#13 Priya | Tailoring her financial future

Whenever I want to make an investment, I talk to my husband as he is very supportive or even my father-in-law sometimes because according to me male members have a lot of knowledge about these things.

“Even my family members sensed that I felt like something was lacking for me after quitting my corporate job, so everyone supported me when I decided to set up this business and they continue to support me.”

Short Story

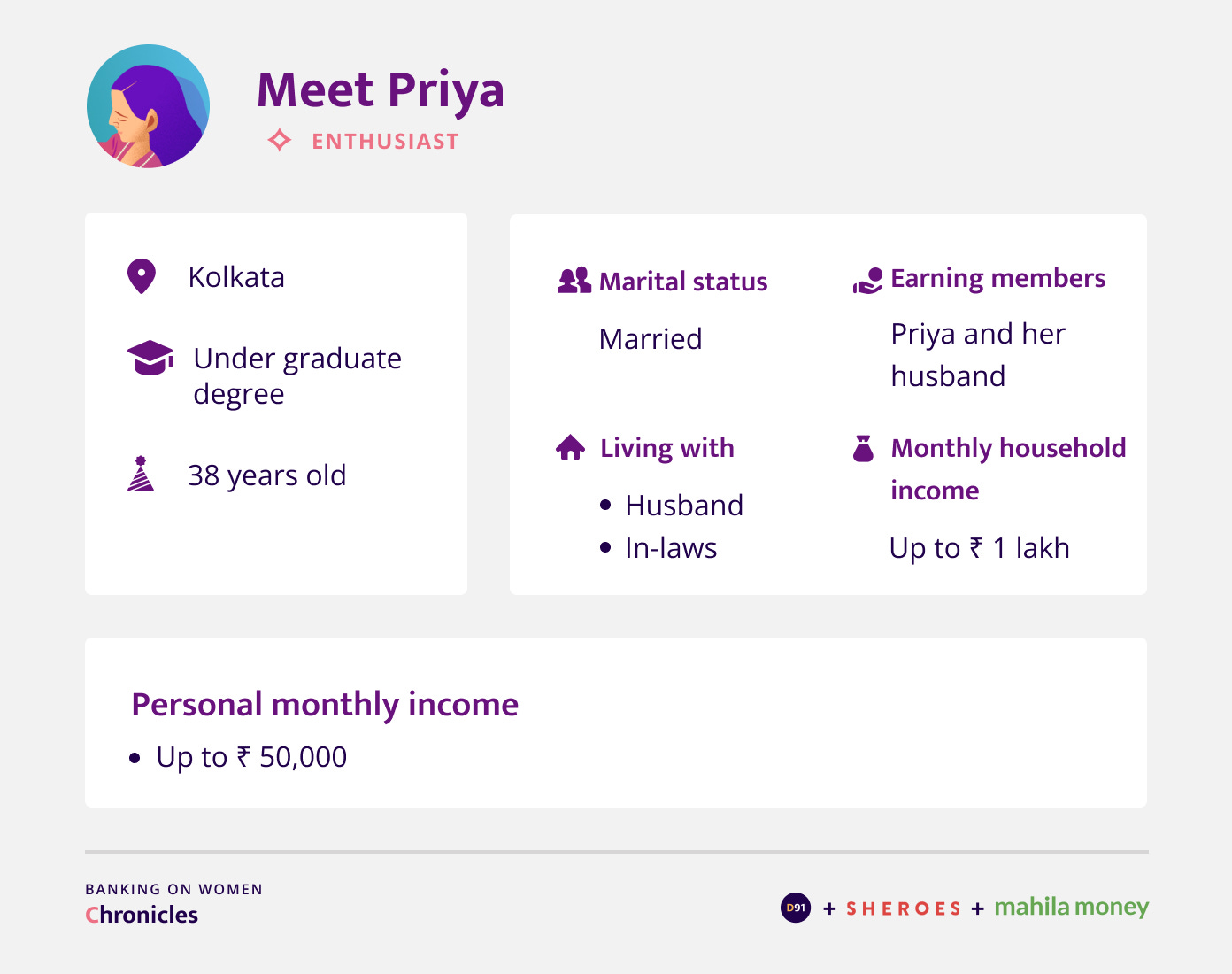

Priya is a 38-year-old fashion designer from Kolkata. After working with a leading global automobile manufacturer for 8 years, she had to quit her corporate job due to a family emergency. Post marriage she decided to follow her passion in fashion design and eventually set up her own women apparel boutique. She has single-handedly built her business from ground zero and managed to expand her customer base overseas as well.

Read on to learn more about how Priya navigated her entrepreneurial and financial journey that has been full of ups and downs.

Personal and financial background

What is your daily routine like?

As is the case for every housewife, doing all the household chores is a significant part of my daily routine. After that I do some planning for the work that I need to do on the SHEROES platform. Apart from this, I have my own business and I ensure that I dedicate some part of my day towards that. I also take online classes for students which used to be in-person classes before the pandemic. My days are pretty much 24x7 busy!

Business Details

Can you describe your business for us?

I have been an entrepreneur for over 12 years! I have been associated with SHEROES for the past 4 years and have been a verified seller under the SHECO partner program for the last 2 years. I am a fashion designer and I curate clothing collections for my boutique which range from wedding garments to regular ladies wear. Before that I had a corporate job for 8 years with a leading global automobile manufacturer.

How much do you spend on your business every month on average?

It actually depends on the income in a strange way because I get orders and then I make the products. So if I want to get an income of around INR 50,000, I will have to buy raw materials accordingly. The raw material costs these days have become very high and the pandemic has reduced business and profits. Before the pandemic I used to have a reasonably good income, but lately it is very low and my investment in the business ends up being more than profit. The business is currently running at a loss.

How did you finance your business?

Whatever income I get from my business, I invest it back into the business. Initially I financed it through my savings, later on I started investing the earnings from my business itself so that my savings don’t get exhausted. I wanted my business to be self-sufficient basically. What I have to invest in ranges from raw material, labour charges and in case we decide to host exhibitions, etc. then I cover the costs for that as well.

Do you have a team that works with you and for your business?

Yes, previously I used to have around 20 to 25 people who worked with me. However, it has now reduced to about 5 people since the rest left us because of the lockdown. Though this is the current situation, I hope to build my business back up in the future.

Any other way that your business has been impacted due to Covid-19?

Since it was a total shutdown for us in the last two years, there were no marriages, even if marriages took place, people preferred to go about it on a minimum budget. So customers who used to invest INR 50,000 to INR 80,000 for a lehenga now decided to opt for dress materials, sarees or outfits worth INR 5,000 or used clothes that were family inheritance as no one wanted to invest unnecessarily for a grand wedding during a pandemic. We were under huge losses for two years, however things have started to pick up now. It will take time to return to the previous state of affairs though.

Business Journey

Why did you choose to do this business?

As I mentioned, I worked a corporate job but after a family emergency I had to quit my job. Eventually after marriage, I thought of doing something that I am really passionate about. That’s when I started my own boutique. It started with design explorations for myself and then slowly I expanded to family members and friends. That’s how it started growing.

How long did it take you to set up this business?

I’d say I'm still in the process because it is an ongoing journey where I am constantly on the lookout for new customers and clients.

But initially when I was starting out, it took about two years to start gaining traction amongst new customers. It started with word of mouth - you know, friends of friends and their family members and it kept growing in that manner. Luckily before the lockdown I was able to export some raw materials and I had clients in Kenya, Fuji and Malaysia!

But after the lockdown that has gone down to zero because of all the restrictions on delivery. So now it feels like I am back to where I started and I am slowly building it up to reach the stage at which it was pre-pandemic.

During these 10-12 years that you built up your business, did you get support from your family?

Yes, of course. I have always received support from my family - my husband, parents and in-laws have supported me throughout. It was because of a family emergency that I had to quit my corporate job. That was a huge change for me after spending years in an office setting and having a regular income. Even my family members sensed that I felt like something was lacking for me after this new change, so everyone supported me when I decided to set up this business and they continue to support me. Of course there are interruptions on some days when as a woman you’re asked to put other things aside and look into household chores first, but again, it’s okay.

What were some of the biggest pain points that you had?

The first challenge was the initial investment. To start anything there is always an initial investment involved, but at that point of time, my family was not in a position to make a very big investment. However, I decided to start with around INR 10,000 and I gradually kept increasing the investment as and when I could. I did consider taking a loan, but again I knew I did not have the income to repay it and since I was just starting out, I did not know how far the business would go and whether it would do well or not. So I made sure I was very deliberate about it. Taking a step that can't be fulfilled by myself might again become a burden for the family and I didn't want my husband, parents or in-laws to worry about my investments into the business. It's my brain child and I wanted to take care of it. So I decided to handle the initial investment on my own even if it was as little as INR 10,000, even that was a big amount for me back then. But I’m glad I took the initiative to start it as I can say I have come a long way today.

Did you have any mentors or any friends who helped you plan and execute this business?

My father guided me through the process and taught me how to invest. Also, since I was a designer, I used to design my clothes even during my college times. I also designed saris for my mother and when she wore those saris to family gatherings, everyone used to compliment her and ask for details about the designer. That gave me encouragement that this might be a good field for me to pursue as people had started to become aware of my work. Though not on a very large scale, it was a good starting point. Under my father’s guidance, I started this business post marriage. Initially, it started with designing for my family and friends, but post marriage, after I quit my job, I brought the business into existence. At that point of time, my husband started guiding me, and I also had some really good friends who used to help with marketing. Some of them were computer and networking specialists, so they guided me as well. But at that point of time social media was not that big, people used to prefer to visit in-person and pick up products. Only around 2012-2015 is when I built an online presence and that gave me a great opportunity to expand abroad.

Is your business registered?

No, I haven't registered my business yet, but I want to. I was looking into this about 2 years ago as I had already started exporting and importing things, but due to the pandemic, things didn’t move forward. I hope to get it registered in the future.

Do you market your products anywhere? If yes, where? Do you use any digital e-commerce platforms or social media platforms to market your products?

Yes, I was a part of Amazon, Flipkart, Snapdeal and Yepme. But there were a lot of processes involved in doing digital marketing on these platforms. Also, on these platforms, you are recognized as an Amazon or Flipkart seller and not as your brand name. I did that for about 4 years, but since I wanted to popularize my brand, I decided to go online on my own, independent of any of these platforms. I have named my brand after my father and I have taken all aspects of going digital in my own hands. Moreover, these days WhatsApp is the best way to market your products for things like connecting with old clients and even new customers. Usually if a customer has chosen a product on my website, they check with me on WhatsApp for additional options and then go ahead with the purchase. So lately, I have found WhatsApp is the best way to interact with customers.

Household finances

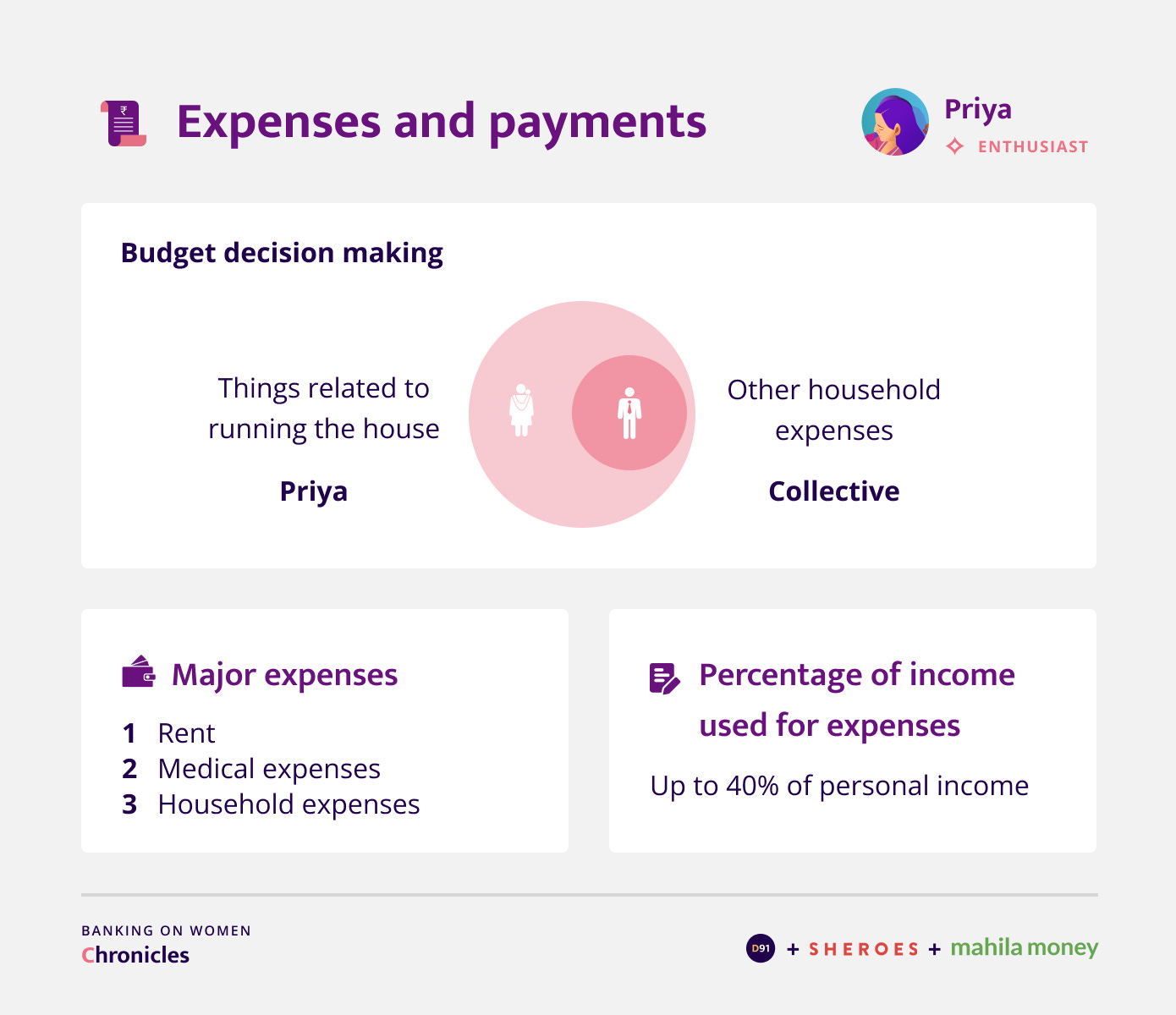

How is the monthly budget decided? Independently or collectively?

If it's things related to the kitchen then I handle it. Even when it comes to festivities I mostly take the decision. But if there are things related to the house that need to be purchased, that's a collective decision.

For utility bills such as gas, my husband and I take turns based on whoever remembers to make the payment. Before the lockdown it was my responsibility to do everything but after the lockdown since everyone is at home, my husband has also started taking care of bill payments because now he has an idea about how things go on in the house in terms of bill payments. The lockdown was that period of time when people got to spend time with their families and it became an understanding. Also, if it’s something related to my business then I am the sole decision maker.

As the beginning of a month is approaching, on the 30th of the previous month we make a list of things we are going to spend on in the upcoming month. I make diary entries for things like gas, electricity, groceries and any such expenses and this is available for all the family members to refer to. Sometimes I also make diary entries for daily expenses in case I go out and buy something and ensure that I mention whatever I have spent on. This makes it easy to keep track of what we are spending on based on the money that is coming in. Even my husband follows this approach to ensure that our expenditure is in alignment with our income.

My father has helped me inculcate this practice. Doing this regularly helps us remain disciplined and set a budget. Moreover, it helps us prioritize purchases better and we forgo certain expenses if it is exceeding our monthly budget and is not a top priority.

Do you save money for yourself?

No, I don’t save only for myself. I do save for my family though. For instance, next month is Diwali so even if I don’t purchase something for myself, I will buy something for my family. So I usually save up for these things so that it doesn’t affect my finances at such times. Even if I don’t have any customers coming in that month and my business is low, that saving will be of use.

Expenses and Payments

Did covid-19 bring any changes to your household’s expenditure?

I have never been that person who spends excessively and I don’t really like to shop a lot. But sometimes I used to do some impulsive buying and that has really stopped after the pandemic. Lately, only if things are absolutely essential, we decide to spend on them. However, in terms of overall expenditure, it hasn’t really decreased. In fact, it did increase a bit but now it seems to have leveled.

Do you use payment apps for your monthly utility bills, rent, fees?

Yes, I do for gas bill payments, but not for house rent because the owner doesn’t accept digital payments. He usually prefers to receive a cheque payment, bank transfer or cash. But the pandemic has definitely pushed people to adopt digital modes as we had to try and reduce contact with surfaces and I have seen more and more people putting up QR codes these days.

Do you remember the first time you used any payment app? Can you tell us more about that experience - how did you set it up?

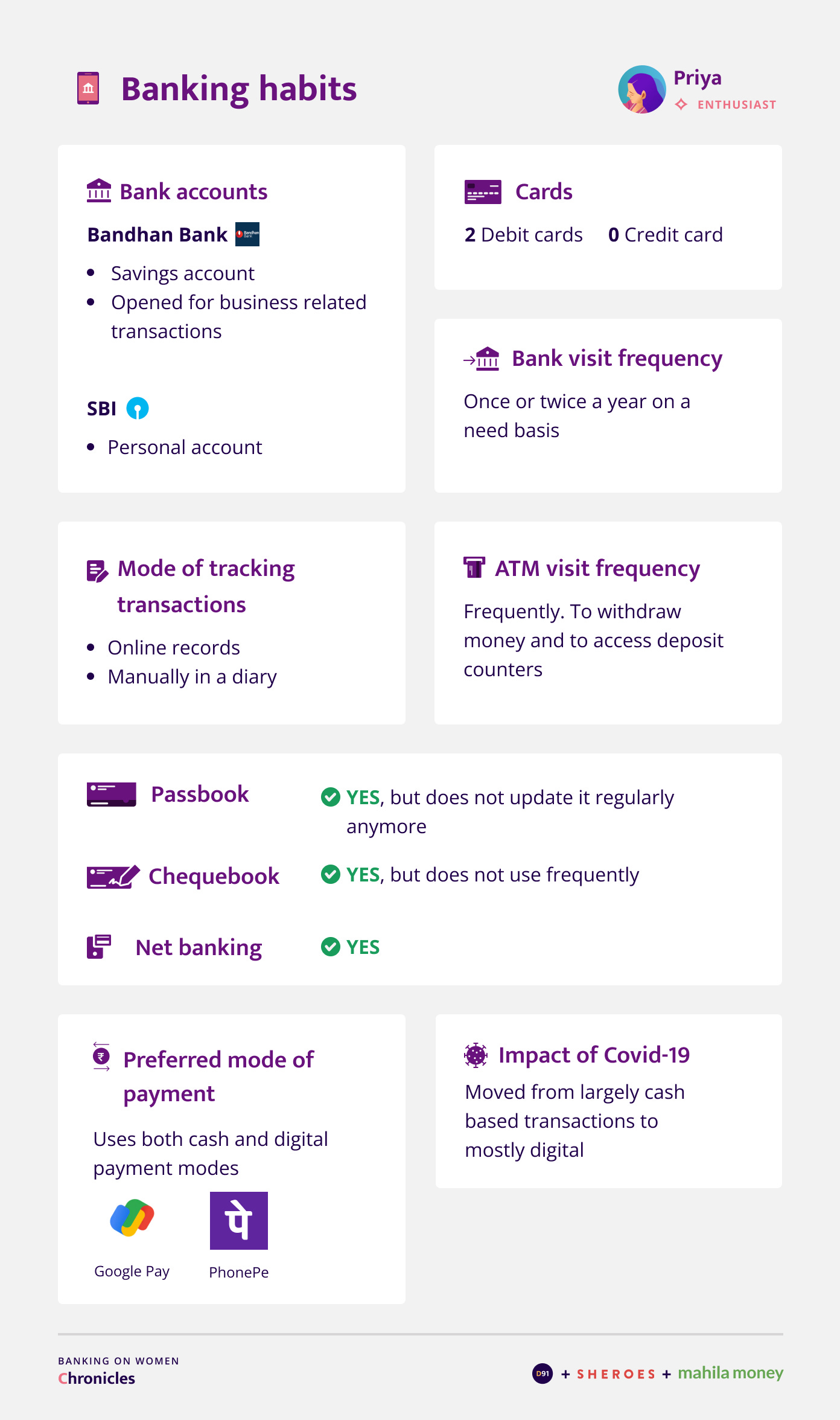

I think my corporate job inculcated the ability in me to learn new tools easily. I taught my family how to use Google Pay and other digital apps. Even till date my husband is not very tech savvy. Though he does work on a laptop and uses various software tools the entire day, when it comes to phone apps he’s still not comfortable. So I usually teach my family how to do things step by step. How I got started was I had a PayPal account around 2008 for the international payments that I receive. They take a large amount as commission though. At that time, there was no Google Pay or PhonePe. Slowly UPI came into the picture and though I am not very tech savvy, I was able to adopt these digital modes fairly easily.

Banking Habits

Is there a reason why you chose Bandhan, and the other bank?

Not that I got any preference in Bandhan bank, I had also enquired in Bank of India (BOI) before that as I was looking to open a current account for my business. But when I approached these banks they said that since the turnover from the business is not very high at the moment, they asked me to open an account in my name first and once the business grows, I can convert it to an account for my business. They suggested this because I don’t have any other income apart from this business, so I decided to take their advice and eventually went ahead with Bandhan bank.

Has covid-19 impacted your transactions with banks?

Yes, to some extent. In fact, one very good thing that has happened is that since we can’t visit banks very regularly these days, they call us to give us updates and also to enquire if there are any issues that we need help with. Additionally, they share helpline numbers to get in touch in case any concerns arise in the future. Before the pandemic we had to visit the bank for any problems that arise such as issues with OTP or a card expiry. But these days it’s easier to get these things done over the phone, so that’s a good thing.

Financial products and services

Investments

What percentage of your money do you invest? Or how much?

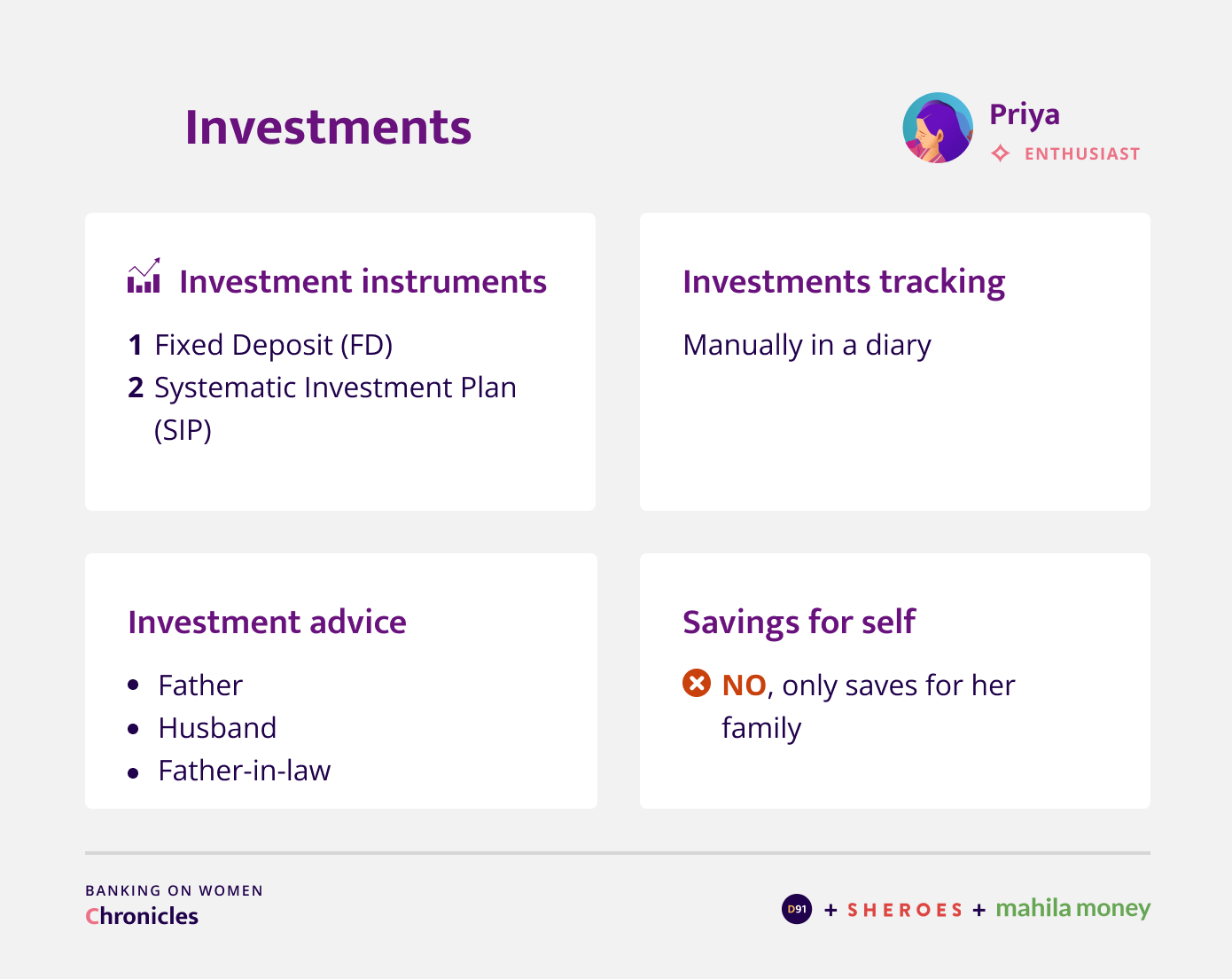

In terms of my business income, I invest about 80% and keep the remaining 20% for myself. Sometimes when I go out, I might come across something that might be useful for my business, I use the remaining 20% on such things. I also invest in FD and SIP.

When did you start your investment journey?

I have had a bank account since I was 13 years old which my father opened for me. My father was always supportive, be it towards my education or towards my financial habits. He also helped me inculcate the habit of savings by making me put my pocket money in the bank account instead of mindlessly spending it. Back then there always was a huge differentiation between men and women, but my parents were very supportive and I am grateful for that. He was often opposed by family members that thought I did not need to be educated because I am a girl. However, I officially started investing in 2006 with an SIP.

What instruments do you invest in?

FD and SIPs. I don’t invest a lot in mutual funds though because I am very new to it. I want to learn how it works as I am very fascinated by it as an instrument and I really want to understand the specifics. I have started with a small amount just to get a hang of it. I also invest in health and life insurance.

Do you invest the same amount every month?

I invest in the range of INR 1000-5000 in an SIP. Lately it has been INR 1000, but pre-pandemic when my financial situation was better, I used to deposit INR 5000 per month and even upto INR 10,000 sometimes. But now it has reduced.

Who do you turn to for investment advice?

When my father was there, he used to guide me. I started investing in 2006 during my first job. I invested in an SIP on my father’s suggestion and he encouraged me to start with small amounts first rather than jumping into large investments. The great thing about investing is that even if you put INR 500 today, then in about three years time, you’ll get an amount that is quite significant when compared to what you initially started with. These days whenever I want to make an investment, I talk to my husband as he is very supportive or even my father-in-law sometimes because male members have a lot of knowledge about these things. Though my father-in-law is not very comfortable talking to me about money, he still guides me and provides valuable advice.

If hypothetically you need some money for an emergency, then how would you approach it financially?

There was an incident that took place that helped me learn the importance of saving for emergencies. To elaborate, two months after marriage, my husband met with a very big accident and at that time my husband didn’t have any insurance. But we were somehow able to manage as luckily my father had opened a Fixed Deposit (FD) for me that I could turn to. After this incident, I invested in insurance because I realised that some things in life are unexpected and happen very suddenly. Of course we cannot be fully prepared for adversities but insurance definitely helps to some extent. I had also opened two or three FDs when I had a corporate job. Though I used to invest very small amounts, in about 5-6 years that FD had grown, so that helped me deal with the situation better.

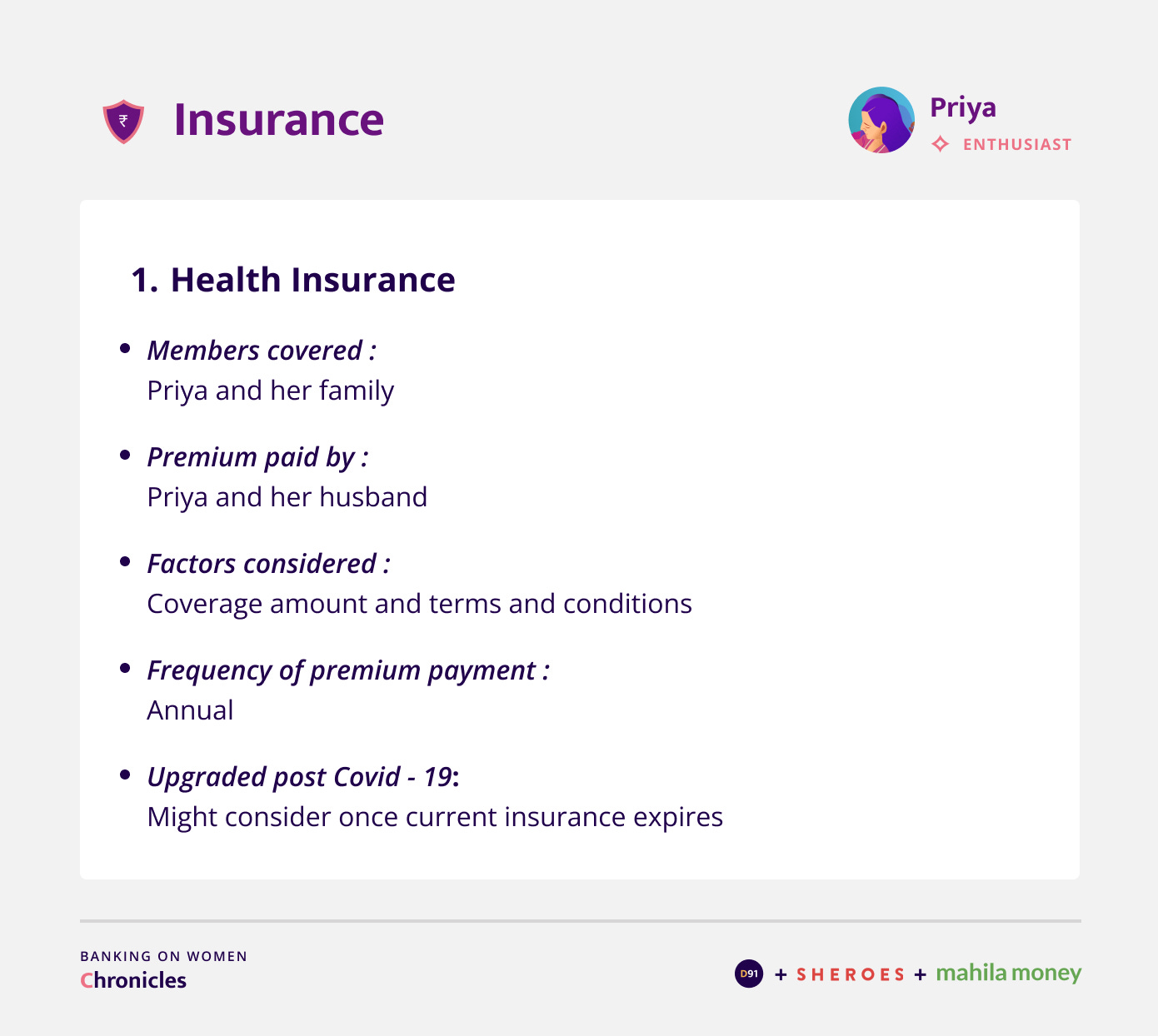

Insurance

When it comes to insurance, was it that event that showed you the importance of insurance in life and led you to start investing in it or did you have insurance before that as well?

Actually I had insurance before since the company I worked at provided it. In fact, It was mandatory and was valid for 10 years, so it was ongoing even after marriage. It was personal insurance though and my husband was not covered under mine. My in-laws had invested in insurance for my husband but they hadn’t renewed it. My father had bought life insurance as well for me. But after my husband’s accident, I made sure that he invested in insurance and encouraged my in-laws to get one as well.

When you buy insurance, what are the factors that you consider?

In terms of health insurance, firstly we consider what the coverage amount is and what the benefits are based on the terms and conditions in case something happens to us. It is important for us to ensure that we get the most out of it, it doesn’t matter if it is a monetary compensation or not but it should be beneficial to us. If something like what happened in the past were to happen to us, not only us, if any family happens to be in a situation like that, then making sure that the person insured is eligible for all the benefits is essential because sometimes it so happens that despite all the merits specified, when you get admitted in the hospital and try to claim insurance, they might say that we are not eligible for it as what we are asking for is covered under a different category of the insurance that we haven’t opted for. So it is important to clarify all this before we sign up. Also condition specific benefits such as if you have a heart patient or cancer patient at home, considering what specific things they will need when they are getting treated is of paramount importance. Otherwise ultimately you will end up paying from your own pocket. After paying the premium for so many years with no advantage in the end, what’s the point?

Outlook towards the future

In your opinion what is that one financial product or service that will have the most impact in supporting your financial journey?

I wish there was more support for women in terms of funding. These days most housewives are really talented, passionate and are capable of doing great things. Not only housewives, but people in general. But they are not able to move forward with things due to a lack of funding. So I wish there was something apart from a loan to help these women and men. Especially after the pandemic, such access to funds has become the need of the hour for every person who is the sole breadwinner of the family. For example, if a person is a carpenter, even if he doesn’t have a store, he has the skill, capability and is mission-driven, but he lacks funding to grow his business further. Even if such a person approaches the bank, he might get rejected because he has to show some proof of funding to get his loan approved. So I really hope that in the future, some institution, be it a bank, fintech organization or any initiative, recognizes their passion and helps them grow. That will be really helpful.

Our understanding of Priya’s journey

Our conversation with Priya threw light upon the struggles of a first generation entrepreneur and how she skillfully overcame obstacles and steered her business towards steady growth. She is extremely practical in her approach to dealing with financial hiccups be it professionally or personally. Priya is ever willing to course correct and relies on her past experiences to take realistic decisions about herself and her family’s future which is incredibly encouraging.

Hope you enjoyed reading this blog. We at D91 would love to receive your feedback on the work we have been doing so far. Here's a brief survey for us to understand your experience while engaging with our content. This survey should take less than 5 minutes of your time and all responses are anonymous.

You can provide your feedback by clicking on the following link - https://forms.gle/4WUzRUBCht2prHs28

About the Research

This blog is a result of an online interview conducted with the participants’ consent. The interview was conducted in English. This is a part of the Banking on Women chronicles.

Disclaimer: The name and other sensitive personal details in this documentation is masked to honour the privacy of the participant.

PROJECT PARTNERS

SHEROES

The SHEROES Network is a content and community ecosystem enabling access to employment, entrepreneurship, and capital for women. It includes the SHEROES app, SHOPonSHEROES marketplace, Babygogo, Naaree, MARSbySHEROES and has a user base of over 24 million women. The SHEROES Network is committed to increasing women’s contributions to GDP.

Sheroes.com | SHEROES App | Twitter | LinkedIn | Instagram | Facebook

Mahila Money

Mahila Money is a full-stack financial products and services platform for women in India. Mahila Money specializes in offering loans to women who want to set up or grow their own business along with resources and community to achieve their financial goals. Mahila Money can be accessed via the Mahila Money app on Android.

Twitter | LinkedIn | Instagram | Facebook | Website | Play Store App

All artworks are designed by Poorvi Mittal.

If you enjoyed reading this blog and would like to receive more such articles from D91 Labs, please subscribe to our newsletter here.

To read more about our work, visit our website