Why Everybody Loves a Good PFM App but It's So Hard to Build One!

Can PFM apps transform personal finance? With AI, automation, and the Account Aggregator framework, they might finally deliver the smarter, personalized insights users need to stay engaged!

The Allure of a Good PFM App

Personal finance management (PFM) apps occupy a unique yet strange space within the fintech ecosystem.

On the surface, they seem like an intuitive entry point for any fintech startup focused on consumers. After all, who wouldn’t want a better grasp of how their money is being spent? It’s logical to think that empowering users with insights into their spending patterns could position a PFM app as the central hub for all their financial needs.

The typical strategy often looks something like this: attract users by offering them a PFM app that provides a clear overview of their finances, then monetize through cross-selling or partnerships. As the user base grows, you expand into offering more financial products and services.

So why does something that starts with so much promise end up being forgotten? Why do so many of us love the idea of a PFM app but can’t stick with it long enough to see real change? Can the expanding Account Aggregator framework and emerging AI capabilities bridge address this problem?

What do Users Want from PFM Apps?

This blog started as an internal research exercise with ~30 Setu employees, revealing a gap in Personal Finance Management (PFM) tools for digitally savvy users in Tier 1 cities. Despite having disposable income, these users lack solutions tailored to their financial behaviours and needs. Our findings identified three distinct personas shaped by their financial life stages.

Here’s What We Learned About Personal Finance Behaviours

We gathered some fascinating insights into how people manage their finances, what they expect from PFM apps, and why many of these apps fail to keep users engaged long-term.

1. Financial Tracking Methods: The Spreadsheet is not dead!

One of the most striking findings? Around 60% of users still manage their finances manually—using tools like Excel spreadsheets or simple bank statements. This is especially common among early-career individuals, or what we call the Budget-Conscious Beginner. These users appreciate the flexibility of creating their categories and personalizing their expense tracking, even though it requires manual effort. But here’s the kicker… engagement typically drops after just 3-4 months because, let’s face it, manual tracking is tedious.

A product lead from a leading Indian fintech platform we spoke to shared, "There’s a cohort that loves PFM apps, but for many, the reality is that they’d rather not think about their finances. The challenge is keeping users engaged, even when they aren’t actively looking to manage their money."

On the other hand, mid-career users, typically our Accomplished Investors, rely on dedicated PFM tools like INDMoney or Fold for tracking their investments and net worth. These users don’t need basic expense tracking—they’re looking for real-time market data and investment insights.

2. Spending and Savings Habits: Impulse Control and Budgeting Alerts

Impulse spending is a real problem. Almost all respondents mentioned that real-time alerts could help them avoid overspending, particularly the Budget-Conscious Beginners who often exceed their limits without timely nudges. On the flip side, Family Planners—who tend to focus on long-term goals like home ownership and education—are more interested in goal-based saving tools that work for their entire household. They want joint family budgeting features, but most current solutions miss the mark on this.

3. Willingness to Pay: Free vs. Premium Features

Except for a few PFM evangelists, almost all users were unwilling to pay for basic income and expense tracking, likely because so many apps, including bank apps, offer it for free. However, 1 in 4 users were open to paying for “intelligent nudges,” like notifications that help them stay within budget on discretionary spending. Accuracy in categorizing transactions and expenses is the key baseline metric that prompts users to continue using the app after initially signing up.

Akash Nimare, co-founder of Fold explains, "In India, the quality of PFM products has been subpar because of the perception that people don’t want to pay for them. We decided to take a different approach—build a high-quality product first based on the user’s needs. There will be a willingness to pay when there is value"

More notably, most mid-career users we spoke to are willing to pay for more advanced features—particularly automated investment services or wealth management advice. However, there is scepticism around the ability of current apps to deliver these automated features reliably in the near term.

4. Attitudes Toward AI and Automation: The Trusted Advisor we all seem to have!

AI holds a lot of promise, but there’s still a trust gap in terms of the credibility and context-specific responses it can offer. Around 70% of users remain sceptical about using AI for high-stakes financial decisions, particularly for investments. They prefer the human touch when it comes to advice. However, findings from an earlier D91 Labs experiment revealed that most people selected AI-generated financial advice over human advice when sources were not revealed. However, younger users—are open to AI-driven insights for budgeting and expense tracking, as long as it makes their lives easier without replacing human validation.

5. Engagement and Retention: Keeping Users Hooked

50% of respondents said they sparingly use PFM apps after the initial excitement fades. Why? Most apps focus on showing users what they’ve already spent or a picture of their financial balance sheet (which usually doesn't deviate much over some time), rather than offering actionable recommendations on how to improve their financial situation. Moreover, several users expressed frustration at needing multiple apps to manage their finances—one for budgeting, another for investments, and so on. They want everything in one place. At the same time, there was equal scepticism and fear of sharing all their financial information through a single platform.

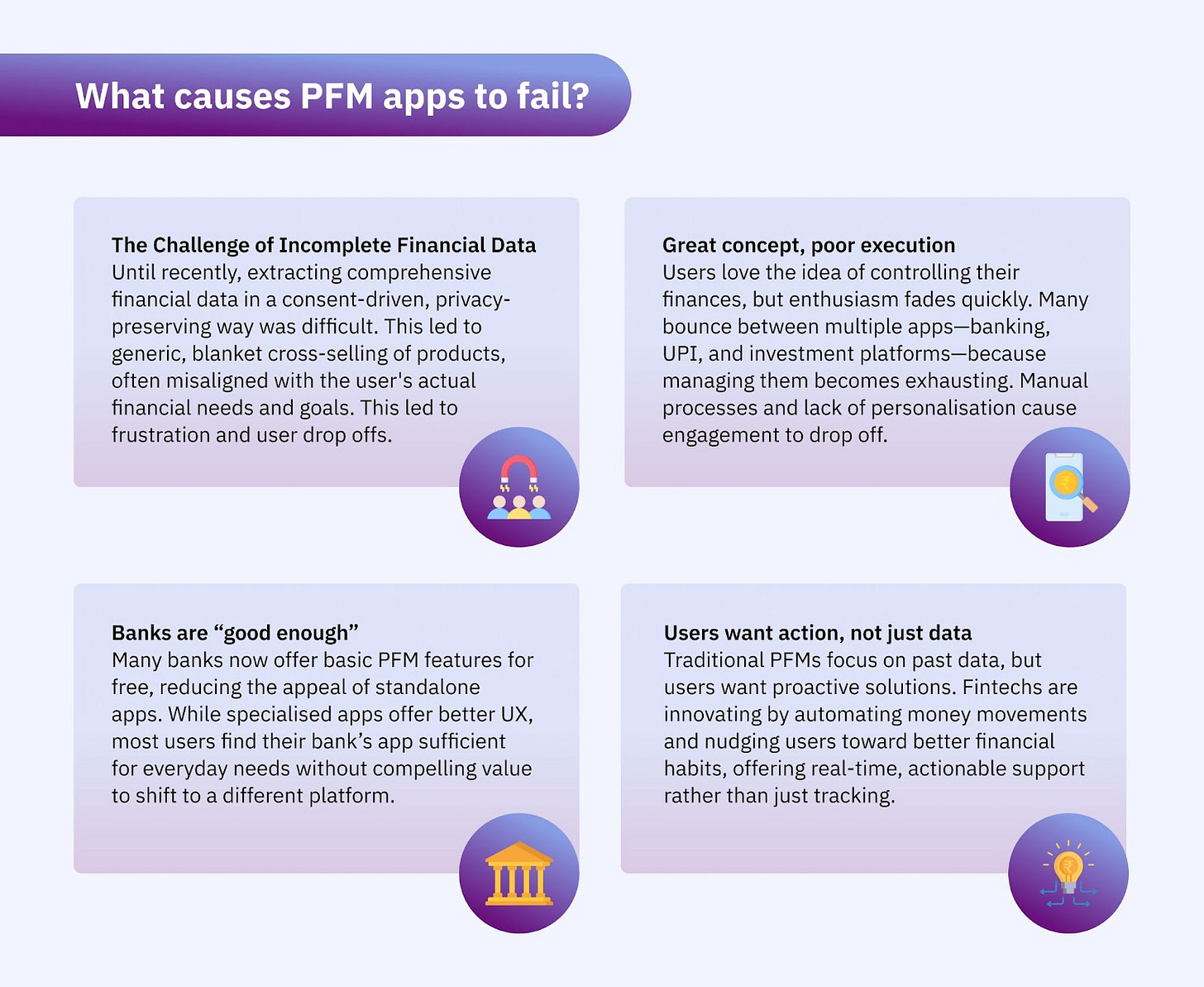

Why Is It So Hard for PFM Apps to Get It Right?

While PFM apps have huge potential, several roadblocks prevent them from delivering on user expectations.

What was originally intended as a tool to give users more control over their finances has slowly morphed into something else. Are PFM apps now more focused on creating rich user profiles from the point of view of cross-selling higher-margin financial products than contextually offering them what they might need?

For instance, the app might recommend a premium credit card with travel benefits because a user’s profile shows that they spend a lot on travel. But what the app doesn’t take into account is that the user is focused on paying off his student loans and hence isn’t interested in increasing their credit exposure right now.

Is This Problematic?

Now this is not necessarily a bad thing if incentives align, but as we have often experienced ourselves, these offerings aren’t always rooted in sound financial advice or tailored to the user’s actual needs.

The focus on monetizing user data has shifted the narrative away from empowering users. Instead of offering relevant, personalized financial advice rooted in the user’s goals, many apps push products that serve the financial institution’s agenda. This creates a disconnect between what the user needs and what they are being sold. As a result, users may end up with financial products that are not aligned with their long-term goals, and in some cases, could even hurt their financial health. Did someone say… increasing credit card default rates?1 This also suggests why users lose interest in these apps as they no longer seem relevant to them.

The Future of PFM: Getting Back to What Matters

PFM apps originally aimed to give users control over their finances, but they’ve since shifted toward profiling and generic cross-selling. So how can they refocus on genuinely empowering users?

The answer lies in AI-based solutions, automation, and the Account Aggregator (AA) framework based on our interactions with several PFM product leads.

AI-powered personalization can close the gap between user engagement and intent. Instead of just showing past spending, AI can proactively alert users to overspending or suggest investments based on their habits. With 65% of users actively seeking better investment management, AI could be the solution—if it can consistently provide reliable and personalized advice.

However, as our research revealed, users remain hesitant to trust AI over human financial advisors, who bring trust, context, and a personalized touch that many users still value. For AI to win them over, it must prove it can not only deliver accurate and timely insights but also provide contextually relevant advice that matches the depth and personalization users expect from human advisors.

"PFM apps will eventually evolve to handle unstructured queries, much like search engines, allowing users to easily solve their finance-related questions. At its core, PFM is a search or action problem—either helping users find the right financial information or enabling them to take direct actions." shared one product lead.

Automation is also reshaping PFMs. The concept of "self-driving money" allows automatic allocation of funds for savings, debt, and investments, making PFMs true financial partners that help users achieve goals without constant manual effort. However, financial decisions are sensitive, and any error can erode trust and cause user drop-off. To succeed, automation must be both accurate and reliable, ensuring users feel secure and confident in the app’s ability to manage their finances effectively.

"Automation is crucial to the future of PFM. By automating tasks like savings, debt repayment, and investment allocations, users can manage their finances effortlessly, without constant manual inputs." he added.

Lastly, the AA framework is transforming how PFMs operate in India. Unlike methods that scrape SMS and email data, AA gathers financial data with informed consent in standardized formats. While data sharing via AAs is more expensive currently, the clear value added through its privacy-preserving nature facilitates better user retention. The appeal of quick onboarding and effortless access to financial data may overshadow the long-term importance of privacy and data control. However, as awareness grows around the risks of data breaches and misuse, and as users better understand the value of informed consent, privacy-preserving frameworks like AA will likely become more attractive.

As Akash from Fold points out, "Users are becoming more aware of privacy concerns, and trust is key. As a fintech company, we need to make privacy a priority, ensuring that we don’t compromise user data while still delivering value."

With expanding data sources like insurance and utility payments, AA helps provide a comprehensive financial picture—offering users relevant advice and maintaining privacy.

The next wave of PFM success will be driven by those who prioritize genuine value for users over quick wins.

https://economictimes.indiatimes.com/industry/banking/finance/banking/indias-credit-card-losses-spike-for-millennials-swipe-spend-default-habit/articleshow/113695284.cms?from=mdr

All artworks are designed by Smriti Krishna. Review by Monami Dasgupta.

Special thanks to Ron Sebastian, now a Senior Product Manager at Axio and formerly with Setu, who initiated this research and contributed immensely by conducting interviews and generating valuable insights.

If you enjoyed reading this blog and would like to receive more such articles from D91 Labs, please subscribe to our blogs here.

To read more about our work, visit our website

You can follow us on Twitter | LinkedIn | Instagram | WhatsApp