Decoding RBI’s Recent Announcements: Enhanced Security, Financial Inclusion, and Consumer Protection

A deep-dive into the RBI's recent Monetary Policy Committee's announcements aimed at bolstering the security of digital transactions, enabling financial inclusion, and ensuring consumer protection.

‘Stability’, ‘inflation’ and ‘growth’ were the most used words in the recent address by the RBI Governor during the Monetary Policy Committee Meeting held on 8th February 2024. The speech paints a picture of confidence and optimism regarding the economic trajectory of the country. For better or for worse, it's one of those addresses that you’d expect or want to be uneventful or rather… boring. Signs that all is well!

In this pursuit of stability, most key monetary policy indicators have remained unchanged and inflation seems to be under control. However, the address highlighted a few key announcements that have significant implications from the point of view of enhancing financial inclusion, consumer protection and opportunity areas for financial service providers and fintechs. We discuss some of these announcements here:

Announcement 1: To mandate all regulated entities to provide the ‘Key Fact Statement’ to the borrowers for all retail and MSME Loans.

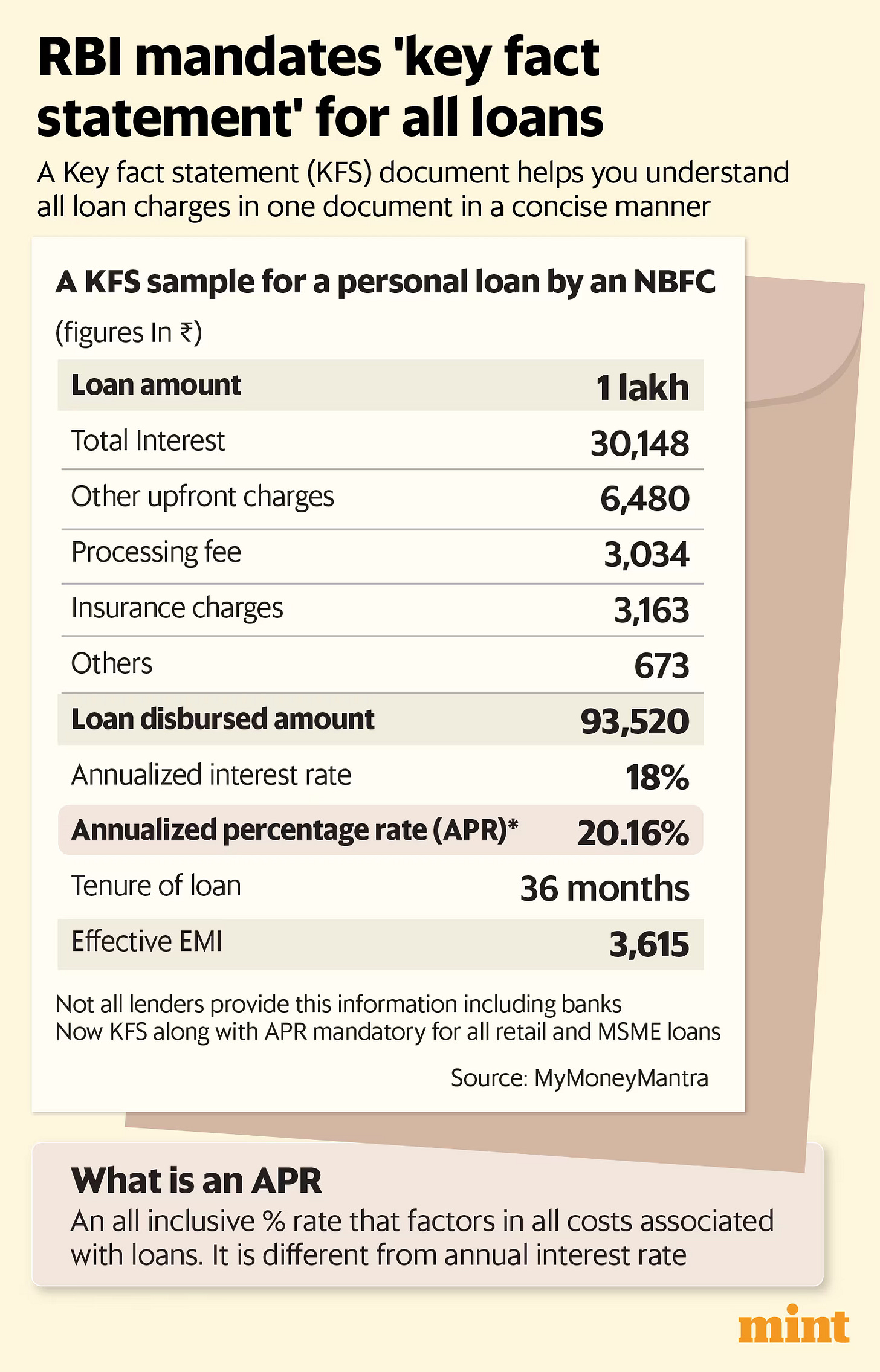

In a bid to enhance consumer protection, the RBI has mandated lenders to provide a ‘Key Fact Statement’ (KFS) to all retail and MSME borrowers.

What is a Key Fact Statement?

A Key Fact Statement is a document that clearly explains lending terms. It has key information regarding a loan agreement, including the all-in-cost of the loan, in a simple and easy-to-understand format. Earlier, the KFS requirement pertained only to certain categories of lenders, specifically loans by banks to individual borrowers, digital lending and microfinance loans. This article from the Mint provides an excellent summary of what a Key Fact Statement could look like.

Currently, when people borrow money, they not only have to pay interest but also other extra costs like processing fees for paperwork. The proposed KFS should make things clearer and more transparent. This statement must clearly show important details such as the total cost of the loan shown as an Annual Percentage Rate (APR) and information on how to address complaints or get back any dues, all in a straightforward and easy-to-understand way. It will help people better understand what they're signing up for when they take a loan. This is especially helpful for short-term loans, which might have high initial fees but lower interest rates, allowing borrowers to compare and make better choices.

Differentiation in the way financial service providers and fintechs implement and communicate the KFS can make for a compelling business case among cohorts currently underserved through digital lending.

Announcement 2: For the security of digital payments, it is proposed to adopt a principle-based “Framework for authentication of digital payment transactions.”

The RBI is set to release detailed guidelines outlining a new authentication framework based on fundamental principles that are aimed at protecting customers from fraudulent practices. Currently, for transactions made through the Unified Payment Interface (UPI), banks often use a One-Time Password (OTP) sent via SMS for verification. However, this method is not completely secure. The Finance Ministry stated that India experienced more than 95,000 instances of UPI fraud in the fiscal year 2022-231. With digital fraud on the rise at a worrying pace, the central bank is prompted to enhance its security protocols, moving beyond the conventional SMS-based OTP system.

Some alternatives to the current approach could include biometric authentication for a personalised security experience using fingerprints, iris scans, or facial recognition; token-based systems that use hardware or software to create unique codes for each transaction; and risk-based authentication, which adjusts security measures based on the specifics of each transaction and the user's profile, offering a more flexible approach to safeguarding online payments. However, concerns about conflicts of interest and data privacy persist across most of these methods. On the back of UPI’s popularity, the main goal here is to build trust among users, encouraging more people to use digital payment methods and supporting the spread of financial inclusion.

Announcement 3: To enhance the security of Aadhaar Enabled Payment System (AePs) transactions.

AePS is a service that lets bank customers use their Aadhaar number and biometric markers to access their bank account and do basic tasks like checking their balance, depositing and withdrawing money, and sending money through a Business Correspondent (BC) or agent.

BHIM Aadhaar Pay is an acceptance infrastructure that allows shopkeepers to get digital payments from customers using Aadhaar for verification. According to RBI data for November 2023, AePS recorded 1,079.59 lakh transactions, totalling ₹28,972 crores2. Meanwhile, BHIM Aadhaar Pay saw 18.82 lakh transactions, with a total value of ₹590 crore. In September 2023, a civil society group alerted the RBI about a wave of frauds happening nationwide. In these scams, criminals are misusing bank customers' fingerprints to steal money from accounts at Customer Service Points through the AePS system3.

AePS, managed by the National Payments Corporation of India (NPCI), serves more than 37 crore customers currently. Given the importance of AePS in promoting financial inclusion through Direct Benefit Transfers and recent fraud cases, the RBI plans to make the process of signing up service providers for AePS more efficient. To begin with, all operators interacting with customers will undergo a standardised, secure process when joining the system. Additional security measures may also be introduced to make the system even safer.

Announcement 4: To introduce programmability and offline functionality in the Central Bank Digital Currency (CBDC) pilot.

India's central bank digital currency (CBDC), known as the e-rupee, saw over 1 million daily transactions as of December 27, 2023, a number that aligns with the Reserve Bank of India's (RBI) goals but is still modest for a population of 1.4 billion. This increase from just 25,000 daily transactions in October was mainly due to banks using the e-rupee to distribute employee benefits4. Despite this growth, the e-rupee has received a tepid response from users, largely because of the widespread success of the Unified Payments Interface (UPI) system. UPI offers free payment transfers and has revolutionised digital payments in India, making it hard for users to see the benefits of switching to or using the e-rupee, which, while direct and instant, offers a similar digital payment experience without the tangible differences that UPI provides.

The recent announcement by the RBI regarding the offline functionality of the e-rupee is aimed at significantly boosting its adoption in India by promoting financial inclusion, especially in remote and rural areas with limited internet access. This move opens up avenues for fintech innovation, leveraging the CBDC's programmable and offline capabilities to offer more personalized financial services. With the potential for specific applications such as government benefits and corporate expense management, and the ability to conduct transactions offline, the e-rupee could see increased usage and compete with existing payment platforms like UPI. However, efforts in financial literacy will be crucial in educating users about the e-Rupee, especially in underserved areas.

For more explainers like these, stay tuned for the next edition of D91 Blackboard.

All designs by Wamika Das and Himanshi Parmar.

If you enjoyed reading this blog and would like to receive more such articles from D91 Labs, please subscribe to our blogs here.

To know more about our work at D91 labs, visit our website!

https://www.businesstoday.in/personal-finance/story/not-otp-rbi-proposes-new-verification-mode-for-digital-payments-new-framework-for-authentication-of-digital-payments-soon-416715-2024-02-08

https://www.thehindubusinessline.com/money-and-banking/npci-swings-into-action-to-prevent-aeps-frauds/article67672192.ece