#11 Pragati | Investing in a brighter future

I invest to have a better lifestyle. I am trying to stabilize my career as I want to become financially independent and early retirement is an aspiration for me.

“I want to ensure that my parents are leading a comfortable life before I get married and leave the house”

Short Story

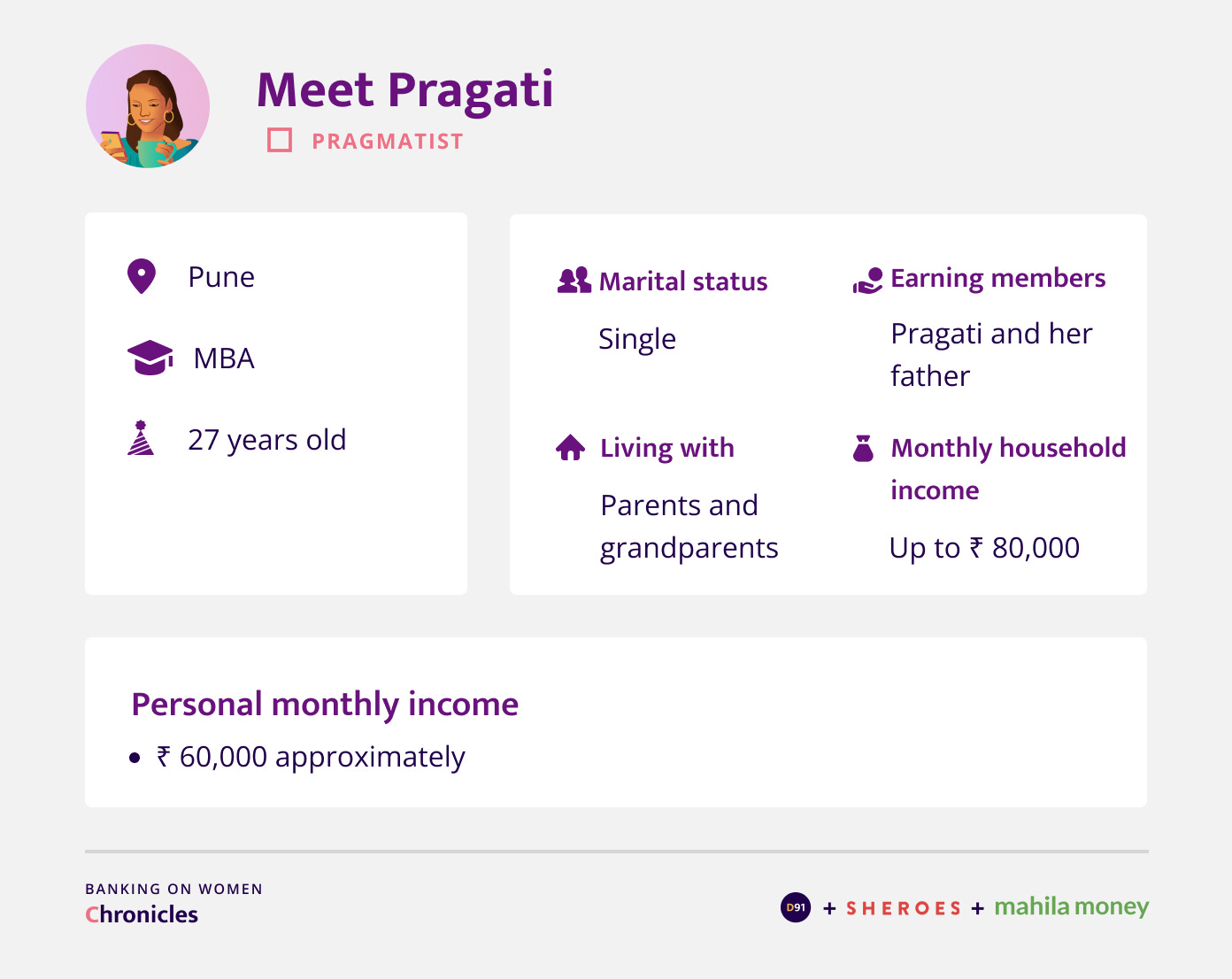

Pragati is a 27-year-old MBA graduate currently working as a recruitment professional for an ed-tech platform. She lives with her parents and grandparents in Pune. Pragati takes a keen interest in managing her personal finances and is an avid investor. She is frugal in her approach as she works towards her goal of gaining financial freedom. Her journey is an example of the early retirement movement that is so widespread amongst millennials.

Personal and financial background

Can you tell me a little bit about your educational background and the work that you do?

After completing my bachelor's degree, I worked with a multinational investment bank and financial services company for 3 years. During my stint there, I considered pursuing an MBA, however, I decided to wait and earn the money necessary to fund my studies. In the end it was a combination of funding from my father and my own savings that I used to fund my MBA. I have now completed my MBA and I graduated in 2020.

I currently work with an organization in the educational technology (ed-tech) space and I am on the recruitment team. I take care of training and recruiting. We are an ed-tech platform with offerings in coding, mathematics and music through one-on-one video classes. But I am currently looking to switch jobs and I also have an offer at hand from another organization. So probably next month onwards I’ll be working with a new organization.

I don’t run any business independently at the moment but we have a family run medical store. I tried my hand at reselling on SHEROES and I made about 2-3 sales, but I got busy with my professional work and could not explore that further.

What is your daily routine like?

Once I wake up in the morning, I usually help out with things like buying milk and other such items. I then freshen up and start work by 9:30 am. I wrap up by 7:30 pm, but I am always available on the phone even after that. I ensure that I enjoy my weekends thoroughly. So you could say I usually live on my weekends since work takes away most of my time during the week. Meetings get extended and some of us don’t even have lunch on time some days though we are working from home.

Can you tell me a little bit about how you decided to get into the line of work that you currently are in?

Sure, I’ll start with taking you through my journey since I finished my Bachelor’s degree. I remember it was my first placement interview through college and I wasn’t really sure if I wanted to pursue a Master's degree or work first and then go for higher studies. But then I decided to attend the interview and I happened to crack it. I did not have any clear aim or goals at that point. But once I joined the multinational bank and worked for about 3 years, that’s when I realised that an MBA is essential for growth in an organization and I decided to apply to study further.

Household finances

Do you have a monthly household budget?

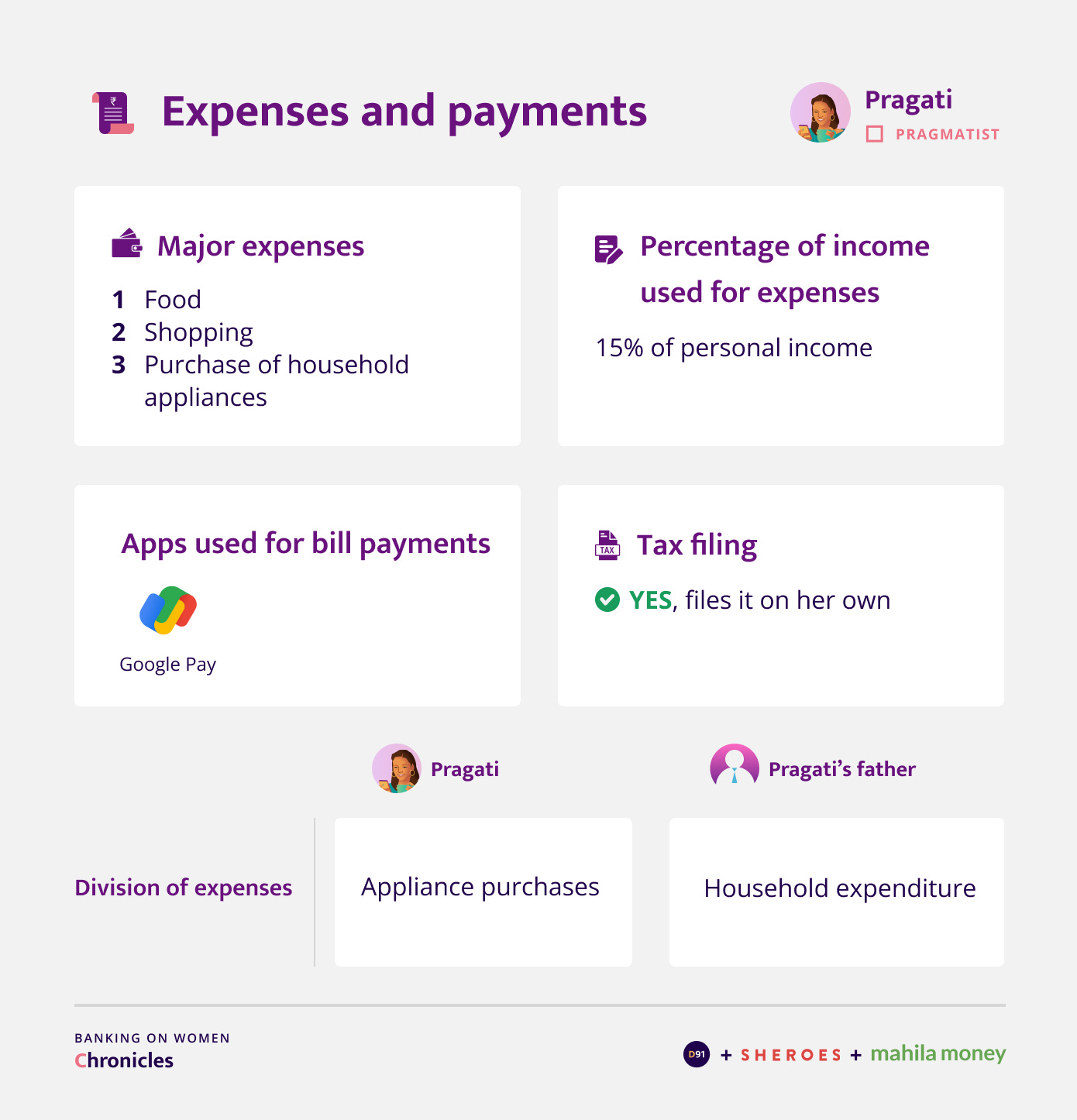

Not really, so when it comes to monthly expenses, it is completely taken care of by my parents. I don’t really contribute to that. It’s up to me to decide how I want to go about my monthly expenses. I have a lot of investments, so I usually divide my money based on that. I don’t spend much on the household.

How is the family budget decided? Independently or collectively?

Since my parents handle it, what I usually do is, when there’s an anniversary or birthday in the family, then I give them gifts in the form of appliances that will be useful for the house. For example, once I gifted my mother a microwave, other times I have bought them a refrigerator, a mobile phone and a washing machine. So I usually take care of buying appliances and I contribute in terms of these bulk payments only. My parents have never asked me to contribute towards household expenditure.

Do you save money separately from the monthly reserves for rainy days or later use?

So I recently started investing in mutual funds and that is kind of an emergency fund for me. I use the Groww app currently. Moreover, my parents are anyway present to help me out in case of any setbacks. In terms of savings, like I mentioned, I invest in the National Savings Certificate (NSC) at the post office which are fixed investments with a lock-in period of 5 years. I find the instrument safe and the rate of interest is pretty decent when compared to a Fixed Deposit (FD) which is why I usually request my parents to take their money out of a FD and invest it in such things with higher interest rates instead. Since the inflation rate has increased there are not too many benefits of investing in a FD.

Whom do you rely on for financial advice?

Initially it was my parents, but once SHEROES came into the picture, I rely on their Money Matters community which is also known as Mahila Money now. I used to post questions there and enquire about how to go about things in terms of investments. I remember in one of the posts somebody had asked if I invest in the pension scheme and that did not make sense to me because we have insurance and I think it’s more than enough to invest for 15-20 years. I personally decided that I’ll look into the pension phase later on in life. I think a platform like this is great because there are a lot of women who come from different backgrounds so it’s easier to get multiple perspectives and take decisions accordingly.

Expenses and Payments

How do you keep track of your expenses?

When it comes to insurance premium payment, I have linked my account through Google Pay itself and I have set a reminder there. It’s fairly easy now because all you need to do is link your policy number through Google Pay and they will send a reminder one month prior to when the premium payment is due and they also specify the amount that is due.

Do you remember the first time you used any payment app? Can you tell us more about that experience?

I remember when Google Pay came out, they used to have a referral scheme of INR 50. That’s what got me excited, I still remember that we were at the office one day and everybody was trying to refer colleagues who were not using the app yet. That’s how I began using it. Initially a lot of my colleagues and I were just experimenting with Google Pay and we used to credit INR 1 back and forth and avail the rewards in the form of cashbacks that they were offering. I think this was back in 2017 or 2018.

Do your parents also use payment apps?

My mother does not use payment apps, she uses cash. My father uses Google Pay and cash both equally.

Do you file your taxes? Do you need help to file your taxes?

I do that all by myself. I just go to the Income Tax Returns (ITR) website. When I was working at the multinational bank, one of my colleagues taught me how to go about tax filing. My parents usually ask me to consider visiting a Chartered Accountant (CA) but I prefer not to spend that additional INR 500 and do it on my own instead because self-reliance in this regard is probably a good thing.

Banking Habits

How often do you visit a bank branch, is it to withdraw or deposit money or for any other purpose?

I hardly visit banks, maybe once every 2 months. I usually visit the post office for the National Savings Certificate (NSC). I also have a recurring deposit there. That’s why I am a frequent visitor when it comes to the post office. Also since the post office is on MG Road, that way I get to shop also.

Has Covid-19 impacted your transactions with the bank, or just your general interaction with the bank rather?

No, I think we are quite comfortable after demonetization. The impact was way back in 2016. That’s what brought about the shift to digital payments. So I don't think the pandemic really had an impact.

Is there a specific reason why you haven't applied for a credit card?

I did not apply for a credit card mainly because I prefer the concept of only using money that I have rather than using money that I don’t have beforehand. Credit cards work on the basis of the latter which is why I don’t use them. Basically I am not comfortable with starting a debt cycle.

Do you have a passbook? Do you update it regularly?

No. I remember having one but I have misplaced it. But I have a post office passbook and even till date they write things manually, there’s no printing and all.

Financial products and services

Investments

Can you give me a little bit of an understanding of the products that you typically invest in and why you chose these products?

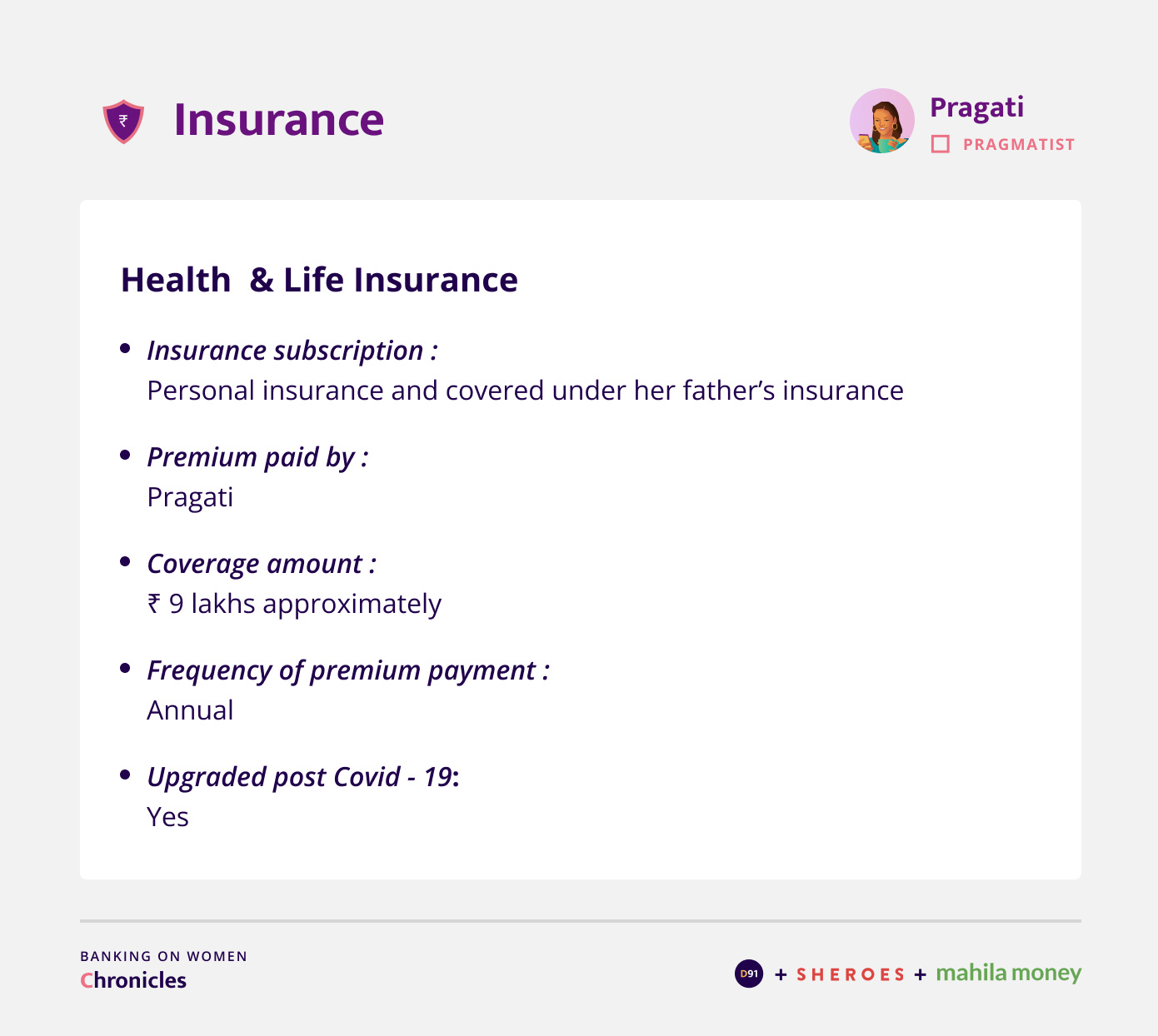

Apart from the investments in NSC, I also invest in Public Provident Funds(PPF). I started this after I got a job post MBA in 2020. I decided to invest in PPF because my father used to invest in it and he always used to tell me that the expenses for my older sister's wedding was handled entirely through returns from PPF. All I have to do is put in INR 1.5 lakhs per year between the 1st-5th of every month. Additionally it is a tax saving investment as well and that’s why I decided to open a PPF account. I also have a few FDs that my father handles because I am someone who would actually take out all that money from FDs and invest it in mutual funds instead. But my father comes from a generation where most of them will tell you that FD is the safest and the best investment option since it doesn’t have an element of risk involved. Probably with time I’ll take out that FD money and invest it in mutual funds. I also have a lot of insurance policies, but the policy period that it covers is really long.

What percentage of the money do you invest? Or how much?

What I usually do is, I save INR 25,000 for 4 months and once it amounts to INR 1 lakh, I invest it in either an FD or NSC. So it varies and depends on how much I intend to invest. I usually prefer to put in 1 lakh for 5 years and earn a decent interest on that via NSC and not FD. But when it comes to PPF, sometimes I do bulk payments and I usually don’t make recurring payments for that. I also have a few recurring investments that are linked to my account so around INR 5000 per month gets auto-debited for that and even the insurance premium gets deducted accordingly as and when it is due.

How did you start your investment journey?

Once I started earning, my father told me about the importance of savings and asked me to look into it. But when it comes to investments, it was after my MBA that I was actually able to save. That’s when I began to think about how much to actually put in various instruments. Initially it was all in the form of savings in my account.

Luckily SHEROES also came in 2018 and through that I got a better perspective about investing, savings, etc. and looked into what instruments are giving me better returns and I became open to try out different options.

Do you have goals attached to your investments?

Not specifically, but I invest to have a better lifestyle. That's the only thing I'm looking for as of now. I also want to ensure my parents are leading a comfortable life before I get married and leave the house. They haven't really brought up my marriage as of now. Also, my grandmother is currently ill and she’s bed ridden so the attention is currently on her. In the meantime, I am trying to stabilise my career as I want to become financially independent and early retirement is an aspiration for me. I have also always dreamt of wanting to be Dr. Pragati, so I want to pursue a PhD later in life after the age of 40 or 45 maybe, once my back has given up on me after spending 8-10 hours in front of a screen in a corporate job. I’ll probably teach after and this is how I intend to spend that phase of my life.

What challenges do you face in investing?

One challenge that I faced in terms of PPF was that no one told me that the deposit had to be done between 1st to 5th of each month to ensure that I earn interest on it, so I literally had to figure that out on my own. Only after a while I realised that I have been losing all my interest since I wasn’t following that. Even insurance for that matter, I have no idea about the maturity, I just keep paying with the hope that one day randomly after 10-15 years it might benefit us. But of course though there are no immediate benefits, it is for a better future and that’s how I look at it. Sometimes it feels like I’m planning for the next generation when the returns are slow just like how the investments that my parents have made for me, it’s actually beneficial only for the future generation.

Loans

Have you considered using digital apps for borrowing loans? If yes, what is the maximum amount you would be comfortable borrowing from a fintech company?

I haven’t taken any loan yet, but it would depend on the goal. For example, if I have to buy a house, I might not be able to fulfill that with only one loan, so we might have to take one in my parents name and one in my name and go about it accordingly. But it would depend on the interest rate I guess, I haven’t really thought about it. But I don’t even use a credit card for that matter so I’m really not sure if I would be comfortable borrowing. In general I am not very comfortable with debt as an instrument. For instance, I could have easily switched after 2 years of my first job to pursue an MBA, but I decided to wait and work for a third year and accumulate a decent amount to be able to fund my MBA without a loan. Even if I were to, I think I would probably rely on something more established.

Insurance

Outlook toward the future

In your opinion what is the one financial product or service that will have the most impact in supporting your financial journey as a consumer?

Maybe in terms of loans if they can provide something where the interest rate is lesser, I would be more open to opt for such loans. In terms of investments, someone who can really guide me based on my portfolio. Someone who can tell me how much I should invest based on my monthly income and expenses would be great.

Our understanding of Pragati’s journey

Speaking to Pragati gave us an insight into her realistic approach to life and her finances from a very young age. She has independently taken charge to build her financial portfolio in a manner that will enable her to achieve financial independence and live on a passive income from an early age. She hopes to dedicate her time towards more passion oriented engagements thereafter. Her ability to prolong immediate gratification to secure her financial future is admirable.

Hope you enjoyed reading this blog. We at D91 would love to receive your feedback on the work we have been doing so far. Here's a brief survey for us to understand your experience while engaging with our content. This survey should take less than 5 minutes of your time and all responses are anonymous.

You can provide your feedback by clicking on the following link - https://forms.gle/4WUzRUBCht2prHs28

About the Research

This blog is a result of an online interview conducted with the participants’ consent. The interview was conducted in English. This is a part of the Banking on Women chronicles.

Disclaimer: The name and other sensitive personal details in this documentation is masked to honour the privacy of the participant.

Project Partners

SHEROES

The SHEROES Network is a content and community ecosystem enabling access to employment, entrepreneurship, and capital for women. It includes the SHEROES app, SHOPonSHEROES marketplace, Babygogo, Naaree, MARSbySHEROES and has a user base of over 24 million women. The SHEROES Network is committed to increasing women’s contributions to GDP.

Sheroes.com | SHEROES App | Twitter | LinkedIn | Instagram | Facebook

Mahila Money

Mahila Money is a full-stack financial products and services platform for women in India. Mahila Money specializes in offering loans to women who want to set up or grow their own business along with resources and community to achieve their financial goals. Mahila Money can be accessed via the Mahila Money app on Android.

Twitter | LinkedIn | Instagram | Facebook | Website | Play Store App

All artworks are designed by Poorvi Mittal.

If you enjoyed reading this blog and would like to receive more such articles from D91 Labs, please subscribe to our newsletter here.

To read more about our work, visit our website