Decoding Emerging Digital Lending Models in India

In our second blog of the series, we delve into the digital lending models that enable fintechs to partner with regulated entities, securing the essential capital required for growth and innovation.

In the vibrant startup hub of Bengaluru, Ravi Jain is actively planning the launch of 'CashVibe,' a fintech platform set to transform financial access for underserved small business owners. Conscious of the financial hurdles typical to new fintech ventures, such as limited capital and restrictive funding options, Ravi understands the critical importance of choosing the right digital lending model.

Ravi weighs several vital factors in his decision-making process. He considered the level of risk 'CashVibe' could comfortably assume, the degree of control he wants over the lending process, and the potential for generating enough revenue to support and expand the business. Each lending model offers different advantages and challenges in these aspects. His goal is to choose a model that best balances these elements, allowing 'CashVibe' to offer reliable, inclusive financial services.

Like Ravi Jain at 'CashVibe,' fintechs face critical strategic decisions as they scale their operations. In contrast to well-established banks and financial institutions, which benefit from access to cheaper sources of capital through extensive customer deposits, fintechs navigate with more constrained resources, typically restricted to equity or debt.

That’s where partnerships with Regulated Entities (REs) come in.

PS - Regulated Entities are financial institutions, such as Banks and Non-Banking Financial Companies (NBFCs), that operate under regulatory oversight from the RBI.

Strong Financial Backing: Partnering with Regulated Entities (REs) gives fintech companies the necessary financial backing to grow, especially those starting with just venture capital.

Regulatory Guidance: REs help fintechs navigate the tricky waters of regulations, including the new Digital Lending Guidelines of 2022.

Boosted Credibility: Working with REs enhances a fintech’s reputation, drawing on the trust that traditional financial institutions have built over the years to attract more customers.

Expert Risk Management: REs bring invaluable experience in handling loan portfolios and preventing defaults, helping fintechs stay robust against unexpected market changes and borrower defaults.

But, this benefits fintech companies right? What’s in there for REs? Why would they join such a partnership?

"Evolve your technological capabilities or perish," warned veteran banker KV Kamath to REs at risk of losing market share to agile fintechs, especially in payments and lending.1 As a result, they have proactively shored up their fintech partnerships. It also enables REs to access a wider and more thin file customer base.

REs typically take the lead in adhering to regulatory frameworks including KYC standards, transaction monitoring, and capital requirements necessary for digital lending entities. In contrast, fintechs bring agility, advanced technologies to streamline processes, a deeper understanding of customer behaviour, and superior UI and UX design capabilities.

It is this partnership that is transforming India’s financial landscape. The collaborative approach between fintech and banks has evolved from competition to cooperation, with over 65% of fintech CEOs prioritizing partnerships2, setting the stage for us to explore the various lending models that have emerged in the market.

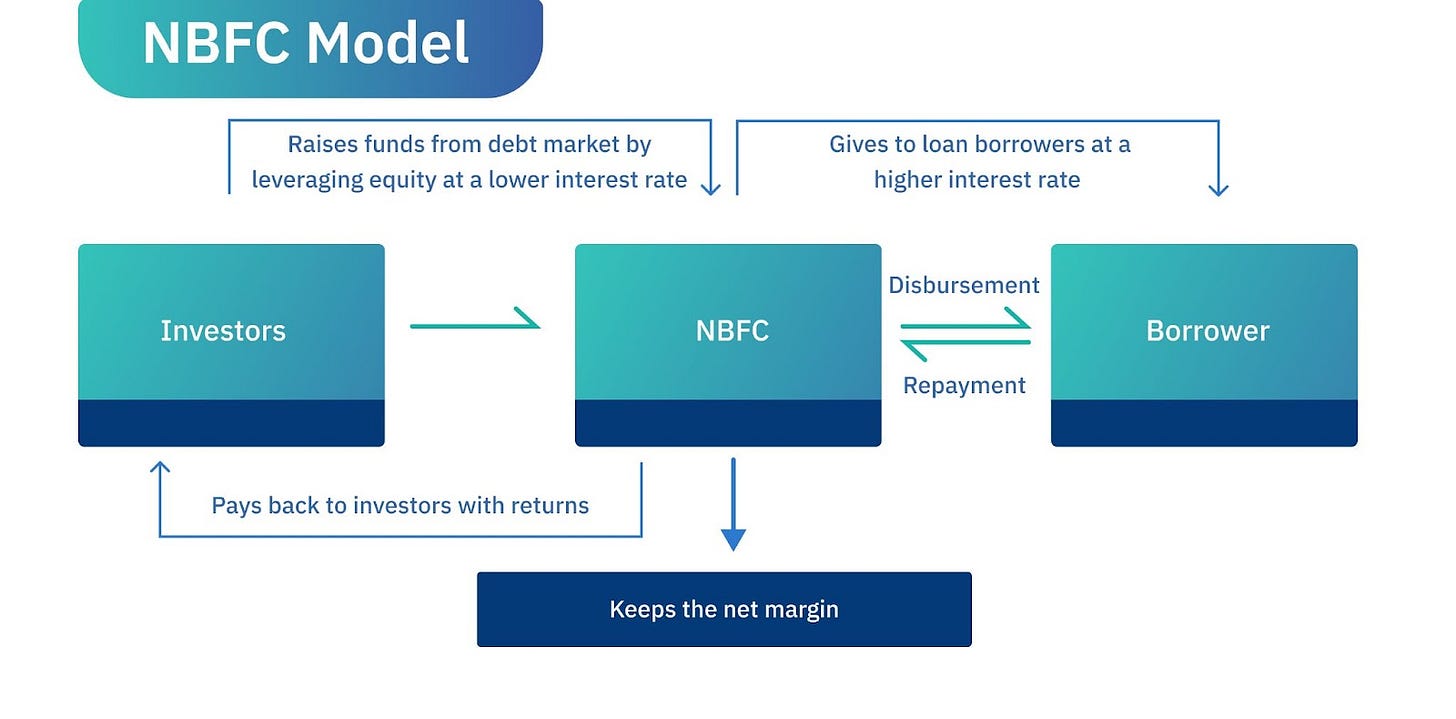

The Fintech-NBFC Model

A fintech company acquires an NBFC (Non-Banking Financial Company) license, starting with its capital and leveraging additional funds through debt instruments like bonds and commercial papers. This blend of equity and borrowed money fuels its lending operations. Effective management allows such firms to significantly boost their funding capacity over time. For example, companies that initially raised ₹25-30 crore can now secure up to 5X that amount, by demonstrating prudent financial practices and sustained growth.

These firms typically pay 6-9% interest on borrowed funds but charge borrowers 12-15%, earning a net interest margin of 3-7%. This strategic approach helps them attract more investors and expand their operations. For instance, companies like Krazybee and Clix Capital have recently raised funds by issuing bonds in the market.

It serves both as a customer acquirer and a lender. The control over underwriting and credit management lies completely with the NBFC, providing it substantial influence over its operations and financial outcomes. They use sophisticated analytics for credit scoring and risk assessment, automate underwriting processes, and streamline loan management systems that enable them to tailor their lending criteria based on their risk appetite and market strategy. However, greater control comes at the cost of stricter regulatory oversight from the RBI.

Co-Lending Model

Co-lending is a collaborative arrangement between a RE and a NBFC, where both share the loan issued to the customer—typically with the bank providing around 80% and the NBFC providing 20% of the loan amount. The interest rates charged to borrowers are a combination-weighted average of the rates from both partners along with their respective commissions. This setup allows for shared risks and income among both parties.

Fintechs participate in co-lending models in two main ways. First, as fintech NBFCs, they directly partner with banks to co-lend, contributing capital and sharing risks. Second, fintechs without NBFC licenses act as Technology Service Providers (TSPs) for both banks and NBFCs, performing tasks such as customer acquisition, credit assessment, and providing end-to-end loan management solutions. For instance, LendingKart, a fintech NBFC specializing in business loans has entered into agreements with more than 25 REs including HDFC Bank and Tata Capital.

Both parties jointly engage in the underwriting process. Co-lending agreements specify the roles clearly: NBFCs often manage customer acquisition, loan sourcing, quicker documentation and customer management, while RE provides the funding and builds credibility to attract and retain customers.

Regulatory encouragement by the RBI and the integration of multiple data points through Account Aggregator (AA) into underwriting has significantly enhanced lender confidence, encouraging more robust co-lending partnerships. For instance, in the case of LendingKart, co-lending now accounts for about 90% of Assets Under Management (AUM), compared to just 6% nearly four years ago!3

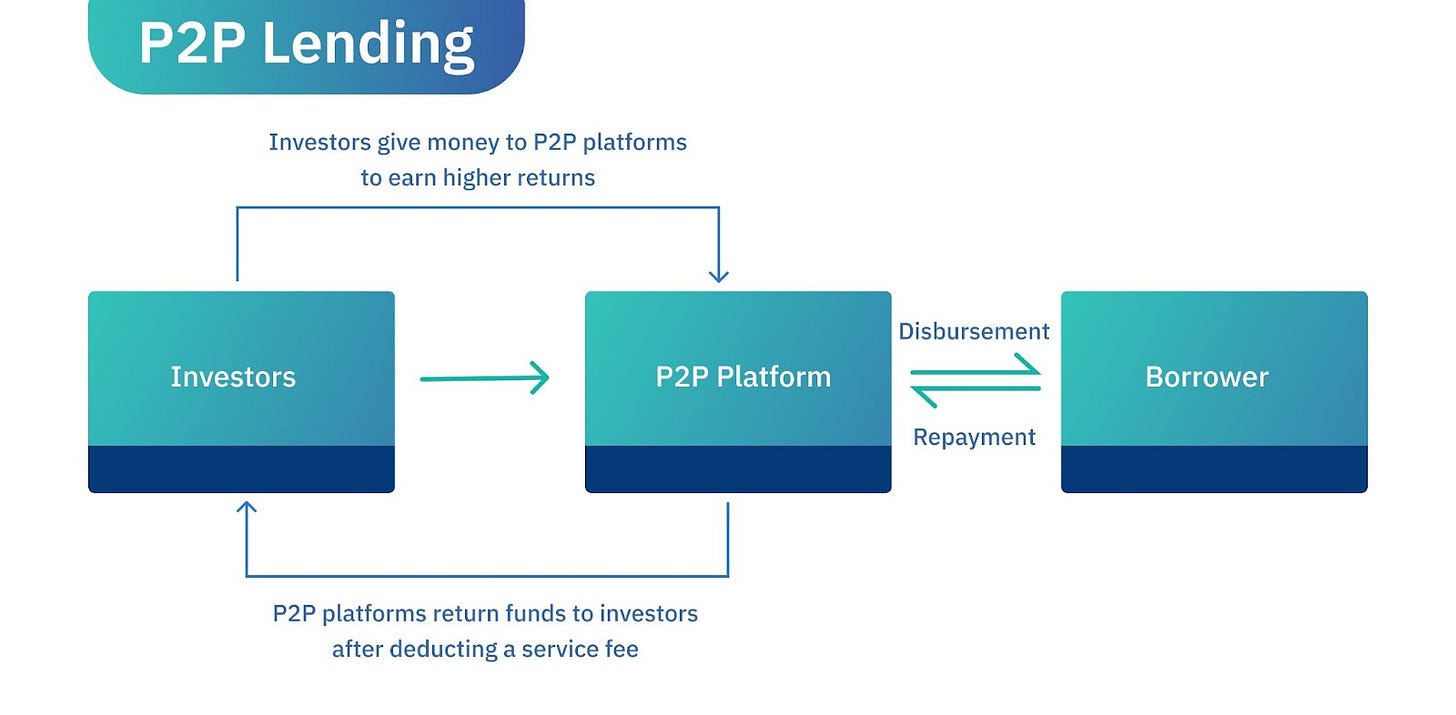

Peer-to-Peer (P2P) Lending Model

NBFC-P2P lending platforms like RangDe and LenDenClub facilitate direct loans between individual lenders and borrowers, bypassing traditional financial intermediaries. Investors and borrowers register on the platform and are matched based on the investor's risk appetite and the borrower's funding requirements, enabling personalized investment opportunities. P2P platforms facilitate this process by managing customer acquisition, underwriting, and loan approvals. To manage these operations and risks, P2P platforms charge a service fee, typically ranging from 1-3% of the transaction value. It allows borrowers to access loans at potentially lower interest rates, while investors might enjoy higher returns compared to conventional savings accounts.

P2P lending is projected to reach $10.5 billion by 2026, after growing at a CAGR of 21.6%.4 Despite the potential for higher returns, it carries the risk of borrower default and fraud. P2P platforms also face regulatory uncertainty after increased scrutiny over non-compliance with guidelines5 by not being fully transparent about the risks associated with their lending activities, promising high and assured returns and mis-selling by marketing their platforms as an alternative to bank deposits.

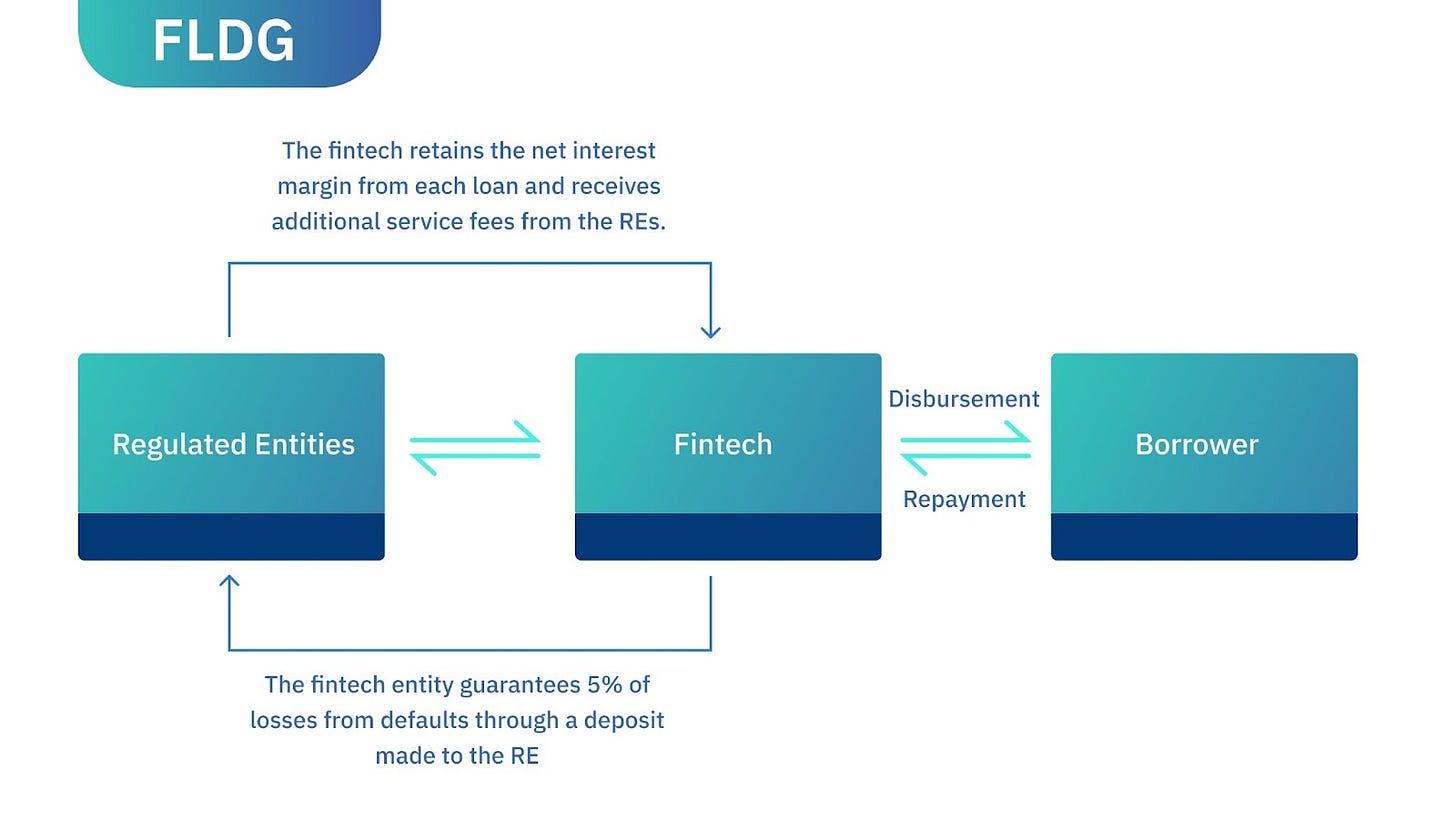

First Loss Default Guarantee (FLDG) Model

A fintech company partners with a RE that provides the necessary capital for lending. The fintech manages all other aspects of the loan service, including customer acquisition, underwriting, and loan servicing. A key feature is that fintech takes a first-loss position by providing a 5% deposit upfront, which covers the initial defaults up to that amount. The fintech company benefits from keeping the net interest margin (the interest rates the fintech charges borrowers and the interest rates it pays to the REs) and may also receive fees for service provision from the REs.

In this model, fintech primarily guarantees to cover initial losses without contributing capital, whereas in co-lending, both the bank and the fintech contribute capital and share risks. The FLDG model is especially appealing for fintech startups looking to innovate in specific risk markets with less capital, while still controlling the underwriting process and customer experience. Its success varies, largely based on the fintech's ability to manage loan portfolio risks. However, the impact of the 2023 Guidelines on Default Loss Guarantee6 is uncertain, particularly given the RBI's concerns that such arrangements might prompt undue risk-taking by lenders.

Loan Marketplace

A loan marketplace serves as an intermediary where multiple lenders can offer their loan products to prospective borrowers who have applied through the platform. For example, PaisaBazaar has 65+ lenders including Axis Bank, Kreditbee and LendingKart. It allows borrowers to choose from a variety of offers, tailoring their selection based on loan terms, interest rates, and lender reputations. The marketplace itself does not assume credit risk but earns a commission on successfully facilitated loans, typically 2-4% of the loan value. This is a low-risk approach from a fintech’s point of view.

This platform thrives on high transaction volumes, drawing its strength from the breadth of options and competitive terms it provides. The recently introduced RBI's draft regulatory framework for loan marketplaces7 is designed to increase transparency and protect customers by mandating that they present a clear digital overview of all loan options available and implement uniform and transparent disclosure practices, significantly enhancing the fairness of digital lending.

Embedded Lending

Embedded lending represents a transformative shift in how financial services are delivered. Customers can browse products, make purchases, and access credit or loans seamlessly into non-financial digital platforms —such as e-commerce websites, ride-sharing platforms or Educational Platforms. Digital lenders collaborate with these platforms, often using the host platform’s customer data to assess creditworthiness. By embedding the entire lending lifecycle— from application to disbursement and repayment, platforms can customize credit products to better suit the specific needs of their users.

Fintechs serve as both lenders and technology providers in embedded lending. As lenders, they directly offer financing solutions, utilizing their tech capabilities for underwriting and streamlining processes. Alternatively, as technology partners, they enable traditional lenders to integrate seamless lending services into various platforms, enhancing accessibility and user experience.

Multiple types of embedded lending integrate seamlessly into various platforms, each tailored to specific sectors and needs. Buy Now, Pay Later (BNPL) options, such as those offered by Simpl, integrate directly into retail platforms, allowing customers to select installment payments at checkout without upfront costs. Similarly, Point-of-Sale (POS) loans provided by companies like Flexiloans are available at checkout for larger purchases, offering structured loans with specific repayment terms.

Education Financing is available through platforms like LEO1, which partner with educational institutions to enable students to enrol in payment plans directly during registration. Healthcare Financing providers such as DigiSparsh function through medical institutions or specialized financing services, offering patients manageable instalment plans for their medical bills at the point of service.

The Indian embedded finance industry is projected to grow at a CAGR of 30.4% and is expected to reach approximately ₹1.73 trillion by 2029.8 However, there are concerns over consumers over-borrowing and making financial decisions that could lead to a cycle of debt in the future.

All of these digital lending models combined are transforming the accessibility of credit across various customer segments, each tailored to meet specific needs.

No matter which digital lending model is used, the primary goal remains the same: to make credit access universal in India. Achieving this requires significant innovations in lending operations, especially in underwriting and collections, to cater to the varied financial needs and risk profiles of a wider audience, thereby creating a more inclusive financial environment. We will explore the crucial role of underwriting innovation in our next blog in this series.

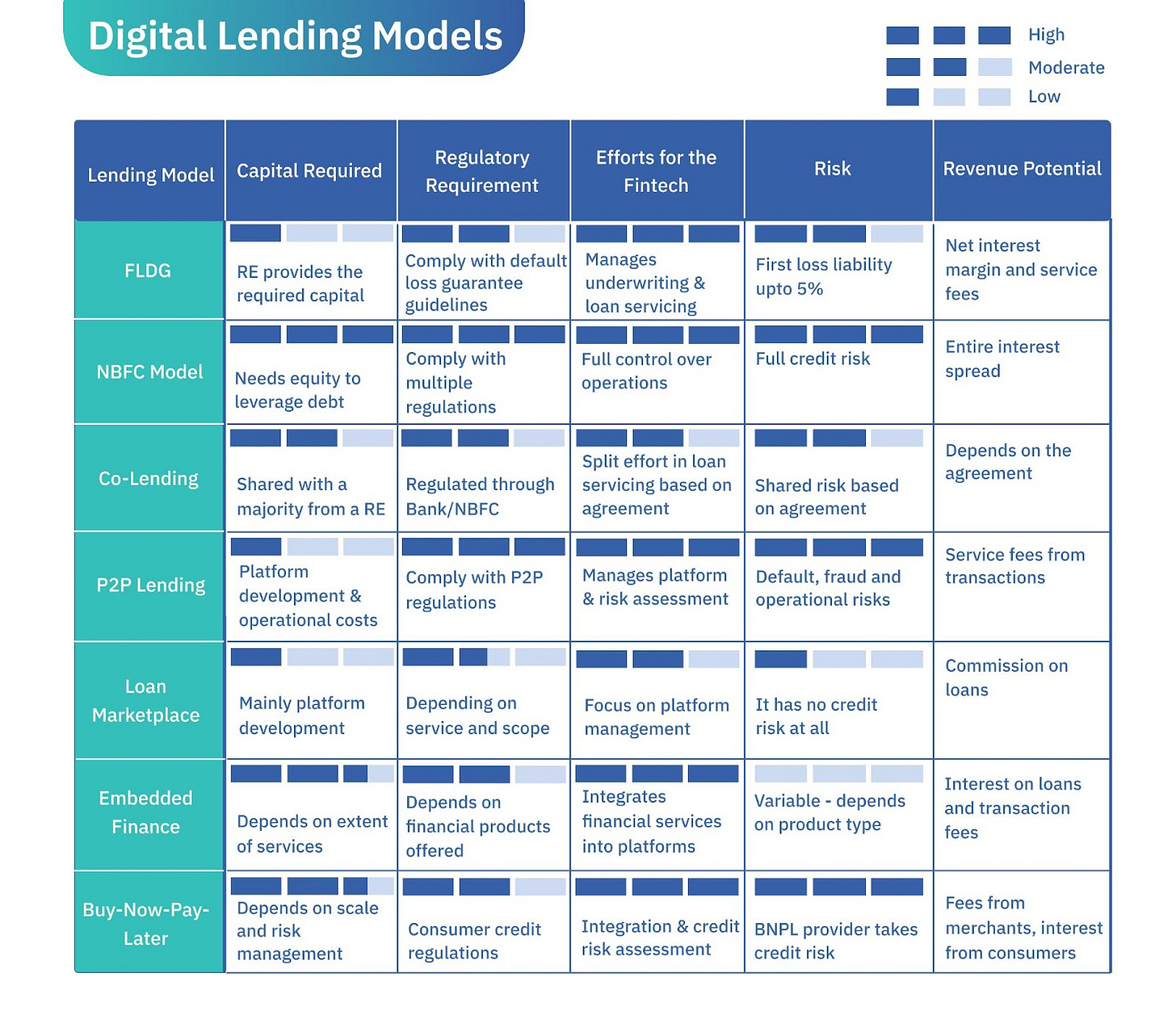

Here’s an overview of all the lending models from a fintech’s perspective:

https://www.financialexpress.com/business/banking-finance-banks-fintech-relationship-from-competition-to-collaboration-3241443/#:~:text='Evolve%20your%20technological%20capabilities%20or,market%20share%20to%20agile%20fintechs.

https://inc42.com/resources/bridging-the-gap-how-fintech-bank-partnerships-are-transforming-indias-financial-landscape/

https://the-ken.com/story/how-lendingkart-became-profitable-by-trimming-its-loan-book/

https://www.industryarc.com/Report/19467/india-p2p-lending-market.html

https://www.financialexpress.com/business/banking-finance-p2p-lenders-await-clarity-from-rbi-on-select-issues-3421694/

https://rbidocs.rbi.org.in/rdocs/notification/PDFs/NT4142A9CBCE6AC04882AD2C3B1E8718965C.PDF

https://rbidocs.rbi.org.in/rdocs/PressRelease/PDFs/PR194DRAFTCIRCULARONDIGITALLENDING065E3A8AF53F40C38AD8D21CE004767D.PDF

https://bfsi.economictimes.indiatimes.com/blog/the-rise-of-banking-as-a-service-and-embedded-payments-in-india/105684040#:~:text=The%20Indian%20embedded%20finance%20industry,and%20financial%20inclusion%20in%20India

All designs by Smriti Krishna and Wamika Das.