#7 Sandhya | From IT to agri-entrepreneurship

If my parents hadn’t told me the importance of investing, I probably wouldn’t have started. Having a service that increases awareness about finances will definitely benefit everyone.

“I usually get comfortable doing things in silence and I think that is a major drawback because I hesitate to put myself out there and ask people. That’s something I want to overcome and start something on my own. Maybe I’ll focus on that once I stop my full-time job.”

Short Story

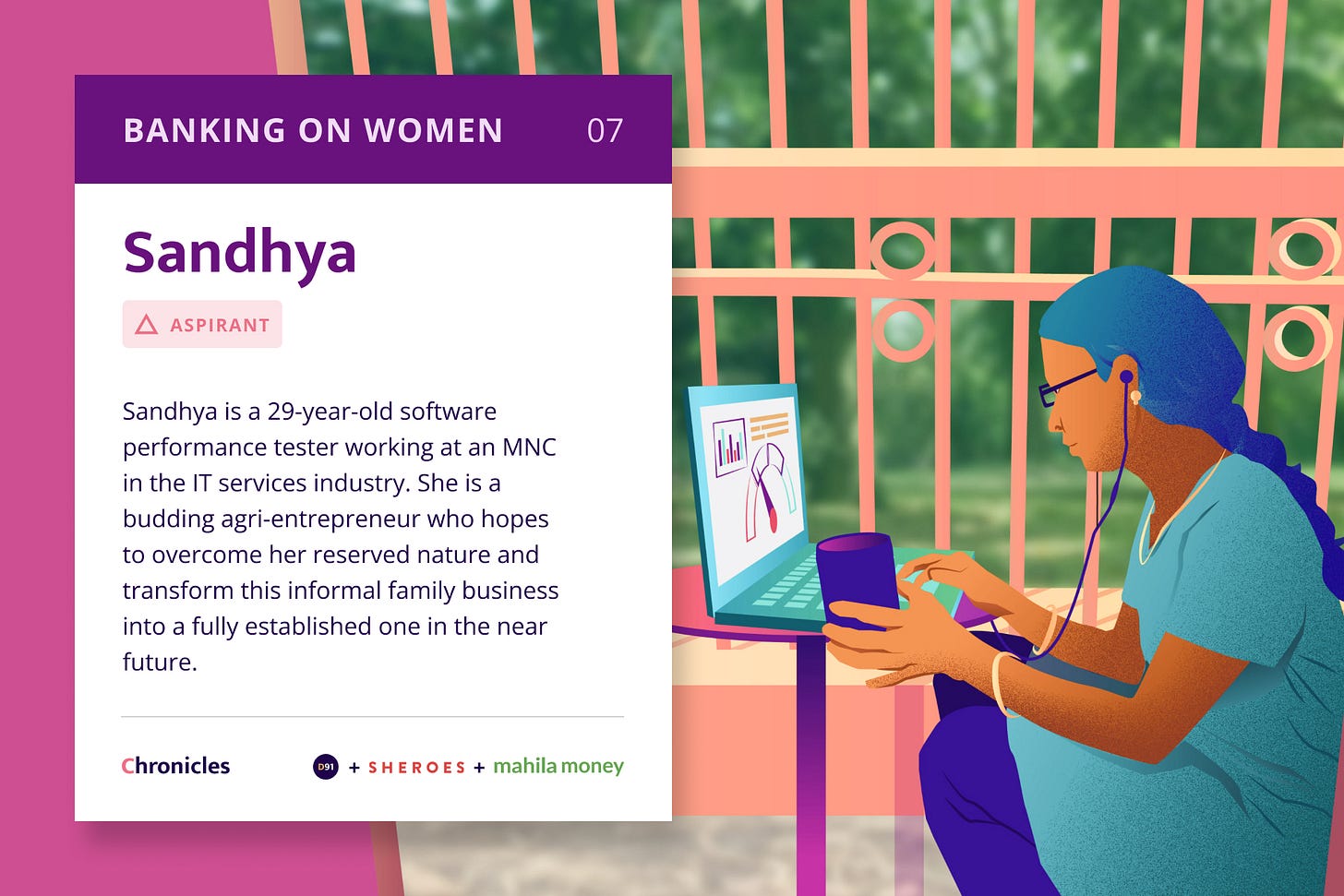

Sandhya is a 29-year-old software performance tester currently working at a renowned multinational company that specializes in information technology services. She is an aspiring entrepreneur who hopes to overcome her reserved nature and transform the informal family business into a fully established one in the near future. Sandhya enthusiastically explores various financial instruments and her journey offers an insight into a goal based planning approach that she has prudently incorporated across different stages of her life.

Personal and financial background

How many people do you live with currently at home?

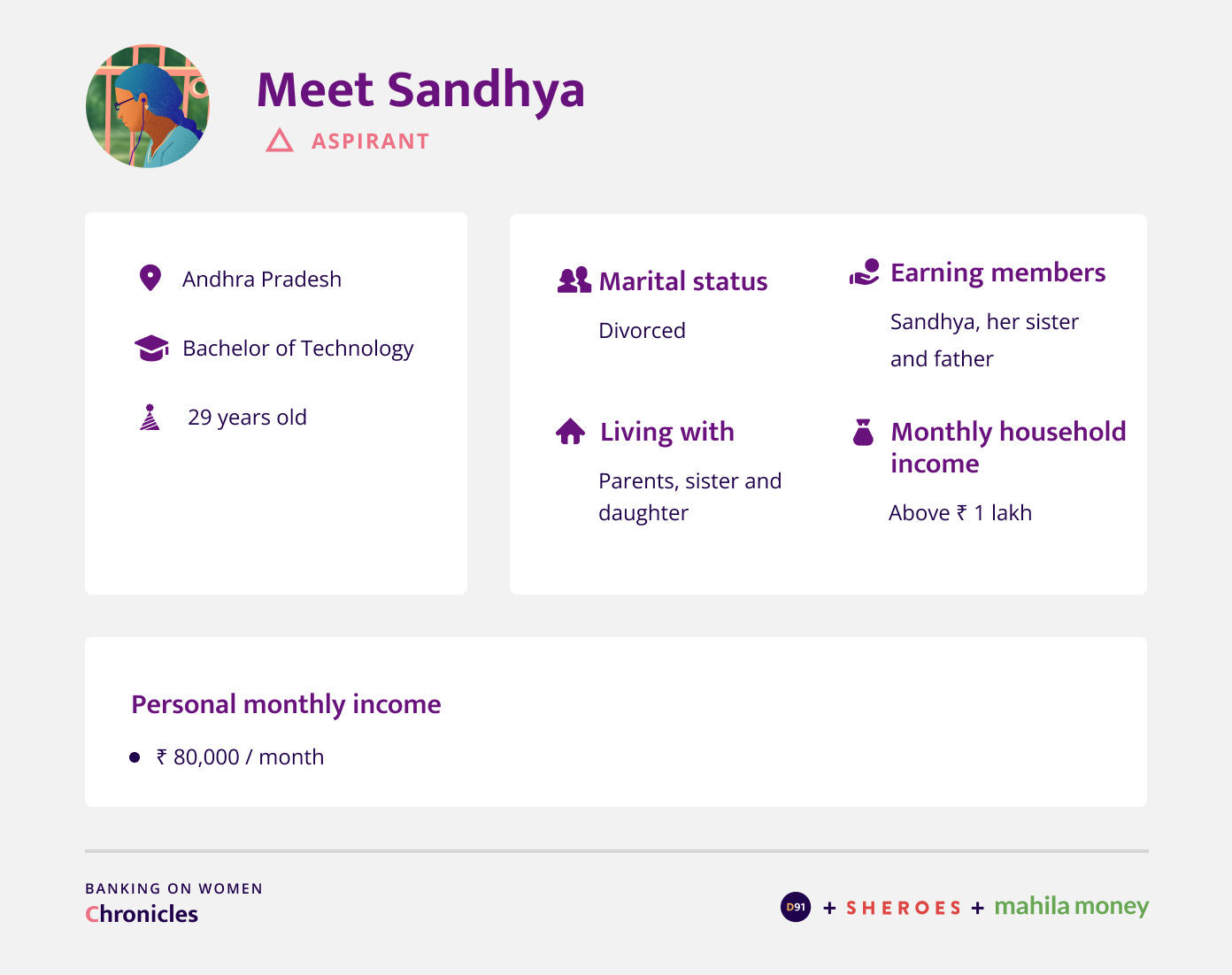

I am a divorcee, so I currently live with my parents, my daughter and my younger sister.

What is your daily routine like?

I wake up at 6 am and if I am not lazy I do yoga or meditation. Otherwise I take care of work in the kitchen, bathe, have breakfast and begin office work for the day. My timings are from 8 am to 5:30 pm and I work for an Australian client. Once I log off for the day, I go for a short walk. If there are any household items to purchase like groceries, we plan and go buy that. After this I spend some time with my daughter, have dinner, watch TV and then go to bed.

Can you describe your current work? Have you worked elsewhere in the past, if yes, can you tell us what it was?

After B.Tech, through campus placements I was recruited into one of the leading Indian multinational information technology (IT) service companies and I worked for an Australian client there as well. I have worked in the IT services industry ever since and this is the fourth company in my career journey. I work as a performance tester. To elaborate, if you consider a website like Flipkart during ‘Big Billion Days’ sale or the Tatkal scheme on the IRCTC website, they receive a lot of website traffic. When several users are trying to access a platform at the same time, it has the tendency to crash and throw an error. My role is to test the performance of these platforms and to understand how these applications behave when many users access them at the same time and too many requests have hit the server. The client that we are working with is a renowned Australia based bank and it is a project in the banking domain.

Family business details

You mentioned that you're a part of SHEROES, is there a business that you're running alongside your full-time job, or are you looking to start something?

I joined SHEROES because I am interested and curious about women entrepreneurship. I wanted to get an understanding of how women entrepreneurs operate, how they got started with their business and in turn develop the motivation to start something on my own.

I want to start something related to agriculture because we own land that is available for cultivation. Maybe something related to selling vegetables or mangoes since that’s something we already do.

Are you aware of how much you might have to invest in such a business and have you already started setting it up?

Not really, I have just explored the Better India platform where they post stories of inspiration and resilience. I have come across courageous people who have left their job and invested in starting a business and I have collected their contact details through the platform. When I have the capital and think I am ready, I intend to visit them and observe how they are executing things on field and subsequently apply the same to my own venture maybe five years from now.

Is there any reason why you chose this particular business in the agricultural sector?

Because there’s no need for much capital as I have my own land and we are already growing vegetables and mangoes. It’s been about 10-15 years since we started this. We haven’t been selling our produce to retailers so it’s not a large-scale operation or anything, however, we sell it in villages and to mandis and wholesalers. We don’t sell directly to customers either and have not set up a brand yet.

How much does your informal business earn in a month on average?

The earnings are not fixed on a monthly basis but we get around INR 5,000 from the vegetables that we sell. Additionally, during mango season, we earn up to INR 10 lakhs depending on the quality of fruits as a result of rains.

How much do you spend/invest in your business every month on average?

We have a borewell that requires electricity but the charges for that are relatively less as there are subsidies. For fertilizers and to plough the land to remove weeds, the cost sums up to around INR 2 lakhs per year. This is a family run business and the finances related to this are taken care of by my father.

Was your business impacted due to Covid-19 since people started ordering online and they stopped going to markets to buy groceries and vegetables?

We did face some issues wherein wholesalers used to say that since there are no customers buying the produce they could not give us a said rate. However, we discovered that they were selling it at INR 60 per kilogram of mango, but they refused to give us anything more than INR 10. So the wholesale rate reduced drastically.

Apart from giving it to mandis, do you use any e-commerce or social media platforms to promote and market the produce from your farm?

No, I haven’t started marketing and promoting it because I am a very shy person, but that’s something I want to overcome. ITC has introduced an app called e-ITC which is a digital intervention for Indian agri-businesses and farmers where we can sell and do various things related to a business. That’s something I intend to start doing.

Are you aware of any basic requirements that you need to formalize this business in the future?

Yes, capital and an understanding of how to get customers and retailers. I joined SHEROES to research these aspects. I have also downloaded the e-ITC app and next April when we get our mango produce, I will try to sell it online through the app. I usually get comfortable doing things in silence and I think that is a major drawback because I hesitate to put myself out there and ask people. That’s something I want to overcome and maybe I’ll focus on that once I stop my full-time job.

Household finances

How is the family budget decided? Independently or collectively?

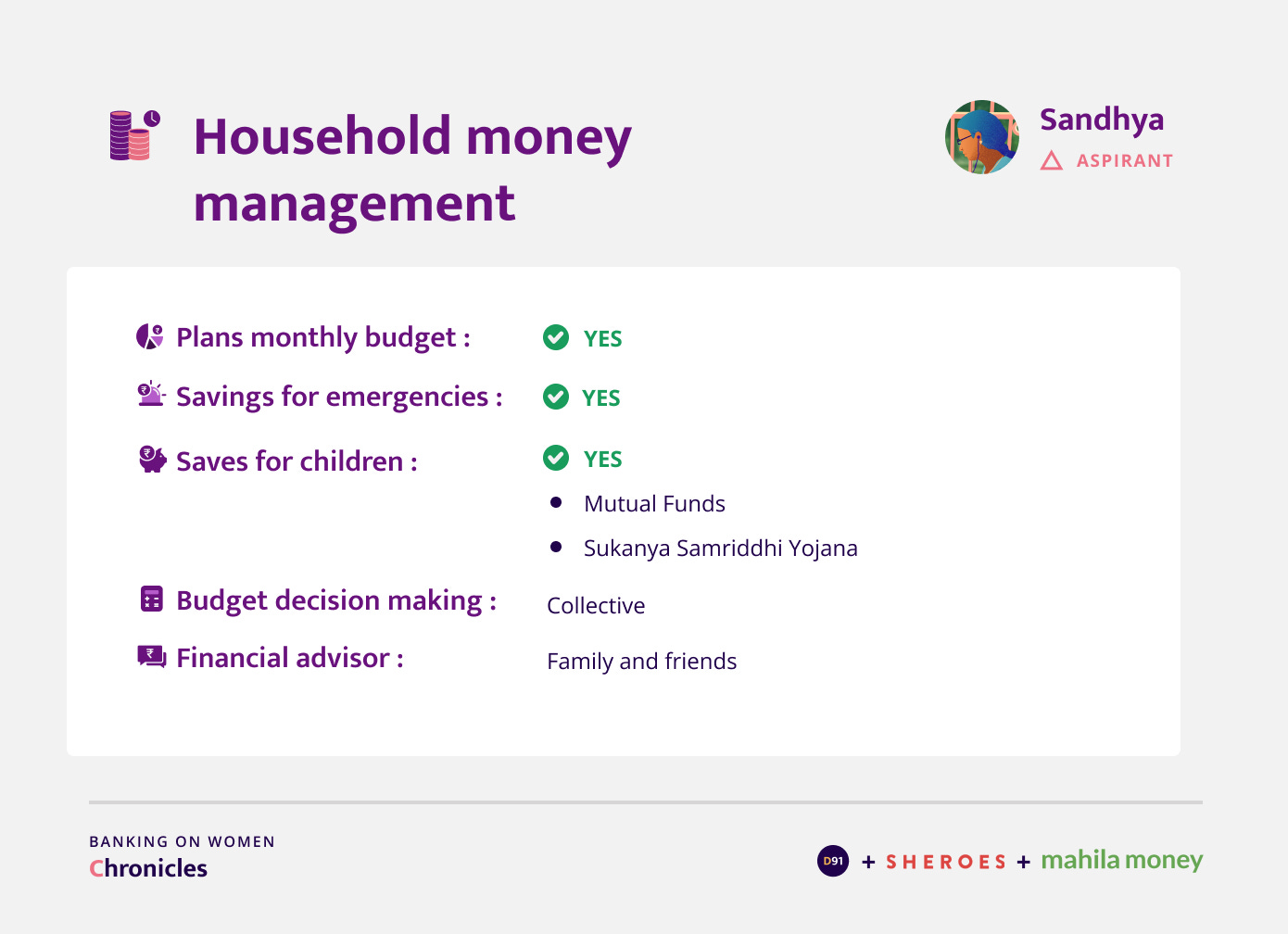

We all discuss it together. Each family member highlights what their requirements are for the month and we take a decision accordingly. Since my mother handles various aspects related to running the household, she tells us what items are yet to be purchased. Similarly if my sister needs something she mentions it during these discussions. We arrive at a budget in this manner.

How are the expenses divided between you and your family members within your household?

There is no fixed division. I might take care of the expenses this month and someone else might take care of it the following month. We don’t really decide these things. For instance, my father usually pays the DTH bill through his PhonePe account, but in case he happens to be away when they come to collect the bill, then whoever is available at home pays. Similarly we take turns to go shop for groceries based on our availability.

Did Covid-19 impact the household budget? If yes, then how?

The pandemic actually increased our spending because we became more health conscious. We have bought a lot of things related to enhancing our health and that increased our expenditure. But during the pandemic, since we shifted to a work from home model, we ended up saving on fuel and transportation costs since traveling to the workplace stopped. Moreover, when I used to go to the office I would end up eating in the cafeteria sometimes and that was expensive. So in a way it’s good that these things have reduced.

Expenses and Payments

Can you tell me what percentage of income is used towards your household's monthly expenses?

I usually don’t have to spend more than INR 5,000 per month. This involves expenses related to my daughter and me and the DTH bill that I pay for sometimes. My father takes care of the rest. To be very honest I am not giving much money to my family.

What are your top 3 categories of expenses in a month?

The first thing would be paying for my daughter's education which is about INR 40,000 per year. If you consider it as a monthly payment it is relatively less, however, they require us to pay for the entire year at once. On a monthly basis the top 3 expenses would be rent, household expenditure and clothing. Since we get produce from our land, we save a lot on vegetables and only buy fruits from outside. Rice is also something that we get from nearby villages and we buy that in bulk for the entire year.

Do you use payment apps for your monthly utility bills, rent, fees?

When I lived in Bangalore I used to pay digitally, but once I moved here the current owner prefers cash payments when he comes to collect it. In terms of household items, if we go to places like D-Mart then we make a digital payment but to normal vendors we pay by cash.

Do you remember the first time you used any payment app? Can you tell us more about that experience?

I explored it on my own and it was very easy. Initially I didn’t know how it works, so it started with sending 1 rupee to my friend to test it. Since the transfer took place smoothly, it gave me the confidence to start using it.

Do you file your taxes? Do you need help to file your taxes? In case someone else files it for you, who is it?

So my company passed on the contact number of Cleartax and they filed it for me once. From the following year, I started filing taxes on my own based on my salary.

Banking Habits

Is there any particular reason why you chose these banks to open an account?

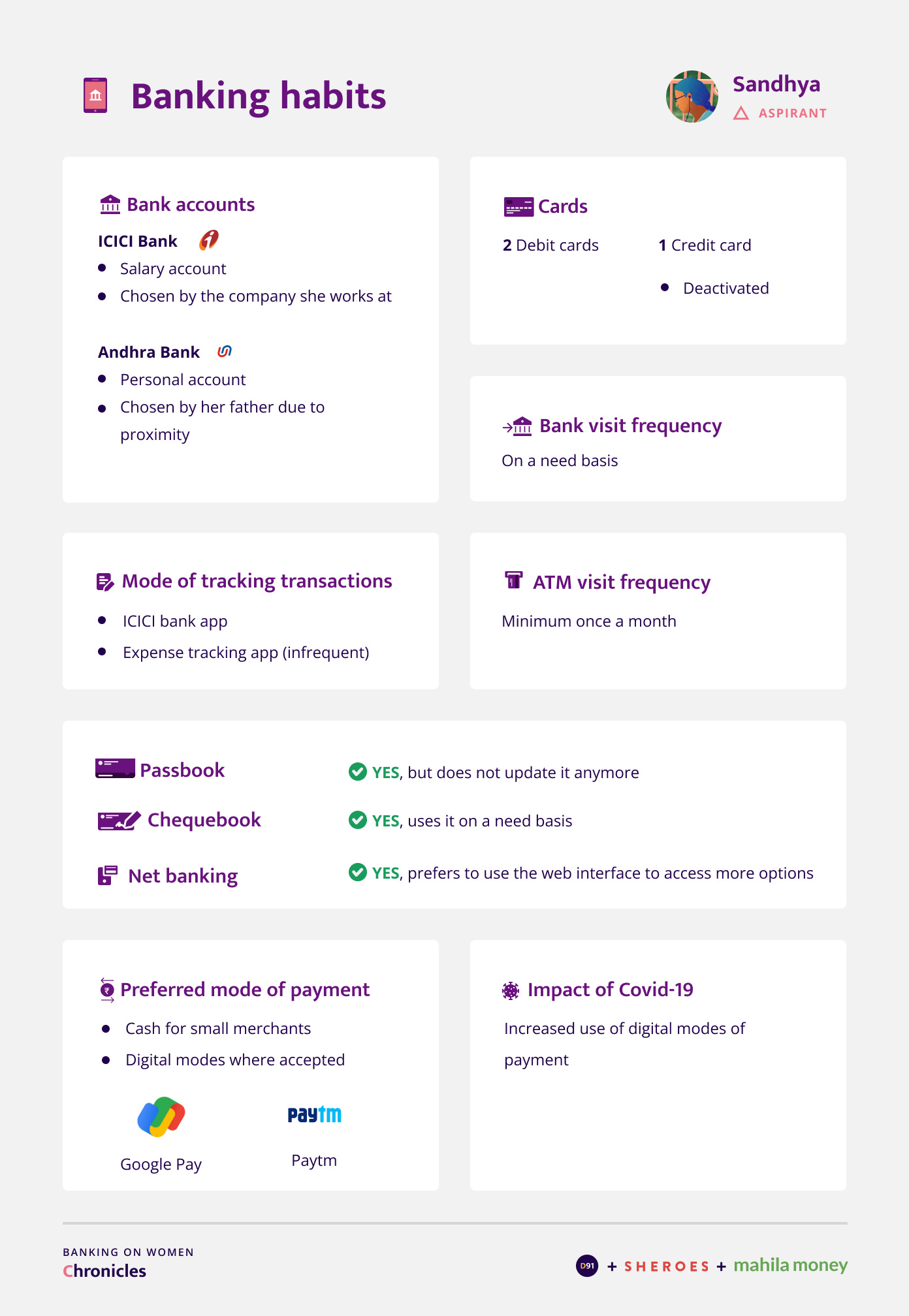

Back in 2012 my father recommended that I open an account in Andhra Bank because it was nearby. The second account at ICICI bank was opened by the company when I started working. They gave me 3 options which were ICICI bank, Kotak Mahindra and HDFC and amongst those I chose ICICI bank.

How do you keep a track of the money in your account?

ICICI bank has an app where it shows the outflows and an indication of our transaction history, so I keep a track on that. I also used an app to track expenses for one or two months where I kept track of the smallest things like the amount spent on fuel, dhobi, etc. However, I didn’t have time to do that regularly.

Did Covid-19 impact how often you visit the bank or your other transactions with the bank?

I had started to use digital modes of payment before the pandemic itself, but post pandemic we have moved to use digital modes for 99% of the things because we can’t go to ATMs and even shops accept digital payments now. I mostly use the Google Pay app.

You mentioned that the expense app that you used didn't work out too well. Would you be open to telling me what exactly went wrong?

I would say I am lazy. It was a very good app actually. Though my monthly expenditure was just around INR 6,000, I felt lazy to note down each and everything I spend on. It will be great if I use it regularly because we get to know where exactly we spend more. They have an option to add tags and in this manner I can keep track of the amount I spend on entertainment, fuel, shopping, clothing, make up, etc.

Do you use debit or credit cards? How many debit cards and credit cards do you have?

I have 2 debit cards, one for ICICI bank and another for Andhra bank. Initially I had a credit card when I joined my company because the bank provides it, but back then I did not know what it is used for and ended up blocking it because it was of no use to me. Even now I don’t use credit cards for anything. The only time I used my credit card was for expenses during my marriage.

And do you update your passbook regularly?

No, it’s not necessary to get my passbook updated manually anymore because if I log into my account online I can see all my transactions.

Do you prefer doing net banking through your mobile or do you use a laptop or any other web interface?

Normally I use it on my mobile when my laptop is not around. However, I prefer the user interface of the laptop because many more options are on the web interface.

How frequently do you visit a bank branch?

The last time I visited the bank was to get details about a home loan. I also went to the bank when I wanted to start investing in the Sukanya Samriddhi Yojana savings scheme for my daughter. Basically I visit it on a need basis, otherwise most things get done online.

Financial products and services

Investments

Do you save money only for yourself? Not for anybody else in the house but only for yourself.

I do save for myself but it’s not for personal use, it is to invest in plots or other such assets. Once my savings amount to about INR 15-20 lakhs, I intend to buy such assets. Additionally I also ensure that I have an emergency fund of INR 5 lakhs in my account at any point of time and the remaining amount I invest. If I don’t have an emergency fund and something happens to come up, then I have to ask my parents, friends or colleagues. Also my company gives an advance salary of 1 month and I might have to avail that. If none of these suffice then I might consider taking a gold loan.

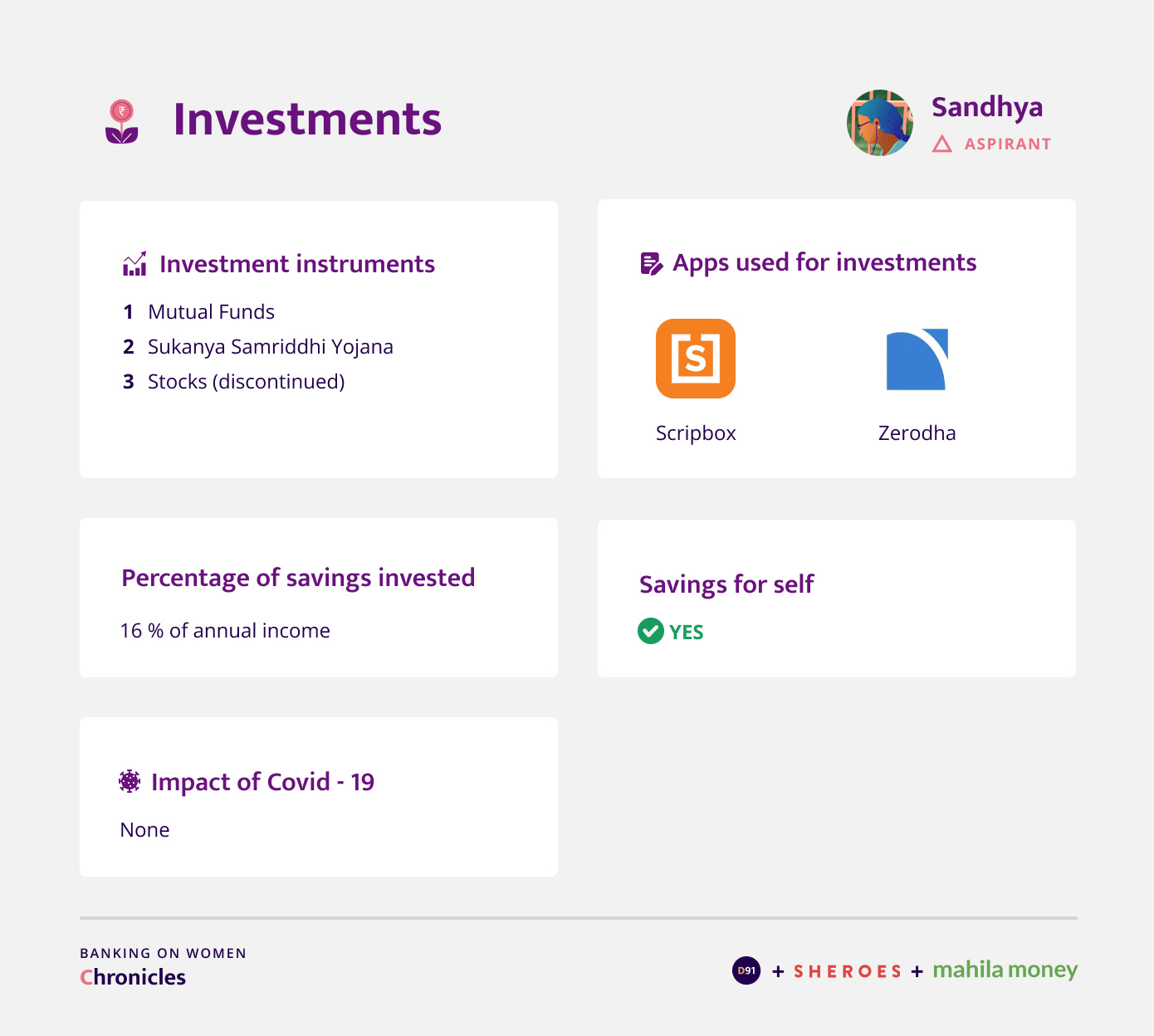

What are the various instruments that you've invested in?

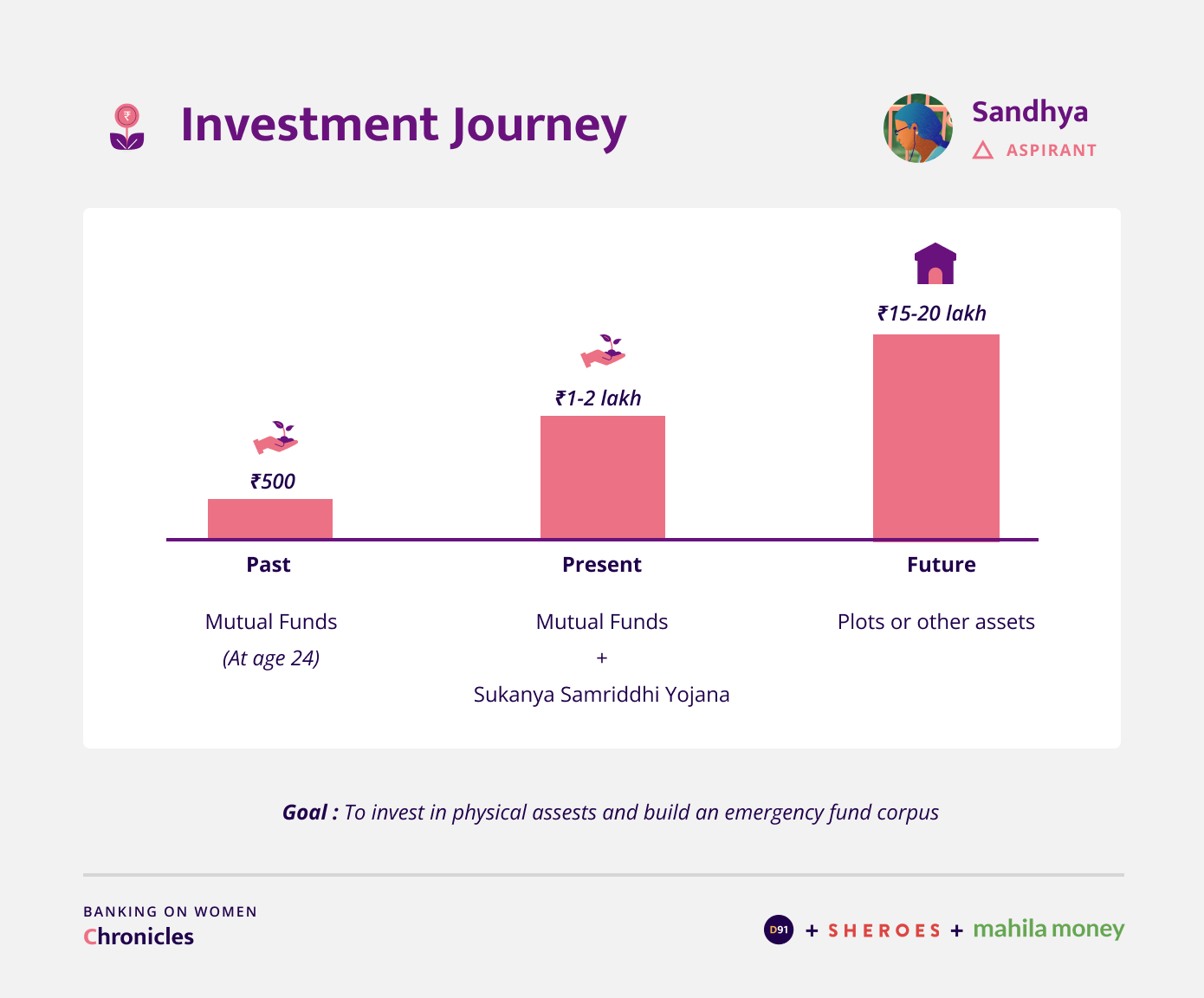

There is an app called Scripbox and they provide suggestions on the best mutual funds, so through that I invest in SIP. When I was studying, the lecturer in one of my coaching classes mentioned SIPs and enquired if any one of us actively invested. That made me curious and I started investing INR 500 in an SIP on a monthly basis. This was when I was 24 and I started with a small amount as I did not know much about how it works. Now my awareness has increased and I ensure that I invest at least INR 1 - 2 lakhs in an SIP out of the 12 lakhs that I earn per year. Last year due to the pandemic, the market went down and that’s when I invested in shares and mutual funds last April. This year my money has actually doubled.

When you started investing, did you have any goals attached to your investments?

Yes, for mutual funds the aim is to earn at least INR 1 crore by the time I turn 50 years old. I also invest in Sukanya Samriddhi Yojana for my daughter’s education and marriage. With the remaining money I aim to buy assets such as a plot. In about 2-3 years I plan to buy a home and I am trying for a home loan but it hasn’t worked out yet.

Who do you turn to for investment-related advice?

My mother's brother who is a retired teacher actively invests in shares and other assets, so I take advice from him about which shares to invest in. I also have a Zerodha account on which I traded for about 2 months, but it became like an addiction and that gave rise to a lot of emotions such as fear and greed. It was very unnerving and that’s why I decided to stop. I want to learn the specifics and only then go ahead and trade. Usually even friends give suggestions, but we can’t share too much information about our finances with them right. That’s why I haven’t discussed it with anyone but my parents and uncle.

Loans

Have you taken a loan in the past?

Yes, for my marriage I took a personal loan through a credit card. I took a loan of INR 2 lakhs from ICICI bank and it got credited within 4 hours itself.

Is there any particular reason why you chose ICICI bank and not take a loan elsewhere?

The ICICI bank app has an option where they will display the loan amount that you’re eligible for and when you click to see details their team gets in touch with us through a call. That’s how I availed it. I didn’t look for any other bank because I already had an account with ICICI. There was no other particular reason for that.

Were there any other factors that you considered, apart from the interest rate?

Not really. I just compared the interest rate of 11.6% that they were offering with other banks and realised that all of them had the same interest rate. Since no other bank was giving it at a smaller interest rate, I decided to go ahead with ICICI only.

And when you were taking this loan, did you need a male family member as your co-guarantor/ signatory?

No, they didn’t ask for that. They just wanted my salary slip and Aadhar card as proof and I received the amount that I asked for.

Have you considered using digital apps to borrow money? Would you be comfortable taking it through a digital app?

Yes, I will compare the interest rates with a few other places and based on whatever seems less expensive, I’ll go ahead. I trust platforms like Google Pay.

Is there a maximum amount that you would be comfortable borrowing from any of these apps?

I will see what interest I have to pay per month and ensure that it doesn’t exceed my salary. If it seems high then I will probably save a little first and then consider taking a loan.

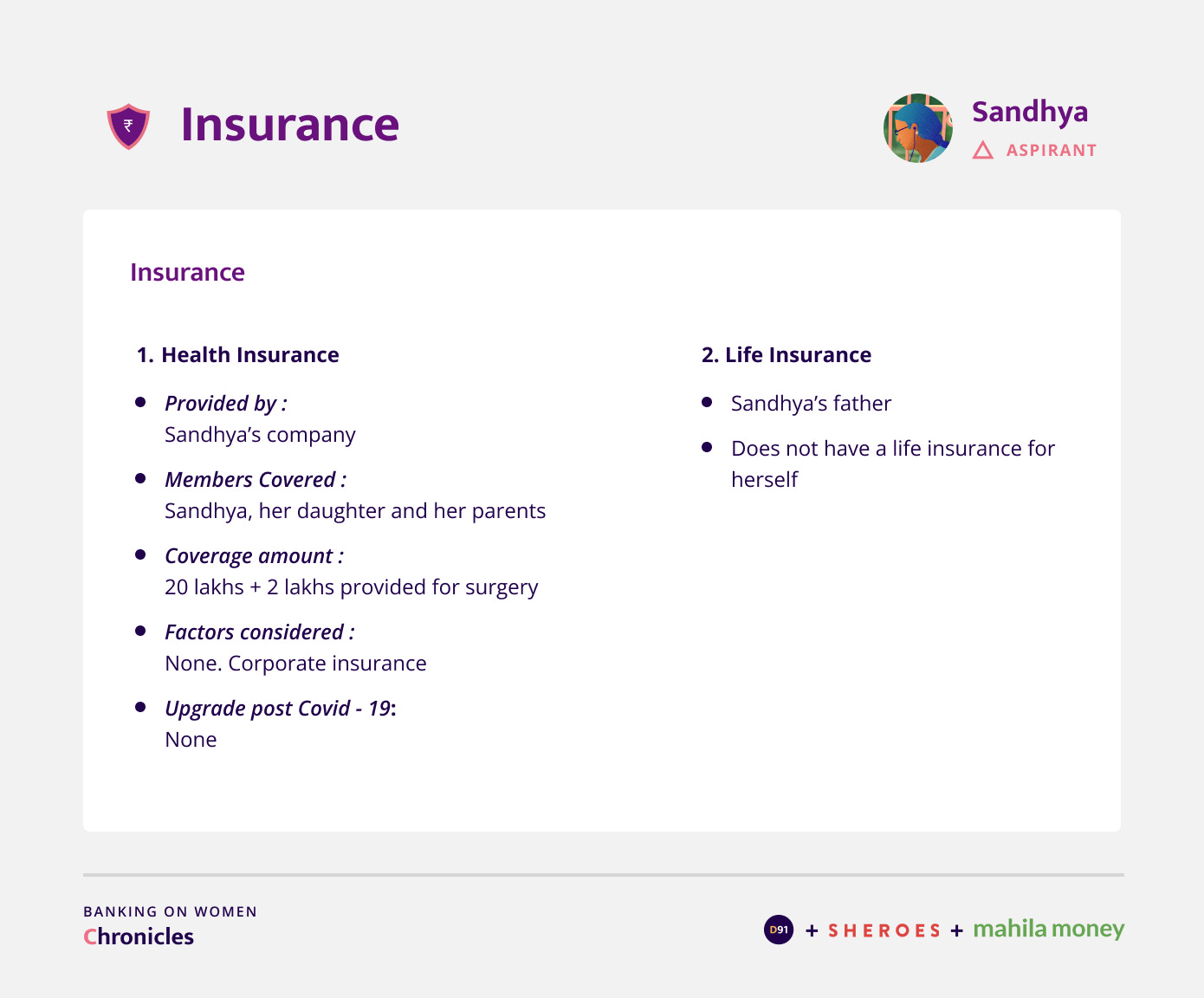

Insurance

Did you buy or renew your insurance due to covid-19?

No, I did not. I got to know about Shriram Life Insurance through SHEROES but I didn’t go for it because my father is a government employee and he has his life insurance there. Also, I didn’t think negatively about my life circumstances and I didn’t have too much awareness which is why I haven’t bought anything.

Outlook towards the future

In your opinion what is the one financial product or service that will have the most impact in supporting your financial journey?

If an app or person provides financial guidance it would be great. Having a service is essential because only if our parents are educated and aware they can pass on the knowledge, if not, who will tell us? For me my parents told me the importance of investments and that led me to invest in mutual funds. If they hadn’t told me, I probably wouldn’t have started. Having a service that increases awareness about finances will definitely help everyone. When my father was studying he didn’t know where to invest and ended up investing in farms, but at that time if he had invested in urban area plots, it would have now been of higher value and more profitable. He didn’t know where to invest and now he regrets the plots he spent on.

Our understanding of Sandhya’s journey

Our conversation with Sandhya highlighted how she proactively takes action to fulfill her short and long term goals. Be it in terms of securing her finances, growing professionally or scaling her family business, she leaves no stone unturned. She is willing to do independent research and takes the effort to build a financial corpus for herself and her daughter’s future. Despite obstacles, Sandhya remains determined to turn hurdles into opportunities and works relentlessly to achieve the dreams that she has set out to achieve for herself and her family.

About the Research

This blog is a result of an online interview conducted with the participants’ consent. The interview was conducted in English. This is a part of the Banking on Women chronicles.

Disclaimer: The name and other sensitive personal details in this documentation is masked to honour the privacy of the participant.

Project Partners

SHEROES

The SHEROES Network is a content and community ecosystem enabling access to employment, entrepreneurship, and capital for women. It includes the SHEROES app, SHOPonSHEROES marketplace, Babygogo, Naaree, MARSbySHEROES and has a user base of over 24 million women. The SHEROES Network is committed to increasing women’s contributions to GDP.

Sheroes.com | SHEROES App | Twitter | LinkedIn | Instagram | Facebook

Mahila Money

Mahila Money is a full-stack financial products and services platform for women in India. Mahila Money specializes in offering loans to women who want to set up or grow their own business along with resources and community to achieve their financial goals. Mahila Money can be accessed via the Mahila Money app on Android.

Twitter | LinkedIn | Instagram | Facebook | Website | Play Store App

All artworks are designed by Poorvi Mittal.

If you enjoyed reading this blog and would like to receive more such articles from D91 Labs, please subscribe to our newsletter here.

To read more about our work, visit our website