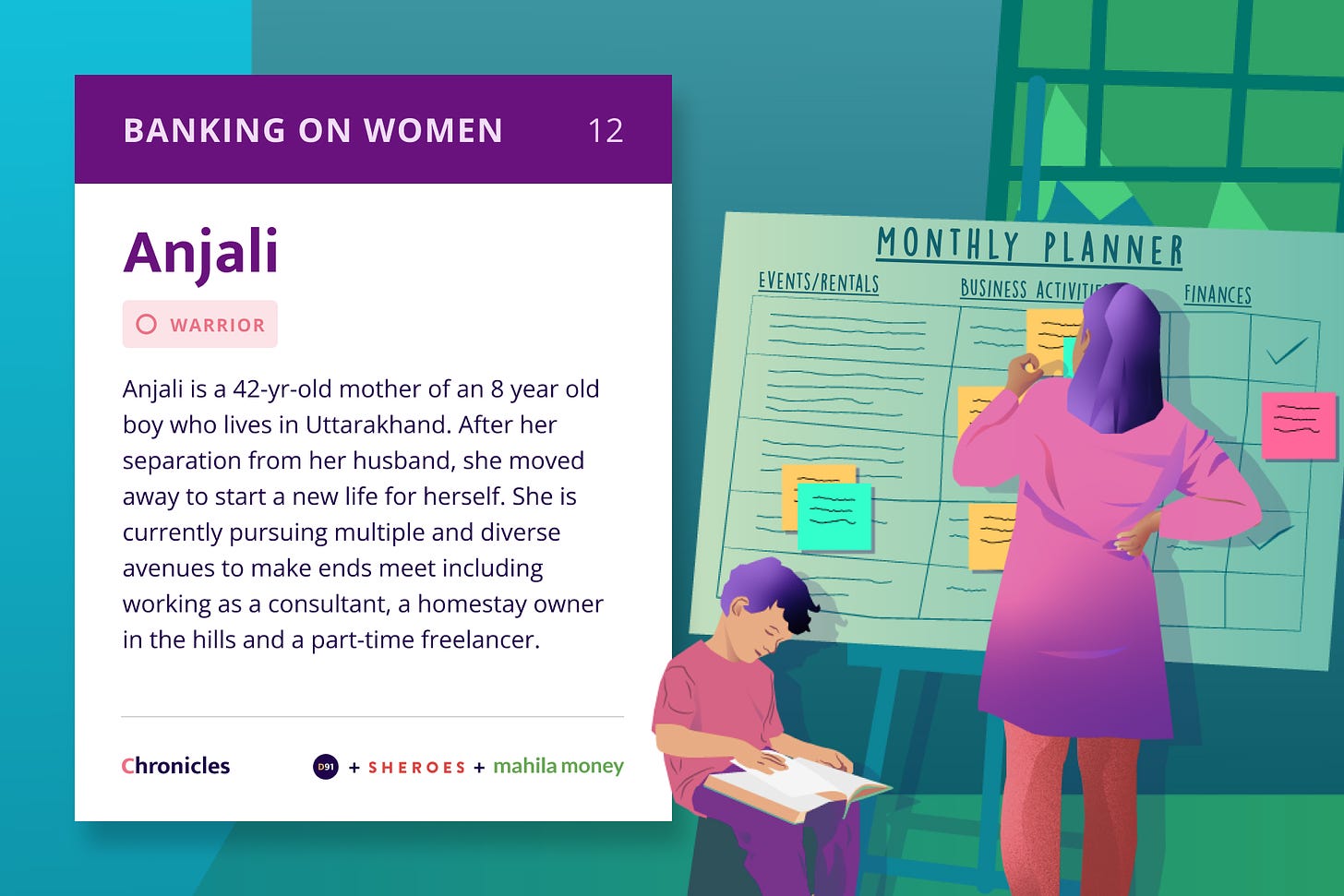

#12 Anjali | Coping with a chequered life

The general financial advice anybody would give you is to have six months worth of your salary in liquid cash, but that is not the case for me.

“If I don't save, I can't sleep so most of the money I save and whatever is left after saving is something that I like to spend.”

Short Story

Anjali is a 42-yr-old mother of an 8 year old boy who lives in Uttarakhand. After her separation from her husband, she moved away to start a new life for herself. She is currently pursuing multiple and diverse avenues to make ends meet including working as a consultant, a homestay owner in the hills, and a part-time freelancer. She hopes to continue working towards stabilizing her financial life while building a great place for her son to grow up.

Read on to know more about her inspiring story!

Personal and financial background

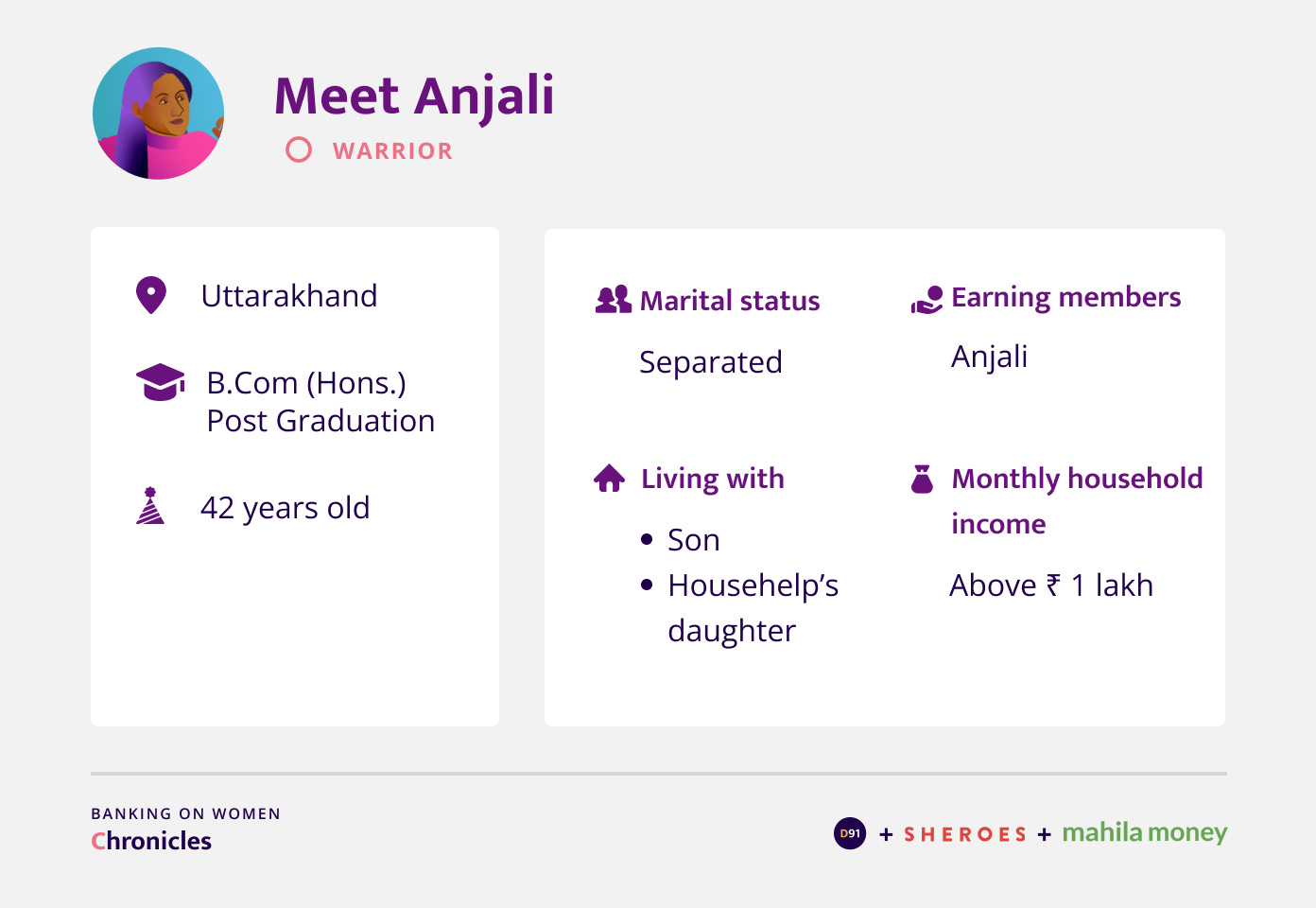

Where do you currently live?

That's a very exciting question for me to answer and for others to hear. I live in Uttarakhand. I chose to be here because I didn't want to be in Mumbai where I have lived all my life. I moved here a few years ago and I am enjoying living in the hills to the fullest.

How many people do you live with currently?

I live with three people. My son and I also live with my house help’s daughter who I take care of and sponsor.

If you're comfortable do you mind giving me an indication of your current personal income?

I am currently a MARS by SHEROES partner from which I earn a nominal income. However, from time to time, I take up some freelance work. So, my yearly income would be in the range of INR 20 Lakhs.

Can you tell me about your educational qualifications and the work that you've been doing up till now?

I graduated with a B.Com (Hons.) and then I did my post graduation in Personnel Management and Industrial Relations. I worked in Human Resources until 2008 when I left to start my own company which was a recruitment consultancy. Also, I am a trained gemologist and a diamond trader, so I ventured into this business after. Soon I started working with a premier members organisation, managing the Mumbai chapter. After that I was going through some personal issues at home and wanted to leave Mumbai. I then moved here to the mountains and I connected with SHEROES, a networking platform for women. I started doing freelance projects with SHEROES after that. I am also a consultant for very high-profile events as and when they come up. Along with this I run a homestay where I live.

Business Details

Can you tell me a little bit more about the work that you are doing right now?

I am currently doing a project with SHEROES. I am continuing to consult on events from time to time and for the last 3 years I have also been running a homestay.

My project with SHEROES is with a logistics company. I am working as a client experience consultant and I handle aspects related to data analysis and other such backend work. Since the other engagements that I do require me to talk so much and be in the front line, I like to be at the backend in this job. There are so many interactions happening in the other work that I do so a little backend and less interaction keeps my sanity in place.

In terms of events, though it is usually one event in a year, it gives me a good income. However, there have been times when there have been no events and therefore no income on that front.

To be honest, the homestay that I run does not need too much of my involvement because my caretaker manages it. To give you a better sense of the arrangement, I live on level zero and the rooms that I offer to tourists and other people who want to rent it out are on level 1 so there’s not too much interference in my living space.

How much do you spend on this business on average?

I don’t have to spend anything on the events business because I am an independent consultant and all my travel and other needs are taken care of by the host organization. The spending happens in terms of taking care of the property I currently live at since I sublet two rooms that are a part of my house as a homestay. Things like caretaker fees, electricity, food for guests, etc.

What are the general modes through which you finance your business? Present and past?

I haven’t taken a bank loan for the business yet, it has been primarily financed by my savings and help from family and friends which is of course an interest free way of borrowing money and I return it as and when I can repay them. Apart from that nothing else.

How was your business impacted during Covid-19?

During the pandemic, we had zero revenue. It has picked up a little now, but it is still 15 - 20% of what it used to be. Tourism is also a very seasonal business where there is higher demand during the holidays or occasions such as the New Year, etc. So we basically bank on those times to maximize our revenue.

When you started down this path three years ago, did you get support from your friends and your family?

Certainly, though my family and my parents were against it, I'm usually known for doing things my way and at the age of 39 I did not want to go back to my parents and be dependent on them. I had to make a living for myself and I wanted to call my own shots, so that has given me a lot of courage. Of course I was scared earlier, didn't know what to do and which direction my life was heading in. But I genuinely believe as I move forward that there is a supreme power that keeps supporting me and telling me that I’m on the right path. In any event, I think I got a lot of support from my friends as I was trying to set up my homestay business and my new life here.

So what were some of your challenges when you were starting out here and setting up your businesses?

I moved out to the hills after my separation. So when starting out afresh so far away from the lifestyle I am used to, most things were an issue - financials, living in the wilderness, the basics of any business really. When you live in a remote location, things like power cuts even in winters are the norm and you need to readjust to this new way of life. Moreover, I think when you set up something like a homestay in a place this remote you have to consider the ramifications on the environment. Sustainability is very important to me and the endeavour was to source and use materials that either come from the earth or will not pollute the earth when disposed off.

Do you market yourself or the homestay on any platforms?

I did go on to some of these portals, but because of the tough competition on them, I think for me the best marketing strategy that has gotten results has been word of mouth. This takes time as it has to be organic and cannot be rushed, but it helps because only like minded people come to stay with us. The homestay is an extension of my home and I would only like to welcome people that understand and value our ecosystem. I guess that does impact business a little, but I strongly believe that because of this if my place is open only for a few days in a month, I am fine with it as long as I know that I'm working the right way.

What are your future plans in terms of scaling this business?

What I'm trying to look at is probably maybe setting up a cafe kind of thing because there are not too many places where I can take my son to have dinner with me. That's where I see a complete lag. Sometimes in a tourist spot, alcohol intake is very high. People who come from the plains to the mountains think that this is what they're here for and sometimes they forget that there is an adult with a child in front of them and how sensitive you should be. So my next project probably would be to set up a cafe here, which is open for parents, families and kids. Where kids can be unrestricted and not think that they need to stay away because somebody is smoking or drinking there. I want to create that kind of a vibe at my place and that's one of the projects that I could probably be looking at.

So you shared about the homestay business, but with respect to your other endeavors are there any specific ways that you consider formalizing or expanding any of your other projects?

SHEROES related work is on project by project basis and there is no real scaling there. But, no. I haven't thought of scaling up for my event management business because it is very time consuming and I only work with a few people. They understand me and I understand them and I'm not dependent on any workforce for that matter. I do not want to take on too much of a load. I want to enjoy the beauty that life has to offer. And for me, you know going for my walk is something that I will not compromise for any work, obviously sometimes I make exceptions, but then if I have to do this every day, I'd be very disappointed. That is in fact one of the reasons that I left city life behind. I had a very high income in a high-profile job but I left it to be where I am. Obviously I need to sustain myself so I picked up these projects and some past earnings helped me sail through, but I did not want to join the rat race. My life is different, I have created that for myself and I would want to pursue it as is.

Household finances

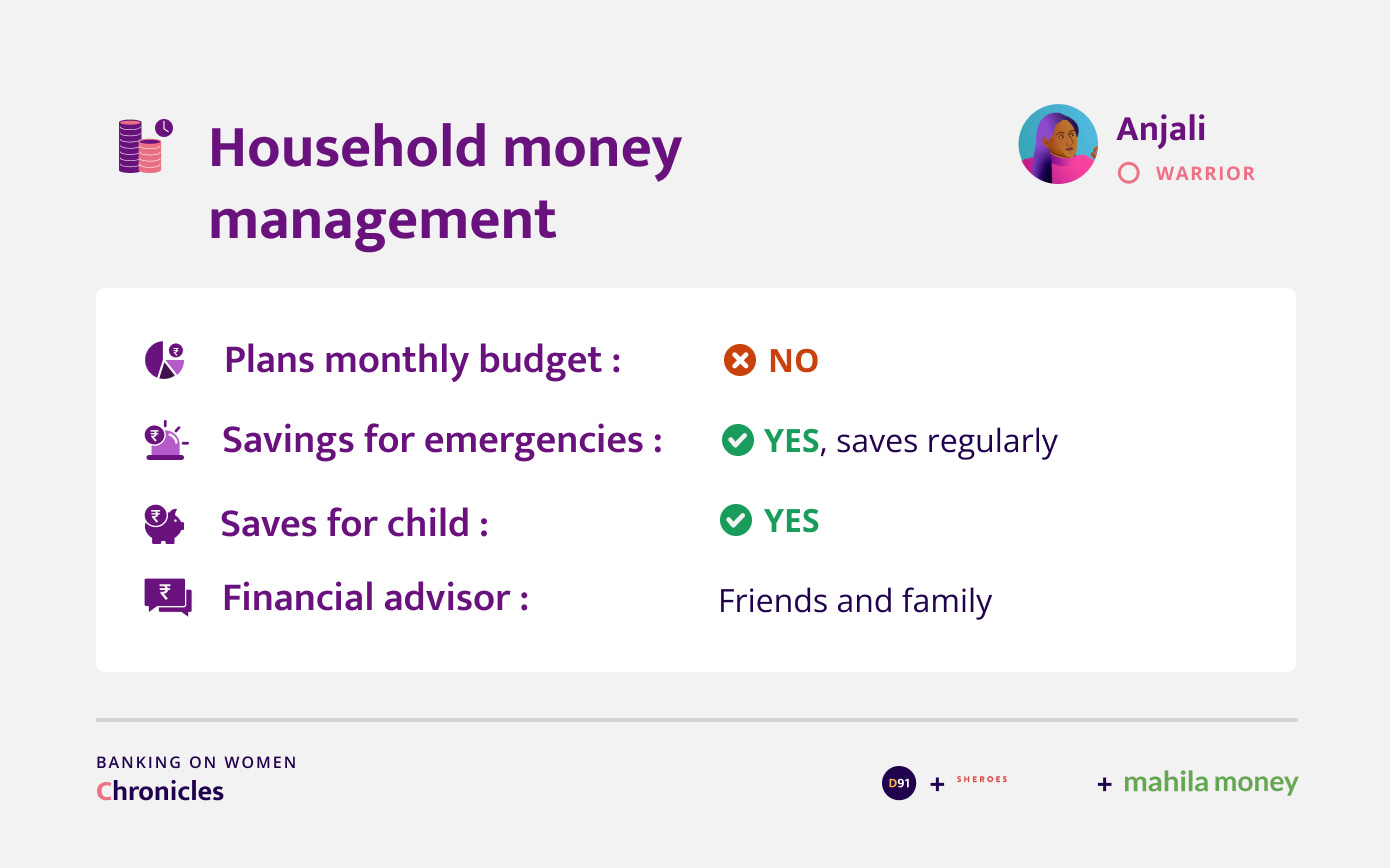

Do you have a monthly household budget?

Not typically, but I know what my monthly expenses are so I'm aware of that completely and I know when my bank balance is dwindling.

Do you save money separately from the monthly reserves for rainy days or for later use?

If I don't save, I can't sleep so most of the money I save and whatever is left after saving is something that I like to spend.

Do you save any money separately for your son's expenses?

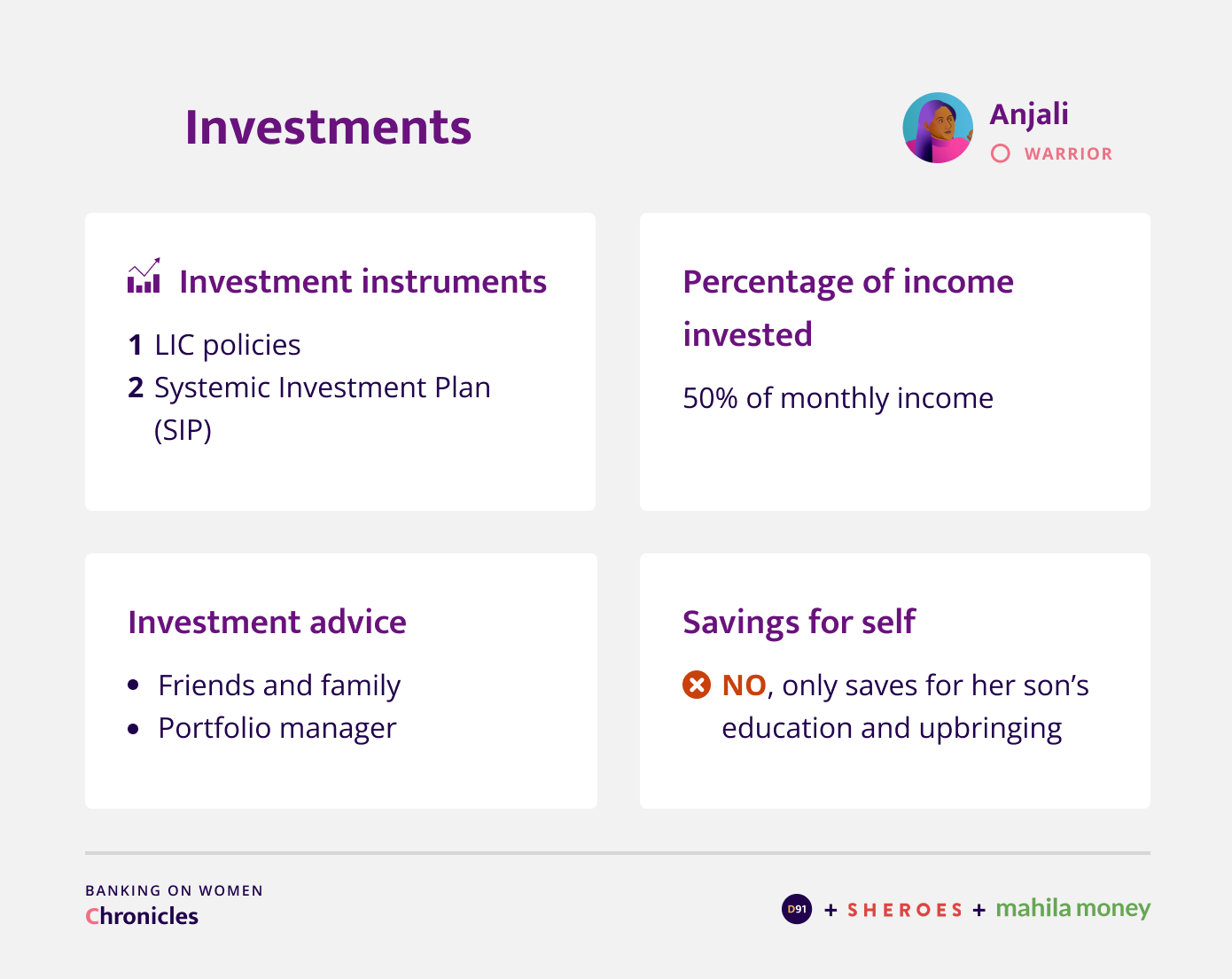

I'm saving all the money basically for my son. For me, I don't have too many needs other than my own need for traveling which is extremely important for me. But beyond that, it’s all for him!

Who do you generally rely on for financial advice?

Earlier I had a portfolio manager who used to help with my money but now I don’t make as much to have that need anymore. But if tomorrow the need arises then I’ll go back to the same company. Because they've been my solid partners and they've always advised me extremely well.

Did the pandemic impact your budget over the course of the past couple of years?

Positive impact was that since we lived here, in the mountains I could go out and also continue whatever work that I was doing as a freelancer. Otherwise I’d probably be saving that money because there was hardly any place to spend it beyond certain things. Because I didn't know what the next month was going to be like, we latched onto whatever we had. So, it did have an impact on our spending behaviour.

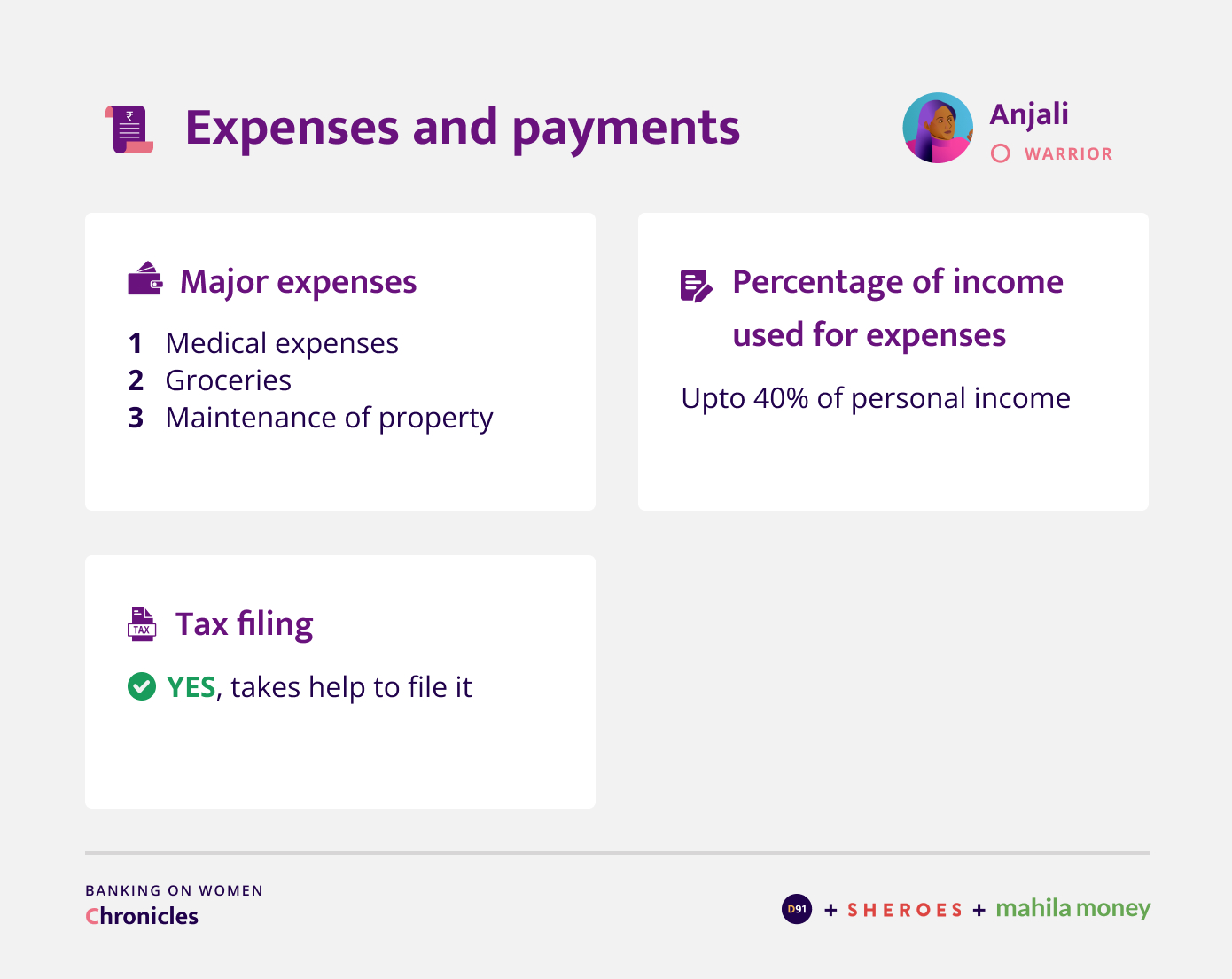

Expenses and Payments

Do you remember the first time you used any payment app? What was your experience like?

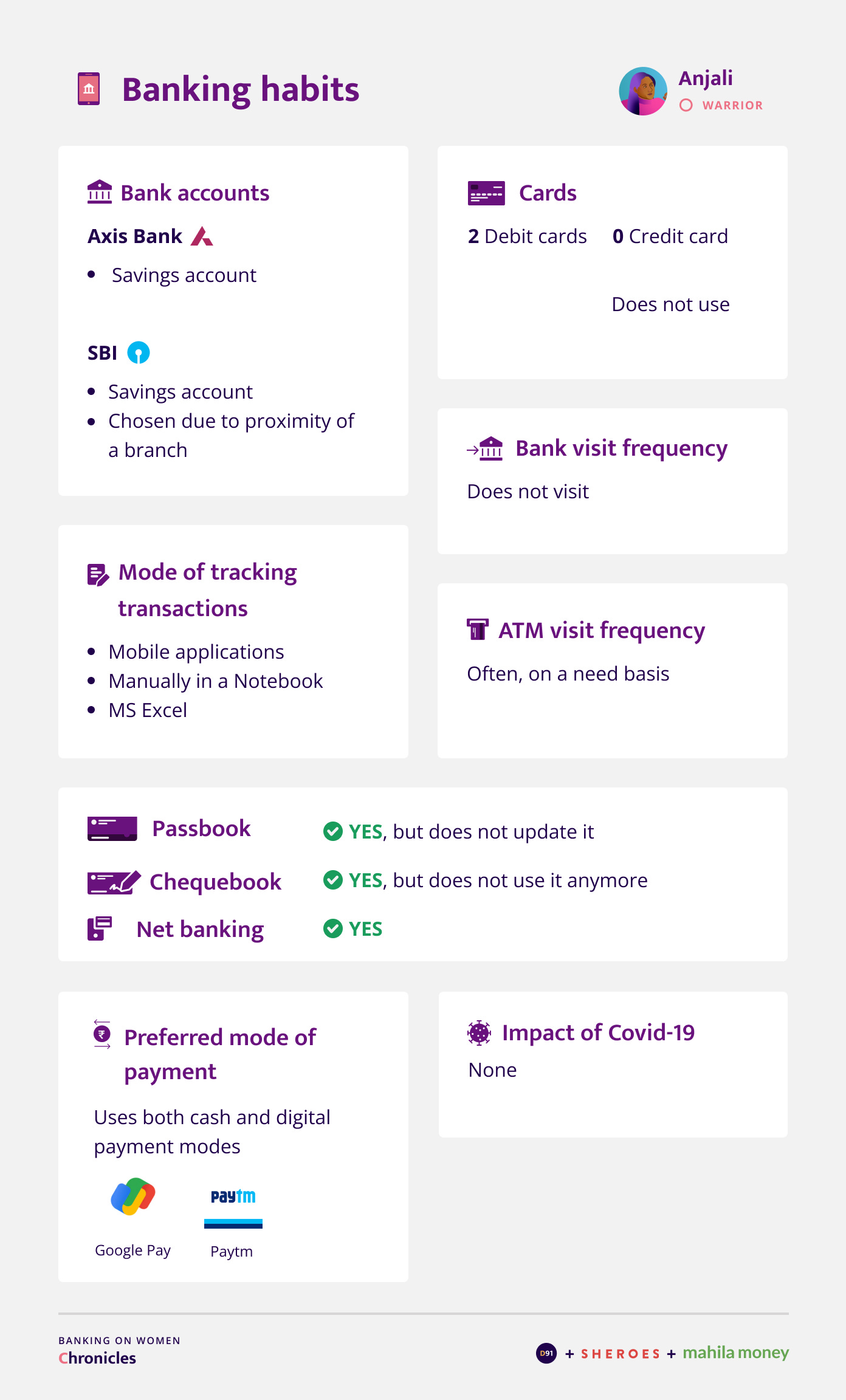

I wouldn't remember but I think it was the Paytm app that I may have used other than a bank transfer which is net banking. I think I was pretty reluctant but then the money was used to pay someone. I think we had gone out for somebody's baby shower and the expenses had to be paid. So somebody said “okay you Paytm the money to me” and I didn't know how to do that so she told me how to do it. And I think there was a transfer of about INR 1000 which happened and that’s how I went about it. I think this was about 5 years ago.

Banking Habits

Why did you choose SBI and Axis as your go-to banks for these accounts?

Axis Bank was chosen because after my separation, my preferred bank was not something I could use due to some issues. I chose SBI because it is a local bank and I wanted to have an account here. In case I am not able to withdraw money or there is an ATM issue, having a bank with a local branch always helps! You will not believe that we do not have a petrol pump until 20 kilometers from here, so every time I need petrol in my car I need to trek there! So yes, local resources to the extent possible.

So the payments that you make, do you typically prefer to make them in cash, or are there any digital payments?

Depends on what the other person’s need and preference is and whether I have cash or money in my account. Sometimes I don't have money in my account and only have cash. So keeping that in mind and depending on what form the other person is looking for money in exchange for any services or goods that I’ve procured, I make a choice.

I'm assuming you go to ATMs to withdraw money as and when required as opposed to just getting a bulk of the money at the beginning of a month?

Yeah, I would withdraw money as and when required because I don't want to be feeling unsafe with all the cash around me. So I only withdraw as much as I need.

Financial products and services

Investments

Where do you invest your money?

So sometimes it is two friends that I have given my money to and they will take it in their businesses and when I need it they would probably give it back. Earlier I had a portfolio manager when I lived in a city, but not anymore.

Do you share any of the investment details that you have for your son with your family?

No, I mean, my family has never been very investment savvy. I don't see a need why. And who’s family? It's basically me and my son. My son is at that tender age that he doesn't need to know anything and my parents are on their own. So they have no interest in what I do.

How do you build investments for your son?

The few instruments would be the LIC I have created for him. An SIP as well. Otherwise it’s just with friends and family so that I don’t need to take care of it.

In addition to this money that you've saved for your son is there any emergency fund?

Not really. Not right now, because I'm struggling to get to a point which is comfortable. Earlier I had and you know the general financial advice anybody would give you is to have six months worth of your salary in liquid cash for you, but that is not the case for me.

Loans

Have you borrowed any loans in the past 2 years?

I haven’t taken any loan as my CIBIL score was completely destroyed during separation issues, so I can’t apply for any loan. But in a way, it’s good because a loan is also a liability and I can’t really afford one, so it has saved me from the trouble of applying for a loan. But beyond that, my family and friends have been very supportive and have helped me whenever I need money. I repay them as and when I can.

Insurance

Outlook toward the future

In your opinion what is the one financial product or service that will have the most impact in supporting your financial journey?

I don't know if it means creation, because I think it's already there, which is the SIP. The effect of the compounding interest, I think it's a phenomenon that people should read and understand about especially women. I started saving at the very formative years of my career. I had an amazing supervisor and he would guide me very well towards finances. So I started working in 2001 and starting 2004 I started investing, but marriage took a lot of money out of everything that I had saved. And I keep telling people that 21 is such a fantastic age to start your financial journey, because by the time you're about 41/42 I know that if I hadn't touched that money which I was saving, even if I was not contributing towards it, I would have been sitting on INR 1 crore if I hadn't spent it on my marriage. Not the ceremony but the years that I was married, there was a lot of financial expectation from me and I had to continuously put in money at home. So that basically took away everything that I had earned and if I hadn't spent it or taken it out today, I wouldn't have to be looking for any freelance project. I would have been sitting with that money and basically be free of any stress.

I think every woman, the moment they start earning, no matter how much they earn, even if it INR 10,000 a month, they should spend but they should invest about INR 1000 or 2000 in SIP and it eventually becomes such an amazing habit that the month that you do not save, you start feeling guilty about it. And that's exactly what happened to me, but my journey is very different right now. I would certainly advise everybody to invest in SIPs.

Our understanding of Anjali’s journey

Anjali’s journey has been one mired with many adverse circumstances. In our interaction with her, we have seen up close and personal her perseverance and indomitable spirit to turn her life around and achieve the independence and financial stability that she had worked towards almost her entire life. Unfazed and resilient, her financial story despite the turbulent middle seems to be headed for a very bright end and we cannot be more inspired by it!

Hope you enjoyed reading this blog. We at D91 would love to receive your feedback on the work we have been doing so far. Here's a brief survey for us to understand your experience while engaging with our content. This survey should take less than 5 minutes of your time and all responses are anonymous.

You can provide your feedback by clicking on the following link - https://forms.gle/4WUzRUBCht2prHs28

About the Research

This blog is a result of an online interview conducted with the participants’ consent. The interview was conducted in English. This is a part of the Banking on Women chronicles.

Disclaimer: The name and other sensitive personal details in this documentation is masked to honour the privacy of the participant.

Project Partners

SHEROES

The SHEROES Network is a content and community ecosystem enabling access to employment, entrepreneurship, and capital for women. It includes the SHEROES app, SHOPonSHEROES marketplace, Babygogo, Naaree, MARSbySHEROES and has a user base of over 24 million women. The SHEROES Network is committed to increasing women’s contributions to GDP.

Sheroes.com | SHEROES App | Twitter | LinkedIn | Instagram | Facebook

Mahila Money

Mahila Money is a full-stack financial products and services platform for women in India. Mahila Money specializes in offering loans to women who want to set up or grow their own business along with resources and community to achieve their financial goals. Mahila Money can be accessed via the Mahila Money app on Android.

Twitter | LinkedIn | Instagram | Facebook | Website | Play Store App

All artworks are designed by Poorvi Mittal.

If you enjoyed reading this blog and would like to receive more such articles from D91 Labs, please subscribe to our newsletter here.

To read more about our work, visit our website