#20 Arundathi | Chief of all trades

No matter how much I have studied, the environment in a village is such that most of us are not very technologically savvy and are unaware of how to transition to the digital age without assistance.

“To be honest, there is no shortage of money in my life. My husband earns well and we receive money from the part of our house that we have rented. But more than for myself, I do this for others as it gives me immense joy to create employment opportunities for people, so that they can earn enough and become self-sufficient. That’s what got me started in social work.”

Short Story

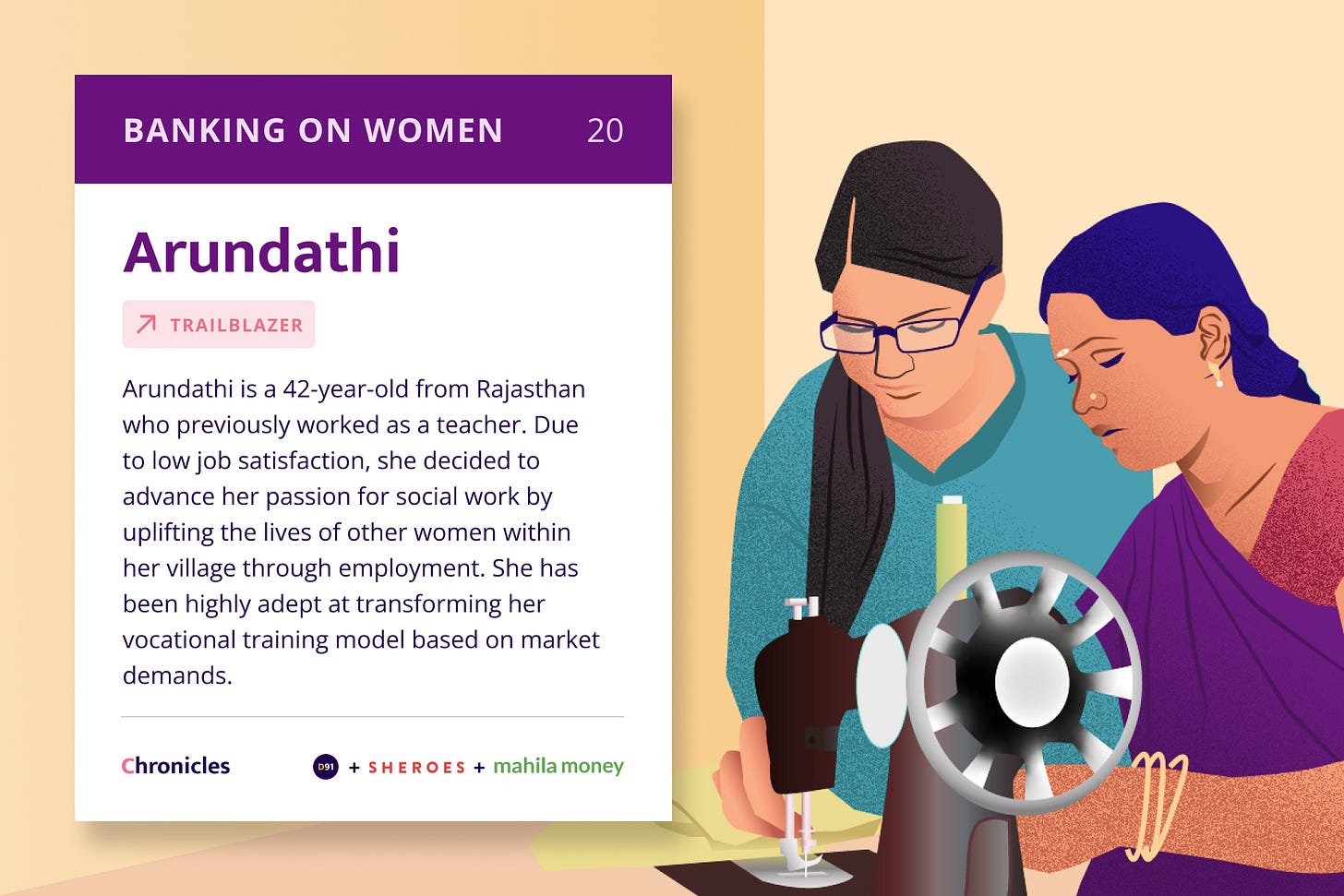

Arundathi is a 42-year-old from Rajasthan who previously worked as a teacher. Due to low job satisfaction, she decided to advance her passion for social work by uplifting the lives of other women within her village through employment. She has been highly adept at transforming her vocational training model based on market demands and this has helped her achieve great success in improving lives. Her resourcefulness and urge to make a lasting impact in society has helped her thrive in her entrepreneurial journey.

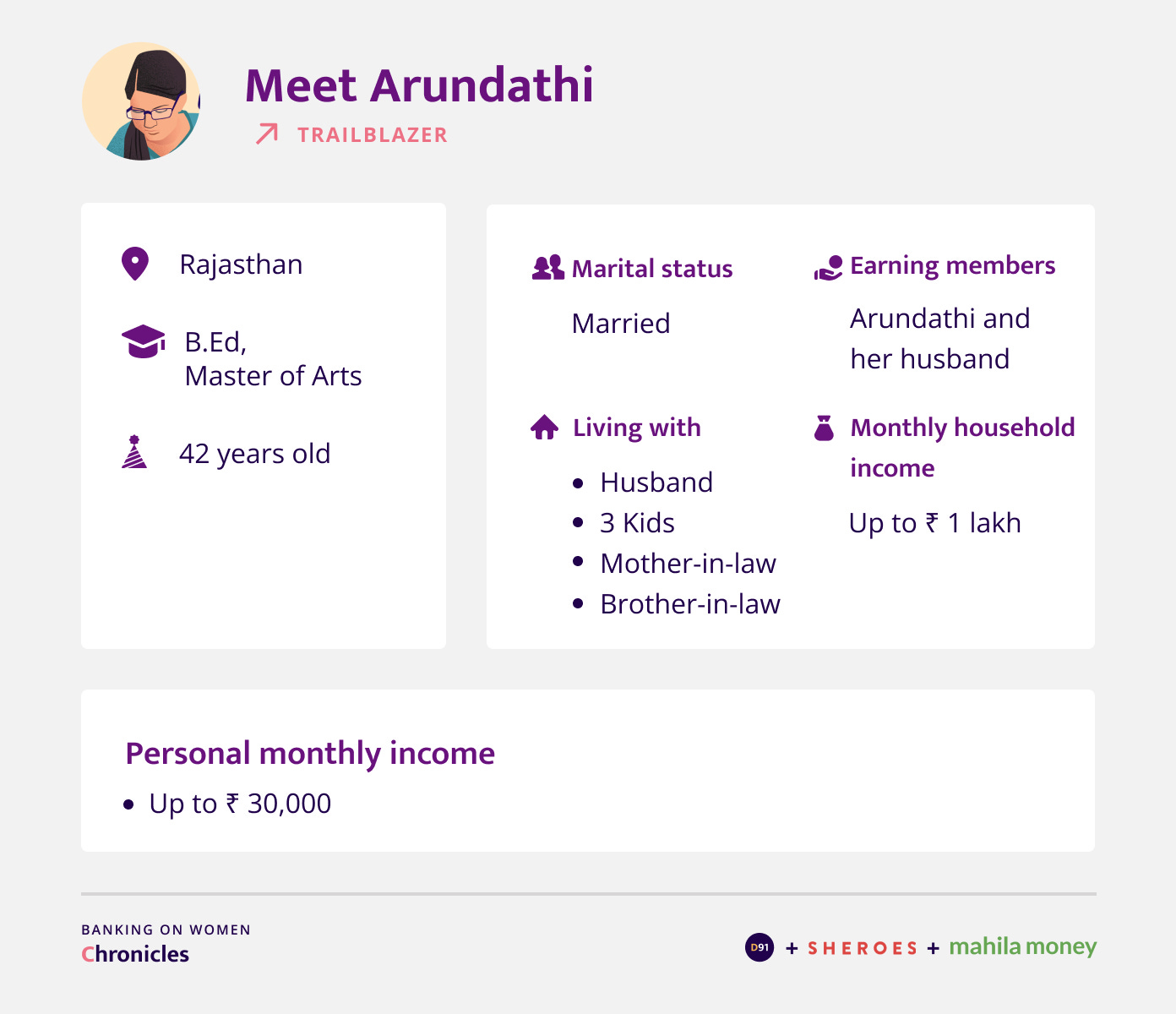

Personal and financial background

What’s your daily routine like?

As soon as I wake up, I take care of some household chores. I then make tea for my husband and green tea for myself. Soon my kids have to leave for school so I keep things ready for them. I also prepare breakfast and pack lunch for my husband before he leaves for the office. After cooking, I look into cleaning the house. Once that’s done, I have a bath and go to the temple where I spend one hour in prayer. My mother in law also accompanies me to the temple. These routine visits give me peace of mind as I feel God is our main support system in this world. Once I return, I spend some time planning my day by making task lists and also devise a work plan. Soon I begin work for the day. I do tailoring work and run a beauty parlour as well. My customers start coming in for the day around 12 pm. Alongside attending to customers, I also train women in tailoring and skills required to become a beautician. I run a bag making business as well and I financed that by taking a loan from Mahila Money. I take some time to have lunch in between and get back to training women through the rest of the day.

In your own words, can you describe your current work? Have you worked elsewhere in the past, if so can you tell us what it was?

After I got married, my plan was to start working as a teacher in a government school. However, I happened to give birth and I couldn’t take on a job immediately. Eventually I started working at a private school. I continued to do so for about 2-3 years but it was a lot of work and I had absolutely no time for myself or to spend time on social service to help the society at large. Despite a hectic schedule, I barely earned INR 7,000. So due to low job satisfaction I thought about moving on from that job and doing something that gives me true happiness. I have always had a keen interest in helping people around me and I decided to undertake that by creating employment opportunities for the people in need around me. I decided to make better use of my skills to help more women become self-sufficient. That’s when I started a beauty parlour in 2010. It began with a set up within my house but as my client base increased, I invested in a more professional setup and got my business registered.

My work involved teaching women in my village skills that will help them become beauticians or to run a beauty parlour of their own. But the thing is, not too many women in the village are interested in beautifying themselves or doing make-up because they don’t really have the money to spend on these things. Therefore, the employment opportunities for women with these skills were fairly less. For this reason I decided to run a tailoring center alongside the parlour after having conversations with a few people about in-demand skills. Through this initiative, I teach all round skill training in tailoring and beauty. Lately I mostly encourage them in tailoring so that they can stitch clothes on their own for themselves and their family members without having to burn a hole in their pockets through shop purchases.

Business Details

How much does your business earn every month on average?

I earn around INR 5,000 in a month from the beauty parlour that I run. As I mentioned earlier that the demand is slightly lower for it. Apart from that, I earn up to INR 25,000 from the tailoring business. This includes the earnings from the bag making business as well.

How much do you have to invest in your business on an average?

Around INR 15,000 is what I have to invest.

How did you finance your business till now?

Apart from the loan of INR 10,000 that I took from Mahila Money, I have financed it with my own money. I began by charging INR 5 for the threading services that I offer and I used to put it aside in a piggy bank of sorts. Those savings eventually started to grow as the inflow of customers started to increase. Soon people began to ask for other services and I invested in my own equipment to offer those services. I keep very little money of what I earn for myself. Most of it goes into growing my business. I have also been experimenting a lot in terms of the products that I use. For instance, after taking a detailed look at the ingredients of a facial kit, I realised that I can make it at home using alternative natural ingredients. This led me to work on formulating a herbal cream at home. Once I made the first batch of the cream using natural and herbal ingredients, I began trials and it provided amazing results. My customers were very happy and the fact that it was chemical free was great. Therefore, I started to make upto 5 kilograms at once instead of the 1 kilogram that I stuck to initially. This product did so well that my investment of INR 500 in making the cream used to earn me INR 5,000. I always put my earnings aside as savings. As people began to realise that the services I offer are good, my business experienced steady growth.

How was your business impacted by Covid-19?

Since everyone had to be confined to their homes during the pandemic, a lot of businesses had to be paused. Movement was restricted, so for whoever wanted to learn from me, I started conducting online training. For the ones who didn’t have a phone to attend online classes, I helped them get a phone and also taught them how to assist their kids in joining online classes since many schools transitioned to an online teaching model. Most people in the village were unaware of how to open and operate these online platforms, how to study and how to go about things on the internet in general.

I also transformed my business as per the need of the hour by teaching people how to make sanitizer at home. Because at that time there was no demand for the parlour or the tailoring business as people were not allowed to exit their homes. There were strict Covid-19 appropriate guidelines to be followed, so I looked into what demand can be met as per the current scenario. Apart from sanitizers, I made a mask template and gave it to the women who had learnt tailoring from me so that they can produce more masks from the comfort of their home through the techniques I had taught them and in turn sell them. I used to give them INR 5 for each mask that they made and this mask was easily sold for INR 10 in the market. An employment opportunity in this form helped them put food on the table. They were happy and that in turn made me happy. Additionally, for women who had a better understanding of chemistry through prior education, I trained them online to make hand wash. In the market there was no hand wash available for less than INR 50, which was considered very expensive in a village. So this training helped them make these things at home without having to spend too much money during a time when financial crunch was widespread. Natural ingredients such as neem, lime, aloe vera, tulsi, etc. are natural disinfectants are easily available in the village because these plants grow in our surroundings. So I devised a model where we could all earn and grow financially without being dependent on market purchases. I also started putting this training content out on a YouTube channel and started uploading tutorials that people could refer to. Several women picked these skills up fairly quickly and sold a significant amount. I also aided them in distribution by donating a portion of them for free and I sold the rest at a fixed price. At a time when a lot of people were complaining about not being able to make money during Covid-19, transforming my business model helped me earn well even during the pandemic.

Business Journey

What made you choose this business?

Mainly because of the satisfaction that I get from social service.

How long did it take you to set up this business?

It didn’t take me too long. I got started within a day or two itself. I had a thought one night and began execution the very next day. I am a person who doesn’t think too much, I believe in taking action. Also since I run it from home, I didn’t have to invest time in getting a space ready.

Did you receive support from your family when you decided to start this business?

Yes, I received a lot of support. Also, since I am running this from home itself, they don’t face any issues in terms of household work, taking care of the kids, etc. When kids go to school and my husband is away for work, spending time training these women keeps me occupied, so it’s a good thing.

What were some of the pain points while you were starting this business?

To be honest, I did not face any sort of problems. To run a successful business, spending money is not the only criteria. I believe gaining your customers' trust is more important than anything else to run a successful business. Since I have worked on building good relationships, people trust me blindly. Also, I don’t dwell too much on losses, I am a very positive thinker. This approach helps me provide a very positive experience for my customers. Funding or finding a customer base was not a problem for me.

Did you have any mentors or friends to help you plan and execute this business?

I handled most things on my own, but to get my business registered and to get a card made, I received support through the Internet Saathi Accelerator programme. As a part of this initiative, I had mentors who supported and guided me.

Do you market your products anywhere? If yes, where?

As a part of the accelerator programme, they taught us how to move forward with our business online by helping us learn how to promote our business on WhatsApp, Facebook and Instagram. I created an Instagram account only after their training and I now put up stories of my products there. I also use the SHEROES app to promote all my products. My mentors also suggested that I start selling my products on Amazon and Flipkart. They are teaching me how to navigate these platforms. Though I am from a village, with the right guidance from a mentor, I can move forward in life to do big things. No matter how much I’ve studied, the environment is that of a village, so I am not very tech savvy and I am not aware of how to upload products or how to do online shopping. But I am glad that I have gained experience and awareness in how to do these things after joining the accelerator program.

Would you consider formalising and expanding your business?

To publicise my work, I have published a book about my success story through an organisation in Lucknow. Hundreds of books have been printed and are available on Amazon and Flipkart for sale. Whenever people are interested in learning more about my story, my products or my business in general, I share a link to the book as they can get a peek into my journey through that. It’s a 100 page book and it is a channel through which my business can gain more traction, I have faith in this. More than doing social service, my main aim is to make people self-sufficient. If I remained a teacher, I would have only educated people with book knowledge, but I wouldn't have been able to equip them with skills that would help them earn a living. Through my current approach, even if they are not educated, they can still earn money through the skills that they learn. This is what I aim to achieve — make every woman self-sufficient, by equipping them with the capabilities to become an entrepreneur. The lives of many women in my village have changed through the initiatives that I have set up.

Household finances

Do you have a monthly household budget?

Yes, having a budget is the most important thing for a homemaker and it is needed to run the household smoothly. First I write down how much goes into my business, medicines, clothes, etc. and whatever is left after that, I save.

Do you save money separately for children’s expenses?

Yes, I put aside INR 100 everyday for them and I give them that money whenever they need it. I divide that money amongst the 3 kids on a monthly basis as pocket money. I keep resuming this at the beginning of every month.

Who do you rely on for financial advice?

Till now I haven’t asked anyone about these things. I take these decisions on my own.

Did covid-19 impact the household budget? If yes, then how?

Quite a lot of changes came about. Kids were sitting at home because schools and colleges were shut and no one was coming to my parlour or for my tailoring services. To turn things around, initially I invested my own money into kickstarting the homemade sanitizer and hand wash training. But once I started selling these things, I started to make money. It was a difficult time financially but my mind was calm that I was at least doing something about it.

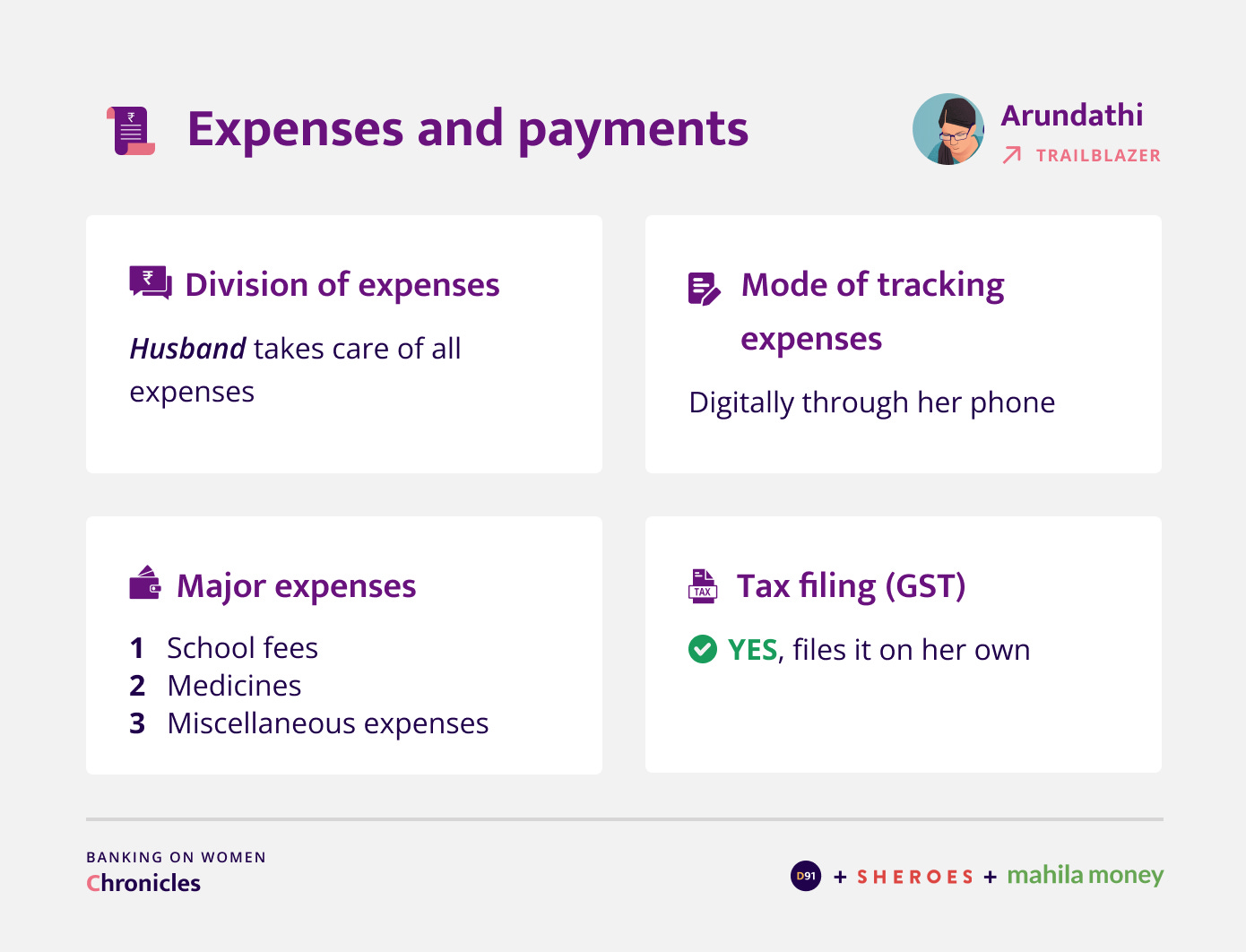

Expenses & Payments

Do you use payment apps for utility bill payments?

Yes, after Covid-19 this is one thing that I’ve learnt to use. This is the only positive thing that the pandemic brought about, wherein we’ve learnt to do everything through our phones. Before we had to maintain books and so many other things but now it feels like the entire world lives within our phones.

Do you remember the first time you used any payment app? Can you tell us more about that experience?

PhonePe was the first app that I used. My son downloaded it and he asked me who I was going to send the money to, hoping it would be him. But I decided to send it to my daughter who studies in Jaipur. I sent her INR 500 through PhonePe and was in awe of the simplicity.

Banking Habits

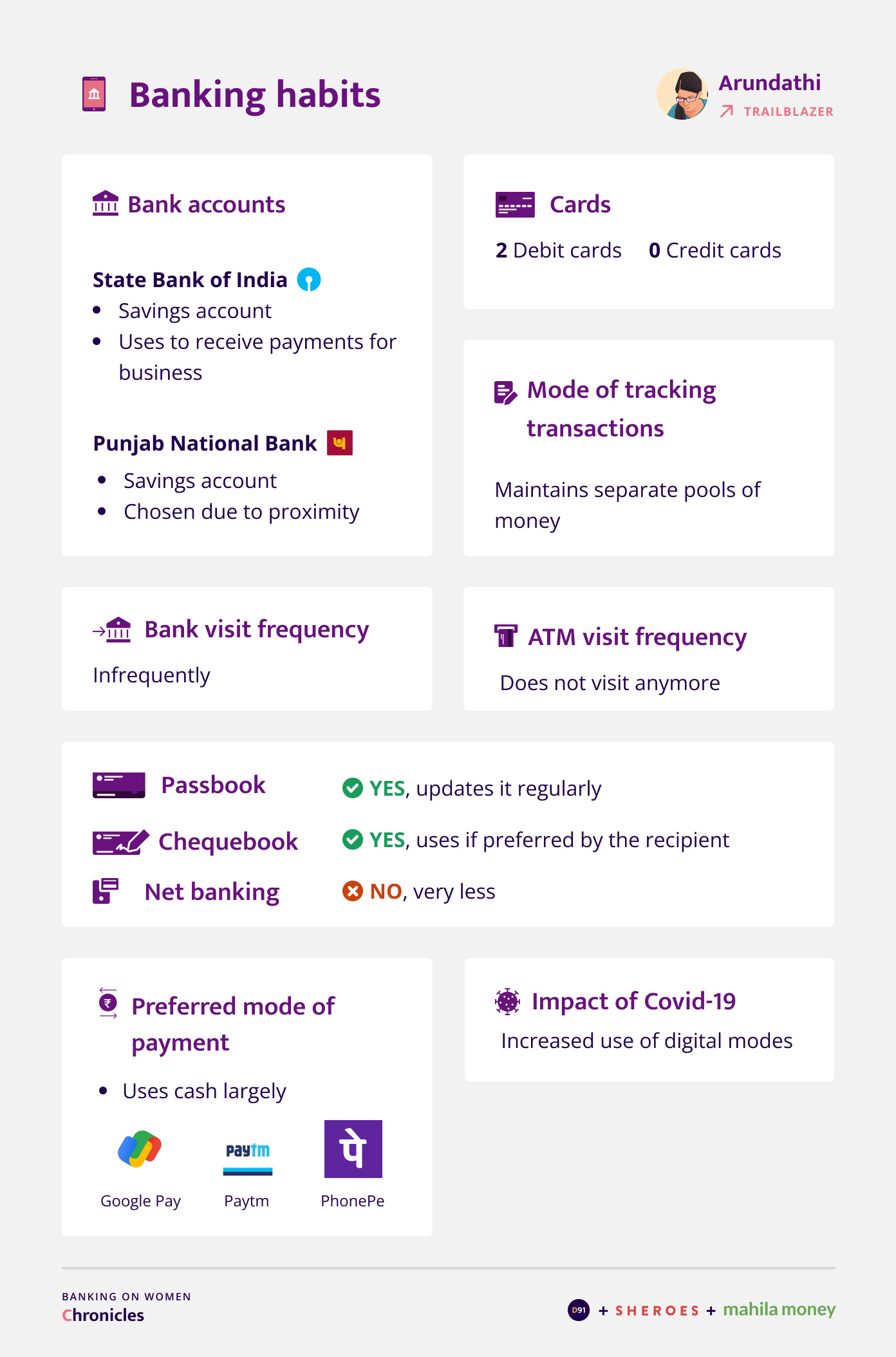

How many bank accounts do you have in your name?

I have an account at Punjab National Bank and State Bank of India. Both are savings accounts. But in our village, interactions with banks are very minimal, especially when it comes to women. Also, most people don’t know how to use PhonePe, PayTM, etc. so we mostly deal with cash.

Do you have a separate bank account for your business?

No, I just have an account on Google Pay for my business through which people can pay me. I receive payments on my SBI account for the training that I do for the women in the village. The rest of the customers give me cash.

How do you keep track of your transactions?

I have three separate pools of money that I keep, a piggy bank of sorts. One is for my income from the tailoring business, the other is for the income from the beauty parlour and the third is for the bag making business. When I take a look at this each night, I get to know from which of the three I have earned more profits. Currently it is from my bag making business. My income is fairly less from the tailoring and parlour business. I do calculate and write down total earnings sometimes, however, even if I forget to write, since I maintain separate pools, I get to know how much I have earned from a specific source.

Financial products and services

Investments

Where do you invest or save?

My money is in the form of cash at home

Do you save money for yourself?

All my earnings are available for my personal use. I don’t contribute towards household expenses.

Any other instruments that you have considered investing in?

I have thought about it but with Covid-19 in the picture, it has been difficult to take action. But soon I hope to grow my business, increase my earnings and invest it in an FD.

Loans

Insurance

Do you have any health or life insurance?

Yes, all of us in the house have.

Is it in your name or husband's name?

There is one personal insurance in my name. I have both health and life insurance.

What is the total coverage amount? And where have you taken the insurance from?

That I don’t know because my husband pays for it and looks into the specifics.

Does your husband have insurance?

Yes, he pays the premium for insurance

Outlook towards the future

In your opinion what is that one financial product or service that will have the most impact in supporting your financial journey?

When I reflect about my journey, I feel I have been able to make progress only because of the mentors through initiatives that have trained me and educated me. So I wish to receive continued knowledge sharing in this manner about all things finances.

Our understanding of Arundathi’s journey

Our conversation with Arundathi illuminated how she is epitomizing the idea of women empowerment. Her ability to empathise and respond quickly and effectively to challenges in society has helped her change the lives of several people in need. She radiates optimism and has been a pioneer in transforming the status of women in her community. We are truly moved by her efforts to boost livelihoods.

About the Research

This blog is a result of an online interview conducted with the participants’ consent. The interview was conducted in Hindi but has been translated to English in the best possible way to reach a large audience. This is a part of the Banking on Women chronicles.

Disclaimer: The name and other sensitive personal details in this documentation is masked to honour the privacy of the participant.

Project Partners

SHEROES

The SHEROES Network is a content and community ecosystem enabling access to employment, entrepreneurship, and capital for women. It includes the SHEROES app, SHOPonSHEROES marketplace, Babygogo, Naaree, MARSbySHEROES and has a user base of over 24 million women. The SHEROES Network is committed to increasing women’s contributions to GDP.

Sheroes.com | SHEROES App | Twitter | LinkedIn | Instagram | Facebook

Mahila Money

Mahila Money is a full-stack financial products and services platform for women in India. Mahila Money specializes in offering loans to women who want to set up or grow their own business along with resources and community to achieve their financial goals. Mahila Money can be accessed via the Mahila Money app on Android.

Twitter | LinkedIn | Instagram | Facebook | Website | Play Store App

All artworks are designed by Poorvi Mittal.

If you enjoyed reading this blog and would like to receive more such articles from D91 Labs, please subscribe to our newsletter here.

To read more about our work, visit our website