#8 Bhakti | Re-entering the workforce after 12 years

In my house though I am the most comfortable with digital payments, somewhere my decision making becomes weak when it comes to financial matters because I have been dependent on my husband till now.

“After marriage, it took a lot of courage and effort to get myself to start a business. So I would definitely like to take this business forward because it is like a suppressed dream that has finally come to life.”

Short Story

Bhakti is a 41-year-old currently working as a reselling partner through the SHECO partner program. She is looking to kickstart her entrepreneurial journey after a career break of close to 12 years. Bhakti artfully balances business-related tasks alongside household responsibilities and is determined to nurture her dream of setting up a brand of her own in the future.

Personal and financial background

Where do you live?

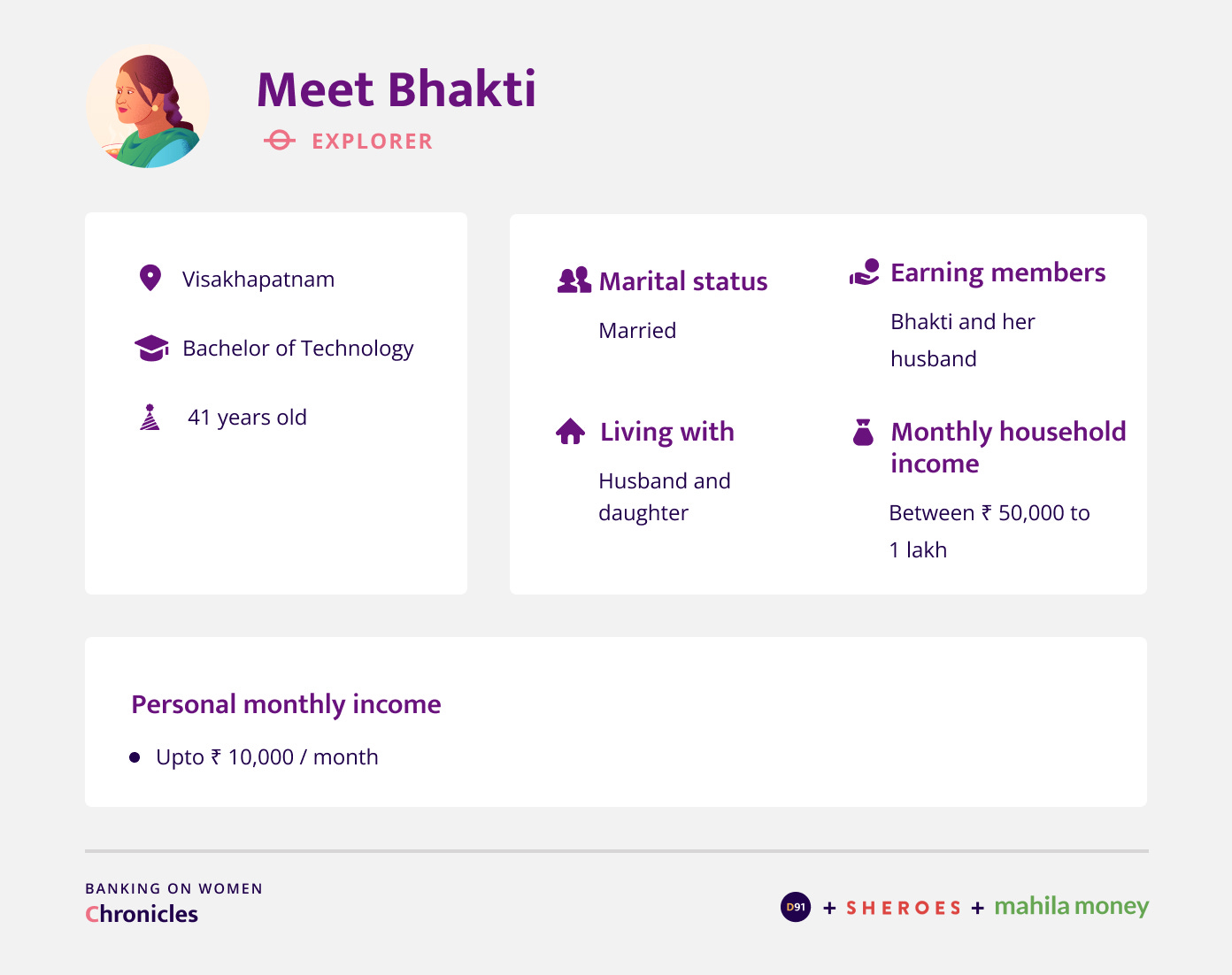

I live in Vizag or Vishakhapatnam currently, but I am from a town in Madhya Pradesh. My husband and his family are from Bihar. He works as a finance manager in the IT industry and we are currently in Vizag because he is on an assignment here.

How many earning members do you have in your family?

Until recently it was only my husband. But now, I have become an earning member too. I joined SHEROES about 8/9 months back and I have started earning a little through the SHECO partner program where I have become a reselling partner. Before marriage I used to work, but post marriage and once my daughter was born, I stopped working. I was a homemaker for about 11/ 12 years. But since my daughter is old enough now, I felt I can start something. I have always been interested in ensuring that I do something to keep myself occupied and it has been my dream to do something of my own.

What is your daily routine like?

My day starts around 5:30 am everyday. My husband and I have a proper routine. He leaves for work at 8 am, so all the time till then is dedicated towards preparing breakfast and packing lunch for him. After that, I take some time out for exercise or yoga. Followed by finishing the household chores. From 10 am till 7 pm I dedicate time to my work with SHECO while also getting some household work done alongside. In between, I also spend time with my daughter once she gets done with classes and make her study in the evening. After this, the time till 10 pm goes into household work such as dinner preparation and spending time with my husband once he returns from work. Around 10:30 pm is when I wrap up my day and go to sleep.

Business details

Since you are associated with SHECO, what type of products do you resell or are involved with?

On the SHECO platform, I have created my own store which is based on the concept of a mall. When you visit a mall, you always see different categories of products. Similarly, I have prepared my shop to mimic that and ensure that people have access to a wide range of products. For example, anything from kitchenware and food products to beauty and skin-care products. To choose which product to sell in my store, I look at the brand and quality. I try to ensure that all the products that I resell are natural, organic, not harmful and are made in India. This way we can uplift the many good Indian products. I am also looking into high quality clothing ranges apart from organic food products. Whatever I purchase for the house from the market is also organic, so I try to ensure the same for the products I sell.

How much do you have to invest?

If it’s through SHEROES then I don’t really have to invest. But without understanding products properly I cannot really sell them, I need to have some knowledge about the products sold. So to that end, I have to invest upto INR 20,000 per month. There is no rule or mandatory requirement for the value of the products I need to buy or invest in, but I plan to invest around INR 50,000 to INR 1 lakh per month in the future, so I am steadily executing this plan.

Do you plan to invest what you earn from this business or from any other source?

I don’t want to take money from my husband for things related to my business. In terms of household purchases, I buy that from my own SHECO store as a customer. I do use my husband’s earnings for this.

I am currently collecting my earnings from the business and that remains mine. My daughter is still young so my investment plan is slow and steady. Over the next 5 years I will build the business up properly. I hope to make large investments into the business by then, for which I will use these savings. But I am clear on the fact that, if I am not able to save sufficiently by then, I would prefer to finance it through a loan instead of taking my husband's money.

And do you feel that you should put in your savings as an investment and not take a loan? What are your thoughts about this?

My financial strategy is that you have to keep some money as capital at hand. If you can take a loan and work comfortably, then we should go ahead and take a loan. Provided you have the capital.

How was your business impacted by Covid-19?

Business wasn’t really impacted in a bad way. In fact the demand increased because during the second wave of the pandemic, people did not have access to items in a physical store but SHEROES was still active and the government continued to permit online deliveries. This was really helpful for us despite the pandemic.

As an added benefit, I was able to build trust among my customers. In fact, when places and markets started opening up, the demand did decrease slightly. But it was not a big change because in today’s world, people don’t have time which is why online businesses are booming.

How long did it take you to set up and get your first customers?

It took at least 5-6 months. Because it’s not enough to just tell people what products I have, it is extremely essential for me to give them in-depth knowledge about the products as well. So that took time and it is still taking up some of my time. When my journey started with SHECO products, just like any other business you do face some problems initially and if you happen to face any problems with your first customer, it becomes very difficult to win their trust again. Though a lot of online businesses have popped up in the past two years, since SHECO is such a trusted platform, we are able to gain the trust of customers easily and the response from customers has been great. I can confidently say that even if I get one new customer in a month, I have gained a customer forever. And if there are some problems in a product or in the delivery, then the vendors support us and we give our customers the same sort of response and satisfaction. This has helped me to maintain a good relationship with my customers.

Did you receive support from your family when you decided to start a business after so many years?

Here at home, it’s only my husband. My parents are at my native place and all of them have some sort of influence on me. My husband has no problem with me working but he expects me to give more importance to the house and my daughter as he believes these are my primary responsibilities. In a manner of speaking there are some issues and we have differing opinions on this. We don’t necessarily always agree on everything. I will definitely say that he supports me a lot both with work at home and outside but it is different for me. Somewhere, the proper freedom to make my decisions is missing a bit for me. For example, I have had no major problems as such in terms of running the business but I haven’t been able to give it as much time as I'd like to. If my husband says he has to work at the office from 8 am to 8 pm, then you can’t stop him from doing that but as a woman, I have to compromise and first take care of other things at home and then deal with work. Running the house along with the business is not easy, that too alone.

But, I have realised that as my business grows, I am gaining more confidence. As long as you don’t have confidence, you have to keep compromising, but when you gain confidence, then others automatically learn to compromise. I strongly believe that if you’ve made up your mind that you have to make it happen no matter what, then you will be able to keep making progress. I have been able to gradually grow with that sort of mindset.

Have you made plans to expand your business?

I belong to a Marwadi family and building a business has been a childhood dream of mine. But like many other families like mine, girls were not encouraged to get into a business. Even with education, I have had my struggles growing up. I have never had it easy. After marriage, it took a lot of courage and effort to get myself to start this business. So I would definitely like to take this business forward because this is like a suppressed dream that has finally come to life. For this business in specific though, I appreciate how interesting it is. Household chores are almost the same everyday and there is no variation. But on this platform everyday feels new and it requires me to utilise new talents everyday and it also pushes me to learn new things everyday. Sometimes I even teach others new things. This is great and is one of the reasons why I want to continue doing this. My plan is to eventually launch a brand or product of my own. I still don’t know where I will land but this is definitely a dream that I would like to work on. For this, I need to understand my customers - how they think and what they want and eventually apply this understanding.

Household finances

Do you have a strict monthly budget?

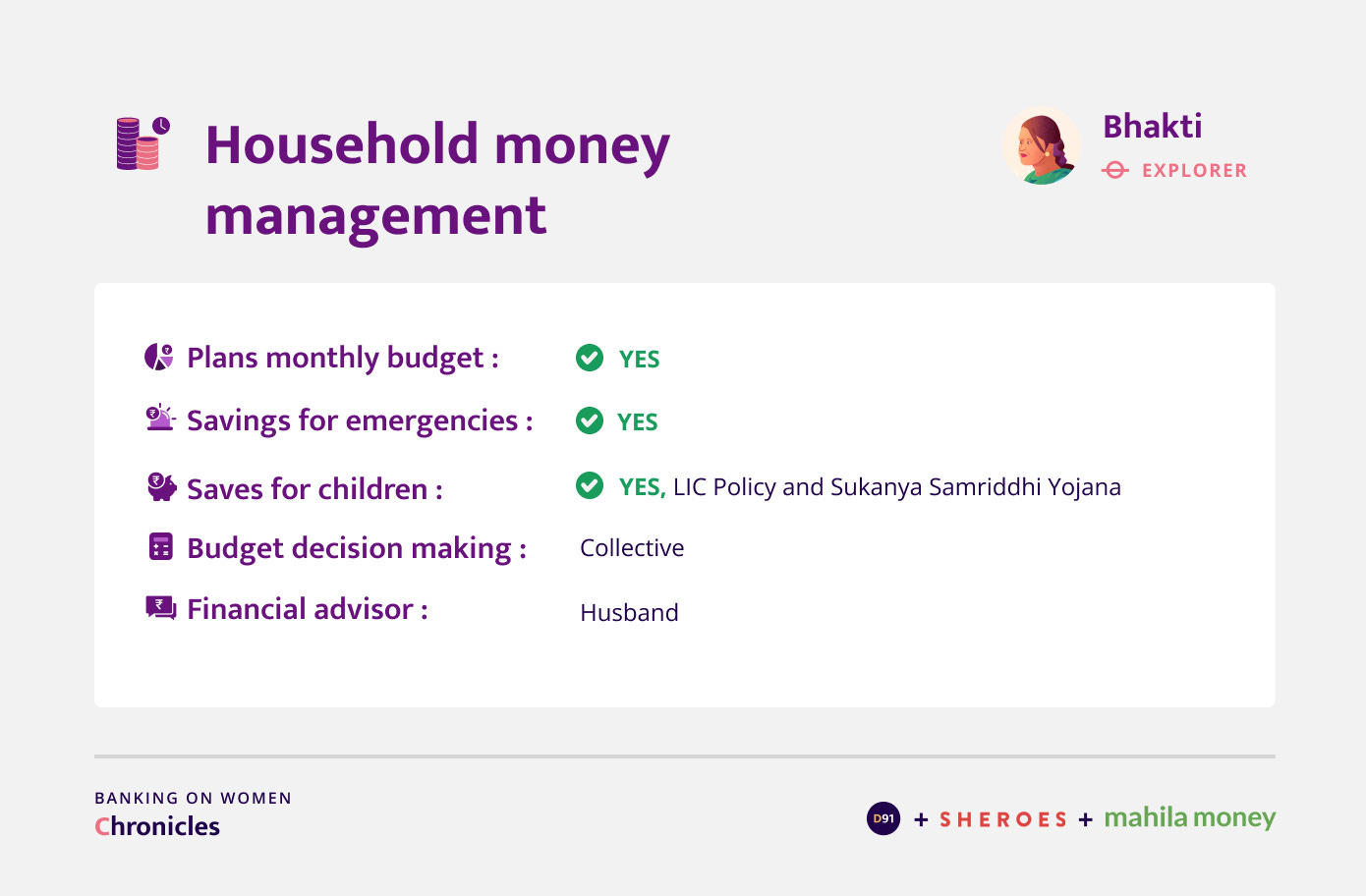

Yes, we have a budget and we try to work around it based on our earnings. But depending on the needs of that month, for example festival season etc. we readjust the budget. We always try to make up for that in other months to the extent possible. It completely depends on the amount we have coming in. Currently, I don’t contribute to household expenses because I just started the business. So whatever I earn is kept aside as savings and that gets reinvested in my business. All the household expenses are undertaken from my husband's earnings.

Who decides the household budget?

Both my husband and I. But the remote control lies in my husband's hands where he keeps things in check. We both decide together about what comes into the house and what doesn’t. Also, we decide what are the immediate necessities in terms of the house, in terms of our daughter, etc. Based on our preferences these things get added on to our expenses.

Does your husband transfer money to you to spend on these things or how does this work?

Household ration related expenses, groceries, milk, etc I take care of and things like school fees are fixed so we’re aware how much goes into that and things like house rent my husband takes care of. So we have divided it amongst ourselves as to who will take care of what expenses. If we need to do anything related to savings or pay for LIC or any such things then my husband takes care of that. But I undertake everything related to household expenses such as ration, electricity, gas bill, etc.

Up to a few months ago when your husband was the sole earning member, did you ever keep aside money as your personal savings?

I have never thought of saving to be honest as such, a situation has not come up for me where it was a necessity. But like I mentioned earlier, the bank account in my native place is only for me and my savings go in there where I put in any amount that I receive as a gift or whatever savings I happen to have. So I have maintained that account for savings purposes. But I haven’t thought of saving from what remains after spending on household expenses.

Have you made any savings for your daughter?

Yes we have taken an LIC policy for her and my husband looks into how much saving happens under that. Since she is really young for us to open an account for her in an actual bank, to teach her the importance of savings, we have made a small money bank at home itself. Whenever she demands for something we ask her to use what she has saved. Only if she feels she has enough money to spend she does otherwise she doesn’t.

Who do you go to for financial advice?

I have only relied on my husband. He has been very particular in terms of financial matters right from the time we got married.

He has been training me since then. Whatever savings he is doing for us, or any finances related to us, he shares all this knowledge with us. So I am aware of each and everything related to this. He also tells me how to handle if any contingency arises and how to manage things in the future.

How did Covid-19 impact your household budget?

Household budget has increased because we have moved towards healthier food choices and as you make a move towards healthier food in the market, the amount spent on groceries automatically increases. We’ve moved towards organic products and that has also increased our household budget. In parallel though this increase has been compensated because we have reduced the amount of money that goes in eating outside food. Every Sunday my daughter used to like to go out to roam but now that is limited after the pandemic. Moreover, my husband's income has also been impacted slightly because he hasn’t been receiving bonuses or any increments. But our expenditure has sort of been increasing every year and this impact has sort of brought about a mismatch in that pattern of income and expenditure. But we have been managing and going forward.

Expenses and Payments

How do you keep a track of your expenses?

We keep track of it manually. Whatever daily expenses we have fluctuates sometimes but whatever fixed expenses are there, we write it down beforehand in a diary. We have maintained a proper diary where we note down all our monthly expenses. We still do cash transactions for groceries, milk,etc. Sometimes I spend on these things and sometimes my husband, so we write down what we spent on respectively. It is much easier to track this manually. If we don’t maintain it manually then there will be no accurate record of our expenses.

How do you decide whether to use cash or digital payments?

We try to use digital payments as much as possible. So our online shopping is all digital payment. Of course salary gets credited in the bank but we have to use cash for a few transactions, right. For daily expenses such as for vegetables, milk, house help, or society guard these small expenses are mostly cash transactions. Moreover, in the market some vegetable vendors might not accept digital payments because people who sell fresh vegetables that are grown in their village have not yet made the switch to digital payments. They prefer cash. And I don’t like to go to big markets or online shopping for groceries, I prefer freshly grown produce.

How was your first experience using a payment app?

I started using these payment apps based on when the need arose. Like I’ve mentioned my husband has always been in a transferable job, due to this we haven’t lived in any city for long. So whenever we moved it used to be a new place for me and we had to search for a market. I always wished there was some sort of a digital platform for these everyday needs. But gradually as digital platforms became prevalent these applications became a very easy mode for me to use. In this manner I downloaded them and learnt them and began using them. Initially when we were moving frequently, I learnt how to use a debit card and started using it, so with that the number of transactions with cash automatically decreased. Further, when I got a mobile phone, I tried to understand how to use mobile applications. As the use of these new modes started increasing, my trust in these modes also increased and I began to understand how to use them and how they can benefit us. Even for shopping it is convenient. In the past 2 years I have learnt a lot of things through these new modes.

Banking Habits

Did you open an account separately for this business? What was the reason for you to open 4 bank accounts?

I already had a savings account. When I was working, I had opened an account at HDFC and I continued that account for my business as well. Until now I have never thought that I needed to open an account at a said bank only. Based on the situation or preference of companies I worked at, the accounts were opened and eventually those salary accounts were converted to my savings account.

How do you keep a track of your money? (inflow and outflow) Be it money from the business or elsewhere.

My husband takes care of most accounts. I have one account that I use and I track my expenses on that entirely through net banking.

Given that there are multiple accounts and sources of income, how do you record or keep track of what goes on in each account?

Both my husband and I get together and check every week or at least once in 15 days. Whenever my husband is at home we sit together and check our financial records online. He’s a semi qualified CA so he is very particular and ensures that we are up to date with the on-goings of each of our accounts. So anything related to finance or banks he oversees. From the time I joined SHECO, my involvement has increased because I need to keep a track of how many transactions have gone through and how much money is coming in. My husband helps me with this regularly.

Do you use net banking through phone or web?

Both, but I don’t check on my phone. I always use my laptop to check anything related to any bank. If some transactions need to happen then I take a call about which device to use for what.

How many times do you go to the ATM in a month?

For the past 2.5-3 years I have been using only online transactions so there has been no need to go to the ATM. All my transactions happen online, even my personal shopping happens through wallets such as Google Pay and PhonePe. So I don’t use ATMs at the moment.

Financial products and services

Investments

Who makes decisions regarding where to invest?

My husband makes decisions related to investments. He has a better picture about where to spend and how much since his earning capacity is more than mine. He oversees how much to put in savings and how much we can utilize for expenses. Thoughts are put forward and we mutually decide how to go about these things. Even though he knows more, if I suggest something, it is definitely considered. For example, last year I opted for a specific insurance policy for our daughter. He considered it and thought about how it would benefit us. If he feels there is no problem in going ahead, then he will take things forward. Sukanya Samriddhi Yojna was also started for my daughter based on my suggestion.

Did Covid-19 bring about any changes in your investments?

Our thought process did change a bit because before whenever we have savings we always looked into where to invest it but now we have started to feel it is important to keep cash in hand as well for contingencies. And also in terms of insurance we began to feel it is essential to have insurances that can handle unexpected situations such as the pandemic if and when they arise. So we increased our investments in such instruments like insurance.

Insurance

You did not consider buying health or term insurance ever?

So my husband gets a Mediclaim insurance policy in his office. So that way we haven’t faced any issues. Since he has a Mediclaim for all 3 of us we haven’t really thought about buying separate insurance or anything.

What difference came about in insurance after Covid-19?

Instead of putting more into savings, we felt it would be better to put that amount in insurance. So that both these things get covered. So we have been prioritising that since the pandemic.

Outlook towards the future

In your opinion what is the one financial product that will have the most impact in supporting your financial journey?

If I can get something in terms of banking that can help me grow my business and is safe for me at the same time then it would be great. Because a business doesn’t grow easily and if I have a loan, I would want something that ensures that it doesn’t have an impact on my husband. So something that accommodates repayment as the business grows would be great to have in the future.

Are you as a woman comfortable using banking services or do you feel the need to take your husband’s or anyone else’s help? What’s your approach?

Somewhere my decision making becomes weak when it comes to these matters because I have been dependent on my husband till now. So I can't say I am completely independent. In my house I am more comfortable using digital payments than my husband because I have been given the freedom to do so. Since most often it is the woman of the house who handles household shopping. But many of my customers who are women are not very comfortable using digital payments because their husbands handle their bank accounts and these women are not given the freedom to withdraw money as and when they wish. So such women opt for cash on delivery and in cases when there is no online payment option available then my business becomes dim. I have seen this in my family as well where my mother or sister cannot shop online sometimes because they do not have a cash on delivery option. So their dependency on their husband is high. Sometimes savings that women have are hidden savings in cash so if not for cash transactions then they can’t do other sorts of transactions online.

Our understanding of Bhakti’s journey

Bhakti’s journey in many ways represents a large number of the women of India as they explore a whole new dimension to their financial journeys after marriage and childbirth. As an independent thinking and curious person, Bhakti is willing to do all that needs to be done to fulfill her aspirations of learning how to build a brand and run her own business. She is trying her hand at various different things to see what she enjoys and can scale up and her uninhibited but adaptable nature primes her for the success that she seeks from her financial and business journey!

About the Research

This blog is a result of an online interview conducted with the participants’ consent. The interview was conducted in Hindi and English but has been translated to English in the best possible way to reach a large audience. This is a part of the Banking on Women chronicles.

Disclaimer: The name and other sensitive personal details in this documentation are masked to honour the privacy of the participant.

Project Partners

SHEROES

The SHEROES Network is a content and community ecosystem enabling access to employment, entrepreneurship, and capital for women. It includes the SHEROES app, SHOPonSHEROES marketplace, Babygogo, Naaree, MARSbySHEROES and has a user base of over 24 million women. The SHEROES Network is committed to increasing women’s contributions to GDP.

Sheroes.com | SHEROES App | Twitter | LinkedIn | Instagram | Facebook

Mahila Money

Mahila Money is a full-stack financial products and services platform for women in India. Mahila Money specializes in offering loans to women who want to set up or grow their own business along with resources and community to achieve their financial goals. Mahila Money can be accessed via the Mahila Money app on Android.

Twitter | LinkedIn | Instagram | Facebook | Website | Play Store App

All artworks are designed by Poorvi Mittal.

If you enjoyed reading this blog and would like to receive more such articles from D91 Labs, please subscribe to our newsletter here.

To read more about our work, visit our website