Designing inclusive solutions for securing the financial future of a kirana wallah

The digital financial inclusion for low value, high volume vendors

In India, the unorganized retail sector forms about 88% of the overall retail market and consists of approx. 13 million ‘kirana’ or grocery stores. These stores contribute heavily to the retail sector whose share in the Indian GDP is about 11%.1 These numbers simply represent our real life dependency on these small value vendors and those that run them.2

A day in the life of anyone living in India is likely to have a stop-by at at least one of these vendors, be it the nearest tapri, kirana store, vegetable wallah or their favourite street food seller!

The pandemic has not significantly reduced the reliance on these low value, high volume vendors but it has catalyzed the rapid digitisation of their business operations. Coupled with increasing smartphone penetration, digital payments have become the new normal for them.

A number of UPI-based payment apps have been targeting this segment and QR-code stickers are commonly found in these spaces. From March 2018 to July 2020, more than 20 million QR codes have been deployed for UPI-related payments and the monthly volume of payments through UPI QR was over 250 million. This speaks to the volume of merchants that are starting to accept digital transactions.3 As digital payments become the norm for these vendors, it seems crucial to discuss what more can be done to improve their present lives and secures their financial futures, on the foundation of such digitization which.

In this piece, we look at designing digital tools for achieving financial stability and preparing for future uncertainties. I spoke with Raguvaran4, a tapri shop owner in a bustling industrial complex of Bangalore. Through his needs and aspirations, we discuss the ways in which financial solutions could be designed to better support him and others like him.

Meet Raguvaran

Raguvaran lives in Bangalore with his wife and two teenage children. He has been running his shop for more than a decade, opening up for business at 7 am and shutting down for the day at 10 pm. His customer profile primarily includes the employees from offices around his shop and college students from institutes nearby. While a lot of his income is small value cash payments, he has embraced digital payments whole-heartedly.

Raguvaran’s son is his tech guru. He taught Raguvaran how to use WhatsApp, watch videos on Youtube and also use Paytm and PhonePe. He is still dependent on his son for things like online shopping on Amazon but he is very willing to explore these new ways of conducting his everyday affairs on his phone.

Despite this, his approach to finances continues to remain cautious. Take for example his relationship with credit. While his regulars have opened a ‘khata’ with him, allowing them to pay collective sums either on a weekly or monthly basis, he does not believe in borrowing loans to purchase items. He runs a 24-hour payment cycle with his suppliers — taking delivery of stock of the products in the morning and paying for them by end of the day. With his new found comfort with digital payments, he is happy that he can pay back his vendors on the mobile phone and can easily keep track of his payments. Apart from that, he uses a small notebook to tally weekly and monthly spending on goods as well as sales and also to track the ‘khatas’ of his regular customers. After deducting his business related expenses, Raguvaran makes an inconsistent and variable income anywhere between Rs. 500 and Rs. 1000 every day, bringing his monthly income to anywhere between Rs 15,000 to Rs 30,000 depending purely on his business.

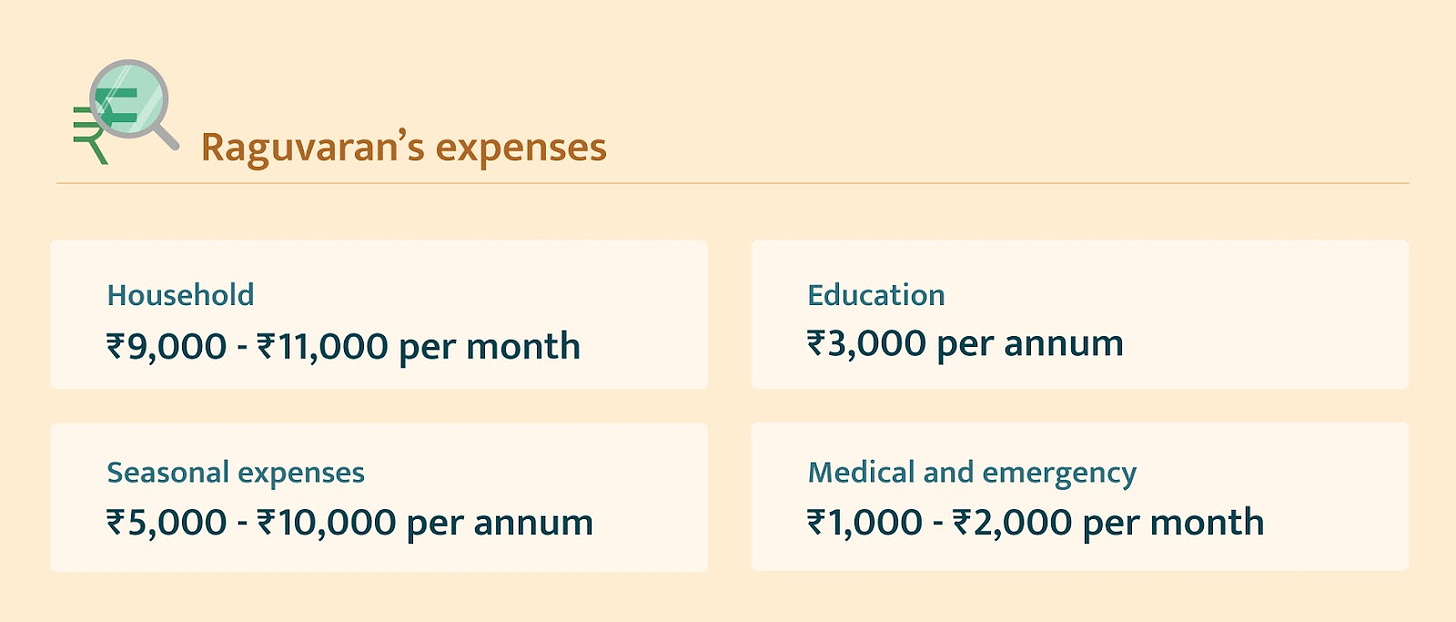

Against this understanding of his income, we discuss first his needs and then his aspirations. So to start with - the expenses of his household. Like most families with a single earning member and multiple dependents, the regular expenses involve monthly payments of groceries, rent, electricity and gas bills, yearly payment of school fees for his children and ad-hoc seasonal expenses around festivals such as Diwali or during the wedding season along with trips made to their native hometowns. Add to this any emergency expenses like medical bills, appliance repair and repayment of small informal loans being taken from time to time.

Looking towards the future, Raguvaran wants to save money to pay for his children's college education and marriage and to set up another shop that his wife can manage. He also wants to set aside some money for emergencies so that he does not have to rely on money lenders and informal loans in his time of need.

Since Raguvaran has been in the habit of making his earnings in cash and his payments in cash too, he used to set aside relevant amounts for his needs and expenses in cash at home. When he opened his savings bank account, he started depositing money into it from time to time and also initiated a monthly recurring deposit for INR 1000 as savings for the future. However, his deposits were not regular and bundles of cash at home segregated by use remained his primary financial management plan.

This plan went through a monumental shift when he started relying more and more on digital payments. Today, Raguvaran confidently uses digital payment apps like PhonePe because he doesn’t have to worry about coins and the money safely finds its way into his bank account. Payments for expenses may still be done in cash from time to time, but the remaining amount stays in his bank account for emergencies and for the future. What’s more, the money in the account also earns a small but consistent interest!

One of the key features that define the earnings of vendors like Raguvaran is the inconsistency due to seasonality and unpredictable circumstances. To take an example, Raguvaran who primarily caters to students in the locality of his shop is likely to have very low footfall and therefore earnings during months when the colleges are shut. Further, during the lockdown period where offices and colleges remained closed, his earnings would have been terribly hit! Therefore, even when he does have a positive bank balance for large parts of the year, financial products that cater to regular and consistent income become unavailable to him. This simply means that despite having a savings account, accepting and making digital payments, and otherwise running a profitable business, the financial planning options currently available in the market today do not serve him and other vendors like him.

So what can be done to make his finances work for him?

A portfolio of financial products and services that can support Raguvaran’s needs and aspirations can range from a simplified money management tool to a pocket-sized insurance cum savings tool.

As digital first products, these can go a long way in making financial security a reality for Raguvaran. But for these to help, these products need to be built with some principles and elements that specifically address concerns that Raguvaran has, in mind. To simplify these requirements, we have bucketed them into three categories — User Experience, Product Features and User Interface. Designing solutions with these principles in mind can make the financial lives of Raguvaran and others like him simpler and can also serve to support them to reach the best possible outcomes for the future.

User Experience

One of the primary concerns that exist for Raguvaran is access to clear and precise information about financial decision making. For example, even today, Raguvaran who is saving in a recurring deposit instrument withdraws an amount from his bank account and physically deposits the same with the financial institution with which he has a deposit account. To us, it might seem almost intuitive to set up an auto debit for the amount from the existing account instead of physically depositing it. Therefore, despite having access to a service, it is only when this fluency and awareness about experiences with financial products is achieved that financial services can see more usage. Some potential ways that can facilitate an improvement in this user experience for this cohort include the following.

Communication

Raguvaran does not understand complex financial jargon. He knows his goals but needs help in figuring out the best ways to achieve them with the means he possesses. Strategising on his behalf and figuring out other aspects of planning is a key requirement. Further, communication in his vernacular language is important to make Raguvaran understand and relate to a product. Options to seek assistance in the same local language can make it easier for him to access help when he needs it. Also, richer media such as images and videos are easier to consume than text and he is more likely to engage with them. Finally, it is important to communicate to him the choices he has in a manner that promotes informed choice in place of fully formulated opinions.

Empowering him with the options and the necessary tools to understand these options makes for the most effective long term strategy to improve his usage of financial products.

Community access and trust building

One of the most significant contributors towards usage of one set of products over another is the trust that the customers have in that product. In order to inculcate that trust, developers need to tap into networks where trust exists. Raguvaran prefers to place his trust on things tried and tested within his social circle. The same applies to financial products and services including savings and loans. In finance, community plays a role in learning about schemes, getting small loans, group investments, informal chit-funds, and self-help schemes. For vendors like Raguvaran who run business with hyperlocal business distribution models, the value of community is necessarily ingrained and has a large impact on shaping their behaviours towards digital finance. Finally, personalized recommendations based on cash flow coupled with timely updates on his financial activities, seamlessly delivered through a communication medium most preferred by a customer also contribute towards building trust. They help in keeping track of goals and show him that the customer’s needs are being considered and prioritized.

Product Features

The next set of elements relate to product features. These aim to address the primary challenge that exists for the cohort. One day Raguvaran makes a profit of Rs. 1000 and the next day he makes only Rs. 500. His income is thus volatile. Ensuring that there is an accommodation for this variability is crucial in building any product for this cohort. The flexibility in instruments targeted for this cohort becomes one of the most important features. Further, in the lifecycle of a person, goals exist that have various timelines and purposes. Each of these goals also need a variable approach towards planning for it. The ability to make these plans and track their progress is key in creating an enduring financial strategy for members of this cohort given the vulnerability of their finances.

Finally, products that are able to assign value to their cashflows and underwrite their risk on the basis of potential of the business are most suited for Raguvaran. There exist very few such options in the Indian market currently and therefore represent a white space for the fintechs to address.

User interface

In order to achieve the above user experience, the technological features that Raguvaran interacts with need to support him. From finding regular prompts in a simple and easily understandable format to finding solutions for his many financial needs in a single window format, UI makes his financial world go round. Let’s take the example of platform integrations.

Raguvaran has been using digital payments comfortably for the past 6 years, however, there are other aspects of his financial life that do not interact with digitisation. He does not feel comfortable with e-commerce or credit on digital platforms. To change that, we tap into his reserve of trust built on existing platforms that he uses. There exist many such platforms that have capabilities of Gold, FD, RD, and insurance schemes within themselves. This is a safer option for him and can be an enabling space for him to try newer financial solutions.

Another example is a simple goal based financial planning tool that serves the purpose of tracking expenses, making savings and also disseminating information about various products and their features in a single window format. If built keeping the user experience at its core, this product stands to contribute heavily in the financial independence and sustainability of a person like Raguvaran.

Finally, UI for this cohort needs to rely on gently nudging the customer into taking steps towards their financial futures. Simple reminders set towards completing requirements that are predetermined and communicated clearly can go a long way in assisting in the achievement of these goals. Further, automated readjustments in the path towards the goal that get activated in case a daily or weekly step is not taken, amount not deposited or smaller goal not met can be a great tool in tracking real time progress and redirecting resources where necessary.

To sum up

India’s reliance on small-value vendors is huge and this sector is rapidly getting digitised. In focusing on simplification and education with the goal of empowerment, inclusive solutions for Raguvaran and his counterparts need to be based on the notion of trust and community. I strongly believe that the first step to building such products is simply understanding the personal needs and aspirations and exploring options that promote an informed choice much like the kirana wallah does when you call him to order your groceries and get them home delivered! Can you think of other ways to make this easier?

Allwin Williams is an Interaction Design Student at the National Institute of Design, Bengaluru. These are his personal views.

All designs by Prajna Nayak. This article has been edited by Neeti Bhatt.

If you enjoyed reading this blog and would like to receive more such articles from D91 Labs, please subscribe to our blogs here.

To know more about our work at D91 labs, visit our website!

https://www.investindia.gov.in/team-india-blogs/modernization-kirana-stores-india

https://qz.com/india/1994922/why-amazon-and-reliance-need-indias-humble-kirana-stores/

https://www.moneycontrol.com/news/business/2021-the-year-upi-became-the-undisputed-payments-champion-7860841.html

Report of the committee on the analysis of QR (Quick Response) code, 2020

Name changed for confidentiality purposes.