Will ONDC solve problems faced by Small Sellers?

In this blog, we share insights from our interviews with small sellers in India on how they imagine ONDC will alter business for them.

Remember the seller on amazon from whom you bought your mugs and spoons? Have you wondered about the ways in which such small sellers use e-commerce tools, platforms, and social media for their business? Do you think ONDC will change the way they currently operate? We have been mulling over these questions, so we went and asked the sellers! And here’s what we found. But before we get to that, here’s a bit of background.

Last month, we interviewed a cohort of small sellers & businesses attempting to exploit “alternate e-commerce channels” such as social media, quick-commerce, local e-commerce platforms, etc. i.e. e-commerce channels other than the big e-commerce platforms, for the discovery & distribution of their products. The primary reason for this research activity was the advent of the Open Network for Digital Commerce (ONDC); for predicting its impact on small sellers and assessing the gravity of the problems it claims to solve.

(All personally identifiable information about the small sellers have been changed to protect their privacy)

The objective was to understand the obstacles faced by small sellers in smoothly accessing e-commerce. The research attempts to explore the various channels of “alternate e-commerce” that work for these sellers currently. For this, we conducted a thorough analysis of the pros & cons of the current system of e-commerce for small sellers. We also asked the seller - what they think about ONDC and whether it will become a gamechanger for them

The sellers we talked to were predominantly sellers in Tier I and II cities who were navigating various digital marketplaces as well as social media platforms to digitize their sales & marketing operations. Most of them were well-educated, digitally literate, and financially stable.

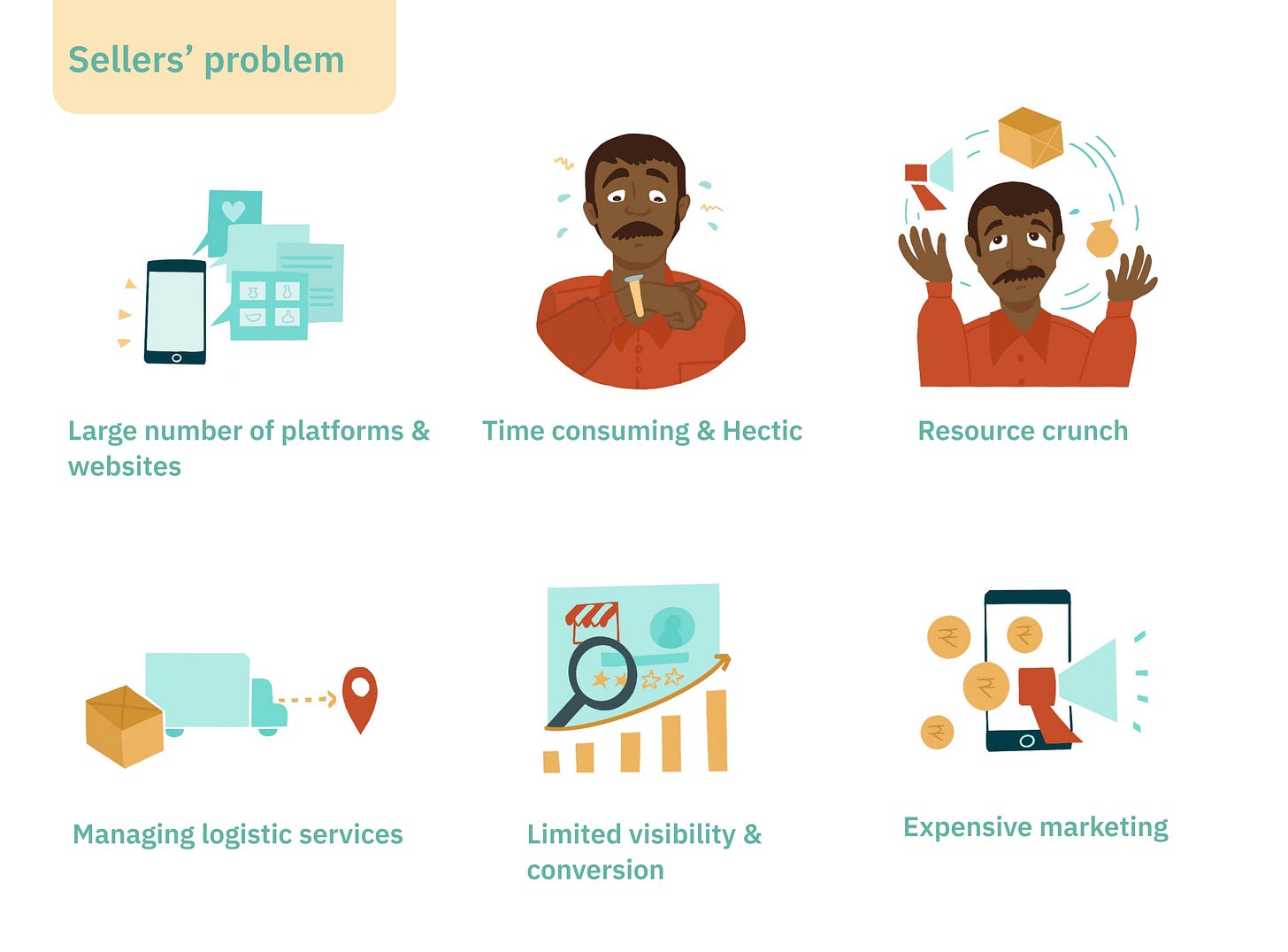

Sellers’ Problems

One of the most recurrent themes throughout all the interviews has been the huge number of e-commerce platforms & websites that the proprietor has to manage, and the large amount of time & human resources required to do so. Some smaller, local platforms do not provide logistical support to the sellers; the sellers have to manage deliveries by themselves. Managing multiple logistic service providers is a time-consuming hassle as well for the sellers.

Raj Kumar, from Nutrition Foods– a start-up crafting & sharing the purest health products & initiatives, put this problem quite evocatively:

“Being a manufacturer, I would like to invest 80% of my day on more important things, such as R&D, manufacturing, & distribution only; but it (managing e-commerce platforms & websites) eats up more than 60% of my day.”

The sellers expressed the need to consolidate their emails, notifications, updates, insights, and invoices distributed across all the different platforms. Few of them mentioned using seller service products that help them manage everything on a single platform. Although such seller solutions are available, the hassle of managing multiple platforms has been a concern among small sellers.

Some sellers have been using 15 to 20 platforms/websites to make their products “discoverable” to consumers. After talking to the sellers, we realized a corollary of this time-consuming activity. The main reason sellers need to onboard, operate & manage multiple platforms is the limited ability of the platforms to provide customers to the sellers due to obstacles such as limited listing, lack of branding, etc. Also, the number of customers are limited on local & small e-commerce platforms.

This “limited discoverability” of small e-commerce platforms pushes sellers to undertake costly marketing campaigns through digital marketing, social media ads, etc.

A seller said that she was asked to spend around Rs. 500-1000 every day, without any surety of conversion into orders. For small sellers with tight finances & budget constraints, this is a high-risk decision.

Priyanka from No Preservatives Added, a home-based business that sells homemade laddoos, put forth an insight into the recurrent nature of marketing expenses. She said that expenses incurred on R&D, design, etc. are one-time expenses. They eventually become a part of the product. So, it is not difficult to recoup that amount. But marketing is required for a long-time and foreseeing that recovery is a big challenge, especially for small businesses.

Sameera from Nature, a company specializing in eco-friendly products ranging from skincare to decorative items, spoke to us about this problem the small sellers face:

“If you are a small business or company, you cannot pay huge amounts on advertisements. Running ads cost almost 30-40% of the cost, which is approximately the same amount big e-commerce platforms are charging as commissions. When you’re small, you have to make sure that you’re utilizing your budget wisely.”

Apart from these problems, small businesses & sellers face a crucial resource crunch, especially human resources. Most of the sellers we interviewed in this cohort were small business owners, mostly sole proprietors, household businesses, or a partnership. The resources they can muster are already limited. Such sellers look towards e-commerce channels to simplify the discovery & distribution needs of their products. Rather than solving these problems within the limited resources of small sellers, e-commerce platforms demand more resources– financial as well as human, from them. This defeats the purpose of e-commerce; at least as seen by the sellers.

Reluctance to join Big E-commerce

Although the monopolistic, big e-commerce platforms have a large customer base and offer a superior value proposition to the sellers, many small sellers are reluctant to join them. One of the biggest reasons for this reluctance among small sellers is the sky-high rates of commission. The sellers feel that a large chunk of their sales revenue will go to these third-party platforms, which they cannot afford; at least not initially.

The sellers realize that onboarding e-commerce platforms are not enough to get new customers. You need to be listed in the first couple of pages to see significant traffic and conversion rates. Thus, the expensive advertising & marketing requirements from platforms for preferred listings also hold sellers back. The advertising & marketing requirements on these platforms are expensive but inevitable for an effective listing of products on search.

“Although the platforms onboard us, they do not project us,” and that they need to pay huge amounts of money to appear on the first or second page, was the reaction of one of the sellers.

Apart from the above reasons, some small sellers had made a conscious decision to NOT join the big e-commerce platforms, despite being comfortable with the high commission rate and the advertising & marketing expenditure. The reason being:

Some of the sellers made a strategic choice to defer joining these platforms, by letting brand inception & recognition take the preference.

There were a few sellers who consciously did NOT want larger discoverability for their products.

One category of sellers catered to the luxury segment and chose to keep their products exclusive.

While the others who provide customized products tended to prefer customer differentiation over larger discoverability.

Few of the sellers we interviewed had previously been onboarded on the big e-commerce platforms. Bad experiences made them leave. These experiences ranged from listing to refund & return policy issues, and from poor treatment by the point of contact (POC) to alleged manipulation of orders. We have documented some of these experiences, as follows:

Chandraraj from Padtrane, claims that he used to receive ‘bot orders’ on an established e-commerce platform. The seller makes this allegation on the basis of multiple experiences of canceled orders, where an ordered product after leaving the facility used to be returned back to the seller because the order was canceled midway!

Sandhya from The Farmer, a farm-to-fork initiative that predominantly provides coffee, spices, and other horticultural produce, was ‘ghosted’ by the POC of an e-commerce platform, and was unable to get hold of her own products from the warehouse. She told us that:

“Our products were lying in the warehouse for three months; we didn't know whom to approach other than the POC. Finally, we got a third-party agent who got our products back. Although we didn't lose any products, the packaging was ruined, and we could not use it again.”

The incentive structure of E-commerce Platforms

These various problems faced by the sellers, point towards a problem within the way the e-commerce industry is structured; irrespective of the size of the platform. The innate biases of the e-commerce platforms favor the well-being of customers over the sustainability of the sellers. This presents an inherent conflict of interest within the various actors of the industry– a dissonance of incentives.

E-commerce platforms, by design, are customer-oriented. The attractiveness of a platform is due to a large number of customers it can provide to the sellers. Thus, the pull factor of platforms, i.e. the number of customers, becomes a higher priority. The platforms struggle MORE to get customers than to get sellers. The incentive structure of e-commerce platforms is such that they cater more to the needs & wants of the customers, rather than the sellers who sell on the platform. As a result, the sellers are undermined.

This fundamental flaw in the e-commerce industry negatively affects sellers. One of the sellers who we interviewed put this issue very lucidly:

“We go to e-commerce platforms, so that we can get new customers. But the e-commerce platforms do NOT provide those to us; rather, they want our customers to purchase our products through their channels. They don’t want our products, they want our customers.”

The orientation of these platforms also affects the return, replacement & refund policies that they offer to the sellers. Although the sellers do get to choose the policies applicable to their products, this choice is offered only after the seller gives a certain volume of products. Below that, the seller is a low-category seller, and therefore, a low priority; and has to adhere to the policy set by the platform.

Chandraraj from Padtrane, who sells designer & customized Kolhapuri Chappals, made an appeal to the e-commerce platforms, and that has stayed with us. He said,

“To the e-commerce platforms what I suggest is that they should become a little bit seller-oriented too. Right now, everybody is a customer-oriented platform. So exchanging, returning, refunding, or even canceling orders is very easy for the customers; but the vendors (us) have to pay for everything.”

This orientation problem is not specific to big e-commerce platforms but prevails throughout the e-commerce industry. Problems specific to the monopolistic e-commerce platforms are the anti-competitive policies such as self-preferencing, improper use of data, predatory pricing, & exclusive agreements undertaken by them. In that context, the Open Network for Digital Commerce (ONDC) has entered the Indian e-commerce industry scene.

What does ONDC solve?

The Open Network for Digital Commerce (ONDC) is a protocol that enables an interoperable network of various microservices, that result from the unbundling of the platform-centric e-commerce model. Entities that provide one or more of these microservices required in completing the order-fulfillment lifecycle are the network participants.

By creating an interoperable network of multiple sellers-platforms, buyer platforms, and logistics providers, onboarding multiple platforms become redundant for sellers as well as customers. The sellers get network-wide discoverability by onboarding any one seller-facing platform. Naturally, the single biggest problem associated with e-commerce of onboarding & managing multiple platforms is solved. Similarly, the problem of ‘limited discoverability’ is solved as well. At the same time, the transactions are consolidated into one single seller-facing interface; given that all the other entities are ONDC-compliant.

The plug-and-play functionality of the network offers multiple options for logistics providers to the sellers. As this is integrated into the system, the hassle of managing is substantially diluted. At the same time, the proliferation of multiple network participants energizes innovation; which can potentially give rise to more customizable seller platforms.

By diluting the functions of the platform into buyer-side, seller-side, and logistics microservices, the ONDC attempts to address the skewed incentive structure in the current e-commerce ecosystem. The seller-facing platforms will have the sole responsibility of onboarding sellers and enabling a smooth user experience of e-commerce. This will ensure the coherence of incentives on the platform. Thus, the expectation of sellers for a tilt in the orientation of e-commerce platforms towards them has been fulfilled by ONDC.

The first-order effect of unbundling e-commerce would be the proliferation of multiple network participants, especially on the seller side. The second-order effect, as a result of competition between these entities, would be the lowering of commission rates. Currently, although the ONDC does not mandate a certain rate slab, it hopes the mutual competition will drive down the commission rates.

Conclusion

The fundamental expectation that sellers have from e-commerce is to get more customers, grow sales and establish a business; thus discoverability/visibility and distribution are the two pillars of seller expectations. ONDC provides for these. At the same time, by driving down commission rates, consolidating & simplifying navigating e-commerce, and giving multiple options from seller apps to logistics, ONDC hits the right spots. The grievance redressal on ONDC is currently open for public scrutiny, comments, and suggestions. Hopefully, sellers will get better refund, replacement & return policies.

Thus, ONDC has been a step in the right direction. With small sellers in mind, the proliferation of multiple seller platforms would attempt to solve the general as well as specific, customizable needs in the long term.

This research has been possible with the help & support of Sonal Agarwal, the COO of Lakshya Foundation. Sonal helped us connect with small sellers whom we could interview for this research.

All artworks are designed by Himanshi Parmar.

If you enjoyed reading this blog and would like to receive more such articles from D91 Labs, please subscribe to our blogs here.

To read more about our work, visit our website

You can follow us on Twitter | LinkedIn | Instagram | WhatsApp

Is the core hypothesis behind non seller centricity of the current e-commerce platforms correct ?

How will ONDC solve for demand still remains open, E-commerce gaints focuses on demand gen because It the reason behind why Sellers list their products their.

How will ONDC generate demand? Else it is yet another chicken and egg issue. (sellers but no buyers)