#9 Anupama | From being digital first to digitizing other women

So what happens in villages is that people really try to fool you when you are a woman and think that you don't understand what has to be done in terms of financial matters.

“We can find everything on Google only if we look for it!”

Short Story

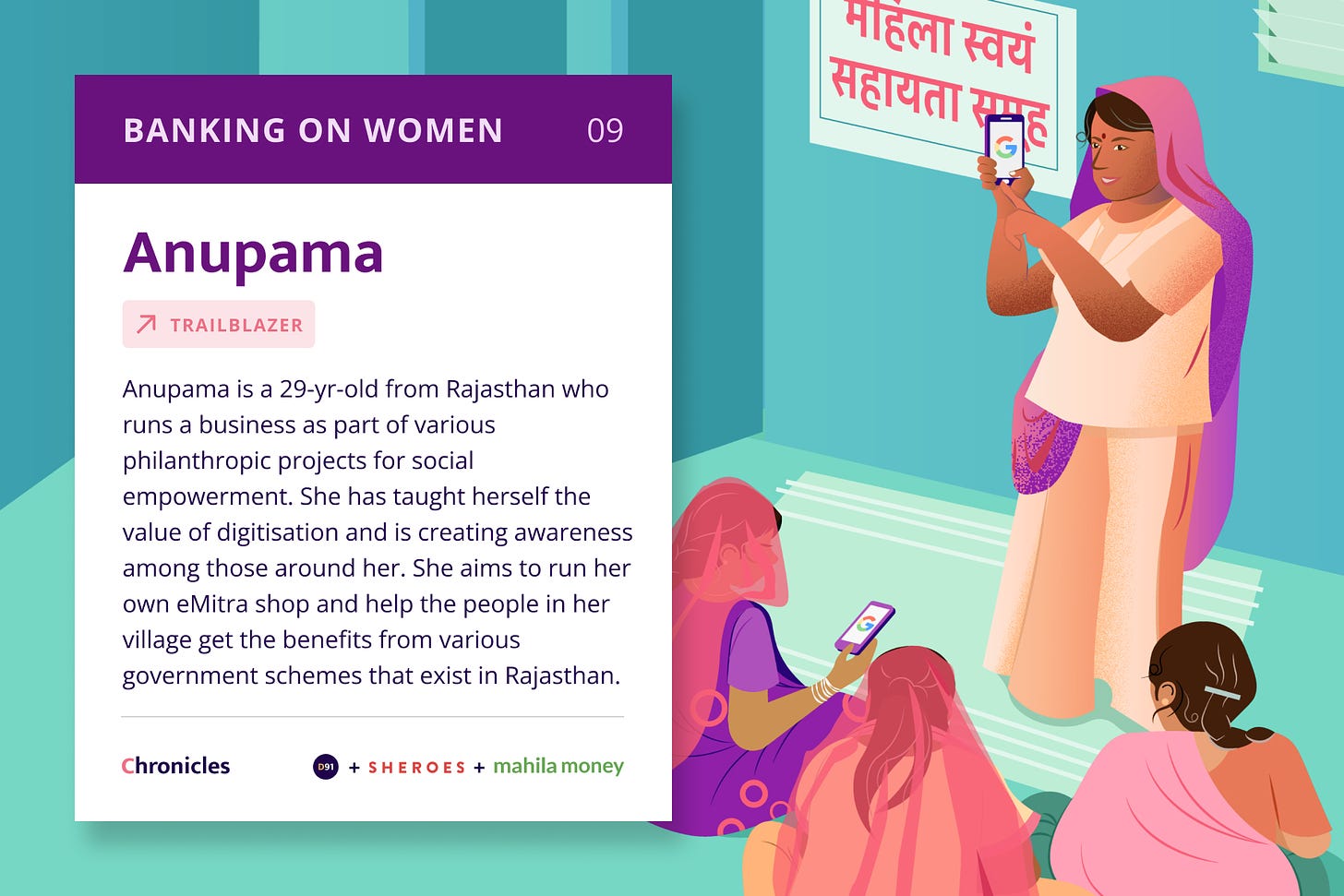

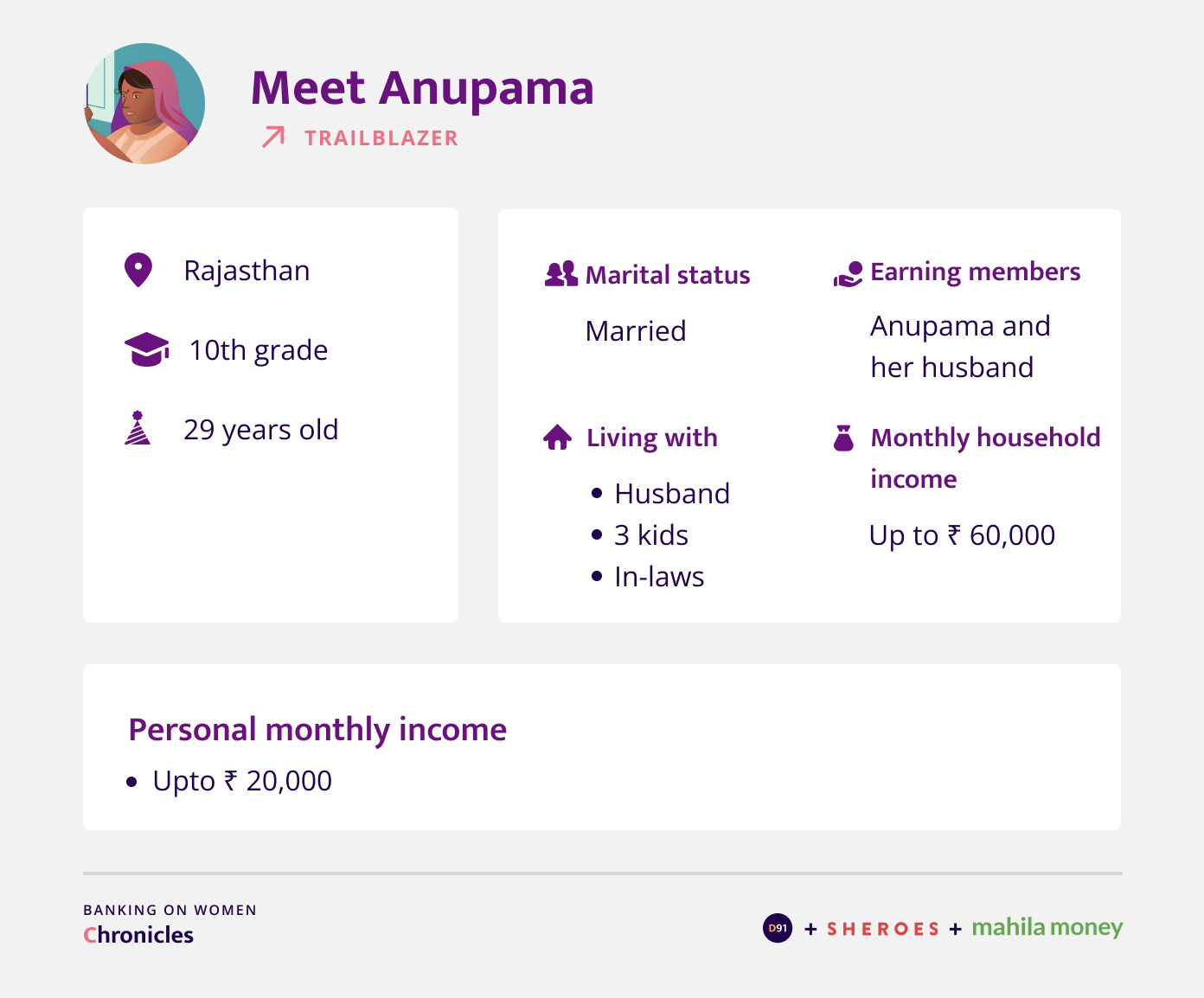

Anupama, 29-year-old woman from Rajasthan established her own business with the help of socio-economic and digital empowerment projects run by philanthropic organizations. She taught herself the value of digitization and is creating awareness among those around her about the value of technology and mobile phones to make their lives better. She aims to run her own eMitra shop and help the people in her village get benefits from government schemes in her village.

Read on to know more about her very interesting life and financial journey!

Personal and financial background

What is your daily routine like?

In the morning, I finish household chores and cook food until about 11 am. After that, I go to the shop that I have opened close to my house where I work until 6 pm. I then come home and take care of household work. If I haven’t been able to do much work during the day, then I have to do some form filling and other such work at night as well, sometimes till 11 pm!

Business Details

Can you describe the work you do?

I run an eMitra shop. In Rajasthan there are many ongoing Government services such as issuing ration cards, Jan Dhan cards, Aadhar cards or PAN cards. My work covers form filling, printing and issuing. For example, if someone has to add on their kids name in a ration card or want to get a new card, avail the pension scheme, discontinue it or want access to any online form or services, they can avail it in my shop. Over time, I have got recognition for the work that I do, so if anyone needs to get such work done, they come straight to my shop.

How did you start and go about the process of setting up the eMitra shop?

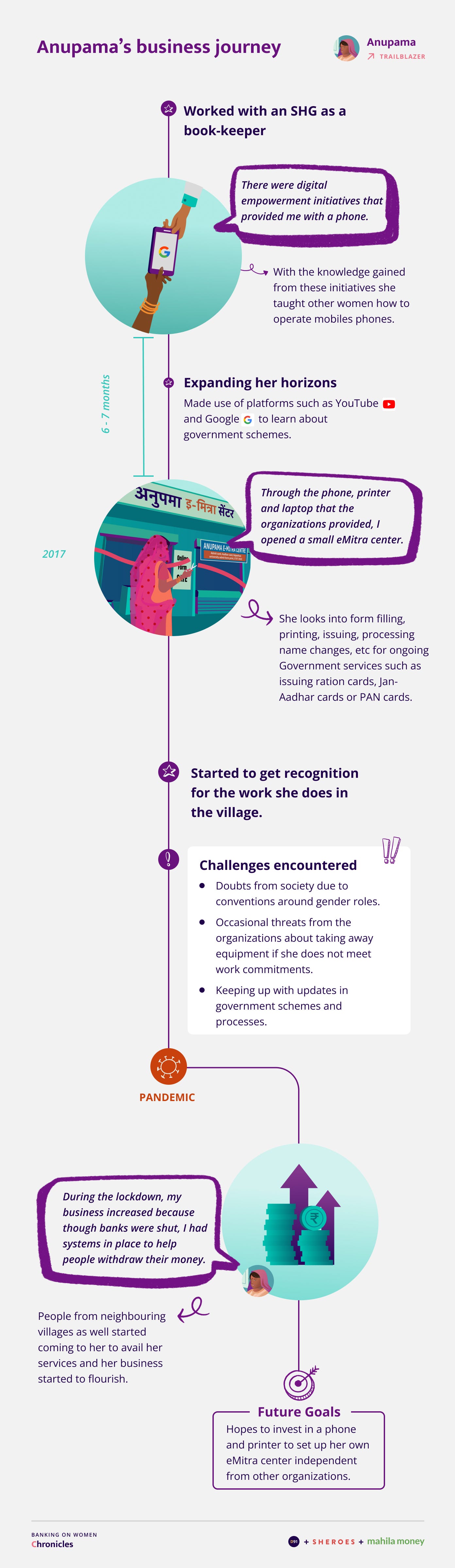

About 5 years ago, I used to work with a Self-help Group (SHG) as a bookkeeper. A student run, women empowerment and social entrepreneurship project and an internet based digital empowerment initiative sent volunteers to my village. They provided us with a phone. At the time, women did not have much knowledge about phones so after learning from the volunteers, I began to teach these skills to women in my village and even those from the neighbouring villages as part of the project.

Soon, I started using the internet and educated myself about sarkari yojanas (government schemes) such as pension schemes, etc. We can find everything on Google only if we look for it! I started telling more people about it and they benefitted from this knowledge. I received a phone and a printer through one of the programs and I opened a small centre in 2017 to take print outs and make photocopies using the phone under the eMitra scheme. We also started conducting camps in the village to make people more aware of the government schemes and how to use technology for availing benefits. But the way the program operates is, if a person does not use the resources they provide in the time and manner they prescribe, they take it back. I realised that, while also managing a household, it sometimes got difficult to meet commitments that they have set. So, there is a risk that they will take back the equipment they gave me.

Could you tell us how you charge for these services? Do you invest any money to run the shop?

For each service, the fees vary. For example, if I make an Aadhar card for someone, then for one Aadhar card I don’t really have to put in anything, I just have to take a printout after putting in the relevant details and I charge them INR 50 for that. If someone wants to get pension related things done online then I charge up to INR 100 for that. I generally make around INR 10,000 to 20,000 a month from the eMitra services I provide.

I don’t really have to invest much because apart from the equipment being mine, I need some blank pages and some other stationery items on which I approximately spend around INR 1000 or 2000 a month. The more work I get, the more I am required to invest in such items.

Do you undertake any other business activities?

Yes. Apart from the eMitra shop, the program has given me a few other projects as well. One such project involves educating people of the village about Covid-19. We create paintings on walls like “wear a mask”, “reduce going out”, “maintain social distancing”, etc. We also conduct meetings where we educate people about what precautions to take, such as advising them to avoid crowded places. I have to do 5-6 activities like this in a month and they give me INR 2,500 separately for this.

There’s another project for women who have learnt how to use technology or want to learn how to use technology. Just like I do eMitra work, we have identified other women in the village who do different work. I train about 100 such women every month and teach them everything they need to know about using a mobile phone. Things like making a call, ordering online, making payments etc. For instance, I taught them about WhatsApp and social media recently. There are 5 or 6 different training modules running like this. This way I am always practicing so I don’t forget!

Business Journey

Why did you choose this business?

When I do work that comes through the programs, it is usually time bound and once that program is over, so is my work. But eMitra work is work for the Government and it’ll never come to an end as government schemes will never disappear. Tomorrow when the organization decides to move on from here or if I have to leave it for any reason, I do not want to sit at home with nothing to work on. So, the eMitra work will sustain me and I will keep learning newer things to benefit me in the process!

How long did it take you to set up this business?

It took about 6 to 7 months. Because it takes time to learn and the government has so many schemes, it’s not possible to learn everything in one shot.

Did you receive support from your family?

Of course, I had everyone’s support and in fact I got the most support from my husband.

What were your pain points while setting up this business?

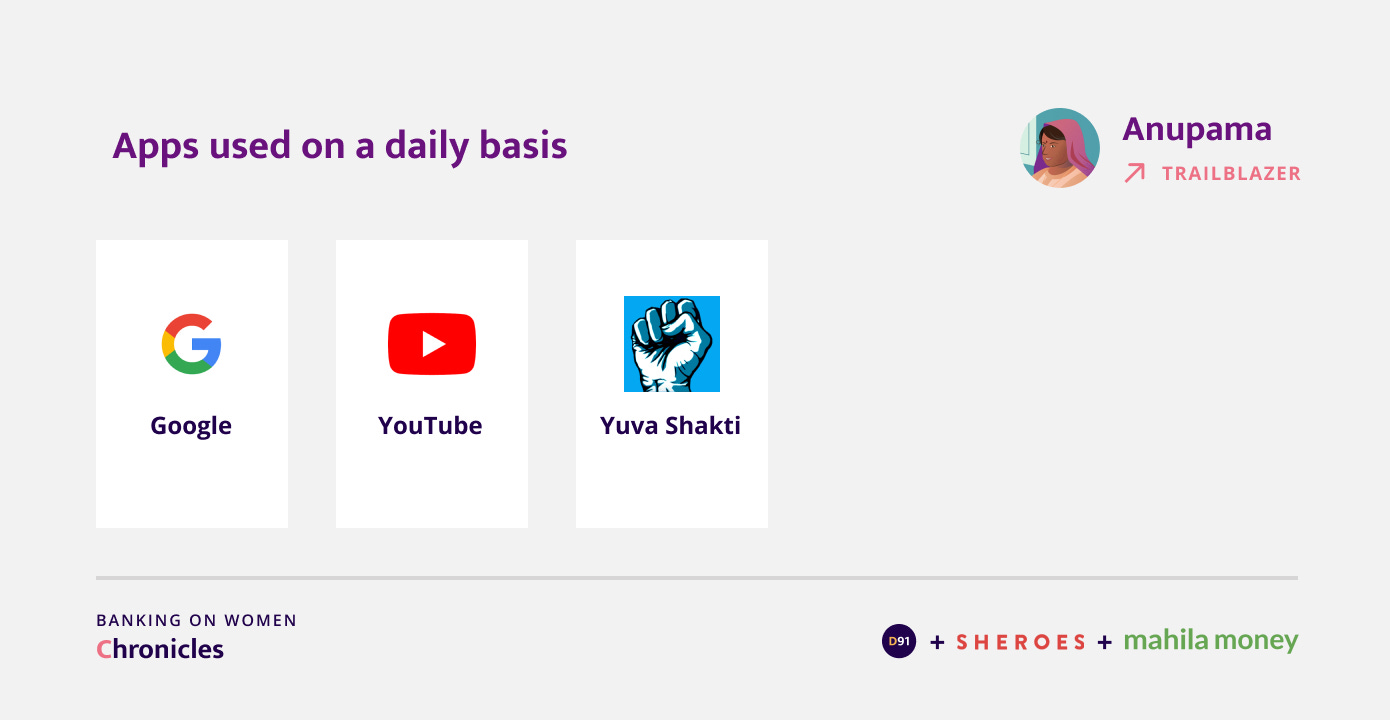

Learning about the scheme was a primary task for me. I used to take some help from the volunteers and I also tried to learn on my own on YouTube or through Google. It took me sometime as you know the government keeps changing their processes very frequently and you have to keep yourself updated as well. Now when people come I am able to do their work in an instant!

In a village there are a lot of problems when a woman wants to work. When I was planning to start working people were shocked and used to say “oh she’s a woman, how will she work? she wants to sit in a shop and work, who knows how much she will be able to do?” But once things took off, people began to trust that even women can do things like a business. Initially, there were very few people who used to come, but once I started doing camps, the entire village started coming to me.

Did you receive mentorship or support when you started out?

Though my in-laws are not well educated, they support me a lot in terms of taking care of my kids when I go to work. Even though my husband has studied only till 10th standard, he still supports me and splits the work and lends a hand when there is too much work. Lately, my 10 year old son is also assisting me in the shop. He does all the work such as photocopying, taking printouts, etc.

How was your business impacted by Covid-19?

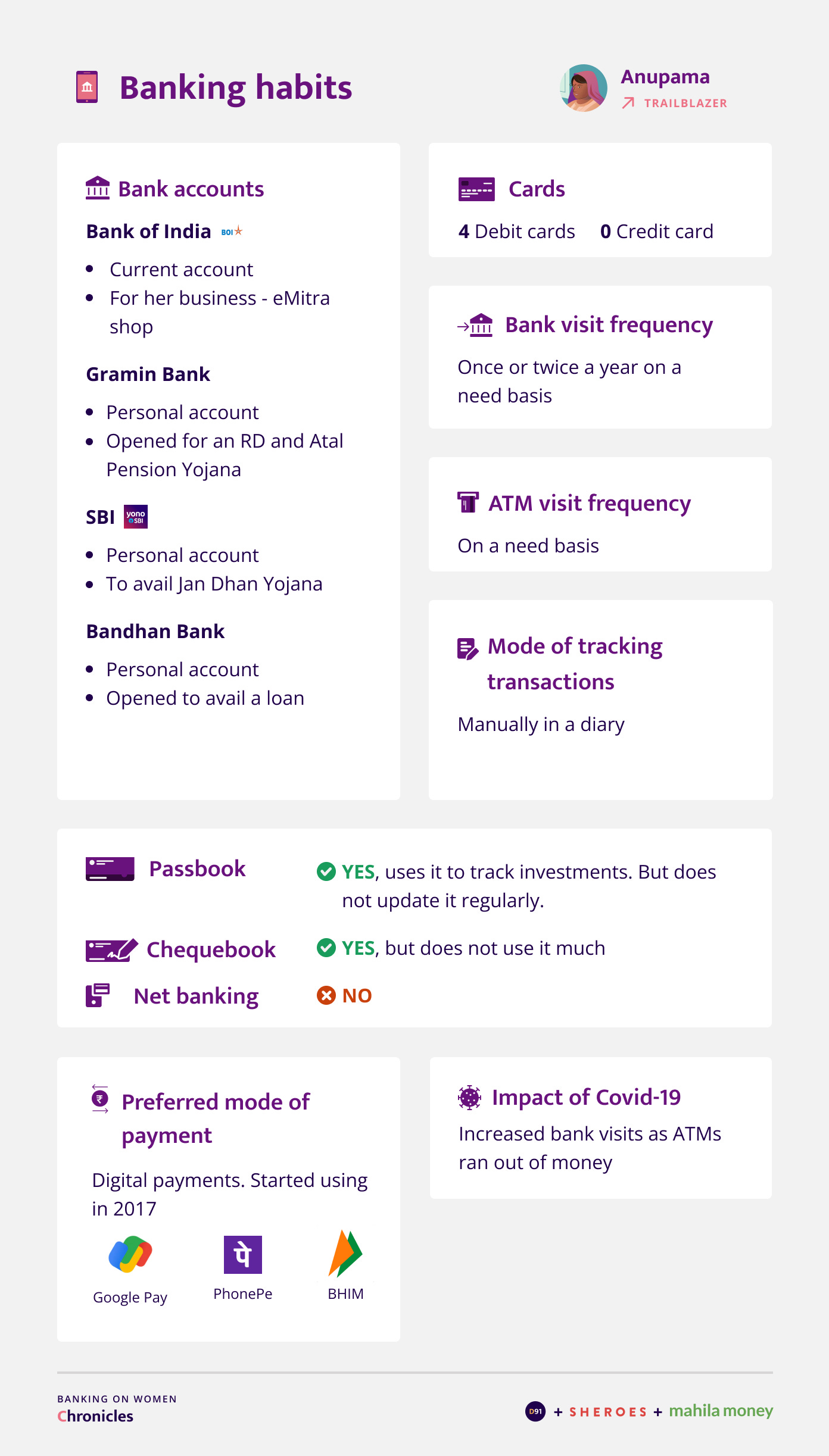

Actually during the lockdown, my business increased. People started receiving money in their account, but since banks were shut and people were not allowed to go there, even residents from neighbouring villages used to come to me as I had systems in place to help them withdraw their money.

Household finances

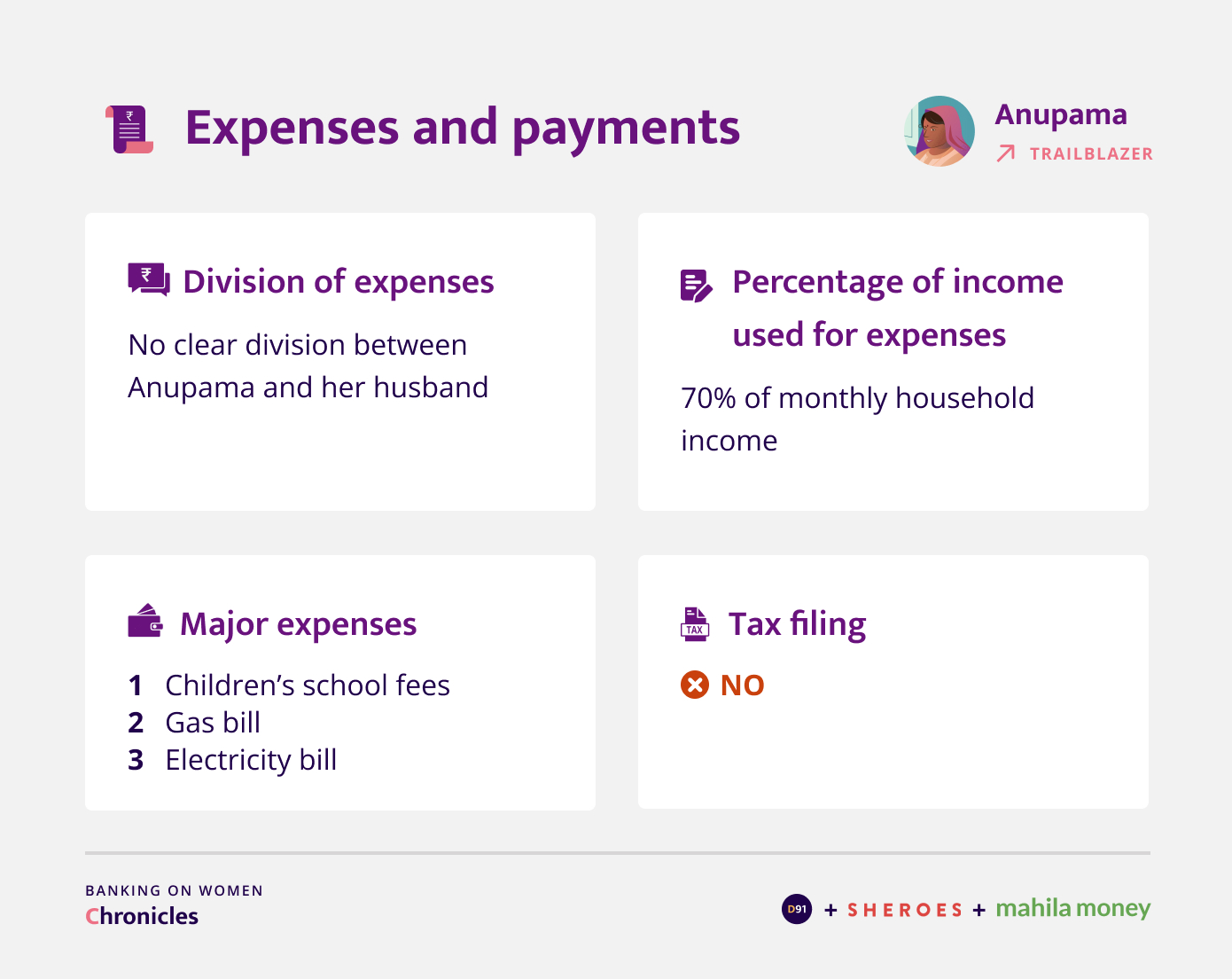

How are the expenses divided between you and your husband?

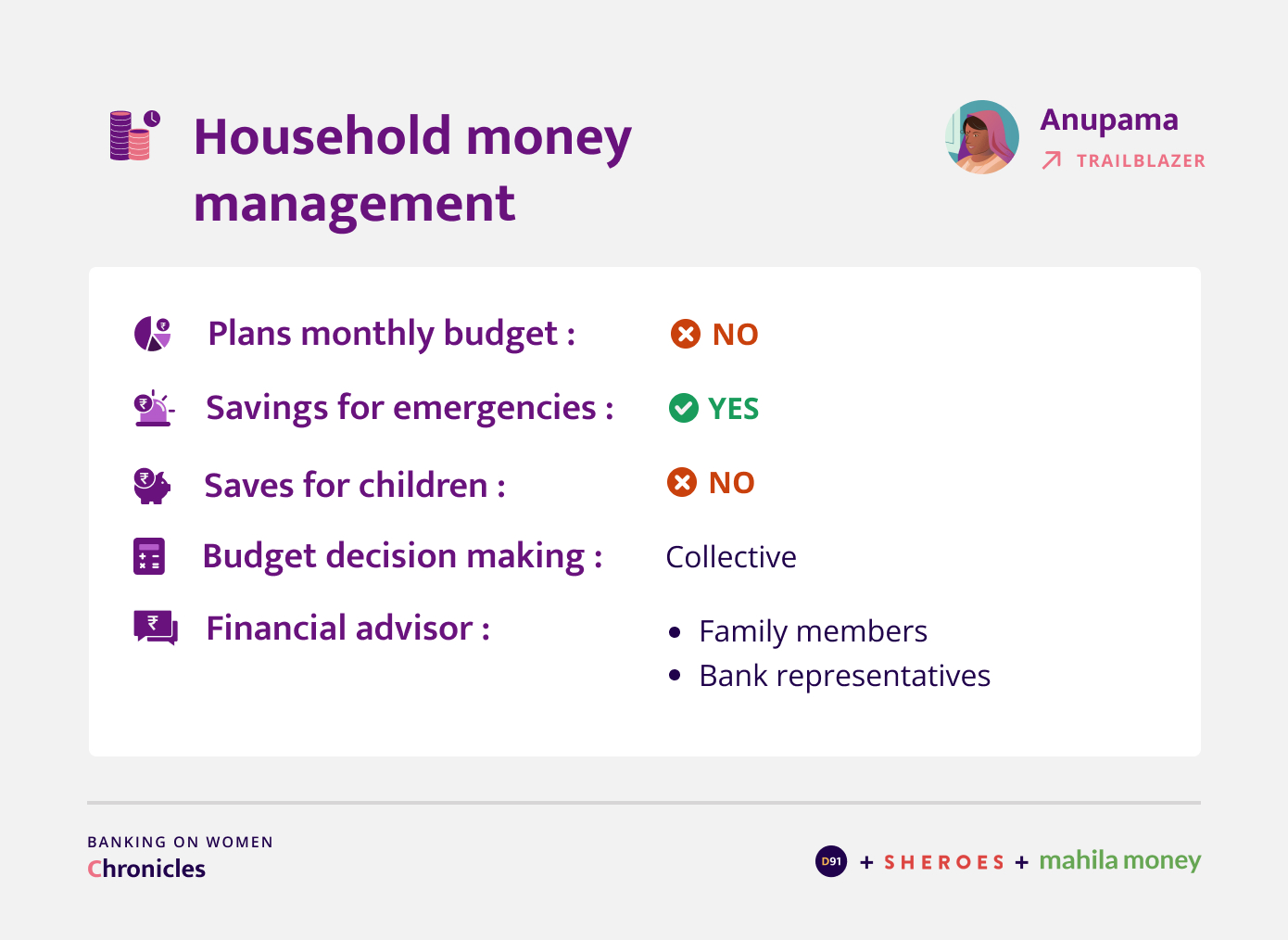

We collectively handle the expenses based on who happens to receive money first or who happens to be free. There is no said division as such. Both our income is meant for the house itself so we don’t differentiate like that.

Who do you rely on for financial advice?

I first ask at home but if we don’t have enough knowledge about things, we go to the bank and enquire. Sometimes even if friends are suggesting things, we can’t really trust what they are saying fully, so instead it is better to go and ask directly in the bank.

Expenses and Payments

Do you take household decisions independently or collectively?

Collectively, because if only one person takes the decision then it might lead to disagreements.

Do you use payment apps for bill payments?

I use apps for bill payments. Also, if I need to collect payment from someone and they say they wish to pay via PhonePe then I accept that. I make very few payments through cash.

What other mobile apps do you use?

Apps like Yuva Shakti that Rajasthan has. I keep viewing these apps for things like withdrawing money, etc. Moreover, if anyone who is aware suggests some app and says download this app and then this task will get done, that way I download and try out a few apps.

Has Covid-19 had an impact on your household budget?

During lockdown we couldn’t go out too often so we automatically reduced the amount spent per day so that way we can make do for a longer duration. So expenses have decreased, not increased.

Banking Habits

How do you keep track of the money in your account?

I usually write it down in a diary and I can refer back to it whenever I need to. I don’t maintain it on my phone because if I happen to lose my phone then I will lose all the records.

Financial products and services

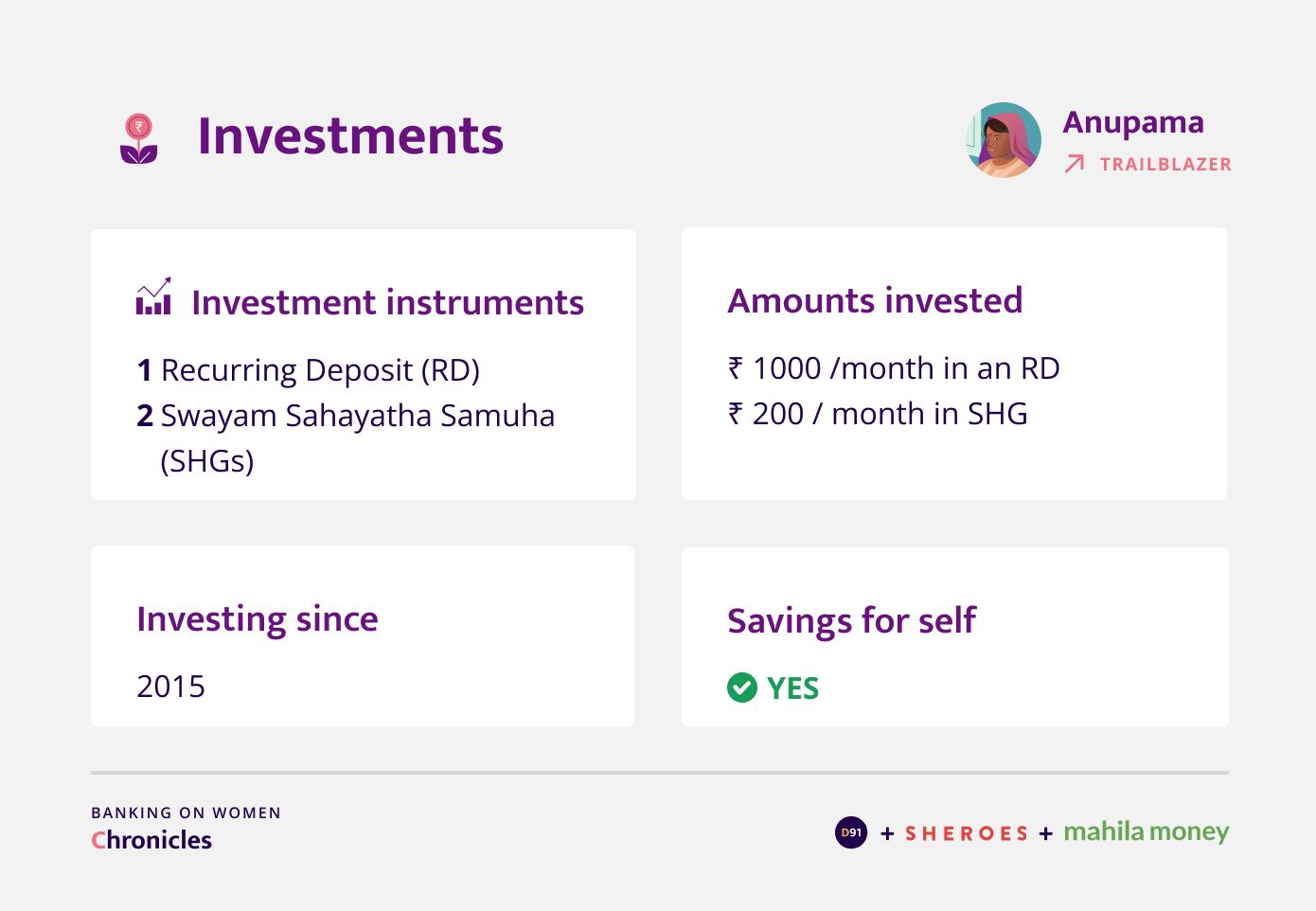

Investments

What was your idea behind starting to invest? Do you have any goals attached to these investments?

In addition to the RD, whatever money is at home tends to be deposited at a Swayam Sahayatha Samuh (SHG). A group of 12 women was created and taught how to make small savings. Once I started savings in such a model, the money keeps growing there and only if there are some essential expenses that come up, I take money out from that and manage expenses. For the RD, it is for a duration of 5 years. So if I pay for that duration then I will get INR 60,000 on maturity.

Apart from these instruments like the SHG group, do you have savings for emergencies?

No, these are mostly the instruments I invest in for emergencies as well. The money invested in the SHG is meant for any sudden needs that arise for the women in the SHG.

Loans

Why did you choose Mahila Money? Did you consider taking loans elsewhere?

I didn’t take a loan anywhere else because they call us to the bank many times and keep asking for some document or the other. I really liked Mahila Money because I did not have to go anywhere to avail the loan. Secondly, I don’t have to photocopy any documents and give it to them. By sitting at home I was able to get all the work done through my phone and I received the amount the same way only. What else can be better than this?

Did the previous institutions that you were considering for loans ask for the signature of any male member of the family or ask any male member to be a co-guarantor?

In most banks, I was asked for photographs with my husband, his Aadhar card, and my husband's signature. It was too hectic. Mahila Money only asked for my documents.

Did you face any discrimination while you tried to avail loans from other institutions as a woman?

In villages, people really try to fool you when you are a woman and think that you don't understand what has to be done. There are many agents who claim that they can help get a loan approved. Just the other day, there was a young man who said that he can get my loan passed. When I enquired further he told me that he will need a minimum of 8 women and will charge INR 700 for each loan he gets approved. I questioned him about why he is charging the money to which he said it is for getting the loan passed. If he is well connected to the bank like he claims, he should not be charging such a large sum to get the loan passed from the bank. If it’s a matter of giving documents, even I can do that directly without paying anyone. Eventually, I dismissed him.

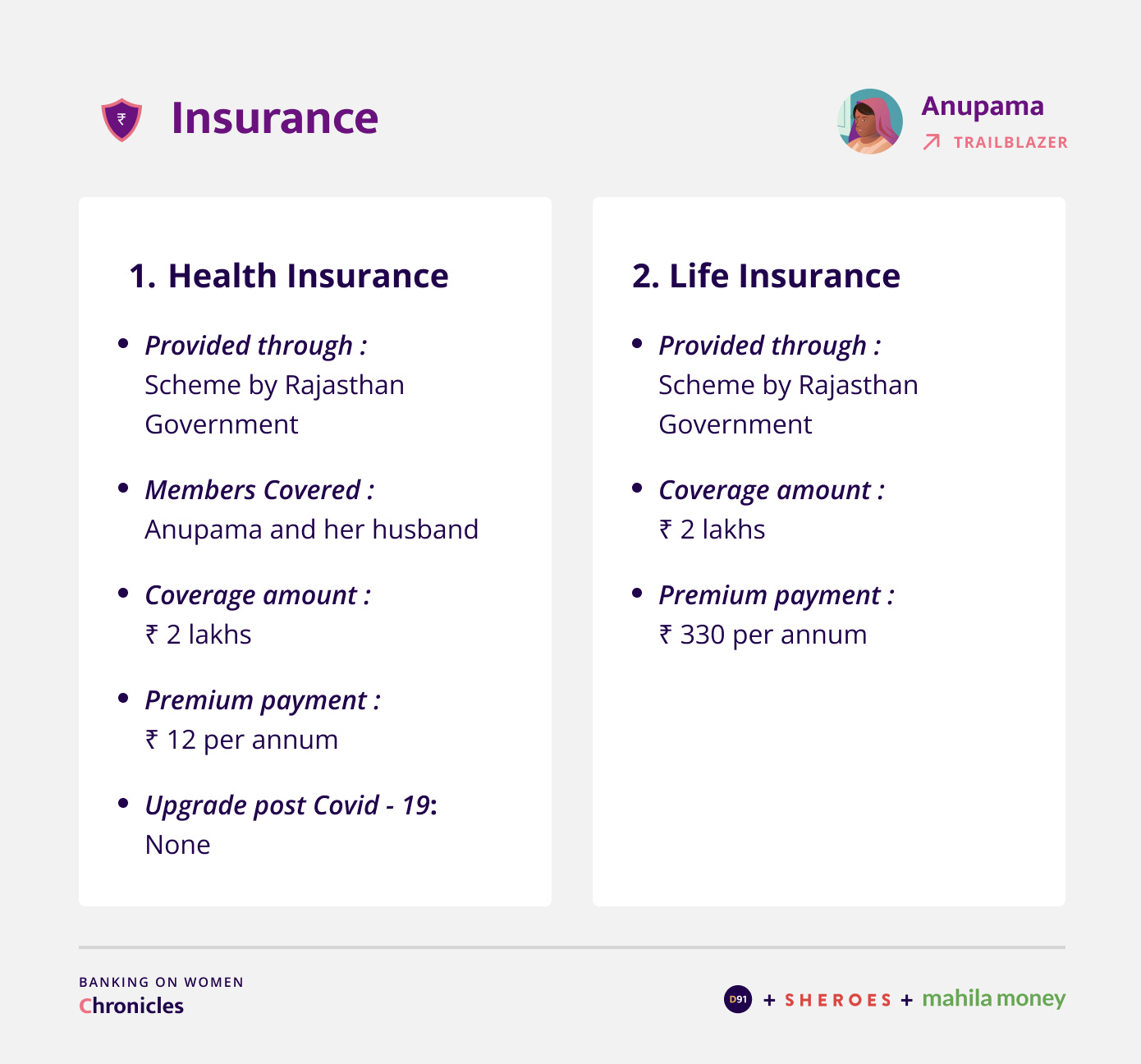

Insurance

Can you give me more details about the insurance?

The Rajasthan government has two insurance schemes that they run here. One is for a premium of INR 12. In case of any durghatana or accident, we get INR 2 lakhs from there. It is for things like falling from the roof etc. The second one is for the family of a person who dies because of whatever reason, at home or because of some illness. The premium for that is INR 330 and we get INR 2 lakh in that case as well.

Have you thought about or planned for the future including for your business?

There is never going to be a shortage of government schemes and even the people of the village are not going to run away anywhere. So if I provide services that are beneficial to them, they wouldn’t hesitate to come to my store even if they have to make multiple visits.

But as I mentioned with the programs, there is always a risk of them ending abruptly or the resources being taken away. Further, I can then make decisions about when I want to work and when I do not, if I have my own equipment. So I decided to invest and do the work on my own. I took a loan of INR 25,000 and I bought a new laptop. I aim to buy my own printer and phone next. I am still affiliated with the program but I will eventually put together all that I need so I do not have to rely on them and instead work for myself.

Our understanding of Anupama’s journey

In speaking to Anupama we saw how she is a mission-driven changemaker. She made immense use of the knowledge she gained from the various digital empowerment initiatives in her village to not only educate herself, but also to help bridge the digital divide in her community. Despite skepticism from society due to conventions around gender roles, Anupama’s unwavering spirit kept her going to establish a successful business and make a positive change in the lives of others. Her practical approach to things has helped her make the most of opportunities that come by, be it professionally or financially.

About the Research

This blog is a result of an online interview conducted with the participants’ consent. The interview was conducted in Hindi but has been translated to English in the best possible way to reach a large audience. This is a part of the Banking on Women chronicles.

Disclaimer: The name and other sensitive personal details in this documentation is masked to honour the privacy of the participant.

Project Partners

SHEROES

The SHEROES Network is a content and community ecosystem enabling access to employment, entrepreneurship, and capital for women. It includes the SHEROES app, SHOPonSHEROES marketplace, Babygogo, Naaree, MARSbySHEROES and has a user base of over 24 million women. The SHEROES Network is committed to increasing women’s contributions to GDP.

Sheroes.com | SHEROES App | Twitter | LinkedIn | Instagram | Facebook

Mahila Money

Mahila Money is a full-stack financial products and services platform for women in India. Mahila Money specializes in offering loans to women who want to set up or grow their own business along with resources and community to achieve their financial goals. Mahila Money can be accessed via the Mahila Money app on Android.

Twitter | LinkedIn | Instagram | Facebook | Website | Play Store App

All artworks are designed by Poorvi Mittal.

If you enjoyed reading this blog and would like to receive more such articles from D91 Labs, please subscribe to our newsletter here.

To read more about our work, visit our website!