#17 Pavitra | The power of starting small

I am happy where I currently am because there have been many ups and downs in my life before. Therefore, I feel as long as things are going smoothly, it’s fine.

“Once I quit my job, it was very difficult for me to remain at home the entire day. We're not living only to follow a mundane routine of cooking, eating and sleeping right? For this reason I have always been keen on learning new things as it makes me feel good and that’s what eventually led me to start a business.”

Short Story

Pavitra is a 39-year-old who currently runs a reselling business for fashion and household products in Indore. She has a bachelor’s degree in computer science and is a holder of two diplomas in similar domains. Pavitra had to quit her full-time job as a skill development trainer for a government scheme as she had to prioritize familial responsibilities. From a very young age Pavitra has dealt with several unfortunate events in her life but she has braved through it all and continues to reach new heights.

Personal and financial background

What is your daily routine like?

I start my day at 6 am and I go for a walk. Once I return, I wake my kids up and get them ready to start their classes. I then make tea for my mother-in-law and breakfast for my husband. My daily routine begins after that. I run a small business so I get some of my work done in between preparing food for the rest of the meals. Cooking is one thing that I really enjoy. In the evening, I help my kids with homework and take them down to play. Once I’m back, I prepare dinner and after eating I place orders for the requests I have received. Then I spend some time with my kids, go for a night walk and wrap up my day by midnight.

In your own words, can you describe your current work? Have you worked elsewhere in the past, if so can you tell us what it was?

I currently run a small business, but my earnings from that are not very high. Since it is a negligible income, I consider it as pocket money. Before we moved to Indore about 3 years ago, we lived in Pune and I had a full-time job there. I was working as a trainer for the National Employability Enhancement Mission (NEEM) which is a government scheme for skill development. Workers from different industries were a part of it and I used to provide them with training in things like computer literacy, chemical industry knowledge, etc. NEEM has offices located all over India, and they have one branch here in Indore as well. But the problem is it is quite far from where I live, around 45 km away, so I had to quit that job once I gave birth because I had to take care of my daughter. Even my husband used to travel that same distance for work, so if both parents were away then it would have become a problem at home in terms of child upbringing. That’s why I decided to quit.

Once I quit my job, it was very difficult for me to remain at home the entire day. We're not living only to follow a mundane routine of cooking, eating and sleeping right? For this reason I have always been keen on learning new things as it makes me feel good and I have tried to dabble in a lot of different things. Around this time last year I received a call from SHEROES to be a part of the Internet Saathi Accelerator (ISA) which is a programme focused on helping women entrepreneurs overcome business challenges such as customer acquisition, marketing and digital presence. It was a wonderful journey where I got to interact with some amazing people. A friend suggested that I can consider setting up a reselling business and she introduced me to some suppliers in Indore. I began by making use of the connections I already had such as friends and relatives from Pune or elsewhere, created a WhatsApp group with all of them and slowly started promoting my product offerings there. Gradually I started to receive customer orders and positive feedback on the products as well. It has been almost 3-4 years now and I truly enjoy it because it keeps me occupied with goals to accomplish in a day.

Business Details

What specific products do you sell?

I sell products related to fashion, home decor and household essentials. I sell kurtis, sarees, purses, bangles, etc. In terms of home decor I have candles and other collectibles, and household items include crockery and other kitchen essentials. I have suppliers from all over India for each of the different products that I sell, such as purse suppliers from Agra, local Maheshwari saree suppliers within Indore, etc. Apart from the supplier contacts that I have, I also pick selective items from the Meesho app. After being a part of the ISA, I was driven to help others nurture their businesses and I decided to help women who make handicrafts locally to promote their items on my groups and sell them.

The cost of the product includes a certain margin that I keep for myself and I give the women their share of the money. These women are not technologically savvy so I have connected them to the delivery partners that I rely on, so that their items can be packed professionally with all essential information such as delivery address and relevant links added. Through this a brand of their own is slowly emerging and it is helping them gain recognition through my online store. I have also urged them to market their products on Amazon, Flipkart and SHEROES. However, they haven’t started using these platforms yet because they need someone to teach them how to use these digital platforms.

How much do you have to invest in your business on a monthly basis?

My business requires no investment, apart from my time. Whatever I earn remains as a part of my profits. However, sometimes what happens is that a customer wishes to return an order. This occurrence is usually about 1 in 100 cases because I verify the quality of products on my own, but of course everyone’s requirements are different. I give utmost importance to building a good relationship with my customers, so if someone says that they are not satisfied with a product and would like to return it, then I ask them to send it back to my address. I trust the quality of my products, so I either use it or I gift it to someone else. Moreover, I take care of the courier charges for the returns and that comes up to INR 70. So that’s the only investment from my side and it is a rare occurrence. Apart from this, recharging the internet pack on my phone is my only investment.

Was your business impacted by Covid-19?

Contrary to what several other entrepreneurs experienced, I would say my business went really well during the pandemic. It was mostly because people who were used to going to shops to buy things could not do that anymore due to the lockdown. So during that period, without me having to publicize my business, my customer base grew way beyond the 50-60 individuals that I had as my existing customers publicized my business and a lot of new people began to join my group. I also adapted my product offerings to suit the need of the hour. Things like mops, bedsheets and everyday essentials are a few things that I added. Another thing is that kids tend to outgrow their clothes almost every month, so since such clothing stores were shut, this is another product I added to my list. With the rising demand to stock up household items, my business did very well. Additionally for festivals that came during the pandemic, I offered products that could help families remain connected through small gestures of kindness. For instance, during Raksha Bandhan, people wanted to send Rakhis to siblings but it was difficult for them to go to a post office to do so due to restrictions. So I started a model where they could get it delivered through me and I also started giving them an option to add on chocolates or dry fruits along with the Rakhi.

Business Journey

How long did it take for you to set up this business and are you satisfied with it?

It didn’t take me too long to set it up, but it took me time to understand the specifics of how to run the business. Initially the problem was that I wasn’t aware of who the good suppliers with quality products were. I made sales in my first week of starting out because a lot of my customers were friends and they will always want to support you. But somewhere I wasn’t satisfied yet because they used to give me honest feedback and tell me when my products are not that good. They encouraged me to ensure that my products are worth the money. So it took me time to filter out the good quality products. Another issue that I am still trying to overcome is that I keep a very small margin for myself. My husband, friends and several family members have pointed this out and say that the price I am selling it for is very less compared to the usual prices in the market. But I am not doing this for the money, it is to keep myself occupied. I agree that money is a necessity for everyone, but why would someone come to me if my products are not cheaper than the price it is sold for in the market? Since my current way of doing things is working well for me, I continue to keep my margin low. Due to this I receive at least 4-5 orders in a day, but also if you look at my monthly income, it is below INR 5,000.

Did you receive support from your family members when you were getting started?

Yes, my family is very nice and they always support me. My daughter was also very happy that I won’t be going to the office anymore and she didn’t have to spend time at a creche. In Pune she had to spend time at a creche.

What were your pain points while starting this business?

Initially I faced problems while trying to filter out good suppliers from the bad ones. However, my friend introduced me to a few reseller apps and since she had experience in this domain, she told me about ones that are reliable and the ones I should stay away from. Another thing my sisters used to complain about is that I don’t have things that are trending lately. Well I don’t go to the market too often so I am not aware of what’s trending. But apart from these issues, I didn’t face any problems as such because there were a lot of people to guide me.

Do you use any e-commerce platforms to market your products?

I have used SHEROES and their SHECO platform. In fact, I offer SHECO products as well on my group. Additionally, I have a Facebook page. I find WhatsApp really easy because most of my target audience is there. Of course I get new customers through Facebook and SHECO, but I find it difficult to manage things on these platforms.

Have you considered formalizing your business by getting it registered?

No, I haven’t thought about it, but my husband says that I have the potential and I should consider formalizing it. I haven’t looked into it seriously though. I am happy where I currently am because there have been many ups and downs in my life before. I feel as long as things are going smoothly, it’s fine.

Household finances

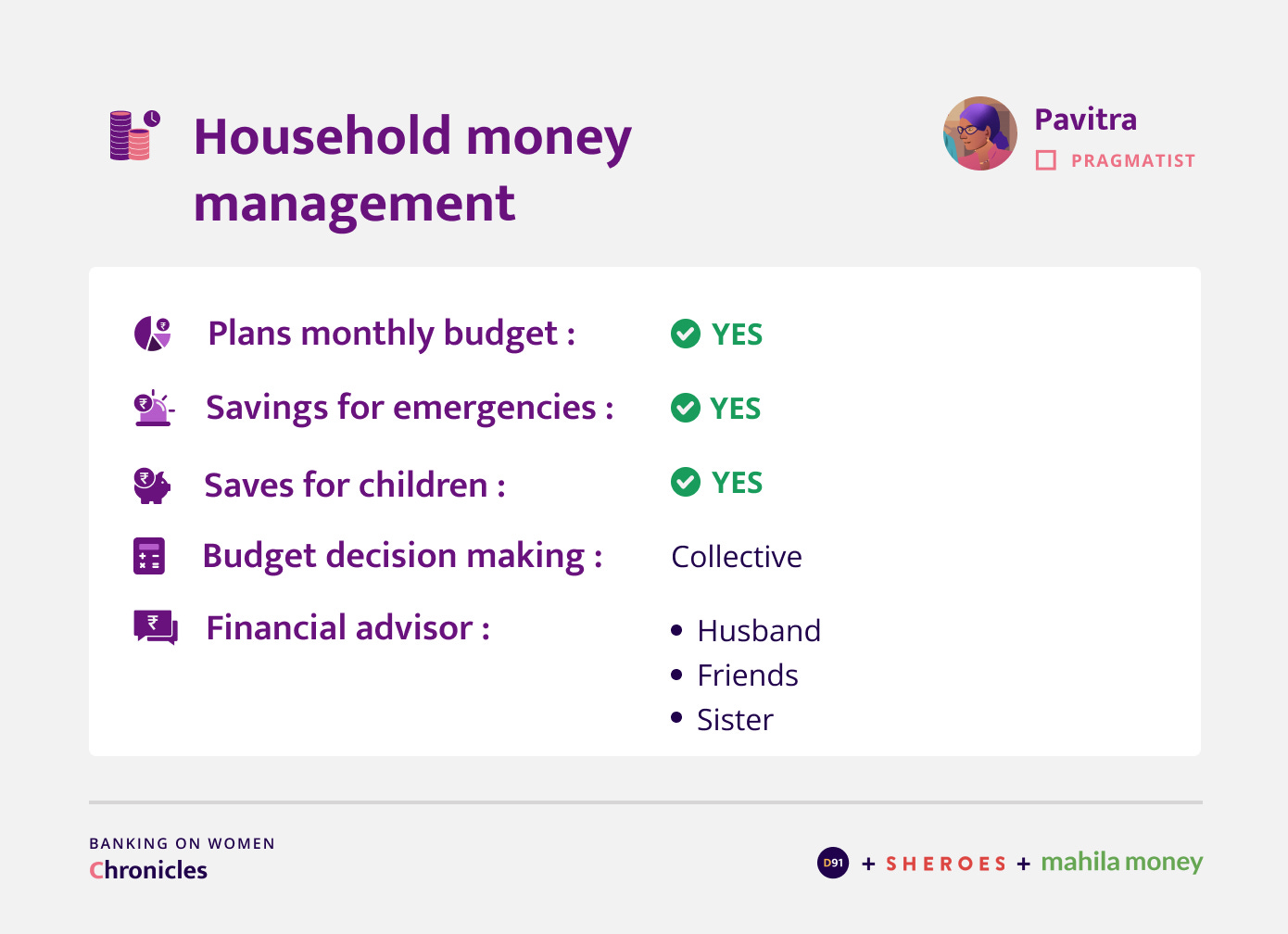

Do you have a monthly household budget?

Yes, we decide and prioritize expenditures for the month. My husband and I are very satisfied and we only try to spend how much we can afford. We have certain priorities and we take care of that in the beginning of the year itself, things like my daughters' school fees and insurance premiums that get auto-debited. Currently we live in a rented house so paying house rent is also a priority. Also, when we need to buy something new, we plan in advance and decide what else to cut down on to accommodate that purchase. Beyond that, through God's grace, things have been going smoothly.

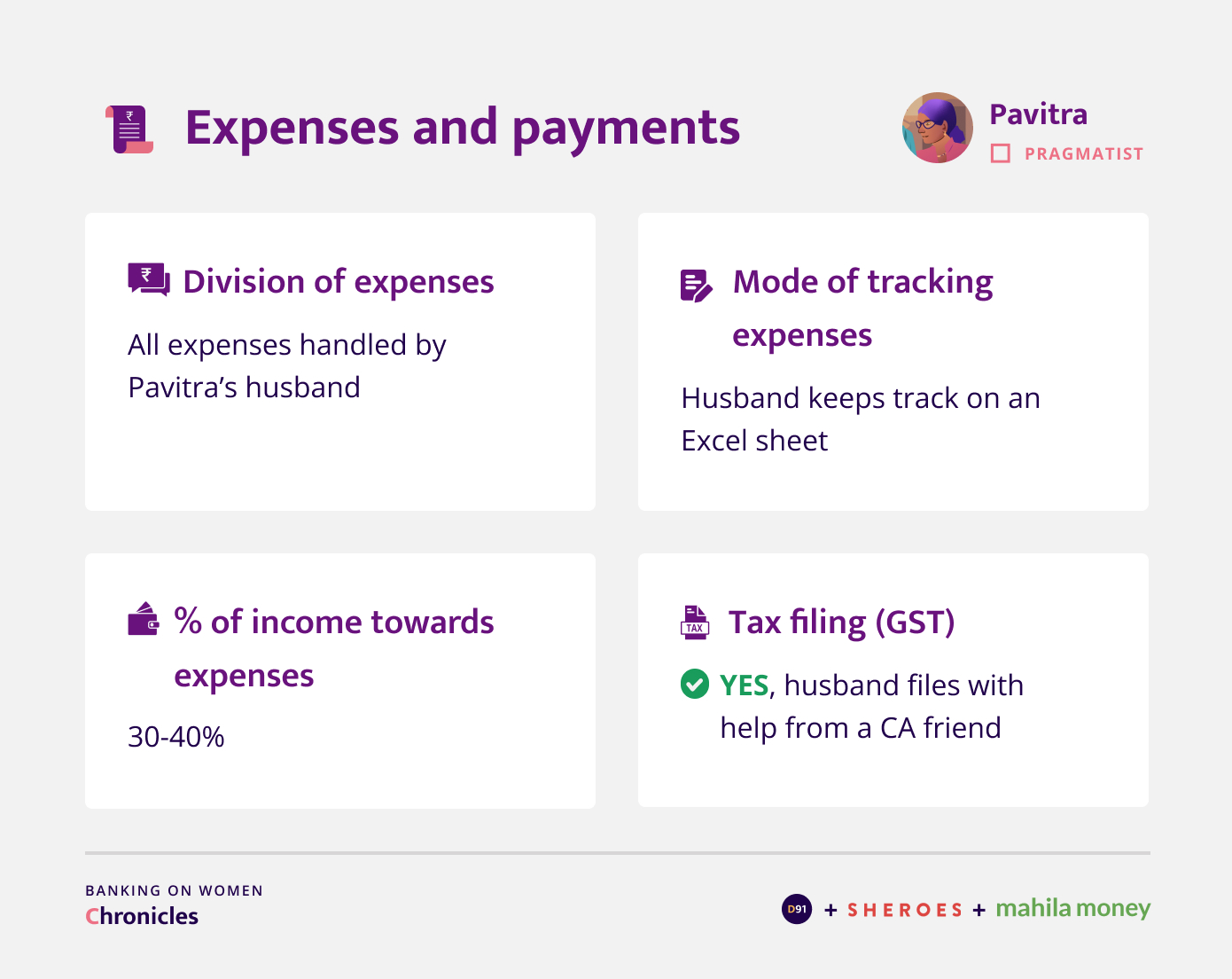

How are the expenses divided between you and your husband?

All payments are taken care of by my husband. He gives me cash and asks me to take care of all the cash based payments in a month. I only use cash to pay people who are not familiar with digital payments such as my maid or vegetable vendors. Apart from that, we pre-book gas and most of our shopping happens online. The rest my husband handles.

Who do you rely on for financial advice?

My husband manages this. Sometimes he asks his friends who are in different field’s about how to go about things. Also, my sister is in the insurance domain so she has a great understanding of these things and guides me. Apart from that, if someone within our circle suggests a policy that has tax benefits, etc. then we consider the specifics and take a decision accordingly.

Expenses & Payments

Do you remember the first time you used any payment app? Can you tell us more about that experience?

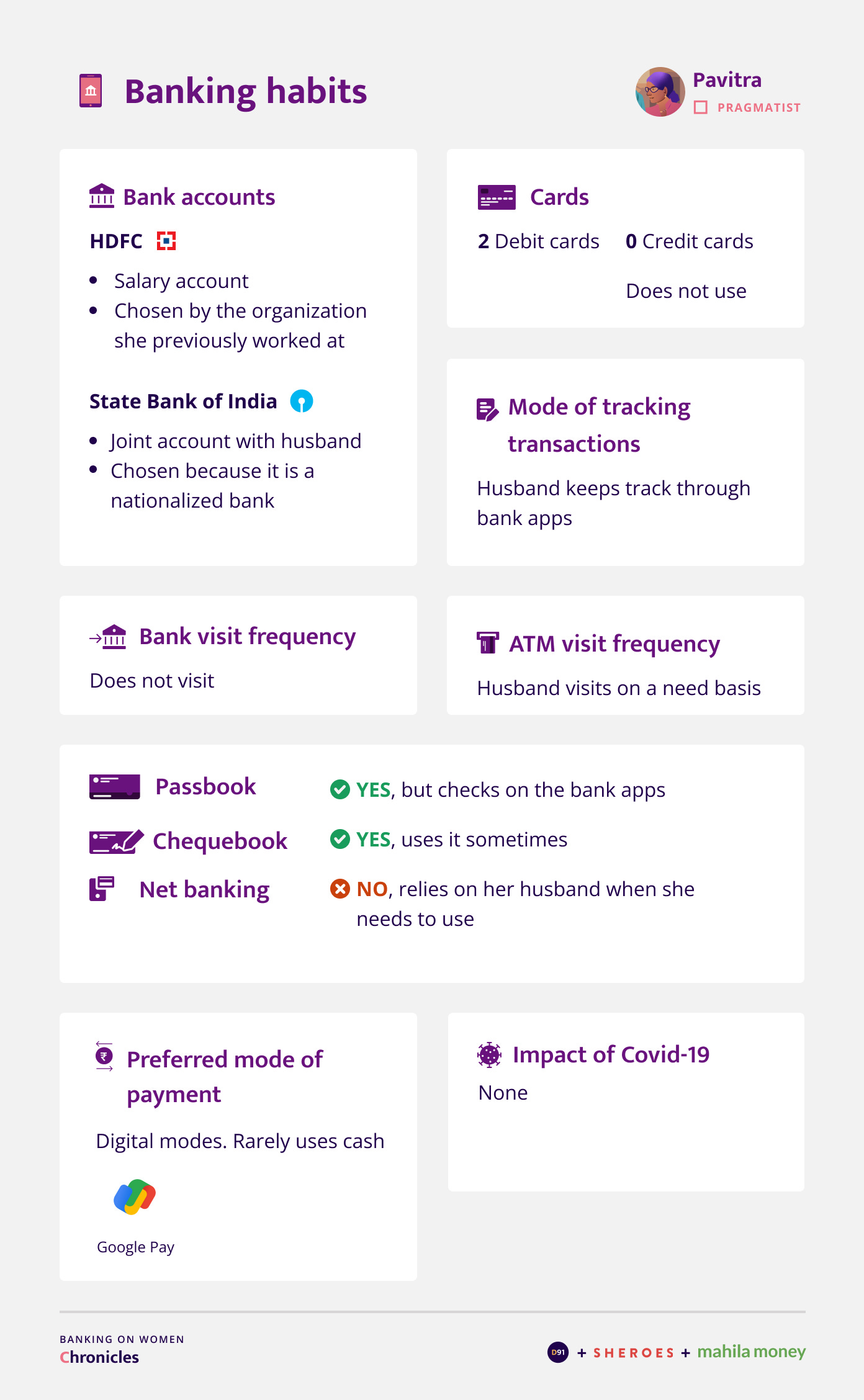

The first time I downloaded a payment app was 4 years ago when I started this business because people had started saying they can’t do Cash on Delivery (COD) and would prefer a prepaid option. Initially I used these apps only to receive payments. Whenever I had to make payments, I used my debit cards. But lately I have started to use Google Pay when I go out. I downloaded the app on my own but when I had to link my bank account and to move forward with KYC, I took my husband's help because I fear that some problems might occur while going about these steps while using these new modes.

Banking Habits

Has Covid-19 impacted your transactions with banks?

It didn’t really impact our relationship with the banks because even before the pandemic we used to make all bill payments online. We only visited banks for things like linking Aadhar or for any essential paperwork. For money there is no necessity to go to the bank.

Do you use debit or credit cards? How many debit cards and credit cards do you have?

I have 2 debit cards. My husband has a credit card, but I haven’t opted for one. We haven’t built a habit of using credit cards. When required, we use the credit card provided by his company in case of hotel bookings for official travel. But for personal use we stay away from credit cards.

Financial products and services

Investments

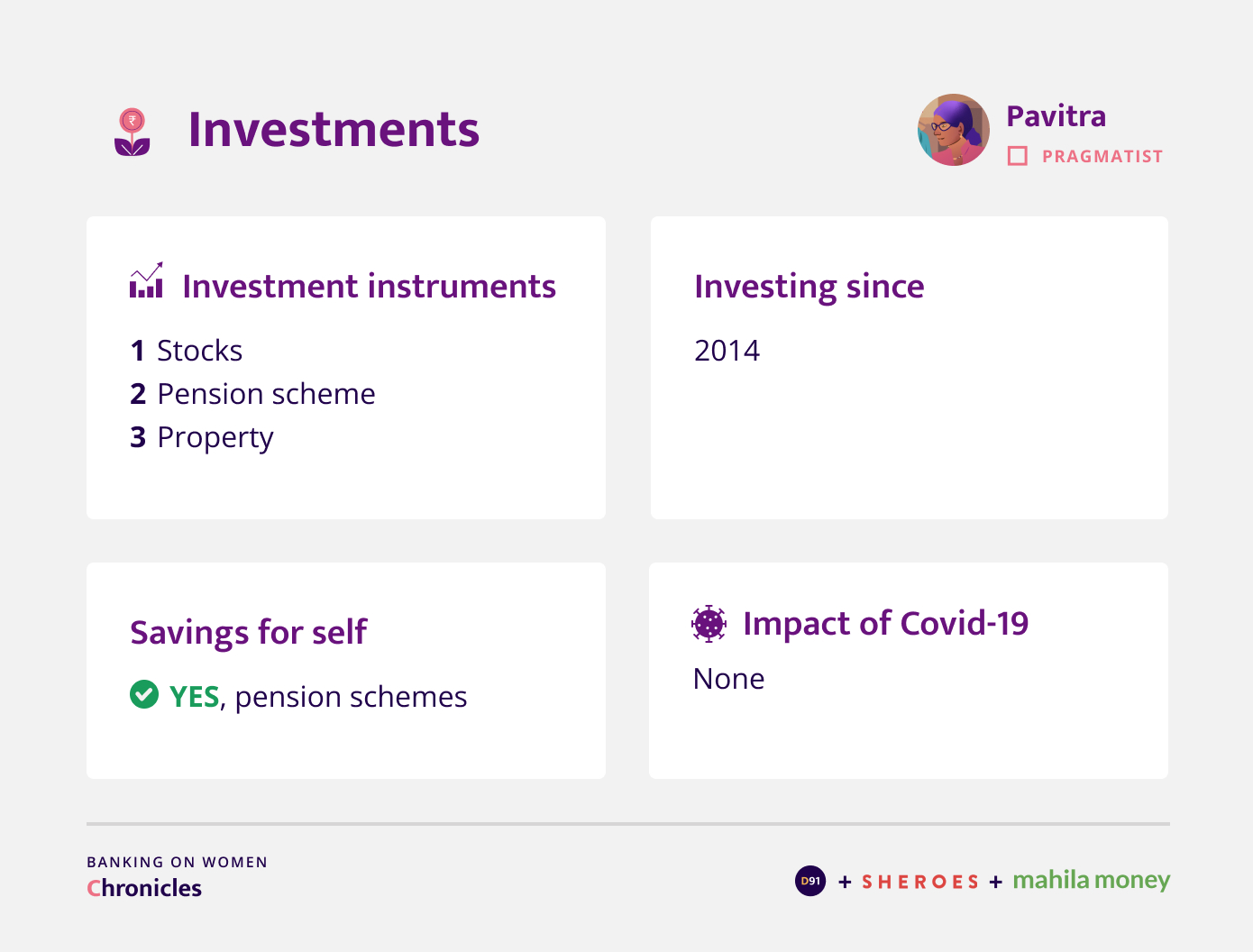

What percentage of your income do you invest?

I do not have an exact number for that, but my husband invests in the stock market. We also have some policies and the government's pension scheme that I mentioned. We have invested in property as well. FD is one instrument we haven’t invested in yet because my husband has given me the responsibility of going to the bank to open an FD account. I haven’t done that yet because you know how tedious bank paperwork can be and how much they make us run around, that’s why we have been putting that off for long.

Since when have you been investing?

Around 7 years ago after the birth of my daughter. We couldn’t start investing earlier due to familial circumstances. To elaborate, my husband lost his father at a very young age, so my mother-in-law took up the responsibility of helping him complete his studies though she wasn’t well educated herself. So after he completed his studies and started working, there was a huge gap to take care of things. Only after the birth of my daughter, when things had settled down at home, we started investing.

Do you have any goals attached to your investments?

Both my husband and I are very satisfied with what we have, we don’t spend excessively, so whatever dreams we had in terms of owning a home and vehicle, we have fulfilled. We bought a home in Pune, but we had to move here. We can’t possibly buy homes in all the places we move to right? Even in our hometown we have our ancestral home which we have renovated. So now whatever investments we have are for our children’s education, marriage and for our post retirement phase. These days even weddings are a huge expense. Though there is no dowry and all of that now, the event in itself requires us to shell out a lot of money.

How do you keep track of your investments?

My husband keeps track. He has a nice habit of making an Excel sheet for everything even back when we had very little money. On the sheet he keeps track of the inflows and outflows into various instruments, what these investments will lead to and this helps us figure out how to compensate for a major investment. He has a detailed record of all this since the time he started working, maybe 18 years ago.

Have your investments been impacted by Covid-19?

Whatever investments we made in shares was during the pandemic itself, so it’s all looking up. We invested at a point when prices were low, but we’re left with very less now because we have invested the amount we gained through stocks in a property. Moreover, even the rent of that property has doubled now after the 2nd wave subsided.

Loans

Would you be comfortable borrowing from digital platforms?

No, I don’t trust these institutions that offer loans. The active loans we have were based on my husband’s decisions. If you ask me, I’d say it is better to accumulate the amount you need first and only then buy what you need. Because when you take loans, you have to pay so much interest that it really doesn't make sense to me. However, my husband disagrees and says that by the time we try to accumulate the amount, the value of the commodity would have gone up further. So I have entrusted him with the responsibility to make these decisions. I prefer to live within my means.

Insurance

Any particular reason why you chose this insurer for the family insurance?

As I mentioned, my sister is in the insurance domain, so she guides me on what is better at the moment. She has been associated with a lot of organizations and updates me about which ones are more beneficial and provides recommendations accordingly. I had undergone training to get into the field of insurance, but I found it hard to wrap my head around things, maybe because I wasn’t interested.

Outlook towards the future

Given your life’s journey, what are the financial products that you would suggest to others?

In my opinion, insurance is a great tool that can help one balance their life. I am saying this because I lost my parents at a very young age. We are 3 sisters and everything was going great, my father was in the army and he was also running his own practice in medicine. My mother was a heart patient and she had a heart attack when I was born. Before this she had her first attack when my brother was born. But this brother of mine passed away due to issues with his heart when he was only 9 months old. That’s when my father quit his job because we needed his support back home. He decided to quit and started his own practice. The age gap between us sisters was quite large and my mother’s health was deteriorating. She was also diagnosed with cancer and there was no viable treatment for her condition. Though she could avail whatever treatment she needed at the army hospital for free, back then even a treatment like chemotherapy wasn’t widespread. Somehow we got through that phase and thought of going forward in life, but 3 years later even my father got diagnosed with cancer when we were in our first year of college. I was doing a diploma at that point. We had a lot of things but of course nothing can take the place of our parents. They had kept aside a lot of savings for us but savings don’t serve the purpose of insurance. Since we have lived through this experience we strongly believe that everyone needs to have insurance. It doesn’t matter how much money you have saved in one particular place, because if something goes wrong with that, then you might lose it all. Instead, it is better to diversify your investments in various instruments. For instance, for things like property, you might have some personal attachment to it and might not be ready to sell it. Sometimes even if you are ready to sell it, you might not find buyers or you won’t get a good resale value. So it is important to ensure that you have some assets that you can easily liquidate. I think it is good to invest in gold as well. In my opinion you need to have investments in multiple places.

Our understanding of Pavitra’s journey

Our conversation with Pavitra illuminated her adaptive nature and her resilience in the face of adversities. She took complete responsibility for her life circumstances and crafted a suitable path for her entrepreneurial journey. Pavitra’s journey offers an abundance of valuable financial advice backed up by lived experience. Despite having to start from ground up several times, no obstacle has ever prevented her from moving forward with a positive outlook. Her invincible spirit is truly admirable!

Hope you enjoyed reading this blog. We at D91 would love to receive your feedback on the work we have been doing so far. Here's a brief survey for us to understand your experience while engaging with our content. This survey should take less than 5 minutes of your time and all responses are anonymous.

You can provide your feedback by clicking on the following link - https://forms.gle/4WUzRUBCht2prHs28

About the Research

This blog is a result of an online interview conducted with the participants’ consent. The interview was conducted in Hindi but has been translated to English in the best possible way to reach a large audience. This is a part of the Banking on Women chronicles.

Disclaimer: The name and other sensitive personal details in this documentation is masked to honour the privacy of the participant.

Project Partners

SHEROES

The SHEROES Network is a content and community ecosystem enabling access to employment, entrepreneurship, and capital for women. It includes the SHEROES app, SHOPonSHEROES marketplace, Babygogo, Naaree, MARSbySHEROES and has a user base of over 24 million women. The SHEROES Network is committed to increasing women’s contributions to GDP.

Sheroes.com | SHEROES App | Twitter | LinkedIn | Instagram | Facebook

Mahila Money

Mahila Money is a full-stack financial products and services platform for women in India. Mahila Money specializes in offering loans to women who want to set up or grow their own business along with resources and community to achieve their financial goals. Mahila Money can be accessed via the Mahila Money app on Android.

Twitter | LinkedIn | Instagram | Facebook | Website | Play Store App

All artworks are designed by Poorvi Mittal.

If you enjoyed reading this blog and would like to receive more such articles from D91 Labs, please subscribe to our newsletter here.

To read more about our work, visit our website