Account Aggregators & The Future of Data Sharing

What does the new entrant in the India Stack hold for the future India?

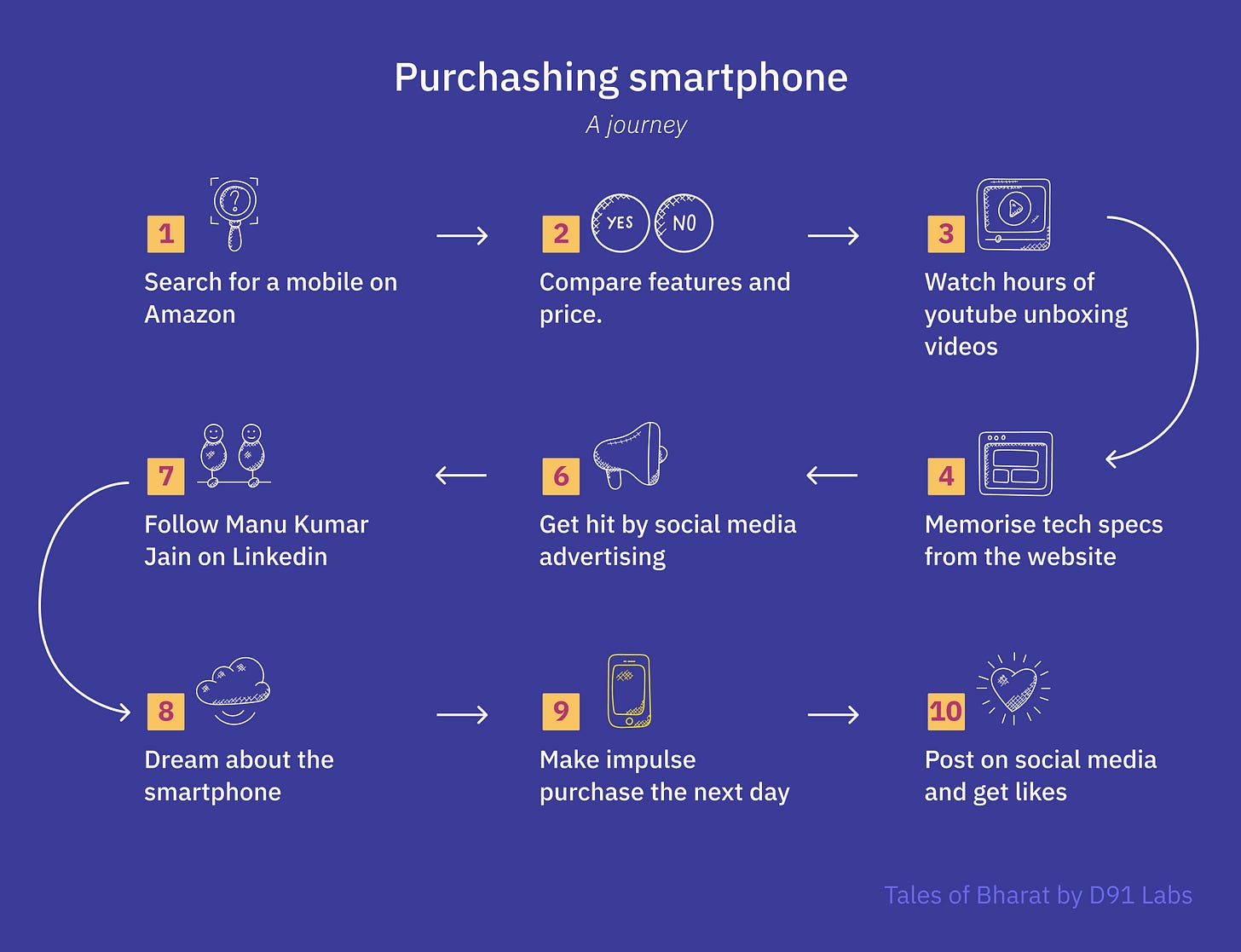

It's a drizzling evening in Bangalore and the sight at your balcony demands to be photographed for your Instagram feed. You decide to strike a pose to only realise that your 3-year-old smartphone isn't capable enough to capture the depth of the drizzle. Falling short of your Instagram celebrity dream, you decide to replace your smartphone with a better dragon-ish processor. Your journey to buying a new smartphone is likely to be this 👇

The way we buy products has drastically changed over the last decade with the advent of technology.

On the other hand, our purchase of financial products (insurance, mutual funds, fixed deposits, stocks and bank accounts) are still influenced by friends, family and ‘trusted advisors’. Let's do a simple thought experiment. If I asked you how did you choose your current bank, what would you say? Your answer is most likely to be one of these:

My parents opened the account for me.

My first employer suggested the bank.

My university/college demanded that I have an account in this bank.

As a user researcher in the fintech domain, I have repeatedly observed the pattern of financial decisions being influenced by the close circle. This also translates into your financial well being and awareness being dependent on your social circle. The more financially-aware friends and family you have, the better off you are. It's not just anecdotal, India as a country has a low penetration of financial products in the world due to lack of financial awareness and accessibility.

Why hasn't banking transformed in the way that e-commerce has transformed in the last decade?

For starters, banking is a heavily regulated domain. If you are an individual with a vision and the ability to build technology, you could start an eCommerce. But you can’t start a bank. Along with your vision and technology expertise, you need one more important component: Blessings of the Reserve Bank of India (RBI).

To put things in perspective, RBI has been very cautious of granting full banking licences. The last licence for a new bank was awarded in 2015 to IDFC (now IDFC First) and Bandhan Bank after a gap of 11 years. Private banking is a market with limited players and a high barrier to entry.

Bundling of services:

A bank typically starts its customer acquisition through the opening of a bank account. It then goes on to convince you into adopting into their offerings. The journey typically looks like this:

The effort that goes into building the brand and trust is massive. Hence when your bank suggests mutual funds or insurance, you seldom question if the institution that is good at managing the bank account is good at managing your financial assets or not. The more products you adopt with a bank, the more data you share. A market where the entry barrier is high with few players and a potential locking of each customer’s data results in lower incentive for innovation. We get used to it as the switching costs are high and the alternatives don't seem very different from your existing banking partner.

If that's the case what has changed now?

Unbundling of a bank:

Unified Payments Interface (UPI) which was introduced as public infrastructure in 2016 changed the game for good. UPI is a real-time payment system that facilitates the interbank transfer of money in the most seamless way possible. Since UPI was developed as public infrastructure, it allowed third-party developers (like Gpay, PhonePe etc) to build a superior user experience that resulted in a huge uptick in the adoption of digital payments and gave rise to a range of use cases that did not exist before. To put things in perspective, UPI has been consistently clocking more than 1 billion transactions in India. A huge part of this success is attributed to the demonetisation in Oct 2016.

Just like UPI democratised payments, other banking products like loans, insurances and investments are waiting to be disrupted. Since most of the financial data of individuals have been locked within a bank, it has been challenging to build innovative financial products, unless the bank itself decides to build it. Let's take a simple example of how creditworthiness of an individual is decided. A financial institution decides to provide credit to an individual based on two factors:

Ability to repay the loan

Intent to repay the loan

The ability to repay the loan is usually evaluated based on the assets (like a house, gold or land) that one owns and is ready to pledge. The intention to repay is evaluated based on the credit score which is an indicator of good repayment behaviour in the past. In the absence of a physical asset and a credit score, the financial institution resorts to their cash flow (income and expense) to gauge their ability and intent. The bank statement which is a ledger of your transactions becomes the holy grail to assess your creditworthiness. Sharing of a bank statement to a third party lender is a challenge and is achieved today through screen scraping of net banking interfaces or uploading PDFs. Both of these methods aren’t reliable or trustworthy methods of sharing data for neither the consumer nor the lender. High barriers to access net banking and the inability to monitor one’s account in real time are some of the challenges.

Just like UPI democratised payments and blossomed the digital payments market, we need a new method to share our own data to avail financial services from third parties other than our banks. That's where the newest entrant to India Stack, called Account Aggregators come into the picture.

Account Aggregators:

The Account Aggregator (AA) framework is the first application of this approach for unlocking value from personal data. The AA framework creates a well-defined and secure mode for users to share their personal financial data with other eligible entities. At the heart of the AA framework is a robust consent system that allows users to pick and choose the type of data they share, and the entities who can access this data.

Account Aggregators (AA) is built as a digital public infrastructure that allows individuals to share their own financial data from one party to the other with their consent. Think of it as UPI for data sharing (loosely used metaphor).

How do account aggregators work?

To make it simpler, I shall draw a comparison with how UPI works. In a UPI payment, there are three major parties involved:

Originator bank: The bank from which the money needs to be deducted

Destination bank: The bank to which the money is transferred

UPI app: The mobile application which enables this transaction to happen (Example: PhonePe, Google Pay, BHIM etc.)

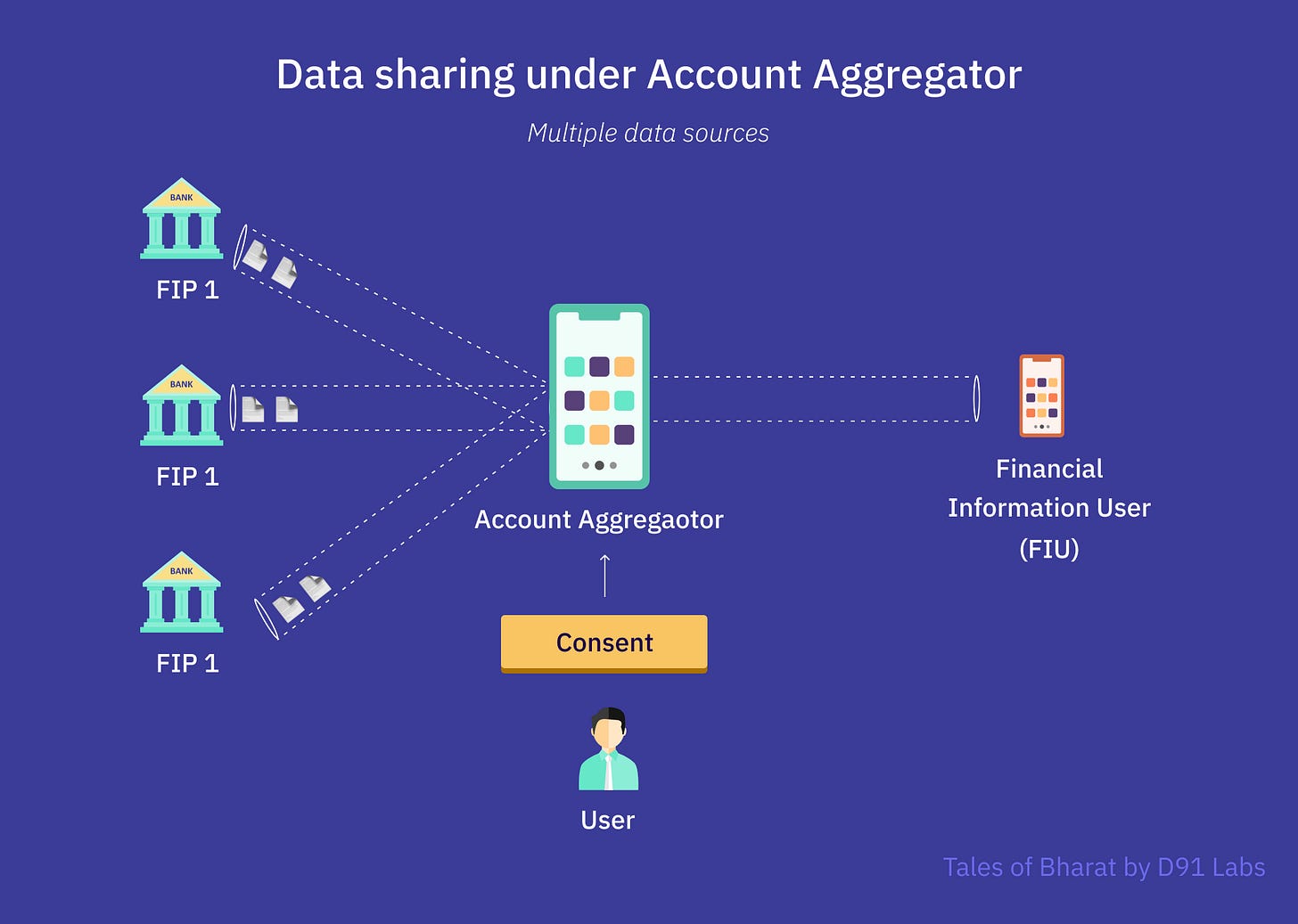

Under the account aggregator framework, data sharing is enabled by three main entities:

Financial information provider (FIP): Entity that holds your data (Banks, Income tax department, GST, AMCs etc)

Financial information user (FIU): Organisation that requests your data (Fintech app, digital lender etc)

Account aggregator (AA): An RBI licensed entity that enables this data sharing (Mostly an app or a website)

(Please note that any FIP can also be an FIU and vice versa)

Unlike UPI, account aggregators share multiple types of financial data from various FIPs.

The consented data sharing under AA allows any third party app to securely receive users data which in turn gives rise to a range of new use cases. Imagine a Uber driver being able to get a loan through their rider app by sharing their bank account statement as opposed to walking to a bank. The possibilities are endless.

In the coming weeks, I shall discuss a use case of a cash-flow based lending application in the account aggregator context.

Credits:

Written by Dharmesh Ba and edited by Lakshmi Ajayan

Future of Data Sharing:

Our new project ‘Future of Data Sharing’ aims to develop good design principles for consented data sharing through qualitative research. The objective of this research is to develop a design toolkit with the upcoming public infrastructure Account Aggregators as the main theme in focus. The toolkit will host resources and assets around designing better user experiences for data sharing and data portability.

Do tune in for more updates :)

We speak banking frustrations topics, when shit hits the roof! we have real time challenges when operating Omni channel payment modes in our FMCG business. Can you guys take up such topics and make a dent?

Interesting and well explained. Insightful article. Thanks.