#10 Zainab | Building structures to building narratives

I believe that in case an emergency arises, we should be in a financially stable position to fight that. I never want to be in a situation where I have to go to someone else and ask for money.

“Due to the pressure from societal conventions, I ended up in the male-dominated civil engineering industry. After all the struggle, I decided to quit and follow my passion in the field of writing.”

Short Story

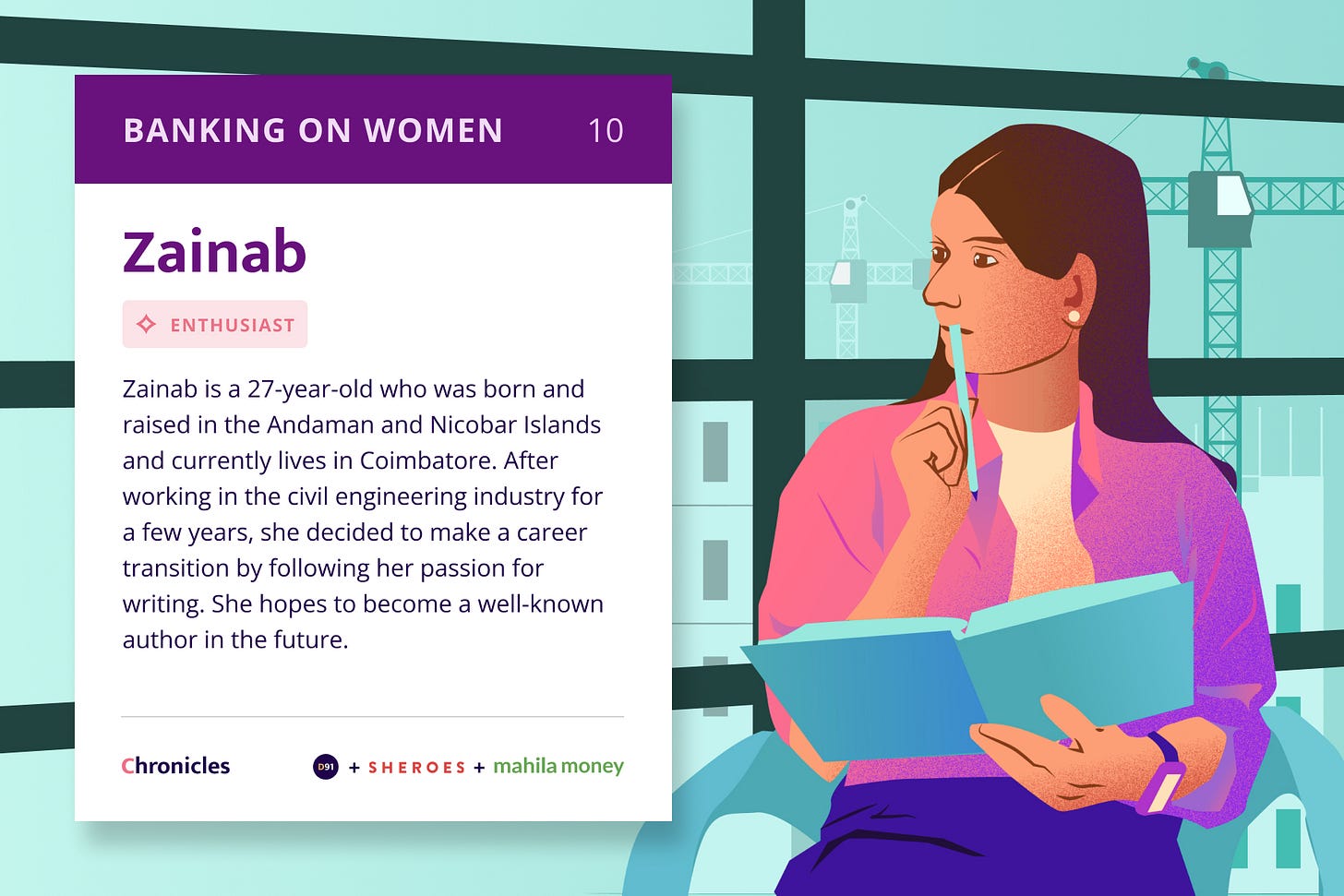

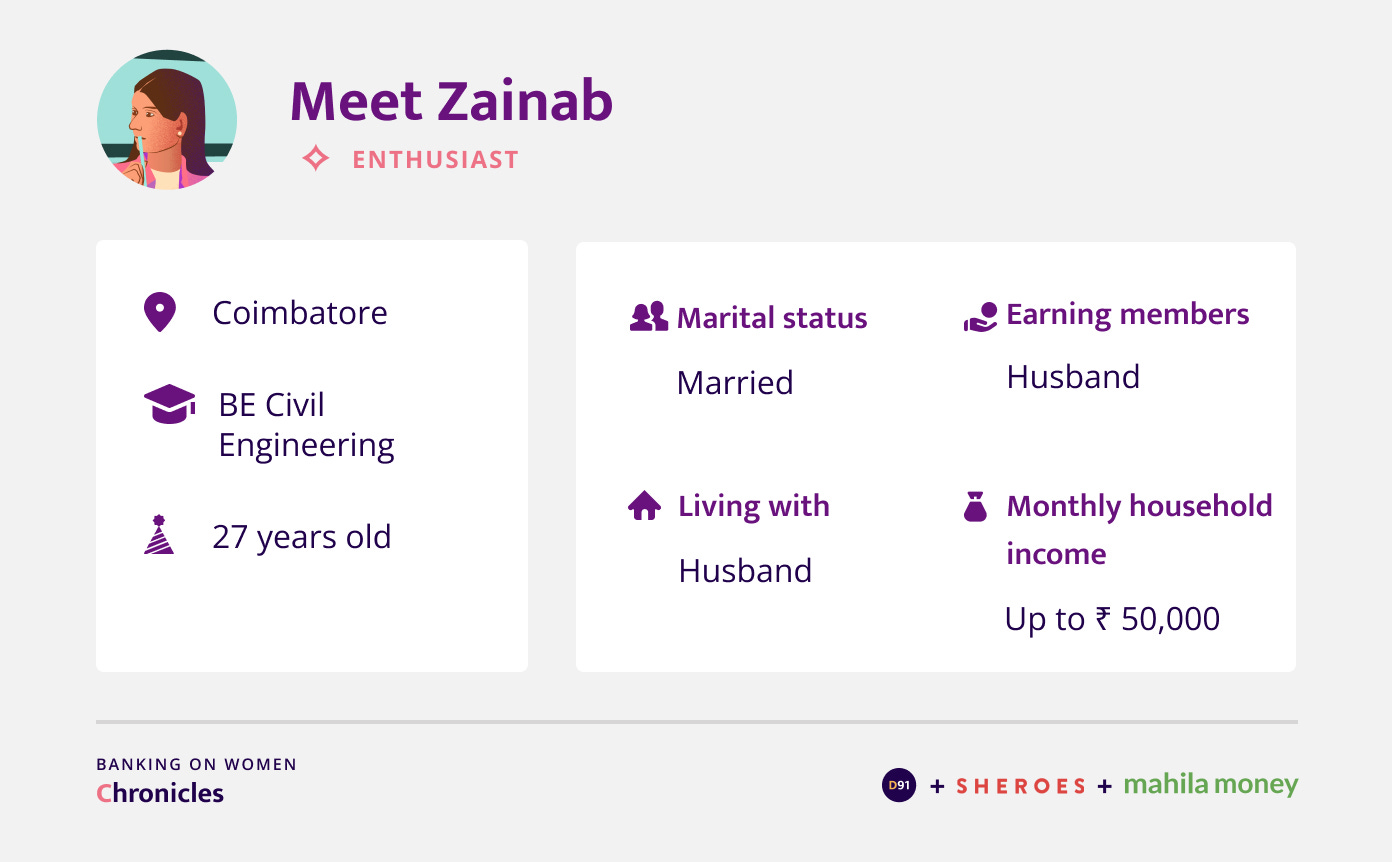

Zainab is a 27-year-old who was born and brought up in the Andaman and Nicobar Islands. She currently lives with her husband in Coimbatore. After being subjected to gender discrimination while working in the civil engineering industry, she decided to make a career transition and follow her passion for writing. Zainab’s independence of thought and action offers valuable lessons for young aspiring entrepreneurs.

Personal and financial background

Can you tell us a little bit about your educational qualifications and your professional journey till now?

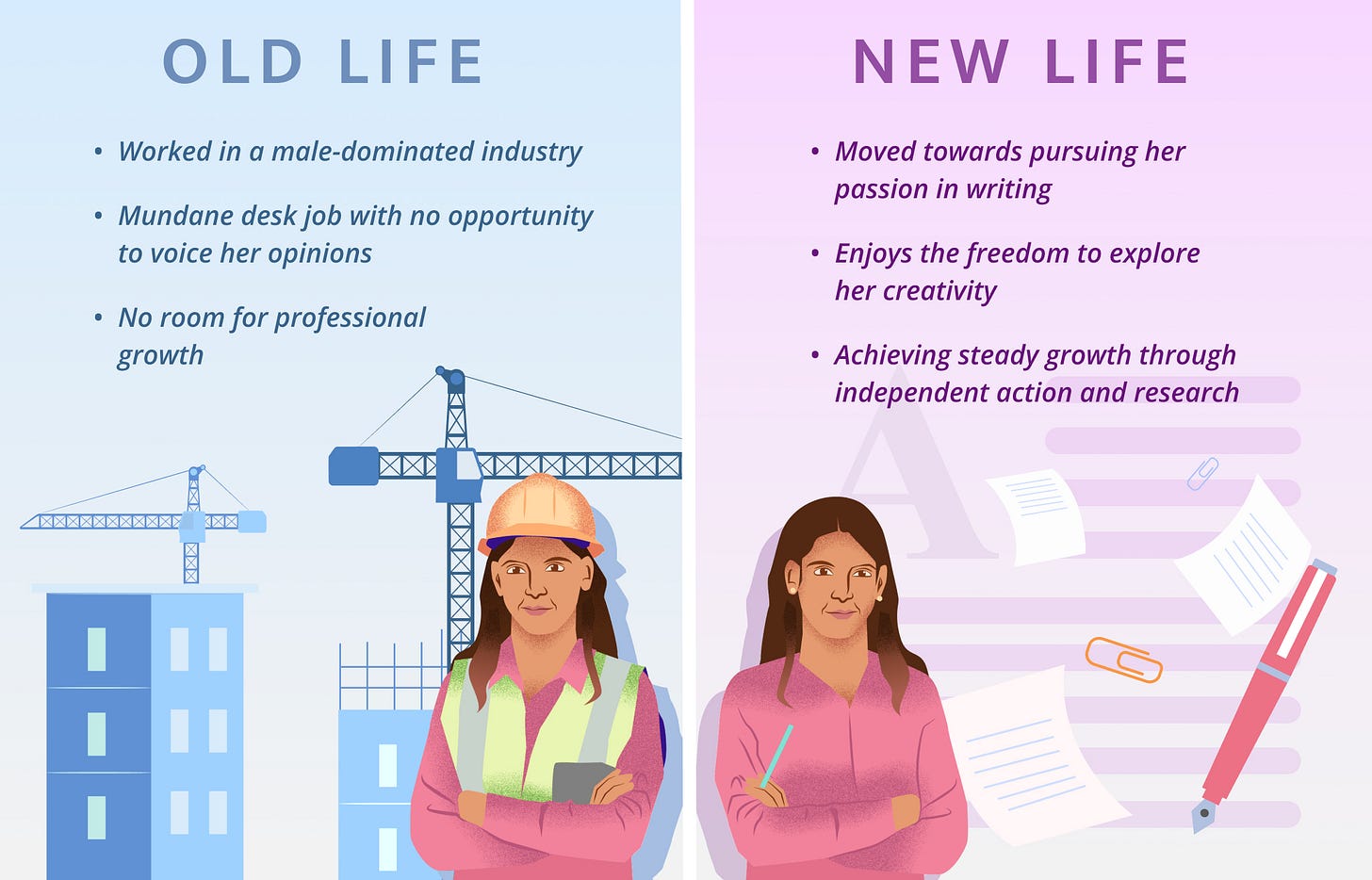

I pursued civil engineering as an undergraduate degree. After graduating, I was working as a design engineer. However, I was not very happy with that job because my role mostly involved sitting in front of the screen and utilizing different software to design. I didn't get to voice my opinions or put my creativity to use. They allotted work to me, and I had to blindly draft those building plans and other such drawings essential for construction and submit it. It became too monotonous and I was not okay working like that. We were also required to do site visits but male employees were given more preference for that. I was not okay with sitting in front of the screen for prolonged hours as it felt like a waste of my own potential and this is very prevalent in the civil engineering industry as they don't prefer to pave the way for growth when it comes to girls. If any woman says that she is working in the building construction industry, then it is highly likely that her work mostly involves sitting in front of a screen. Moreover, I was promised that I will be promoted to the project management department where we get to meet clients and other people. I thought it would be an interesting role to take on, but it was a false promise and I was never promoted. I was asked to continue with the estimation and designing department, but I was highly dissatisfied with my role. Also when the pandemic started, it turned out to be a very hectic job as they would call me as they please, even at 11 pm sometimes and would ask me to do design work. Even the HR would behave very badly. So one fine day I wrote a letter and submitted my resignation. I decided to pursue my interest in writing seriously thereafter.

Can you tell us more about the interest in writing that you’re pursuing?

I have had an interest in writing since my childhood. I used to write short stories and other such things, but you know the society we live in, we are looked down upon if we don’t pursue science, so I was pushed into taking science and eventually pursued engineering. During my engineering days, I wrote quite a lot of papers and got them published. I also have an interest in public speaking and have won a number of debates, speech competitions and other such things. But due to the pressure from societal conventions, I ended up in a male dominated industry. After all the struggle, I decided to quit and follow my passion in the field of writing.

I intend to make a career in writing and I am focusing on perfecting my skills currently. To be more specific, I don't want to be a content writer, but I am mostly interested in creative writing. I want to write books, mostly fiction and incorporate more creativity in what I do.

Are you also continuing to do anything else for your personal income at the moment?

Right now I am not doing anything else for my personal income. When I was working, I used to save as much as I could because I knew one day I would get back into the field of writing. But I never thought it would be so soon. Though I am not earning now, one fine day I hope to be a well-known writer.

What is your daily routine like?

When I was working, I used to stay alone. Now that I am married, my routine is quite different. My husband does all the household work, so I don’t have too much to worry about. In the morning I wake up around 5 am. After that, I do yoga as it helps keep my mind calm. Actually, I lost my parents, so I was in severe depression after that. It took me a very long time to recover from that. Now I continue practicing yoga because if I don't then I feel I will go back into depression and that’s something I definitely don’t want. By the time I am done with yoga and meditation, it is around 6 am. Since I love driving, my husband and I go for a short drive and once we come back, we cook breakfast together. Around 9 am he leaves for work. That’s when I take some time out to write and also do some work on SHEROES. I have also started writing a novel. Apart from this, I also read books and articles as I love reading. In the evening when my husband comes back, we go for a drive again or for coffee and then we come back home and make dinner.

Business Details

If you were to create this future career as an author, do you think you'd get support from your family?

I am sure that my husband will support me because he was the one who encouraged me to get back to writing. We even postponed our honeymoon, because my book was getting published. My husband is very supportive, but his family is not that supportive as they are a bit conservative. That’s the reason why we decided to live by ourselves. Moreover, all my relatives are in Andaman and I’m not very close to them because if I say something then they start imposing more restrictions. They will say things like “Why do you want to pursue writing as a career? Who will read your books?”. I don't want to be put in a position to answer such questions.

What are some of the pain points that you have been facing while setting up your career as an author?

Marketing is a very big issue. I faced a lot of issues in terms of marketing even for the previous book that I published. I had put my book on a leading self-publishing e-book platform but marketing through that didn’t work out too well. For this reason I am trying to build a reader base on social media platforms such as Twitter and Instagram right now, so that when I publish my next book it won’t be as challenging for me to market. Also, in India we don't have many reader’s circles like the ones in other countries. Through Twitter I learned that in other countries most authors have their own reader’s circle and they offer their books for free to people who are a part of it and this is how they go about marketing. I am trying to take inspiration from their ideas, so that I can do something similar myself.

When I was trying to publish my previous book, there were no proper set of instructions available on the self-publishing platform that I could make use of as an author. So I had to go through many videos on YouTube and learn how to do all these things and only then was I able to publish. Considering that it was an offering from one of the big tech giants, I definitely felt they should improve their offering. They only have count down deals or free book promotions. Even the free book promotion is valid only for five days and that's not enough for anyone to create a community. The SHEROES community helped me a lot while I was publishing the book.

Are there any other platforms where you market yourself or the books that you're writing?

I recently read about the Pencil app and I felt that the app is much better than the previous one I was using. It is also a self publishing platform where our books are automatically made available across Flipkart, Amazon and many other websites once we publish. Moreover, the royalties are much higher than on the previous platform that I was using. What I had experienced on other platforms in the past is that only if people are buying my book, I get royalty, also they give more preference to established authors is what I felt.

How are you planning to market and organize your content in the digital media space?

To start things off I am building a WordPress website so that I can share my stories for free. I also intend to have a section for the books I read, review those books, market books that are available for buying, etc. So that way I can put all these things out in one place. Another thing that I do on Instagram and Twitter is that I write one or two lines about my story with a picture and then below that I say “if you want to read more, you can go and buy the book on Amazon”. So some sort of marketing in this manner. I am aware of the basic requirements that I need to have in place to grow my online presence. And though I don't have a MA degree in literature, I am confident about my writing skills.

Household finances

Do you have a monthly household budget?

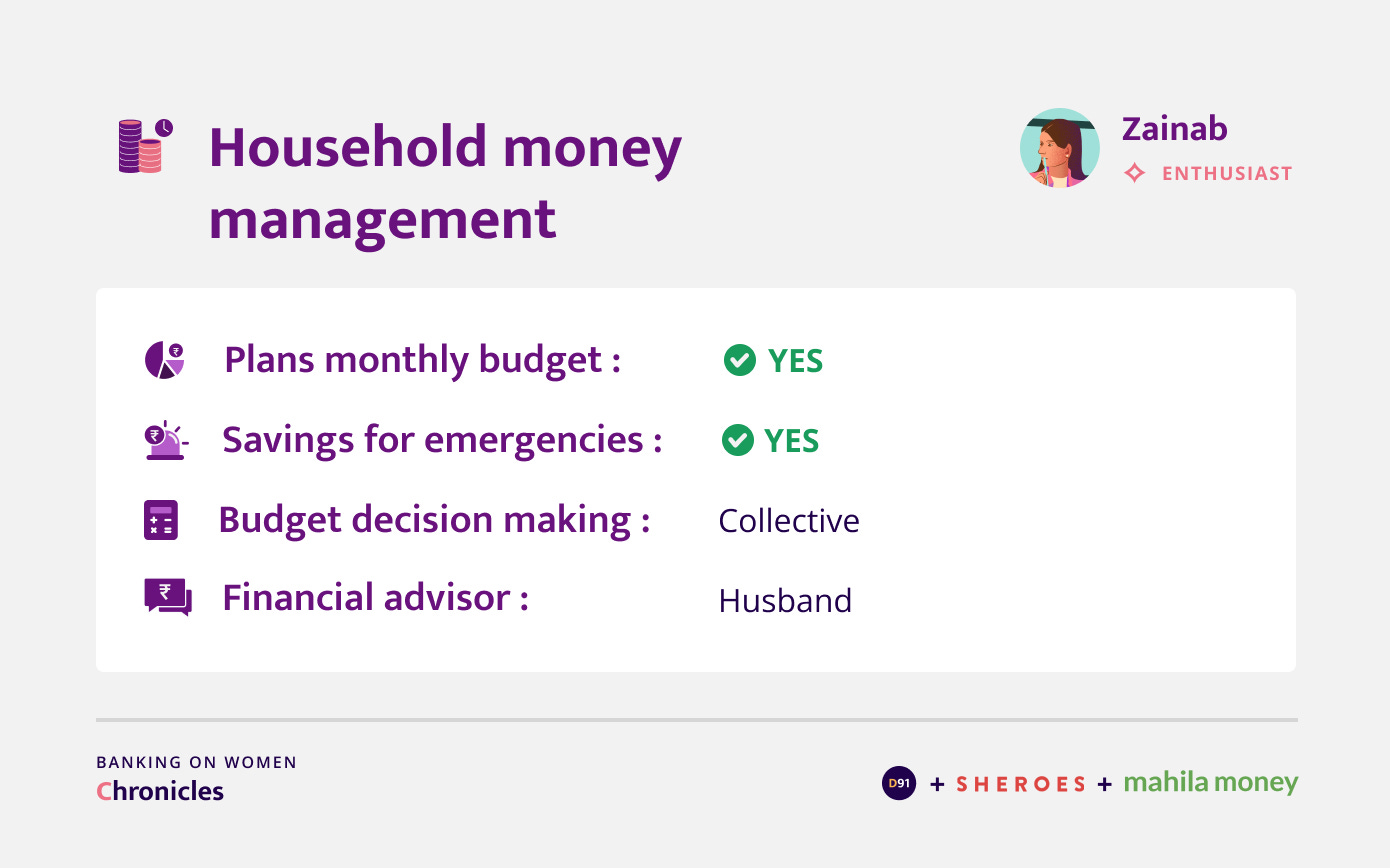

Yes, we do have a monthly household budget. Right now we are staying in a rented house so it is necessary for us to maintain a budget since we plan to buy a home of our own in the future and we have to save now. Though I really like buying clothes, now I have limited such expenses because I have understood the importance of saving.

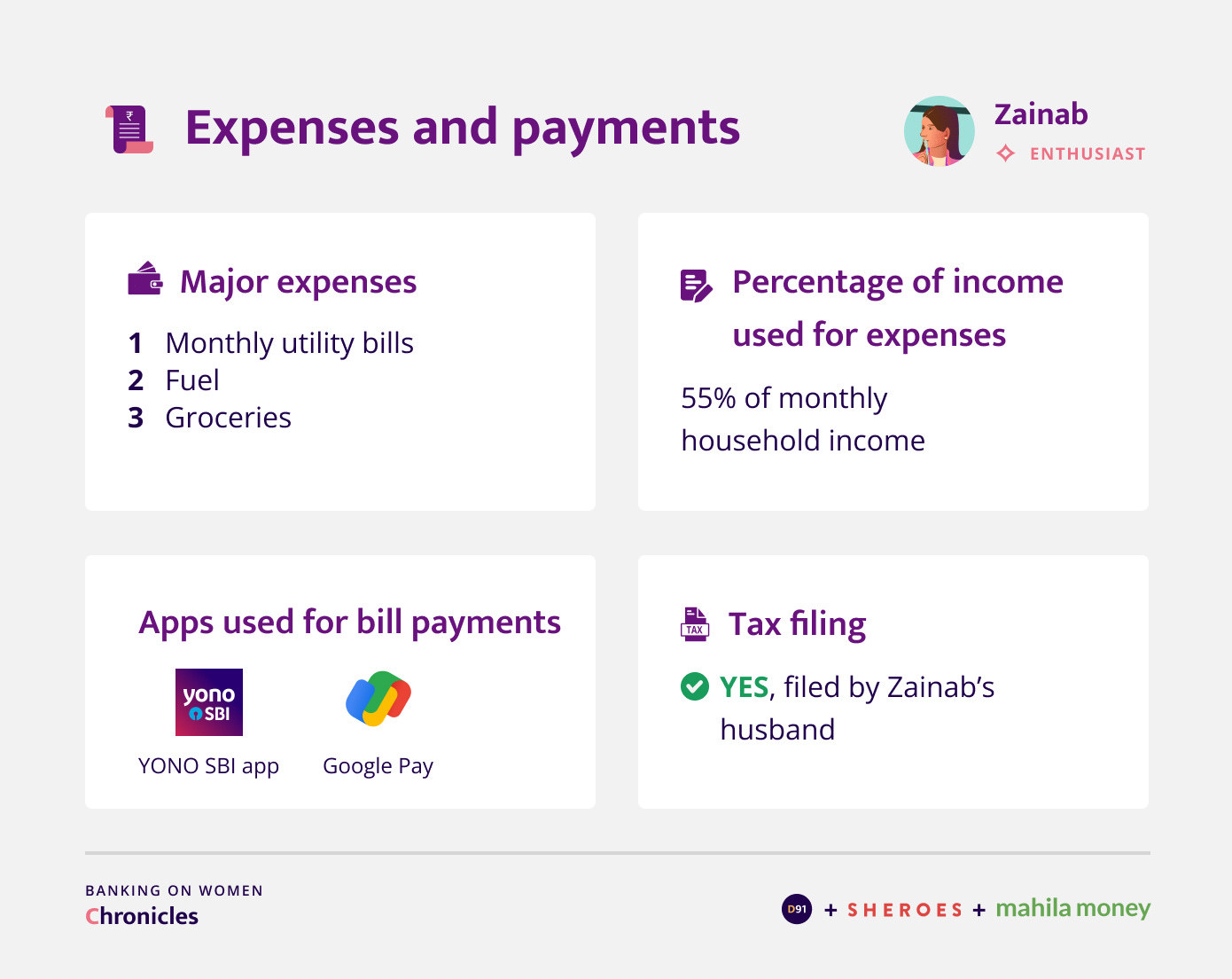

How is the family budget decided?

We both sit together and decide what are the things we are going to spend on in a particular month. First we keep aside part of the income for rent. Next we take care of all the bills, mainly electricity bill, water bill and general maintenance. Once we minus these things from the income, we keep some amount for groceries from whatever amount is left. We then take a call on things like travel and decide on a budget so that we can plan our other expenses around it. Also, now diesel and petrol costs are too high, so we have to keep money aside for fuel as well. We try to save a portion of it and the remaining is for personal needs or if we are going outside for coffee, dinner or other such things.

Do you save money for yourself?

Yes, I do that often for self-care purposes. I keep some money aside at the beginning of the month for myself in case I want to purchase something or if I want to visit a spa.

Did covid-19 bring any changes to your expenditure?

Of course it did. Back when I was working, I did not have any kind of responsibilities, so I did not practice saving money. Whatever I earned, I spent. However, I used to keep aside a sum of money because I knew that in the future I want to get into writing and will need that money while making the transition. After that, whatever I was left with went towards rent since I was staying alone and the rent was quite high there. The rest I spent on shopping.

Expenses and Payments

Do you remember the first time you used any payment app? Can you tell us more about that experience?

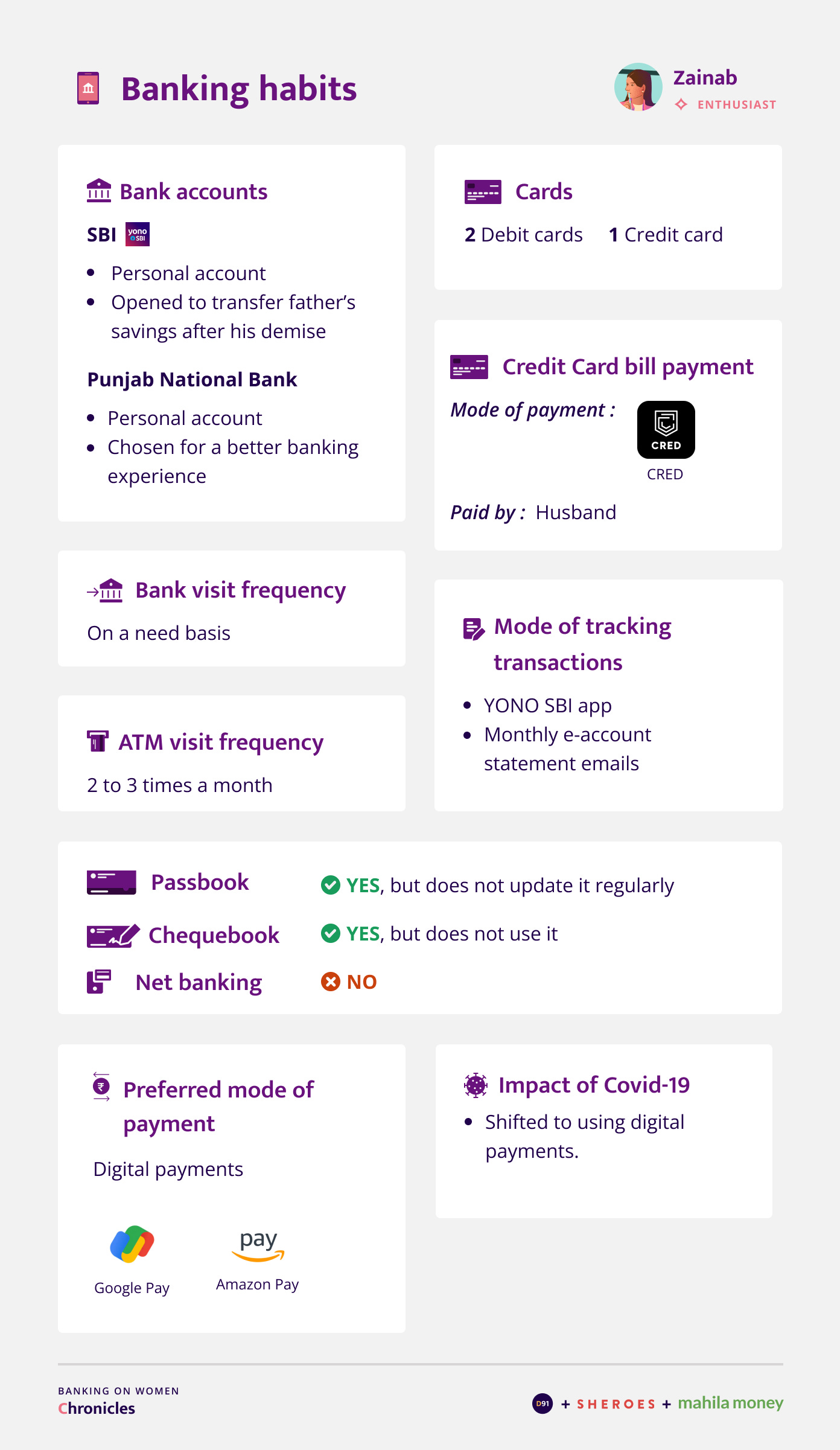

I started using Google Pay during the pandemic. Before that, I only used my debit card or I went to an ATM to withdraw cash if needed. Most of the time it was cash withdrawal because I used to prefer the Cash on Delivery (COD) option to pay for orders from Swiggy, Amazon, Myntra, etc.

However, post pandemic I have totally shifted to digital payments. The first payment app I used was Google Pay, followed by YONO Lite and YONO SBI apps. The apps were pretty intuitive so I was able to set it up myself.

We have not faced any issues with Google Pay and other payment apps, but I remember when I was staying alone, the house owner was a bit old, so she would often call me and ask about Google Pay, because she wasn't able to use it and faced a lot of difficulties I remember. So these apps are not very friendly especially for older people. They are not able to use them comfortably. Sometimes I used to get irritated because she would not allow me to do any work and would call me constantly asking me to help. Even if you teach them once they do not understand and we have to repeat these things time and again. Even though I stay in a different place now, she still calls me for assistance.

Banking Habits

Have you considered opening a fixed deposit(FD) through apps and online platforms which have this option?

Yes, I was actually reading about this, but because of my experiences in the past, I feel they are unreliable sometimes. I am skeptical about where my money would go if I did it online, so I prefer visiting the bank for things such as opening an FD. So that even if something goes wrong, I can go and ask them where my money is and get an understanding of what exactly happened.

Has Covid-19 impacted your transactions with banks?

Before the pandemic, I used to visit the bank to resolve any problems that arise, but now I prefer not to visit the bank. Even if I face any problem, I try to solve it on my own by Googling it or I call my branch and ask them how to resolve the issue that I am facing. If they ask me to come to the bank, I make excuses because we are living in fear all the time these days that we might catch the virus. Since my husband and I are living alone, we don’t have any external help, so that's a big drawback and all the more reason to stay safe. For that reason I don't like to visit public places where a lot of people are present. In this manner it has impacted us a lot because before I was comfortable and I used to step out quite often, but now things have changed.

Financial products and services

Investments

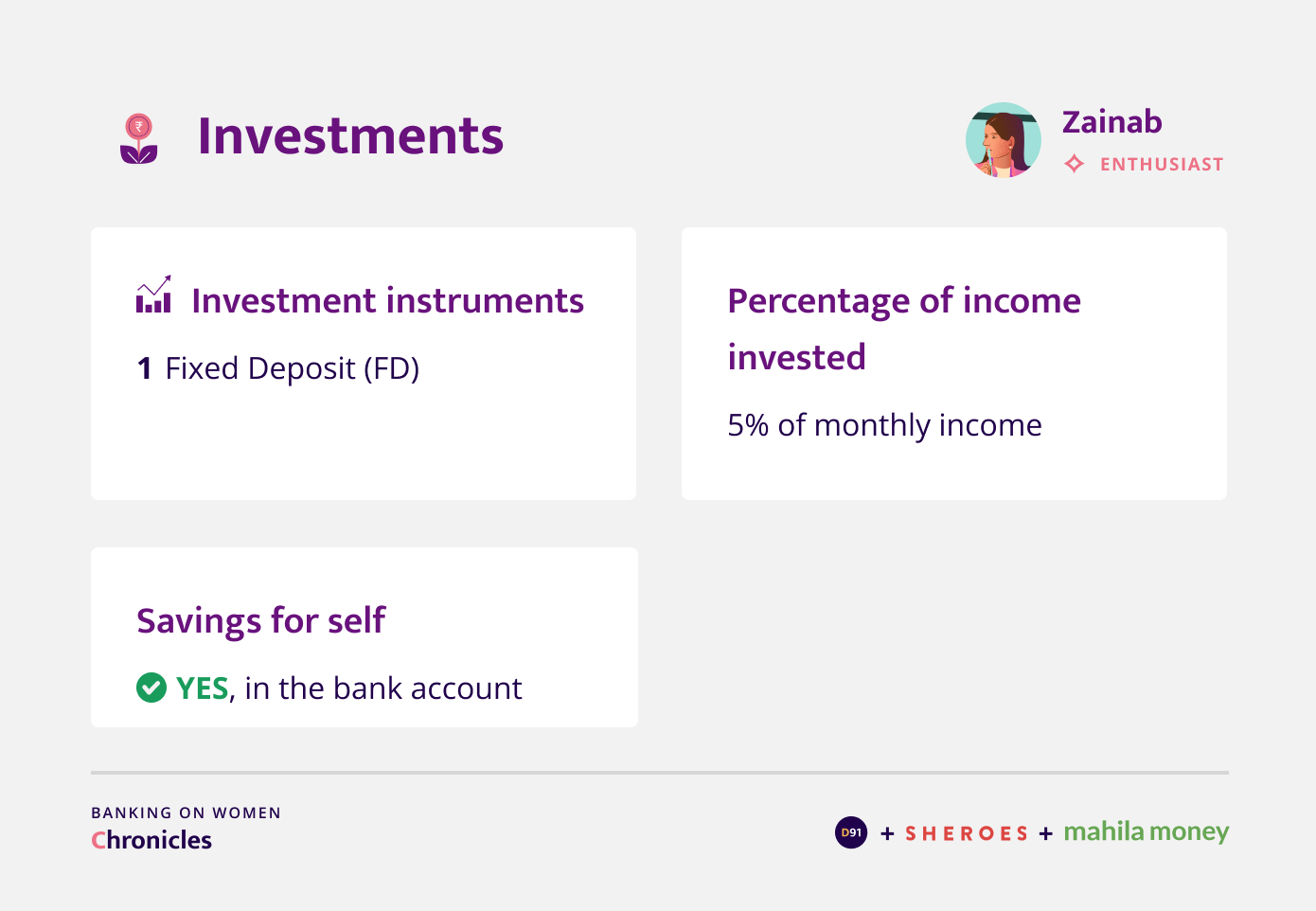

Do you invest in any other instruments apart from the FD that you mentioned?

No, I don't invest anywhere else. I haven't thought about investments yet, but maybe in the future I will invest.

What percentage of money do you typically save?

5% of the total monthly income is what we save. The savings are in the form of money in a bank account since it's only been three months since we got married and we haven't thought about what instruments to invest in yet.

Who would you turn to for investment advice or how would you go about investments if you were to?

To begin with I would do my own research on Google and then I would visit the bank for advice. In my family there is no one who can guide me in these matters, so I prefer to go to the bank and enquire about how such things work. According to me we should not blindly make an investment in whichever bank we visit, it is essential to do our own research and only if the recommendation seems reliable, we should go ahead and invest.

When you think about starting to invest, do you have any specific goals in mind?

Yes, medical emergencies. In the future, if anything goes wrong and we have to go through rough times, then there should be something we can fall back on. I don’t want to be in a situation where I have to go to someone else and ask for money.

Moreover, the money which I kept aside when I was earning is for emergency use. I am not touching that money. I believe that in case an emergency arises, we should be in a stable position to fight that.

Is the FD that you mentioned earlier linked to this money that you've kept aside?

No, the emergency fund is completely different. I have kept that aside to navigate the transition to writing. The FD is something I started very recently, so that in the future when we decide to buy a house, then the savings from this FD will be there.

Loans

Have you ever checked your credit score? Do you frequently check your credit score?

No, I haven't checked my credit score. Actually my husband had taken an educational loan when he was studying. He was able to finish repaying that loan only recently just before our marriage because the interest rate was quite high. So I used to check the credit score from his account. I haven't taken any loans yet.

Have you considered using digital apps to borrow money?

Yes, I have. In fact, recently when we visited Big Bazaar, a young man told us about an app we could try out to borrow money. I don't remember the name of the app, but when we came home and tried to set it up, it consistently displayed an error in the app even after entering all the details. We were not able to proceed to the next steps, so we deleted the app.

What is the maximum amount you would be comfortable borrowing from a fintech company?

Even if it is for an emergency, I would not be comfortable borrowing more than INR 25,000. I would consider digital platforms only for such small amounts. For larger amounts of money, I feel it is better to approach a physically present financial institution and talk to someone and receive help from them.

Insurance

Do you have any health or life insurance?

No, we don’t have one right now, but we are planning to get one maybe in a month or two.

What are the various factors you would consider while buying the insurance?

First we will consider the premium we have to pay and the coverage amount. That is the main thing because in some cases we keep paying but there is nothing in terms of a benefit for us and we can’t do anything about it when we are trying to claim. Moreover, the coverage amount offered is very less sometimes. I would not want to be associated with such insurance schemes. I believe that for security purposes, the end amount we can claim should at least be double the investment we are making.

Outlook towards the future

In your opinion what is the one financial product that will have the most impact in supporting your financial journey?

I’d say something like what a credit card does would be helpful. To elaborate, some kind of product that allows us to borrow money when we need it urgently and repay it on a monthly basis as and when we have money in our hands. It need not be much, it can be even for sums below INR 10,000. I would have used such an app instead of a credit card.

In your opinion what is the one service that financial institutions and fintech companies can provide that will have the most significant positive impact on your financial journey?

One issue I have faced several times is that payments get stuck. If this happens when it’s the end of the month and we have very little left in our account then it can be a cause of serious concern. For instance, say we try to make a payment for a Swiggy or Amazon order or for FASTag while traveling and the amount gets debited from our account, but the payment does not get credited in the receivers account. In that case, we have lost our money despite the payment being unsuccessful. Moreover, we might not be in a position to make the payment again due to low balance after the deduction, especially when it’s the end of the month.

When we contact customer care, they say that it will take five to six working days to resolve the issue and it is really difficult to wait because our money gets tied up and we are not able to use it. Sometimes we have to chase them and make multiple calls to get the issue resolved. This is the worst thing I have faced in terms of digital payments and I have also written an article about this. So I hope to see a service that can provide quicker resolutions when such a situation arises, otherwise it is very difficult for people.

Our understanding of Zainab’s journey

Our conversation with Zainab highlighted how she is fueled by passion. Despite the various obstacles that she has encountered, be it professionally, personally, or financially, Zainab continues to persevere. Her remarkable ability to draw from her own experiences and rely on her innate intelligence has helped her take complete charge of her life as she sets out to achieve her dreams.

About the Research

This blog is a result of an online interview conducted with the participants’ consent. The interview was conducted in English. This is a part of the Banking on Women chronicles.

Disclaimer: The name and other sensitive personal details in this documentation are masked to honour the privacy of the participant.

Project Partners

SHEROES

The SHEROES Network is a content and community ecosystem enabling access to employment, entrepreneurship, and capital for women. It includes the SHEROES app, SHOPonSHEROES marketplace, Babygogo, Naaree, MARSbySHEROES and has a user base of over 24 million women. The SHEROES Network is committed to increasing women’s contributions to GDP.

Sheroes.com | SHEROES App | Twitter | LinkedIn | Instagram | Facebook

Mahila Money

Mahila Money is a full-stack financial products and services platform for women in India. Mahila Money specializes in offering loans to women who want to set up or grow their own business along with resources and community to achieve their financial goals. Mahila Money can be accessed via the Mahila Money app on Android.

Twitter | LinkedIn | Instagram | Facebook | Website | Play Store App

All artworks are designed by Poorvi Mittal.

If you enjoyed reading this blog and would like to receive more such articles from D91 Labs, please subscribe to our newsletter here.

To read more about our work, visit our website