Understanding the Mechanics of Digital Lending in India

Our first blog of the series explores the process of digital lending highlighting the roles played by multiple entities including fintechs in democratising credit in India.

Raj, a small business owner, faced a financial crunch needing Rs. 50,000 immediately. Traditional banking channels were a roadblock due to lengthy paperwork and his lack of credit history. When an instant loan notification appeared on his phone, offering up to Rs. 5 lakhs with a simple three-click process, Raj decided to take a chance. Within minutes, the funds were in his bank account. Raj's experience is not isolated; it reflects a growing trend across India.

What has driven the shift from the tedious, paper-laden banking processes to swift, app-based loans? The transformation is attributed to a synergy of collaboration, advanced technology, untapped market potential, and supportive regulatory frameworks.

However, the fintech sector isn't operating in isolation. Various entities are collaborating to streamline the digital lending experience. This synergy has catalyzed the growth of India's digital lending market, now valued at $350 billion1.

In this blog series, we delve into the dynamics of these entities and their contribution to making digital lending a seamless, efficient, and widely accessible financial solution. With the RBI’s recent scrutiny of retail lending, the focus of our blog will be on retail borrowing, however, the process flow with some differences remains applicable across other digital lending use cases.

Hey there!

We've got a short survey to understand how people access and use their financial data. We’ve got some exciting solutions brewing at Setu. Just 5 minutes of your time can help us understand your challenges better & come up with tailored solutions to make your financial journey smoother. Spare a few minutes?

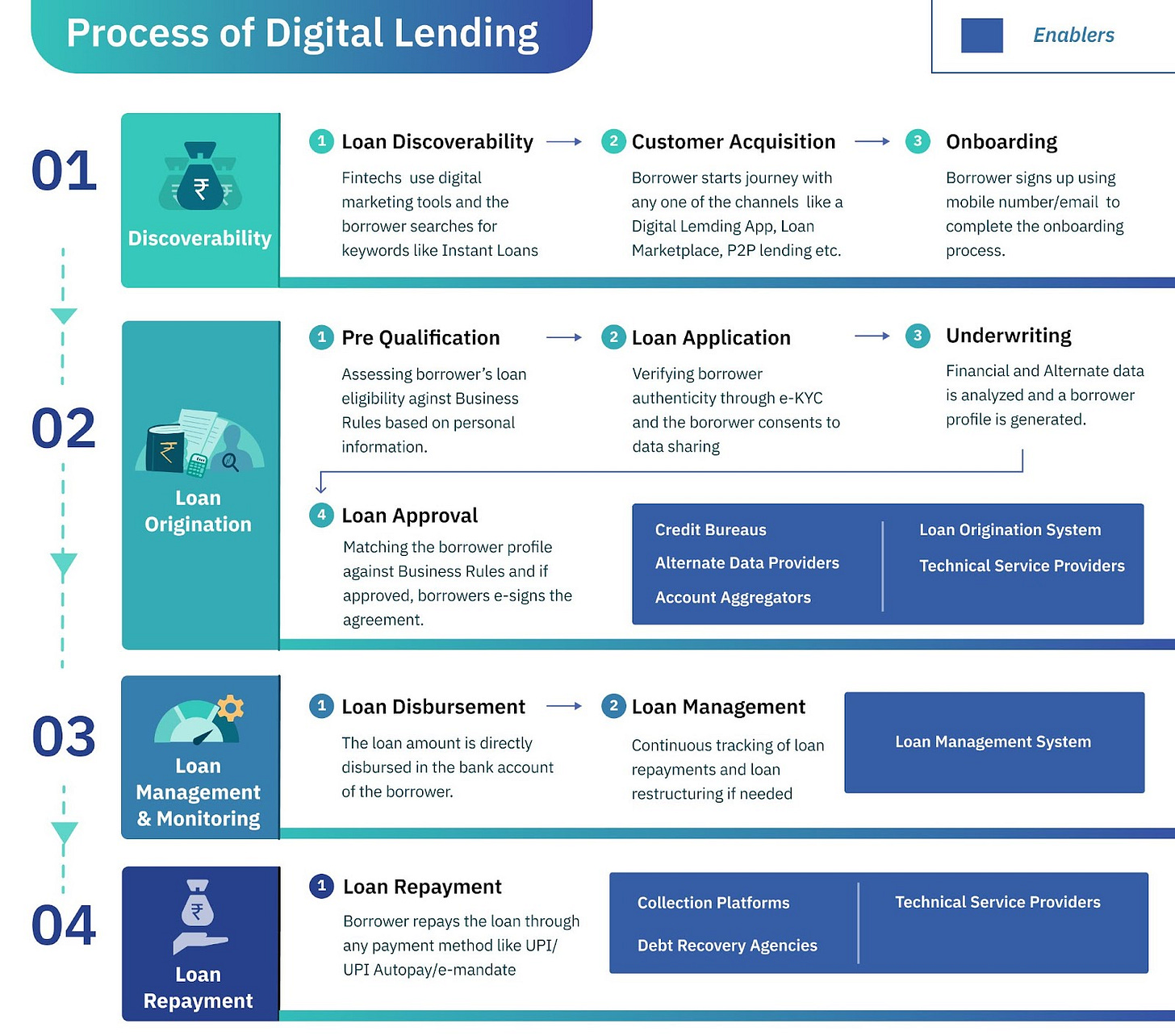

Stage 1: Loan Discoverability and Customer Acquisition

To acquire customers, fintech companies use marketing tools including SMS, emails, search engine optimization, online banners, and social media advertising campaigns. The process of discoverability in digital lending is influenced by the borrower's specific needs and motivations, leading them to various channels where they can find the most suitable loan products.

For more traditional loan products like salary loans and personal loans, standalone Digital Lending Apps like Moneyview, TrueBalance and Fibe are often discovered by searching for keywords like Instant Loan/Personal Loan. If the borrower intends to research to compare and find the best terms possible, they may use Loan Marketplaces including Paisabazaar and BankBazaar which present a variety of loans from different lenders. Search Engine Optimisation plays a key role here.

Embedded financing is discovered as part of the user journey within an app. For example, borrowers are drawn to Buy Now Pay Later Apps like Simpl and LazyPay for their ease and convenience, often discovering these options at the point of sale on e-commerce platforms or retail apps. Moreover, E-commerce, ride-sharing and food delivery companies including Amazon, Ola and Zomato provide financial services to their customers. It's like saying, "Hey, since you already enjoy shopping with us or taking rides, why not check out these other services we offer?"

Peer-to-Peer (P2P) lending platforms like Rangde and LenDenClub, become go-to places for those motivated by the possibility of obtaining loans with potentially lower interest rates and more flexible terms. These platforms are also increasingly becoming an attractive investment opportunity within Tier-1 geographies.

Once a suitable platform or app is found by the borrower, digital onboarding is done by these platforms. In the case of digital lending apps, it involves signing up and creating an account. However, it might differ in other channels like Loan Marketplace, Embedded Financing apps and P2P Lending Platforms.

Once the onboarding process is complete, the borrower proceeds to the loan origination stage.

Stage 2: Loan Origination

When the borrower applies for a loan through any of these apps/platforms, they determine the eligibility criteria, evaluate the user's creditworthiness based on data shared by the borrower and decide on the loan approval. It is facilitated with the help of Technical Service Providers (TSPs) and Loan Origination Systems (LOS).

TSPs are partner entities that provide technical services to streamline certain aspects of the loan origination process. For example, Setu - a TSP, provides E-KYC, Insights generation and E-sign services.

LOS provided by companies like Finbox and Fiserv are a suite of software tools which automate the process of loan origination to efficiently manage and streamline the entire lending value chain from pre-qualification all the way to credit assessment and credit decision.

Pre Qualification: Assessing the eligibility of the borrower

The app determines loan eligibility by collecting basic personal information and performing a soft credit check, enough to assess eligibility.

LOS efficiently automates this process and determines eligibility based on Business Rules. Business rules are a set of predefined conditions/criteria that help lenders draw inferences to arrive at a decision. For example, having a minimum credit score requirement for a borrower.

If found eligible, the borrower goes ahead to file the loan application.

Loan Application: Verifying identity and data sharing

To verify that you are a genuine borrower, they do a fraud check through Know Your Customer (KYC) process involving E-KYC/ Video KYC/ Aadhar-based KYC. In the case of E-KYC, the borrower provides identification details and relevant documents through the app itself. For Aadhar-based KYC, the borrower has to upload their Aadhar manually or it can be accessed through DigiLocker as well. It verifies identity via Aadhar-linked OTP. For Video KYC, the camera along with microphone access is often used for real-time document verification.

These apps may onboard TSPs for streamlining the verification process.

TSPs will provide ready-made Application Programming Interfaces (APIs) that are integrated into the app for successful verification of the customers.

LOS will automate and streamline the KYC process as part of the loan application workflow.

After successful KYC, the borrower consents to share financial data. This can be facilitated through integration with many entities including Credit Bureaus and Financial Data Providers which include Account Aggregators (AA) and Alternate Data Providers.

Credit Bureaus like TransUnion CIBIL, Equifax, and CRIF come up with neat, easy-to-understand credit reports and scores based on the management of previous/current loans, credit cards, and other financial obligations. However, a crucial caveat for new-to-credit or thin-file individuals is that credit reports might not reflect their entire financial picture, often omitting regular non-credit payments like savings, utilities or rent that could otherwise indicate financial reliability.

Financial Data Providers provide a deep dive into borrowers’ life sharing both financial and alternate data.

Account Aggregators, such as Setu AA and Finvu have streamlined the secure transfer of financial data from financial information providers to financial information users based on user consent. This is seen as the gold standard for sharing financial data.

Alternate Data Providers like JuicyScore and Satsure go beyond traditional financial metrics and tap into unconventional data sources like utility bill payments, rental histories, online shopping behaviours, etc. These data points are often used to complement or supplement traditional credit information to build a holistic view of a borrower’s creditworthiness.

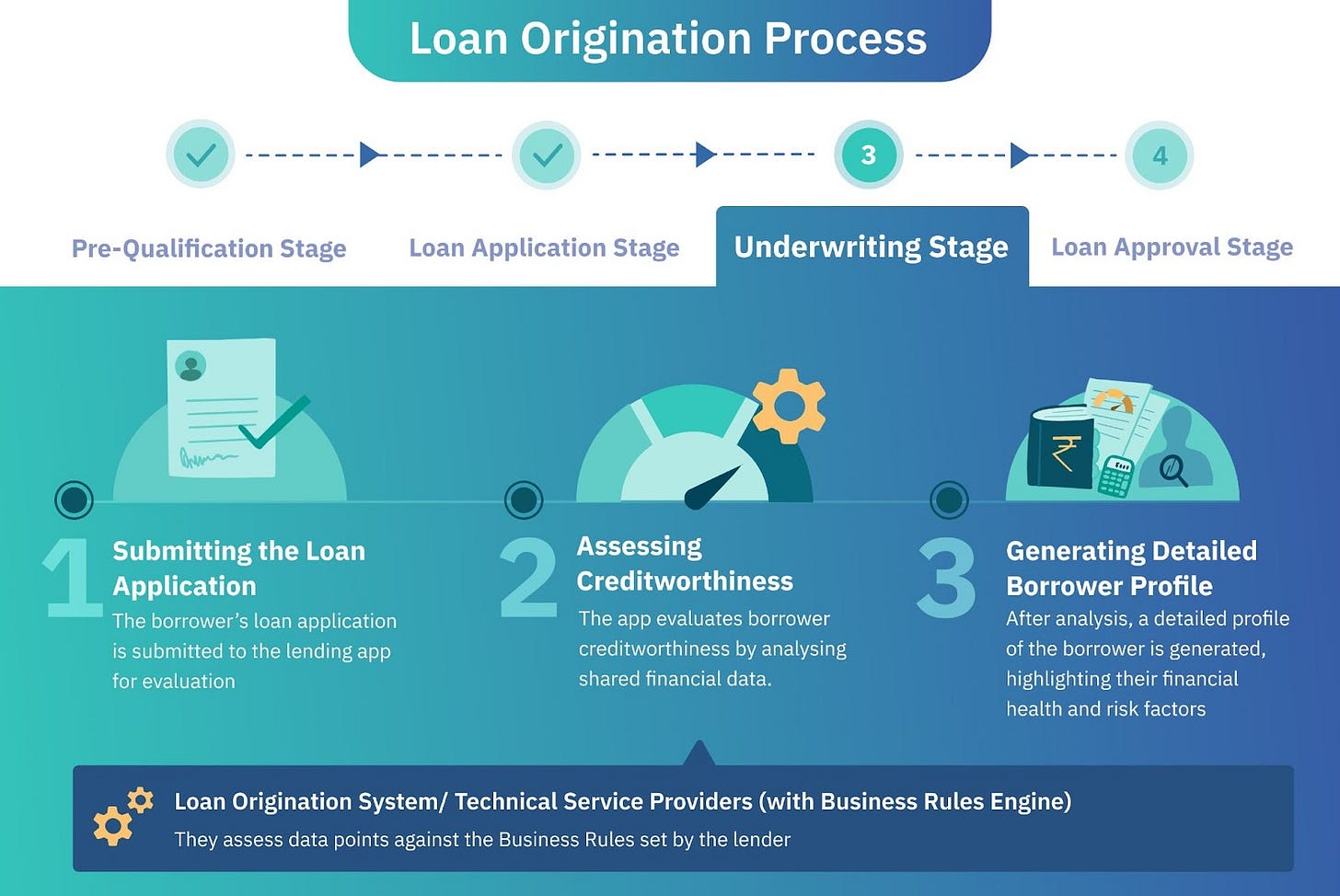

Underwriting: Analysing the data to assess the repaying capacity of the borrower

Once the data has been shared by the borrower, the next step is to analyze that data to determine the borrower's creditworthiness – ability to repay the loan in the future. This is known as Underwriting.

These apps may rely on internal analytics or LOS/ TSPs that provide Business Rules Engine (BRE) Services. The BRE is an automated credit decisioning system that assesses millions of data points against the Business Rules set by the lender and offers insights into borrower behaviour.

They evaluate credit reports from major bureaus and analyze bank statements and payment history. They calculate the Fixed Obligations to Income ratio (FOIR) to assess the borrower's ability to take on and repay new debt. They also analyze alternative data, like how fast someone fills out a loan application or their app usage, to decide on loan approval. For example, completing a loan form too quickly under 5 minutes or frequent gaming app transactions might flag a borrower as risky.

Based on these analytics, a detailed borrower profile is generated, summarizing the borrower’s financial health, risk factors, and creditworthiness. AI enhancements can significantly improve the credit decision-making at this stage.

Approval: Getting a Nod for the Loan

To further validate the borrower's information, the app might analyze social media profiles for employment verification. They may also ask for references from a few people for social verification.

The LOS matches the borrower's profile with the Business Rules, for example, ‘if bureau score > 650, then max loan value = ₹2,00,000.’ to come up with a loan decision.

If approved, the borrower instantly receives a loan offer with interest rate and repayment conditions. The borrower reviews the final loan agreement within the app and provides an e-signature to accept the terms and conditions.

TSPs like Setu facilitate the e-sign process, enabling users to securely sign documents online. They employ encryption to protect the integrity of the signed documents.

Once the agreement is signed, it concludes the loan origination stage.

Stage 3: Loan Management and Monitoring

It begins with loan disbursal directly to the bank account of the borrower. It ensures the borrower quickly gains access to the funds, facilitating an efficient process.

After loan disbursal, apps may use Loan Management System (LMS) software services from Core Platform fintechs, like Defi and Finflux, to manage the loan. LMS integrates with the apps' backend operations, automating the loan management process.

Tracking Information: It tracks all the loans in one place, due dates, repayments made, and outstanding balances, aiding in risk management. It helps to compute interest rates and repayment performance and generate monthly statements.

Account Maintenance: Based on tracking, it updates the borrower’s account information, including contact details, payment history, and any changes to the loan terms.

Reminders: Based on accounts, it sends automated reminders to borrowers about upcoming payments, improving the rate of on-time repayments.

Loan Restructuring: In case a borrower faces financial hardship or requires changes to their loan terms, these apps evaluate and implement loan modifications or restructuring options.

Customer Service: It provides tools for customer service teams to answer borrower queries and manage accounts effectively.

Stage 4: Loan Repayment

In this stage, fintech companies face challenges due to the need for personal interaction that has existed traditionally. Here, balancing automation with personalized service is crucial for managing repayments and addressing borrower issues.

When the payment of the loan is due, the borrower may hear from Collection Platforms that the app has partnered with to collect payments and recover dues.

Collection platforms like Moneytor, Spocto, and Credgenics send personalized reminders via multiple channels including WhatsApp messages, SMS and calls. They also streamline collections by supporting various digital payment methods, making repayment easier for borrowers. These companies also monitor borrower behaviour to calculate the probability of repayment on time and provide the best suitable collection strategy.

When borrowers fail to make timely payments, the lender communicates with the borrower to resolve payment issues and potentially initiate foreclosure or repossession procedures. They may take help from Collection Platforms and Debt Recovery Agencies to do it.

Debt Recovery Agencies, often including on-field teams, step in after initial attempts by the lender to recover dues have been exhausted. They use methods like calls and in-person visits to negotiate repayments. They ensure that lenders recover the entire amount or a portion of the outstanding debt, thereby minimizing financial losses.

These apps have made repayment of a loan seamless by incorporating various digital payment methods including automatic deductions from a bank account (e-mandate and UPI Autopay), online transfers, or even mobile payment apps.

TSPs may play a role depending on the preference of the lender. For example, the TSP may integrate the lender with the Bharat Bill Pay System (BBPS) so that the borrower can repay the loan through any of the mobile payment apps like Paytm, Phonepe etc, that they use.

As borrowers fulfil their repayment obligations, they not only conclude their current financial commitment but also build their creditworthiness for future needs, making this phase a crucial step in their financial journey.

Yet, the question remains: has fintech fully leveraged this opportunity to establish digital lending as a viable alternative to traditional lending solutions?

The total lending market in India as of March 2022 is at ₹174.3 Lakh Crores2. Fintechs have been able to increase their share across categories, particularly personal loans. They held a 47% market share in the personal loan sector in 2023, up from 13% in 2018. In loans with a ticket size of less than ₹1 lakh, fintechs’ share has reached 73% in 2023 from 45% five years ago3. In the backdrop of progress, fintech lending is projected to exceed traditional bank lending by 20304.

These fintech companies are transforming the lending landscape by being inclusive and faster than ever before.

Leveraging their achievements, fintechs are now uniquely positioned to unlock even greater opportunities in enhancing and expanding India's digital lending ecosystem.

On average, Indian millennials spend about 17 hours online weekly with 11% of time spent on banking including transactions5. It aligns perfectly with the strengths of fintech companies, which offer innovative, user-friendly digital lending solutions that can be accessed anytime, anywhere.

However, there are challenges. Given their focus on customers with limited credit history, fintechs face higher default risks. Recent regulatory changes by the Reserve Bank of India (RBI), such as the increased risk weights on unsecured loans, reflect growing concerns around unsecured lending. Incidents like the actions against IIFL Finance highlight the imperative for fintechs to practice prudent lending and adhere to regulatory compliances, underscoring the RBI's focus on financial stability.

As fintechs in India steer through these complexities, they are pivotal in transforming the credit landscape—making credit more accessible, and thereby fostering economic growth and financial inclusion. This evolution in digital lending is not only noteworthy but essential to monitor.

In upcoming blogs, we will delve into the intricacies of digital lending, beginning with the diverse business models that drive this industry.

Here’s a recap of the entire process of digital lending from loan discoverability and customer acquisition to loan repayment.

https://www.experian.in/wp-content/uploads/sites/27/2023/09/Experian_White-Paper_Fintech-led-Digital-Lending.pdf

https://www.crifhighmark.com/media/3115/how-india-lends-fy2023.pdf

https://bfsi.economictimes.indiatimes.com/news/fintech/about-350-billion-loans-disbursed-digitally-in-india-fintechs-emerge-big-lenders-in-last-two-years

https://www.cafral.org.in/sfControl/content/NewsEvent/CAFRAL_Report.pdf

https://www.experian.in/wp-content/uploads/sites/27/2023/09/Experian_White-Paper_Fintech-led-Digital-Lending.pdf

All designs by Himanshi Parmar and Wamika Das.