Women's obscure path from awareness to adoption of insurance products

The fourth blog of the insights from the “Banking on Women” series covers our respondents’ views and apprehensions when it comes to insurance policies.

Over the past 3 blogs, we have observed how women navigate through banking and digital payments, credit and investments. We find that, in the interest of their family’s well-being, most women often deprioritise their own future and healthcare needs such as having a comprehensive healthcare plan or an insurance policy.

Fintech in India has become synonymous with lending or investments. There are plenty of options available to borrow at the touch of a fingertip but when it comes to securing one’s future, individuals have to jump through hoops of paperwork and fill long forms with convoluted language and legalities. The Economic Survey results show that India has one of the highest levels of Out-Of-Pocket Expenditures as almost half of all health spending in the country is paid by the patients themselves at the point of treatment1. This is due to the fact that most Indian households do not own an insurance policy. They either borrow or dip into their savings, in times of unexpected emergencies.

Historically insurance as a product offering has been a push product, hard to sell especially when it comes to low-income households2. Even in the innovation space, there’s limited discussion about the advancements in insurance making it an unattainable target for most of the digitally non-native Indians. While some users consider investing in an insurance plan as an extra expense (e.g. Products like term insurance) rather than a safety net, some are unaware that they might be covered by insurance that is embedded into the credit products they own. This demands a need for de-jargonize insurance and making it accessible for users from all walks of life.

As per the IRDAI’s annual report published in 2021-22, out of the total number of policies issued in the country, women accounted for only 34.7% of new life insurance policies issued that year. That means that only 1/3rd of the policyholders are women. This number is still higher than 33% from 2020-21 but lower than 2018-19 which had 36% participation from women3.

Out of the 20 women we interviewed, 15 of them either have term insurance or life insurance policies that were suggested by friends, or family or offered by the self-help group. Some of them also have medical insurance either paid by themselves or covered under their spouse’s employer’s health plan. 5 of the 20 women have no insurance at all. This is either due to defaulted premium payments or losing trust in the product due to some bad experience in the past. While they are aware that the lack of health insurance hinders their access to healthcare, they are oblivious to the various other kinds of insurance products and their advantages. These women who don’t own an insurance policy however are aware of and use other formal financial instruments such as app-based investment platforms and mobile banking indicating that insurance still is a complex product for an otherwise financially literate user.

Out of the 15 women who are covered under some form of insurance, only 6 of them are aware of the coverage and details of their insurance policy. The rest of them said that the policy was chosen for and paid for by a male member of the household (usually their father or husband). The lack of awareness of the different policies owned by them or their families has obscured our assessment of the respondents’ knowledge.

Having insurance acts as a safety net for the women as well as their families, protecting them against adverse events that can lead to catastrophic financial loss. Over the past blogs in this series, we have covered the risk-averse nature of women comes to play in the allocation of resources for contingency funds. Therefore, the absence of awareness of insurance pushes them to use their financial resources largely to hedge against unexpected risks. In the absence of insurance coverage, they tend to dip into their savings or resort to informal borrowing in case of adverse health events or loss of livelihood. This goes to say that with an adequate insurance plan in place, women can make smart investment decisions and secure their futures.

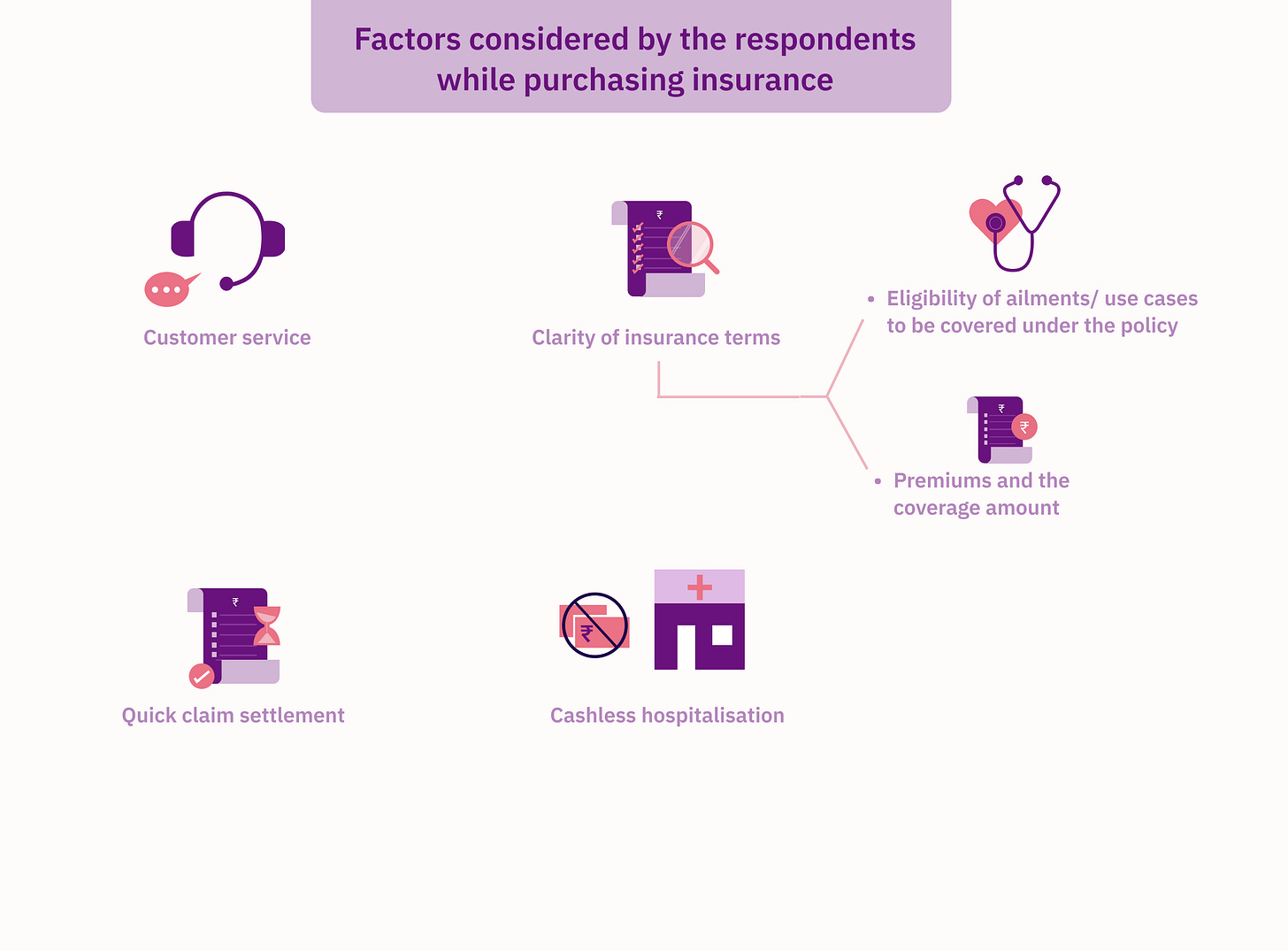

When asked what are the important factors they consider before investing in an insurance policy, women said they would choose a policy provider that offers the following:

Designing insurance products for the women of Bharat

Insurance as a concept is very complex for both men and women alike. Unlike savings-based investments, insurance is one instrument that many of the women we interviewed are aware of but don’t have much information about. Insurance offerings and covers are both complicated and confusing to many and therefore, the users end up under-investing or skipping altogether.

Awareness

Most women in the cohort we interviewed have heard of or have owned insurance products in the past. Though they are aware of insurance as an instrument they lack clarity on the coverage terms, understanding which policy or kind of insurance to choose and building trust with the provider.

Lack of education:

There is a need for educating women on the different kinds of insurance available and help them choose the most suitable option for their needs. Many of the women who have dropped out of paying the premiums said that they are looking for the right offering for them and are ‘talking to agents’ about choosing health, term or life insurance policies.

Agent-assisted model

The complex nature of the product makes it difficult for a user to comprehend the terms from an FAQ sheet or a comparison table. Insurance has always been a hybrid model with a strong foundation of trust, where the users interact with agents in person and discuss their needs, the agents then suggest the best coverage and policy that the user must choose. Removing the physical aspect might work out for an advanced-level user but for users who are new to insurance, it is crucial to add a face to the product.

Another misnomer is that to think about insurance, one must look at life with a pessimistic lens rather than being pragmatic about the future.

No, I did not get insurance. I got to know about Shriram Life Insurance through SHEROES but I didn’t go for it because my dad is a government employee and he has his life insurance there. Also, I didn’t think negatively about my life circumstances and I didn’t have too much awareness which is why I haven’t bought anything.

-Sandhya, 29 year old IT employee working from home in Tirupati

An agent could help the women see the advantages that come with insuring their life and businesses and make an informed choice.

Social proof:

When it comes to women, social proof also plays a pivotal role. Many a time when women seek financial products, they rely on referrals from their trusted circle of friends and family. These circles function as informal agents of the product. Therefore, it is crucial for any insurance product that aims to serve the women cohort, to adhere to the highest standards of customer service at each of the touchpoints, consistently.

Mistrust in Insurance:

When it comes to digital financial products like payments, credit and investments, mistrust is localised to certain providers and stems from issues of usability, access or fraudulent experiences in the past. But in the case of insurance, there is a general lack of trust in the product category itself. Complex terminologies paired with poor awareness, lack of guaranteed returns, sub-par after-sales services and various other factors disincentivize users of both genders from trusting and eventually purchase of insurance in the country. Some users might even see insurance as a sunk cost if no claims are made.

…Since we have been cautious, we felt that there was no need for any insurance for Covid-19.

- Raksha, 39 year old pursuing her B.A from Ahmedabad

Therefore it is important to tackle the mistrust at the root. A good start would be investing in imaginative solutions to educate the user about the importance of insurance.

Rather than pushing the users by means of intimidation, insurance providers should opt for nudges to persuade the users and suggest products that have the women’s best interests in mind

Use transparency in communication at all touchpoints

Investing in the after-sales support staff who would talk to the users with empathy and provide timely solutions

Consideration & Usage

To consider investing in an insurance product, women must see the benefit for her. Ease of operations, clarity of terms and being heard are among the top factors that come to play when influencing women’s decision to purchase insurance.

Customer service:

“We need somebody to respond when we have queries, nothing more than that.”

-Raksha, 39 year old pursuing her B.A from Ahmedabad

When a user trusts a platform to help them out in their time of need, they need to be reassured that they could depend on the service at any time. As insurance is a product that a distressed user might need in times of adversity, having a sound customer service team that provides prompt solutions is a prerequisite. Clarity needs to be provided on how to contact the customer support team, get quick responses on any queries that the user might have and terms of validity of the insurance.

Transparency:

Some insurers skip mentioning limitations to the claims when cashless payments cease to be valid and do not share the pricing breakup upfront while the users sign up for the insurance policy.

When we get admitted to the hospital and try to claim insurance, they might say that we are not eligible for it and as what we are asking for is covered under a different category of insurance that we haven’t opted for. So it is important to clarify all this before we sign up.

- Priya, 38 year old fashion designer from Kolkata

While signing up the user needs to be made aware of the ailments and categories that are covered under the option they are choosing, and clarity into the various offerings such as cashless payments, the coverage and the premiums so that they can make an informed decision.

Tailor-made solutions

Instead of offering a one size fits all approach to insurance with features and covers that are of no interest to the target audience, the insurance providers should tailor the policy to meet the needs of women, understanding their needs. The usage of vernacular language in insurance policy documents could help onboard new users and help them build confidence in using the product as well. This could help in increasing the adoption of life, health and even other forms of general insurance like crop insurance for farming communities, and insurance from fire for businesses etc.,

Educating the user:

Onboarding is also a great place to educate a customer on the importance of timely premium payments, kinds of insurance and grievance redressal mechanisms. As covered earlier, insurance currently is a very complex product with needlessly long terms and conditions written in convoluted language deliberately making them difficult to understand. To help users understand and make better decisions, the language used in the apps needs to be simplified and free of jargon.

Adaptive information architecture:

Once the user has chosen their preferred insurance product, the dashboard needs to be designed to be accommodative of the use cases a user might revisit the app for.

It is important to understand the primary use case for returning users and adapt the screens to address their immediate needs. For instance, a user approaching the app in a distressed situation may need comprehensive instruction for claim filing or availing cash-free payment option. In this scenario making the app clunky by cross-selling products or prompting them with upgrades might stress the user further. When it is time to pay their insurance premiums, the dashboard could prioritise that aiding ease of access. Other features like increasing the cover limit or adding dependents/nominees take second precedence but still need to be easy to discover.

Retention

Why do they fall off the wagon?

Even the women who do not actively own an insurance policy are aware of insurance as a product and the advantages of having one. They have not adopted the product due to various reasons inherent to it or their perceptions of the product. Many a time it is users who stop paying their premiums due to bad service or lack of financial discipline and they end up losing their past premiums. There is a lack of knowledge on the portability of insurance as providers intentionally obscure the terms of policy porting in their documents, which leads to unhappy users abandoning the product segment due to poor service by one provider.

Lack of social proof:

Women rely on referrals and reviews from trusted circles when making most decisions. Insurance on the other hand is a product that thrives on user trust and social proof, helping the user believe that the premiums that they paid for years would help them out in their times of need. A few bad reviews about the unreliability of the product can cause users to lose their trust. This could hurt them as not paying premiums would lead to them losing their coverage and the past premiums paid.

My husband had health insurance, but we didn’t continue with it because I felt the reviews were not good. Apparently, they delay payments while claiming, that’s what a lot of people have told us. I have heard that xxx health insurance service is good, which is why we are considering that.

So currently we don’t have any insurance apart from vehicle insurance.

-Raksha, 39 year old pursuing her B.A from Ahmedabad

Lack of clarity on the coverage terms

Women users might assume that a policy that is designed for them might cover maternity spending but if the policy opted by a certain user excludes it, they need to be made aware of that as well. It is important to highlight the exclusions just as clearly as the inclusions. When the usage terms are clear and transparent, users are confident about their cover and might be prompted to upgrade policies based on their needs. Many a time users are underinsured and fall off the wagon disheartened that they could not avail insurance despite paying hefty premiums.

Actually, my husband had health insurance so it can be helpful for my second delivery. But when we tried to claim it, they said it was not valid in that particular hospital and we couldn’t claim for the services we were availing. After paying for so many years, if we can’t claim the amount, it’s such a waste for us. It feels like they have benefitted from our money rather than the other way around.

-Farah, 31 year old cloud kitchen owner based out of Bangalore

Instead of overburdening the user with long terms of insurance, the app could allow the user to search the diseases/ use cases or provide a clear directory of policy coverage terms would help the users pick the plans best suited for their needs.

When claims get rejected without a reason, a disheartened user then stops paying premiums feeling dejected by the system. Giving a proper explanation as to what caused the rejection and how might the user avoid such an experience in the future could help in user retention.

Grievance Redressal

A lot of new-to-technology users have apprehensions about insurance or any mobile-based apps due to a lack of trust. It is imperative to chart the shortest route to grievance redressal to retain the customers. Designing the flow of the apps to match the users’ mental model helps in solving most of the usability pitfalls. For example, making customer support inaccessible or delaying responses could frustrate the user. Therefore, mapping the shortest route to customer support or the grievances section by adding a quick access button at each screen helps in gaining users’ trust.

As covered earlier, the gap in the adoption of insurance as a segment primarily stems from a lack of trust and awareness among the users. Among underserved communities, trust is tricky to build. But luckily increasing awareness through education and well-intended marketing will help in certainly reducing the gap and gaining trust in the long run. In the next and last blog of this series, we will take the learnings from women’s perceptions of the various financial product segments like banking, payments, credit, investments and insurance to build guidelines on how we could design these very products better.

IRDAI individual new business data – number of policies and first-year premium for the year 2021-22 https://irdai.gov.in/annual-reports

All artworks are designed by Himanshi Parmar and Rahi Deroy from NOCT.

If you enjoyed reading this blog and would like to receive more such articles from D91 Labs, please subscribe to our blogs here.

To read more about our work, visit our website

You can follow us on Twitter | LinkedIn | Instagram | WhatsApp