Bridging the credit gap with 'Buy now Pay Later' products

'Pay Later' products have the potential to provide small-ticket loans to customers who are new to credit or do not own a credit card. Read to know how.

Role of credit

Credit is a key driver of personal and economic growth. It allows a person to borrow from potential future income to fulfill needs and aspirations today. However, access to formal credit (from RBI-regulated institutions) is limited by complex processes, a high credit score bar, and high collateral worth/ liquidity. While informal credit is low on the process, it bears usurious interest and even collateral risk. Therefore, at one end the risk is too high, at the other end the entry barrier is too high for a common person.

Need for credit - dreams, aspirations, and needs

Responsible formal credit can unlock dreams for individuals, it can unlock new business opportunities and it can also facilitate the development of human capital. And just like a business needs starting capital/ working capital, goals, aspirations, and needs also need capital to fulfill.

Aversion to Credit

While the above needs are some of the most basic needs in today’s world, using credit to fulfill them is still considered a taboo, or a sign of an unfortunate state of personal financial management.

We often hear people say “Beta loan kabhi mat lena,” “Apne dum pe aage badho, kisi se karz nahi lena”, or the colloquial - “udhaari grahak maaf kare” (Never take a loan and live by your own means)

In general, credit is largely looked down upon as an inability to finance one's needs, or as a sign of aspirations way beyond one's capacity, or is considered a trap due to loan sharks/ debt trap.

Some of the other factors that add to credit aversion by low to middle-income households are -

Lack of access to suitable credit products

The informal industry thrives where the organized industry can’t fill a gap

The bottom of the pyramid is not covered by institutes or the access is too costly in terms of time/money/network.

If one does have access, an informal/ aggressive industry also thrives by lending irresponsibly contributing to create the debt trap

Lack of education of Personal Finance Management -

Leads to poor decisions such as revolving debt or being overindebted

Allows spending more than their means.

Or not taking insurances to safeguard one against financial implications of unfortunate incidents.

Lack of awareness

Of options, one has when they want to fulfill their needs/aspirations.

To understand the credit landscape better, let’s look at the popular credit products available in India.

Comparison of various credit sources

If so many products are available then why is there a lack of access to credit?

Let’s understand the basics of the credit industry

A financial institution lends money to a person when it has sufficient indicators of the creditworthiness of the individual. The credit-worthiness is defined in two key ways -

Sufficient Intent to pay signaled by

Credit score

Ability to pay the loan amount signaled by

Income

Cash flows

Valuation of assets

If any one of the above two (intent to pay and ability to pay) is not clear/ unknown or is established to be poor, then the institute is likely to reject the loan or ask for collateral. Collateral is an asset that can be used by the institute to recover the money in case of non-payment.

Absence of intent to pay (a formal credit score) creates a unique catch 22 situation -

One would not have a credit score unless they take a credit instrument from a formal institute

But an institute would not extend credit unless the individual has a credit score.

A line from an old hindi movie comes to mind - “Golmaal hai bhai sab golmaal hai, paisa kamane ke liye fir paisa chahiye”. In this context, it would mean “Credit lene ke liye fir credit chahiye…”

This creates a unique gap in the industry where a section of society faces significant challenges in availing credit products. They are low on collateral and credit history. Like most industries today, technology has created a condition where this gap can be filled in while fulfilling the core principles of lending.

Enters Technology

In our rosy worldview, most people are good. From what we have seen till now, in the lending industry, most people pay back the loans when the conditions permit. The tricky part is to identify who those people are, and what are those conditions.

Around 3 decades back, in a world where banks still operated on passbooks filled in by pen and when people would still queue to get access to their own money (in the bank accounts) establishing the intent to pay, or the ability to pay was hard.

But technology has made that easier. A large section of the population has some kind of bank account and these banks are largely digitized to the extent that one need not even step into a bank branch. More importantly, many of us have phones. Thus, we are easily reachable, have phone bills/ recharges, and have SMS communication which creates our data footprint. In addition, UPI is also bringing billions of transactions into a digital world where the cashflows can be recorded.

Each of us, thus, has a digital footprint, that can be accessed with sufficient consent and permissions. Technology thus plays an enabling role for users and institutes and also reduces the cost of customer acquisition and delivery.

This eases access to credit products in the following ways

For Users

a. Cost of Search of credit reduces (it’s a google search away instead of going to every institute with documents)

b. Cost of establishing intent is easier (digital footprints are records of your money habits)

For Institutes

a. Cost of processing a loan is quick and seamless (no papers, no files, no storage rooms, branches)

b. Cost of establishing creditworthiness is easier (instead of a person doing the diligence, it’s now a computer that does it)

c. Cost of finding a customer is quicker (through Google, Facebook, Flipkart, Amazon)

This allows institutes to establish both intent to pay and ability to pay.

Every additional loan disbursed is a digital entry instead of a paper trail that can be processed in a matter of milliseconds instead of days. And thus, the Return on Investments (RoI) from an institute’s perspective, is achievable even for a loan of as low as Rs 500/- or Rs 1000/-. As the amount that can be loaned has been reduced, so has the tenures. You can now even see loans of durations of 7 days, 15 days.

But is this applicable for credit card companies too?

For credit cards companies such small amounts or such small repayment cycles do not fulfill the RoI requirement. The reason you ask? It costs a lot to run a legacy traditional credit card business. For example - SBI cards in its IPO filing said almost 24% of its revenue is spent in sales and marketing activities (Ref). Where’s this money spent - in a gamut of activities, such as rewards/ offers/ salespersons (have you seen SBI card stalls in the malls?)

Another big share of the costs of credit card companies goes towards bad debt (The money that they can’t recover). The money that doesn’t come back. Thus, they ensure that they don’t lend to those users for whom they don’t have sufficient indication of “intent to pay”. Hence they are really selective in providing credit cards. Quoting a line from SBI Cards IPO here - “We have limited access to credit and other financial information on cardholders, which may decrease the accuracy of our assessment of credit risks and thereby increase the likelihood of cardholders defaults.” (Ref)

For good or for bad, the banks that offer credit cards have not done the jump towards digital-first acquisition and operations. This gap has been existing for a long time, and thanks to technology, is now being filled by new-age credit providers.

The new age of Credit

Simplifying Credit to “Pay Later”

The new age of credit has led to a simplification of credit and is perceived to be more user-friendly (than the underlying banks of course).

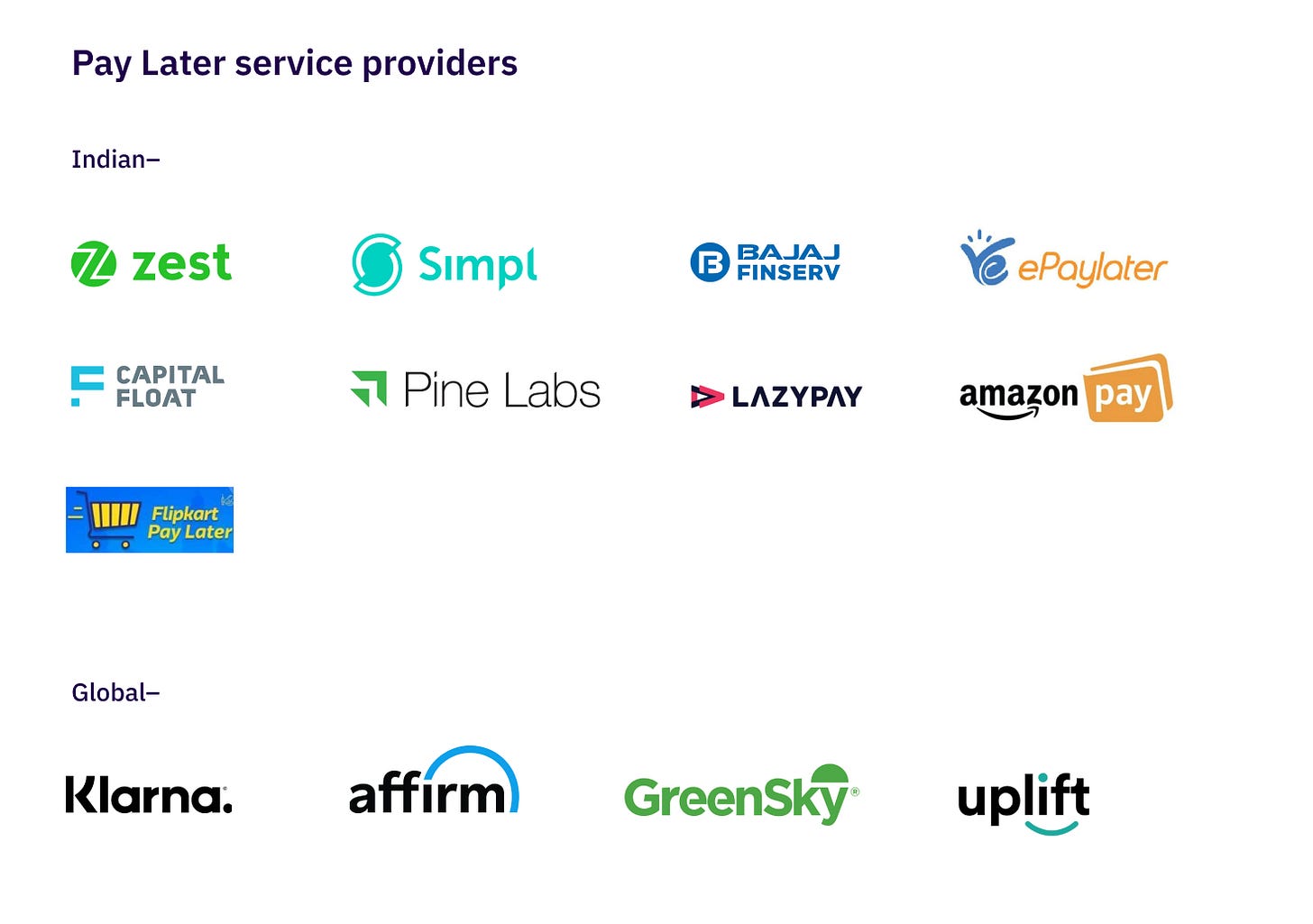

It has given birth to Pay Later products such as - EpayLater, Simpl, Flipkart Pay Later, Paytm Postpaid, LazyPay, Amazon Pay Later, and many more, are examples of such new-age credit products. Given the core requirement of technology powering these, it’s no surprise that these pay Later products are offered by fintech companies. Most of these have traditional NBFCs/ banks that are supporting the core loans that power the product, but it’s the fintech companies that make them user-friendly and a breeze to use.

Pay Later in quite simple and modified terms are nothing but a rebranding of the world of credit into more user-friendly terms. You can now -

Take Credit Card or avail EMIs - “Buy Now, Pay Later”

Take an Education Loan or “Study now, Pay Later”

Take a Travel loan or “Travel now, pay Later”

And much more

All the above use cases have few things in common,

they require low amounts at one go

they have a fast repayment cycle

they are low cost - typically 0 to very small flat fee structures

they allow for a fast means of checkout (often being secured by alternative signals such as digital signatures etc, and require no OTP)

The above use cases are compelling enough to create a significant moat over traditional credit instruments. More so, because of the user-friendliness, the loyal users of these platforms have shown a lot of interest in Pay Later products.

In the last 4 years, Pay Later has successfully crossed the boundaries of a nascent product to a product that needs to be regulated. It started as a deferred payment product but has matured into an industry-defining, short-term, and easy credit alternative that’s riding the tech wave.

Given the scale at which it's expanding, this would be the right time for the policymakers to set up a framework where tech can be used eminently as an enabler, as well as a ground of execution.

Pay Later user Journey and Regulatory improvements

The convenience of Pay Later

Currently, most Pay Later products are available on eCommerce sites at their checkout point. Customers are offered a deferred payment option through the Pay Later choice. The Pay Later choice is offered by banks/NBFCs in partnership with Fintechs and is typically for up to Rs. 20,000. For a user, the Pay Later option is convenient at the check-out point as it is simple to use, time-saving, and does not require any login, pin, OTP like in the case of paying with a credit card. The whole process is much quicker than paying by credit card. So convenience > old habits.

Why do we think Pay Later will thrive?

There are various reasons why the Pay Later option will thrive in India. To begin with, there are around 6 crores credit cards in circulation. The number of online shoppers is between 20-30 crores. Thus, there’s a massive gap even within the segment that’s tech-savvy enough to transact and make payments on online platforms. A potential 24 Crore more users (4x the current credit cards in circulation). Pay Later can thrive on the shoulders of low credit card penetration in India.

These are a few more reasons why Pay Later will work for customers and providers

For customers

New to credit customers without any credit history can avail of this option

No need to have a credit card

Favorable option if they are short on cash currently but need to order a high-value item

Credit limits are low and manageable

Pay later option is often clubbed with attractive offers and discounts

Suitable for card averse customers

For providers

Can offer small-ticket credit at scale

Brings more customers to the credit ecosystem

Builds funnel for credit card and personal loans

Expand the credit industry to younger customers (25-30 years onwards)

Can partner with multiple online and offline merchants help them expand their business

Risk assessment of Pay Later customers

Pay Later credit risk assessment is backed by traditional sources of information (such as credit bureau reports) and based on data available from a host of other sources. These sources are collectively referred to as alternative data for lending.

Given the expansion of digital data, the alternative data sources that can be used to determine the creditworthiness of the users are plentiful. Provided the right consents, data sharing pipes, and strong data processing capabilities (read Machine Learning models), 1000s of new data points can be used to back a user’s application.

For the Pay Later products, a large share of users is usually evaluated for risk through a variety of alternative data sources. Broadly alternate data sources can be categorized as follows. Currently, Pay Later providers ask for consent to use some of these data points in real-time.

This expansion of creditworthiness indicators has created opportunities for credit companies to serve users who were underserved till now.

A typical profile of a BNPL customer is below

Technology friendly user

Hasn’t availed any formal credit till date, usually in their college or first jobs.

May not have steady salaried employment but can afford to shop online

Knows how to navigate payment gateways

Pay Later landscape

Future of Pay Later

Pay Later solves problems for customers that require small-ticket loans for financing their purchases, particularly customers without credit cards. With Pay Later options at offline stores, last-mile customers with a smartphone and digital know-how can spread out their expenses over a short term. It is a convenient method of delaying payments and also reduces the financial burden through no-cost EMIs.

Given that the ticket sizes are low, the chances of default and even the impact of defaults are much lower than credit card loans but it still requires robust underwriting for assuring responsible lending. Low credit penetration in India, along with complicated loan application procedures, implies that there is a sizeable underserved market with the absence of credit history.

Currently, the product is available at the top of the funnel through e-commerce websites, fintech companies, Edtech companies, travel agencies, health tech companies, and more. In the future, as access to smartphones and the internet grows, we can expect the Pay Later product to move the needle of financial inclusion by being prevalent in multiple offline markets.

Some of the potential use cases of expanding the Pay Later option are -

Financing small working capital needs for small mom & pop and kirana stores.

Critical and emergency use cases such as medical loans. (instant underwriting is a big plus here to reduce the time from ask of loan to money in the bank)

Ability to pay school/college fees of traditional institutes

Ability to use pay Later for agricultural inputs and pay

References

https://www.hdfcbank.com/personal/pay/cards/millennia-cards/millennia-easyemi-card

https://www.idfcfirstbank.com/personal-banking/loans/easy-buy-emi-card

https://www.bajajfinserv.in/what-is-the-rate-of-interest-of-bajaj-finserv-emi-card

https://www.bankbazaar.com/personal-loan/lazypay-instant-personal-loan.html

https://economictimes.indiatimes.com/tech/technology/buy-now-pay-later-is-the-flavour-of-festive-season-for-top-internet-firms/articleshow/85194811.cms?from=mdr

https://economictimes.indiatimes.com/news/morning-brief-podcast/morning-brief-bnpl-is-buy-now-pay-later-a-financial-genius-or-a-bubble/podcast/85260767.cms

Disclaimer

This article and its contents are completely the views and opinions of the co-authors (Anurag and Monami). They do not represent the views of their employers (Flipkart Group and D91 Labs)

Anurag Gupta works as Product Manager at Flipkart and Monami Dasgupta is the Head of Research at D91 Labs.

All illustrations designed by Prajna Nayak

Very good article on tech role in credit & how new tech & catalyst like AA can make loan availability easier for non credit informal section of society or at bottom of pyramid who have very less access to credit.