Declining Household Savings Rate: An Opportunity for Fintech?

The recent decline in household financial savings and the RBI's cautious approach to retail lending presents interesting opportunities for fintechs working on savings-based solutions.

Arjun, a young IT professional in Bangalore, saves money in two ways; buying shares in companies and investing in a mutual fund every month. Investing in shares can be a bit risky but can also give big rewards. Mutual funds were a relatively safer bet, growing his money steadily. Arjun's strategy not only paved the way for his financial growth but also supported businesses to grow which in turn led to the growth of the Indian economy. Arjun has also been dabbling with some investment in cryptocurrencies after seeing his colleagues make huge returns.

In his hometown in Mangalore, Arjun’s father, a college professor, chooses a different approach to save his money. He invests in gold and real estate, a symbol of security and stability in Indian culture. While gold is a safe bet against rising inflation, real estate investment offers long-term appreciation potential. His choices are a great example of how traditional savings instruments are still powerful in the Indian context driven by culture and social conditioning.

Behind Arjun and his father’s different approaches to saving, there's a bigger picture emerging in India. The way people are saving is changing, not just because of personal preferences, but due to a mix of behavioural and macroeconomic policy factors. Could one dismiss these differences in saving choices as just another generational shift in thinking?

But wait, there’s more to it. This comes at a time when India's household savings rate has hit its lowest point in 50 years and it doesn’t seem to be going up any time soon. While this may sound like some boring, abstract macroeconomic statistic, like the GDP numbers to most of us, this directly affects us.

How do we measure savings?

Saving is a concept we've all heard about: at an individual level, it's simply the money that's left over after we spend what we need (liabilities) from our earnings (assets). Whether it's from our allowances as kids or our salaries as adults, the idea is the same. It's about setting aside a part of what we get for later use – for emergencies, big purchases, or even for a rainy day.

Now, this might seem like a personal financial strategy at first glance, but it is also a key contributor to our country’s economic growth. Think of it this way, every time you tuck away a portion of your income into a bank account, your bank puts your deposits to work by lending them out to businesses. These businesses use your money to kickstart new projects, expand their operations, and grow. This isn't just business growth; it's the growth of our economy, powered by the simple act of your savings.

At the national level, savings contributions come from three types of entities: households, corporations and the government. Of these, households contribute to nearly 70% of total gross domestic savings1. At an aggregate level,

Household Savings = (Household Assets - Household Liabilities).

Assets can be classified into financial or non-financial (physical) depending on the avenues we choose to invest in. Each of these savings instruments represents a different strategy that a household might choose to save in, create wealth and build financial stability.

Financial assets are usually directed towards financial institutions and markets which provide liquidity needed for investments and consumer spending. It drives the economy's growth in the short run. In contrast, physical savings offer long-term appreciation in value and are relatively less volatile during times of economic stress. It offers a buffer against inflation and market fluctuations.

So, why are we talking about this topic at length right now?

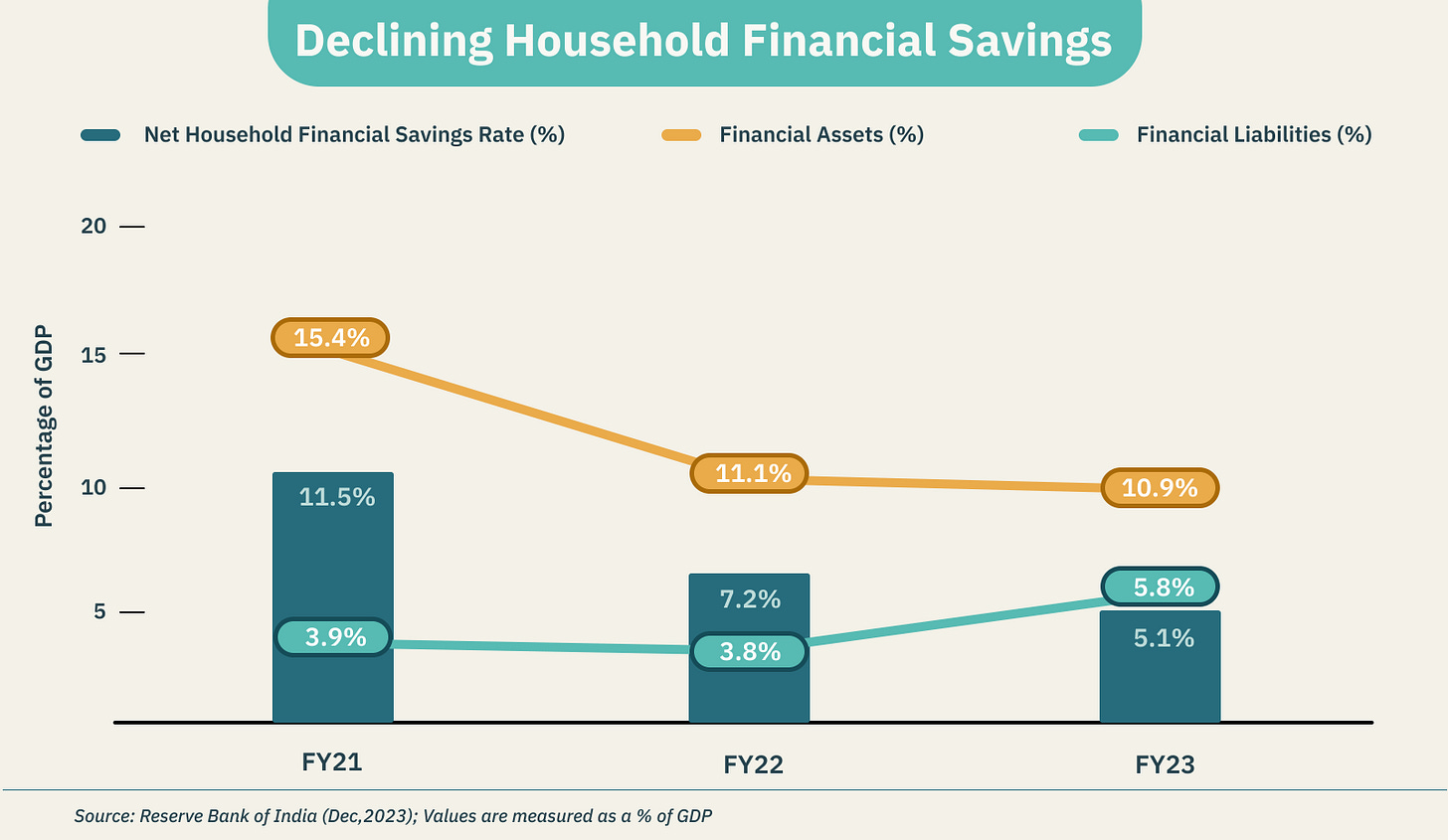

The Reserve Bank of India (RBI) dropped a bit of a financial bombshell in its bulletin in late 2023. It revealed that India's Net Household Financial Savings Rate has declined from 11.5% of GDP in the financial year 2020-21 to a five-decade low of just 5.1% in 2022-232! For the savings rate to decline - either financial assets need to drop or financial liabilities need to increase.

In the current context, financial liabilities, which include all loans from banks, NBFCs, housing finance companies, and insurance corporations, seem to have been climbing from 3.9% of GDP to 5.8% in the same period. This hike in debt is the second fastest since India's independence, only outpaced by the spike back in 2006-07 when it hit 6.7%3.

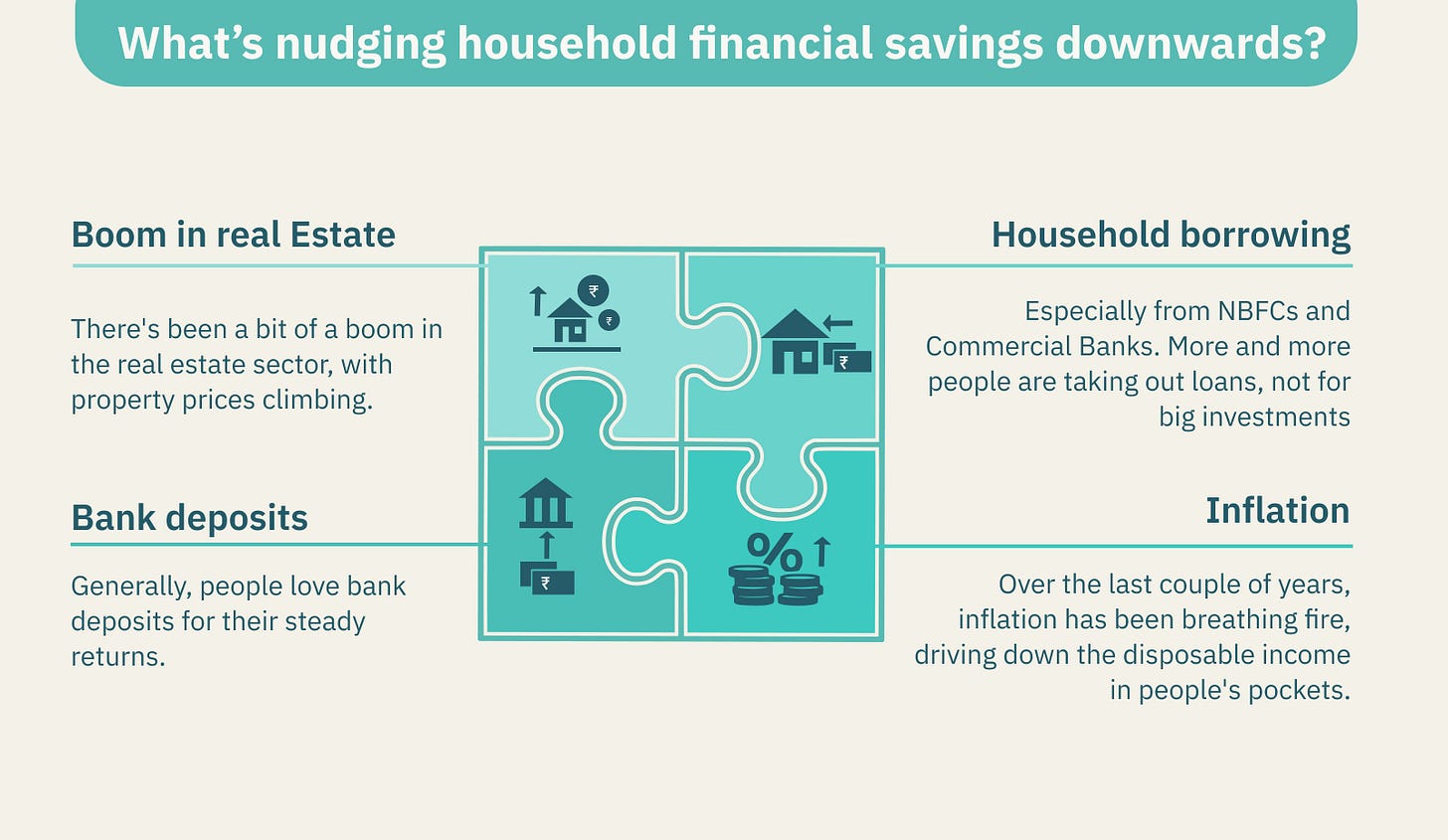

What's nudging financial savings for households downward? It's like a puzzle with several pieces fitting together to reveal a bigger picture.

First up, there's a significant uptick in household borrowing, especially from NBFCs and commercial Banks. More and more people are taking out loans, largely for day-to-day consumption needs and snapping up real estate4. Till June 2023, personal loans represented the largest share of bank credit, accounting for 49% of all borrower accounts5. On top of that, personal loans made up 83% of the disbursement volume and 72% of the disbursement value by the fintech companies with an average ticket size of only Rs.11,360 in FY 2022-236.

Over the last couple of years, inflation has been breathing fire, driving down the disposable income in people's pockets7. Less money to spend means even less to save, putting a dent in the overall ability of households to set aside funds.

Another twist in the tale comes from the bank deposits. Generally, people love bank deposits for their steady returns. But during the pandemic, interest rates on these savings instruments took a nosedive, making them less attractive8. This nudged people to move their money from financial savings to physical ones.

There's been a bit of a boom in the real estate sector, with property prices climbing during the pandemic. This has become a magnet for savings, with every rupee put into housing loans giving more than double in physical asset savings9.

That doesn’t sound so bad, should we really be so worried?

First off, let's talk about household debt. Household debt in India has seen a noticeable rise recently, growing from a relatively modest level a decade ago to a considerably larger proportion of household income today10.

Well, it's crucial to note that a huge chunk of this increase is due to 'credit widening' – more people getting access to loans11. This isn't just about more debt; it's about more people being able to borrow, which can be a positive sign of financial inclusion.

Credit is undoubtedly one of the important levers of unlocking economic growth. However, the quality of the credit’s end use case; whether productive, consumption-driven or speculative will determine long-term outcomes.

Recent actions by the RBI to increase risk weights for unsecured personal loans, credit cards and lending to NBFCs seem to be signalling some worry. They have warned of the concentration of retail loans in the banking sector as posing potential systemic risks.

The growth in credit in the last few years has largely been on the back of personal loans, often with a more opaque end-use. As per the available data12, the share of unsecured loans in the retail segment has risen from around 20% in 2018 to 25.2% in FY23.

The demand for credit cards and vehicle loans within personal finance has significantly surged in India, with credit card loans being unsecured. This rapid adoption has raised concerns, especially as the RBI reported a 24.5% rise in credit card loan NPAs in the first nine months of FY23, signalling potential financial risks13.

What’s more… Recent trends show a notable spike in speculative activities like cryptocurrency trading, equity derivatives, and online games including teen patti, rummy and sports games in the past year. The RBI's Financial Stability Report14 highlights a significant increase in equity derivatives trading, with individual investor participation soaring nearly sixfold since 2018-19, reaching 6.9 million active traders by October 2023. The cryptocurrency market in India also saw a 160% jump in trading volume, according to CoinSwitch. This surge in speculative investments, often financed through unsecured loans, has caught the RBI's attention, particularly as most participants are under 40 years of age15. The uncertainty of repayment in such speculative ventures raises concerns about potential systemic risks.

Amidst dwindling savings, the question arises: Is credit-led growth worrying for Indian households?

From the household perspective, the rise in financial liabilities signals increasing indebtedness. It's important to consider what this borrowing is for – largely consumption. This trend might have deeper implications down the line. In the medium to long term, a larger chunk of their disposable income will be earmarked for repaying these debts16. Presently, Indian households use about 12% of their income to service their debt17.

Highly indebted households are more vulnerable to changes in their income. An income shock, such as job loss or a reduction in wages, significantly impacts their financial stability18. This situation is further compounded by India's social security system, which offers limited cushioning against economic downturns, job losses, or health emergencies, especially for those in the informal sector.

To remind you, more than 85% of India’s workforce is in the informal sector.

Policy Prism

So it’s evident that even in the face of credit-fuelled growth, For sustained long-term economic well-being, India needs a robust level of financial savings. Policymakers are thus faced with the challenge of encouraging more households to engage in financial savings, a proven catalyst for economic development. The key lies in striking a balance – ensuring that the boost in consumption doesn’t overshadow the fundamental need for financial savings.

Government policies and digital infrastructure have significantly boosted innovations in savings, with the JAM trinity (Jan Dhan Yojana, Aadhaar, Mobile connectivity) democratizing financial access over the past decade. The introduction of IndiaStack, including UPI, E-KYC, E-sign, DigiLocker, and Consent Architecture, further enriches this landscape. The potential for savings among Indian households is significant, but the real challenge lies in shifting these savings from informal channels into formal financial systems19.

Do low household savings rates present opportunities for Fintechs in India?

Amid a backdrop of falling household savings rates in India, there's a compelling opportunity for fintech companies to devise innovative strategies that promote savings and tackle the growing inclination towards retail unsecured borrowing. Although lending remains a notably profitable sector within fintech, recent regulatory changes by the RBI hint at a more challenging future, particularly for small-scale unsecured loans. On the other hand, savings-driven innovations have consistently received positive reinforcement from policy frameworks.

Here are some opportunities and product areas that fintechs could consider:

By developing tools focused on savings that align with the varied needs of India’s populace, fintechs have the potential to not only improve individual financial well-being but also enhance macroeconomic stability!

All designs by Himanshi Parmar and Wamika Das.

If you enjoyed reading this blog and would like to receive more such articles from D91 Labs, please subscribe to our blogs here.

All of our work is open-source and aimed at fostering innovations for financial inclusion. To know more about our work at D91 labs, visit our website!

https://www.livemint.com/market/stock-market-news/real-estate-dominates-indian-household-savings-with-highest-allocation-report-11708337956937.html

https://rbidocs.rbi.org.in/rdocs/Bulletin/PDFs/0RBIBULLETINNOVEMBER20235BCADEB54DAA4F44929E9614FE1B28B9.PDF

https://scroll.in/latest/1056295/household-savings-fell-to-nearly-five-decade-low-in-2022-23-shows-rbi-data

https://www.moneycontrol.com/news/business/personal-finance/indias-household-savings-hit-50-year-low-easy-tips-to-boost-your-savings-11866361.html

https://rbidocs.rbi.org.in/rdocs/Bulletin/PDFs/3DYNAMICSOFCREDITGROWTH0476E36BE81B4E889541DEC9EC2D819C.PDF

https://assets.equifax.com/assets/india/face_26th_july_option_2_14-08-23.pdf

https://economictimes.indiatimes.com/news/economy/indicators/falling-household-savings-a-risk-to-indias-world-beating-growth/articleshow/103925983.cms?from=mdr

https://www.idfcfirstbank.com/finfirst-blogs/savings-account/how-has-the-COVID-19-pandemic-impacted-savings-account-interest-rates

https://www.sbi.co.in/documents/13958/36530824/210923-Ecowrap_20230921.pdf/619c6dec-9b71-161b-d981-540c14f08179?t=1695273908872

It surged to 48.1% of income in FY23, up from 43.3% in FY20. A decade ago, it was around 35% of GDP https://www.motilaloswal.com/site/rreports/638320929256543242.pdf

https://www.motilaloswal.com/site/rreports/638320929256543242.pdf

https://business.outlookindia.com/economy-and-policy/what-if-indian-banks-create-a-million-nirav-modis-with-default-of-rs-50000-each

https://rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=57005

https://www.thehindubusinessline.com/money-and-banking/sharp-spike-in-speculative-trades-triggers-rbi-curbs-on-unsecured-loans/article67692597.ece

https://www.motilaloswal.com/site/rreports/638320929256543242.pdf

Household Deleveraging and Saving Rates: A Cross-Country Analysis (imf.org)

https://www.dvara.com/research/wp-content/uploads/2021/01/Analysing-Trends-in-Indian-Households%E2%80%99-Potential-to-Save.pdf