Financial report card of the people of India (Assets)

We have parsed through the All India Debt and Investment Survey (2019) to map where Indians stand in terms of accessing and using financial products and services.

This article is best viewed on a desktop. However, the links to all the maps used in this analysis are provided in the article and can be viewed on mobile too.

This blog is about the “what do Indians do with their money”. It neither answers why they do it nor how they do their financial transactions. The idea is to map the data to get a visual understanding of how similar or dissimilar financial behaviour among Indian households is, across states as well as between rural and urban areas.

We have used the data from a nationally representative All India Debt and Investment Survey (2019) to answer questions related to assets and liabilities. For the purpose of this article, we have considered access and usage of only formal financial products. Since this is a map-heavy article, we will be discussing only the assets held by Indian households in this blog. Our forthcoming blogs will examine liabilities and other aspects of financial portfolios.

But before we talk about the assets owned by Indian households, let’s take a step back and ask a more fundamental question -

Do ‘all’ Indians have bank accounts?

It’s a win in the deposit account section! Bank accounts owned by adults in India are above 70% in both rural and urban areas. Multiple factors have led to strong growth in bank accounts in India in the last decade, such as the long-standing effects of the JAM trinity (Jan Dhan Yojana - issuance of Aadhar cards - high adoption of Mobile phones), creation of more last-mile touch points through banking correspondents and launch of new deposit taking institutions such as Small Finance Banks. However demonitization in 2016 might also have pushed the opening of bank accounts even for people working outside of the formal labour market.

In urban India, the states with the highest and lowest percentage of bank account ownership are Kerela and Bihar, respectively.

(Link to bank account ownership map - Urban)

The urban districts of the Southern states (along with Rajasthan and Punjab) in India exhibit high ownership of bank accounts, relative to other states.

P.S. - the account ownership data is for 18 relatively large states and not for all of India. If you would like to toggle over the numbers for each state, click on the link to the dynamic map above.

Let’s look at the extent to which rural India owns bank accounts.

(Link to bank account ownership map - rural))

The ownership of bank accounts in rural districts of 18 large states looks impressive. Similar to urban areas, the southern states are top performers in terms of ownership of bank accounts by rural populations. Chhatisgarh and Rajasthan, both have above 90% of bank account ownership. The relative underperformer is Gujarat, with 73.8% of the rural population holding a bank account.

The above statistic is good news because access to bank accounts is a gateway to most other financial products. Term deposits, loans, overdrafts, credit and debit cards, insurance, UPI, and digital financial products - none of these can be accessed without a basic bank account.

Having a bank account is a necessary but not sufficient condition for financial inclusion. The natural follow-up question would then be -

Are people ‘using’ these accounts to deposit money?

A quick disclaimer here - the data for financial deposit allocations made by Indians are available for 36 states and UTs, and are at a household level. Let’s see what story lies in here.

At an all-India level, Indian households hold a small percentage of their assets in the form of savings in bank accounts. So all the bank accounts that are owned by Indians are most likely not being used for the purpose of depositing money.

Here’s the status of financial deposits held by urban households in India.

(Link to financial deposit map - Urban)

Among urban households in India, Arunachal Pradesh has the highest value of assets stored as financial assets. On the other hand, urban households in Kerela hold only 6.1% of their total value of assets as financial deposits. ( FYI - In Kerela, 60% of the total assets of urban households are held in the form of land!)

What about rural households? Is it worse?

Here’s the map that depicts the status of financial deposits held by rural households in India.

(Link to financial deposit map - Rural)

The story of financial assets owned by rural households is a bleak one! Multiple rural areas have a single-digit percentage of assets held as financial deposits. Rural households in Andhra Pradesh, Mizoram, Chhatisgarh, and Odisha have the highest value of assets stored as financial deposits, ranging between 16-20% of total assets. To add some context, rural households in Haryana hold on 2% of total assets as financial deposits but have 82% of their assets locked as land ownership (not shown on the map). This is in line with research that shows that Indian households allocate most of their resources toward land and real estate1.

By now, some of you might be wondering that if Indian households don’t save in the form of deposits, where do they save? And is there a difference between urban and rural households?

Here’s what the data shows.

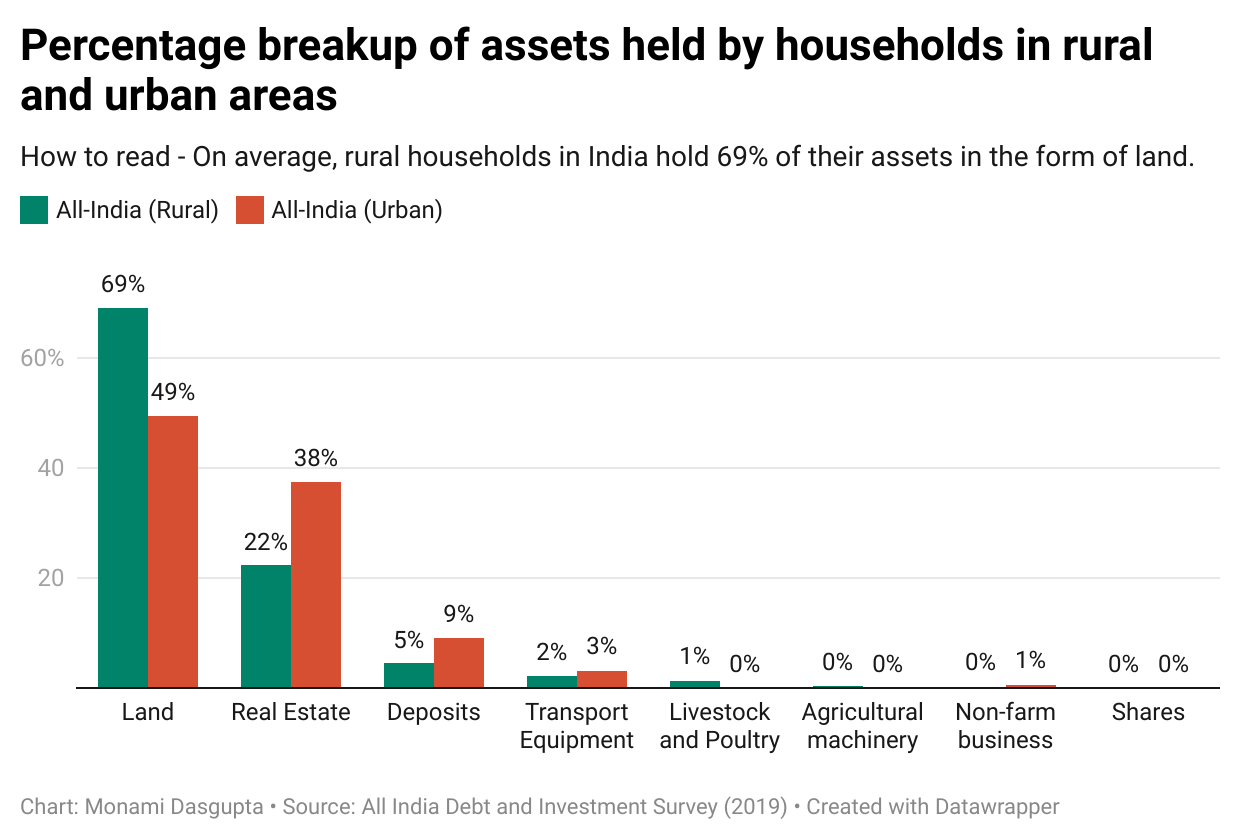

Rural households allocate 70% of their assets towards possessing land, followed by real estate2. Less than 10% is allocated towards financial assets or other tools and equipment.

Urban households allocate relatively less than rural households towards land but compensate with their investments towards physical property (flat, independent house, plot). Financial deposits are less than 10% even for urban households.

(P.S. The percentages add up to 100%)

That’s a lot of data to process, summarize please?

As per, the All India Debt and Investment Survey (2019), pre-pandemic data

Bank account ownership has increased over the last decade and is at an all-time high in India. This is encouraging as deposit accounts serve as a gateway to other traditional and digital financial products.

However, for Indian households, ownership of bank accounts has not led to an increase in savings deposited in bank accounts.

In fact, in urban areas, the percentage of deposits held by households is within the range of 10-20% of their total asset portfolio.

In rural areas, the figures are dismal and rural households across India barely save between 5-10% of their money as savings in banks.

Land continues to dominate the asset portfolio in terms of value and volume of money invested, in both rural and urban areas.

This blog discussed the asset portfolio of Indian households. In the next blog, we will discuss the liabilities of Indian households. Stay Tuned!

If you enjoyed reading this blog and would like to receive more such articles from D91 Labs, please subscribe to our Tales of Bharat blog here.

You can follow us on Twitter | LinkedIn | Instagram | YouTube

https://rbidocs.rbi.org.in/rdocs/PublicationReport/Pdfs/HFCRA28D0415E2144A009112DD314ECF5C07.PDF

Real estate covers flats, independent houses, plots for houses, office space owned by households, etc.