Fintech for the Ageing Indian Population

This blog delves into a potentially evolving whitespace in the Indian fintech landscape, focusing on the unique challenges faced by the elderly population.

In this blog, we delve into a potentially evolving whitespace in the Indian fintech landscape, focusing on the unique challenges faced by the elderly across rural-urban and rich-poor divides. From unique personal case studies to broader demographic shifts, we analyze the implications of India's ageing population and propose solutions tailored to their financial needs. Drawing parallels with the mature fintech market in the United States, we highlight potential use cases and discuss the essential steps needed for technology adoption among the elderly in India. Join us on this journey as we uncover the opportunities and challenges in shaping a tech-enabled, financially secure future for India's ageing demographic.

Population ageing is an irreversible demographic reality associated with declining fertility and the advancements in medical care increasing life expectancy. The traditional Indian joint family structure with collective control over family income and inheritance rights lying with the elderly family members has gone through a radical shift due to changes in job structures, family orientations, and the net worth of the aged.

Some of the financial characteristics of the elderly population in India, as per a study by the Agewell Research and Advocacy Centre (2016) are as follows:

The net worth increase in urban-rich areas for older persons was significantly higher owing to rent on land and dividends on investments.

"Over the years, prices of my house and land properties have increased many times and now I earn a good monthly income in the form of rent and return from investments. I spent most of my income on my medicines/medical treatment."

- Radhakrishna Gupta, 68, Noida, Uttar Pradesh

In comparison, the rural aged, which constitute more than 70% of the older population as per the 2011 Census, has also witnessed an increase in net worth owing to higher growth in cash crop production and India strengthening its position as a food exporter. However, this shift has been incongruent between the rich and the poor.

"We are going through a very tough time in our life. Both of us (me and my wife) worked as agricultural labourers throughout our working lives. Now we have no regular source of income except a paltry old-age pension from the government. "

- Om Prakash Purohit, 69, Betwa, Madhya Pradesh

Owing to the change in the financial status and ever-increasing independence of older persons, their role in financial activities has also undergone significant change.

" I have been living alone for 8 years. I always remain in fear of robbers and criminals. I want my household goods to be insured so I can live with peace of mind, but there is no insurance service available around."

- Sukhbir Singh, 65-year-old retired govt. pensioner, Chandigarh

‘India is a young country right now but the demography will change significantly in the coming decades as it has for other countries.’ ~ India Ageing Report 2023

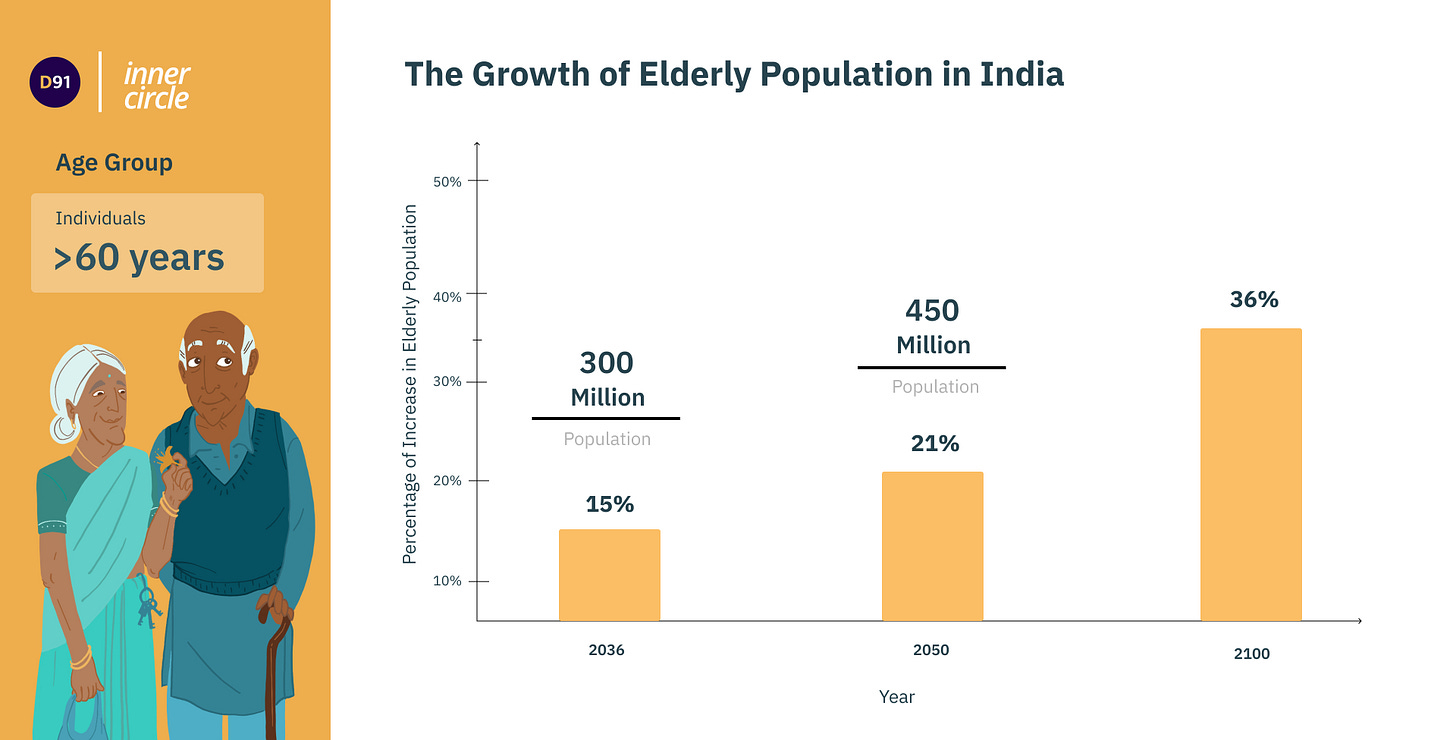

India currently boasts a predominantly young demographic, with around 65% of the population below 35. The current median age of 28 is comparatively lesser than that of the US (38 years) and China (39 years). As of 2023, approximately 10.5% of India's population, 149 million people, is aged 60 and above.

However, a shift is occurring as the elderly population is growing rapidly. As a result, the demographic landscape is poised for significant change in the coming years.

This shifting demographic dynamic holds substantial implications for India's socio-economic landscape over the coming decades. This unique trajectory, contrasting with the ageing populations in the United States, Latin America, and China, require nuanced approaches to address the distinctive needs of an ageing population while leveraging the advantages of a youthful workforce. Understanding and adapting to these demographic nuances are crucial for policymakers and businesses to navigate the evolving landscape and ensure a sustainable and inclusive future for India.

Use cases that could be interesting from an Indian perspective

A 2016 study conducted by Agewell Foundation with 15000 elderly respondents shed some light on the fast-growing concerns of older people in India - the top concerns revolve around access to healthcare and basic financial stability for self and future generations.

Be it financial security in old age, increasing medical expenses in comparatively longer old age or coverage of assets such as property, India’s insurance infrastructure continues to play a critical role. Insurance is a highly under-penetrated market with life/ non-life premiums as a % of GDP at 3.1%/ 1% versus 7% for developed markets. Life, health and general insurance continue to be fast-growing categories with innovation required across types of products, distribution and servicing.

While insurance can protect from accidental loss, the problem of economic dependency due to loss of income, and low formal economy participation post-retirement resulting in restricted access to pensions and higher medical expenses breeds financial insecurity among the elderly. As per the study, 29% of elderly males and 53% of elderly females had no income.

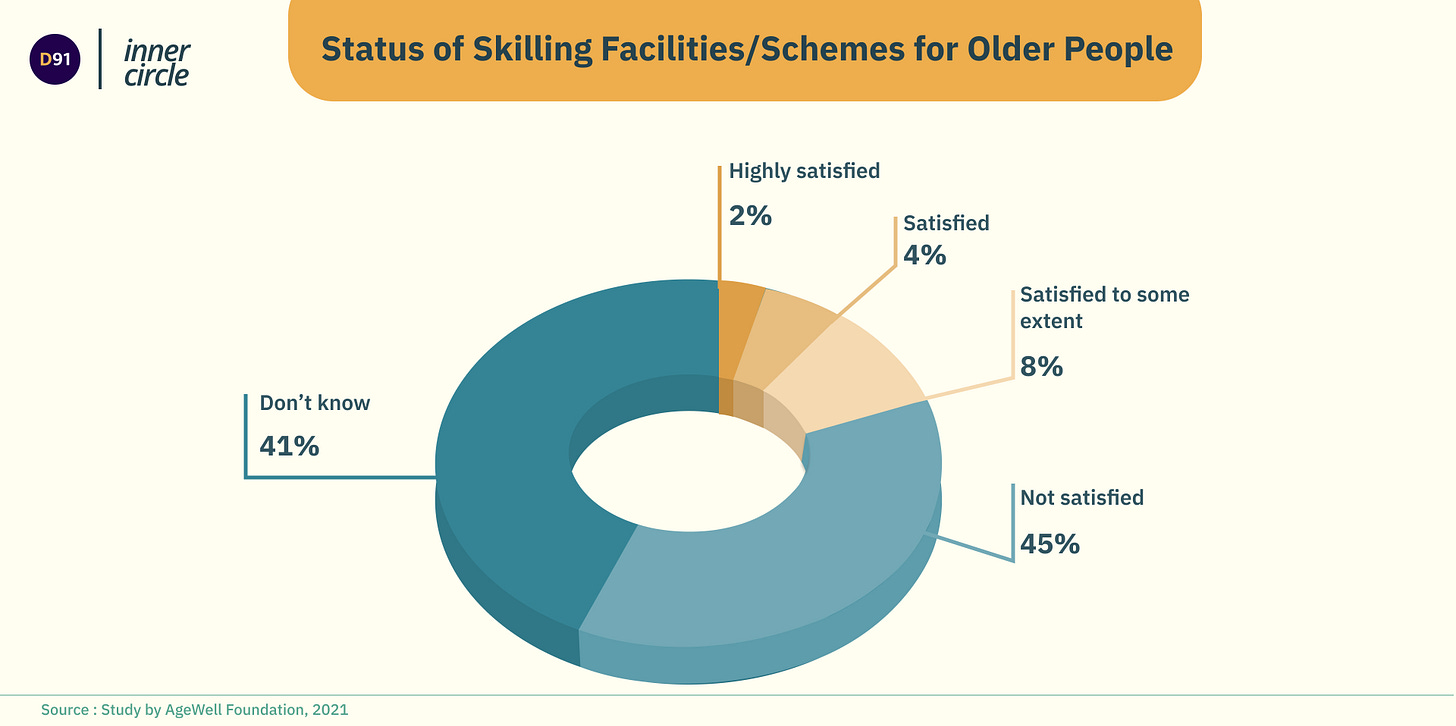

Recent studies reveal that while the elderly Indians wanted to work, they felt there was a gap in terms of their skills and a lack of supporting infrastructure.

And while some elderly members have income, cash flow planning to last through retirement continues to be a concept embraced by a few.

Even high-value assets such as property might not translate to any relevant cash flow for many due to illiquidity, fear of parting with the “only” safety net, or sentimental reasons.

"After the death of my husband, I got her entire house property worth almost a Crore in my name as per his will. I want to utilize my house property in a way so that I can get some monthly income regularly to meet my daily needs. I don't want to sell this house."

- Sarangi Devi, 63-year-old widow, Bangalore

These factors lead to ample opportunities for solutions around post-retirement wealth planning, tailored investment recommendations and tapping into illiquid real estate. Further, supplemental income planning would also become relevant as people continue to live healthier and longer lives beyond the age of 60.

Dipstick on Fintech for the Ageing Market in the US

In a nation characterized by a significantly older population, it is anticipated that elderly individuals in the United States will encounter unique challenges. However, due to the widespread adoption of technology, the fintech landscape has effectively adapted to address specific issues affecting the older demographic. Let's delve deeper into this phenomenon.

Over the past century, the older population in the US has seen a substantial increase, swelling from 4.9 million individuals, constituting a mere 4.7% of the total population in 1920, to 55.8 million, representing 16.8% in 2020. Projections suggest a continuous trend, with the number of retirees in the US anticipated to reach 72 million by 2035 (Source: US Census Bureau).

This ageing demographic, coupled with extensive technological adoption, has led to a significant maturation of the 'Fintech for the Ageing' landscape within the United States. This evolution has spurred the emergence of compelling and diverse use cases, signalling an intriguing intersection between financial technology and the needs of an increasingly older population. A few use cases we discuss here.

Roughly one in every five seniors in the US is a victim of financial fraud, generating annual losses estimated at around $37B (source). Eversafe is using ML to create a financial profile of its customers, which it then uses to identify signs of exploitation or bad habits in users’ bank and credit card transactions.

Another company, True Link Financial, offers a customizable, reloadable card that families can set up for an individual. The goal is to help a parent or grandparent independently make purchases for essentials like food, medications, and entertainment, while blocking transactions that are more likely to be linked to fraud, such as wire transfers, over-the-phone purchases, and international charges.

According to research, nearly 60% of Americans lack will or estate planning, causing many seniors to leave their families behind vulnerable to exploitation (source). Companies like Kindur and Trust&Will are building mobile-first and senior-friendly solutions that simplify the process of estate planning, breaking down barriers and increasing participation while providing a platform that acts as a single source of truth.

Lastly, as life expectancy increases, retirees find themselves redefining the concept of retirement. To maintain flexibility and stay active well beyond the age of 60, retirees and those approaching retirement are seeking avenues to earn supplemental income and pursue professional development. The shifting landscape of retirement has prompted a reevaluation of traditional notions, with individuals exploring ways to remain engaged in the workforce and acquire new skills. Companies like GetSetUp have seized the opportunity to cater to this demographic, offering tailored programs to teach elders valuable skills that empower them to explore fresh occupational opportunities.

Additionally, startups like Silvernest are helping retirees find roommates to share their houses. This innovative approach aims to reduce expenses, create more opportunities for companionship, and bring in additional income, thereby enhancing the overall retirement experience.

Not every use case in the picture above will be relevant for ageing Indians but with changing demographics and increasing technology adoption we expect unique use cases ready.

What is the scope for fintech innovations for the elderly in India?

There are three axes on which the adoption of technology-led financial services within the growing elderly population in India is centred upon -

Financial & technical awareness,

Increased accessibility through elderly-friendly product design,

Use-case-specific applications targeting unique pain points.

Although awareness of technology and financial products within India is steadily on the rise, in line with the broader digitisation wave, there is a visible disparity among individuals based on their age group. According to a survey by Agewell Foundation, more than 75% of seniors expressed feeling excluded from India’s nationwide digital push due to unfamiliarity and gaps in knowledge. With few avenues to get digitally trained and an over-dependence on family members to avail most of these digital services, seniors refrain from interfacing with them on their own. Investments in community-led programs and ad campaigns by NGOs, banks, and government agencies covering aspects of digital financial literacy, online safety, and prevention of scams will fill these knowledge gaps & empower seniors to safely and independently ride the wave of tech-first services.

Additionally, there is a need to de-friction consumption of digital services within the elderly population. This can be efficiently achieved with regulatory mandates for the creation and enforcement of accessibility standards on apps and websites catering to the elderly population. Notably, a precedent has already been set when Practo, an online health services provider, was asked in August last year to make its app and website disability friendly by the courts, in compliance with the PwD Act. Along similar lines, implementing simplified navigation, legible font sizes, audio descriptions, high-contrast colour schemes, broader language coverage, and elderly-friendly user guides will eliminate day-to-day adoption hurdles faced by seniors. A regulatory push by the government in this regard can help standardize these practices and compel both new & existing players to make use of these design choices.

Even with improved user experience, the perception of a lack of security remains an additional adoption challenge due to the elderly being at the receiving end of numerous frauds. Despite the meteoric rise of UPI, seniors are hesitant to use it extensively, due to the threat of being scammed. This can be mitigated with elderly-friendly security features also natively embedded into the design philosophy of products - such as multi-factor authentication to not have a single point of failure, biometric verification to not be reliant on passwords which may be hard to remember, and having real-time unusual activity checks to identify cases of fraud before it's too late. Implementation of these will instil confidence within the elderly population and their families & completely remove both actual and perceptive barriers to usage.

Finally, specific financial applications will need to be scalably built using technology to capture the unique demands of the elderly population in India. This potential value, mostly overlooked by traditional players like banks institutions, and non-banking financial companies (NBFCs) is more likely to be captured by the fintech ecosystem. Whether it be existing fintech entities adapting their services or innovative newcomers entering the scene depends largely on the specific use case at hand. Established players have an advantage with distribution already in place, and can add elderly-focussed use cases to their platforms. For example, a wealth management app can tap into this user segment by offering specialized savings instruments and will-planning as additional services. On the other hand, use cases like upskilling and creating employment opportunities necessitate the development of entirely new platforms tailored to the unique demands of the elderly in India. The ecosystem is already seeing green chutes - Khyaal, a super app aimed at senior citizens, has launched payment cards to simplify offline and online payments with enhanced security features, OTP-free logins, and transparent spend tracking. Genwise, a lifestyle app, digitizes passbooks across all major banks for seniors to keep track of their expenses in a way familiar to them. This wave will continue to get stronger over time, offering increased complexity in both the length and breadth of problems being solved for the elderly in India.

Bhuvan Beejawat is a Tech Investor at Nexus Venture Partners, Bhaskar Gurnaney is a Product Manager at PayU, and Veni Gupta has previously worked at Lightrock and McKinsey consultancy.

All designs by Himanshi Parmar and Wamika Das. This blog has been reviewed by Monami Dasgupta.

If you enjoyed reading this blog and would like to receive more such articles from D91 Labs, please subscribe to our blogs here.

To know more about our work at D91 labs, visit our website!