#5 Ritika | From teaching kids to learning business

Initially, most of my investments were for my children, but now they're old enough and don't need it. Since that money and my Guwahati flat rent had accumulated, my brother suggested that I invest it.

“As I belong to a business family, at the back of my mind, I always wanted to start something of my own. During the pandemic, I had a lot of time on my hands and I began to think of starting something here in Kolkata.”

Short Story

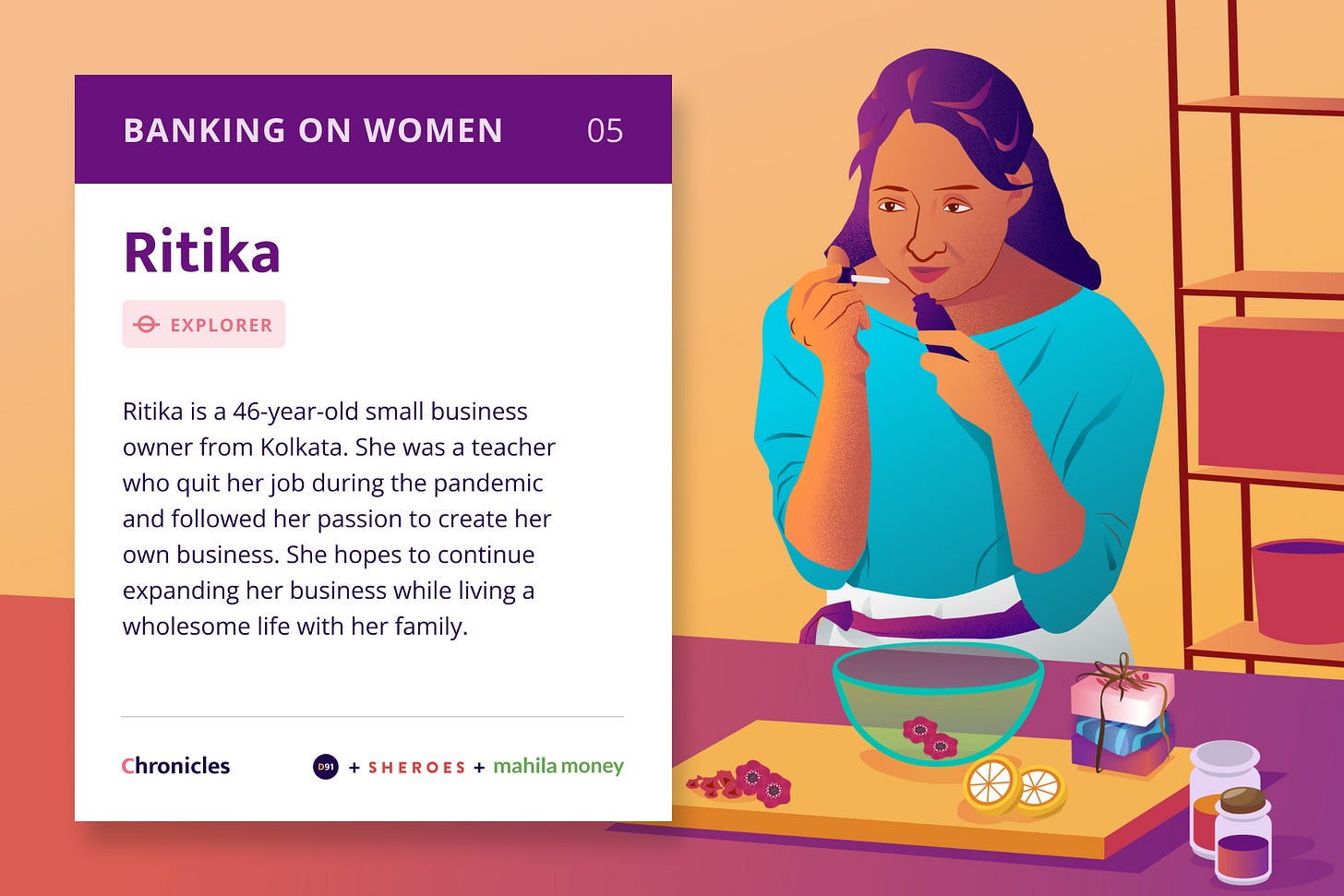

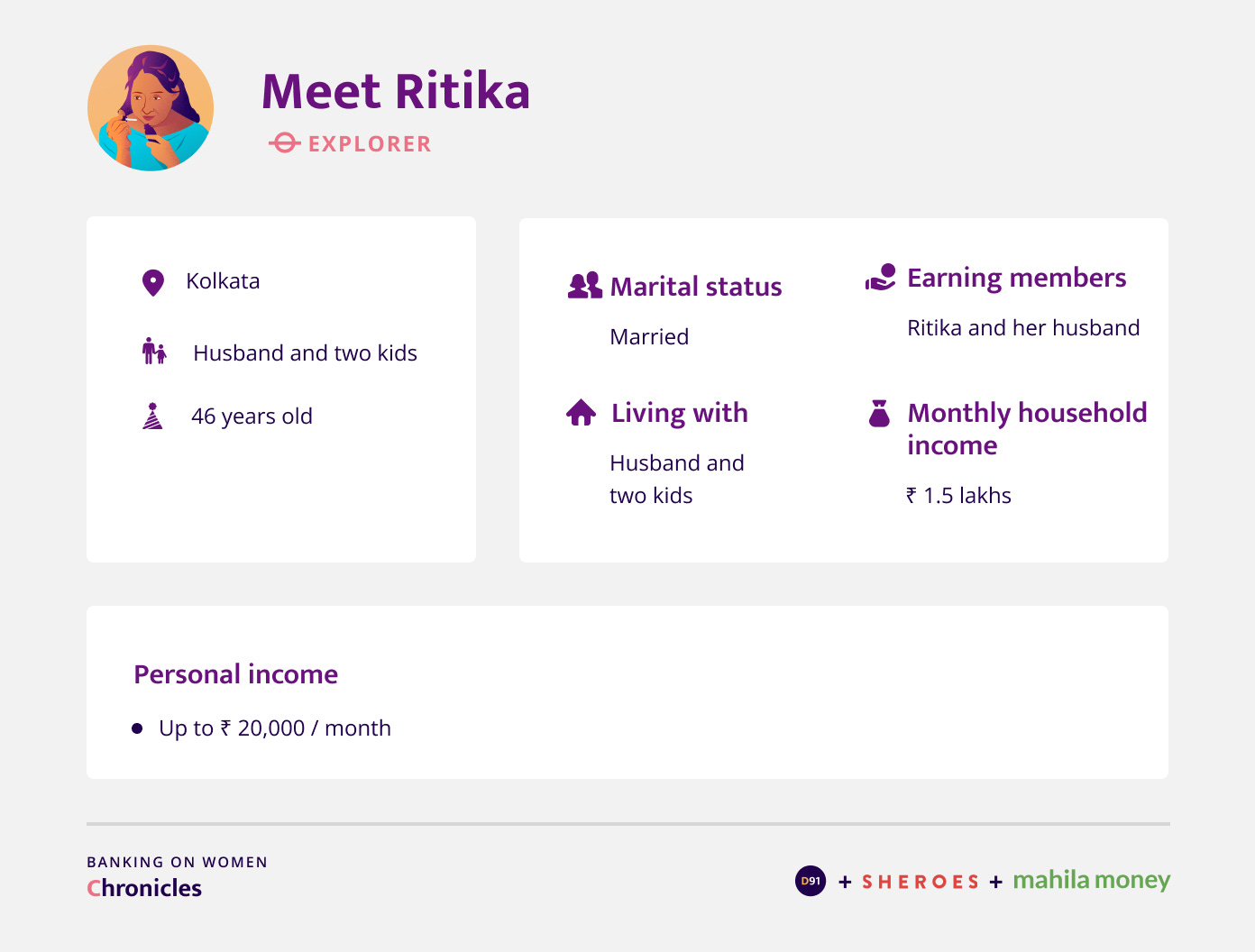

Ritika is a 46-year-old small business owner based out of Kolkata. She was a teacher before she quit her job during the pandemic and set up a handmade organic soap making business. She learned the ins and outs of her business and relied on the right tools and people to make a profitable enterprise. She takes her financial decisions in tandem with her family relying on people she trusts for their advise and expertise. She hopes to scale her business and continue living a wholesome life while following her passion for business that she inherits from her family.

Let’s see what she has to say about it all!

Personal and financial background

What is your daily routine like?

I wake up early in the morning, go for a short walk and then prepare breakfast. I have a few hours to myself before I start preparing lunch. Post lunch to evening I am free to take care of anything I want to. In the evening I go for a walk again before starting preparation for dinner. My kids are all grown up now and I don’t have to look after them very much. In the time I have during the day, I spend it on my business.

Can you tell a bit about your professional journey so far?

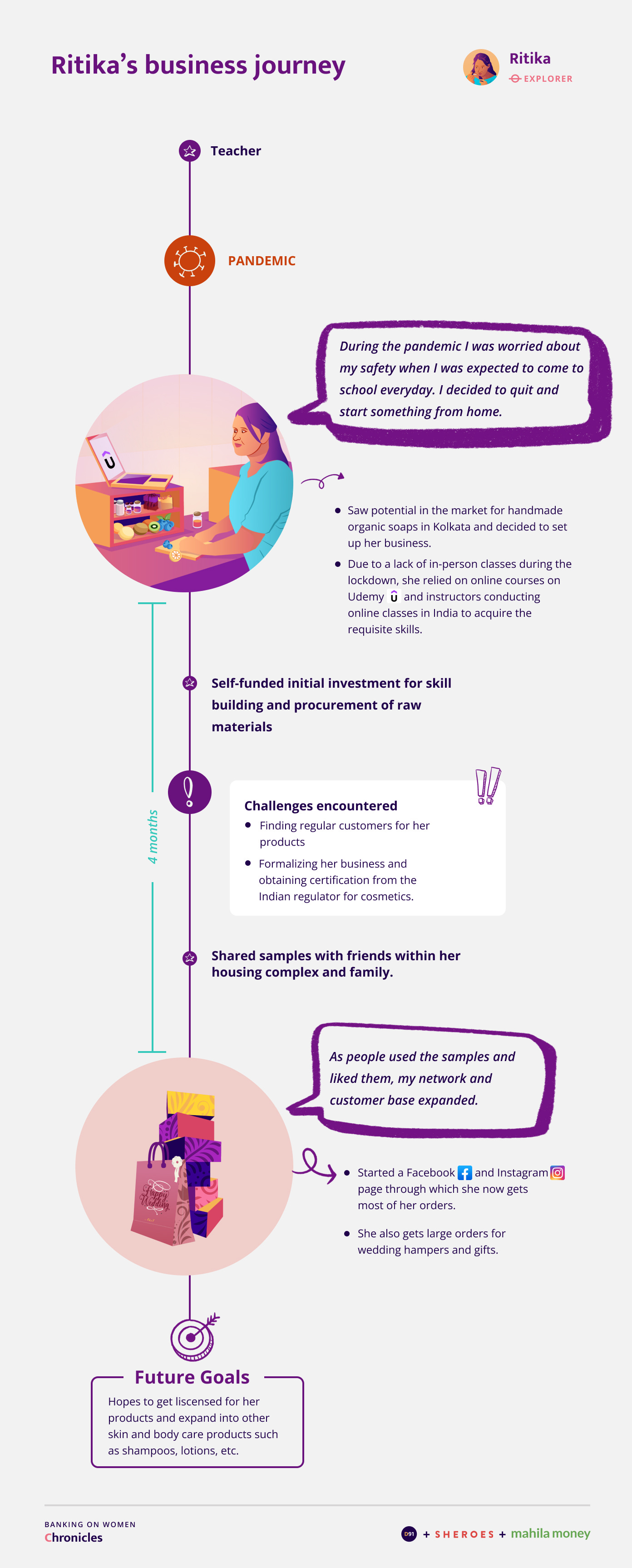

I was a teacher before the pandemic started. I quit that job during the pandemic because the teachers at my school were asked to come to school every day. Since I was worried about coming in contact with someone with Covid-19, I felt it was better to leave and do something from home. I therefore quit and started working on my business idea.

Business Journey

How did you get into this business?

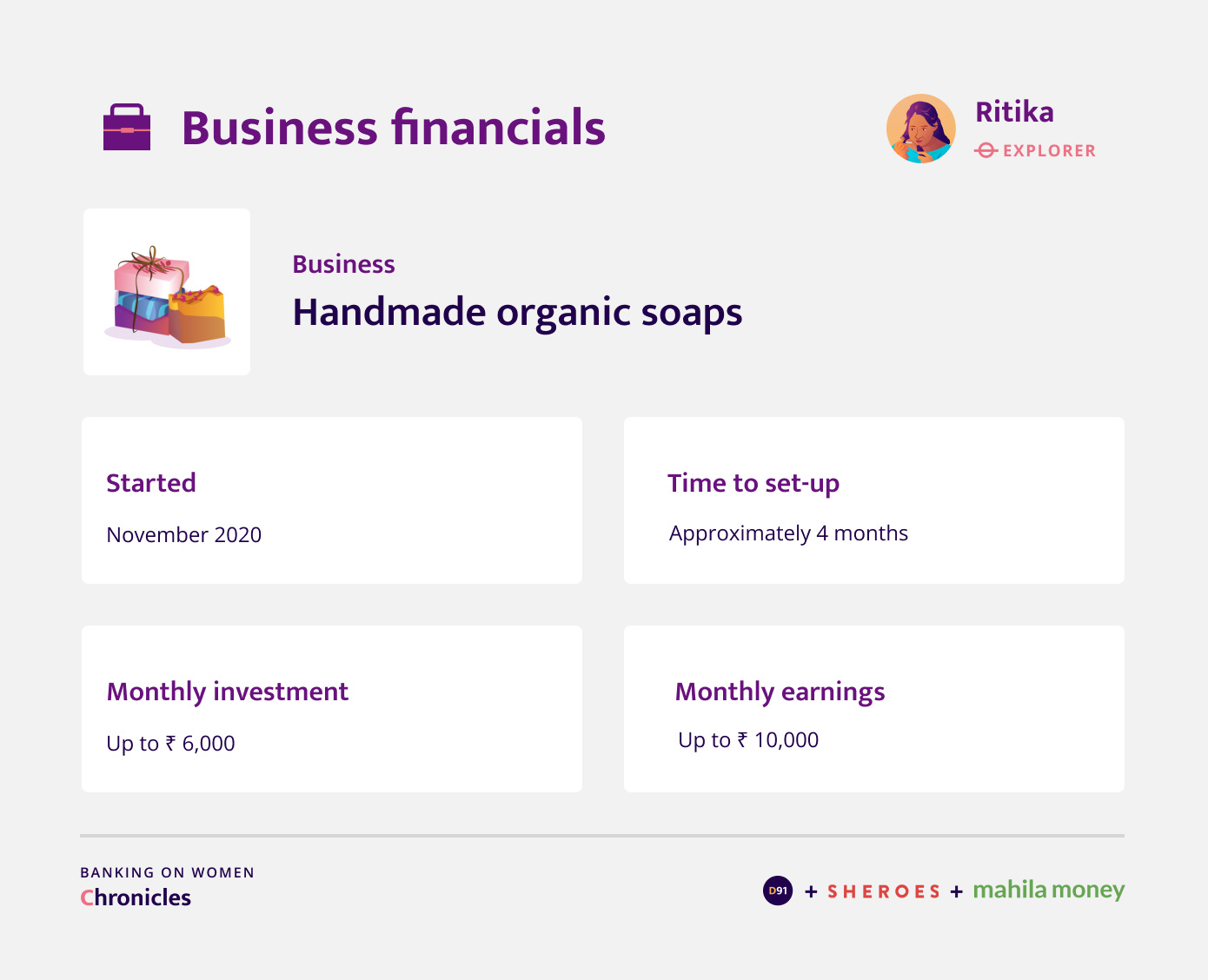

As I belong to a business family, at the back of my mind, I always wanted to start something of my own. During the pandemic, I had a lot of time on my hands and I began to think of starting something here in Calcutta. Since I am a good cook, I initially thought of starting a bakery. However, the home bakery market in Calcutta is very saturated and that’s why I thought about handmade organic soap making as something new that could possibly earn me a good revenue.

How much time would you say you spend working on your business on a daily basis?

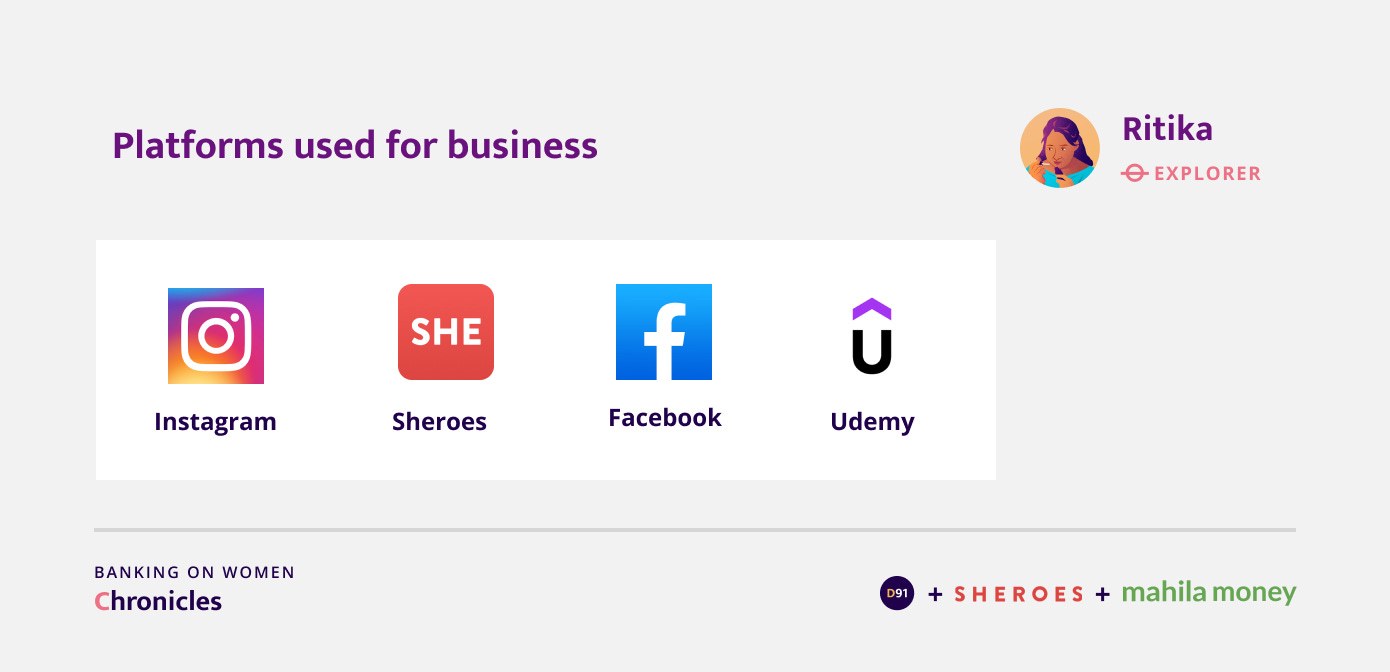

It depends, at times when I get large orders for hampers, I have to work more. Other times I keep researching as to what I can do better, where I can get more attractive packaging and I do some desk research on Google about various ways to improve my business. These days since we hardly go out to check things in the marketplace, my work has mostly become online.

How did you fund your business initially? What does most of the funding get used for?

Funding was not really an issue as I used my savings from the time that I was a teacher to start this business. But I decided to start small, invest wisely and gauge things based on the initial response I receive. I allocated INR 30,000 to experiment with. I started by spending an initial amount of INR 3,000 on learning the skills necessary for soap making and followed it with INR 3,000 that I spent on basic raw materials.

Most of the money then and even now goes in buying raw materials. I prefer to purchase good quality raw materials in bulk from Coimbatore. I buy a large quantity beforehand because if I get a large order, I would not want to miss out on that opportunity simply because I did not have enough raw materials.

How long did it take you to set up this business?

It took me around four months. When I first started thinking about it, I wanted to learn it hands-on. However, physical classes were not possible due to the pandemic, so I started learning through an online course on Udemy. After that, I needed to source raw materials. If I had learned through a class in India, I would have probably managed to find local sources for raw materials through the instructor, but Udemy instructors were from around the world. I had to then look for a teacher in India. I found one in Bangalore but her raw materials were very expensive and the margin for me was very small. So I had to work through those concerns before starting the process of actually making and selling my own soaps.

Can you tell me a little bit about some of the pain points that you had when you started the business?

Since I had the funding element under control from my savings, my first challenge was to find a market for the products. I began by sharing my work and some samples with my friends and family. I live in a housing complex with about 270 apartments. As people came to know about my business, used the samples and liked them, my network and customers both expanded.

My second biggest challenge was formalising the business by registering the company and obtaining licenses. In my initial research I came across a certification from the Indian regulator for cosmetics which was necessary to make products and there is a requirement to have studied Chemistry for that. I have an arts background and I did not fulfill that criteria directly. In order to ensure the quality of my products, I only purchase raw materials from websites that have licenses and certification from the relevant authorities. In fact, I wanted to expand my business and add other products such as shampoos, lotions, etc. but the licensing requirement applies to these but not to organic products so I have limited my product basket for now. I do not want to compromise on the quality of my products at any cost because my clients trust the products that I sell.

Did you have any mentors among your friends and family that helped plan and execute this business? Did your family support you through this?

It was my brain child and I worked on it myself. In fact, many people questioned me and asked why soaps? But I was confident in my choice and continued to march forward and put all my creativity into this.

This is not to say I don’t have support from my friends and family. I have a great support system! In fact, when I get large orders I make my family work for me. My kids become my employees and I give them a little bit of money because it helps inculcate the value of labour and remuneration.

Household finances and expenses

Who do you generally rely on for financial advice?

My younger brother is my go-to person for taking investment advice. He has knowledge about investment instruments such as mutual funds and he is quite keen on this. I ask him and invest accordingly.

Have your investments, or budgeting and expenditure for the household been impacted by the pandemic? If yes, how?

During the lockdown, a lot of expenses have come down because before the pandemic we used to travel a lot and now that has reduced. Kids used to go to college and we had to pay for that, but now they're doing online classes so that is saving us money. Outings, going for food and other things have also reduced drastically. However, I think groceries have increased because most of the time the kids are here at home and I have to supply them with their munchies and other food cravings.

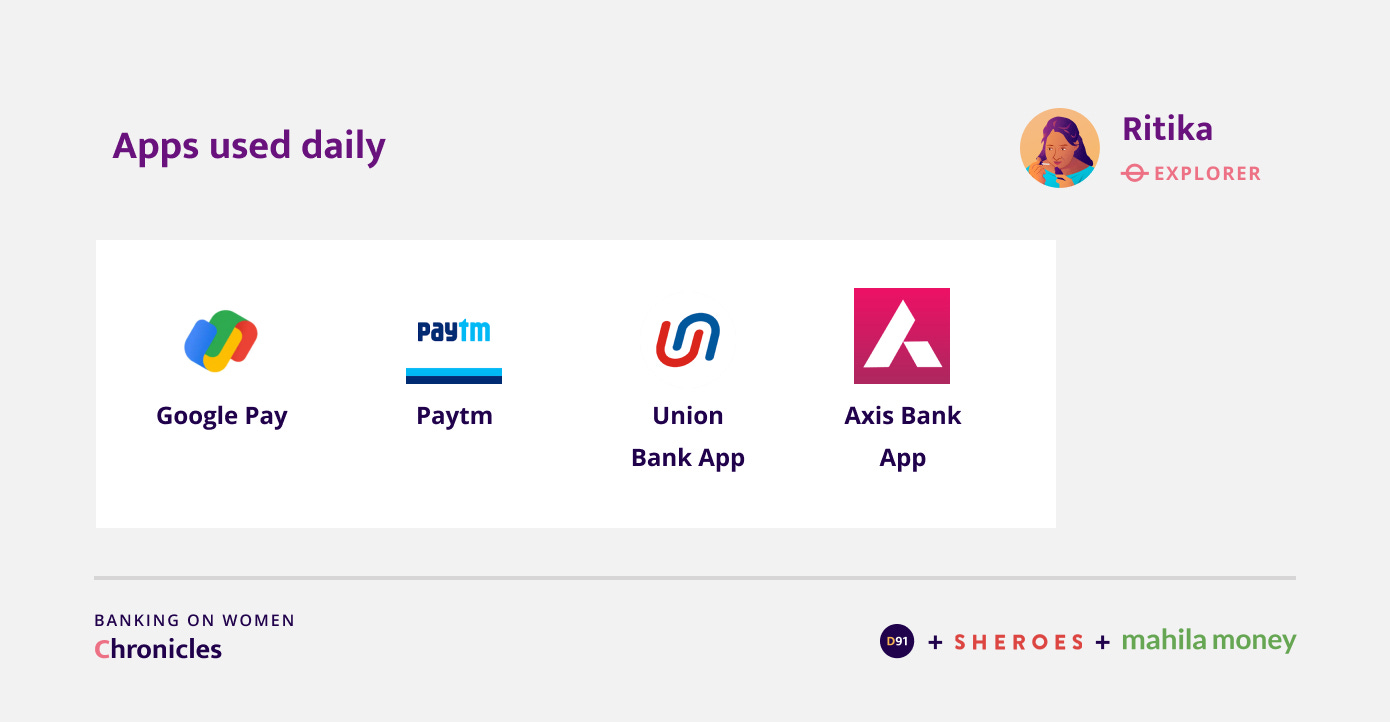

Do you remember the first time you used a payment app? Can you tell me a little bit about that experience?

The first app I used was Paytm back in 2014 or 2015. My friend was reselling a bag and she did not live nearby, so I could not give her the money in cash, I had to make an online payment. At that time she suggested I could use Paytm. That’s when I downloaded the app and attempted to make the payment. I have to say I was unable to link my bank account and eventually had to ask my nephew to make the payment on the app and I paid him back in cash. But that is when it started. I eventually figured out how to use the app and have been using it since.

Banking Habits

Do you update your passbook regularly?

I used to, but recently when I went, they said because of safety concerns during the pandemic they are not updating the passbook.

When you use bank apps do you use the web interface like the net banking platform that they have online?

Actually I have connected it with my Google Pay account so it's very convenient as everything is going and coming through Google Pay itself. I find it to be the most convenient, so I'm using that.

Financial products and services

Investments

Do you save money separately for your children's expenses?

Yes, since both of them are above 18 years, we have made some mutual funds for them.

Is there any amount that you save for yourself, not for your children or as part of your family?

I own a flat in Guwahati and the rent from that house comes to one of my bank accounts. Though it is a joint account with my husband, he does not use that account ever, so that money is all for my use. I invest about 60% of this and keep the remaining amount for myself.

Do you remember how you started your investment journey?

My Guwahati flat that I mentioned before, was gifted to me by my father. The rent from that house had accumulated in my account, so my younger brother suggested that I invest the amount in mutual funds. He has knowledge and helped me figure out a way to diversify and invest in different mutual funds so that I can get a higher return as opposed to fixed deposits and other such instruments.

Can you tell me if there are any specific goals that are attached with your investments?

Initially, most of my investments were for my children and their education. However, luckily both my children got married so they did not need it.

Do you share any of your investment details with your family?

My husband and I both discuss the investments to be made from all the money.

Do you have an emergency fund for any sudden expenses?

I use one of my bank accounts with Union Bank as an emergency fund.

Do you have a broad investment strategy for your own funds?

Besides the investments made from the Guwahati flat rent, when I used to get a salary from my job, I saved 50%, gave 25% to charity and spent the remaining 25%. Now my income varies every month and that changes the amount I am able to invest. The percentage of savings is lesser and the amount I have to spend on my business is also higher than usual. Moreover, I am investing in better tools and materials for the business over time and all of that comes from the money I make, so it's hard to follow the same strategy but I am trying to.

Have your investments changed since Covid-19?

During the pandemic, my husband's salary was deducted, then I left my job, so we had to reduce the number of mutual funds and other investments. We are hoping to restart soon.

Loans

Insurance

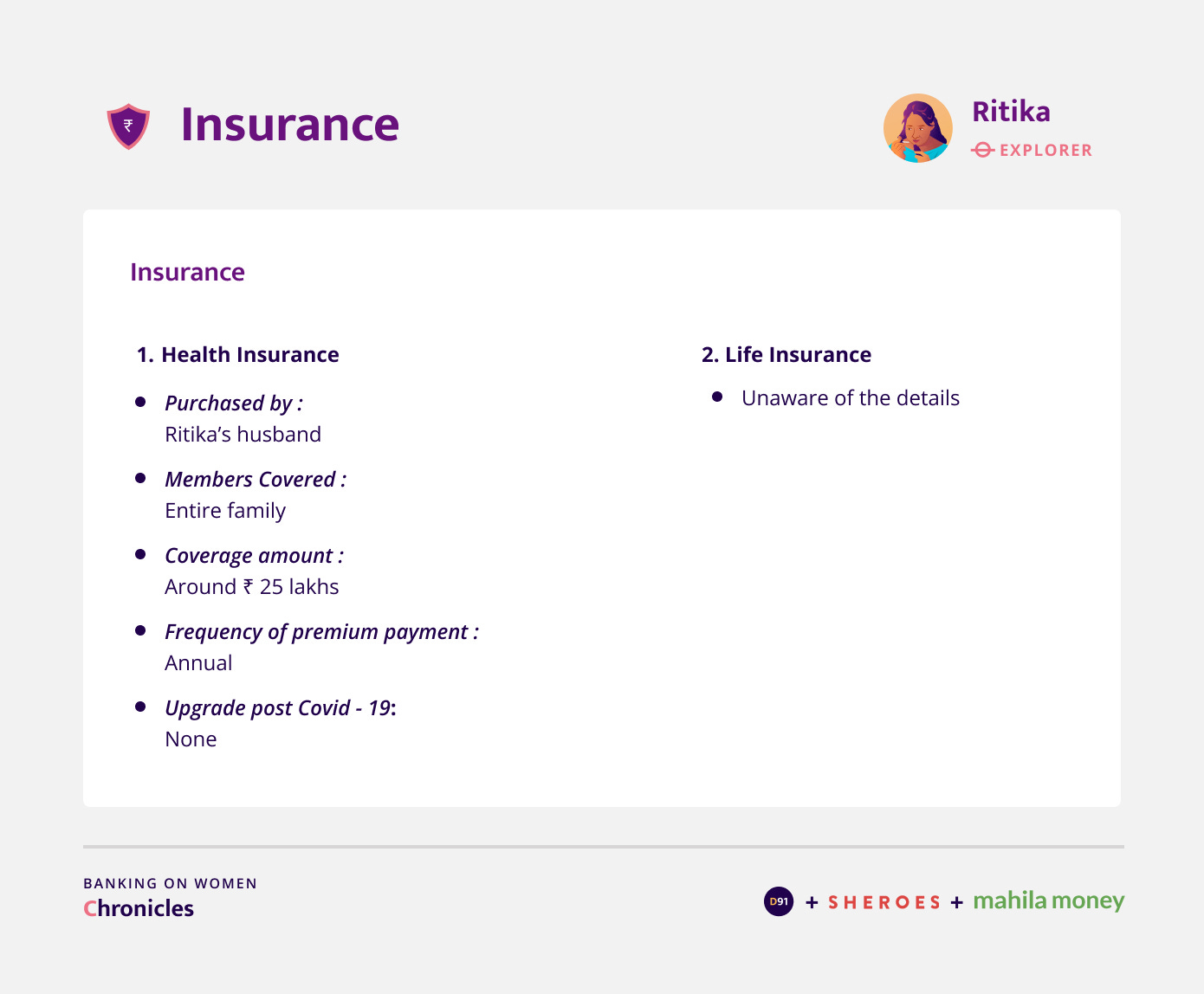

Do you know how often you as a family pay an insurance premium?

Once a year I think, I am not too sure because that's totally taken care of by my husband.

Outlook towards the future

In your opinion what is that one service that financial institutions and fintech companies can provide that will have the most significant positive impact on your financial journey?

I would prefer if the claims filing process for medical insurance was easier. I have seen it get tedious first hand and I think it can be improved.

Our understanding of Ritika’s journey

Ritika’s journey has been shaped primarily by her choices and her circumstances. She has given her all to a chosen profession and followed that with a different path when it stopped making sense for her. She adapts well to her circumstances and believes in making the most of it. She is driven and uninhibited when it comes to taking risks and dealing with the things that most matter to her. She explores new avenues with ease and hopes to reap the rewards from these avenues in the future.

About the Research

This blog is a result of an online interview conducted with the participants’ consent. The interview was conducted in English. This is a part of the Banking on Women chronicles.

Disclaimer: The name and other sensitive personal details in this documentation is masked to honour the privacy of the participant.

Project Partners

SHEROES

The SHEROES Network is a content and community ecosystem enabling access to employment, entrepreneurship, and capital for women. It includes the SHEROES app, SHOPonSHEROES marketplace, Babygogo, Naaree, MARSbySHEROES and has a user base of over 24 million women. The SHEROES Network is committed to increasing women’s contributions to GDP.

Sheroes.com | SHEROES App | Twitter | LinkedIn | Instagram | Facebook

Mahila Money

Mahila Money is a full-stack financial products and services platform for women in India. Mahila Money specializes in offering loans to women who want to set up or grow their own business along with resources and community to achieve their financial goals. Mahila Money can be accessed via the Mahila Money app on Android.

Twitter | LinkedIn | Instagram | Facebook | Website | Play Store App

All artworks are designed by Poorvi Mittal.

If you enjoyed reading this blog and would like to receive more such articles from D91 Labs, please subscribe to our newsletter here.

To read more about our work, visit our website