Decoding the Fintech Revolution in Underwriting

In our third blog of the series, we explore how fintech companies transform the underwriting process with AI and machine learning, making credit more accessible for millions of Indians.

Nikhil, a small business owner, applies for a loan at his local bank, which requires extensive documents like financial statements and tax returns. After days of gathering paperwork and weeks of manual review by the bank's underwriting team, Nikhil finally receives approval, exhausted by the lengthy process. In contrast, Priya, a tech-savvy professional, applies for a loan through a fintech app. With a few taps on her smartphone, she completes the application and grants access to her financial data. The platform’s AI analyzes her data in real time, including transaction history, social media activity, and e-commerce transactions to assess her creditworthiness. Within minutes, Priya is notified of her loan approval.

Ravi and Priya’s experiences highlight the stark contrast between traditional and new-age underwriting.

Traditionally, underwriting has been a manual process, heavily reliant on a range of evaluation metrics such as credit score, income, age, number of dependents, bank statements, past and current debts, nature of employment, and other assets. Borrowers were required to gather necessary documents, print and sign them, and then manually submit these documents by visiting the bank.

This cumbersome and expensive method left many small-ticket borrowers underserved. Around 408 million adult Indians under the age of 65 remain credit unserved1, highlighting the need for a more efficient and streamlined approach.

How did we transition from a highly manual process that took weeks to one where loans can be approved with just a few taps on your phone in minutes?

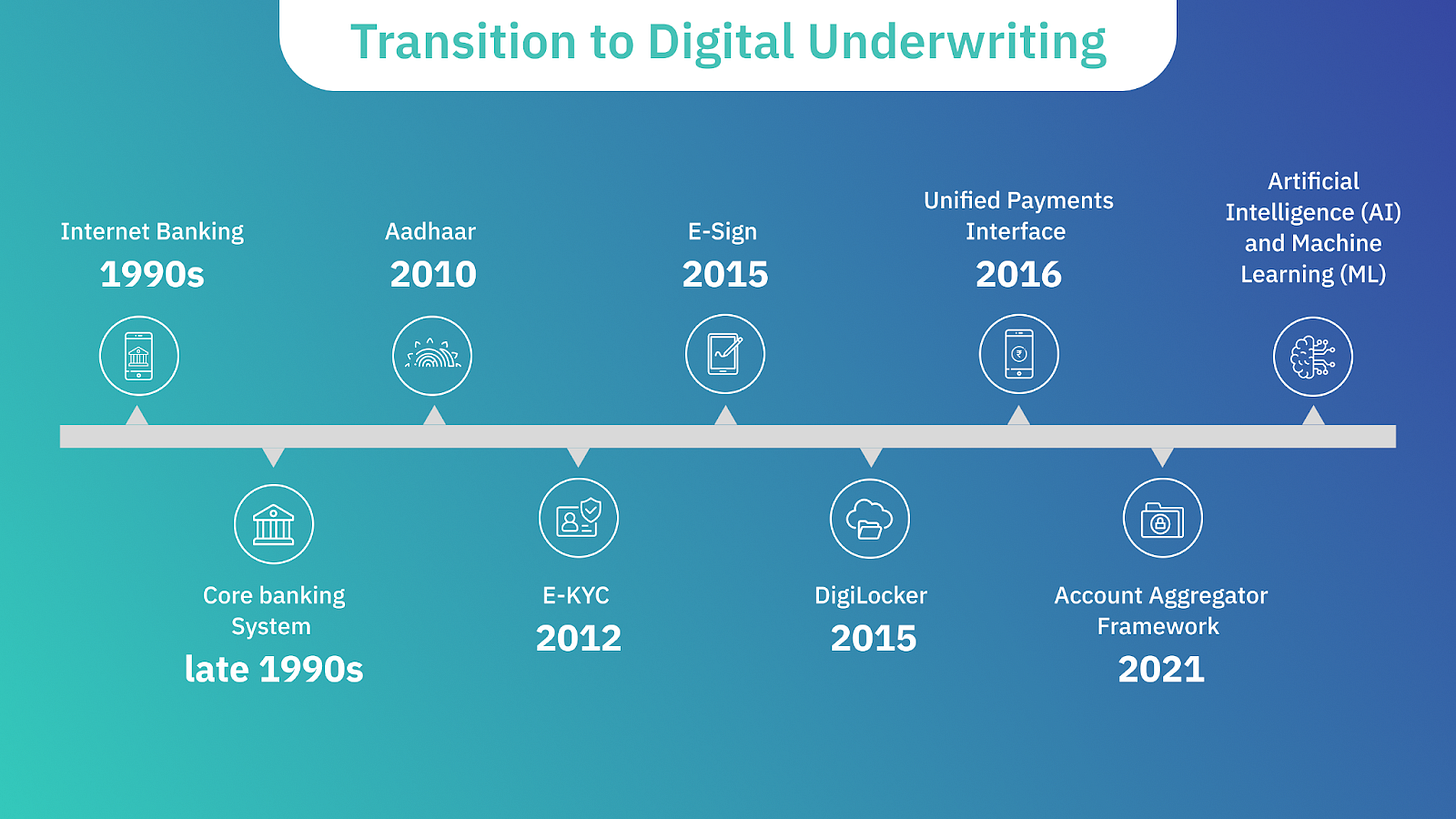

The transition to digital underwriting has been driven by significant technological advancements over the past three decades. The introduction of internet banking laid the groundwork for online financial services, while core banking systems enabled real-time transaction processing and data centralization. Digital public Infrastruture such as Aadhaar provided a unique identification number for residents, facilitating easier verification and reducing fraud. The implementation of e-KYC allowed financial institutions to electronically verify customer identities, significantly reducing onboarding time and paperwork. Additionally, e-Sign and DigiLocker further streamlined the process by enabling secure digital signatures and providing a cloud-based platform for document storage.

More recent advancements have continued to transform digital underwriting. The Unified Payments Interface (UPI) revolutionized digital payments by making transactions seamless and integrating financial data across platforms. The Account Aggregator Framework allows for the secure sharing of financial data, providing lenders with a comprehensive view of a borrower's financial history. Furthermore, Artificial Intelligence (AI) and Machine Learning (ML) have enabled lenders to analyze large volumes of data quickly and accurately, identifying patterns and predicting borrower behavior.

In partnership with Sarvam AI, Setu recently launched Sesame, a domain and region-specific AI/ML model tailored for India’s BFSI sector, further enhancing the underwriting process. These technological advancements collectively enable fintech companies to assess creditworthiness efficiently, making credit more accessible and inclusive.

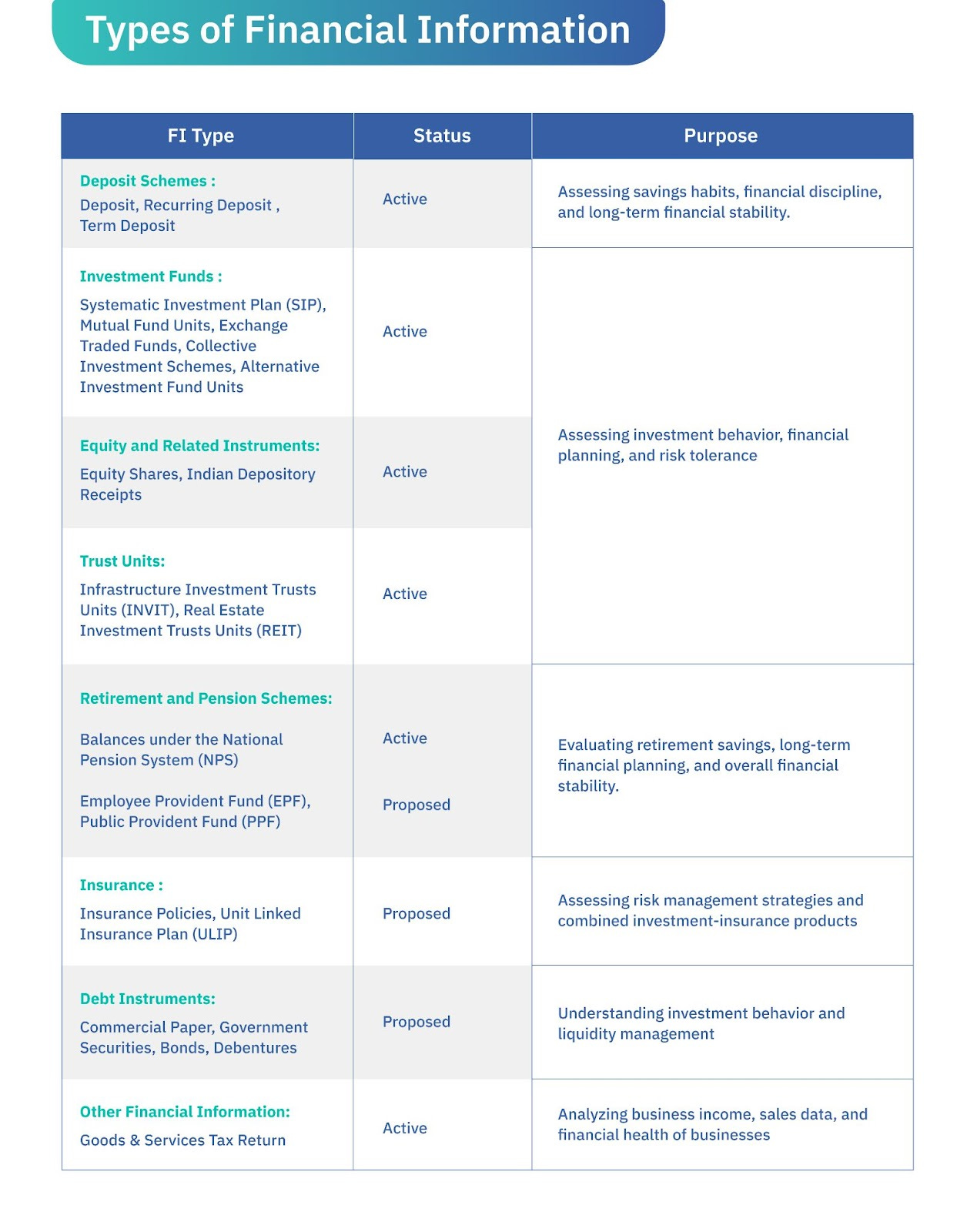

Financial data remains a cornerstone of the underwriting process, including credit scores, income statements, bank records, and other documents that offer a detailed view of a borrower’s financial health, such as their income-to-expenses and debt-to-income ratios. Account Aggregators provides more than 20 types of Financial Information concerned to a borrower.

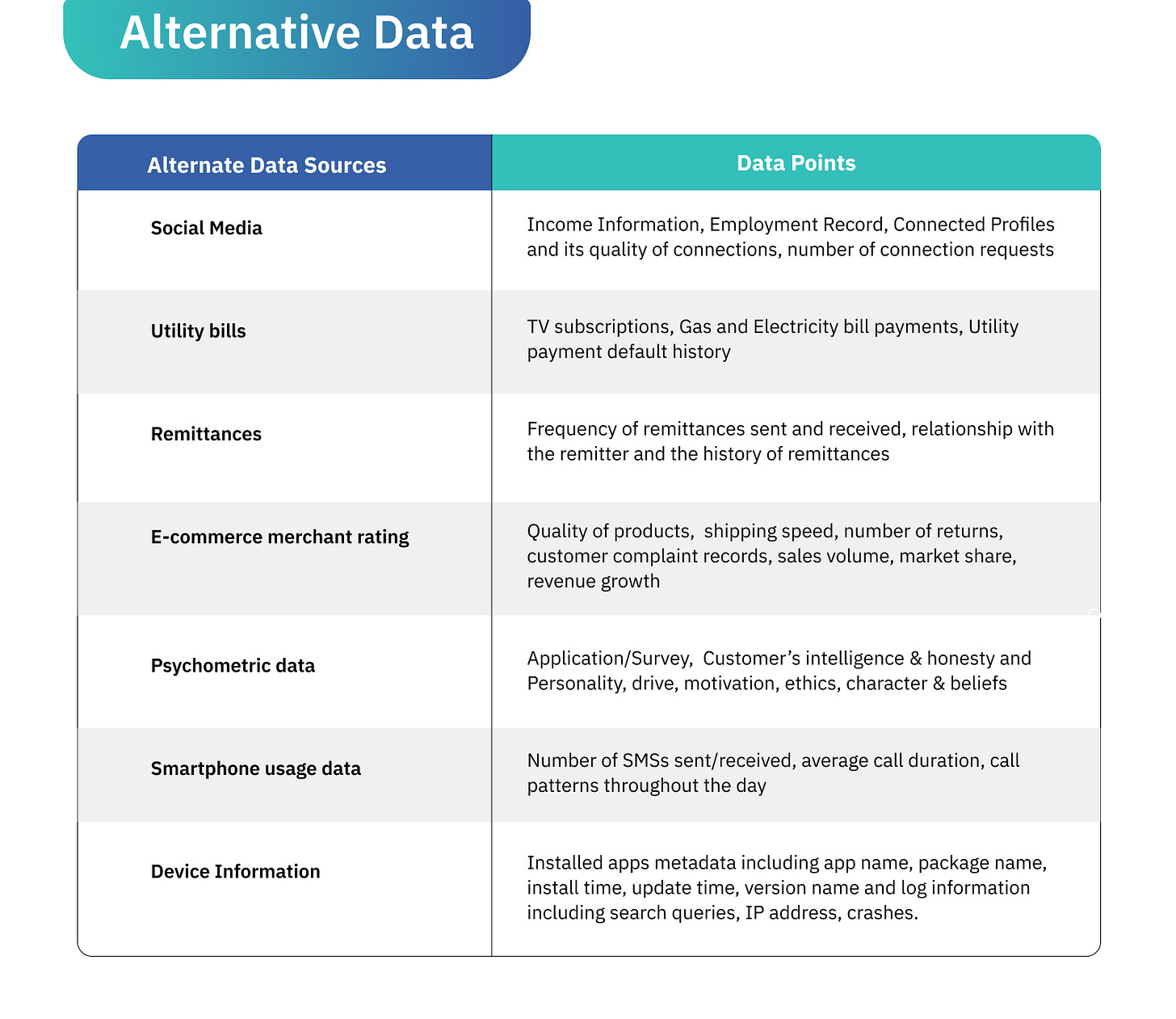

However, not everyone has a credit history, leading to a lack of financial data required for underwriting. This has driven the increased focus on alternative data, which is crucial for fintechs, particularly as they serve thin-file customers and new credit applicants without any credit history.

By relying on alternative data sources, these companies can evaluate the creditworthiness of applicants who might be underbanked, credit invisible, or categorized as 'no-hit' or 'thin-file' by traditional models.

Alternative data gives a well-rounded picture of consumer behavior and helps fintechs make better decisions on whom to target and design superior products, ensuring higher adoption rates and market sustainability. Alternative data sources are less susceptible to manipulation and provide a comprehensive picture of an applicant's financial behavior. Accurate assessments of consumers' risk status also ensures that loans are both profitable and moderated for risk. Leveraging alternative data in underwriting allows for personalized lending and loan pricing, ensuring borrowers pay interest rates tailored to their risk profiles rather than generic rates.

Now, you might be wondering, how do fintechs use all this data to figure out if someone is creditworthy, and do it all within minutes?

Data Collection and Structuring

Following the collection of diverse data, it is structured and curated in a format that can be processed and analyzed efficiently. Here’s where Artificial Intelligence (AI) and Machine Learning (ML) play a crucial role in underwriting.

Fintech companies develop proprietary algorithms that use a combination of traditional financial data and alternative data sources, applying machine learning techniques to analyze patterns and make predictions. These algorithms are trained on historical data to learn patterns and relationships that signify good or bad credit risk based on different borrower groups. The proprietary nature means they are tailored to the specific needs and risk models of the company. Inputs from the risk assessment team are essential to building accurate algorithms.

Borrower Categorization and Analysis

Fintech companies categorize borrowers based on their risk profiles. For example, digital lending platforms lend to customer segments earning between INR 1.5-4.5 lakh, including a significant number of Indian households known as the "next billion." Within this group, segments are further classified based on whether individuals are salaried, self-employed, or gig workers.

Customized algorithms assess these unique segments and build products tailored to their users. For example, for a cohort of gig workers, tailored products could include flexible repayment schedules and micro-loans based on their irregular income streams.

These algorithms handle vast amounts of data from multiple sources, quickly processing and analyzing it to create thousands of variables and identifying relationships between them. By selecting the most relevant data points, these algorithms effectively predict a borrower's creditworthiness. Based on the analysis, they generate a multidimensional customer profile and an overall credit/risk score.

Business Rules Engine

The final stage in the underwriting process involves using Business Rules Engines (BREs), which are automated decision-making systems applying predefined logic to the insights generated by the proprietary algorithms. It functions like a regression equation, incorporating various rules and criteria to make lending decisions and come up with the grantable loan amount, set fraud prevention measures, and establish interest rates. For instance,

Credit Score: Scores of 750 or above indicate a higher chance of approval.

Income Levels: Higher incomes increase approval likelihood.

Knockout Rules: Disqualify applicants with more than three bounced checks or from high-risk pincodes.

Range-Based Rules: Apply different interest rates based on salary ranges.

These rules ensure that the lending decisions align with the financial institution's business goals. These rules help the BRE assess creditworthiness and make tailored lending decisions.

Now, after a loan is approved by the Business Rules Engine (BRE), is there a credit analyst sitting there verifying all of the analysis to decide whether to give the loan or not?

For smaller loans like personal loans, the process is fully automated with no human involvement. However, for larger business loans, above a certain amount as set by the lender, let's say 25 lakhs, a credit analyst may review the BRE's analysis before final approval. The bottom line is that the ticket size determines involvement of humans, with higher amounts requiring more thorough human oversight.

This AI/ML based underwriting has revolutionized access to credit, opening doors for many who were previously left out. What sets top fintechs apart from the rest is the robustness of their underwriting practices. Effective underwriting leads to better portfolio, increased profitability, and sustainable growth for the fintech companies.

However, despite these technological advancements, the digital underwriting process is not without its challenges.

Getting the right data is complex and prone to multiple points of failure. Data sources such as Account Aggregators (AAs), credit bureaus, and other vendors can sometimes fail to provide necessary information.

Structuring the data into the right format is a challenge. If the data is not properly organized, the Business Rules Engine (BRE) may not be able to process it effectively and give accurate results.

AI/ML models carry the risk of potential algorithmic bias. This can disproportionately harm underserved communities, going against the primary goal of financial inclusion that these companies are trying to serve. This was also highlighted by the Deputy Governor of RBI Swaminathan J in his recent speech:

“…many NBFCs are increasingly turning to rule-based credit engines to accelerate the growth of their lending portfolios. It is crucial to recognize that rule-based credit engines are only as effective as the data and criteria upon which they are built. Over reliance on historical data or algorithms may lead to oversights or inaccuracies in credit assessment, particularly in dynamic or evolving market conditions”

The "black box" nature of AI-driven underwriting raises transparency concerns, leaving borrowers unaware of the criteria used for loan decisions. This lack of understanding can frustrate borrowers, who may feel confused and mistrustful when their applications are denied despite providing all required data.

AI-driven underwriting raises issues of data privacy. While alternative data provides a comprehensive view of creditworthiness, it raises issues of surveillance and intrusion into personal privacy, especially when consent for data collection is sometimes obtained using dark patterns.

Finally, with the passing of the Digital Personal Data Protection Act, 2023 and the extensive use of financial and alternative data by fintech companies, there is an increased burden on fintechs to comply with regulations regarding explicit consent, data storage, and the right to withdraw consent and right to delete personal data.

Calibration of credit models, ensuring data security, and maintaining regulatory compliance require significant resources. Fintech companies can only allocate these resources effectively when they achieve profitability which is closely tied to the efficiency of their loan collection processes. Similar AI/ML models based on data variables are used for effective collections that help banks and fintechs in debt management lower their non-performing assets (NPAs) and improve their financial health. In our next blog, we will delve into the collection strategies and techniques employed by fintech companies that has traditionally been a manual and costly affair for lenders.

https://newsroom.transunioncibil.com/more-than-160-million-indians-are-credit-underserved/

How do you collect the Alternate Data? How would you collect information from social media, if you aren't a friend of mine or a connection? How would you assess the subjective feeling on posting a gym picture of me working out into my credit worthiness? Or a status update about how that bitch broke my heart and I will have my revenge?

How do you get the data of my TV subscription? How do you know if I subscribe to HD channels? Or how many OTT platforms I have? What are my viewing habits? Do I watch explicit content or am I clapping my hands when Bade Miyan Chote Miyan run away from a blast?

Psychometric Data - How do you even begin to quantify my personality? Do you ask all your clients with smartphones to undergo a Brigg Myers Test? Intelligence? Ethics? How do these subjective factors become data points for any algorithm which does not have the capability to understand what is "right" and "wrong"?

Smartphone Usage? With all the hullabaloo surrounding Whatsapp chat privacy concern that occurred couple of years ago which resulted in Meta spending millions of dollars in reassuring the customer, are network providers willing to give this data to your FI to use in their algorithims?

Device Information? Are you really telling me that details of my apps, my internet history is available to bankers for their assessment?

I can understand gaining access to KYC details, ITR, Bank statements, credit scores, TPC checks. But how is AI or even for that matter a Credit Underwriter gaining access to my Alternate Data points?