Women’s choice between savings and investments to gain financial freedom

The third blog of the insights from the “Banking on Women” series covers our respondents’ views on savings, investments and emergency funds

Our previous blog will help you get more context on the socio-economic status of our respondents. Read the Banking on Women series for a deeper understanding of all the 20 personas.

The difference between Saving and Investment:

Savings and investments are two sides of the coin1, the difference being the risk attached to investments. In the past blogs, we have covered how women are risk averse and it is pretty evident even when they make investment choices. While almost all of the women we interviewed expressed the intent to set money aside systematically, only a handful of them actively invest with the intention of growth.

“Sometimes, it becomes very overwhelming when I do not understand how a particular instrument works. I rely on friends and others in my circle who are aware of these things to educate me because I do not want to lose my hard-earned money by making wrong investment decisions.”

-Tara, 40 year old Human Resources Professional based out of Bangalore

Many global studies show that women are often motivated by goal-based savings favouring their family’s well-being2. Most of the women we interviewed believe in saving money in some form or the other as a key to their financial freedom as well as their family’s well-being.

According to a survey conducted in 2020 by Scripbox, a digital wealth management company, 22% of the women respondents chose mutual funds as their preferred investment instrument, followed by shares and gold3.

Saving for a Rainy day:

The Scripbox survey says, after the pandemic, 54% of the respondents - both men and women expressed an inclination to save or invest in an emergency fund. Even our respondents resonate with that - 18 out of the 20 women, have kept aside money in some form or another for emergencies or adverse events.

“Yes, I do keep aside a fixed amount for emergencies. First I take care of my fixed investments such as RD, FD, PPF, etc and after that, whatever is left, I keep aside for savings as an emergency fund.”

-Rachana, 39 year old aspiring financial planner from Nashik

In most households, the usual savings and investments double up as the emergency fund for future mishaps or unexpected expenses. Despite their intent, only 25% of the women we interviewed have a dedicated bank account or cash reserve set aside for any uncertainties or emergencies that might arise in the future.

“Yes I do save money but it's a secret because the moment someone knows that it exists, they will have needs. I often tell one person in my family who will possibly add value to it”

- Susan, 37 year old working on short-term contracts in rural Karnataka

What does saving for a rainy day mean?

As we can observe, most women might not have financial goals around pensions or savings accounts, but they are investing to ensure a bright future for their family.

Saving for self

The thought of saving money for themselves is seen as a selfish act of indulgence among most women. Most of the respondents save for the family, and the children or invest the money back into their business.

No, I am not so self-centered. I do have savings in the form of a few LIC policies that I pay quarterly or half yearly”

- Susan, 37 year old working on short term contracts in rural Karnataka

No, I don’t save only for myself. I do save for my family though. For instance, next month is Diwali so even if I don’t purchase something for myself, I will buy something for my family.

- Priya, 38 year old fashion designer from Kolkata

When asked if they save for themselves, the married women with children said that they don't, while 2 out of the 3 unmarried younger women said that they set aside a personal care budget that involves shopping for clothes or visiting a spa.

“Yes, I do. Every month once I get a salary from my company, I keep aside a portion of it as a salary to myself.

- Bhavana, 33 year old Mandala artist from Kolkata

When it comes to investments, around 45% of the women responded that they invest in Mutual funds either by themselves or as a household, more than 50% of them invest in either Fixed or Recurring deposits or Post Office savings and 20% claim to invest regularly in gold. The findings from a survey that Zest money conducted among their customers confirm that most women prefer to invest in Gold and Fixed deposits as they are considered less risky4. But when it comes to gold, women prefer to invest in jewellery rather than bonds or biscuits.

“The pleasure is when you put on the gold”

- Susan, 37 year old working on short-term contracts in rural Karnataka

Apart from being an ornament, gold jewellery is considered a married woman’s security5 helping them use the jewellery as collateral to secure loans in their time of need, be it personal or for the household.

Impact of children on investment patterns:

“I started investing about 10-12 years ago primarily for my children.”

-Preksha, 47 year old counselor from Kolkata

When it comes to women with children, saving for the future becomes synonymous with saving for their family and children’s education or marriage. Even the Scripbox survey noted a difference in priority between men and women when it comes to emergency funds. A majority of men - 47% prioritized investing for retirement while a majority of women (55%) save for their children’s education.

“Initially, most of my investments were for my children, but now they're old enough and don't need it. Since that money had accumulated, my brother suggested that I invest it.”

-Ritika, 46 year old small business owner from Kolkata

Especially for female children, Indian mothers take up the onus to save for their future in terms of education and marriage6.

Only after the birth of my daughter, when things had settled down at home, we started investing

- Pavitra, 39 year old reseller from Indore

We started saving once my first daughter was born, so it has been about 9 years since we started.

- Farah, 31 year old cloud kitchen owner based out of Bangalore

An SBI account was opened when my daughter was born, probably 2011.

- Raksha, 39 year old pursuing her B.A from Ahmedabad

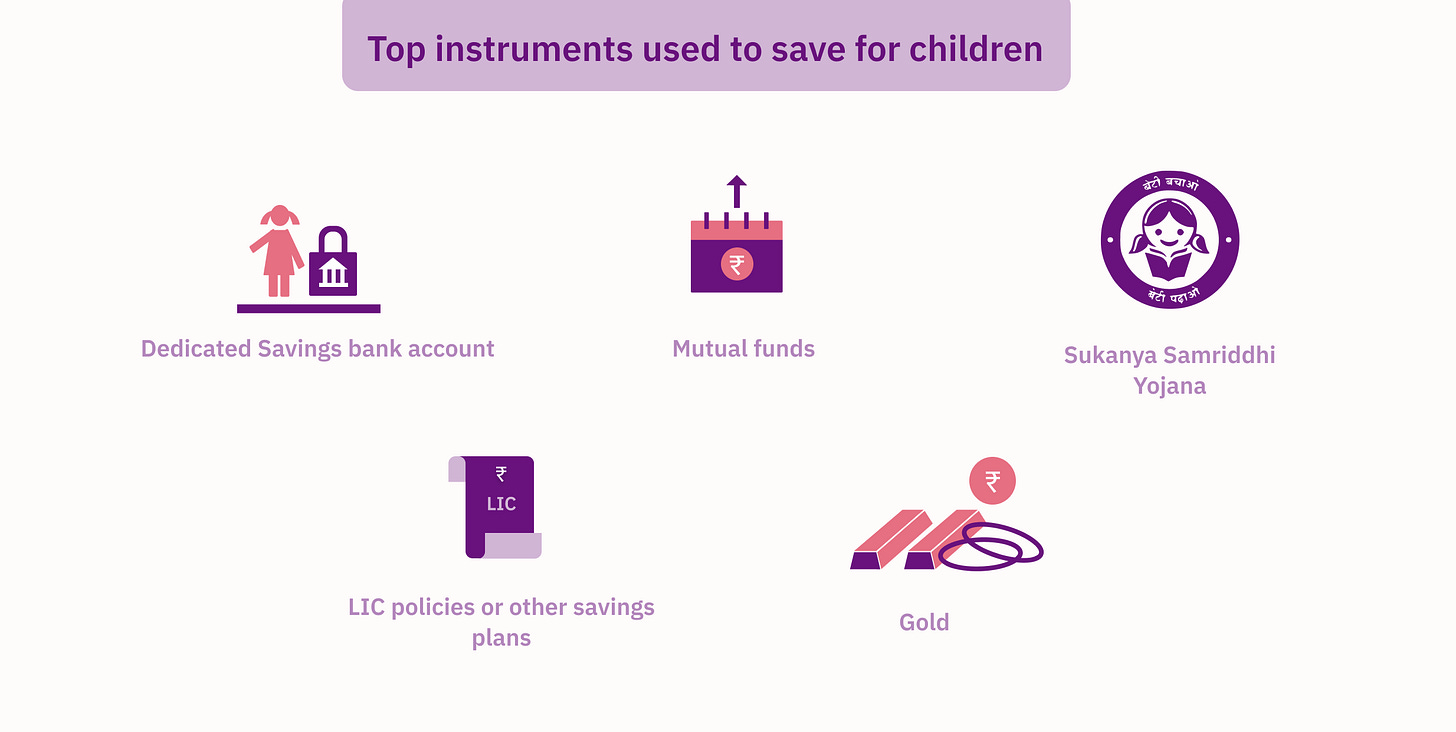

The survey by Zest money also found out that women not only prefer low-risk but also invest in long-term goals such as buying a house or securing their children’s future. More than 35% of the women said they actively invest in their children’s future either on by opening a savings account, investing in mutual funds or government-backed small savings schemes that are aimed at securing the future of the girl child.

I started investing about 10-12 years ago primarily for my children. The first one was an RD for my elder daughter in her minor account.

-Preksha, 47 year old counselor from Kolkata

Risk preference vs Risk capacity

Almost all of the respondent’s households arrive at a collective consensus over the monthly budgets, investments and other expenses. Their urge to take the risk might not be entertained by the rest of the household, and in such scenarios, it is difficult to assess her risk capacity and tolerance. Most of the women said their income goes into the household pool and is used to fulfil the family’s expenses, only 3 of them have autonomy over their personal income and invest it back into their business.

Is age just a number for women to make financial decisions?

When it comes to investment and risk-taking abilities, the age of the women plays an important role when making

“I have investments in SIP. Apart from that, we tend to buy gold during Diwali so that's one part of the investment. I am not a very big fan of gold though. Also, my father invests in Fixed Deposits(FD) and Recurring deposits(RD) since he believes in them more than mutual funds.”

- Bhavana, 33 year old Mandala artist from Kolkata

Financial Decision-making

“There are certain things which we have decided that I will handle and there are certain things my husband handles. If you compare his income to mine, his is greater, so he handles a major chunk.”

-Tara, 40 year old Human Resources Professional based out of Bangalore

When it comes to the well-being of her family, women tend to pull out all the stops. This would require her to anticipate adverse events and save up for the same. Indian women’s estimated income is only 1/5th of men’s, ranking India at 140 among 156 countries on the World Economic Forum’s Global Gender Gap Report, 20217. This implies that women - almost half of our country’s population, make significantly less for the same earning years as men.

“Household expenses are independently taken care of by me. Investments are taken care of by my husband. Even though I am aware of the kind of instruments he is putting money in, the execution and payment are handled by him.”

-Preksha, 47 year old counselor from Kolkata

In our research, 90% of the women who live with family or spouse, said that they pool in all their income and budget the financial decisions of the household collectively. This means that they have autonomy on the day-to-day spending decisions but not the investments or insurance premiums. This data along with the gender gap report suggests that almost all of the money the women make would be depleted on household spending leaving little for saving or investments. Having no money to exercise her financial independence, thus excludes her further from making bigger financial decisions for the household. This chain reaction of lack of opportunity and low-risk capacity tugs at women’s agencies to make informed financial decisions. Thereby men become the defacto financial decision-makers in a household while women handle the household finances.

“Even between my brother and me, there was a difference. For men, my brother in this case, even if something goes wrong he has something to fall back on like a “comfort cushion”. But that was not the case for me. So I independently sought out and gained financial and investment knowledge.”

-Rachana, 39 year old aspiring financial planner from Nashik

Contrary to the belief that women save a lot, the money power survey 2022 by Lxme indicates that more than 73% of women save less than 20% of their income8. Among the households we interviewed, the percentages of savings vary based on their capacity and saving patterns. Only 5 women said they invest around 30 - 50% of their income. Despite their intent, more than 8 women said their plans for investing money get sidelined by other financial goals.

With little money to invest, women automatically get excluded from the formal investment decisions of the household. Therefore they resort to informal saving methods to ensure the financial well-being of their families, especially their children.

Women are excluded from investment decisions in households where they either voluntarily choose to give up financial independence to maintain peace in the household or when they lack financial literacy and knowledge of available instruments. While the first reason can only be addressed through cultural intervention, the latter can be resolved by introducing gender-sensitive financial education, targeted marketing campaigns and avoiding gender-neutral approaches when designing interfaces.

Designing better investment products for women

In this section, we will discuss some of the guidelines that could help in designing the interfaces of saving and investment platforms that aim to grow their female customer base. In order to achieve financial inclusion in the investments segment, the focus must be on helping every woman gain confidence in the instrument, in terms of both trusting the platform as well as ease of use. We will cover the steps to achieve that in the following sections, covering the guidelines to follow at each stage of the user journey funnel: Awareness, Consideration, Adoption and Retention.

Some of the design suggestions that were shared in the earlier blogs for banking and lending still hold true in terms of earning women’s trust, and making the designs inclusive and they can be accessed here and here.

Awareness:

Many women are aware of the traditional instruments for investment and their limitations. Some are also aware of the new-age methods and app-based technologies that enable people to make smart investments but work needs to be done in the area to make them more approachable.

Leveraging social proof and employing community leaders to create an assisted onboarding model could help in gaining traction among digitally non-native cohorts.

We have covered more on the importance of community leaders to help in building awareness in the earlier blogs - Banking & Lending

Consideration:

For women to consider investing in a platform, it needs to be convenient and trustable. While the simplified KYC and onboarding process certainly helps with convenience, trust can be earned by leveraging familiarity and relatable user flow.

“At present, investments are something I am very allergic to and scared of. It would be extremely beneficial if the modes of investment are presented in a simple manner and made accessible so that I can break out of this mindset and become open to trying out newer instruments.”

-Preksha, 47 year old counselor from Kolkata

Taking from the learnings and building on it:

Understanding why most women trust traditional platforms can form the foundation for new products to stem from. On the other hand, we need to eliminate possible pitfalls that women face with these traditional instruments. For example, traditional investment products require women to visit banks and financial institutions in person and fill out long forms in order to start using their services. To avoid this hassle, women prefer to save money instead, as cash at home or in their bank accounts.

FD is one instrument we haven’t invested in yet because my husband has given me the responsibility of going to the bank to open an FD account. I haven’t done that yet because you know how tedious bank paperwork can be and how much they make us run around, that’s why we have been putting that off for long.

-Pavitra, 39 year old reseller from Indore

In a world where technology has made its way into our homes through smartphones and applications, it is counterintuitive for a user to travel to an institution that’s miles away from home in order to deposit smaller amounts of cash. Adding last-mile points for women across tiers both physically and digitally could help bring more women into the investments ecosystem.

Mobility and privacy:

One of the major issues in seeking the active participation of women in investment decisions is access. In most cultures, women tend to be in charge of the household and their mobility outside still remains an issue. Many fintech products try to solve this issue by assuming that women have access to a personal mobile phone or privacy to their funds.

Women have a collective mindset. Cash is accumulated into one pot for the family, and while a woman may stash some personal money aside, it is likely a small sum. This family pot in the home may be managed by a matriarch, but going to the bank is likely the role of her husband or son. The way digital accounts are set up assume that individuals in a family hold their own portion of money, and have the mobility to access services.

- IDEO, women and money

It is not just her funds but even her mobile phone, if she owns one, that is shared by the household. Therefore it becomes crucial for platforms that aim to attract this cohort, to move out of the screens and create a hybrid model. Various SHGs and women-run unions have proven effective in collaborative and assisted training modules among women from villages and smaller communities. Leveraging the learnings from such models and applying them to a technologically enabled hybrid saving platform can provide the required trust and convenience among this cohort.

Adoption

Evidence from our conversations, states that most mothers tend to rely on a long-term goal-based saving scheme that helps their children. Therefore, products that help them along the way as they save for the long term and avoid pitfalls like unexpected situations that demand them to break their investments, could be designed.

Tailor-made solutions:

For women to commit to a service it needs to resonate with their goals and aspirations. Gender-neutral options might work when it comes to accessibility to basic financial services like banking but, when moving to advance usages like goal-based saving, longer-term investments and other such products, tailor-made solutions work better as they resonate with the cohort.

Gender Intentional User experience

Many fintech companies assume that men are early adopters of technology and tend to design their interfaces with a gender-neutral approach. To encourage more women to invest time and energy into a product it needs to assure them that their needs are heard. This can only be achieved if the products are intentionally designed from a gender-intelligent lens, not reinforcing stereotypes of gender and other social inequalities.

“It is not something that only men should be handling, every single person despite their gender should be in control of and aware of their finances. I wish that for the future and for my daughter that would change.”

-Preksha, 47 year old counselor from Kolkata

Retention:

While assistive models and field ambassadors drive more female traffic to the platforms, simple and intuitive workflows can further the adoption and help the users inculcate a habit of saving.

The habit of saving vs a habit-forming app:

The problem is that I can't invest regularly because things are very unpredictable lately. If I want to invest in something, I may have to stack up a little bit of money because if I only invest small amounts, then it’s not going to be of significant worth to me.

- Susan, 37 year old working on short term contracts in rural Karnataka

From our conversations, we also learnt that many women don’t have a large sum of cash available to invest all at once and that’s why they choose to either store it as cash reserve at home or in a savings bank account. Therefore, it becomes crucial to draw a line between helping women use the app often - as and when they have surplus money while staying non-intrusive and keeping the entire engagement user-driven.

Investing in education

Technology remains a major hurdle for most women who intend to save better. Apps and communities need to address women’s concerns about cybersecurity and phishing scams to gain their confidence.

“My first investment was an RD when I was in college. I introduced this concept of RD to my husband as well. I also invested in some mutual funds. However, I did not understand these new instruments well and relied on my husband to keep track sometimes. That’s why I stuck to simple and safe options such as RD and FD, though the interest rates are not very good. ”

-Tara, 40 year old Human Resources Professional based out of Bangalore

Community-led training initiatives or in-app assistive training modules nested within the application can help women learn various ways to grow their money, gamify savings ethically or encourage them to save smarter.

“I feel for somebody like me who is hesitant about digital platforms and investments such as mutual funds and stocks, it would be great to have an app which enables me to understand the different ways I can invest to reach my targets. It would also help to receive suggestions that I can rely on and learn where to invest my money without having to think too much.”

-Preksha, 47 year old counselor from Kolkata

Such a module can help women learn the difference between investment, contingency fund and insurance. Cross-selling products when the user sees the transparency of the platform makes it trustworthy and increases retention.

Conclusion:

Our next blog will cover more on how women perceive insurance and the factors that determine the choice between investments and insurance to gain risk resilience for themselves and their families.

Findings based on a survey by Scripbox conducted on ‘Wealth and well-being’, to understand investor behaviour and sentiment amid Covid-19, as well as to create awareness on the importance of saving and investing. https://scripbox.com/blog/indians-and-saving-scripbox-survey-for-world-savings-day/

ZestMoney, India’s largest and fastest-growing Buy Now, Pay Later platform today revealed the findings from a customer survey conducted to understand how women are taking to personal finance and investment decisions. The survey was conducted with a sample of 1900 respondents across key metros and Tier II/III cities in India, the majority of whom were Gen Z and Millennials. https://www.livemint.com/money/personal-finance/gold-and-fixed-deposits-emerge-as-top-investment-options-among-women-survey-11646724518354.html