Outsmarting Fraudsters in Digital Lending: Detection and Mitigation Strategies for Lenders

Part 2 of our blog maps how digital lenders are using AI, analytics, and collaboration to combat fraud, ensuring security while maintaining seamless UX in a rapidly evolving threat landscape.

We’ve all heard the saying… ‘Prevention is better than cure.’ It’s the golden rule repeated through the COVID-19 pandemic… masks, sanitizers, and social distancing all became our armour against an invisible enemy. In the world of digital lending, this wisdom is just as vital. With fraudsters growing more inventive by the day, a single unchecked scam can snowball into crores of losses, bad loans, and eroded trust. It’s no surprise, then, that the global fraud detection and prevention market, valued at $ 43.97 billion in 2023, is set to skyrocket to $ 255.39 billion by 20321. Let’s explore how some of these tools and strategies work in practice.

A. Identity Verification and Authentication

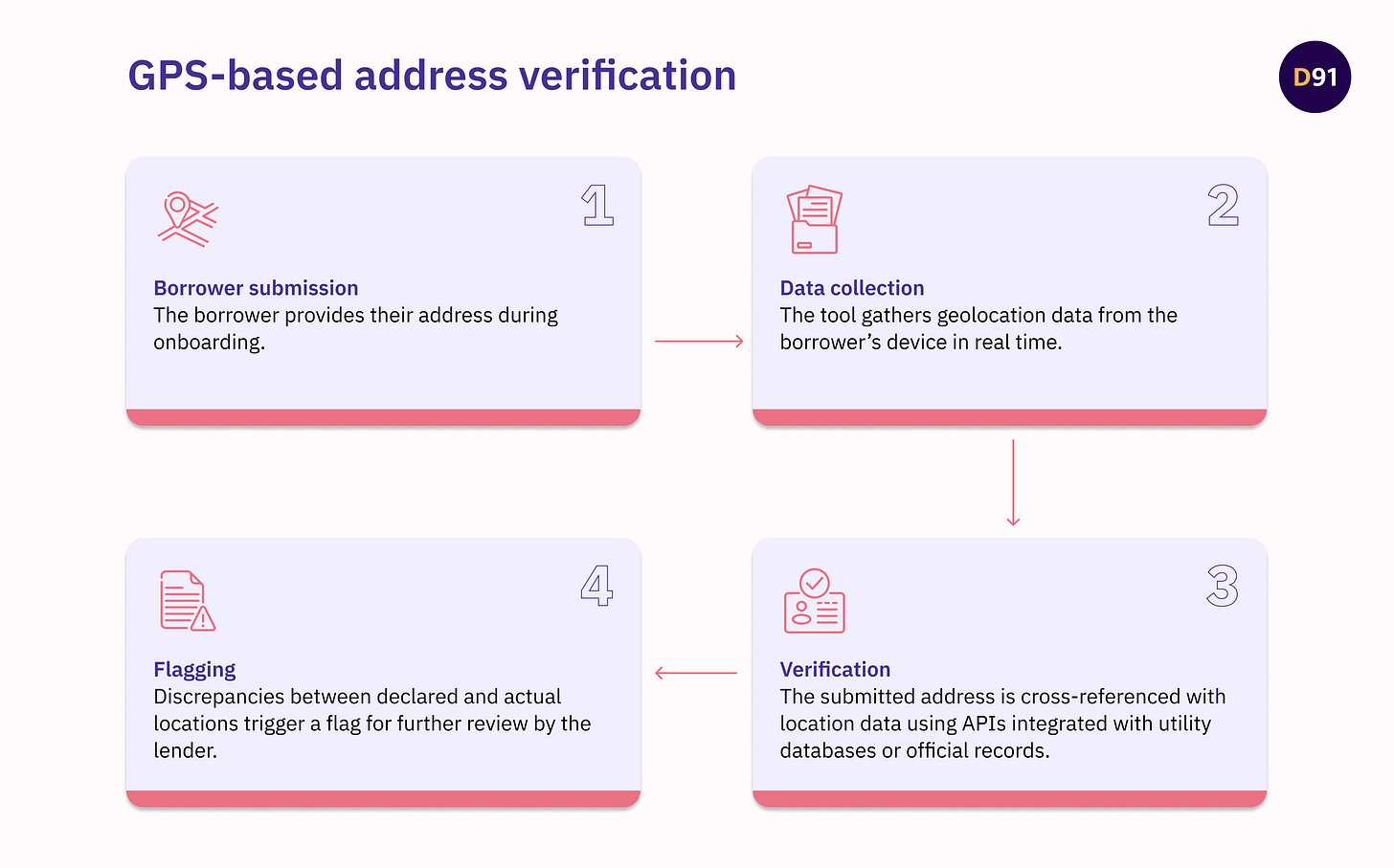

One of the first defenses against fraud is ensuring borrower authenticity during onboarding and other stages of the lending process. Identity verification tools combine advanced technologies to tackle common threats like identity theft, synthetic profiles, and false addresses2.

AI/ML-Based Document Validation: These tools analyze submitted documents for inconsistencies, flagging falsifications.

Biometric Verification: Fingerprint or facial recognition ensures that the person applying is genuine, adding another layer of security.

Device Integrity Checks: These detect attempts to tamper with or spoof devices during the application process.

Cross-Referencing with Databases: Public database APIs (such as Aadhaar or utility records) validate applicant information for enhanced accuracy.

B. Data Integrity and Verification

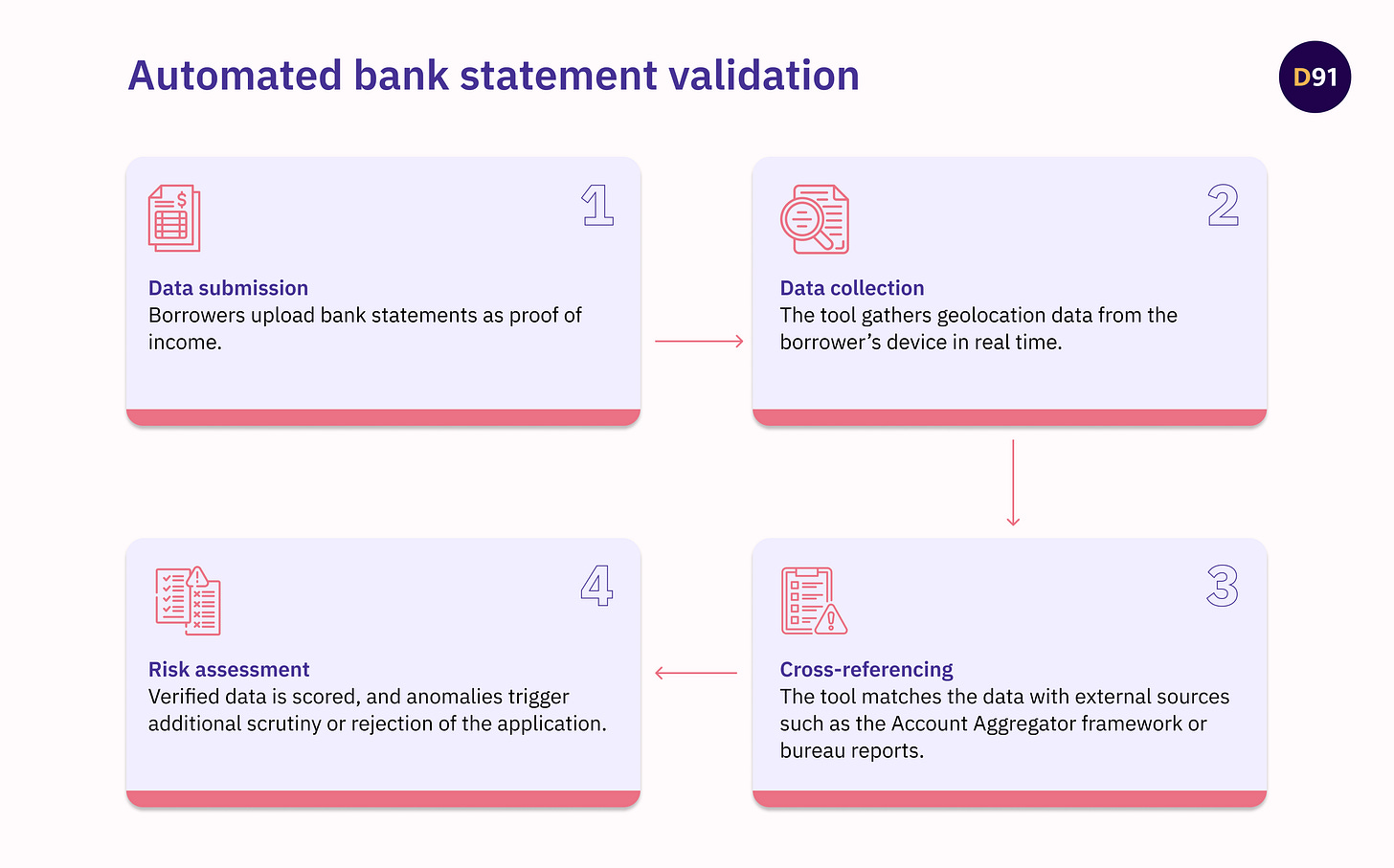

Data manipulation, such as falsifying financial details, is a significant fraud vector during underwriting. Ensuring the accuracy and integrity of submitted data is crucial for lenders to assess creditworthiness effectively.

Tamper-Proof Document Verification: Tools detect alterations in uploaded documents, ensuring the data remains trustworthy.

Account Aggregator Integration: Real-time bank statement validation ensures income and expense data is accurate, reducing dependency on self-reported figures3.

Bureau Data Checks: Employment and credit history verification helps identify fabricated details.

C. Behavioural and Predictive Analytics

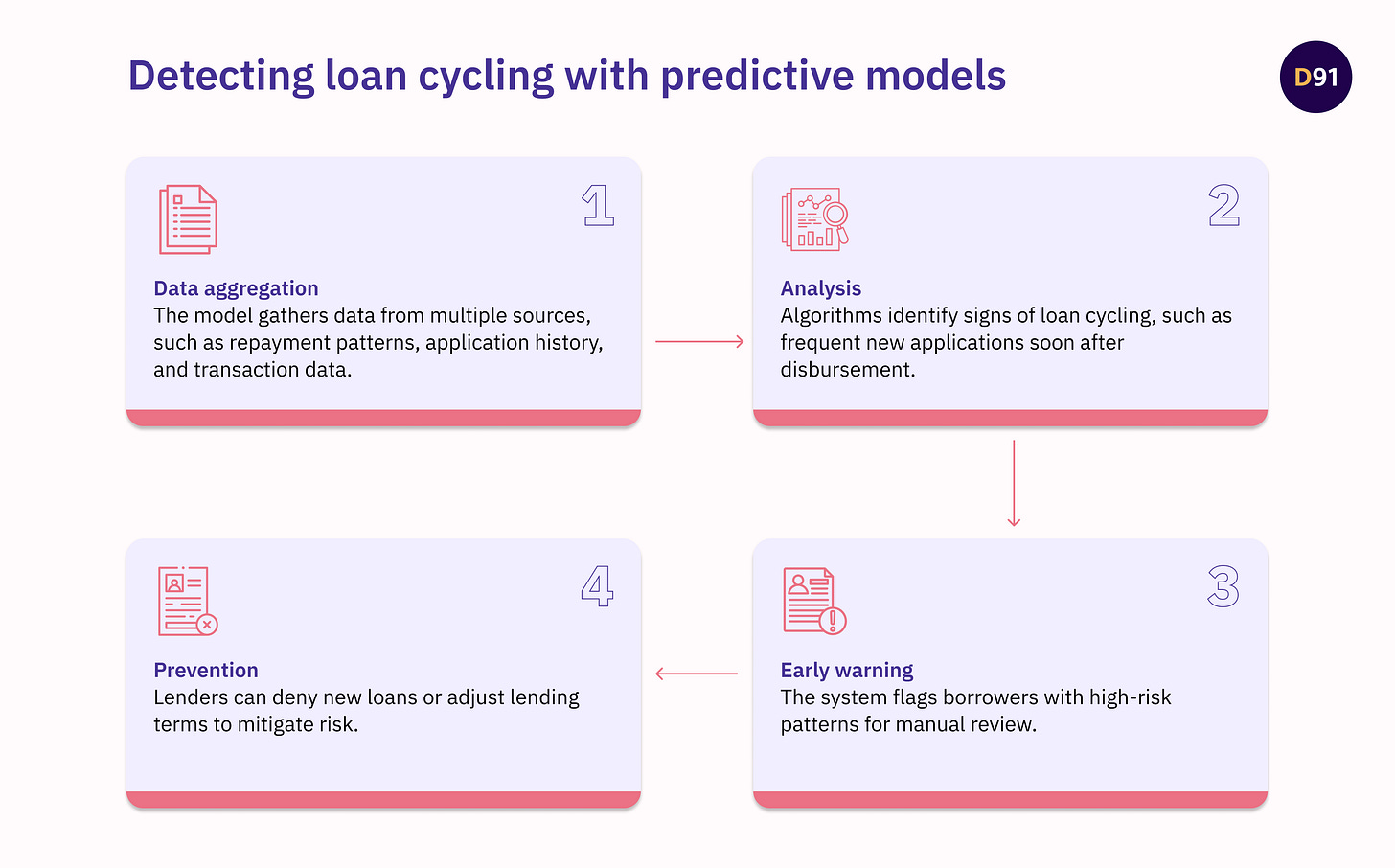

Fraudsters often exhibit patterns that deviate from typical borrower behaviour. Behavioural analytics, coupled with predictive models, helps lenders proactively identify such risks.

Behavioural Scoring Models: Analyze repayment patterns to detect anomalies.

Predictive Analytics: Leverage historical and real-time data to identify early warning signs of delinquencies or fraud.

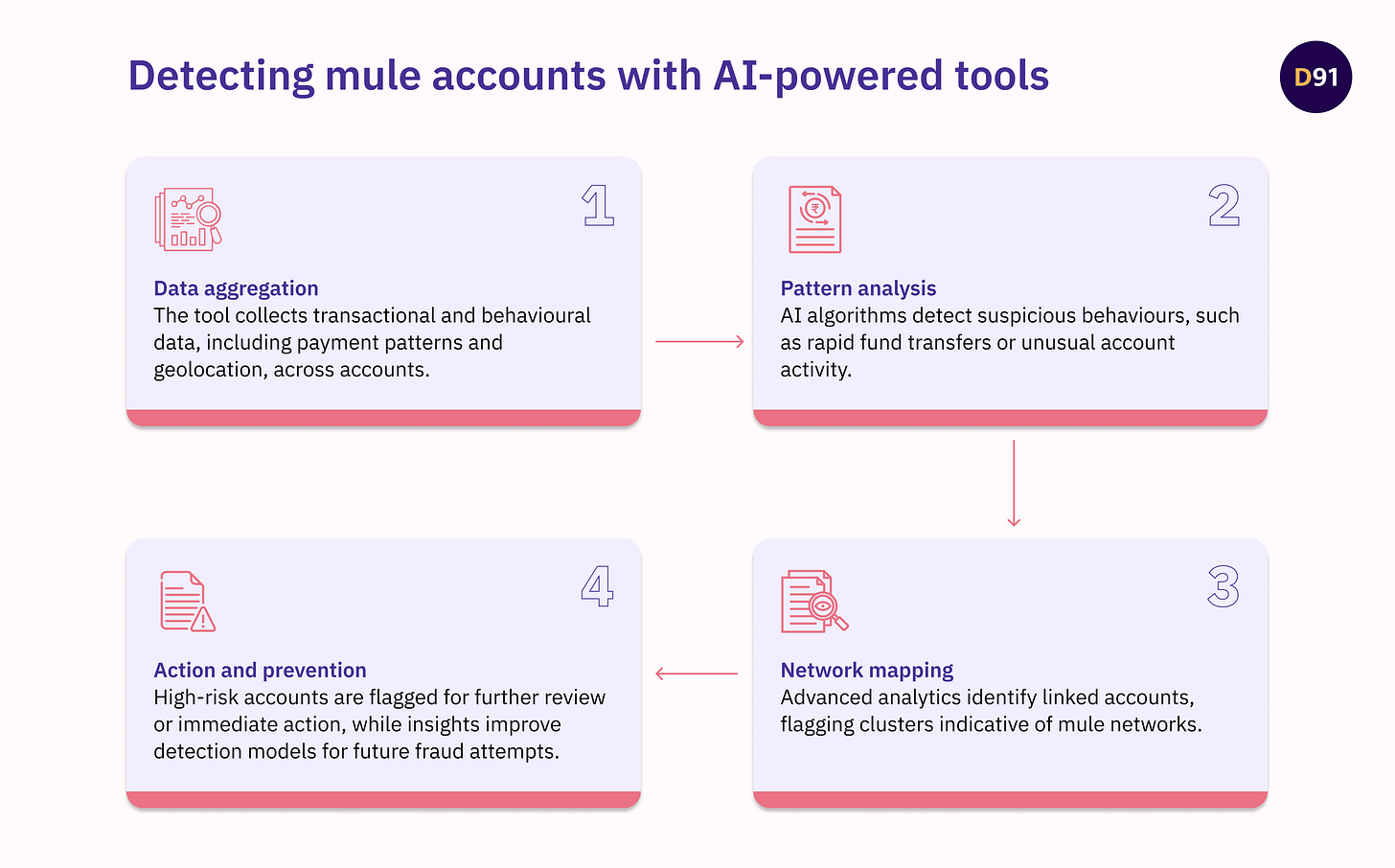

Social Network Analysis: Detect mule accounts or collusive networks by tracing links between borrowers.

D. Cybersecurity Measures

Cyber-enabled fraud, such as phishing attacks or account takeovers, requires robust preventive measures such as the MuleHunter.ai solution proposed by the RBIH4. Cybersecurity tools are designed to safeguard borrower accounts and lender systems.

Multi-Factor Authentication (MFA): Adds layers of security, ensuring only authorized users access accounts.

Blockchain-Enabled Digital Signatures: Ensure the integrity of loan agreements by making them tamper-proof.

Digital Footprint Monitoring: Detects unauthorized attempts to access borrower accounts through phishing or social engineering.

E. Collaborative Ecosystem Measures

Fraud prevention isn’t just an individual effort - it requires collaboration across the financial ecosystem. Industry-wide cooperation led by regulators and government bodies5 enhances fraud detection and mitigation.

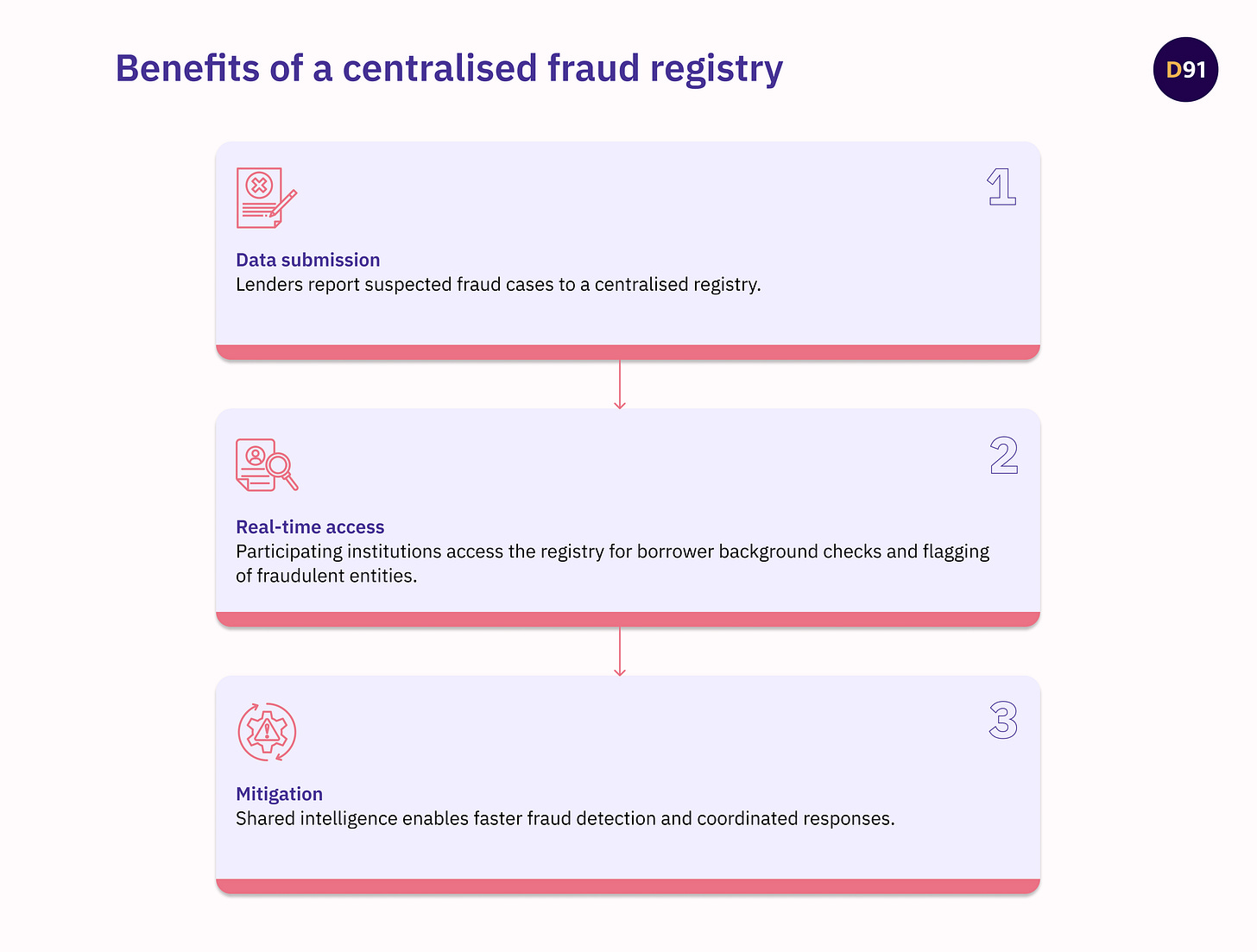

Centralized Fraud Registries: Allow real-time sharing of suspicious activity data among lenders.

Regulatory Collaboration: Establish industry-wide standards for fraud management.

Insight-Sharing Platforms: Facilitate the exchange of information on emerging fraud trends.

F. Identifying Emerging Threats

As fraud tactics evolve, so must the frameworks used to counter them. Adaptive measures leverage real-time data and cutting-edge technology to address emerging risks.

AI-Powered Risk Models: Continuously evolve with fraud patterns to adapt detection methods.

Geo-Fencing: Combines location data with borrower information to identify inconsistencies.

Dynamic Rules Engines: Tailor detection frameworks to specific borrower segments or loan products.

Navigating the Fraud Frontier in Digital Lending

Digital lending fraud costs the global BFSI sector billions annually, and India is no exception. Fraud detection and mitigation in digital lending face three main challenges:

Balancing UX and Security: Lenders must maintain a seamless user experience while implementing robust fraud checks.

Scalability: Adapting solutions for high-volume lending without compromising accuracy.

Privacy Compliance: Ensuring advanced analytics adhere to regulations like India’s DPDP Act.

As the digital lending landscape continues to expand, collaboration between lenders, regulators, and technology providers will be crucial to building a fraud-resilient ecosystem. By staying ahead of emerging threats and fostering a culture of innovation and shared responsibility, the digital lending sector has the opportunity to transform vulnerabilities into strengths. Prevention, after all, isn’t just better than cure—it’s the foundation for trust, growth, and sustainability in the financial ecosystem.

https://www.fortunebusinessinsights.com/industry-reports/fraud-detection-and-prevention-market-100231

https://www.incognia.com/solutions/detecting-location-spoofing#how-does-incognia-detect-location-spoofing%3F

https://docs.setu-aa.com/

https://rbihub.in/mule-hunter-ai/

https://www.business-standard.com/india-news/india-launches-online-suspect-registry-1-4-mn-listed-for-financial-fraud-124091200207_1.html

All artworks are designed by Smriti Krishna.

If you enjoyed reading this blog and would like to receive more such articles from D91 Labs, please subscribe to our blogs here.

To read more about our work, visit our website

You can follow us on Twitter | LinkedIn | Instagram | WhatsApp