#16 Mary | Carving out a niche for herself

Sure you need money to do things, but thinking about personal development is also important and money is not the only factor that comes into play.

“Just like several other people, my parents don’t usually encourage setting up a business because my dad is a government employee so they prefer stable jobs like that and they don’t understand the concept of a business. They feel that only if you have lots of money can you take a chance and start a business. However, they are slowly changing their perception about it and are happy that I am doing something and they are happy for me.”

Short Story

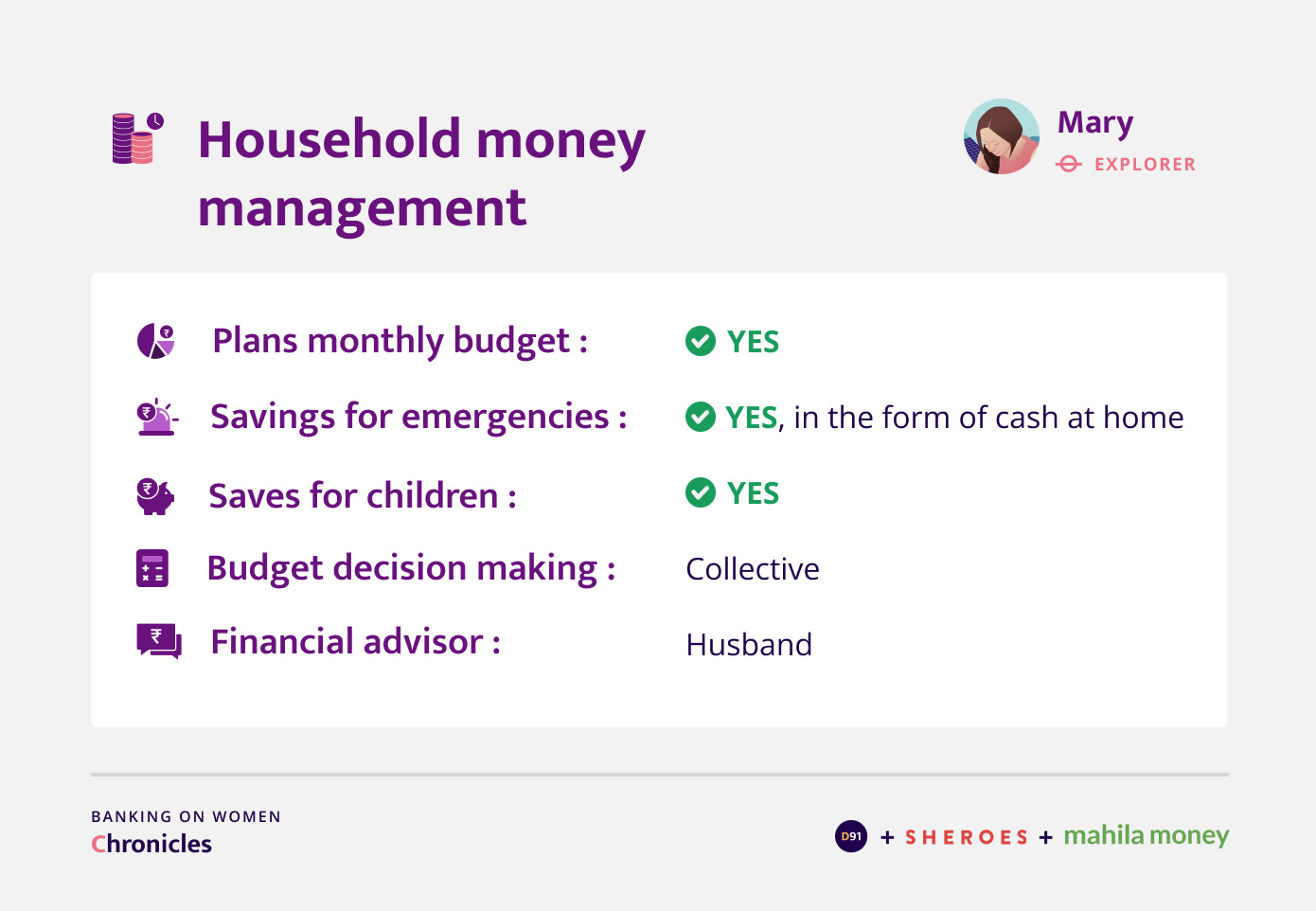

Mary is a paper-cutting artist and businesswoman from Meghalaya. She is a mother to her 4 sons and she also supports her family-run business of watch sales and repair. Her financial journey is that of a self-made businesswoman who is always keen to learn new ways to market her products and new skills to expand and scale her various businesses. She manages her money with the support of her husband. Mary wishes to learn more about finances and accounting so that she can do this more independently.

Know more about her inspiring personal and professional journey in this blog!

Personal and financial background

What is your daily routine like?

Once I wake up I take care of all the household chores like cooking and cleaning followed by taking care of my kids. One good thing is that for the household chores, everyone chips in and so that reduces the burden on me. I leave the house for work around 8:30 or 9 am. My husband drops me to the shop and my schedule starts from there. I remain in the shop till 6 pm, after which my husband picks me up. Once I go home I get back to cooking. Alongside the shop that I run with my family, I also do weaving and knitting whenever possible. In general, due to the many jobs I am associated with, I sometimes also have calls and meetings after 9 pm.

In your own words, can you describe your current work? Have you worked elsewhere in the past, if so, can you tell us what it was?

I started my career in the corporate sector. I worked with a bank as a sales executive. I had some issues with salary and expectations there so I moved to a company in Kolkata as a business development manager. Even though I was in-charge of the whole North East region for that company, my salary did not reflect that and I had concerns with it. At that time, I was also running a reselling business in my hometown for clothes, utensils and other household items. Since I was struggling, my husband suggested that I could try to pursue my interests such as knitting more seriously because at least then I will not have to deal with unequal pay and I could control the production myself. Then he introduced me to paper cutting art. Initially, I was bad at it but after practicing regularly I really started enjoying it. Now I do it professionally. My husband is a designer and a visual artist and he often helps me with the designs. He is very good at it! I am also running a business of reselling clothes and some other household items that I buy through a wholesale trader.

Sometime around last year my father-in-law requested for my help in the family watch shop and I agreed. He takes care of things like purchasing things from wholesalers etc. and another member of our family, an uncle, helps with repairing watches. We realized that during peak hours it is difficult for one person to manage all the customers so I help out in managing them while they wait for their turn.

When I reflect on my journey I did not like the work that I did initially but now despite how busy I am and the many things I have to juggle, I really enjoy and love the work that I do. I am also learning to repair watches now and I am so excited to learn these new skills!

Business Details

You seem to be working on a lot of things, which of these would you say are part of the business you run?

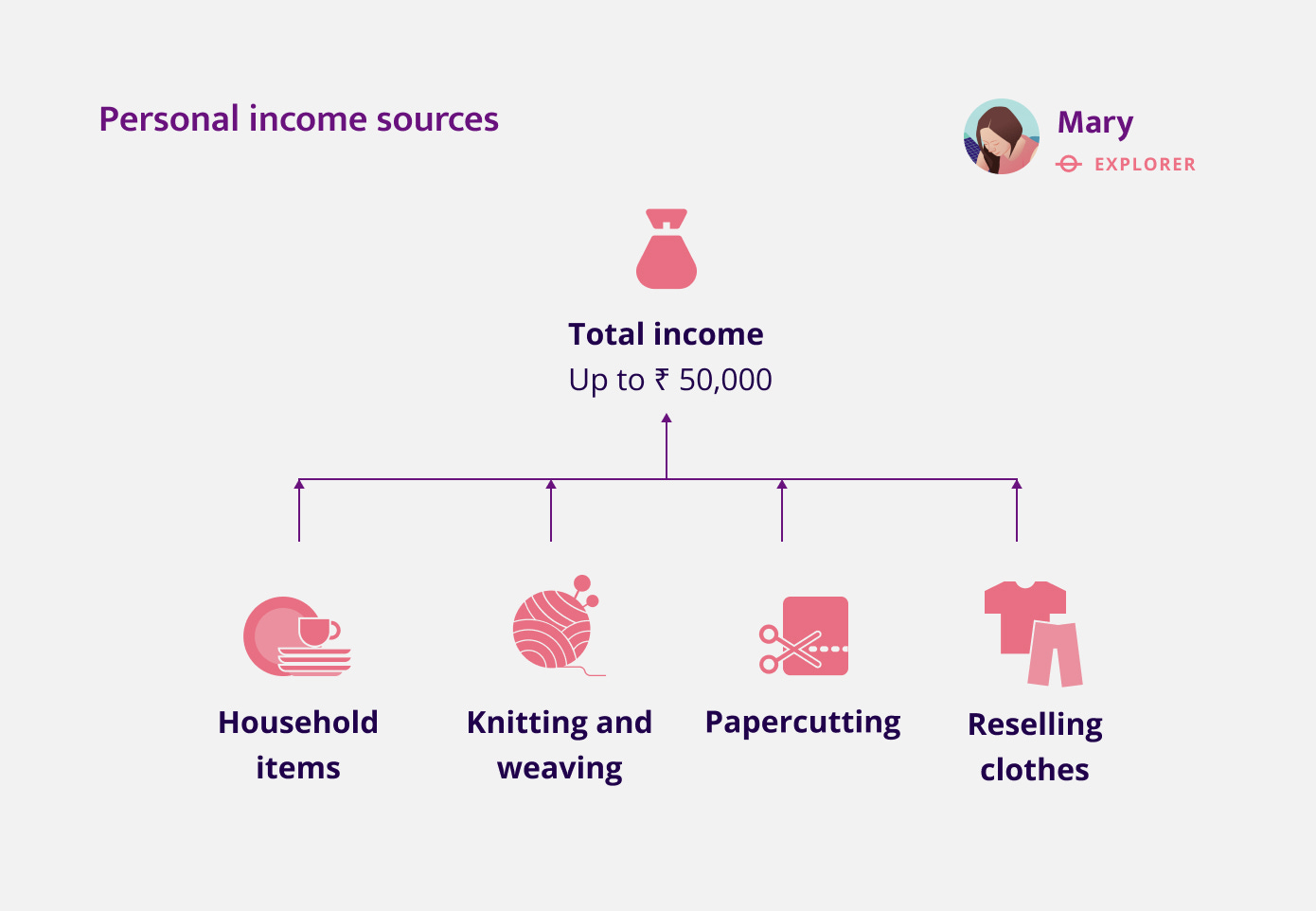

Currently, my business includes household items, clothing, paper cutting art, knitting and weaving. It changes on a monthly basis depending on the orders I get.

Can you describe your paper cutting work to me?

So over the past 2-3 years my husband and I had this soap making business and we used to handle everything by ourselves where we customized packaging and it was very good. Sometimes customers used to come to us and tell us that they don’t feel like opening the boxes because it looks so good. But we soon saw that there was no market for this product where we live and people did not really understand the value of handmade soaps. The effort that it took to source products sometimes from abroad and also dealing with customs, etc. did not seem proportionate so we decided to not move forward with that. That’s when we decided to venture into paper cutting art. Basically what I do is, I draw on an A4 size paper and create designs. Sometimes my husband helps me draft the outline on a computer and we print that out to use as a template. I then cut this design out of the paper. Sometimes I just draw with a pencil and proceed. Once the cutting is done we frame it.

Typically, different customers have different ideas of what they would like. So whatever they want, I customize their orders as per that.

How much does your business earn on an average in a month?

It depends and changes on a monthly basis. Sometimes it goes up to INR 50,000 or INR 60,000 but I think on an average it is INR 40,000.

On average, how much do you have to invest in your business every month?

It depends month to month but I will give you an understanding. In terms of raw materials, the A4 size paper doesn’t cost me much. It costs around INR 250 for the entire bundle, so that’s not very expensive. In terms of wool for the knitting and weaving business, it costs me around INR 1,000 per kg. But it totally depends on the item I plan to knit. So based on the product, the investment varies.

About the reselling business, I purchase inventory on a monthly basis and pay for the courier charges on that as well. I sell it at a margin and often give customers a discount if they ask for it! You know people always bargain! So my investment and earnings vary on a monthly basis.

How did you finance your business till now?

Initially, I considered taking a bank loan. But usually for bank loans they need so many kinds of documents and they ask for a guarantor from our side. But when I took from SHEROES it was so easy to avail a loan. It got done smoothly on the phone with a few clicks. I was so happy with the experience. It felt like a blessing.

First time I took INR 10,000 and later I took a loan of INR 25,000. I am considering taking a third loan as well. It feels so nice that they believe in you and trust that you will repay them. I’d say it’s one of the best things that has happened to me. This simplicity in the process of availing the loan has opened the doors for me to explore so many opportunities in my life.

How was your business impacted by Covid-19?

It really hampered a lot of things. My business didn’t make much for many months, but I guess it’s okay because at least I got to spend time with my family and it gave me time to think about what I can do next. A lot of reflection happened about what I can do once the lockdown is lifted to make up for all the loss I underwent.

Business Journey

Was there any reason that you chose to do this business?

Each of us are gifted in different ways and there are so many different kinds of jobs based on each one’s preference. So I feel we need to do something that gives us happiness. People, especially from our generation, are always looking for a government job and they are under the assumption that it’s the only way to live a successful life. I don’t agree with that way of thinking at all. In fact I am happy that the younger generation now have tried to break that and they have realised that a government job or a desk job is not the only path to success. There are so many other wonderful things to pursue on your own. And sometimes people can earn more than they do with a government job. Though some people are not satisfied with a desk job, they’re still doing it because they feel there is no way out and no other options. Even my parents used to initially say that you need money to set up a business. Sure you need money to do things but thinking about personal development is also important and money is not the only factor that comes into play.

How long did it take you to set up this business when you were starting out?

I have been working for 5 years on these various businesses. But there were so many drawbacks. I have failed multiple times during the journey but that’s always the case. There are going to be ups and downs and uncertainty. But you just need to believe in yourself and keep going. I believe that nobody can stop you, only you can hold yourself back. In the same way only you can work on creating wonders for yourself.

Did you get support from your family when you were planning to start this business right?

Yes, my husband always motivates me and encourages me in positive directions. He tells me not to neglect myself and to dedicate time to reading and expanding my knowledge.

What were some of the pain points when you were starting your business?

I think building a customer base was my primary concern.

People reject you initially when you try to market your products and they try to negotiate prices a lot. Sometimes they don’t like the material, colours or design and sometimes their demands are unrealistic. Moreover, I usually prefer buying things in small batches and then refilling my stock every 2-3 months. But when I call them to refill stocks, I need to keep following up and that’s really annoying. Sometimes, when you call they don’t pick up and they act as though they’re giving us things for free. Also, getting payments on time from customers was a huge issue.

Did you have any mentors or friends and family members to help you plan and execute this business?

Only my husband. My parents don’t usually encourage setting up a business because my dad is a government employee so they prefer stable jobs like that and they don’t understand the concept of a business. They feel that only if you have lots of money can you take a chance and start a business. I can’t do anything to change their mentality. They are slowly changing their perception about it and are happy that I am doing something and they are happy for me.

The various products that you sell, do you use any platform such as Amazon or Flipkart, etc. to market your products?

I don’t have a GST number to do that. I was having this discussion with my husband yesterday about selling my products on Amazon or Flipkart or other such platforms. So this way I can expand my business beyond my home town. I do have some customers from outside my home-town who are my friends. But if I get on an e-commerce platform then I can scale my business. So I am planning to do that. It’s the first on my list. But for now I mostly promote it on WhatsApp. I also have an Instagram account where I promote my paper cutting art work.

Is your business registered?

Not yet, but I am planning to get it registered. First I will find out the basic requirements to get it registered. My husband is very good at assisting me with these things, so I don’t have to worry.

Household finances

Expenses & Payments

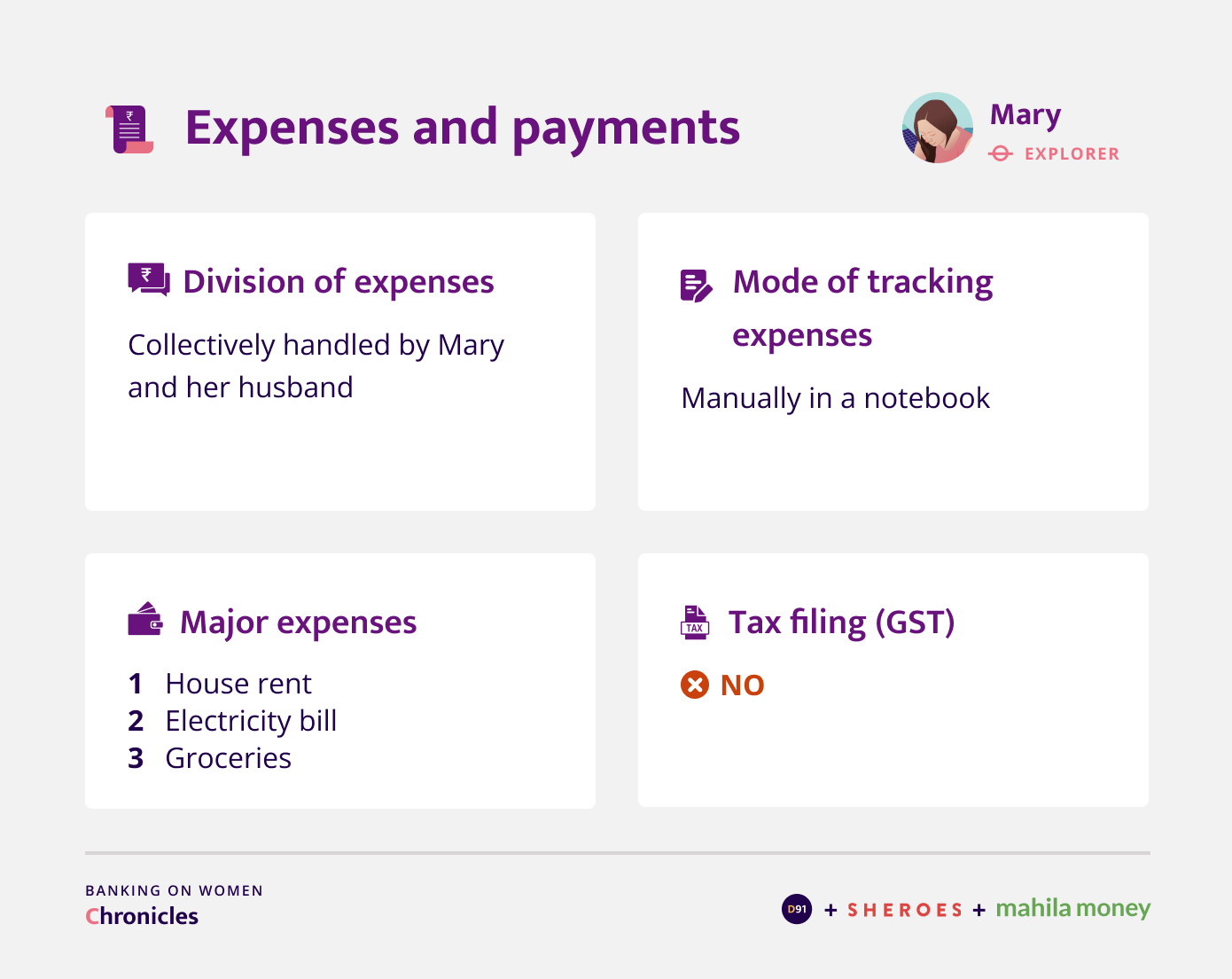

How are the expenses divided between you and your husband?

To be honest, I try to handle as much as I can on my own because I want to be less dependent on my husband.

Banking Habits

Do you prefer to make cash or digital payments?

I do both. Because when I go to purchase, sometimes they don’t have Google Pay or any other UPI payment app, so in those cases I pay in cash. In fact, today I am going to purchase crockery from a wholesaler. So I am going to pay by cash.

Was there any reason that you chose these two banks?

SBI because they have e-corners where you can go and deposit the money and it’s easy to use and I find that very convenient. UBI because my husband’s cousin brother is working there and even the branch manager at that point was a relative, so it was easy for me to open an account and I could skip the long queues.

Did Covid-19 impact your transactions with the bank?

No, here there was some relaxation from time to time and during those hours we could go and purchase what we wanted. During those hours I used to visit the bank.

Financial products & services

Investments

Have you faced any sort of challenges while investing?

Yes, there have been challenges. I used to be confused about where to put my money and that’s when my husband told me that I should read the history of the company first and only then invest. When they went public, their background, etc. This has helped me but I do think I need more information and a better way to invest.

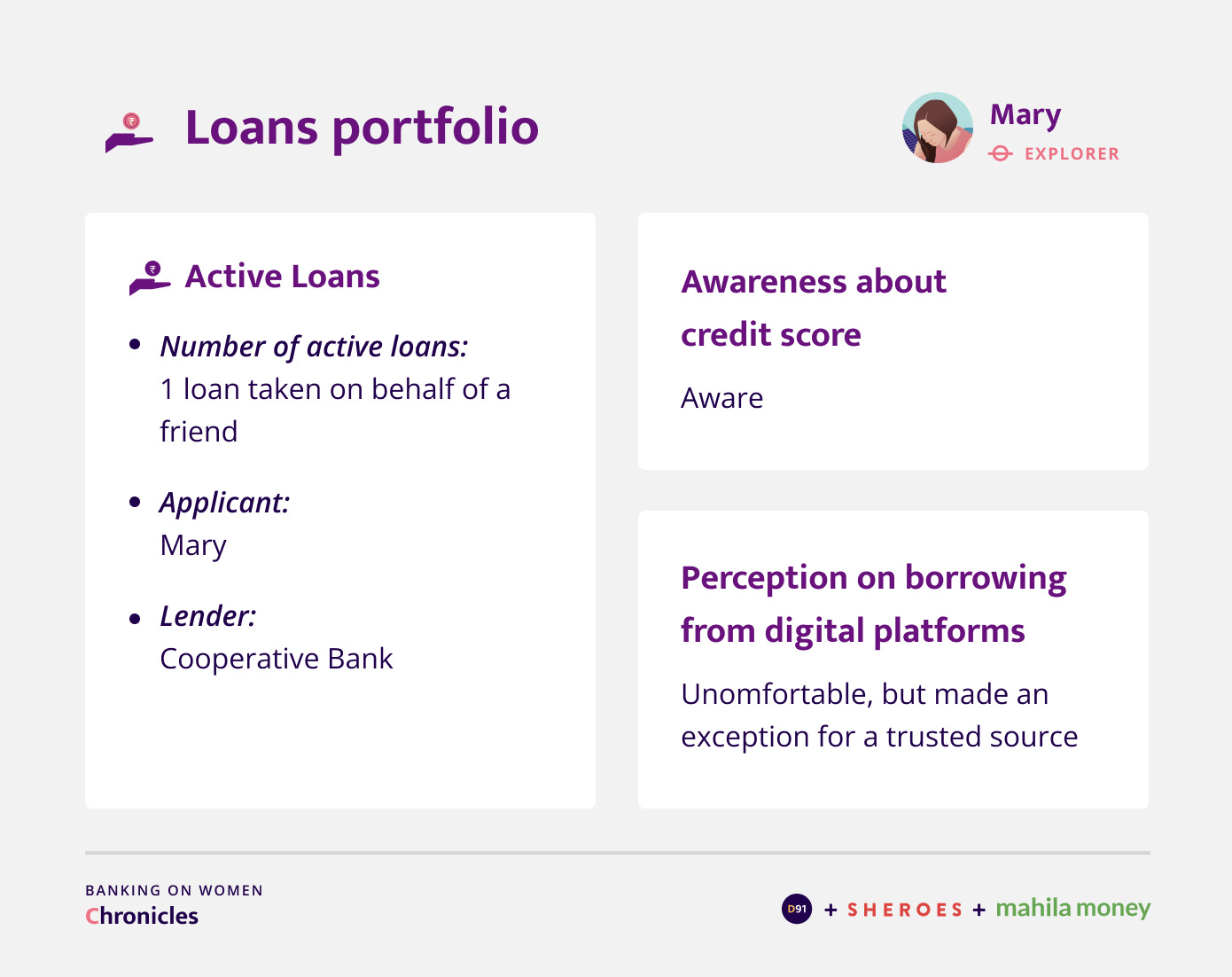

Loans

Have you taken any loans in the past two years?

Not really, I took one loan in my name but it was for my friend for her personal use. But she’s almost done repaying. It was taken in my name because she doesn’t live here and it was difficult to get her documents. So I offered to help and took it in my name.

Any reason you chose this lender?

Because it was a small amount of INR 50,000 I didn’t think too much about which lender to choose. I based the decision on convenience.

Did you need a male guarantor to avail this loan?

No, nothing. For INR 50,000 you don’t need any guarantor

Have you heard of the term credit score?

I have heard about it and I’ve even wanted to check it sometimes but I have found it confusing. If there are any fintech apps that can simplify how to check credit score it’ll be helpful.

Have you considered borrowing from digital platforms?

No. I only trusted SHEROES and Mahila Money because I have known them for a few years. Other apps might have a very high interest rate and I don't know what their lending process will be like. So I am not comfortable even for a very small amount.

Insurance

Do you or your family members have health or life insurance?

No, I was having this conversation with my husband that it’s high time we get one.

Have you all started looking into which insurance to purchase?

No idea about that. I just have what the Government provides here.

Outlook toward the future

In your opinion what is the one financial product or service that will have the most impact in supporting your financial journey?

If there is something that teaches you about accounting and finances it would be great because many of us don’t know these things. These are basics that are important for everyone to know.

Our understanding of Mary’s journey

Speaking to Mary, we saw her adaptable and diverse nature shine through. Her approach is to always self-learn and course-correct where necessary. She has built an arsenal of skills that she hopes to use to expand her business and her financial security in the future with the support of her family. It was extremely interesting to observe her savvy when it comes to understanding the product-market fit for her products. We can imagine her reaching new heights with her uninhibited personality and business acumen!

Hope you enjoyed reading this blog. We at D91 would love to receive your feedback on the work we have been doing so far. Here's a brief survey for us to understand your experience while engaging with our content. This survey should take less than 5 minutes of your time and all responses are anonymous.

You can provide your feedback by clicking on the following link - https://forms.gle/4WUzRUBCht2prHs28

About the Research

This blog is a result of an online interview conducted with the participants’ consent. The interview was conducted in English. This is a part of the Banking on Women chronicles.

Disclaimer: The name and other sensitive personal details in this documentation is masked to honour the privacy of the participant.

Project Partners

SHEROES

The SHEROES Network is a content and community ecosystem enabling access to employment, entrepreneurship, and capital for women. It includes the SHEROES app, SHOPonSHEROES marketplace, Babygogo, Naaree, MARSbySHEROES and has a user base of over 24 million women. The SHEROES Network is committed to increasing women’s contributions to GDP.

Sheroes.com | SHEROES App | Twitter | LinkedIn | Instagram | Facebook

Mahila Money

Mahila Money is a full-stack financial products and services platform for women in India. Mahila Money specializes in offering loans to women who want to set up or grow their own business along with resources and community to achieve their financial goals. Mahila Money can be accessed via the Mahila Money app on Android.

Twitter | LinkedIn | Instagram | Facebook | Website | Play Store App

All artworks are designed by Poorvi Mittal.

If you enjoyed reading this blog and would like to receive more such articles from D91 Labs, please subscribe to our newsletter here.

To read more about our work, visit our website