Credit for truck drivers using FASTag information - an opportunity

The trucking industry in India has a sizeable untapped opportunity i.e. access to short-term credit for truck drivers. This blog explores how FASTag infrastructure can help to solve this problem.

During one of our recent road trips (prior to the third wave, of course), we happened to observe the truck traffic on highways zooming past us and wondered what kind of financial instrument caters to this segment? Soon after our trip, we conducted brief desk research where we found some interesting insights about the small fleet industry.

Ninety percent of trucking spends today are in cash1 and the spenders are usually small fleet owners who operate less than 5 trucks. In most cases, the drivers are constrained by a standardized credit repayment cycle and limited availability of loads to transport. This in turn restricts their contractual relationship to a small network of local service providers. The introduction of FASTag has enabled them to convert some of their spendings to digital modes. Given that FASTag has narrow applicability, i.e. paying for tolls, only a small part of their costs are digitized. The distribution of FASTag with existing vehicles enables it to be used for a far wider set of use-cases which are valuable for fleet owners. Enabling the use case of Lending over FASTag can help unlock value for these owners.

Let’s take the example of Adheer, who is a truck owner in India. His typical day starts with contacting or answering calls from brokers for the proverbial clause “Bhai Load hai Kya”2. Ironically, this is the beginning of the challenge for him. Should he get a “load” he needs to ensure that the truck is full both ways or else he will lose money on the return trip. Let us say the stars align and he was to get a load, then his next concern is about how to fund this load. In the trucking business, most of the payment is done after the delivery of goods and, that too, not necessarily immediately post-delivery. These are usually called credit accounts in the logistics industry.

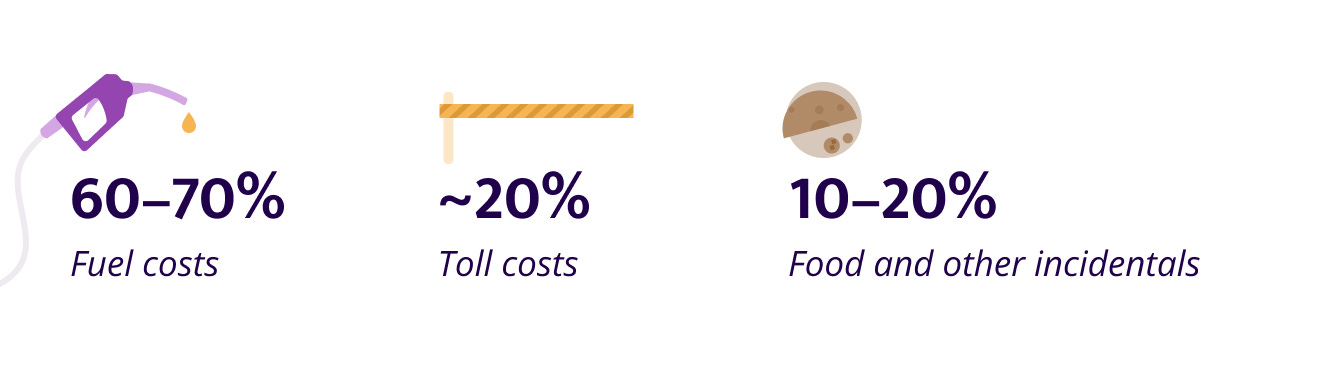

To cover for this period where Adheer is out of money, he has a staggering payment for his costs.

Given that fuel is the lion's share of these costs, Adheer’s trucks would never go farther than 1000 Kms from his home. This is mostly because he has a “friendly” set of petrol pump owners who give him credit. If at all he does go beyond the 1000 Kms range it’s because the broker gives him an upfront payment of the overall amount. The artificial boundary of 1000 Kms also makes it hard for Adheer to scale his business.

The trucking industry in India is constrained by these challenges and this has manifested in the form of an industry where 85% of truck fleet owners have less than 5 trucks3 (scale challenge) and operate mostly within a tight perimeter.

Loan product tailored for truck drivers

What Adheer really needs is a way to access and avail credit at market rate at a familiar touchpoint like fueling stations across India. This takes away his restrictions of borrowing informal credit from his selected “friendly” petrol pumps. Providing digital credit for fuel costs can help in ensuring that fleet owners like Adheer are able to operate on longer trips without carrying cash.

Let’s see how this could work

Imagine a world where Adheer could agree to a “load” without being constrained by the 1000 kms distance. Adheer gets a load, said load is put on the truck and the truck can start moving. To make this happen Adheer will need access to basic banking services and the following document as a transporter:

E-way bills

FASTag

Vahan or RC verification by a lender

What are E-way bills?

In India, truckers are exempted from GST and therefore there is no specific GST invoice that a lender can use as proof to ensure that the truck is actually being used. An E-way bill is, therefore, the only documentary proof that a particular truck is being used (or has a load). An E-way bill carries the truck license plate that is being used for the transport.

How will FASTags information help in availing loans?

FASTags are mandated for all vehicles at toll plazas. The FASTag is helpful for tracking the movement of a vehicle and also for establishing the payment mechanism. Lenders could also use the FASTag information to validate (at a gross level) the fuel capacity for a vehicle and this can be relevant for fraud prevention.

And what’s Vahan?

Vahan is the central database of all vehicles registered in the country.

Bringing these together we can create a solution for enabling lending to help a trucking business:

Steps involved for availing credit from petrol pumps/toll plazas:

Trucker receives the e-way bill number and shares a copy to the lender. Trucker also shares the registered FASTag information with the lender for that specific vehicle

The lender uses the e-way bill and FASTag as a way to track the movement

All the charges on that specific FASTag are funded just in time by the lender with the following validations:

Toll Plaza: Basic check to ensure that the toll plaza is on the right route between the start and finish location.

Fuel:

The amount of fuel should be proportional to the size of the fuel tank. For instance, a FASTag issued to a car cannot be filling fuel for Rs 20,000.

The fuel station is on the same route as per the e-way bill information

Geographic triangulation to validate that the last toll plaza passes through at the right location relevant to the fuel station

The Lenders can choose to design the loan based on a single trip’s information or can use the past information to offer suitable credit products.

Lender offer credit which is accepted and availed by the customer (truck fleet owner)

Repayment - The truckers or the fleet owners ensure the collection of the payments from their customers and pay back the short-term credit. This ensures that they have a strong repayment history which by itself can help in improved credit terms, tenures, and amounts in the future. Thus, helping to bring them into the organized credit market while expanding their business.

The ability to succeed in making FASTag a mechanism for fuel payments will also require fuel outlets to accept and use FASTag information. In our view that might be a smaller problem to solve given the sheer size of the fuel purchase business and the fact that there is a ready segment of users (not only truckers but also regular cars that operate on highways). They will benefit from not having to fund the truckers which in turn increases their profit pools. The incentive to maintain an additional payment acceptance mechanism, therefore, gets covered in this manner.

For truck owners, the incentive of having access to credit at reasonable interest rates will also make it attractive to adopt FASTag-based payments. They also don't have to make any incremental investments for FASTag.

Finally, there are the lenders which get access to a large sector like trucking. The trucking industry is valued at $150Bn and is growing at a 10%+ CAGR4. The scope for lending in this industry remains strong and will be an area of focus and growth for the country.

Thus, by connecting the truck owners and lenders using the FASTag as a point of sale delivery of the loan, the trucking industry and in turn the Indian economy’s growth, can be fuelled using cashless transactions and lending.

Sumanth Suri is the Head of Product and Strategy at Karza Technologies and Anurag Gupta is a Product Manager at Flipkart. These are their own personal views.

All illustrations were designed by Prajna Nayak.

If you enjoyed reading this blog and would like to receive more such articles from D91 Labs, please subscribe to our blogs here.

To know more about our work at D91 labs, visit our website!

https://www.rivigo.com/blog/macro-insight/making-logistics-cashless-can-reduce-40-of-india-s-cash-needs/

https://eng.blackbuck.com/bhai-load-hai-kya/

https://www.rivigo.com/blog/macro-insight/making-logistics-cashless-can-reduce-40-of-india-s-cash-needs/

ibid., (2)

Really interesting post. Loved how the problem and solution were detailed. So....why arent you guys building this? Or is anybody. Would love to chat - Sajith Pai (sp@blume.vc)