Decoding the draft co-lending regulations by RBI

Have you heard about the comparative advantage concept in economics? Co-lending arrangement (CLA) is just that. Read to find out more about the recently published draft CLA guidelines by the RBI.

Imagine this - a collaboration wherein banks contribute through their low cost of funds while NBFCs and fintech bring their agility and reach to underserved markets. The co-lending model facilitates partnerships like this while bridging the gaps in traditional lending models and providing affordable and timely credit to underserved segments.

Let’s consider the example of Smitha, a 28-year-old tailor from Tumkur, Karnataka, who does patchwork for garment manufacturing units and wants to expand her business by setting up her own shop. To raise funds for her new venture, she applied for a business loan at a few banks in the area. While banks rejected her loan application due to her limited credit history, loans from NBFCs had high interest rates.

However, her access to affordable credit changed with the new regulation on co-lending, which enables loans for micro enterprises at lower interest rates. Similar to Smitha’s business, more than 63 million micro enterprises in India will benefit from the revised co-lending regulations issued by the RBI (Reserve Bank of India) in April 2025. Read ahead if you are wondering how!

But first, let’s understand what co-lending?

Co-lending is a lending arrangement wherein financial institutions jointly fund, underwrite, and disburse loans to borrowers. Banks and NBFCs collaborate to provide loans to underserved segments while leveraging each of their strengths in lending. While banks have a lower cost of funds, NBFCs have better distribution channels to acquire and service customers.

Loans provided through the co-lending model thus enable better interest rates for borrowers, improve processing time for approval of loans, and provide an affordable source of credit for new-to-credit customers. As of 2023-24, banks and NBFCs have disbursed more than INR 25,000 crore through co-lending partnerships for housing finance, consumer finance, and MSME financing.

So, how does this arrangement work?

The key to a well-functioning co-lending system lies in the execution. In a standard co-lending arrangement, two regulated financial institutions (REs), let’s say a bank and an NBFC, enter into a formal agreement about mutually servicing a loan. The parties involved will decide the quantum of loan to be funded by each. They will also mutually decide all other modalities such as customer acquisition, loan underwriting, processing, disbursal, collections, and grievance resolution.

For the borrower, the involved funding REs need to make upfront disclosure of who is responsible for sourcing, funding, and servicing. In addition, the agreement should also mention the provisions for customer protection and grievance handling.

Sounds interesting, but what’s in it for the financial institutions?

Here are some of the reasons why REs can benefit from the CL arrangement -

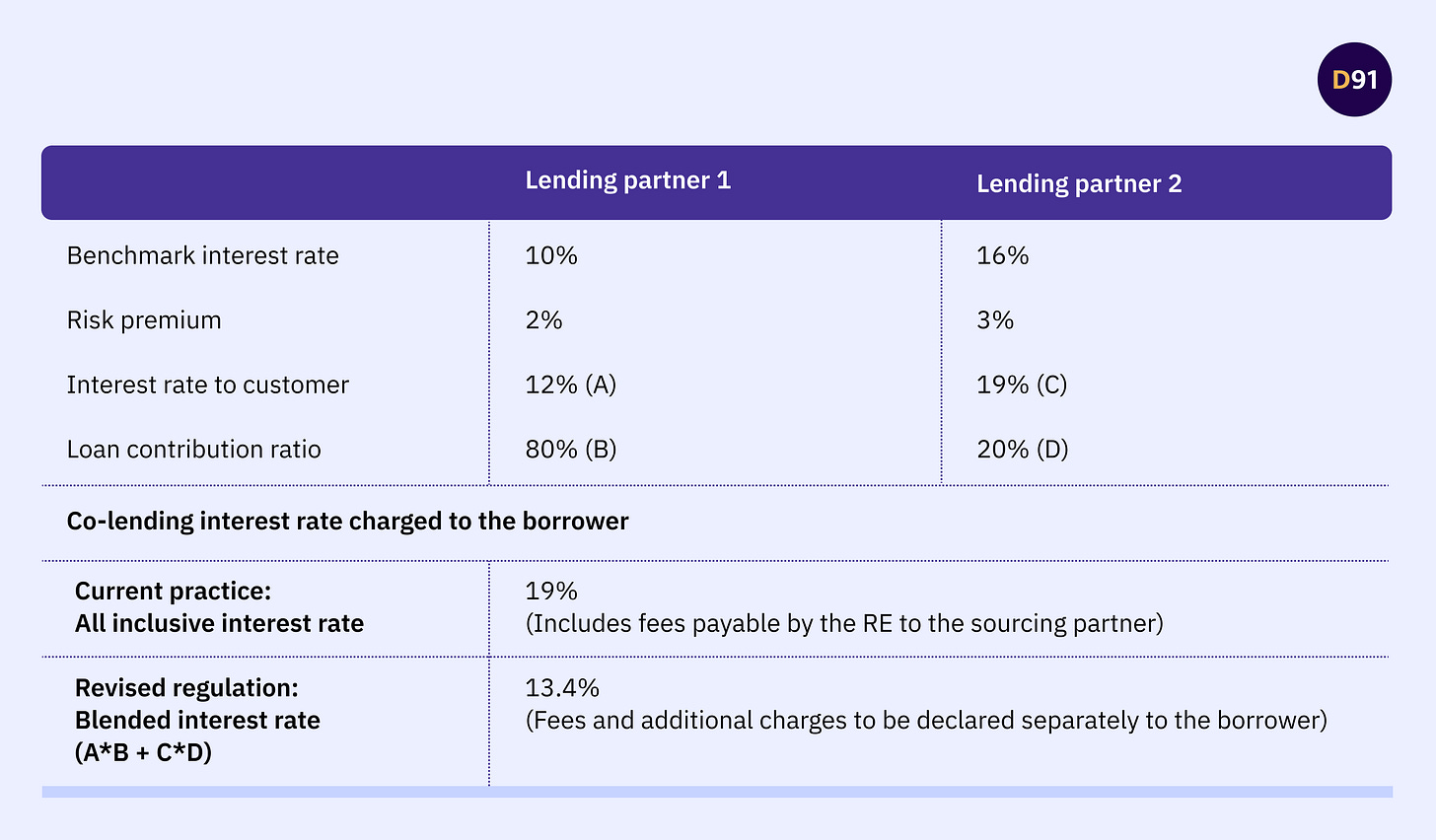

Credit cost optimization - When a bank co-lends a loan with an NBFC, the borrower will be charged a blended interest rate. A blended interest rate is calculated as an average rate of interest derived from the interest rates charged by respective funding REs. More on that later.

Better risk-sharing arrangements: The REs involved can decide the proportion of the lending portfolio they want to fund, as well as allow a First Loss Default Guarantee(FLDG) up to 5% of the loan outstanding under the co-lending agreements. In case you don’t know what DLG is, refer to our footnote below1.

Wider distribution: In a co-lending arrangement, the two REs involved will have their comparative advantage. The NBFC/ NBFC FinTech will bring in agility with wider customer reach and digital forms of customer acquisition channels, and the banks will have a lower cost of funds. This will improve the distribution of loans for the lender as well as lower the cost of the loan for the borrower

Interesting right? Here’s more on the who-what-when of co-lending -

When two regulated entities join forces to jointly service a loan or a loan portfolio, the credit policies of both REs, should mention the following:

Internal limit for the proportion of their lending portfolio

Target borrower segments

Criteria for the selection of borrowers

Specific product lines and operational areas

Fees applicable to the loan

Overall segregation of responsibilities2

Customer interface

Customer protection

But wait - why was the co-lending regulation revised?

The co-lending regulations were revised for two main reasons:

Increase participation beyond banks and NBFCs

Expand the loan segments beyond priority sector lending

The co-lending ecosystem has evolved as NBFCs and banks partner with fintechs for digital lending and loan sourcing. Digital lending in partnership with fintechs helps NBFCs to tap into new customer segments through the fintech’s digital reach. Further, loan sourcing agreements with fintechs help streamline operations across the customer journey , including customer acquisition, underwriting, collections, and grievance redressal. The draft regulation recognises these innovative partnerships beyond the traditional bank-NBFC co-lending model.

With new forms of co-lending partnerships, the type of loans offered through co-lending has moved beyond the non-priority lending sectors (non-PSL) such as personal loans and consumption loans. As per market estimates, 75% of the loan volume disbursed by banks through co-lending are non-PSL loans. Although RBI provides case-by-case approval for non-PSL loans through co-lending, the expansion of scope to non-PSL loans in the draft regulation would help financial institutions to develop new loan products and serve new customer segments.

What are the key changes in the draft co-lending regulation?

The draft co-lending regulation issued by RBI in April 2025 aims to address the evolution of co-lending arrangements in India, expanding its scope beyond the bank-NBFC model.

*Calculation of interest rate under the current practice vs the revised regulation

Does the draft CL regulation say anything about the LSPs?

While lending service providers are primarily governed by the Digital Lending Guidelines (DLG), the aggregation of loans through a platform intersects with the co-lending model. Let’s take a look at what the draft regulation states to understand this further:

Digital lending arrangements shall continue to be governed by the Guidelines on Digital Lending dated September 02, 2022 (DLG) as amended from time to time.

Provided that any digital lending arrangement involving co-lending by the REs shall, without derogation to the DLG, be guided by the provisions of these Directions.

The draft regulation brings the sourcing of loans by LSPs under the same regulatory oversight as co-lending arrangements. This implies that if an LSP is involved in sourcing loans for an RE without any funding contribution, its operations would be governed by the co-lending regulation (in addition to the digital lending guidelines).

Banks and other regulated entities (such as NBFCs, HFCs, and MFIs) outsource lending-related services to LSPs3. The draft regulation brings such services under the regulatory purview of the co-lending regulation.

Here is an illustration of how a sourcing arrangement works:

As per the draft regulation, an LSP would need to:

Disclose the list of lending partners on their platform (also applicable for LSPs as per the Digital Lending Guidelines)

Develop a separate agreement for fees charged by the lending partners for loan sourcing services, separate from the blended interest rate charged to the borrower

Provide a breakup of the interest rate and additional fees charged for services to the borrower

In the case of both types of partnerships, sourcing arrangements with an LSP, or a co-lending arrangement between financial institutions, the entities need a technology solutions provider (TSPs) to integrate their systems. Examples of TSPs that provide solutions for co-lending partners, from onboarding to repayments, are Saison OMNI and Yubi Co.Lend

A word of caution - Two heads aren’t always better than one!

In a co-lending arrangement, there can be conflicts on matters related to credit risk styles, operational risk, as well as abiding by regulatory guidelines. For instance, the NBFC responsible for acquiring customers might have less stringent checks in place, which can lead to higher delinquencies. This can impact the overall arrangement between the two lending institutions.

For a partnership to work out efficiently, the REs have to be cognizant of the different systems, protocols, APIs, terms and conditions, disbursement cycles, collection practices, complaint resolution, as well as overall accountability when things go wrong. As the draft RBI guidelines indicate, the contract should cover all expected and edge cases and should be abided by in case of a conflict.

What is FLDG ? A contractual arrangement, called by whatever name, between the RE and another entity, under which the latter guarantees to compensate the RE, for the loss due to default up to a certain percentage of the loan portfolio of the RE, specified upfront. Any other implicit guarantee of similar nature, linked to the performance of the loan portfolio of the RE and specified upfront, shall also be covered under the definition of DLG. In the case of co-lending agreements, the upper limit is upto 5% of loan outstanding.

Customer responsibilities are set of activities related to lending such as customer acquisition, underwriting, pricing, servicing, monitoring, and recovery of specific loan or loan portfolio, etc. performed by permitted REs or the agents on behalf of the permitted REs

Lending related services provided by the LSPs to banks and other regulated entities includes customer acquisition, underwriting, pricing, servicing, monitoring, and recovery of specific loans or loan portfolio.

All artworks are designed by Smriti Krishna.

If you enjoyed reading this blog and would like to receive more such articles from D91 Labs, please subscribe to our blogs here.

To read more about our work, visit our website

Good article . Co lending often becomes a headache not due to process but due to egos of underwriting officers of the partner REs . The loan approval part has to be very clear to the 2 parties . As they move to bigger ticket sizes , this problem will likely grow. Ideally common scorecards and seamlessly integrated loan origination systems should help.