but not the whole thing. Since we’re communicating long distance, it is not always possible to update him about everything.

How do you typically make payments?

I go to the ATM a few times a month but otherwise I use Paytm for my payments. For groceries I make payments using my card.

Do you use credit cards?

I do not believe in spending money that I do not have so a credit card is not a necessary product for me.

Do you remember the first time you used any payment app? Can you tell us more about that experience?

I learnt to use it by myself, but I am still a bit hesitant to use it and prefer to use other modes of payment. These days kids use our phones a lot, and sometimes there’s no control over what happens on our phone because they keep roaming around and disappear with our phones. (with regard to making payments on an app by mistake). That’s why I prefer net banking.

Do you file your taxes?

No, but I intend to. I am looking for a CA who can help me with it. Because we did not have too many transactions before, but currently, we have the home loan, which is in both my husband and my name. One thing I noticed is, until I was working, I was respected, and the treatment I received was very different. However, once I quit my job, I felt no one listened to me. This has been my personal experience. Which is why I decided to take things in my own hands.

Banking Habits

Apart from deposits & withdrawals, is there any other reason for which you visit the bank?

Yes, I have a Demat account and when I need to use my account, I visit the bank. Separately, when I need to transfer money for registering for any online course, then I prefer to go to the bank and make the transfer. For example, when I have to register for a course then I transfer from the bank only.

Do you use the cheque book and net banking facilities offered by the bank?

I prefer to use a cheque book over net banking for high value transactions. Sometimes circumstances require that I pay through cheque. We have only one laptop which my daughter uses for online classes. I don’t always get access to the laptop for net banking and so I end up using the cheque book. Recently, I bought a washing machine and my mobile was not working. The seller preferred a cheque payment, so I paid using one.

Financial products and services

Investments

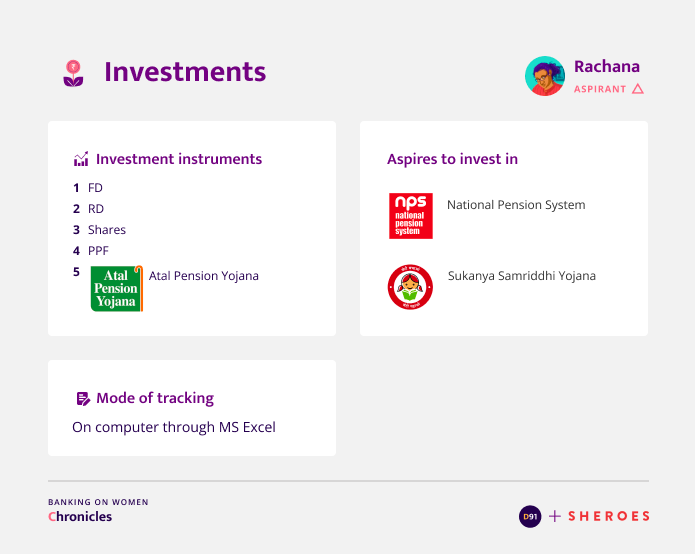

What instruments do you invest in and how do you go about making investment decisions? Did you always know how to invest or is this a more recent interest?

I have invested in various instruments, although the most significant investment for me is in shares. I am very interested in the share market and I tend to invest after doing a lot of research. I used to research about the company and about its future plans but now I also use the internet to keep updated about investment products. There is a small role that instinct also plays in investing for me. For example, when I read the company’s balance sheet, it does not always tell me much but it sometimes gives me a sense of whether it will do well or not, and I invest on that basis.

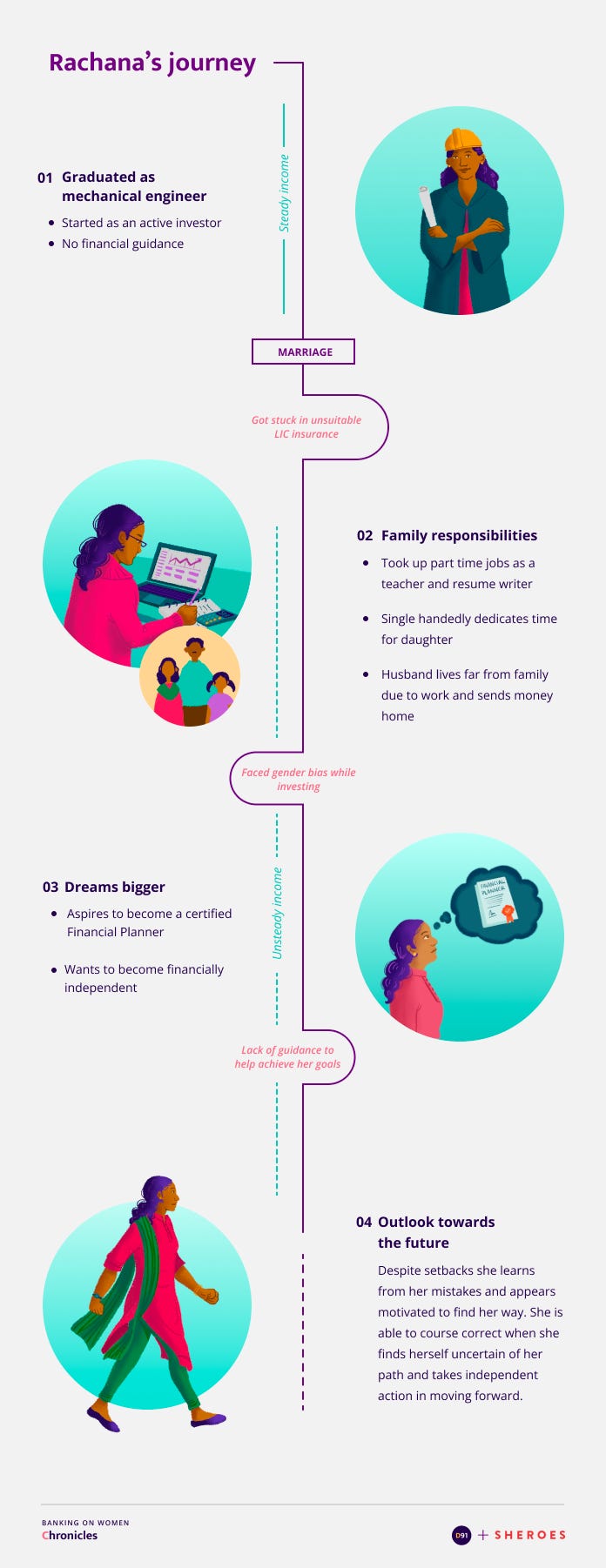

Even though I have been gathering knowledge on this for a while, I have just about started investing. The irony is that my father is an accountant, but neither my brother nor I were told about or given knowledge about investments and why they are important. I don’t know why the previous generation did not pass on the knowledge to us. Even if they didn’t pass on the knowledge they should have secured our future in some way, but they didn’t do that. Even between my brother and me, there was a difference. For men, my brother in this case, even if something goes wrong he has something to fall back on like a “comfort cushion”. But that was not the case for me. So I independently sought out and gained that knowledge.

Since when have you been investing independently?

I first started investing when I was salaried, but I put things on hold once I gave birth to my daughter. We were a nuclear family and it was a bit difficult since my husband hadn’t fully settled yet and I had quit my job. However, gradually, due to specific adverse incidents, our awareness increased about the importance of investing and we got started. Over time, even when we invested, I could not give it much time so my husband started handling the investments. He was busy and sometimes the premium remained unpaid. Eventually, I realised that it was important for me to take these matters into my own hands. I have since then taken decisions for all the investments in my name. Now, I do not have to rely on anyone for signature or decision-making. All this is very clear to me in terms of where to invest, how much to invest, and I have learned to take responsibility for my own mistakes.

How did covid-19 impact your investments?

During the pandemic, I became aware of the National pension scheme and Atal Pension Yojana (APY), and I plan to invest in these. Also, when the pandemic started, we were living in a rented house. Though we could not shift into this new house, the EMI had already started. The pandemic presented a great opportunity to save more and I did so. Things go wrong sometimes but we need to see how to turn that situation around to benefit us. Eventually, I myself got COVID, and those savings really helped me.

Loans

You mentioned you have taken a home loan. Can you share the details of the loan with us?

My husband and I took a loan a year ago. The loan and the house are both jointly in our name. However, he is paying the EMI from his salary. My husband chose the lender and agreed to the terms, I did not make any comparisons since the pandemic was at its peak then and I could not dedicate time to this. We moved into the new house at the beginning of this year. Lately, the interest rates have fallen, and we plan to take advantage of this and pay at least one extra EMI.

If you have to take a loan in the future, would you prefer it to be in your name or a joint loan?

It depends on what purpose the loan is for. If it is for something to do with me, I’ll take it in my name. If it is something involving my child’s education or something related to the house, that will be a joint loan. It will be the case until I am back to working at least.

Would you consider taking this loan digitally? If not, why?

Firstly, I do not think I will need a huge amount for anything else. Even if I do, I will try to accumulate that money by saving from now itself. Despite saving, if I still need to take a loan, I will approach my bank or any other financial institution, but not any digital platform. I am not comfortable with them.

Insurance

Do you remember the first time you or your family purchased an insurance product? Why was it purchased?

I had purchased term insurance with my first salary in 2005. It was for a short term which matured and gave me a good return. At that time I had no awareness about the products that are there to invest in. It was with my first salary and I was just 23 at that time. We learned about it from my husband's colleagues who seemed to have experience with it. We trusted them and at that time we did not know any other instruments. So for the short term I purchased that insurance product.

What was your experience with insurance products you have purchased so far?

Well, we have purchased a few insurance products. However, the experience has not always been great. To elaborate on what happened, we had a LIC policy which we had availed through a person within our friend circle. He advised us in a manner that profited him more and we trusted them blindly. That was a huge mistake and the mess has not been resolved yet. When we first started purchasing insurance, all the policies were in my husband's name. Due to this, without his signature, no changes or closures could be made. I help him as much as I can but ultimately he has to sign and make final decisions. We currently have about 3 or 4 LIC policies out of which we want to close 2. Though we can opt for other options for the ones we want to continue, I cannot single handedly make any change to these policies and we hope to resolve these issues with insurance as quickly as possible.

Outlook towards the future

In your opinion what is the one financial product or service that will have the most impact in supporting your financial journey?

I feel more and more women should have knowledge and awareness about the share market. Shares are a flexible and convenient product. When I started, there were very few women investing in the share market. When I visited any office to invest, they asked me to not visit the office since it was always filled with men and asked me to instead give my trades through the phone. Often, they would not pick up the phone on time or make entries immediately. Time and opportunities to make money both got wasted. Now that you can make trades on your phone, it is simpler and much more convenient to participate in the share market. More women should do this.

What are your hopes for the future?

I feel that there is no proper concept of financial planning in our houses and many families like ours. For instance, if something happens healthwise, we run to the doctor, but we do not immediately consider if we have the means to pay for such services. I have learned that finances have to be customized for them to serve each family. I have always been interested in finance and I want to do a financial planning course with the Financial Planning Standards Board (FPSB). Unfortunately, I have not been able to find a suitable mentor to teach me. I registered for a course but the provider was not very proficient in financial planning. I am looking for alternatives since the longer I wait to train the more time it will take for me to start applying my knowledge as a practitioner.

In my life, I have learned the hard way about the value of financial knowledge and so I am educating my daughter about finances at a young age itself. I give her pocket money and ask her to update me about where she spends her money. That does not mean she spends the entire amount I give her. She needs to put something aside, and she does. Unless and until you do it on your own, then nothing gets done. This was the biggest learning in my life.

Our understanding of Rachana’s financial journey

In speaking with Rachana we saw how her financial journey was shaped not just by personal and familial circumstances but also by external factors including lack of guidance and her past experiences with financial products and services. Despite setbacks, she learns from her mistakes and appears motivated to find her way. She is able to course correct herself when she finds herself uncertain of her path and takes independent action in moving forward.

Most importantly, she aspires to achieve her potential and create a great financial future for herself as well as for her family!

About the Research

This blog is a result of an online interview conducted with the participants’ consent. The interview was conducted in Hindi and English but has been translated to English in the best possible way to reach a large audience. This is a part of the Banking on Women chronicles.

Disclaimer: The name and other sensitive personal details in this documentation are masked to honour the privacy of the participant.

Project Partner - SHEROES

The SHEROES Network is a content and community ecosystem enabling access to employment, entrepreneurship, and capital for women. It includes the SHEROES app, SHOPonSHEROES marketplace, Babygogo, Naaree, MARSbySHEROES and has a user base of over 24 million women. The SHEROES Network is committed to increasing women’s contributions to GDP.

Sheroes.com | SHEROES App | Twitter | LinkedIn | Instagram | Facebook

All artworks are designed by Poorvi Mittal with input and guidance from Prajna Nayak.

If you enjoyed reading this blog and would like to receive more such articles from D91 Labs, please subscribe to our newsletter here.

To read more about our work, visit our website

Such a brilliant initiative! absolutely love this series!

Wow. Appreciate the efforts and initiative. Keep it going.