Digitizing Traditional Retail: Promising Fintech Solutions for Indian Merchants

This blog explores fintech solutions like diverse payment methods, improved credit accessibility, and tailored insurance offerings for offline merchants.

In the not-so-distant past, the buzz around the tech integration in ‘kirana’ stores and the digitization of offline retail was seen as a nearly $ 1 Trillion opportunity1. VCs eagerly poured funds, and innovators hustled to create novel solutions. Yet, the outcome was far from the anticipated digital revolution for the nearly 13-15 million kirana shops2, making up over 90% of FMCG sales in India. Surprisingly, many of these innovations fell short of achieving liftoff, forcing startups to pivot into entirely different areas, largely in fintech and digital lending. The post-pandemic resurgence saw people flocking back to physical stores, raising questions about why certain forms of digitization failed to resonate with offline retail merchants. Several factors may have contributed to this resistance, from infrastructural challenges to entrenched traditional practices and even consumer behaviour patterns. Understanding these elements becomes crucial in comprehending the complex relationship between technology and the traditional retail landscape. Earlier blogs in this series cover these aspects through primary insights in some detail.

Why did the humble ‘soundbox’ take off where others failed?

Simple innovations like UPI sound boxes became a resounding success among offline retail merchants primarily because of their ease of adoption and immediate tangible benefits. They are deeply rooted in solving ‘real’ user problems, i.e. Such businesses are usually understaffed and one person must multi-task as a salesperson, cashier and manager. In such a scenario, the soundbox relieves the need to physically check the success of a transaction during a busy day. In contrast, other tech solutions such as digitising inventory management necessitated significant changes in existing workflows, training under-skilled staff, and infrastructure, presenting a higher barrier to adoption for retailers already navigating complex and low-margin operations. Frugality is at the heart of technological adoption in India. This is why the humble ‘paper and pen’ is still able to compete with these complex technological solutions. Most digitization efforts fail on account of a combination of many of these factors:

Despite these challenges, a promising array of fintech solutions are poised for substantial scalability. These solutions, rooted in practical problem-solving, focus on addressing tangible challenges faced by brick-and-mortar merchants. In our fifth blog of this series, we highlight a selection of these innovative fintech solutions.

1. Taking Payments beyond UPI

Driven by zero transaction fees and depth of acceptance, person-to-merchant (P2M) transactions in India are expected to account for 75% of all United Payments Interface (UPI) transactions by 20253. While UPI integration has been a game-changer, merchants are increasingly seeking diverse payment modes to cater to varied customer preferences. However, several factors inhibit their adoption of alternative payment methods. From complexities in onboarding processes to concerns regarding transaction fees, MDR and interoperability, merchants often grapple with the challenges of integrating and managing multiple payment options.

The rapid rise of consumer finance and Buy Now, Pay Later (BNPL) solutions and uptick in credit card usage have also significantly reshaped consumer spending dynamics, providing greater purchasing power. Even categories such as clothing and footwear are seeing purchases on EMI, previously unheard of! However, this surge in consumer-centric finance also necessitates a more flexible acceptance infrastructure for merchants. They seek adaptable systems that seamlessly accommodate these evolving payment preferences without adding undue complexity or operational burdens. Enter Integrated Point of Sale (POS) systems…

While integrated POS solutions offering functions such as inventory management and customer relationship management (CRM) have been around for a while, these have been sold using an all-at-once approach that requires merchants to pay for and utilise all integrated services as a suite. Learnings from our primary insights reveal that offline retail merchants tend to have a graduated approach to technology adoption and prefer incremental disruptions to their process flow, all the while being highly sensitive to rising costs.

Newer integrated POS systems like Pine Labs Mini4 have emerged as crucial innovations in this space. These solutions are incremental innovations. They not only streamline UPI payment processing but also offer added functionalities such as card tap-and-pay features and easy-to-use to enable card-based transactions at a fraction of the cost of a traditional POS system.

For fintech firms, the allure lies in offering solutions that directly address these merchant pain points. By developing user-friendly, versatile payment infrastructure, fintech companies can carve a niche by aligning their offerings with the evolving needs of merchants. It leaves the door open for more contextual cross-selling of relevant digitization solutions such as POS financing. Digital payment systems are the gateway for the adoption of more complex financial products and services that yield higher margins for the service provider.

2. Business Credit - Supercharged by Account Aggregator and OCEN

Small businesses struggle to access credit and tap into formal financial markets. In India specifically, the micro small & medium enterprises (MSME) credit gap, which is the credit demand that is unmet by the financial system, is estimated to be about $250 Billion5. Imagine a scenario where only 11% of MSMEs have formal credit access and more than 60% of credit demands go unmet. Historically, the reasons for this unmet demand are three-fold:

Risk in lending to small businesses: Most potential borrowers have poor or non-existent credit scores or other relevant data or documentation, and hence collection and repayment become a challenge for lenders

High operating cost for loan servicing: Acquisition, underwriting, and collection costs make it cost-prohibitive for lenders to target smaller borrowers.

Poor credit footprint beyond the metros: Most lenders can’t even access a vast majority of prospective borrowers through existing online and offline channels

Consider Ravi, a vegetable shop owner who obtains a loan in the morning to purchase supplies. Throughout the day, he sells his goods at a slight profit and repays the loan by evening. Despite the accessibility of loans from informal moneylenders, the interest rates Ravi faces amount to approximately 3-5% per week, which annualizes to around 150-200%! The challenge for people like Ravi lies in their inability to furnish sufficient data or assets as collateral, despite their pressing need for working capital. Consequently, these smaller businesses resort to NBFCs, which charge higher interest rates.

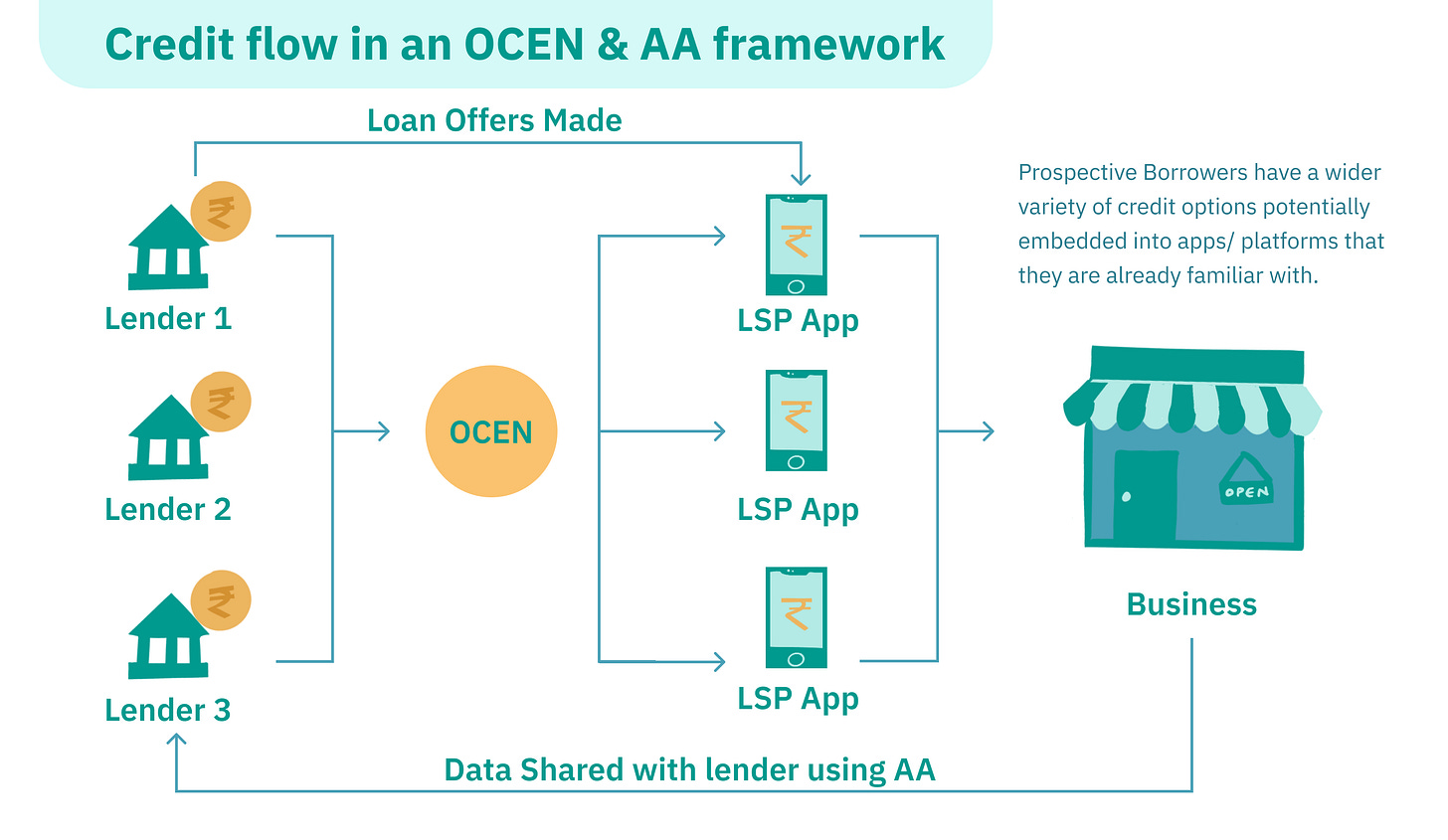

However, initiatives such as the Account Aggregator framework and the Open Credit Enablement Network (OCEN) are driving substantial change. These advancements are diversifying Ravi's opportunities by introducing a more competitive credit environment. Now, instead of being confined to limited borrowing options, he has the flexibility to explore and select from a wider array of credit sources that may better suit his business needs. Interestingly, many erstwhile kirana tech providers have shifted their focus to this space, recognizing the untapped potential in serving small and medium-sized enterprises, including offline retail merchants. Crowdfunding of microloans and P2P lending based on cash-flow-based underwriting models are some upcoming channels that could further increase borrowing options for small businesses.

Cash flow-based lending is a type of financing where a lender evaluates a borrower's ability to repay a loan primarily based on the cash flow generated by the borrower's business. Instead of primarily relying on collateral or assets, this approach assesses the company's historical and projected cash inflows and outflows, analysing its operational performance and ability to generate steady cash flow to meet debt obligations. The Account Aggregator (AA) framework is designed to make this data flow seamless across the ecosystem.

In this framework, any retailer-facing platform can become a Loan Service Provider (LSP) and play a novel role as borrower-facing agents or intermediaries in this reimagined digital lending flow. This opens up multiple acquisition channels through embedding financial services into apps or entities that retail merchants already access such as supplier groups or logistics partners. This also enables lenders to leverage the data that is already being captured by these Buyer applications or LSPs so that lending can become a cash-flow-based operation instead of the current balance sheet focus. Account Aggregator simplifies this flow further by enabling lenders with newer data sets such as GST data and real-time UPI transaction analyses to make easier underwriting decisions.

In the long-term, this may incentivise retail merchants to the digitization of inventory and invoicing, serving as gateways to enhanced credit offerings. Much like the cash flow-based lending empowered by UPI, these digital records provide invaluable insights into a merchant's operations. This convergence of multiple technological frameworks can have a transformative effect on the business credit landscape.

3. Making a case for B2B Insurance

B2B insurance, short for Business-to-Business insurance, refers to insurance products and services designed specifically for businesses to mitigate risks associated with their operations, assets, employees, and liabilities. Unlike insurance for individuals or consumers, B2B insurance caters to the distinct needs and complexities of businesses, offering policies tailored to cover various aspects such as property, liability, professional indemnity, cybersecurity, and employee benefits. In India, the uptake of B2B (business-related) insurance products within the offline retail sector has been relatively sluggish compared to more developed markets. One primary reason for this slow adoption is the limited awareness and understanding of the various available insurance products tailored for businesses among offline merchants.

Several types of business insurance products exist in India, catering to diverse needs:

While several fintech players have delved into the B2C Insurance Business, there has not been much traction so far in the B2B space. Fintech companies can play a pivotal role in boosting the adoption of business insurance among offline retail businesses through several strategies:

Customised Insurance Products: Fintechs can develop tailor-made insurance solutions specifically designed for the unique needs of offline retailers. These could include packages that cover inventory protection, business interruption, or even niche offerings such as coverage for specialized equipment or perishables.

Streamlined Digital Platforms: Fintech firms can create user-friendly digital platforms that simplify the insurance application, management, and claims processes. By providing intuitive interfaces and mobile accessibility, they can make insurance more accessible for retailers just as in the case of B2C insurance.

Flexible Payment Options: Offering flexible payment plans or micro-insurance models can make insurance more affordable for small and medium-sized retailers. Fintechs can enable pay-as-you-go or monthly payment options, easing the financial burden of lump-sum premium payments. This can initiate an interest in trying out insurance products within this segment.

Partnerships and Integrations: Collaborating with retail POS systems or inventory management software, fintechs can seamlessly integrate insurance offerings into these platforms. This integration simplifies the process of selecting and purchasing insurance, making it a natural part of the retailer's business operations.

In this evolving landscape, increased awareness, simplified access through technology, and collaborative efforts within the industry can gradually bridge the gap, enabling more offline retail merchants in India to recognise the value and necessity of embracing business insurance products to safeguard their enterprises against potential risks and uncertainties.

4. Digitising Storefronts and Value Added Services

For offline retail businesses, the evolution of digitization isn't only about transitioning to online platforms. It's the convergence of physical and digital experiences, a blend termed 'phygital,'. In a study on offline retail businesses 9 out of 10 customers surveyed6 said that they plan to use their local corner shops the same or more in the future. The same survey also points out that 80% of shopkeepers underwent some form of digitization during the COVID-19 pandemic. This was primarily in terms of online inventory purchasing, online cataloguing and hyper-local delivery services. This assumes significance also because the neighbourhood retail store home delivery business is estimated to be worth $70 billion annually but is largely unorganised with no online ordering or trackable delivery features7. While the traditional brick-and-mortar setup endures, leveraging digital interfaces has become pivotal in enhancing customer experiences and business operations.

Most startups in the ecosystem have focussed on the sale of ‘technology’ to the offline retail business8. However, these businesses serve a much larger role. The store plays a valuable role in the community, providing convenience, customer service, and credit. Digitization of offline retail businesses must not be seen in the context of directly competing with e-commerce. The integration of digital interfaces within physical stores offers an array of use cases that redefine the shopping experience. These include:

Initiatives like the Open Network for Digital Commerce (ONDC) hold immense promise. However, for offline retail merchants to fully reap its benefits, certain pieces are yet to fall into place. Digitization solutions that focus on the hyper-local characteristics of offline retail rather than attempting to scale its operations beyond its means are likely to be more successful.

Summing it up…

For fintechs navigating the space of offline retail in India, the failures and successes of past innovations offer crucial insights. Simplified, user-centric solutions like UPI sound boxes succeeded by addressing real pain points and offering immediate benefits, contrasting with complex systems that demanded significant changes in operations. Promising areas for innovation lie in integrated POS systems catering to the gradual technology adoption of merchants and offering versatile payment infrastructure at lower costs. Initiatives such as OCEN and Account Aggregator hold immense potential in bridging the credit gap for smaller businesses, demanding user-friendly lending solutions that align with merchants' needs.

The key takeaway is the need for fintech solutions to be practical, incremental, and seamlessly integrate into existing merchant workflows. Focus on tangible pain points, offer flexible payment options, and simplify access to credit and insurance products. Moreover, fintechs should tailor solutions that preserve the essence of offline retail while enhancing convenience and operational efficiency.

All artworks are designed by Himanshi Parmar.

If you enjoyed reading this blog and would like to receive more such articles from D91 Labs, please subscribe to our blogs here.

To read more about our work, visit our website

You can follow us on Twitter | LinkedIn | Instagram | WhatsApp

https://www.cbinsights.com/research/kirana-store-india-retail/

https://www.mckinsey.com/~/media/mckinsey/industries/retail/our%20insights/the%20state%20of%20grocery%20retail%20in%20india/the-state-of-grocery-retail-in-india.pdf

https://in.worldline.com/news/worldline-releases-its-india-digital-payments-report-for-H1-2023

https://www.pinelabs.com/media-analyst/pine-labs-introduces-mini-a-qr-first-device-with-card-acceptance

https://economictimes.indiatimes.com/small-biz/sme-sector/msmes-indias-growth-engine-face-a-rs-16-lakh-crore-credit-gap-msmeday/articleshow/69968156.cms

https://flourishventures.com/wp-content/uploads/2023/04/FV-16245-DCS-Downloadable-India-FINAL-2022-10-26.pdf

https://www.businesstoday.in/latest/corporate/story/this-start-up-aims-to-get-your-friendly-neighbourhood-store-on-ondc-382916-2023-05-26

https://medium.com/saison-capital/the-shuttering-of-digital-storefronts-ba0f3145a6c5