Identifying Technology Adoption Gaps Among Long-tail Merchants

In this blog we uncover the barriers to a long tail retailers' access to digital tools. Using formative research, we chart technology usage across various stages of their retail businesses.

Amid Bangalore's lively retail scene, a contrast emerges between two hardware stores. Mukesh and his wife manage a modest yet surprisingly well-stocked shop. With over 2000 building supplies sourced from 30 distinct suppliers, whose details Mukesh has carefully recorded in a notebook on his desk. When customers seek products, Mukesh consults his shelves or the inventory register to gauge their availability. For out-of-stock items, he relies on memory to recall the supplier’s name, consults his notebook for contact details, and places orders via phone. This warrants his presence at the store at all times. The sole technology he has employed is the acceptance of UPI-based digital payments. For pricier sales, Mukesh makes a handwritten bill, while smaller transactions often slip past unnoticed. At the end of the month, Mukesh hands his bill book with approximate sales figures to an accountant for digital conversion and GST filing. He pays the accountant Rs. 2500 for the job, each month.

A few shops away, Dhiraj operates a similar hardware store with a comparable range of products. The critical distinction is that Dhiraj has been using accounting and inventory management software, for a decade. His staff are trained to invoice, monitor and order the stock and largely manage the daily operations. Dhiraj's auditors have access to the software for annual taxation, while he personally handles monthly GST filing. The auditor charges Dhiraj a one-time fee of Rs. 12,000 every year and he pays a yearly subscription fee of Rs 6000 for the software.

Though both of them have embraced technology in the payments aspect, Dhiraj's integration of technology into the various other aspects of his long-tail retail operation has enhanced its efficiency. His adept use of technology has streamlined his day-to-day operations, improved inventory management, and reduced the need for his constant presence at the store. In contrast, Mukesh's reliance on manual methods hints at potential inefficiencies.

We set out to understand the factors that influenced merchants like Dhiraj to invest in software and why merchants like Mukesh rely on manual methods.

The Research:

To understand these factors as well as explore the extent of digitisation in the smaller retail industry, we spoke to a few small retailers in Bangalore about their experience running a store, their relationship with technology in day-to-day business and their financial preferences.

Methodology

We conducted formative research among 15 long-tail retailers in Bangalore across various sectors such as hardware, apparel, home furnishing, footwear, imitation jewellery and accessories. With monthly revenues spanning from 1.5 to 18 lakhs, these retailers showcased a broad array of scales within certain residential as well as prominent business areas in Bangalore including Commercial Street and its adjoining areas. It's worth noting that the majority of the shop owners were under the age of 40. While we understand that 15 is a very small number to represent the entire retail landscape of the country, the insights we gained from our conversations still offer valuable preliminary observations. One must recognise that a city like Bangalore tends to have 'first adopters' before the technology makes its way to other markets. Therefore, the insights presented should be interpreted within that context.

We noticed that the usage of technology currently exists as a spectrum. Advancements in affordable technology such as the ubiquitous UPI have meant that even the smallest retailers have adopted some forms of technology. However, the adoption is restricted to certain domains. When we refer to technology in the context of our study, we imply a wide scope of tools and applications. These range from on-premise software solutions and Software-as-a-Service (SaaS) platforms to mobile applications on the retailers’ phones. Some categories might have more than one response from the respondent.

In our research, we engaged with long-tail retailers to understand the extent of their technological utilisation across various stages of their retail journey. In the last blog, we segmented the journey into 5 stages: Inception and Funding, Regulatory Requirements, Supplier and inventory Management, Financial management & bookkeeping and Value-added services. We analysed the responses from the retailers and categorised them into these very stages to understand the impact of digitisation.

1. Inception and funding of the business

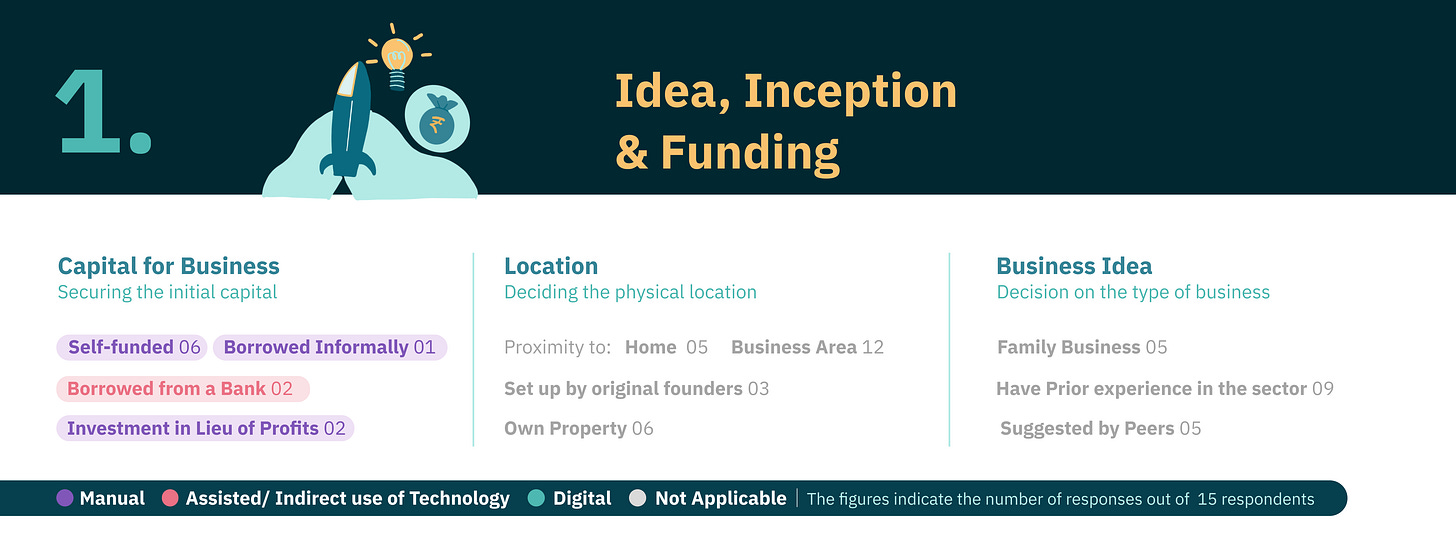

This initial stage marks the birth of the retail venture and encompasses capital, setting up the shop, and creating the business. We requested the merchants to share their experience with selecting the business sector, location and how they secured the initial capital. Some of the retailers we interviewed were second or third-generation business owners and had little involvement in the initial set-up.

However, those who set up their business in the recent past chose the location based on proximity to home or central business areas that might help the business thrive. In terms of capital, most of the retailers sourced funds informally, utilised personal savings or visited a bank, often their existing account. We noticed a common aversion towards loans and debt was regarded as not virtuous. Their belief is rooted in starting their business with their personal funds rather than borrowing. Some were guided by their value system while some merchants refrained from borrowing at an interest due to religious reasons. The latter however accept informal investments in lieu of a percentage of profit from friends & family.

“I don’t even use a credit card. Neither I nor my father like the concept of debt. We believe one should only start a business if you have the funds”

- Kanimozhi, Owner of a Book Shop

“As this is my first business, I don’t have anything to show for documents. My father has a footwear store in our hometown, so we took the loan in his name”

- Jamal, Owner of a Footwear store

2. Regulatory Requirements and Compliance

Navigating the regulatory landscape the right way is integral to any business. When it comes to matters of registration and aligning operations with legal frameworks such as Goods and Services Tax (GST) registration, most retailers seek guidance from auditors – a role that emerges as a crucial component in a retailer's business.

“Back when they started the business, all they had to do was go to an office and give a letter - under the Shops and Establishments Act. There are no renewals or anything. But nowadays with GST, all those things are taken care of every year.”

- Fawaz, Partner at a Hardware Store

Some of the businesses we approached were registered by their original founders, who filed offline forms with municipal corporations or other government bodies. Many of the merchants who established their stores more recently remain unaware of the availability of digital tools for business registration and rely on auditors or agents for the process.

“I have no idea about the steps. Our auditor helped us with all the Licensing, Registration and GST certifications. We just need the certificate, we don’t need to file GST as books are exempted”

- Kanimozhi, Owner of a Book Shop

3. Supply Chain & Inventory Management

Efficient supply chain management is a cornerstone of successful retail. Most of the merchants we interviewed were aware of the tools but were not convinced to adopt the technology as yet. In fact, many of the long-tail merchants expressed that they would consider inventory management as their entry point into retail technology adding that they might invest in the future when they scale their business.

“When I get a new shop, first I will digitise my stocks. If I digitise stocks, everything falls into place. It all starts with the inventory.”

- Hameed, Hijab Store owner

While the role that technology plays in optimising procurement, managing inventory, monitoring stock levels, and fostering strong relationships with suppliers is apparent, many small retailers are apprehensive about making the switch. The main reasons cited include the manual effort involved initially, the potential disruption during stock digitization, and the non-standard nature of their goods rendering off-the-shelf tools unsuitable for their business model.

Certain medium-sized apparel and bookstores have invested in tailor-made software tools designed to accommodate their extensive inventory range. However, these unique solutions aren't accessible to smaller retailers.

4. Bookkeeping, Compliance & Financial Management

Effective financial management is crucial for sustained growth. Our research examined how much technology is utilised in bookkeeping, tracking transactions, managing cash flow and staying updated with the changing regulations.

Fawad, a hardware store owner, mentioned that he acquired Tally skills from software providers around 10 years ago. He used these skills to implement the tool in his business as well as train his staff to perform billing and tracking inventory.

“I do all my accounting and GST filing myself. I take out 2 hours each week to work out all the accounts and once a month, I file my GST as well. Only for the year-end auditing do I reach out to my chartered accountant, as that’s mandatory”

- Fawad, Partner at a Hardware Store

From our conversation with Fawad, it's apparent that retailers who seek autonomy need to invest additional effort in learning and implementing tools. While autonomy might not be their top priority in all the aspects of the business, it's a goal they aim to achieve by adopting technology in other aspects of their business except bookkeeping.

“The software we use has an accounting feature built into it. But since we are not from an accounting background we could not use that. So, we have hired an accountant and an auditor to do our accounting. We use the inventory and billing features.”

- Ahmed, Toy Store owner

Due to the complex nature of accounting, even the retailers who use on-premise software, rely on an accountant to help them with the digitisation of the books. This was achieved by granting the accountant access to the software, sharing the invoices or even sending them the physical handwritten bills which are then digitised by an accountant for filing the GST.

“I note down all transactions in a ledger during my free time. I send this ledger to the accountant through WhatsApp who then helps with filing GST”

- Suresh, Owner of a Luggage store

5. Value Added Services

Today offline retail is about customer satisfaction. This means that the long-tail retailer needs to transcend their core business offerings to deliver services that engage with the customers beyond the physical space. The outcomes of these value-added services can broadly fall into the categories of improving the customer experience, better engagement, growing the customer base & boosting their loyalty.

Improving Customer Experience

Retailers who enhance customer convenience through delivery and after-sales support, including installation are highly sought after. Many merchants use app-based delivery partners like Dunzo, Pikkr etc., to make deliveries while some have made offline arrangements for the same. Additionally, certain merchants provide complimentary delivery for orders within a specific radius.

As for gaining insights, the merchants favoured personal experiences or advice from their peers and associations like the Karnataka Hardware Allied Merchants Association (KHAMA) over any digital analytical tools.

Enhancing Customer Engagement

To engage with their current customers beyond their physical space, retailers use messaging platforms like WhatsApp to convey details about upcoming sales, stock availability, and new arrivals. They leverage the insights gained from customers' previous purchases to offer tailored promotions. Some merchants encourage customers to save their contact information, enabling them access to the retailers' WhatsApp stories or participate in WhatsApp groups dedicated to sharing images of new collections and stock updates.

Gaining New Customers

Some retailers blend technology with marketing to attract new customers and expand their reach. They achieve this by leveraging online resources like Google Business listings and social media platforms such as Instagram. A few of them even explored e-commerce but could not match up to their Omnichannel retail counterparts.

Additionally, they engage in sale festivals organised by trade or street unions, such as the Commercial Street Retailers Association, with the goal of luring more traffic to their location and consequently enhancing their sales.

A stronger emphasis on customer experience and engagement was noted among businesses like apparel, home furnishing, accessories, and toys that serve the end users. This trend contrasts with those catering to service providers like hardware and other peripheral stores. They however focussed on cultivating customer loyalty.

Boosting Customer Loyalty

Numerous small retailers provide incentives like credits to dedicated, long-standing customers and corporate clients, along with hassle-free returns of merchandise. To aid ease of return, these establishments also experience an elevated frequency of cash transactions compared to stores that primarily serve end users.

“When new stocks arrive, I put the pictures up on my Whatsapp stories. If the customers like something, they can come and buy from the shop”

- Jamal, Owner of a Footwear store

By mapping retailers' technology usage onto these five stages, we gained a comprehensive understanding of how technology intertwines with each phase of their journey. The chart below shows a quick overview of the prevalence of manual as well as technology-driven interventions across the five stages.

Prevalence of Manual vs. assisted vs. direct technological interventions

In the mapping, Supply Chain and Inventory Management exhibit a higher presence in both manual and digital interventions. This seeming contradiction can be attributed to the fact that certain aspects of Inventory management, such as stocking multiple non-standard items are complicated and are done more efficiently using manual methods. Whereas, tracking the inventory and invoicing the merchandise is more efficient with digital tools. Due to its inherently digital nature, value-added services, take the lead in technology adoption with many retailers handling delivery and communication using their personal smartphones. Assisted use of technology was significant in registration, licensing, and GST processes as well as in bookkeeping. In these stages, the accountants and auditors hired by the retailers, play an important role in accessing and using the technology.

While the nuances of each retailer's experience vary, categorising them by stages provides a framework to assess the impact of technology on the various aspects of the retail sector. This emphasises the fact that technology should not be considered a monolithic force but rather a versatile toolset that empowers retailers to improve efficiency, navigate challenges, seize opportunities, and innovate throughout their journey.

From our understanding, those who use tech, use them for these reasons:

As you might have observed, of all the stages, Inventory management, Financial management & bookkeeping, and in some cases value-added services exhibit a higher uptake of technology. Albeit used across a wide range of applications, we observed that retailers employ technology to address challenges in these three categories:

Communication

Retailers employ software as well as mobile apps to stay in touch with their suppliers, market to customers and stay informed with the trade associations.

WhatsApp, in particular, is extensively used to connect with customers, with groups functioning as product catalogues and stories serving as marketing tools. Retailers also utilize the platform for supplier order tracking. Trade associations operating on WhatsApp groups communicate regulatory changes pertinent to their industry.

Management

Retailers use on-premise software to bring about efficiency in their day-to-day operations like tracking inventory and managing stocks across their stores and warehouses through a unified platform. Some retailers use the inbuilt accounting features, either personally or with assistance to record transactions and stay current with the GST slab alterations.

“Stock checking, invoicing, checking numbers of suppliers. Tally is very easy. We learn by practice. And if have any doubts we call Tally and they give us the solutions”

- Bala, an employee at a Hardware store

Growth & Improvement

Many retailers view incorporating technology in the store as aspirational. Even those who don’t use advanced on-premise software or a SaaS tool, employ tech in their day-to-day running like:

Marketing online on sites such as Google Business, Instagram or Justdial

Improving customer experience by offering a wide array of payment methods, offering convenient delivery services with app-based partners, sharing product catalogues and accepting orders via WhatsApp etc.,

Coming up next

While the retailers who use technology attribute it to the aforementioned areas and opportunities, there are numerous reasons for a lot of the retailers to not use technology. Our conversations with retailers revealed some of the most common perceptions they hold about technology such as Lack of Personalised Offerings, Time-Effort > Perceived Benefits, Lack of Trust, Lack of Awareness, Resistance to change from familiar Methods and Reliance on Accountants.

In our forthcoming blog, we delve into these perceptions retailers have towards technology, offering ideas and principles that software makers might employ to enhance technology adoption among smaller retailers in the country.

All artworks are designed by Himanshi Parmar and Rajashree Gopalakrishnan.

Formative research conducted by Rajashree Gopalakrishnan and Vinith Kurian

If you enjoyed reading this blog and would like to receive more such articles from D91 Labs, please subscribe to our blogs here.

To read more about our work, visit our website

You can follow us on Twitter | LinkedIn | Instagram | WhatsApp