#18 Farah | Silver lining of cloud kitchens

I am not aware of how to do things online, so I rely on my husband to manage my finances. But with the right guidance, I hope to change that for myself soon.

“I chose to do this business because my kids are very young and I have to be around to take care of them. I can’t go out of the house to run a business. I wanted to be able to look into household responsibilities and my business parallelly. That’s why this business idea worked well for me as I could do both.”

Short Story

Farah is a 31-year-old who transformed her restaurant into a cloud kitchen1 during the pandemic. She lives with her husband who is a delivery partner with Zomato and three children in a low-income housing settlement in Bangalore. Farah also runs a reselling business for clothes and household items from her home. As one of the many businesses that were severely impacted during the pandemic, she has been quick to adapt to the situation and alter her business model with the help of her husband. She currently relies on her husband to manage her finances, but hopes to become independent in this respect under the right guidance.

Personal and financial background

What’s your daily routine like?

As soon as I wake up in the morning, I prepare breakfast for my kids, get them ready and drop them off at school. After that I have breakfast and begin work for the cloud kitchen that I run. Once I open for the day I begin to prepare food and keep it ready so that as and when I receive orders I can cook it and get it delivered on time. In the afternoon I have to go and pick up my youngest child from school. Once I’m back, I keep my cloud kitchen open till about 3 pm. Soon after, I have to go and pick up my other two kids from school so I pause the cloud kitchen work for sometime. After returning, I keep my cloud kitchen going till about 10:30 pm. Alongside the cloud kitchen work I have to take care of other household responsibilities as well, but as and when I get orders, I prepare food and get it delivered. In between I also have to take care of dinner for my family and also look after my children as they attend tuitions. Finally, after I shut my cloud kitchen for the day around 10:30 pm, I have dinner, put my kids to sleep and then I go to bed.

In your own words, can you describe your current work? Have you worked elsewhere in the past?

Initially we used to run a biryani hotel, but one year after we started, we underwent a huge loss due to the pandemic and decided to shut it down. We tried to look for other spaces to rent but they were very expensive. That’s when one of my husband’s friends suggested that we can try to run something from our home itself. He said that since our hotel business is already registered, we can look into doing something from home under the same name. A lot of people appreciated my cooking and encouraged me to start something from home. Initially my husband was a little hesitant about this and it took time for him to make up his mind about starting something from home. But soon while going about his everyday duties as a Zomato delivery partner, he realised that a lot of people have been ordering through Zomato, Swiggy and Dunzo from kitchens that operate from homes and he came home and shared this with me. He encouraged me to consider starting off as well. I was a little hesitant because with kids at home I felt it might be difficult to execute this, but my husband supported me and assured me that he will help me in whatever way possible and encouraged me to get started. Soon we got started with the help of someone we knew. He helped us set up our online accounts/profiles and taught us various aspects necessary to kickstart the business. We decided to carry on the name of our hotel itself.

Business Details

How long has it been since you started the cloud kitchen?

It has been 6 months since I started it. There are still some ups and downs. For instance, I had some health issues to address and also if my kids fall ill, I can’t afford to dedicate time towards work as I have to take care of them. So it is difficult to maintain the same momentum in terms of the business every month.

Were you running any other business before this hotel?

About 6 months after starting the hotel, we also opened a store where I used to sell readymade clothes and cosmetics. But after the lockdown that underwent a loss as well. For a while I continued selling the items from home itself based on whoever had requirements or was interested to purchase. I continued to receive orders mostly from relatives and friends and I used to take care of deliveries.

6 months before the hotel closed is when I started the store. After we shut down the hotel, I started running the clothing business and the cloud kitchen parallelly. This is something that I am still continuing to do and I receive orders from time to time.

What is your monthly income from this business?

The income from the clothing business is quite less to be honest, but it serves as pocket money and that’s why I continue to run it as a side business. My combined income from both the businesses would be around INR 30,000. My income varies because I don’t receive orders for clothing on an everyday basis. Once in a while when someone approaches me, I get it delivered to them. But the cloud kitchen remains active everyday and I keep receiving orders.

How much do you have to invest in your business in a month?

My husband takes care of the finances related to the business. I only handle preparation, cooking and delivery. He looks into buying ingredients and other things that I require to run the cloud kitchen. I give him a list of things that I require and he purchases it for me. But to give you an estimate, he invests at least INR 10,000 in a month for all this. Meat is quite expensive, so that forms a huge part of our investment on a monthly basis.

How did you finance your business till now?

I borrowed INR 30,000 from an institution known as Grameen Koota which offers collateral-free loans and other financial services to women from low-income households. We have to repay with interest, but if we repay on time then we become eligible to take more loans from them in the future. I also borrowed another sum of money through a scheme that HDFC bank had where they had created a model specifically for women. They created a group of 5 women each and used to lend specific amounts to us. That’s how I was able to start the business.

How was your business impacted by Covid-19?

Once the pandemic came into the picture, people started to become cautious about where they ordered food from and also had concerns whether the kitchens are well maintained or not. They were really scared and unsure if it’s safe enough to order from restaurants. Because of that our business went down and we underwent a huge loss. Whatever ingredients we had invested in remained unused and we had to distribute it amongst people we know so that they don’t go to waste. Sometimes I used to utilise the meat and other ingredients to cook meals at home. But my cloud kitchen had absolutely no business to the extent that I wouldn’t receive a single order and it became very difficult. That’s when we decided to reopen only once the lockdown is lifted to avoid wastages.

Business Journey

Why did you choose to do this business?

I chose to do this because my kids are very young and I have to be around to take care of them so I can’t go out of the house to run a business. I wanted to be able to look into household responsibilities and my business parallelly, that’s why this business idea worked well for me as I could do both.

How long did it take for you to set up this business?

It didn’t take me too long. I always ensure good hygiene at home, so I started by using utensils that I had at home itself . However, it is still taking time for my business to pick up. I still don't receive back to back orders yet. I’d say If I receive 5-6 orders per day, that’s on the higher side because these days almost every lane has one such business and it has become tough competition. In my lane itself 3-4 people have started something like this. But if offices resume in-person work soon then my business will pick up. Due to the lockdown offices and PG’s are closed and people have gone back to their hometowns, that’s why I haven’t been receiving too many orders. We are waiting for things to settle down and hopefully once the situation changes, my business will flourish.

Did you have mentors who helped you plan and execute this business?

I received a lot of support from Udyam, the MSME registration from the government to set up my business. Initially they gave me a loan and helped me procure ration. That really benefited me.

Any online platforms that you promote your offerings on apart from Zomato that you mentioned?

My husband and I promote it on WhatsApp by putting up our offerings using the status feature. Additionally we also promote it amongst our friends. Since some of my husband’s friends have really enjoyed the food from my kitchen. They give us leads when any parties or events are happening and they require catering. We take care of arranging food at such events. Apart from WhatsApp, I have also shared it on Facebook and Instagram. Even our family members and relatives have helped us publicize it a lot since they find the food from our restaurant delicious. They have urged several others to try it too and offered their support to our business.

Have you considered expanding this business?

Yes, I do plan on expanding it if things go well. The thing is when Zomato or Swiggy delivery partners come to pick up orders from my house, I don’t feel comfortable calling them to my doorstep because of the way my living arrangement is. There are 5 houses on each floor and privacy is compromised. Due to this a lot of neighbours exhibit jealousy if someone else’s business is doing well and that creates a very negative environment. That’s why I want to look for a small space from which I can cook and run my business. But the rent is very high for such spaces and even the advance payment that they ask for is ridiculously high. That’s why I haven’t gone ahead with this plan.

Household finances

Did Covid-19 impact the household budget? If yes, then how?

During the pandemic we had to cut down on our budget. Actually my business was doing well initially and our earnings had increased. But after the lockdown our business went down drastically. Just when my business had started to gain traction and was doing well, the lockdown happened.

Expenses & Payments

Do you handle all expenses related to the household?

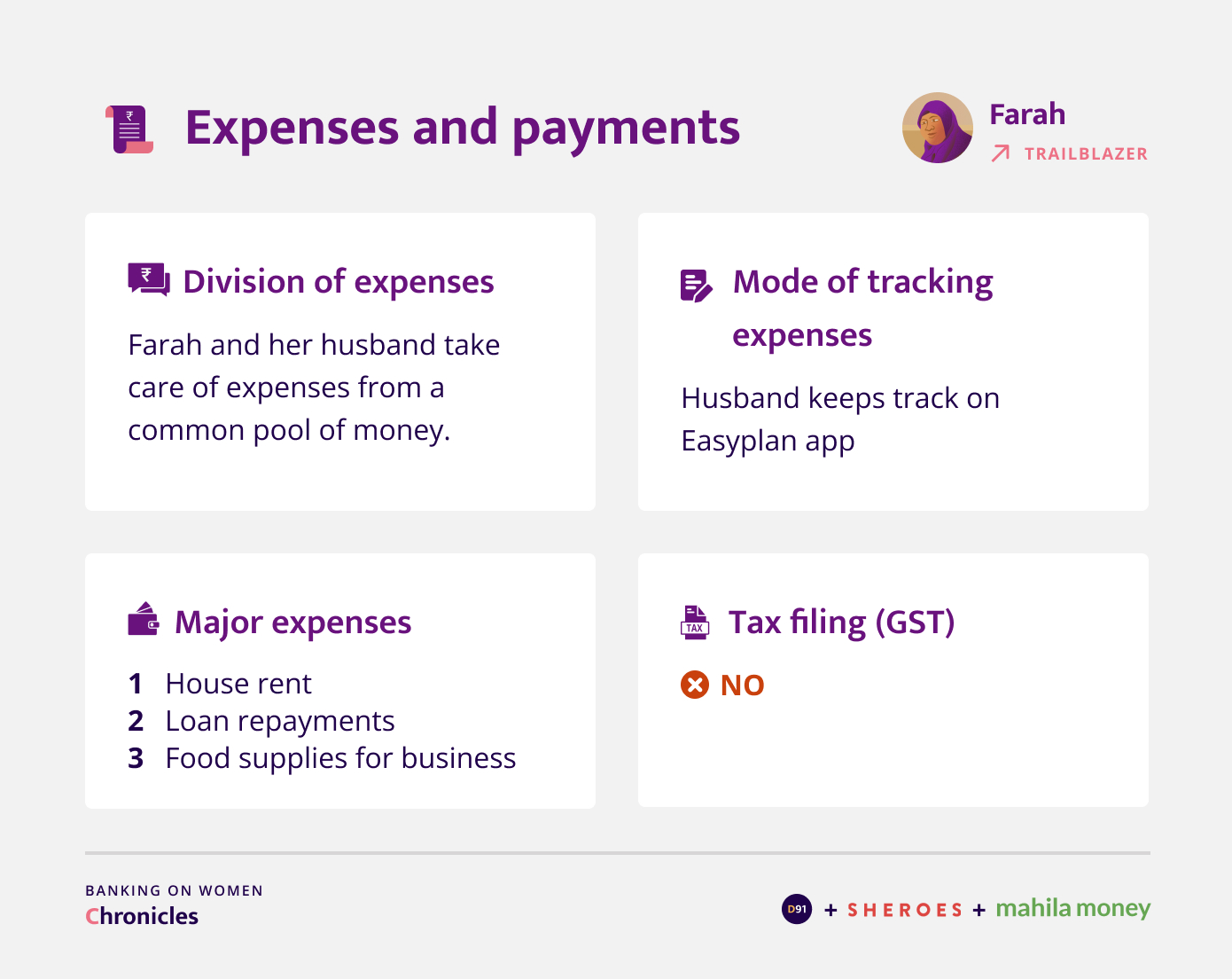

My husband takes care of all purchases and brings home whatever I need. Sometimes for small things such as milk purchase, etc. I take care of them. But in terms of the money that we use, both of us pool in for most expenses such as bill payments, school fees, etc.

Can you tell me what percentage of income is used towards your household's monthly expenses?

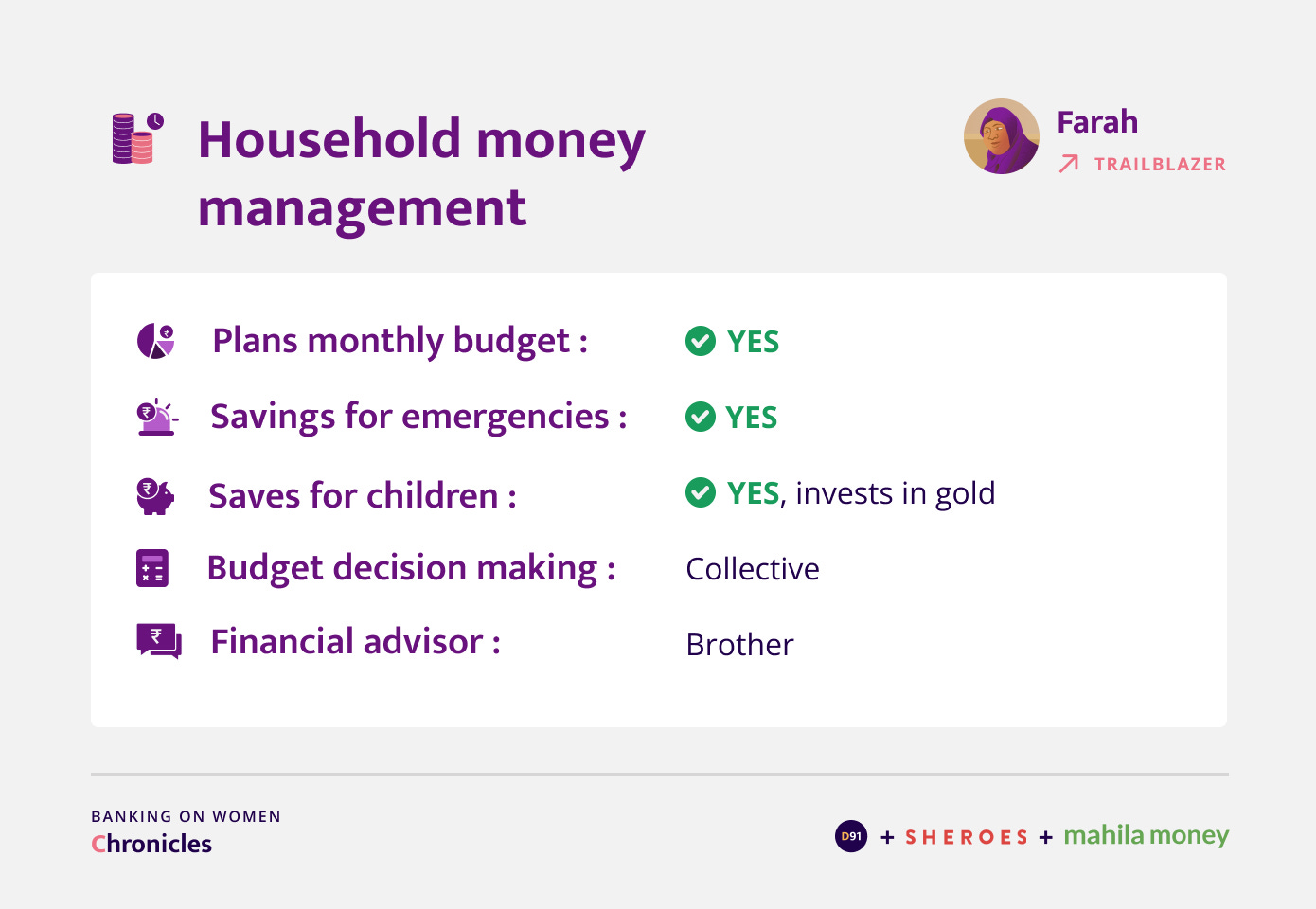

After we have paid the rent, electricity bill, loan repayment, etc. We are left with around INR 10,000 per month. If my kids fall ill and we have to take them to the hospital or if any other unexpected event arises, we use that INR 10,000, if not, it remains as savings.

What are your top 3 categories of expenses?

Rent

Loan repayment

Food supplies for business

These are 3 expenses we cannot forgo. So first we take care of all these major expenses, but when the month end arrives it becomes very difficult for us to manage sometimes as the money we earn gets over at the beginning of the month itself. For the first 15 days we manage and don’t face any issues, but after that, we find it difficult to make ends meet.

Did Covid-19 impact your household expenditure?

Yes, it did impact the amount we spend on ration and we had to optimize our overall spending. But things like rent are non-negotiable expenses. Even with loan repayment we have no option but to pay. Even if we try to ask for an extension, they ask us to figure it out amongst ourselves and work out some adjustments since it is a group of 5 women that have taken the loan together. But since all women who take loans from these groups are women from low-income groups, it’s hard for them to repay their own share of money, let alone being able to pay for others. So each of us try not to get a bad reputation within the group and ensure that we don’t give them the impression that we’re irregular with repayments. Once we have committed, no matter what happens we try to repay on time, even if it means we reduce the amount of food we eat. Since our income has decreased even the amount that remains after taking care of major expenses has decreased.

Do you remember the first time you used any payment app? Can you tell us more about that experience?

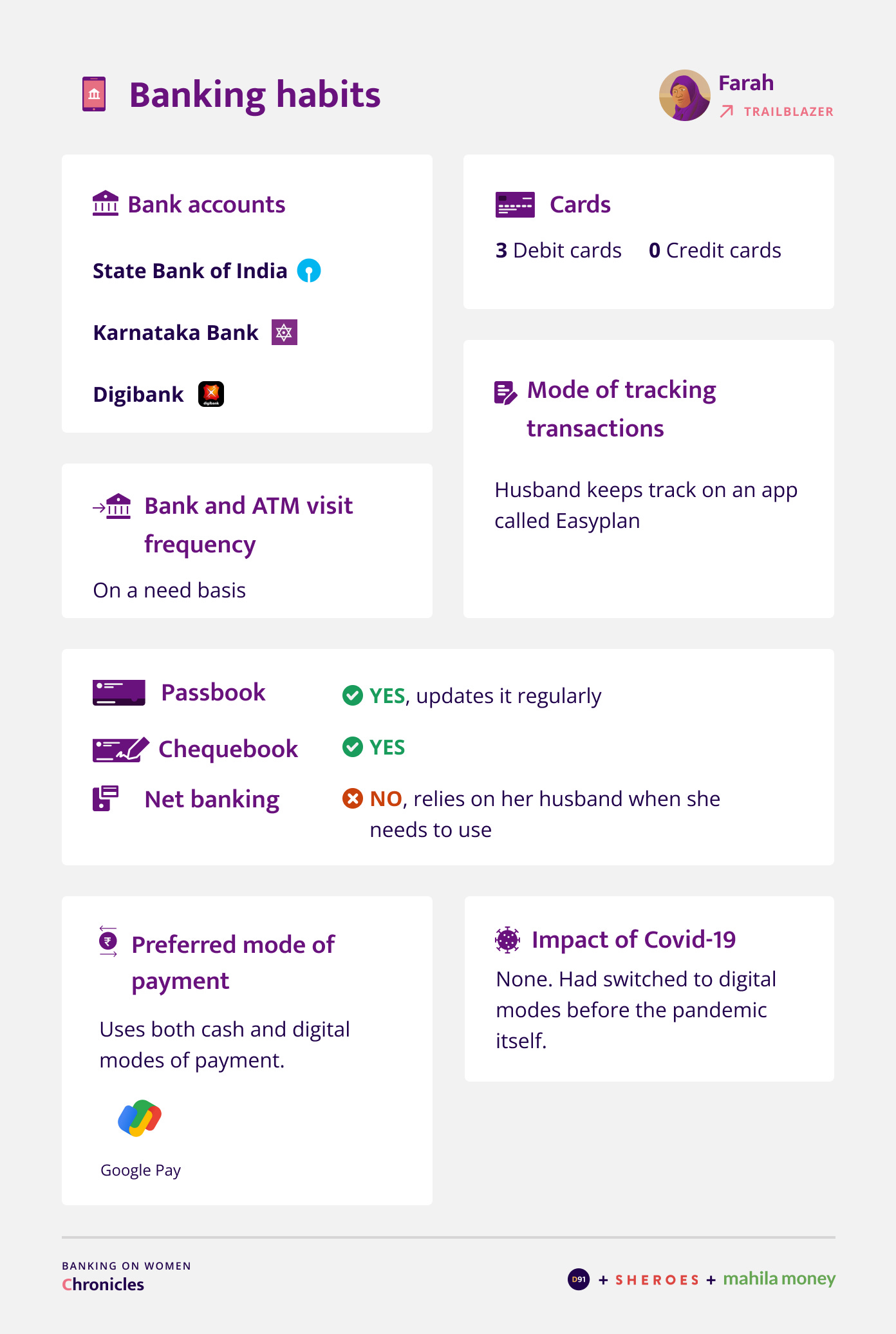

Actually I still haven’t gotten accustomed to using apps such as Google Pay. I am fully dependent on my husband for such things. The main reason why I am skeptical to use these apps is that I once received a fake call saying it’s from Google Pay and after sharing a few details with them I ended up losing money. They called and said I would have received an OTP. I was also mistaken that an OTP is that 3 digit pin at the back of a debit card and I didn’t know I wasn’t supposed to share that. So that incident has instilled fear in me. I am scared to make payments online and even when I receive calls saying it’s from a financial institution I get scared. In fact, very recently I received a call from MyShubhLife which is an instant personal loan platform and they called to tell me that the loan that I had applied for has been approved. But I thought it’s a fake call and didn’t entertain them. Later I realised it was actually from the organization, so I called them back and told them that I am indeed in need of a loan and apologized that I had been mistaken. Though I have these digital payment apps on my phone, I have left it to my husband to handle.

Banking Habits

Do you have a separate account for your business?

I use my husband’s account for business related transactions. He has an account at Kotak Mahindra Bank. I don’t know how to do things online so my husband manages these things in terms of running the business.

Financial products and services

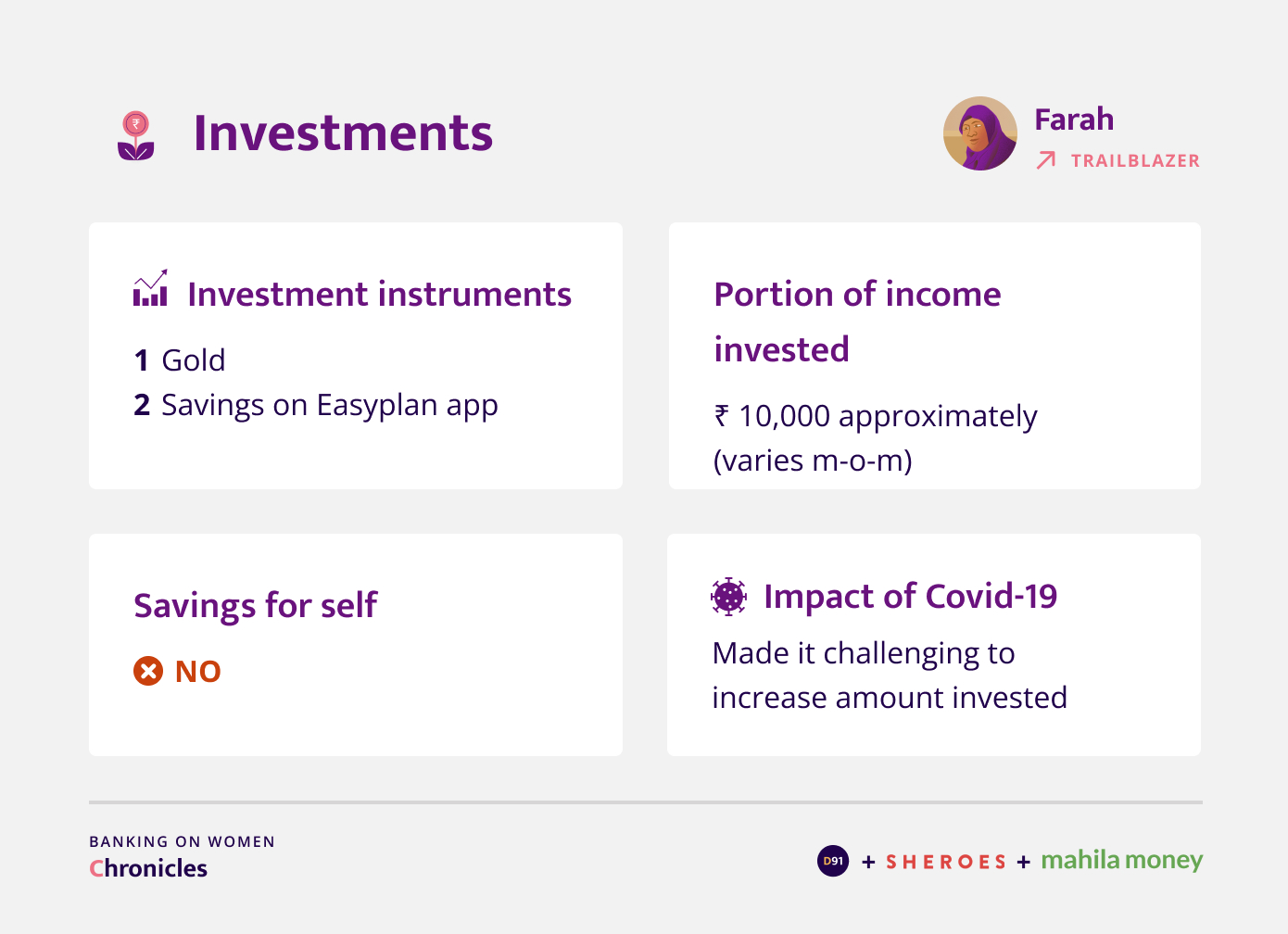

Investments

Where do you invest or save your money?

We save on the Easyplan app. How it works is that if we invest INR 10,000 per month, we earn an interest on it. We can set a goal on the app. For instance, if INR 45,000 is our savings goal, then once we reach that goal within a certain duration, we have an additional 10-15% credited into our savings pool. My husband had explained to me that we can grow our savings if we continue to invest regularly on this app. Since alongside saving our money, we are able to earn an interest, we thought this is a great way to make our money grow. We do online transfers for these investments.

Since when have you been investing?

Initially I didn’t have the habit of saving. My husband has been actively saving for quite some time. We started saving once my first daughter was born, so it has been about 9 years since we started.

Do you have any goals attached to your investments?

Yes, we do. Since we have 3 children, their school fees that we pay yearly becomes a major expense as it comes up to INR 1 lakh. That’s why we try to be prepared for such expenses by saving throughout the year so that it becomes easier to pay fees when the time comes. We are also looking to move to a new house so we are saving for that as well.

Whom do you turn to for investment advice?

As I mentioned, my brother advises me. Additionally friends and neighbours help us, provide suggestions and share knowledge on how to go about these things.

Have you faced any challenges while investing?

Yeah we do face challenges. We can’t always invest as much as we want because sometimes suddenly something or the other crops up within the house or it gets used on our kids or sometimes we ourselves fall ill.

Have your investments been impacted by Covid-19?

We have been trying to increase the amount we invest because we know this is not enough, but we haven’t been able to. The hope is that once our business grows we will automatically be able to save more.

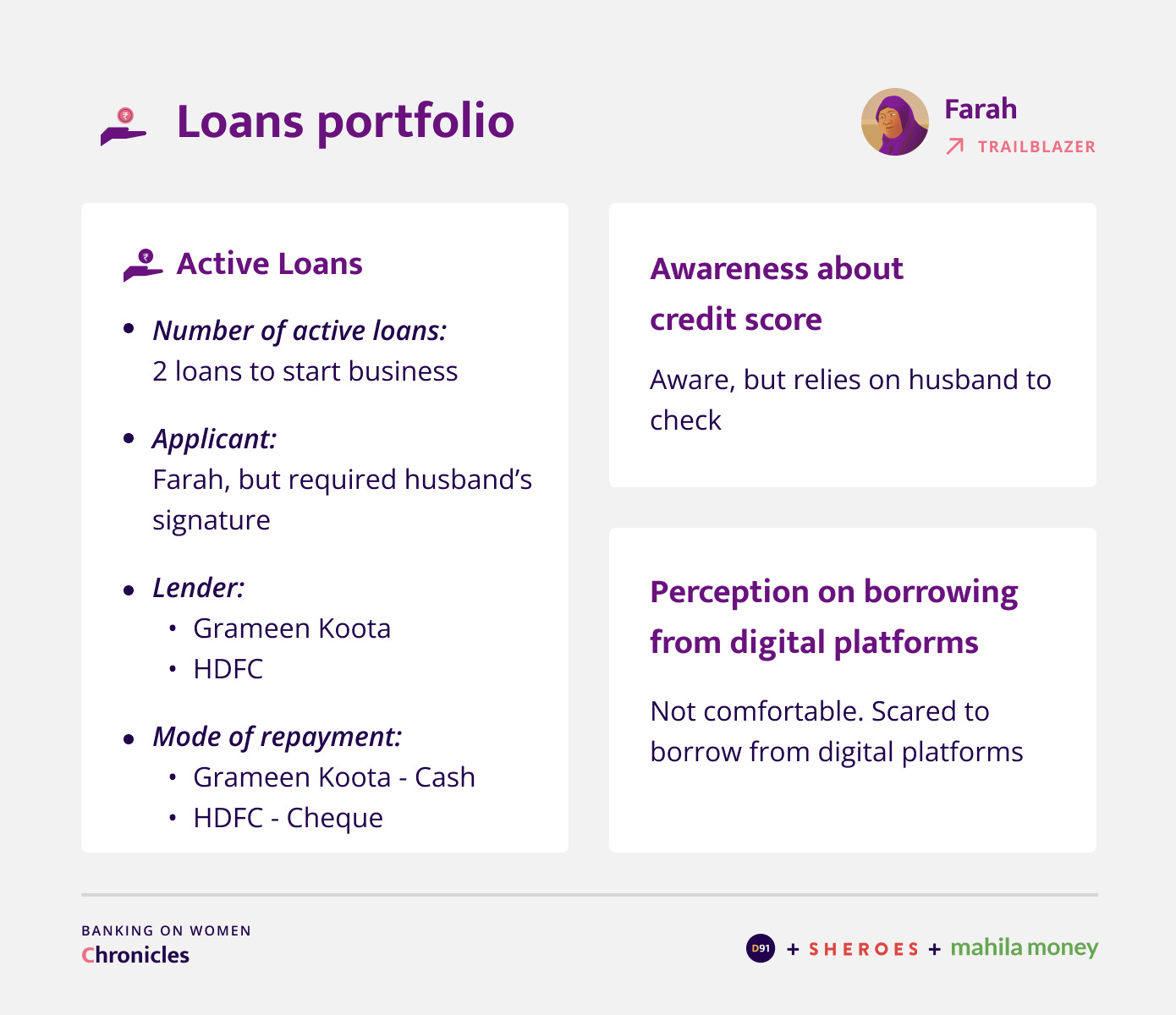

Loans

Any particular reason why you chose these lenders?

No particular reason. They approached us and said that if we have an Aadhar card or any other relevant ID, we can avail a loan. Since I was in need of a loan anyway, I handed over my documents, they validated it and approved my loan.

Did you need your husband or a male family member as your co-guarantor/ signatory?

Yes, my husband's signature was essential. All husband’s are required to be aware of the loan amount we are availing.

Did you face any challenges to borrow because of your gender?

I haven’t faced any problems because these organizations are offering loans for the benefit of women and they themselves are approaching us so there is no running around required. However, when it comes to men, considering how stern some of them can be, even if they can’t repay they might fight back and try to buy time when they are in no position to repay. Some might also be unbothered by the consequences of late repayments. But when it comes to women, we rarely stand up for ourselves, so they are strict with us and urge us to repay on time. Also, since 4 people have availed the loan together, late repayments will inconvenience other members so we are forced to repay.

Have you considered using digital apps for borrowing loans? If yes, what is the maximum amount you would be comfortable borrowing from a fintech company?

I wouldn’t be comfortable borrowing from a digital platform. I am scared because it might be a scam with fake claims. Also, I fear that they might misuse our data once they have access to our ID. On the other hand, in terms of the organizations that I have borrowed from, there are people right in front of me who I can approach and they teach us everything properly. Moreover, since 4-5 of us take a combined loan, there is added trust in the system. I receive so many fake calls and messages saying my loan has been approved. Sometimes up to 2-3 messages per day. These messages contain a call to action to open a link, but since I am aware of fraudsters, I am very cautious. Therefore, if digital platforms say they will offer a loan, I will be skeptical to trust them.

Insurance

Do you or any other family member have health or life insurance?

No, we do not have currently

Have you thought about purchasing one?

Actually my husband had health insurance so that it can be helpful for my second delivery. But when we tried to claim it, they said it’s not valid in that particular hospital and we couldn’t claim for the services we were availing. After we faced these issues, we were extremely disappointed that the amount we had paid all these months was of no use and we lost hope in the product.

Who used to pay the insurance premium back then?

My husband used to pay. After paying for so many years, if we can’t claim the amount, it’s such a waste for us. It feels like they have benefitted from our money rather than the other way round.

Outlook towards the future

In your opinion what is that one financial product or service that will have the most impact in supporting your financial journey?

I feel it would be really helpful if someone helps us understand banking and finances better based on what’s important for us to be aware of. Support in the form of guidance and advice would make things really easy for us.

Our understanding of Farah’s journey

In speaking to Farah we got a glimpse into her journey that has involved consistent growth. She has been ever-ready to adapt to her circumstances and continues to trod towards success through original and creative tweaks to her business model. Despite being new to the digital world, Farah remains driven to fulfil her personal and business aspirations through support from her husband. Her ability to capitalize on opportunities even during the most tumultous times is uplifting.

Hope you enjoyed reading this blog. We at D91 would love to receive your feedback on the work we have been doing so far. Here's a brief survey for us to understand your experience while engaging with our content. This survey should take less than 5 minutes of your time and all responses are anonymous.

You can provide your feedback by clicking on the following link - https://forms.gle/4WUzRUBCht2prHs28

About the Research

This blog is a result of an online interview conducted with the participants’ consent. The interview was conducted in Kannada but has been translated to English in the best possible way to reach a large audience. This is a part of the Banking on Women chronicles.

Disclaimer: The name and other sensitive personal details in this documentation is masked to honour the privacy of the participant.

Project Partners

SHEROES

The SHEROES Network is a content and community ecosystem enabling access to employment, entrepreneurship, and capital for women. It includes the SHEROES app, SHOPonSHEROES marketplace, Babygogo, Naaree, MARSbySHEROES and has a user base of over 24 million women. The SHEROES Network is committed to increasing women’s contributions to GDP.

Sheroes.com | SHEROES App | Twitter | LinkedIn | Instagram | Facebook

Mahila Money

Mahila Money is a full-stack financial products and services platform for women in India. Mahila Money specializes in offering loans to women who want to set up or grow their own business along with resources and community to achieve their financial goals. Mahila Money can be accessed via the Mahila Money app on Android.

Twitter | LinkedIn | Instagram | Facebook | Website | Play Store App

All artworks are designed by Poorvi Mittal.

If you enjoyed reading this blog and would like to receive more such articles from D91 Labs, please subscribe to our newsletter here.

To read more about our work, visit our website

You can follow us on Twitter | LinkedIn | Instagram

A cloud kitchen is a delivery-only restaurant that has no physical space for dine-in. It relies entirely on orders placed online.