Transforming Credit Access with Digitized Life Insurance Policies

This article explores how digitized financial assets like life insurance policies can enable credit access for underserved households, offering affordable liquidity and building credit profiles.

Please take a moment to meet these hard-working individuals from different walks of life in India…

Whilst these people are vastly different in their professions, age, gender, income (the range is from INR 3L to INR 15L per annum) and where they hail from, they are all representative of “middle India”. Their financial experiences unite them; they are all:

Thrifty, and prioritise savings each month

Conservative, in their asset choices, trusting life insurance, fixed deposits, PO Savings, voluntary PF and gold over market-linked or riskier instruments

Aspirational, with a focus on long-term goals such as better homes, education, marriage, and their own businesses.

Liquidity-seeking, as they are underserved or have an entry barrier into formal credit, they choose savings instruments that can be liquidated, pawned or that offer partial withdrawals to meet short-term needs

This last point is particularly interesting. Despite a high level of financial inclusion and use of formal savings and investment instruments, they struggle to access adequate, or in some cases any, formal credit given their credit profiles or lack thereof. To access funds, therefore they1:

Make-do amongst friends and family or explore the informal, expensive credit market

Liquidate assets, often at a loss: premature exit of FDs, life insurance, sale of gold

Use risky instruments such as informal community chits2 just to have liquidity optionality

The market

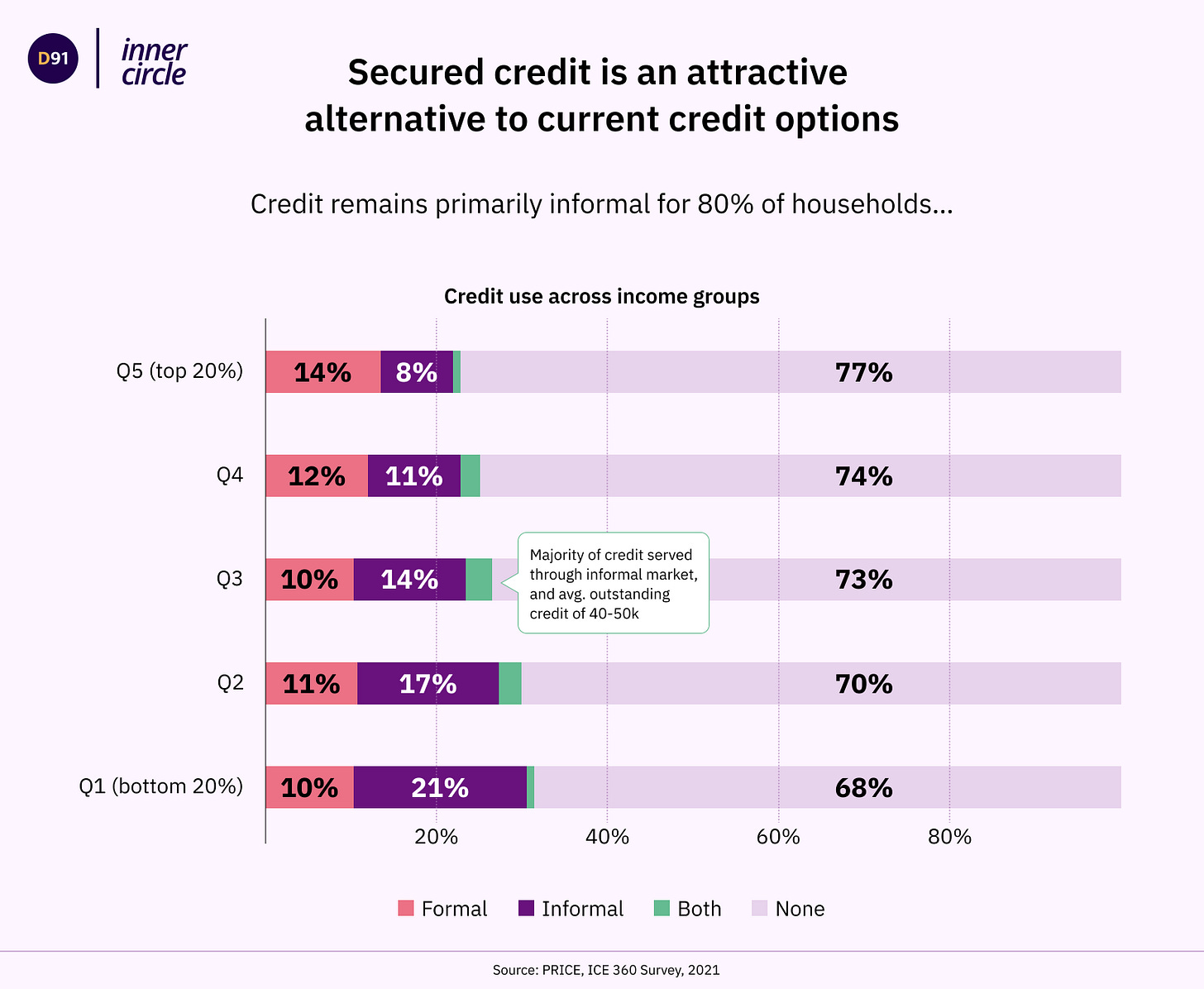

In India, 70% of adults either don’t have a profile on credit bureaus or have thin files on bureau3. Formal salaried employment makes up just a quarter of all jobs in the country. Yet, the eligibility criteria for a bureau profile is having a bank or NBFC loan or a credit card history. These in turn typically require a bureau profile and/or a salaried job with a company of a certain vintage and size, often making it a circular reference. In this context, the traditional approach to lending against salary slips and bureau scores doesn’t work for the majority.4

Whilst much progress has been made by fintechs over the last decade in building digital user-friendly loan journeys and using alternate underwriting models to enable quicker credit decisions for more customers, the average cost of a digital fintech loan remains 25%5. This is similar to the price at which microfinance institutions were able to include new-to-credit borrowers starting in the ‘90s using joint liability.

To both bring down the cost of credit and widen the credit access net to millions more we need to look at other entry points for formal credit.

Household savings are increasingly financialized - over 34% of household savings are now held in financial assets6. As reflected in the portfolios of Paroma, Sameer, Krishna, Abhijit and others, many employees and micro and small business owners, who don’t have credit scores or formal salaried jobs, do hold financial assets. Whilst physical assets such as land, property and gold have been extensively leveraged, these financial assets hold untapped potential and once digital could be a more scalable solution. For this reason, we believe leveraging these existing financial assets holds the key to affordable credit access and building credit profiles for the next 100mn households.

Loans against Life Insurance

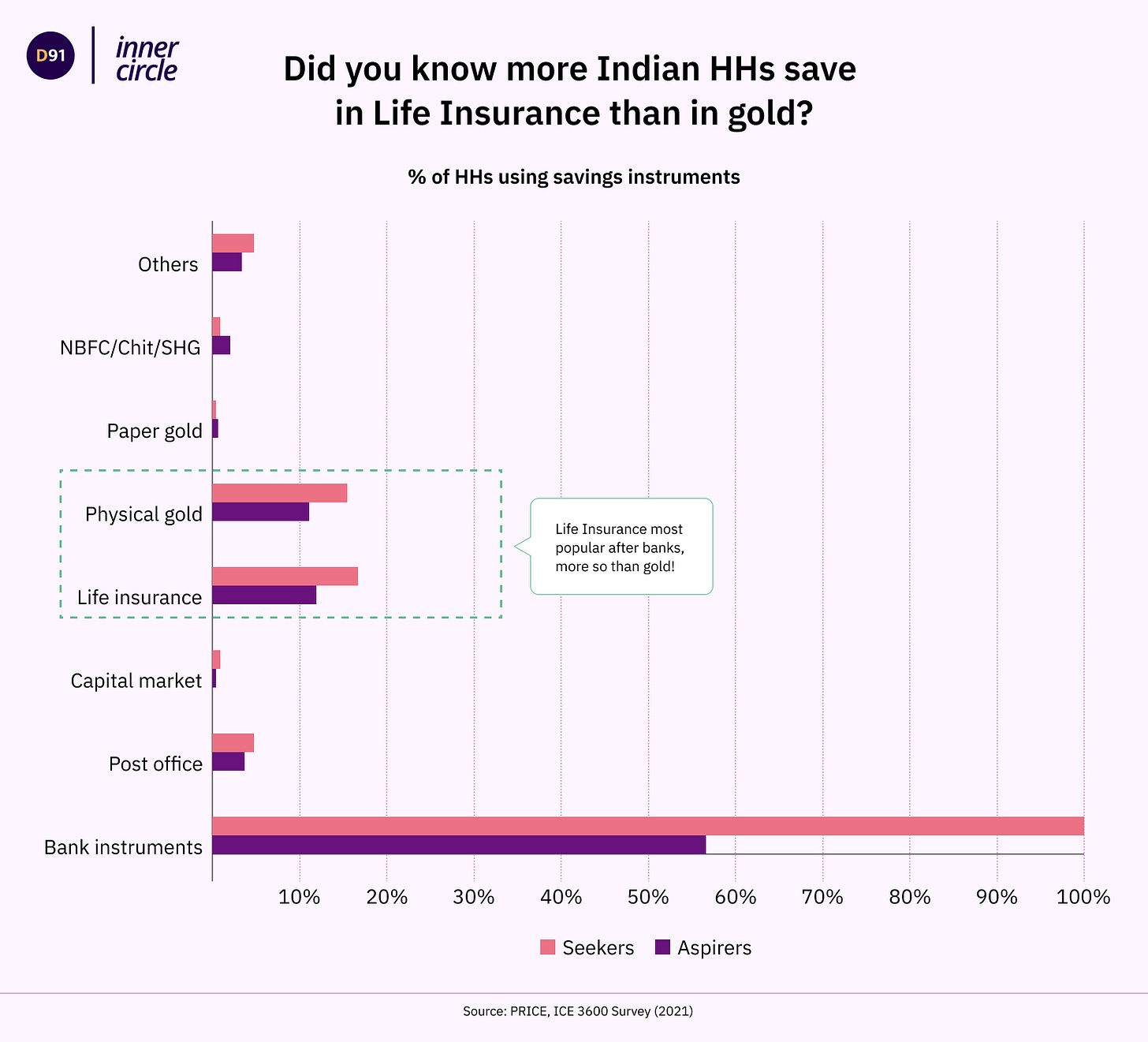

Life insurance is an interesting financial asset class to start with, for a few reasons. The first is that it’s a large and popular asset class: with over 400 million active policies and 29 lakh active agents selling them, 40% of households in India hold at least one policy7. Unlike many other assets, 34% of active policies are held by women. As it’s a trusted savings instrument, there is almost as much in assets under management in life insurance as there is in mutual funds in India. According to the 2023 PRICE survey, middle-income households have a slightly higher propensity to save in life insurance than in gold!8

The second is that these instruments are typically long-term contracts, often with terms anywhere from 10 years to whole life. Breaking these contracts to finance a liquidity need thus attract severe penalties, even more than 70% of paid-in capital in the early years of a policy, leave alone any accrued interest. Despite this, 50% of all life insurance policies in India are either lapsed or surrendered within 5 years of commencement. In the year that ended in March 2023 alone, INR 2 Lakh Crore was the value of surrendered policies9.

Finally, the time is right to digitise this asset class now, with alignment across key stakeholders:

Regulators: Digital public infrastructure makes data for underwriting and risk management digitally available and regulatory changes from 1st April 2024 mandate that policies are issued and held digitally

Consumers: are more digital than ever before, with over 400mn UPI users

Life insurance industry: the structural shift underway favours a climate of innovation

So how does it work?

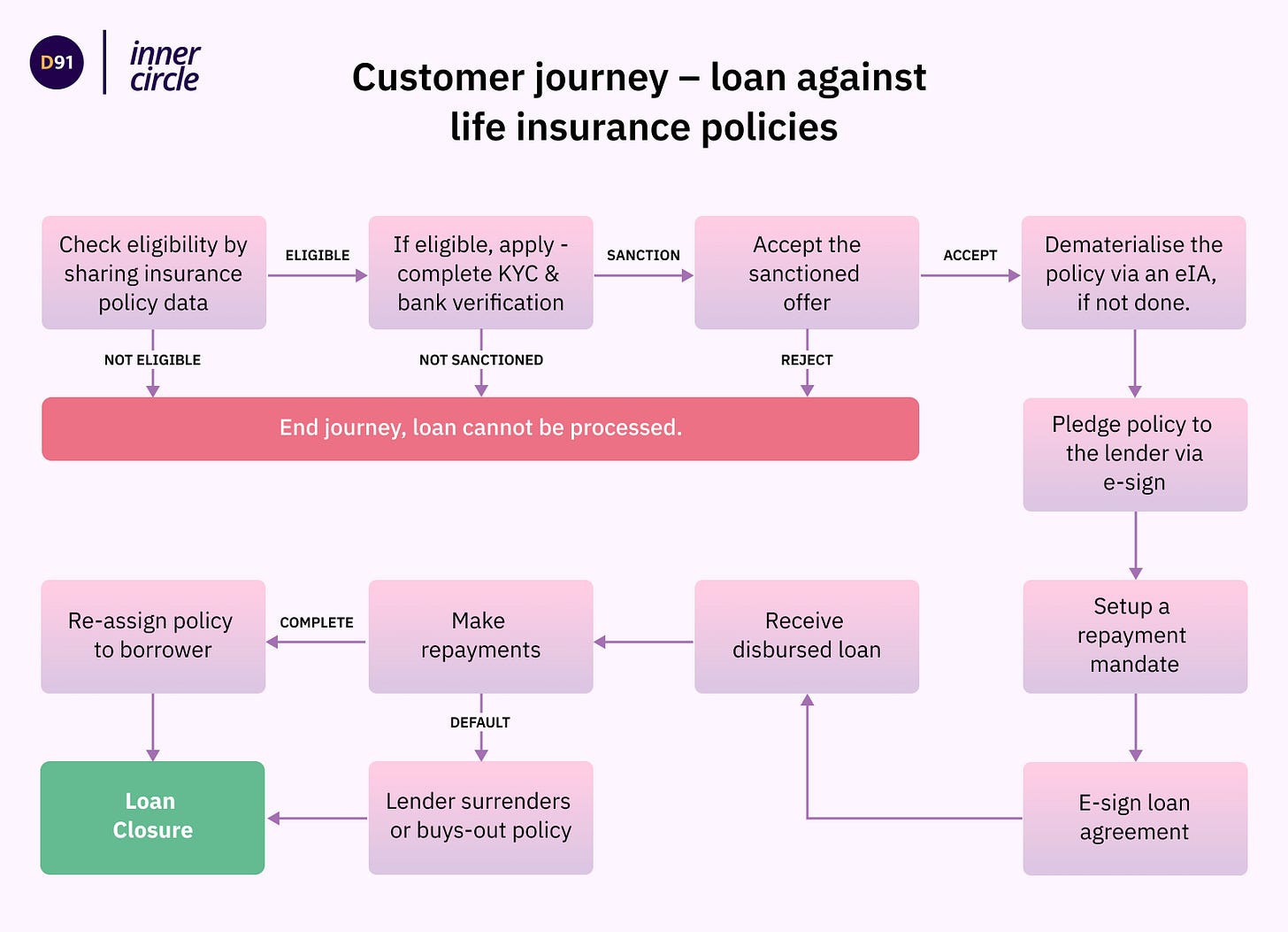

This is a loan against what is known as the surrender value (SV) of a policy. This is the value that the insurer will pay out if a policyholder chooses to exit the policy part-way through the contract.

The SV is determined by various factors, including the type of the policy, premium amount paid, duration for which the policy has been active, term of the policy, bonus accrued and specific terms and conditions of the insurance policy. The delta between the current value of a policy and the SV can be extremely high, making leverage a way to optimise the financial outcomes for the customer.

Historically, lenders and insurers who offer loans against life insurance policies require multiple forms to be filled in, branch visits to the lender and the insurer, and 7-15 days to process the application. This has meant that these loans are unviable at small ticket sizes, leading to a high rejection rate at banks and low awareness of the option; less than 1% of outstanding life insurance policies have been leveraged to date.

With digitisation, this changes. By giving the lender consent, the customer may share up-to-date information on their policies, upload supplemental data and get a credit decision in real-time. The digital process of pledging life insurance as collateral will utilise mobile OTP-based consent, enabling a lender to then have the security to issue a loan agreement. Similarly, at the end of the loan, if all repayments have been cleared, the lender can issue a “no objection certificate” digitally, enabling the lenders to un-pledge their policies. In the event of a default too, lenders can request recovery from the asset.

Products like this open up possibilities for the underserved. For Abhijit, this could have saved him over 2 lakhs in interest paid at 25% instead of ~12% for a few years. For Sameer, it could have avoided premature exit of his FDs to fund his son’s college, and Paroma could have accessed working capital for her business. Krishna could build a credit profile with a loan against his life insurance policies and then qualify for a home loan.

Over INR 240 Lakh Crore is now held across life insurance, mutual funds, fixed deposits and Post Office and Small Savings schemes in India, and less than 1% of the AUM across these asset classes have been leveraged to date. Aside from equity mutual funds, lenders are comfortable with up to 90% loan-to-value ratios, as the underlying assets are largely government securities, bank deposits or corporate debt. As these asset classes digitise, there’s a tremendous opportunity to enable leverage and thus alternate, efficient sources of liquidity to meet goals and gain formal credit access for millions in middle India.

All flowcharts and graphs are created by the authors. Design by Smriti Krishna.

Mera Kal, a fintech working on secured lending against financial assets for middle India, conducted primary research, which also aligns with Ignacio Mas’ work on Liquidity Farming: How the Poor Cultivate Relationships to Create Sources of Future Cash https://nextbillion.net/liquidity-farming/

The informal market for chit funds is estimated to be up to 40x the size of the formal market, thus the risk in the asset class is high, with as many as 18mn estimated to have lost 2 Lakh Crore to date. Source: Economic Times, Nilesh Shah, MD Kotak AMC. https://economictimes.indiatimes.com/markets/expert-view/not-banks-chit-funds-ponzi-schemes-are-svb-of-india-nilesh-shah/articleshow/98599576.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

Transunion CIBIL 2021 data, Empowering Credit Inclusion: A Deeper Perspective on Credit Underserved and Unserved Consumers (https://newsroom.transunioncibil.com/more-than-160-million-indians-are-credit-underserved/)

Majority of credit for middle and low-income India is informal as seen in the research by PRICE, ICE 3600 Survey (2021)

Experian, Small is Big: How Fintechs are Revolutionising Lending, 2024

RBI FY’23 data on household assets in India

CMIE Consumer Pyramids Data, Q1 2023

ICE 3600 Survey (2021), PRICE

IRDAI Annual Report, 2023