How Fintech is Solving for Debt Collections

In our last blog of this series, we explore how fintech innovations are streamlining debt collections using tech solutions to improve efficiency and borrower experience.

Amit, a small business owner, struggles to keep up with his loan payments during a particularly tough season. The collection process from his bank was a nightmare. He dreaded the relentless phone calls from bank agents, unannounced visits to his shop, and calls to his relatives, which often embarrassed him in front of his customers. This traditional collection approach was stressful and invasive, relying heavily on manual methods and personal interactions to recover overdue payments. Amit felt overwhelmed by the pressure and the rigid repayment terms that left him little room to negotiate.

Despite Amit's financial difficulties, it's important to recognize that banks and non-banking financial companies (NBFCs) also face significant challenges in recovering funds from borrowers.

Traditionally, banks have relied on collection agencies, including telemarketers and field agents, to recover debts. This approach often results in a negative customer experience and frequent harassment incidents. Traditional collection methods typically involve repetitive phone calls, bulk mailing of letters, and field visits for recoveries. These practices lead to poor customer experience, decreased overall collection efficiency, longer recovery times, and higher costs.

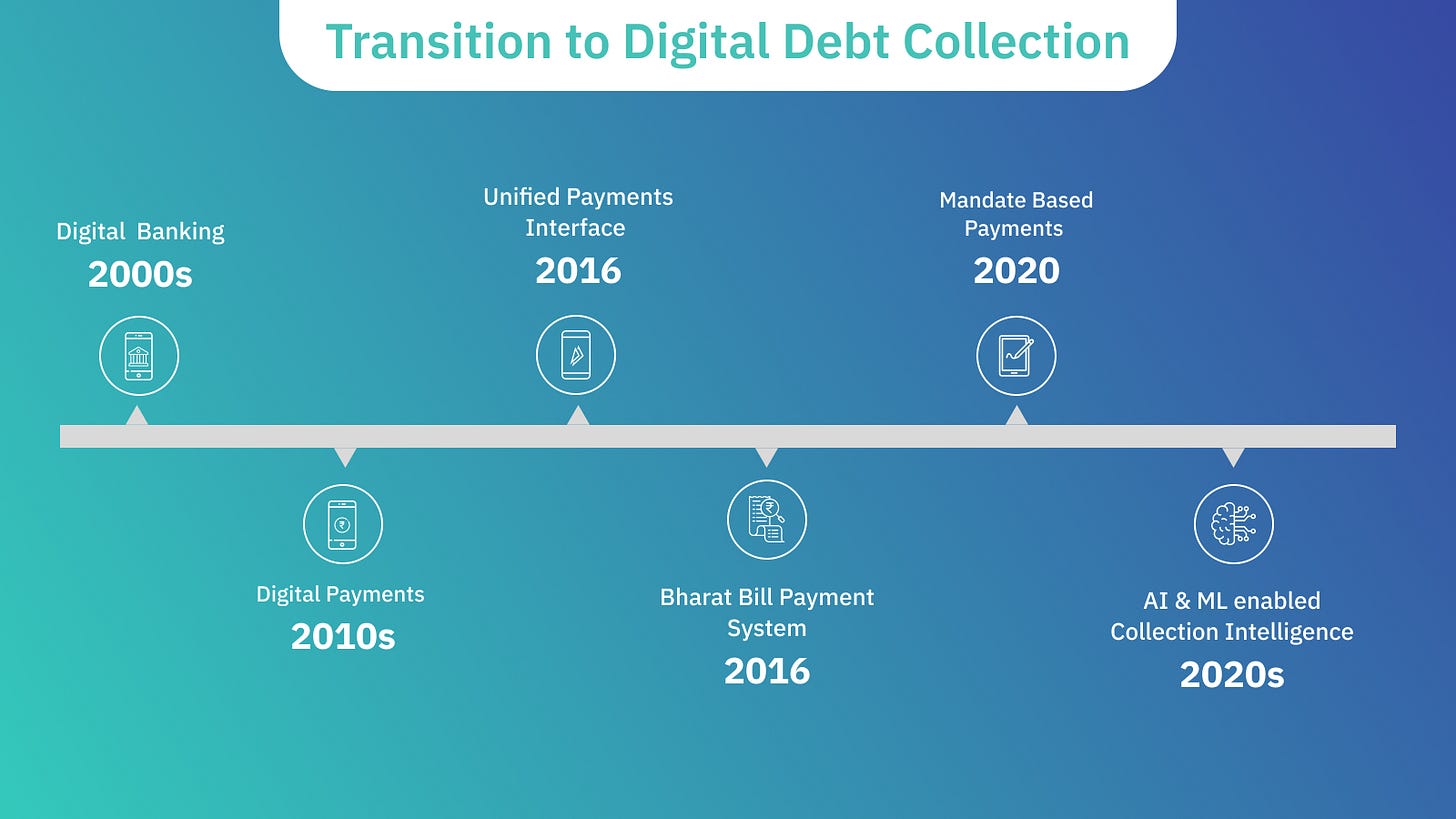

However, over the years, multiple technological advancements have significantly transformed debt collections in India.

The mid-2000s saw the increased adoption of Internet banking, which facilitated easy and secure loan repayments. In 2016, the introduction of UPI enabled payments directly from bank accounts, significantly enhancing the speed and ease of loan repayments. The same year, the launch of the Bharat Bill Payment System (BBPS) provided a seamless and standardised platform for bill payments through UPI apps, further simplifying the loan repayment process for borrowers.

The 2020s brought even more advancements with mandate-based payments such as UPI AutoPay and E-NACH, which allowed for automated recurring payments, making loan repayments more streamlined and reducing default rates by ensuring timely payments without manual intervention. Additionally, the implementation of AI-based solutions enabled the analysis of debtor behaviour, prediction of defaults, and optimization of collection strategies, thereby improving overall efficiency in debt recovery and reducing non-performing assets (NPAs).

While these technological advancements have greatly improved convenience for borrowers in terms of loan repayments and have also benefited FIs to some extent, there are still a lot of challenges from a lender’s perspective.

One of the major challenges faced by Financial Institutions (FIs) is irregular payments and loan defaults by borrowers, potentially leading to a buildup of non-performing assets (NPAs). Additionally, debt support and risk mitigation are hampered by long turnaround times, undignified collection methods, and poor grievance handling, making the entire process inefficient.

Fintech companies face even more challenges in debt collections than traditional banks due to their diverse and risk-prone customer base, which includes individuals with limited credit history. Fintechs rely on digital channels, which may be less effective for unresponsive borrowers. Banks, with extensive branches and agents, can maintain direct contact with the borrowers, unlike fintechs. Additionally, fintechs often lack mature collection processes and robust legal frameworks.

Given the 12-14% annual growth of India's credit market and the debt collection industry’s Rs 40,000-crore valuation growing at 18%,1 a scalable loan recovery mechanism is essential.

This is where the role of new-age fintechs comes in. Tech innovations have the potential to enhance efficiency for lenders by up to 22%.2 Banks and NBFCs are partnering with fintechs to modernize the process, aiming to maximize collection efficiency, minimize NPAs, and prevent credit losses.

What is digital debt collection, and why are both traditional and modern lending institutions favouring it to enhance their debt collection processes?

Digital collections align with modern expectations, where borrowers expect respectful treatment, timely notifications, and communications at their preferred frequency. This proactive, non-intrusive approach to debt management uses omni-channel communication, including voice bots, IVR, emails, WhatsApp, and tele-calling. These methods improve customer engagement and experience and also expedite customer outreach with higher collection efficiency.

Digital debt collections effectively address the challenge of geographical reach and are crucial for fintech companies due to their cost-effectiveness, speed, and superior customer experience. Most borrowers in the early stages of delinquency pay on time and simply require a gentle reminder, making digital collections the most appropriate strategy. This approach also avoids complications and leakages associated with handling large amounts of cash. With the growing demand for digital debt collections, India’s debt collection software market is expected to touch over $272 million by 2027.3

At what stage does the digital debt collection process begin? It starts immediately after the loan is disbursed to the borrower’s bank account and involves multiple stages depending on whether the borrower makes timely repayments or not.

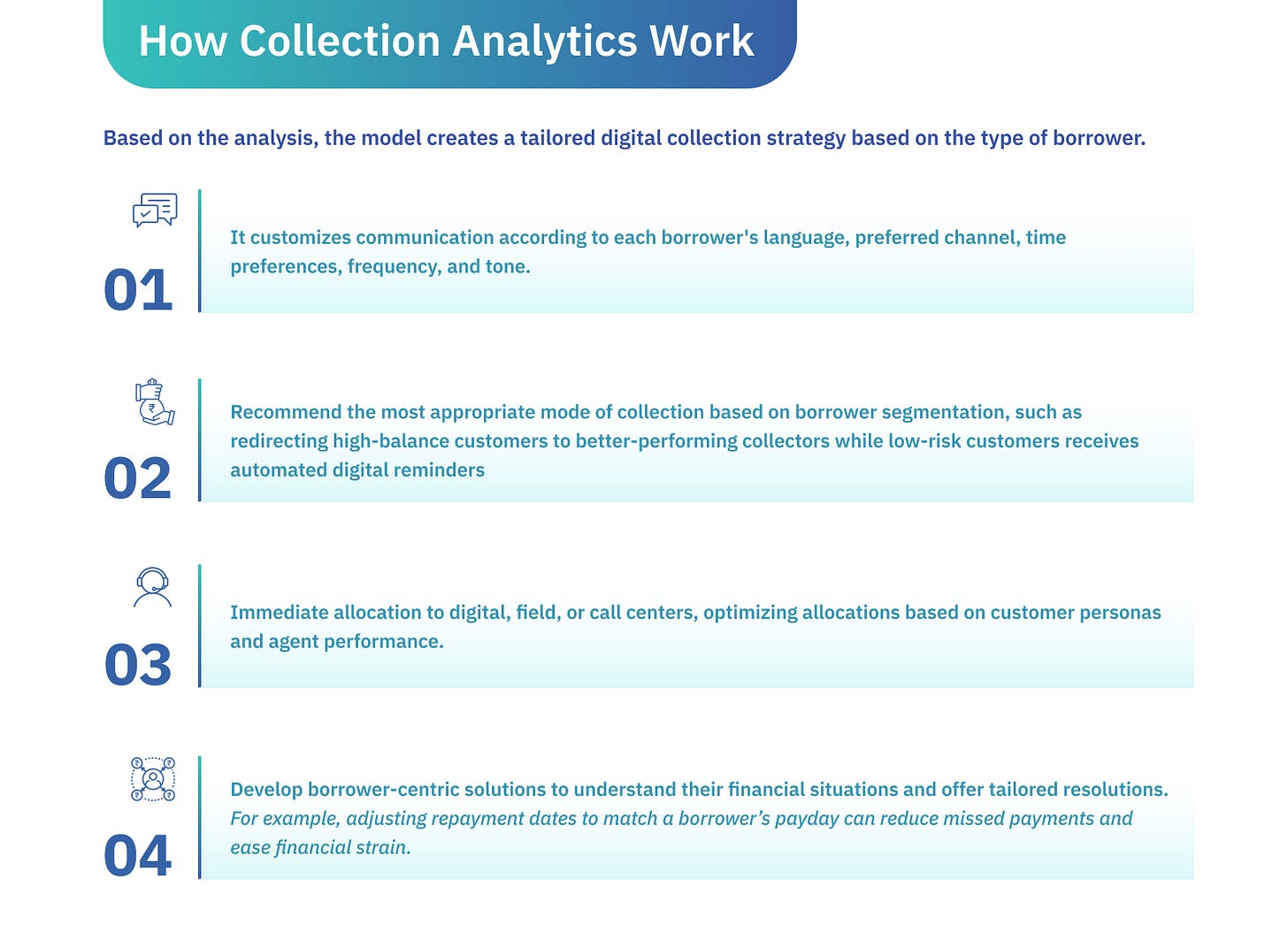

Step 1: To create a tailored collection strategy for a borrower, Collection Analytics is critical.

These entities employ data analytics and AI & ML models (as mentioned in the third blog of this series on underwriting) to analyze historical and real-time data. This helps assess repayment ability, identify early warning signals, and predict bounce rates. Customers are then segregated based on risk, contact ability, and channel touchpoints.

Step 2: Based on Collection Analytics, fintech companies employ strategies to encourage on-time digital payments.

Digital payment solutions have transformed the way borrowers make loan repayments. These solutions utilize all digital communication channels to achieve the best contact rates in the industry. Simple, concise messages are delivered in multiple languages, accompanied by single-click personalized payment links. These links accept all common modes of digital payments, including credit and debit cards, net banking, UPI, mobile wallets, and QR code payments, making it convenient for borrowers to make their payments.

Additionally, borrowers can use mandate-based payments including UPI AutoPay and E-NACH for automated recurring payments and Bharat Bill Payment System (BBPS) for standardised bill payments through any UPI app. Lenders leveraging these advanced digital payment solutions have observed a significant reduction in their bounce rates.

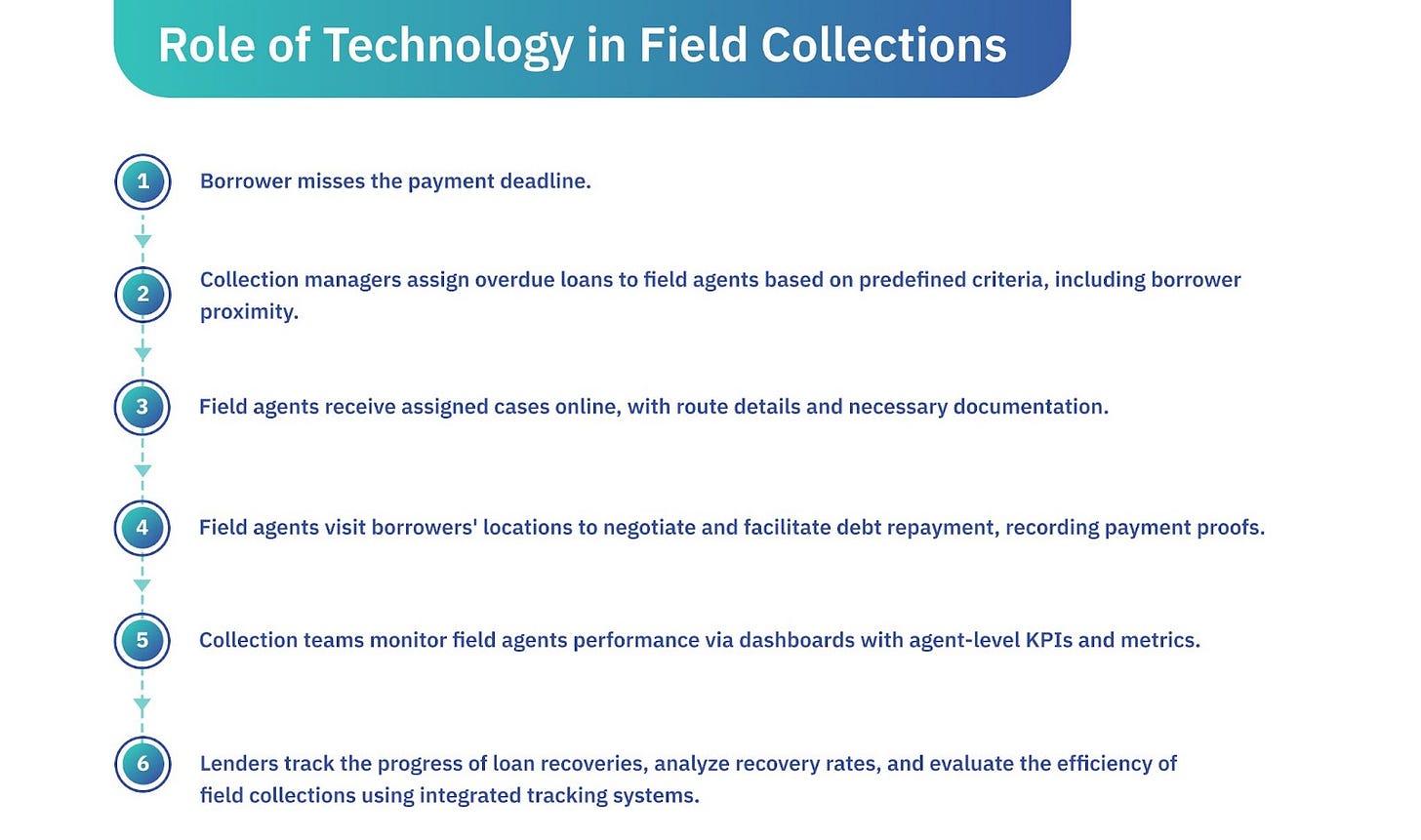

Step 3: When the borrower misses the repayment deadline, the process of field collections kicks in.

Field debt collections are typically employed for larger or more complex debt cases when other methods have proven ineffective or when the borrower has ceased responding to digital channels. This process is usually initiated between 30 and 60 days past due (DPD), combining field efforts with digital collections to expedite loan recovery rates. Field loan collections involve sending agents directly to the borrower’s location, based on their registered address. It offers the advantage of face-to-face contact with borrowers, which can enhance understanding and enable the creation of more flexible repayment plans.

Fintech companies have introduced advanced technological solutions to streamline door-to-door loan recoveries.

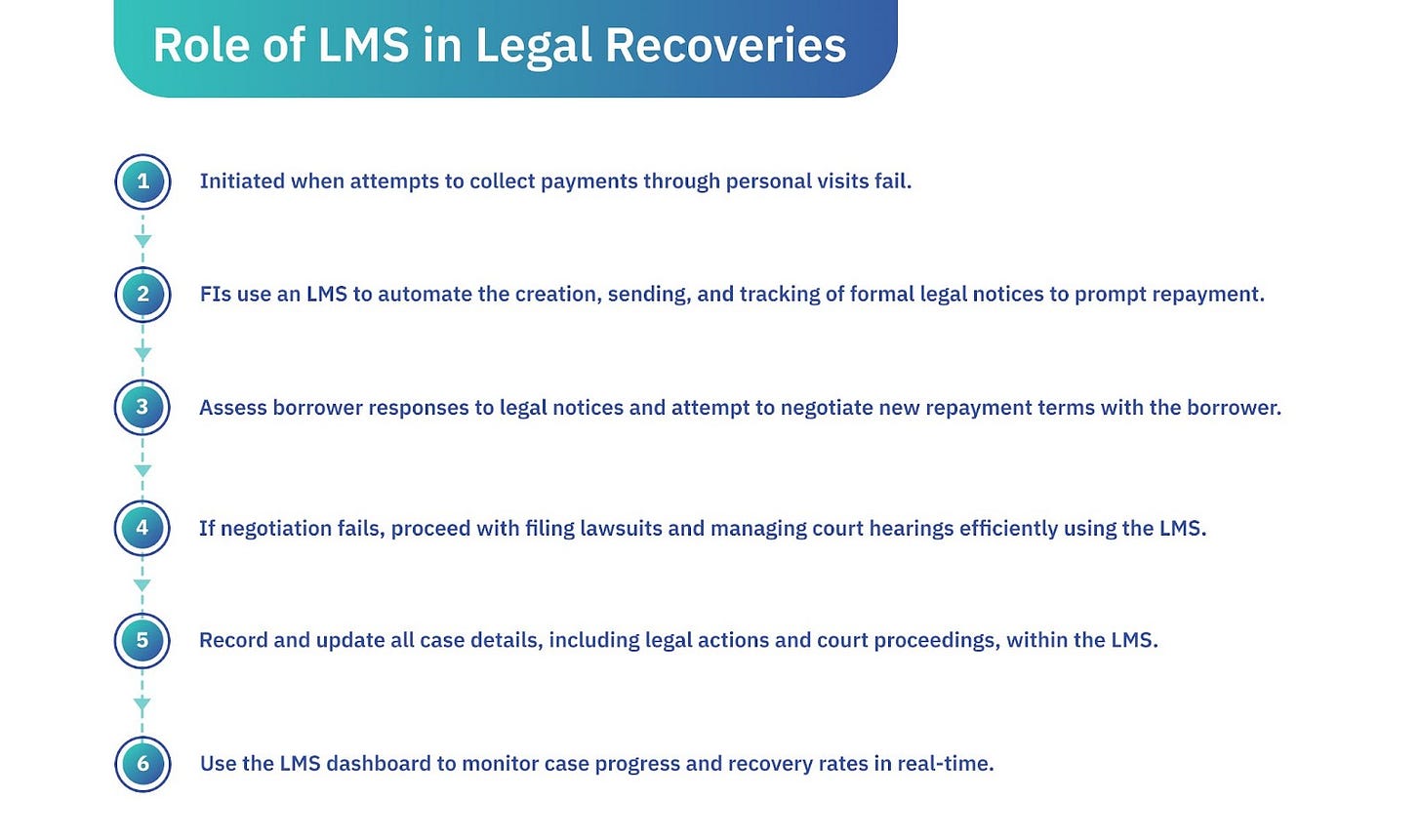

Step 4: When the loan recovery through personal visits and other conventional methods is unsuccessful, the process of legal recovery comes in.

Financial institutions may issue legal notices as a final attempt to prompt repayment before initiating legal proceedings. These notices highlight the seriousness of the default and potential legal consequences, often motivating borrowers to settle dues. Managing the legal processes involved in debt collection requires efficient handling and collaboration among legal teams. However, handling thousands of legal notices for numerous defaulting borrowers can be challenging for financial institutions.

This is where an advanced Litigation Management System (LMS) comes in.

By utilizing such a system, financial institutions can significantly improve the efficiency and effectiveness of their legal recoveries, ensuring better management of legal proceedings and enhanced recovery rates.

The debt collection process has been significantly streamlined thanks to technological advancements made by fintech companies. However, these improvements are not without their challenges.

The debt collection space in India navigates a complex regulatory landscape, bearing the compliance burden of various regulations. These include the Reserve Bank of India (RBI) guidelines, the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act, 2002, the Recovery of Debts Due to Banks and Financial Institutions (DRT) Act, 1993, and the regulations set forth by the Telecom Regulatory Authority of India (TRAI).

Recovery agents in the field do not always adhere to the Loan Recovery Guidelines established by the RBI. They sometimes resort to aggressive or unethical tactics that violate prescribed protocols. This non-compliance can result in harassment, intimidation, and other forms of misconduct that undermine the integrity of the collection process.

FIs are currently relying on existing systems, databases, and processes. However, these older software solutions are outdated and comparatively inefficient compared to their modern and automated counterparts. Integrating new software with current infrastructure can be complex and time-consuming, posing a considerable challenge for many FIs.

Borrowers often don't intend to default. For example, if someone is paid on the 7th but their EMI is due on the 1st, this timing mismatch can cause issues. Adjusting the repayment date to the 10th can help, but lenders still struggle to differentiate between intentional and unintentional defaults with simple rule-based system

The use of AI and ML in debt collections raises ethical concerns, particularly the potential for algorithmic bias. These biases can lead to the misclassification of borrowers based on risk or contact-ability, resulting in inefficient allocation of resources and unfair treatment of certain individuals.

The effectiveness of these efforts and establishing a long-term relationship with the borrower will depend on how human-centric and non-intrusive the approaches are, ensuring a fair and efficient recovery process. As the industry continues to evolve, striking the right balance between technology and empathy will be key to sustainable success in debt recovery.

https://economictimes.indiatimes.com/markets/stocks/news/why-compliance-in-debt-collection-will-usher-in-dignity-for-borrowers-and-agents/articleshow/97415717.cms?from=mdr

"Tech innovations have the potential to enhance efficiency for lenders by up to 22%."

I am assuming that the innovations mentioned here includes analytics, communication and the use of LMS to manage legal steps.

Is there a case study that can tell us the impact that AI/ML and analytics has in this process?