Can Credit on UPI drive Financial Inclusion in India?

Our fourth blog examines the implications of enabling credit on UPI for financial inclusion in India. Is it an effective concept or just a case of much ado about nothing?

Kamal (27) is an aspirational young man from a small town in northern Karnataka. He works as a call centre executive in Bangalore, earning close to Rs. 25000 a month. It's not much but at least he has a regular paying job unlike many of his friends. His family depends on him to send some money home each month. Kamal, though, wants to start his own mobile phone store in his hometown someday. He diligently tries to save some money each month in a deposit to help him have some starting capital in a few years’ time. After all his major expenses, Kamal is often left with no money for a few days at the end of the month. He has to borrow a small amount from his roommate for fuel expenses or maintain a credit account at the local kirana store for groceries. Sometimes, his salary is delayed by a few days, causing his landlord to check in about the pending room rent. He wishes he didn’t have to resort to these arrangements to tide over his temporary liquidity crunch.

Kamal hears about a new credit card that can be issued against his deposit. He applies for the card and gets approved for a small monthly credit limit of Rs. 10000. Even this small amount of credit is very useful for him. He can now make some of his month-end payments for food, grocery and fuel using credit and repay once his salary comes in. However, many of the shops that he frequents, don’t accept credit cards. While UPI QR stickers have become almost ubiquitous in a city like Bangalore, card acceptance infrastructure continues to remain limited, especially for smaller merchants.

Enter Credit Cards on UPI…

An innovative solution from NPCI that enables users to link their credit card to their UPI ID, which is a virtual payment address that can be used to send and receive money. By linking a credit card to UPI, users can perform various financial transactions directly from their credit card, such as paying bills, transferring money, and making online purchases. Now, Kamal can make payments for his month-end expenses on credit through the familiar UPI platform. Currently, the offering is limited to RuPay-backed credit cards.

So… Why is this a big deal?

Credit is an important tool for financial inclusion because it provides access to money for individuals who may not have the funds available to pay for expenses upfront or make investments. Individuals can make purchases, invest in their future, and grow their wealth by accessing credit. There is a significant credit gap in India for low-income households, who often struggle to access formal credit from banks and financial institutions. This is due to a variety of factors, including lack of collateral, insufficient credit history, irregular cash flows and limited financial infrastructure, particularly in rural geographies. As a result, many are forced to rely on informal sources of credit.

Credit Cards are a formal instrument offering short-term revolving credit to users. However, until recently, they were largely accessible to higher-income individuals or individuals with steady salaried incomes. Their acceptance infrastructure also remained limited due to high merchants' initial costs in acquiring the PoS setup and the associated MDR1 charges. There are about 7 million PoS acceptance points2 across the country. RuPay credit cards were issued in India as a domestic card scheme to promote financial inclusion and reduce the dependency on international issuers like Visa and MasterCard. The aim was to provide a scalable low-cost and secure payment system that caters to the needs of Indian consumers and merchants.

On the other hand, the UPI platform has gained global recognition for its rapid adoption and ease of use. The introduction of QR Codes has increased merchant acceptance points to about 60 million across the country. As of January 2023, UPI has recorded 803 Crore transactions worth INR 12.98 Lakh Crores3. This accounts for nearly 3 out of every 4 retail transactions by volume!

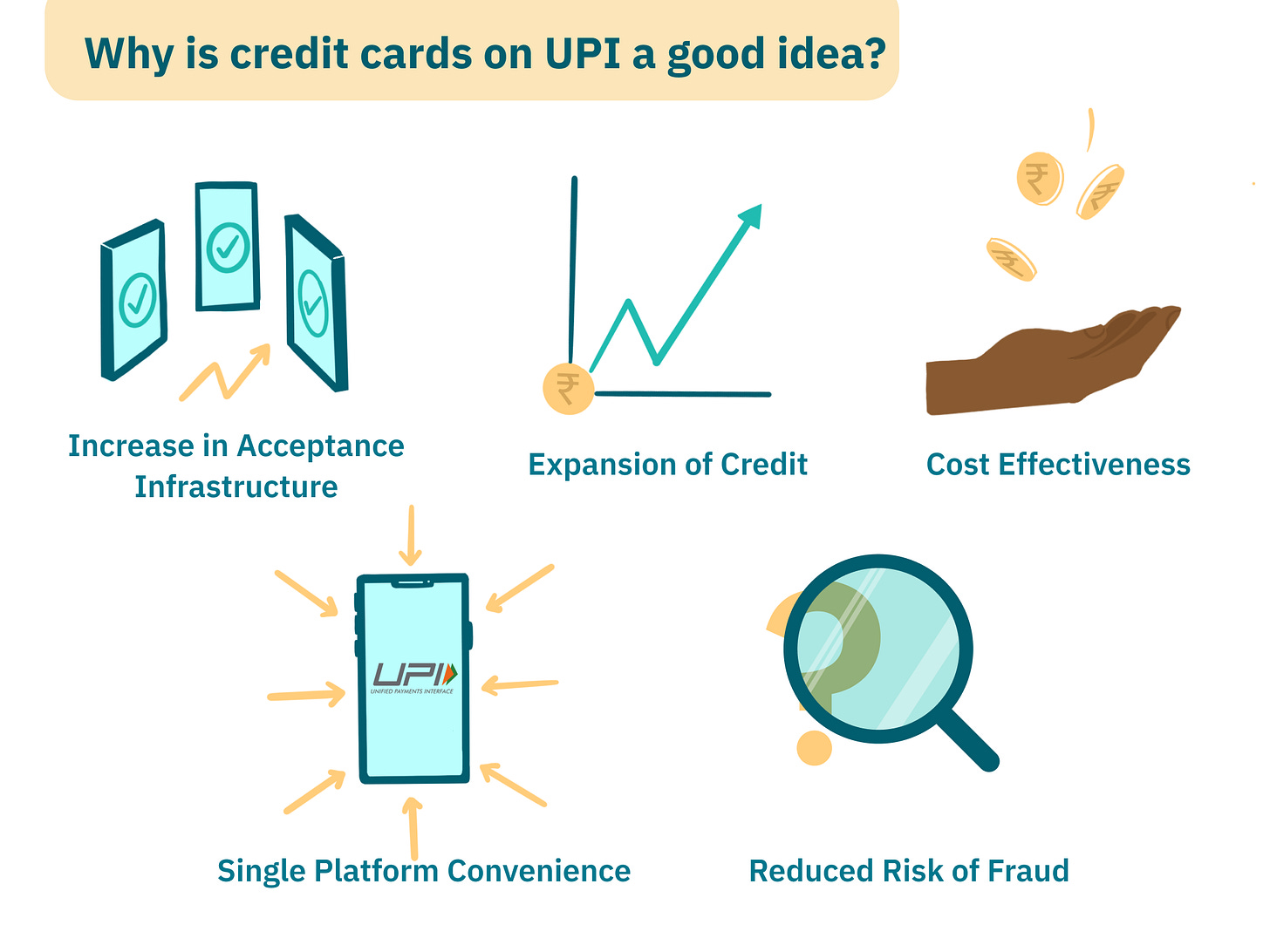

UPI transactions so far were ‘debit’ flows, i.e. linked to a savings or current account from where the money is debited. By enabling credit cards on UPI, users can make use of the convenience and speed of UPI transactions while also earning rewards and benefits of paying by credit. The solution combines the advantages of both worlds. It also eliminates the need to carry a credit card physically, reducing the chances of theft or loss.

By combining the two solutions, there is a potential to expand credit to the entire ~300 million user base of UPI. With newer offerings like UPI123 Pay and UPI Lite, NPCI anticipates, this number will rise to nearly 500 million users4 within the next 5 years. For banks, it will enable an efficient and faster way of disbursing credit and hence profitability. Merchants are expected to benefit by enabling another choice of payment for the customer at no additional cost in terms of additional acceptance infrastructure. UPI apps and technology service providers (TSPs) are also expected to benefit from this move eventually. The likes of PhonePe, Google Pay, Paytm and CRED were unable to charge any fees for processing UPI transactions, due to the government’s zero MDR policy, despite being integral to the widespread adoption of UPI. Payments through credit cards could provide a potential revenue stream for them.

Does this really mean much for the low-income consumers of Bharat?

Credit card penetration remains abysmally low in India. At present, just ~ 4% of India’s adult population has access to a credit card5. What’s more, 65% of these cards are issued in Tier-1 cities alone6. Credit cards have remained the domain of the relatively well-to-do. Higher interest rates associated with credit cards also make them less attractive to low-income customers7.

Historically, risk-modelling tools utilized by credit card providers have been inadequate in assessing the creditworthiness of individuals with irregular income streams such as those in the informal sector and the self-employed. Employment in India remains predominantly informal in nature. Nearly 75% of the informal workforce is also self-employed8.

The challenge of low financial literacy is another reason limiting credit access. It can lead to irresponsible credit card use without knowledge of the consequences of delayed repayments. It can also make users more susceptible to financial fraud. There is also a negative perception that credit cards lead to a debt trap in the absence of financial discipline. These reasons put together have contributed to limiting the adoption of credit cards in India.

The intent of RuPay credit cards9 was to counter some of these barriers to adoption, however, it hasn’t seen significant buy-in from banking partners. RuPay cards only form 3-4% of the 81 million credit cards issued in India at present10. The RBI intends to allow MasterCard and Visa credit cards to be linked on UPI. However, these cards tend to cater to even more premium customer segments. At this scale, the present solution alone is unlikely to move the needle in terms of expanding credit to the underserved and unserved cohorts of Bharat.

The current approach also does not allow credit card payments on UPI for P2PM11 transactions; i.e. small merchants in unorganized retail. This limits the argument on the significant increase in acceptance infrastructure for credit cards, as it excludes a significant proportion of merchants on UPI. Large merchants are likely to possess PoS facilities already to facilitate card transactions, thereby making the Credit Card on UPI solution more of a convenience feature.

There is also the question of pricing around credit card transactions on UPI. So far, merchants of all types have accepted UPI because it’s free. But now that UPI payments can be done via a credit card, the merchants may have to pay for it. This might have negative implications for the acceptance of UPI as a mode of payment itself. To address this, industry experts suggest that there may be differential pricing12 for credit card transactions on UPI, at least for low-value transactions upto Rs. 2000. However, it is unlikely that financial service providers offering credit cards are willing to take another significant cut in earnings unless they see a significant value proposition in linking the two instruments.

Much ado about nothing?

With India’s young demographic, the new face of retail credit over the next few years is likely to be individuals below the age of 30. They are likely to come from non-Tier-1 cities. There is also a likelihood of greater borrowing by women. Traditional models of risk assessment will not increase credit access to these cohorts. However, with the expansion of the DigiLocker platform, the Account Aggregator and OCEN frameworks and the budget announcement for the National Financial Information Registry13, there is a significant policy and digital infrastructure push for credit expansion for various segments of Bharat.

While the present move itself may not seem like a ‘game-changer’ immediately, the RBI allowing for the linking of credit cards with UPI has increased the scope for innovation within the payment ecosystem in the next 5 to 10 years. The concept of linking retail ‘credit’ through UPI is one that resonates better with the goal of financial inclusion. This would entail (in addition to credit cards) including BNPL and other innovative products that cater to the evolving credit needs of users. Riding on the coattails of the UPI platform can amplify the reach for these credit products. However, the challenges with expanding credit access to underserved segments of the population continue to persist and must be addressed first!

Stay tuned for more updates as we closely watch this space.

All artworks are designed by Himanshi Parmar.

If you enjoyed reading this blog and would like to receive more such articles from D91 Labs, please subscribe to our blogs here.

To read more about our work, visit our website

You can follow us on Twitter | LinkedIn | Instagram | WhatsApp

Part of our series on Digital Payments for the Next Half Billion

With transactions over INR 12 lakh crores clocked in January 2023, the impact of UPI in furthering the digitization of payments is unprecedented. The next wave of growth is likely to come from Tier 3-6 locations, as evidenced in the past two years wherein these cities have contributed to nearly 60-70 per cent of new mobile payment customers. Recent initiatives have highlighted the need to make digital payments accessible for all. With digital payments deepening financial inclusion, we explore the opportunities and challenges that these new initiatives offer to the next half-billion through this series.

The merchant discount rate, or MDR, is the rate charged to a merchant for the payment processing of debit and credit card transactions.

RBI Payment Systems Indicators, Dec 2022 | https://rbi.org.in/Scripts/PSIUserView.aspx?Id=19

NPCI UPI Product Statistics | https://www.npci.org.in/what-we-do/upi/product-statistics

https://www.digfingroup.com/npci-voice/

https://www.statista.com/statistics/675371/ownership-of-credit-cards-globally-by-country/

https://www.pwc.in/assets/pdfs/consulting/financial-services/fintech/payments-transformation/decoding-indias-credit-card-market.pdf

https://www.livemint.com/money/personal-finance/why-are-interest-rates-on-credit-cards-so-high-11621075187921.html

https://pib.gov.in/PressReleaseIframePage.aspx?PRID=1738163

https://www.rupay.co.in/our-cards/rupay-credit/explore-the-credit-card-range

RBI Payment infrastructure Statistics | https://rbi.org.in/Scripts/PSIUserView.aspx?Id=19

Merchants with expected inward UPI transactions worth up to Rs 50,000 per month are classified under the P2PM category

https://www.business-standard.com/article/finance/upi-charges-may-partially-offset-loss-on-credit-card-mdr-rbi-paper-122081801188_1.html

https://www.medianama.com/2023/02/223-explainer-national-financial-information-registry/