UPI's Next Frontier: Delegated Payments and the Future of Financial Access for Dependents

Delegated payments on UPI could be pivotal in empowering dependents and underserved users with secure access to digital finance. Could it also unlock downstream financial products for them?

UPI now boasts over 350 million unique users1, an impressive achievement considering this number exceeds the entire population of the United States!

If UPI is already the Swiss Army knife of payments, what’s the need for an extra tool like delegated payments you ask?

Is it simply because certain user groups lack the confidence to operate UPI independently, or is there a deeper issue of mistrust with formal financial services? To begin with, despite its amazing achievement, less than a third of India’s population is currently on UPI with an estimated 250-300 million smartphone users itself who are yet to make use of the real-time payment system!

Let’s see the example of Mr. Nagaraju, a 70-year-old retired government employee, who lives comfortably on his pension but struggles with using digital technologies. He relies on his son, Rajesh, to handle tasks like recharging his phone and paying bills, which makes him feel dependent. Though Rajesh is happy to help, he wishes there was an easier way for his father to manage these tasks independently. Through delegated payments, Rajesh can cover these expenses through his father’s account directly.

Then there’s Meena, a 38-year-old mother living in a semi-urban area, who runs the household but leaves online transactions to Ravi, her husband. Since Ravi frequently travels for work, he wishes Meena could handle small payments without waiting for him or resorting to keeping a lot of cash at home. Delegated payments through UPI would allow Meena to manage routine expenses securely while still enabling him to oversee major transactions, giving her confidence without relinquishing control over larger financial decisions.

The introduction of UPI Circle for delegated payments aims to address these very scenarios—offering a secure and supported way for users like Nagaraju and Meena to access digital payments without relying entirely on others. Let’s dive deeper into how this innovation could unlock financial freedom for millions across India.

Understanding Delegated Payments on UPI

Delegated payments are not a new concept. Think of add-on credit cards, also known as supplementary or secondary cards. It is an additional credit card that's issued under a primary cardholder's account. However, an analogous solution on UPI rails has significantly higher scalability… some estimating even up to 300 million new users. At its core, UPI Circle2 allows a trusted secondary user3—such as a family member, caregiver, or employee—to manage payments on behalf of the primary user4. This delegation can be either full or partial, depending on the level of control the primary user wishes to retain. What’s more… the secondary user need not even have their own bank account to begin with, thereby allowing even unbanked populations to try digital payments.

In a scenario of full delegation, the secondary user has the autonomy to complete transactions independently, with the primary user having set predefined limits or conditions. For example, Ravi could delegate the authority to Meena to pay bills and transfer funds up to a certain limit without needing to consult him each time. On the other hand, partial delegation allows the primary user to authorize each transaction individually, offering an additional layer of oversight.

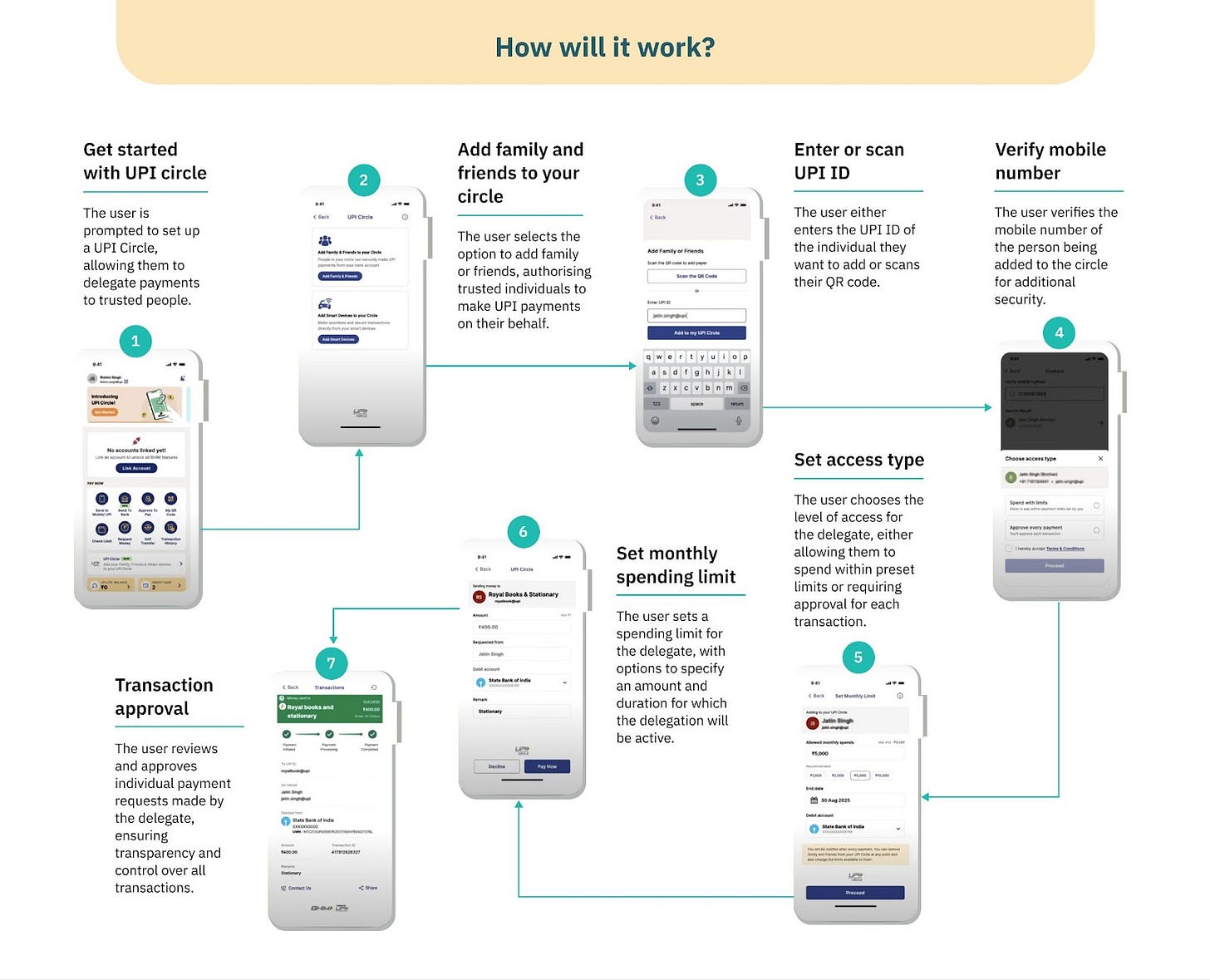

How will it work?

At the recently concluded GFF 2024, NPCI showcased an intuitive step-by-step guide on how users can easily create a UPI Circle and customize delegation settings for safe and controlled transactions. Here’s the flow.

Use Cases and Beneficiaries of Delegated Payments

Delegated payments via UPI could be useful for individuals and groups that struggle with directly managing digital transactions. Delegated payments can address these challenges by enabling a trusted person to handle transactions on their behalf, offering convenience, security, and greater access to digital financial services. Here are some potential use cases and beneficiaries of delegated payment solutions.

Household-centric Use Cases

Elderly and Dependent Individuals: Delegated payments can be highly beneficial for elderly individuals and dependents who may find digital interactions difficult to manage. A trusted family member can handle their financial transactions, allowing them to access digital payment systems without the stress of learning new technologies.

Shared Living Expenses: Families can use delegated payments to manage shared household expenses. For example, parents can delegate specific payment responsibilities to young adults or teenage children, helping them learn financial management while maintaining oversight. Additionally, households can authorize their domestic help to handle essential purchases, such as groceries, within predefined limits.

Business-centric Use Cases

Corporate Payments and Expense Management: Delegated payments can be beneficial in corporate settings, where various departments or team members need to manage routine payments and expenses. Finance teams, office administrators, or project managers can be assigned the responsibility to handle payments for office supplies, travel arrangements, event logistics, or vendor contracts.

Small Businesses: Small business owners who juggle multiple tasks can benefit from delegated payments by assigning trusted employees the responsibility to make payments for routine expenses, such as vendor or supplier bills, within set limits. This reduces the operational burden on the business owner and ensures smooth operations without constant oversight.

Financial Inclusion-centric Use Cases

Savings Groups, Pooled Funds and MFIs: Delegated payments can simplify the financial management of community savings groups, such as ROSCAs, SHGs, or Chit Funds, by enabling trusted leaders/ bookkeepers or treasurers to handle pooled contributions and loan repayments on behalf of the group. In microfinance settings, borrowers in rural or underserved regions can assign repayment tasks to family members or group representatives, ensuring that payments are made on time, even if the primary borrower is unavailable.

Assisted Digital Payments for Rural Populations:

Delegated payments can significantly promote financial inclusion for rural or underserved communities where digital literacy is low. In such settings, tech-savvy family members, intermediaries, or agents (such as BCs) can manage digital transactions on behalf of individuals who may lack the confidence or skills to use UPI independently. This support helps bridge the gap between cash-based economies and formal financial systems.

Can delegated payments deepen financial inclusion for the underserved?

Yes, delegated payments on UPI will open the doors of being financially included for a large segment of the underserved population. It can also enable access to more advanced financial products down the line. Here’s how:

Creating a Digital Transaction Trail:

Each transaction conducted by a delegate creates a digital record tied to the primary user’s account. This results in a digital footprint, even for individuals who may not have actively participated in the transaction. Over time, this transaction history becomes crucial in painting a picture of the user’s financial behaviour, such as regular payment patterns, spending habits, and cash flow management. This record can serve as verifiable data for financial institutions, which is otherwise unavailable when individuals rely solely on cash transactions.

Building Credit Profiles for Thin-File Users:

Many dependent users, such as stay-at-home spouses or elderly individuals, are considered "thin-file" customers because they lack a formal credit history. However, a consistent digital transaction trail through delegated payments can serve as a proxy for financial activity. Banks and fintechs can leverage this data to assess creditworthiness, enabling these users to access loans, credit cards, or buy-now-pay-later (BNPL) schemes that would typically be unavailable due to a lack of formal financial records.

Unlocking Access to Personalized Savings and Investment Products:

As delegated payments generate transaction data, financial institutions can use it to offer personalized financial products like savings accounts, micro-investment plans, or tailored insurance packages. For example, a consistent pattern of utility bill payments or household expenses could signal a stable cash flow, making the user a candidate for specific financial products designed for their needs. Imagine a user whose spending data shows a steady surplus each month—this could trigger an automated recommendation for an investment product or a long-term savings plan.

Enabling Financial Autonomy:

For users like elderly individuals or women who are financially dependent on others, delegated payments provide a bridge to digital financial services. As they become more comfortable with the concept of having their financial transactions digitally managed, they may gradually transition to conducting small digital transactions independently, leading to greater financial autonomy. Moreover, users who avoid digital payments due to mistrust or unfamiliarity with banking processes are gently introduced to the ecosystem through trusted intermediaries.

Navigating the Perils of Delegated Payments. How do we ensure security and trust?

Delegated payments have the potential to deepen financial inclusion by bringing millions of new users into the digital economy, but they also come with inherent risks. Without the right safeguards, users—especially vulnerable populations—could face misuse, fraud, or coercion. To ensure these risks don't undermine its potential, fintechs and financial institutions must build thoughtful, secure solutions. Here’s what must be considered:

1. Mitigating Misuse and Fraud

One of the main risks with delegated payments is fraud, particularly when primary users are less vigilant. To combat this, we could introduce positive frictions like transaction limits, real-time alerts, and two-step verification. Additionally, the ability to quickly undo a transaction if an error or misuse is detected should be built into the system, giving users peace of mind.

2. Preventing Coercion and Exploitation

The risk of coercion is significant, especially for elderly or vulnerable users. Solutions could implement features such as periodic check-ins and transaction approval notifications, allowing users to remain informed and in control. For situations of coercion or mistakes, a quick grievance redressal mechanism (GRM) should be easily accessible, providing users with a fast route to resolve issues and revoke delegation if necessary.

3. User-Friendly and Secure UI/UX

Delegated payments must strike a balance between simplicity and security. The setup process should be intuitive for users with limited digital literacy, but security protocols like multi-factor authentication and approval workflows must be integrated seamlessly. Thoughtful UX design can help maintain user confidence while ensuring they remain in control of their financial delegation.

Delegated payments hold the potential to unlock new pathways for financial inclusion, but their success depends on more than just seamless functionality—it’s ultimately about ensuring safety, transparency, and control for users. Embedding positive frictions like spending limits and transaction alerts can enhance security without overwhelming users. Offering the ability to reverse transactions and providing a robust grievance redressal system is crucial not only to prevent misuse but also to build lasting trust. We will be watching this space closely!

https://www.livemint.com/money/personal-finance/upi-the-world-s-favourite-payment-method-hits-964-billion-in-record-time-digital-payments-credit-cards-11724997818372.html

https://www.npci.org.in/PDF/npci/upi/circular/2024/UPI-OC-No-201-FY-24-25-Introduction-of-UPI%20Circle%E2%80%93Delegated-Payments-for-secondary-users.pdf

Secondary User - A UPI user who will be performing UPI payments with the appropriate authorization of the primary user.

Primary User - An UPI user who is delegating the UPI authentication to make payment to a secondary user

All illustrations and infographics for this post have been created by Smriti Krishna.

If you enjoyed reading this blog and would like to receive more such articles from D91 Labs, please subscribe to our blogs here.

All of our work is open-source and aimed at fostering innovations for financial inclusion. To know more about our work at D91 labs, visit our website!

Great insights and use cases! However, the success of a product lies in mitigating the risks around core points of failure.

The delegated payments feature has been designed with the following core users in mind: the rural or less privileged elderly (senior citizens), non-tech-savvy individuals, or children.

This segment of users' ability to identify when fraud has occurred and report it via a Grievance Redressal Mechanism (GRM), coupled with the GRM's ability to trace, act, and resolve the issue with minimal financial loss, will determine the success of this feature with the masses.

The scope and margin of error for delegated payments are extremely narrow due to the type of core customer segments (i.e., the rural or less privileged elderly, non-tech-savvy individuals, or children), with whom trust, once broken, will be very hard to regain.