#15 Dimple | Inspiring hope for rural business women

To be honest, in the initial phase of my journey a lot of people have tried to fool me for the simple reason that I am a woman.

“Somehow I felt that before I encourage other women to do something on their own, I should do that myself and set an example. That’s when I decided to start a business”

Short Story

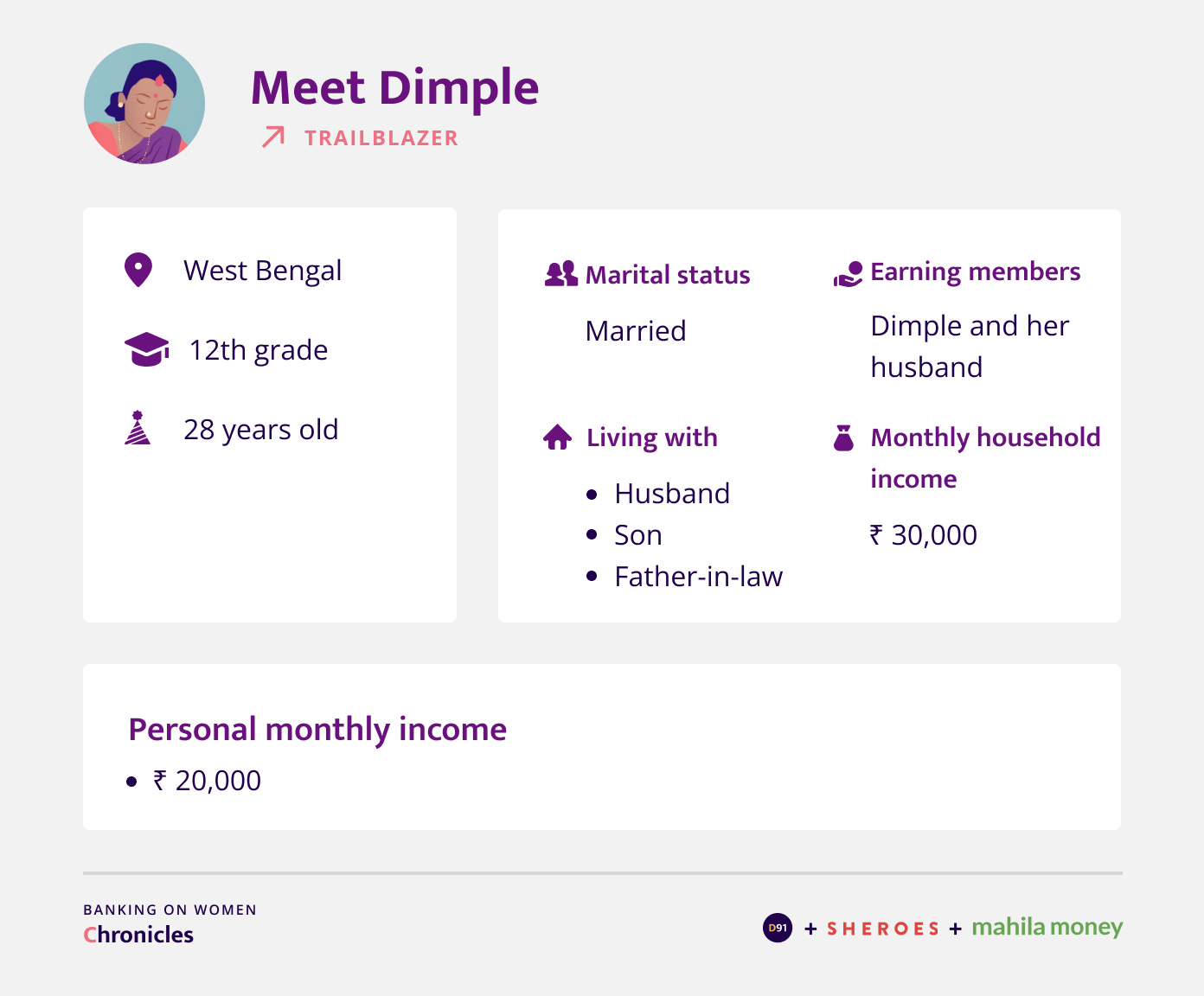

Dimple is a 28-year-old agarbatti (incense stick) factory owner from West Bengal. She lives with her 9-year-old son, husband who runs a decorators business, and father-in-law who is a retired high school teacher. Dimple used the knowledge she gained through digital literacy initiatives to her advantage and set up a successful business despite a lack of support during the initial phases of her entrepreneurial journey. She has also been steadfast in her efforts to empower other women within the village and helped them break the conventions around gender roles and become first generation entrepreneurs.

Personal and financial background

If you are comfortable, can you give us an indication of your current personal income?

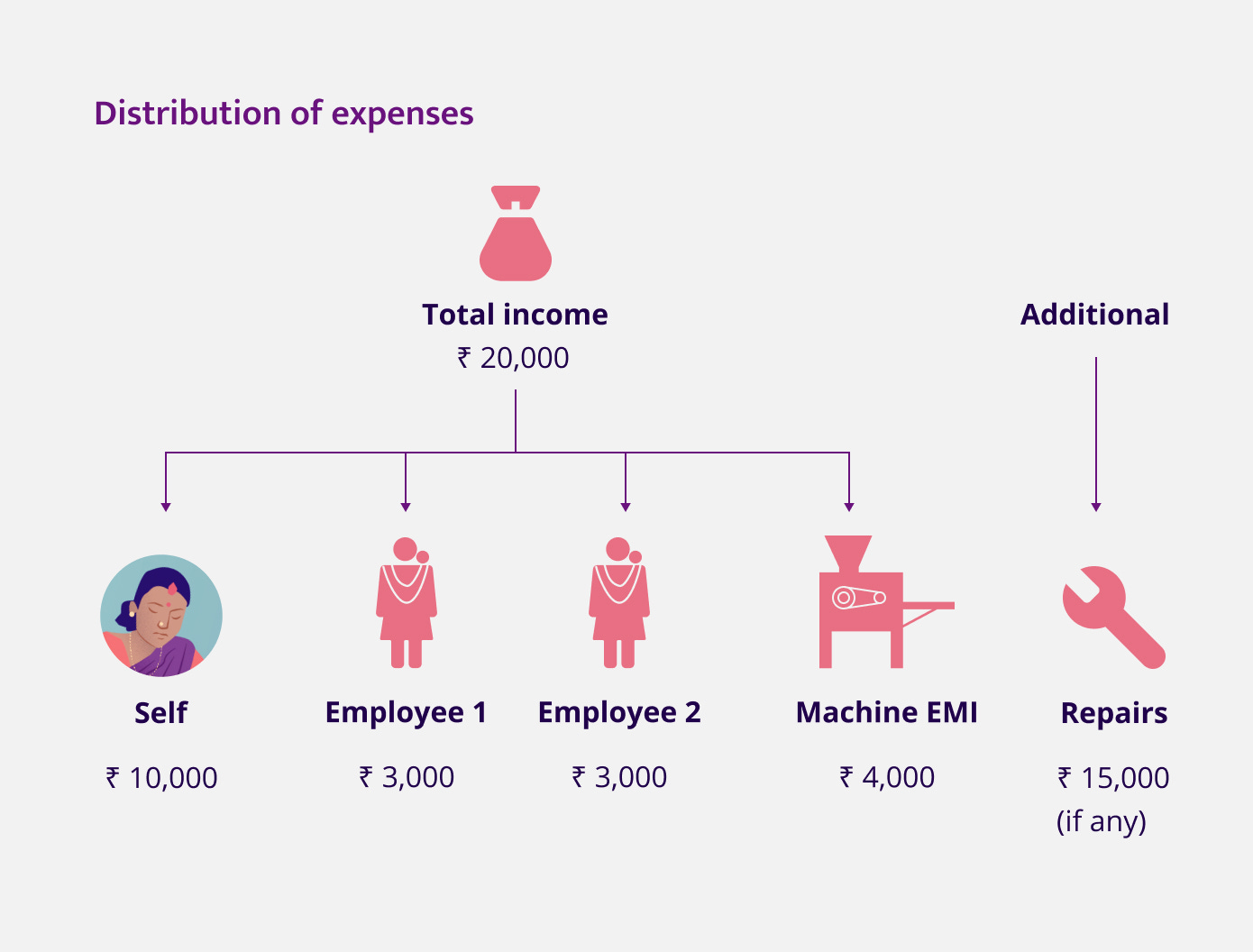

Since it has only been 2 years since I started the business, my earnings are not very high. The income is based on the investment that I make and the more I invest, the more profit I make. In the first year my business went very well but after that things came to a standstill due to the pandemic. However, in the past 5 months or so the business has slowly started to pick up. I earn an income of around INR 20,000 per month. I keep about INR 10,000 for myself and the rest goes in paying the EMI for the agarbatti making machine that I purchased and in paying the two women who work with me. I pay them INR 3,000 every month. Apart from that, if the machine requires any sort of repairs then I’ll have to shell out up to INR 15,000 to get that fixed.

Can you tell us your total household income per month as an estimate?

My father-in-law has retired and he receives a pension. My husband runs a decorators business and though it is a very well established business, in a village all businesses are small scale and there’s no concept of big businesses here. So he makes around INR 10,000 per month. Our combined income is around INR 30,000.

What is your daily routine like?

I wake up at 4 in the morning because my son is currently learning how to sing and play the harmonium and I need to get him ready for that. After that, once I get done with household chores, from 7 am to 9 am I run a school set up from my house by tying up with an NGO. I have been doing this for the past 5 months and I conduct this for 40 students who are in the age group of up to 5 years. So two hours of my day goes into that and once it becomes 9 am, I help with my son’s studies and get on with other kitchen work. In the afternoon, post lunch I commence my agarbatti factory work. Even at night after dinner I do some factory related work. Then I have dinner and go to bed.

What are your educational qualifications?

I have studied up to the higher secondary level (12th grade). But once my son becomes 10 years old, I hope to continue my education. At the moment there’s no one at home to take care of my son apart from me. Even my mother-in-law is not there so it is a problem if I'm not around.

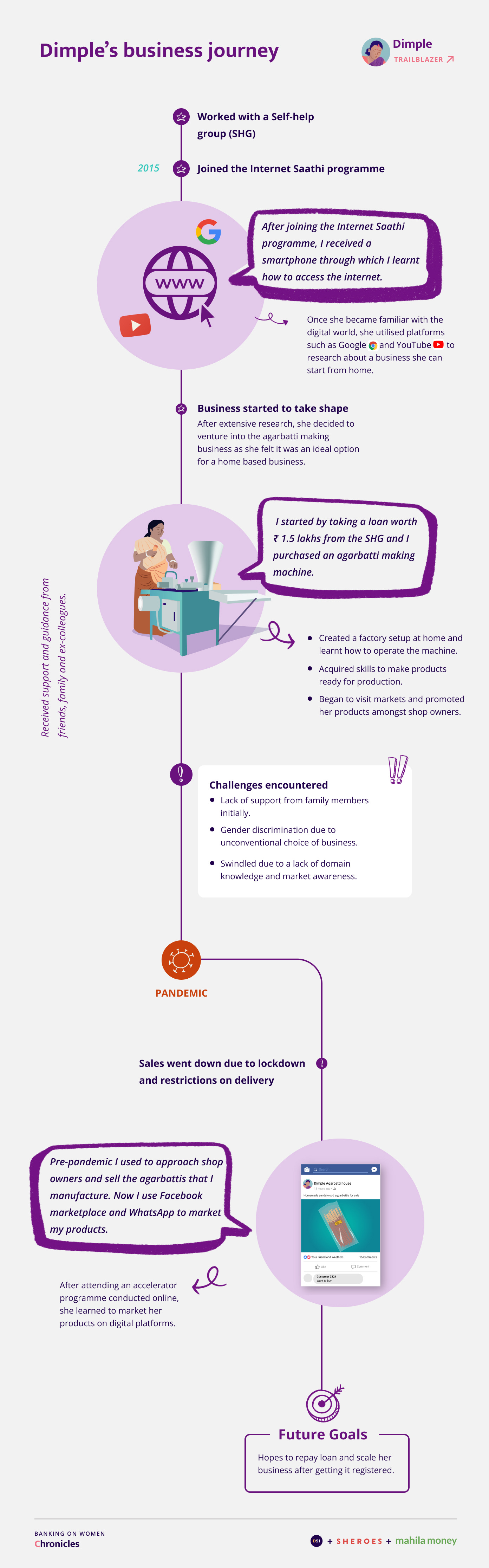

In your own words, can you describe your current work? Have you worked elsewhere in the past, if so can you tell us what it was?

It has been 10 years since I got married. Post marriage I joined a Self Help Group(SHG) which is a group of about 10 women. The women who are a part of a SHG, are eligible for a loan of about INR 1-2 lakhs. Out of this, women usually take around INR 10,000 or 20,000 and start a business that they wish to. The businesses range from sheep farming, chicken farming, vegetable farming, etc. Initially I used to take a loan from the SHG and give the money to my husband to aid his decorators business. In 2015 I joined the Internet Saathi programme which is an initiative to improve digital literacy among women in rural India. In the beginning I didn’t know how to use platforms such as YouTube. But after joining the Internet Saathi programme, I received a smartphone through which I learnt how to access the internet. Once I became familiar with the digital world, I taught 1000 other women in the village how to use the internet. But somehow I felt that before I encourage other women to do something on their own, I should do that myself and set an example. I began to search extensively on Google and YouTube as to what sort of a business I can run from home. Out of everything that I came across, I felt that the agarbatti business is the best option to go ahead with in terms of something I can do while sitting at home, under my own roof, with other women. Initially my husband and father-in-law didn’t support me because they felt that a woman is not well versed with how to run a factory and that I am physically incapable of handling such a huge machine that sometimes even men find difficult to operate. But now that they have seen that I am capable of operating machines, running a successful business and even initiating efforts to expand it, they are very happy about the direction in which I am headed. In and around the village, no woman is running such a business. They’re doing other things such as tailoring, or being a beautician, etc, but no other woman is running a factory and that’s why it took time for my family to warm up to this.

Business Details

Can you tell me about the agarbatti business that you run?

Firstly, I started by taking a loan worth INR 1.5 lakhs from the SHG and I purchased an agarbatti making machine. How I went about this is I told 10 other women within the group that I want to start a business and I urged them to give me their share of money and they agreed to let me take that pool of money from the SHG to start the business. Five months after I bought the machine I realised that I have been scammed and have been charged INR 50,000 extra. Even my husband wasn’t aware of the pricing back then to be able to point this out to me. Though I have recovered that money through my business earnings now, the fact that I had been cheated really bothered me.

How did you finance your business till now?

Through a loan. The interest for the loan that I have taken through the SHG is very high which is why I borrowed from Mahila money as well 3 months ago. If I had received a larger amount it would have been great because I could have repaid my bank EMI like that.

How was your business impacted by Covid-19?

Initially before the pandemic, I used to approach shop owners and sell the agarbattis that I manufacture. Some shop owners used to come to my house as well to procure the agarbattis that I make. However, that was not possible during the lockdown. But things changed after I attended the virtual accelerator program through SHEROES that took place on Zoom. It was for a duration of 6 months and they taught us how to market our products on Facebook, Google Mart and WhatsApp by posting a picture and adding a price. So I now receive online orders and a lot of our products get sold in this manner.

Business Journey

Why did you choose to do this business?

I chose to do this particular business because back then my situation was such that my mother-in-law was not doing well healthwise and my son was only 2 years old. Moreover, my husband and father-in-law were undergoing a lot of problems and at that point of time it was very difficult for me to leave the house for work. That’s when I joined the Internet Saathi programme and realised that businesses can be run from home as well. Out of all the businesses that I was considering, the agarbatti business was one which I could run from home itself. Only initially I had to go to the market to promote my products, but after that vendors themselves used to come to my house to procure my products.

How long did it take for you to set up this business?

First I prepared a room to accommodate this factory setup. After purchasing the agarbatti machine, I approached one of my relatives who has a machine at home and I spent a month learning the specifics of how to use it. Things like how to take out the agarbatti from the machine, how to make the product ready for production, etc. After that I was able to handle things on my own.

Though not initially, did you receive support from your family members later on?

Yes, I receive a lot of support now, but initially my husband used to ask me why I wanted to start a factory instead of sticking to something like tailoring or running a beauty parlour like a lot of other women do. He also said that it’s not child’s play to run a factory and when a lot of highly influential men are finding it difficult to do this, he asked me what makes me think that someone like me who doesn’t even have enough money will be able to run it successfully. But now once he realised my capabilities, he supports me. In fact, both my husband and father-in-law support me immensely now and even help with things like packeting. Since my father-in-law has retired, he has time to help. Even when relatives come home they find this very interesting and they also get excited and begin to help with packeting.

What were some of the pain points that you faced while getting started?

I faced a lot of problems initially. To elaborate, the relative that I mentioned taught me well first but later when my machine started to give me problems and the agarbattis stopped coming out, that’s when she started acting up. I decided to let it go because it was my relative and I didn’t want to ruin the equation from my end. That’s when I decided to consult a mechanic. Initially when I called the mechanic, he used to assume that since I am a woman, I don’t know anything and he used to charge me very high amounts. I assumed that it might cost that much itself, but later I discovered that he has been scamming me. To be honest initially a lot of people have tried to fool me for the simple reason that I am a woman. But now no one can pull such things with me because my awareness about how these things work has increased. Things like market prices, cost of machine spare parts in the bazaar, etc. Initially when I didn’t have too much knowledge, I used to try and check online or ask someone, but with that approach I have incurred a lot of loss. Back then since my husband also didn’t support me he used to be like see I warned you that you will not be able to run a factory and this is a very expensive affair. Those were very challenging times.

Did you have any mentors to help you plan and execute this business?

As I mentioned, my relative taught me everything in the first month, however, when I started to face issues she stopped cooperating and provided no help. That’s when I realised that I can’t run a business like this and I needed to find someone I can rely on all year round whenever I run into issues. So I began to look for someone I can trust and eventually found a person who helps me till date. He is very knowledgeable and he guides me. He has a setup with 50 machines, so I felt that someone who has such a big business will not scam me for amounts as small as INR 5000 and that turned out to be true.

What platforms do you use to market your products?

I use Facebook marketplace and WhatsApp. On WhatsApp I send across pictures of my products to relatives and even small business owners whose phone numbers I have. I also put it on the SHEROES business app and I get a lot of customers through that. People from all over tried to place orders with me during the pandemic, but I was not able to deliver to them because of the restrictions.

Household finances

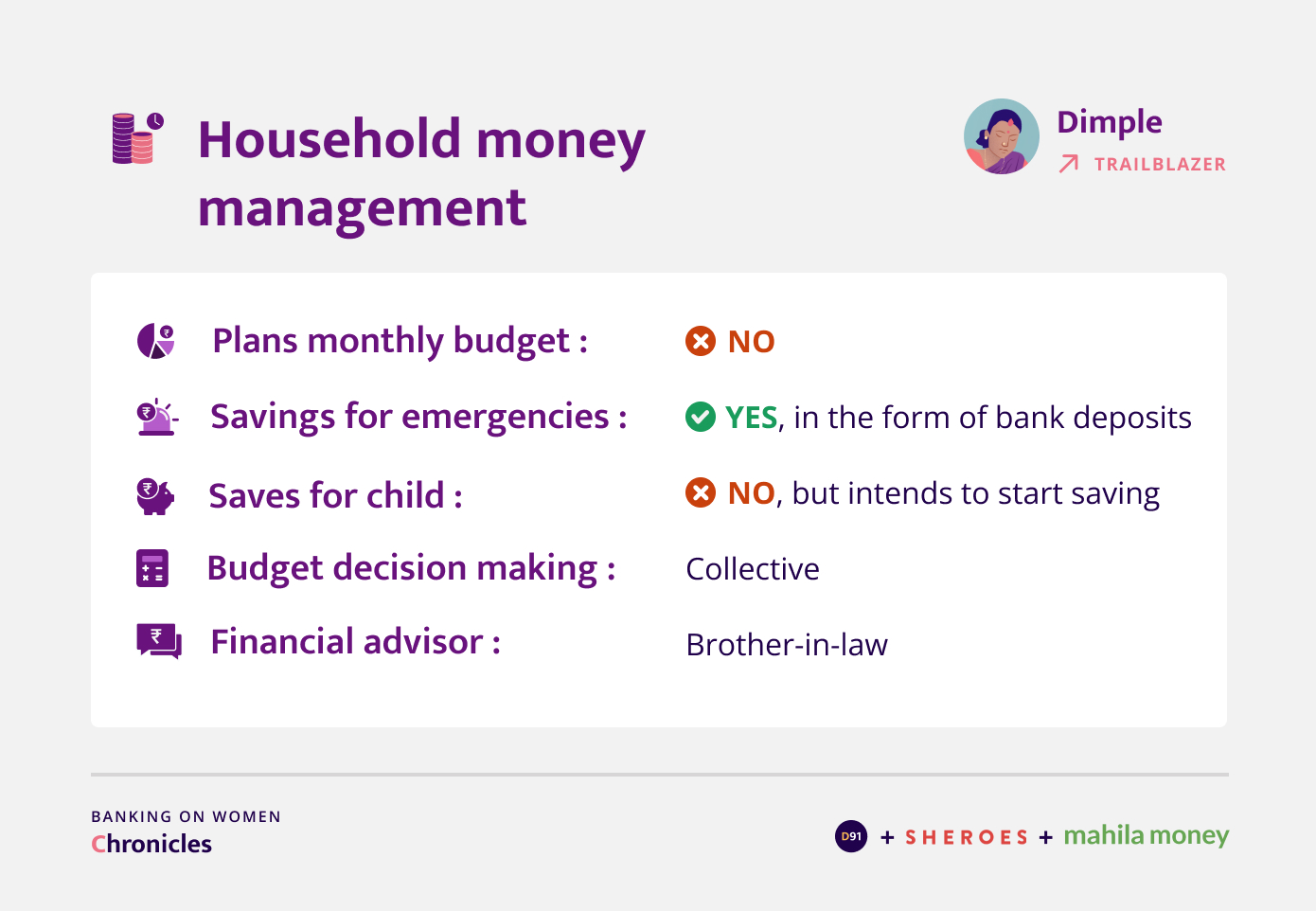

Do you have a monthly household budget?

No, we don't maintain a budget as our expenses are not fixed. We do keep a certain limit and set aside some amount for our son’s education, household expenses and emergencies. For instance, three months ago I underwent a gallbladder surgery so when unexpected expenses like that come up, money goes into that.

Did covid-19 impact the household budget or your expenditure? If yes, then how?

The household expenditure increased, and a lot of changes came about in our income because my husband’s decorators business came to a standstill as no weddings or events were allowed to take place during the pandemic. Due to this my husband has been undergoing a loss for 2 years. Our expenses remained the same but our earnings were significantly lesser. My father-in-law receives his pension which is around INR 15,000 so he helps us run the house.

Expenses and Payments

What are your top 3 categories of expenses?

Our electricity bill is pretty high because my husband runs the decorators business, so the room that decorators use requires the lights to be on throughout the day and night otherwise rats come in and ruin everything. Apart from that the next big expense is my son’s school fees, tuition fees and also the INR 1000 per month for the singing classes, INR 3000 towards the purchase of the harmonium. So in this manner a lot of expenses are there. And since the school is 7 km away, I spend around INR 3000 - 4000 on petrol as I go to drop off my son. So a lot of expenses on my son as well.

Do you remember the first time you used any payment app? Can you tell us more about that experience?

My brother taught me how to use it. It was easy to use and I didn’t face any problems.

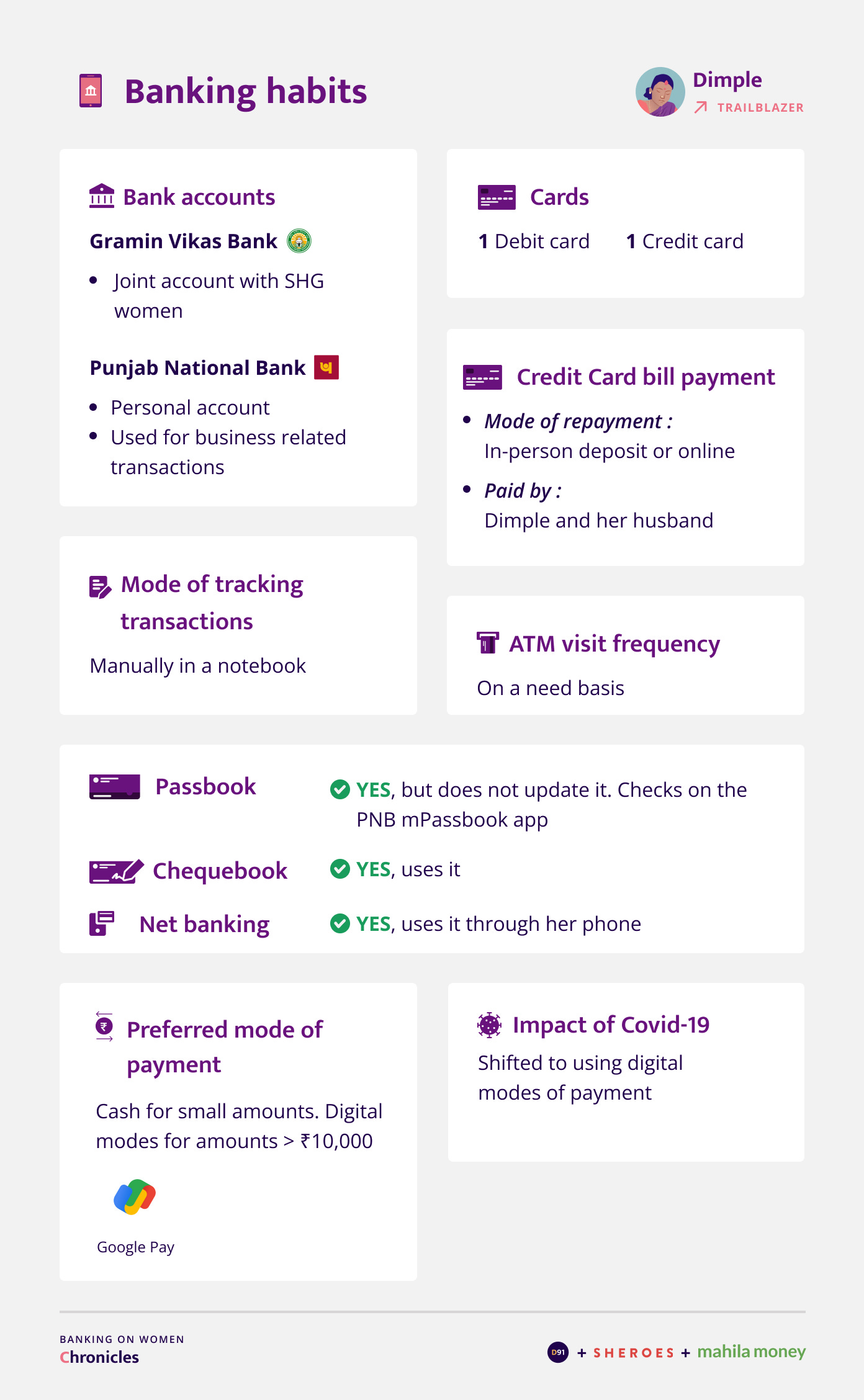

Banking Habits

Any particular reasons why you chose these banks to open an account?

So here there were only two banks, Union Bank of India and Gramin Vikas bank. At Gramin Vikas bank only women part of SHG open accounts. So one is a joint account of 10 women who belong to the SHG and the other PNB one is my personal account which I opened when we were urged to open a personal account during the Internet Saathi programme. They told us that we all need to have a personal account and an ATM card of our own and that’s when I opened a separate account at PNB.

How often do you visit a bank branch?

Once or twice a month. It’s very far, it’s about 7 km away, so I go on my Scooty. Since my husband doesn’t have time to take me, I only go on my own.

Financial products and services

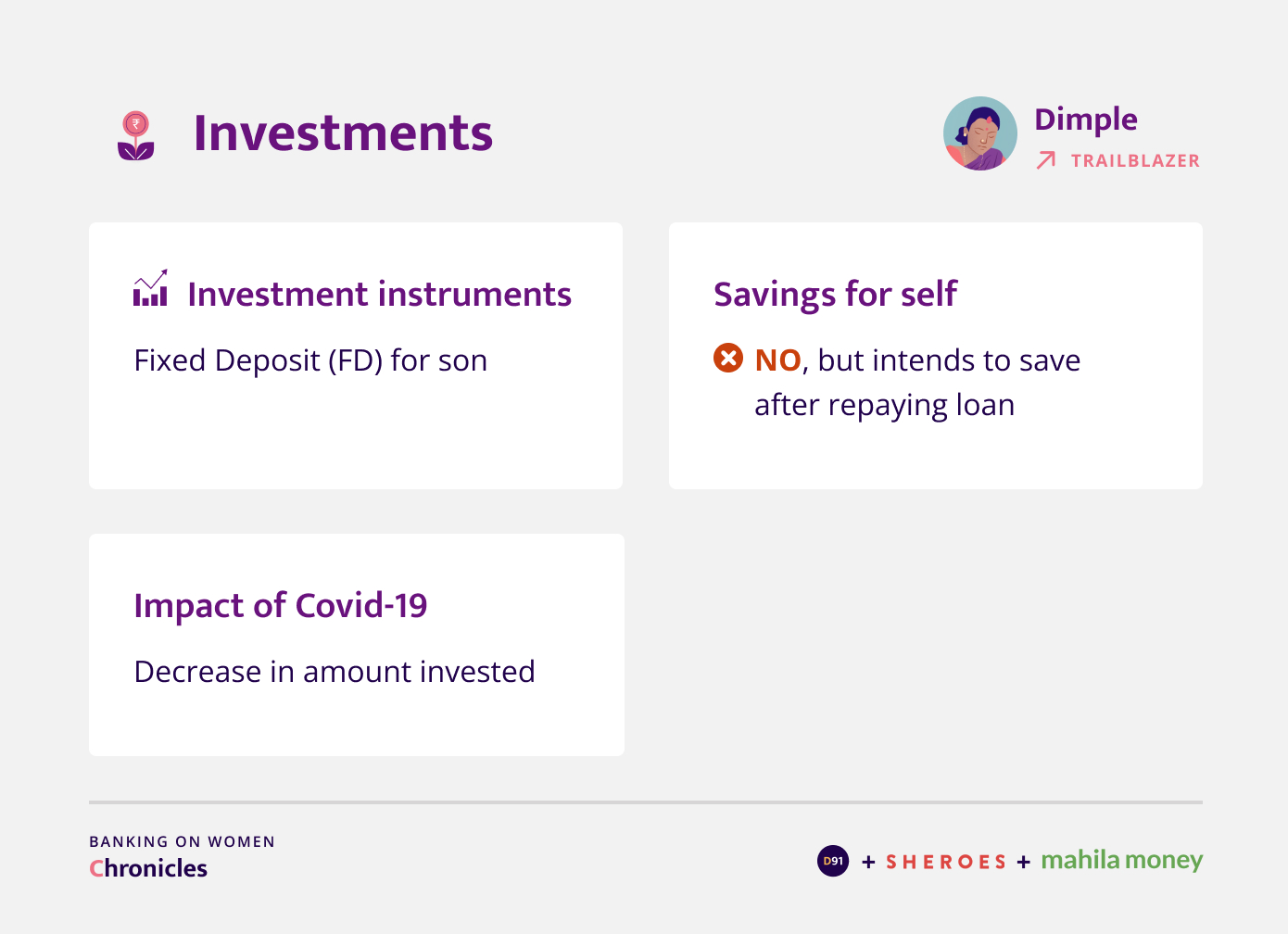

Investments

What percentage of your income is invested?

I don’t have any investments at the moment. Whatever I earn goes into the EMI because I want to finish repaying that as soon as I can.

Do you have any money related worries for the future?

One thing I often think about is that, at the moment, my father-in-law receives his pension, so that really helps us run the household. But a few years down the line when he’s not with us anymore then that income will be absent from the household income. So we need to work on filling that gap of INR 15,000 and both my husband and I should work on contributing towards this to balance the situation. Since my son is growing up, even the expenses required for him will start to increase. Now though he’s only in class 3, the musical instruments that he requires are around INR 50,000 sometimes. So after my father-in-law we only have to cater to those needs. The two of us have to start doing 3 people's share of work.

Have your investments/savings changed post Covid-19? If yes, can you share how?

It has decreased because I am running my business on a loan and even my husband’s business is on a loan. So if we earn INR 10,000 per month, then INR 5000 goes towards household expenses and INR 5000 goes towards the EMI. And the house runs on my father-in-law's pension. But in the future when he’s not there, my husband and I have to be prepared to run the house along with the business.

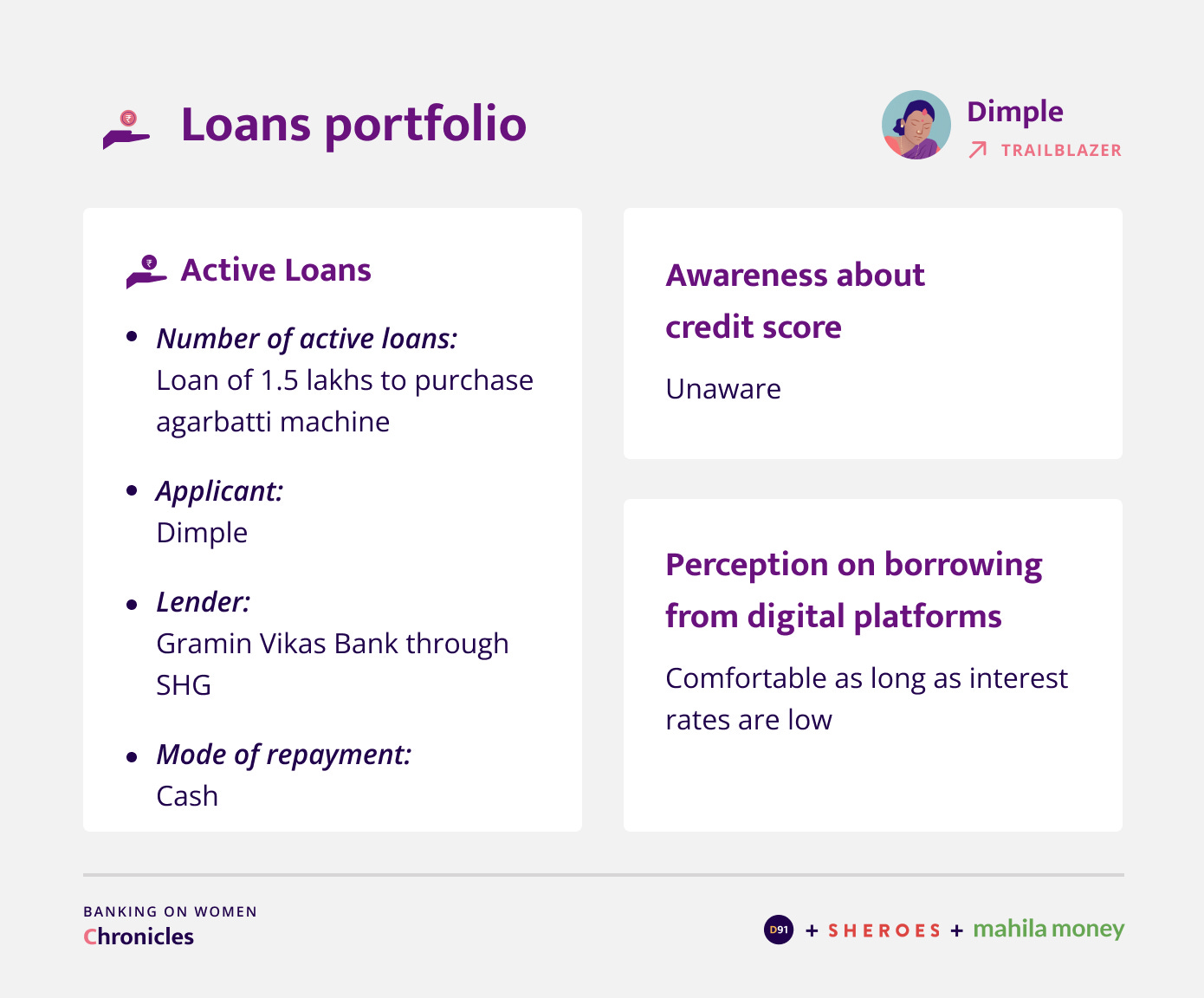

Loans

Why did you choose this lender?

Because this is the easiest way to take a loan. Otherwise to get a loan from banks they ask thousands of questions about what we do and ask for several documents. Whereas for the loan through the SHG, they don’t ask for anything. I just went and told the manager that I want to start a business and I asked for a loan. They immediately agreed and asked me to fill up a form. That’s how SHG loans work. There are many men who get a SHG loan through their wives when they want to start a business because it is less tedious. Though the men themselves repay it, it’s an easy way to avail loans.

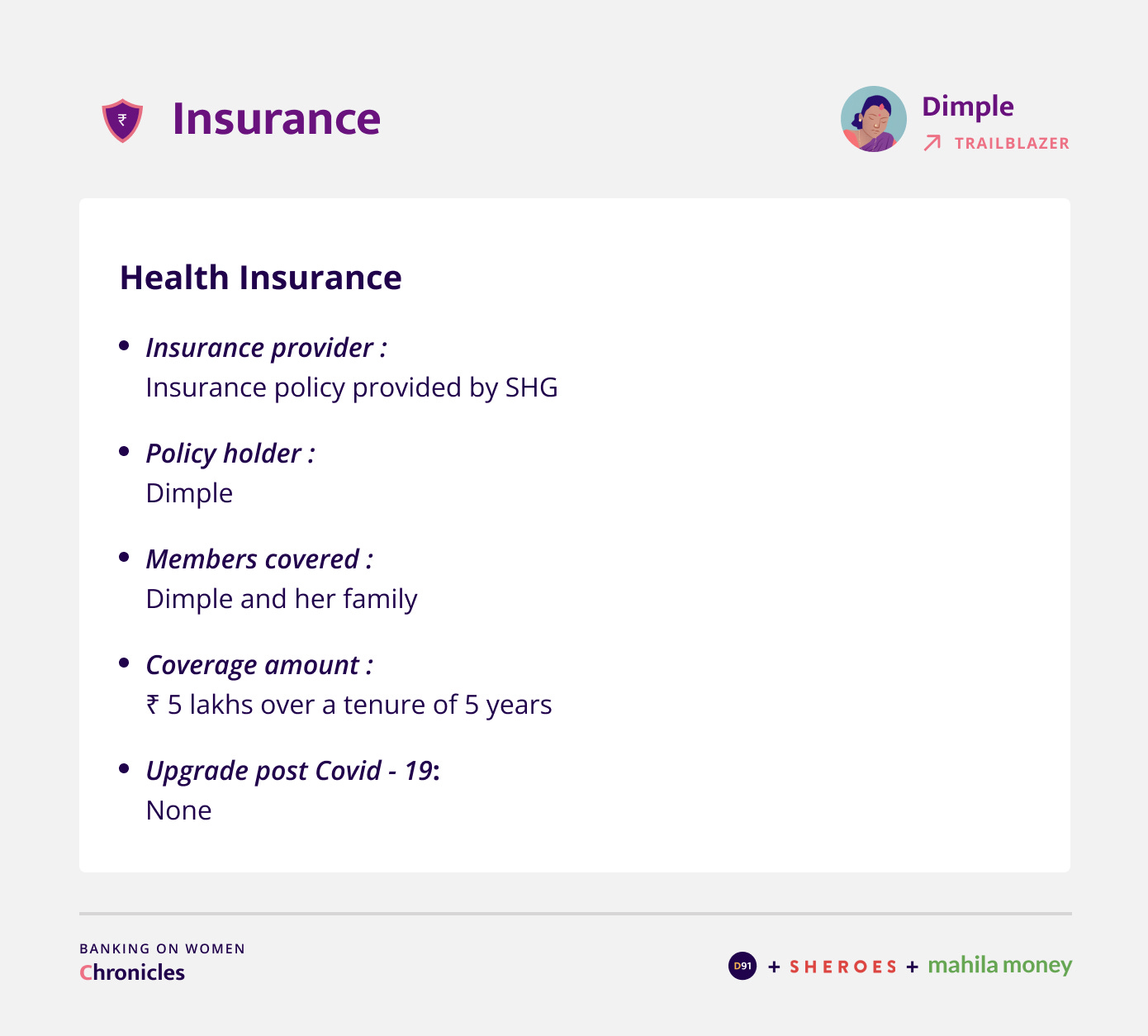

Insurance

Do you or any other family members have any health or life insurance?

Yes, all three of us have health insurance. Women part of a SHG receive an insurance card and if we have to undergo any surgery or anything, then the government pays for a portion of that. Even the gallbladder surgery that I mentioned, costs around INR 50,000, so since I had the card, around INR 38,000 was paid for through the government and the remaining amount I paid from my own pocket. In my card itself my husband, father-in-law and sons name has been entered and they are covered.

Any specific reason you chose this insurance?

Actually all women in the SHG were urged to avail this insurance. Initially mostly women from financially weaker sections used to be a part of the SHGs, but once all these benefits started being offered, there was no difference between the rich and poor. Women from all sections of society have started to join the SHGs because if you’re not a part of an SHG then you won’t get loans easily, you won’t have insurance, etc. After joining the SHG we received a call saying we will be issued a card and they urged us to bring our husbands and other family members so that a photograph can be captured, names entered and a small card was issued. Now even the rich are eagerly waiting for that card.

Do you have to pay a premium for this insurance?

No, there’s no necessity to pay for this

Outlook towards the future

What advice would you like to give aspiring entrepreneurs?

When I reflect about my business journey, I feel I have done things in a hurry, I should have done more research before starting the business to avoid facing problems initially. Without even knowing the market properly I blindly invested INR 1.5 lakhs in a machine. Initially I got a lot of calls through the accelerator program where many people used to call me and say that they really want to start an agarbatti factory like me because they really liked the concept of it. So one advice to all women is that they shouldn’t get trapped in the ways that I did. Even if they want to start then they should ensure availability of finances, availability of a mechanic in the vicinity and have family support, only if all of this is okay they should go ahead and take a step in this direction. Because I struggled a lot for 2 years, but not everyone is capable of undergoing this prolonged struggle and it might become a problem for them. There’s no use making large investments blindly in the beginning. I did things in a hurry but others shouldn’t repeat the same mistake.

Our understanding of Dimple’s journey

In speaking to Dimple we saw how she is a self-determined learner with an objective to pay it forward. Despite an initial lack of acceptance for her chosen path from her family and society at large, she remained committed to her goals and devised a remarkable business model. Dimple even improved the lives of others within her community by bridging the knowledge gap amongst women with recent access to digital technologies. We are certain that her unbridled passion for learning will help her fulfill all the dreams she has set out to achieve for herself and her family.

Hope you enjoyed reading this blog. We at D91 would love to receive your feedback on the work we have been doing so far. Here's a brief survey for us to understand your experience while engaging with our content. This survey should take less than 5 minutes of your time and all responses are anonymous.

You can provide your feedback by clicking on the following link - https://forms.gle/4WUzRUBCht2prHs28

About the Research

This blog is a result of an online interview conducted with the participants’ consent. The interview was conducted in Hindi but has been translated to English in the best possible way to reach a large audience. This is a part of the Banking on Women chronicles.

Disclaimer: The name and other sensitive personal details in this documentation is masked to honour the privacy of the participant.

Project Partners

SHEROES

The SHEROES Network is a content and community ecosystem enabling access to employment, entrepreneurship, and capital for women. It includes the SHEROES app, SHOPonSHEROES marketplace, Babygogo, Naaree, MARSbySHEROES and has a user base of over 24 million women. The SHEROES Network is committed to increasing women’s contributions to GDP.

Sheroes.com | SHEROES App | Twitter | LinkedIn | Instagram | Facebook

Mahila Money

Mahila Money is a full-stack financial products and services platform for women in India. Mahila Money specializes in offering loans to women who want to set up or grow their own business along with resources and community to achieve their financial goals. Mahila Money can be accessed via the Mahila Money app on Android.

Twitter | LinkedIn | Instagram | Facebook | Website | Play Store App

All artworks are designed by Poorvi Mittal.

If you enjoyed reading this blog and would like to receive more such articles from D91 Labs, please subscribe to our newsletter here.

To read more about our work, visit our website