Streamlining B2B payments for businesses: How Bharat Connect B2B reduces friction and eases payments

What if Tally could talk to Zoho to exchange invoices, and make payments? Read to learn how Bharat Connect B2B can help create this ecosystem of interoperable ERPs for B2B payments.

Amit, a supplier for FMCG products to Bangalore’s kirana stores, negotiates quotes with multiple buyers and follows up for payments through calls and WhatsApp messages. Despite having an ERP software that generates invoices and accepts payments, he often uses manual processes since most of his buyers either use a different ERP software or use spreadsheets to manage their accounts.1

In India, business-to-business (B2B) payments are often patchy as both parties use different solutions to raise invoices or prefer different payment methods. Typically, there are three types of retailers: unorganized retail (small-scale independent shops), organized retail (franchise/retail chains), and e-commerce retail. While most B2B payments in organized retail are digitized and synchronised (since the buyers and sellers use the same ERP software), payments made by buyers in unorganized retail and e-commerce retail are partially digitized and remain fragmented (since each of the parties may use different ERP softwares).

What does the current B2B payments landscape look like?

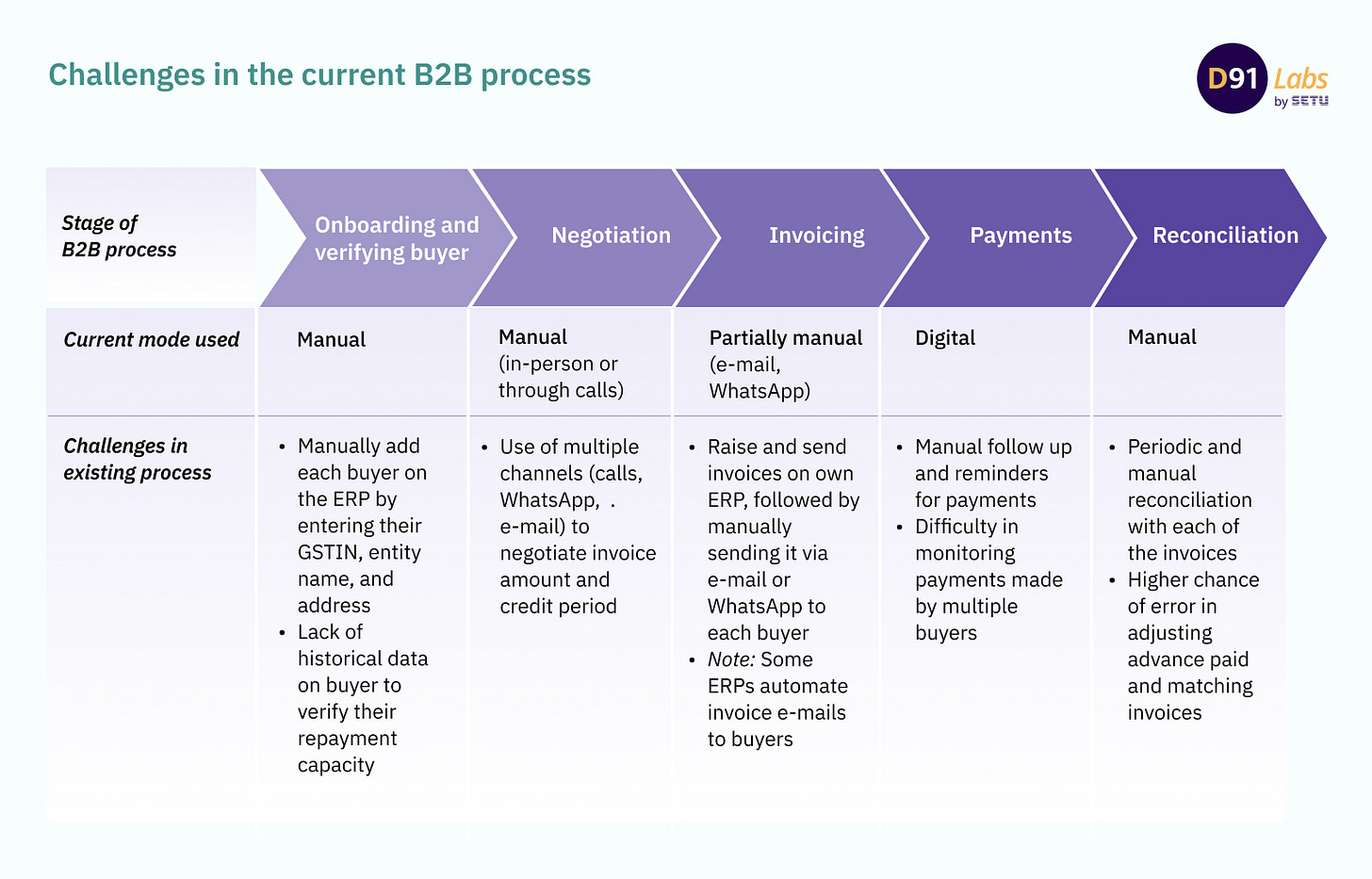

The B2B process begins with onboarding supplier or buyer details on the ERP, followed by exchange of goods or services, invoicing, payment, settlement, and reconciliation. Generally, a buyer sources goods or services from multiple suppliers that may use different, and sometimes local ERP software. Each of the stages in the B2B workflow require some form of manual intervention which makes the journey tedious and lengthy for the buyers as well as suppliers.

While raising the invoices and reconciling transactions through the ERP software is automated to some extent, entering the bank account details of the supplier, negotiating the invoice amount, deciding the credit period, making the payment, and sending confirmation of the payment is often a manual process. This is mainly due to the use of different platforms and tools, broken dashboard view, and hence the difficulty in tracking and monitoring payments made to each supplier.

Understanding the supplier’s PoV

Let’s take the example of Amit’s B2B journey when he deals with a buyer. If the buyer is new to him, he needs to manually enter his details onto the ERP software, and has limited means to verify the buyer’s credentials. Once he onboards a buyer, he takes a call on the credit period and invoice amount through multiple calls and messages exchanged over e-mail and WhatsApp. Then, the goods are sent and the invoice is raised on the ERP software. Amit calls the buyer for bank account credentials to match it to the invoice for reconciliation later. Finally, once he receives the payment, he sends the invoice to the buyer through e-mail. This is the level of effort he needs to make to coordinate with just one buyer. Add another dozen buyers to the mix, and most of Amit’s day is spent in coordinating and following up on payments.

How does Bharat Connect’s B2B solution help in resolving a supplier’s challenges?

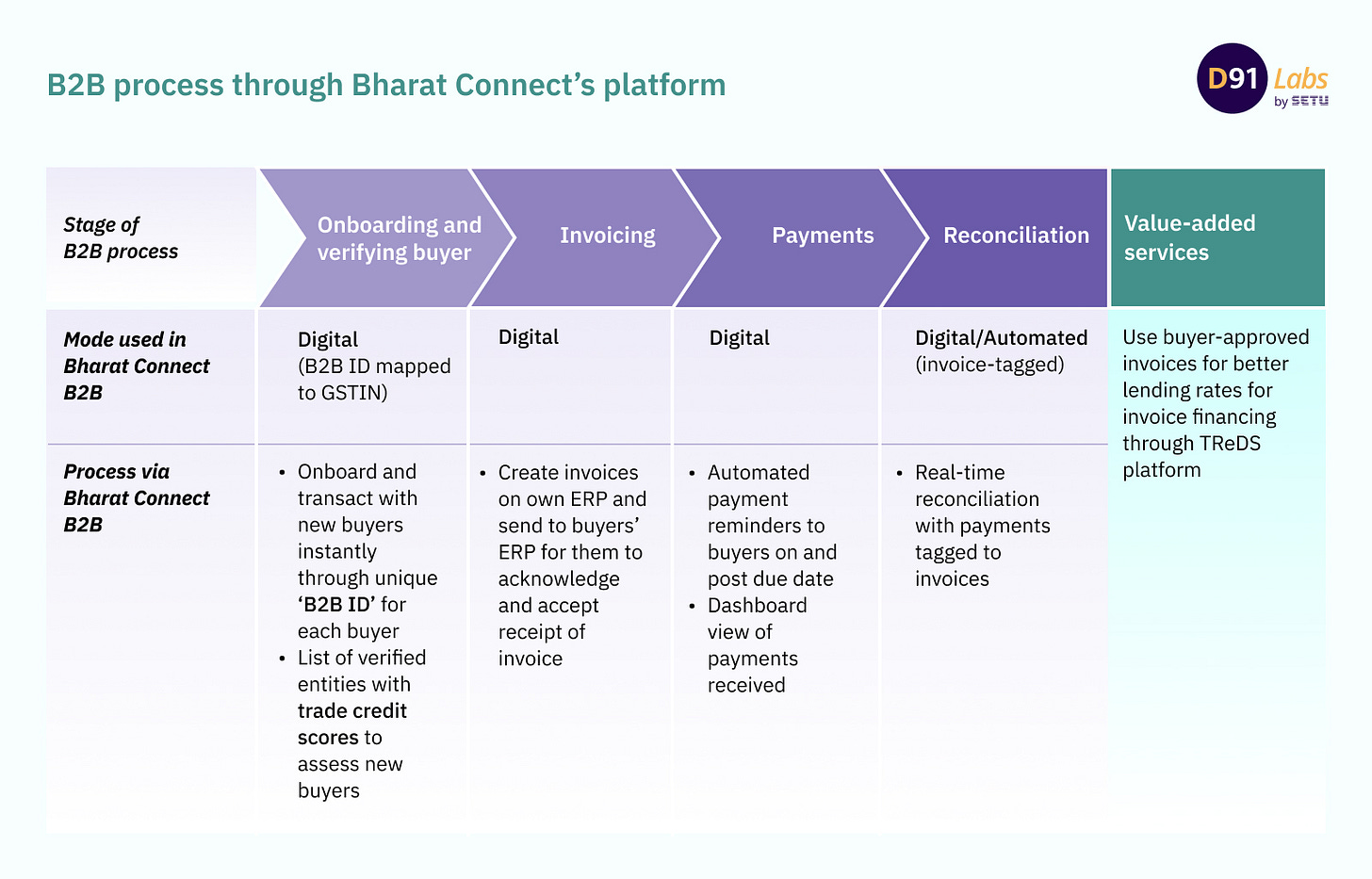

With Bharat Connect’s B2B payment solution, Amit’s B2B workflow becomes fairly simple. Here’s how different features of the solution can ease the process for suppliers like him:

Bharat Connect’s B2B is interoperable across ERP software: This means he can raise invoices, receive payments, and reconcile transactions across buyers on his ERP software, irrespective of the accounting tool they use.

Verified list of entities with trade credit scores: Instead of relying on recommendations from other buyers or word-of-mouth, Amit can assess new buyers through Bharat Connect’s trade credit score. He can decide on the amount and period of credit that he can offer to a given buyer and reduce the risk of default.

Automated payment reminders: Amit would no longer need to follow up on calls and messages with multiple buyers for payment dues. He can set up automated collection reminders through his ERP software on due dates, and send follow up reminders post the due date.

Integrated payment modes and ease of reconciliation: Instead of manually reconciling each of the invoices with the payments made by the buyers, payments received in the account linked to the Bharat Connect B2B platform are automatically reconciled and tagged to the invoice on the ERP software.

What was once a fragmented and partially manual process, is now streamlined and frees up the supplier’s time to focus on growing his business.

What is the process flow and who are the key players in the Bharat Connect B2B solution?

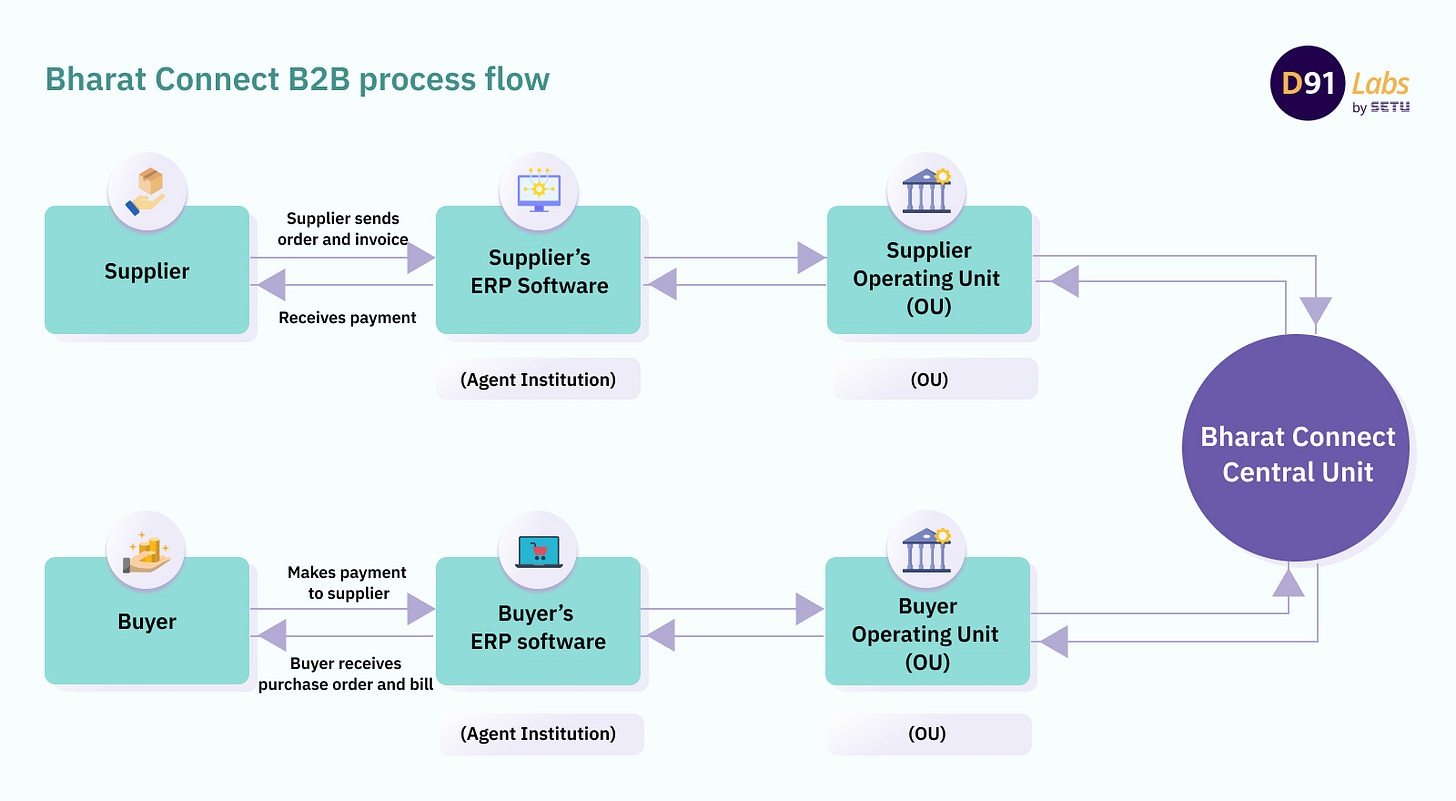

Bharat Connect’s current process flow for bill payments and collections (person-to-merchant transactions) is an interoperable network that connects banks, third-party payment applications, billers, and end-users. Using the tenets of the same architecture, Bharat Connect has developed the B2B platform.2

The ecosystem players involved in facilitating a B2B transaction through the Bharat Connect B2B platform are similar to the players currently engaged in bill payments and collections (P2M transaction) facilitated by Bharat Connect (erstwhile Bharat Bill Pay). There are four key players on the Bharat Connect B2B platform:

Bharat Connect Central Unit (CU): It provides the governing and operational standards for the transactions and functions as the central switch.

Operating units (OUs): They are regulated financial intermediaries that onboard and connect the buyer and seller to the CU. They are responsible for facilitating the payments, and clearing and settlement of transactions.

Agent Institutions (AIs): This is the customer facing interface (the ERP providers) through which the supplier raises invoices and receives confirmation of payments on their own ERP software, and the buyer receives invoices and makes payment through their ERP software.

Technology Service Providers (TSPs): The TSPs provide the technical infrastructure, such as APIs, integration tools, and support for the OUs and AIs to connect to the Bharat Connect B2B platform. They handle integration, certification, maintenance, and ongoing enhancements of the technology stack.

How can ecosystem players benefit from Bharat Connect B2B?

B2B payments in India comprises more than USD 6 trillion transactions by value on an annual basis. While many of these transactions are digitized, they are fragmented and involve manual processes that can be streamlined through Bharat Connect’s B2B solution. Considering the early adopters that already use digital modes for payments and invoicing across their value chain, Bharat Connect B2B players can tap into USD 250 billion transactions annually.3

Currently, nine ERP providers are live on Bharat Connect B2B among which some of the providers (such as Zoho) have an OU license as well. In April 2025, Axis Bank became the first bank to go live on the platform.

What are the target segments with high potential for uptake of the platform?

The Bharat Connect B2B platform focuses on digitizing B2B payments, but a key part of the offering is also to streamline each of the stages involved prior to and post a B2B payment. Form factor is an important aspect of uptake of this solution, which means that it is important to understand whether most businesses use mobile phones, desktops, or a combination of the two for B2B payments. Also, what payment mode do they prefer to use: NEFT, UPI, cards, or cash?

The platform aims to reach businesses where they raise the invoice, reconcile their transactions, and maintain their books: the ERP software. Typically, medium to large enterprises in India actively use ERPs and have digitized most of their payments. As a result, they would most likely be the early adopters of the solution.

What’s next for B2B payments in India?

Bharat Connect’s B2B platform can help make domestic B2B payments seamless, but cross-border B2B payments are still tough to crack as they are often slow, costly, and complicated. As Bharat Connect works on linking the foreign exchange solution, Fx Retail for mobile applications, integrating it with the B2B platform can help make it easier for businesses to send and receive money internationally.

As the B2B platform evolves, the trade credit scores assigned to businesses and the history of transactions can provide better access to affordable credit for medium to small scale enterprises.

An ERP (Enterprise Resource Planning) software helps manage different parts of the business (such as finance, supply chain, product) through an interconnected database of business applications that ease each of these functions. Some of the prominent ERP software providers include Tally, PayMate, Zoho, and EaseBuzz.

Process flow visualization is based on the brief by an ERP provider onboarded by Bharat Connect B2B and NBBL’s presentation on the solution.

As per Bharat Connect’s analysis, B2B transactions in FMCG, pharmaceuticals, automobile components, and agricultural inputs could be the early adopters of the solution.

All artworks are designed by Smriti Krishna.

If you enjoyed reading this blog and would like to receive more such articles from D91 Labs, please subscribe to our blogs here.

To read more about our work, visit our website